Solana 2025 Report Card: Annual Revenue of $15 Billion, Surpassing the Sum of "Hyperliquid + Ethereum"

- Core Viewpoint: In 2025, Solana surpassed Ethereum to become the king of the on-chain ecosystem.

- Key Elements:

- On-chain fee revenue exceeded $600 million, ranking first among public chains.

- Annual total revenue surpassed $1.5 billion, with a trading volume of $1.6 trillion.

- Strong ecosystem vitality, with a median transaction fee below 1 cent.

- Market Impact: Consolidates Solana's leading position and drives industry activity to shift on-chain.

- Timeliness Note: Medium-term impact.

Original|Odaily(@OdailyChina)

Author|Wenser(@wenser 2010 )

The year 2025, which belonged to cryptocurrency, has passed. This year, beyond a series of favorable developments at the policy level, the growth of on-chain ecosystems has been even more explosive.

From the Meme coin issuance wave sparked by Pump.fun, to the on-chain Perp DEX trend led by Hyperliquid, and further to the stablecoin and PayFi financial wave driven by Circle's (CRCL) public listing, the on-chain ecosystems of numerous public chains have also entered a period of explosive growth. Among them, Solana, leveraging its ecosystem vitality, underlying infrastructure development, and its "application-first" internet-style capital network positioning, surpassed Ethereum to become the "new king of annual on-chain networks."

Odaily will use this article to systematically review the Solana on-chain ecosystem, attempting to explore the "best business model" in the current crypto market(Odaily Note: Data sources vary, statistical methods differ, for reference only)。

Solana On-Chain Revenue Exceeds $600 Million, Outshining Ethereum and TRON to Become the "Strongest Public Chain"

Solana's "year-end report card" begins with public chain revenue. Although SOL's price has been declining since it surged to a new high near $300 last year, with its highest rebound not reaching $270, from an operational perspective, its revenue-generating capability is already "unquestionably number one."

2025 Solana On-Chain Fee Revenue Surpasses $600 Million

On January 2nd, Nansen data showed that Solana's on-chain fee revenue for 2025 exceeded $600 million, surpassing TRON and Ethereum to rank first. The top five blockchains by on-chain fees last year were:

- Solana ($603 million);

- TRON ($581 million);

- Ethereum ($514 million);

- BNB Chain ($259 million);

- Bitcoin ($172 million).

Furthermore, Solana's number of active on-chain addresses exceeded 1.05 billion, and on-chain transactions reached approximately 23.01 billion, both higher than those of public chains like Ethereum, Bitcoin, and Tron.

Latest data shows that,as of the time of writing, Solana maintains its top position in active addresses, transaction count, and fee revenue over the past year.

2025 Solana Annual Revenue Exceeds $1.5 Billion, Surpassing the Combined Revenue of "Hyperliquid + Ethereum"

According to Blockworks Research data, Solana's full-year revenue for 2025 exceeded $1.5 billion, leading all public chain networks. Hyperliquid followed closely with $780 million in revenue; Ethereum generated $690 million in the same period, both trailing Solana. Simultaneously, and even more commendably, Solana achieved this revenue milestone while maintaining a median transaction fee of less than 1 cent.

In response, Solana co-founder Anatoly Yakovenko acknowledged this achievement, pointing out that capacity growth and cost efficiency were the core drivers. He believes sustainable revenue expansion is supported by network scale, not high fees.

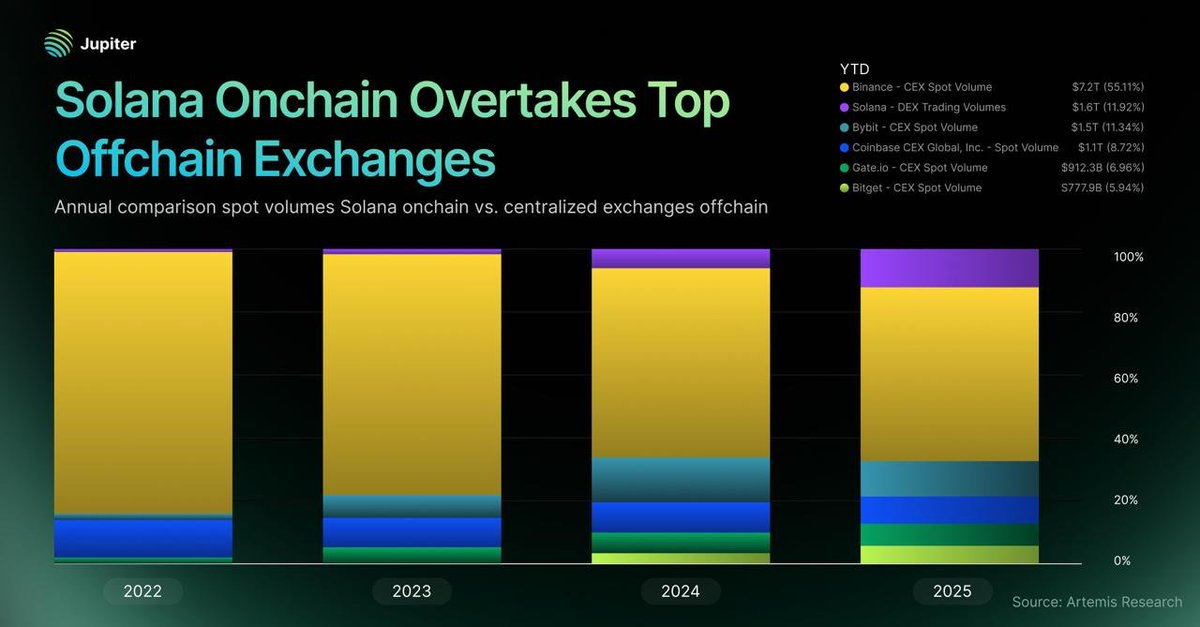

2025 Solana On-Chain Spot Trading Volume Reaches $1.6 Trillion, Surpassing All CEXs Except Binance

Recently, The Kobeissi Letter posted that Solana's on-chain spot trading volume officially reached $1.6 trillion in 2025, surpassing all centralized exchanges except Binance.

According to JupiterExchange data, the proportion of Solana's on-chain trading volume to total trading volume has grown from 1% to 12% since 2022. In 2025, Solana's total trading volume officially exceeded that of Bybit, Coinbase Global, and Bitget, ranking second only to Binance.

Meanwhile, Binance's market share has declined from 80% to 55% since 2022. This also signifies that industry activity within cryptocurrency is rapidly shifting on-chain.

Decoding Solana Ecosystem On-Chain Revenue Composition: 4 Major Components Support Over $600 Million

Based on available information, Solana's network revenue primarily stems from on-chain transaction fees. Unlike Ethereum and others, its fee mechanism design emphasizes deflation and validator incentives. The composition of the total $603 million fee revenue in 2025 is as follows:

Primary Revenue: Base Fee

- A fixed, extremely low base fee is charged per transaction (approximately 5000 lamports).

- This portion of fees is entirely burned, not distributed to validators, directly reducing the total SOL supply and creating deflationary pressure.

- It constitutes a significant proportion of total fee revenue, especially in 2025 with explosive transaction growth, where the burn mechanism significantly enhanced SOL's scarcity.

Secondary Revenue: Priority Fee

- An optional additional fee paid by users to expedite transaction confirmation.

- During periods of high congestion (e.g., meme coin frenzy, large DEX trades), priority fees increase substantially, becoming a major incremental revenue source.

- This portion is distributed to block producers (Leader) and stakers, serving as the primary reward source for validators.

Tertiary Revenue: MEV (Maximal Extractable Value) Related Revenue

- Tips paid by searchers through MEV clients like Jito further supplement revenue.

- The proportion of MEV revenue increased in 2025, closely tied to complex arbitrage opportunities in DEX and meme coin trading.

Quaternary Revenue: Other Minor Sources

Such as account rent (storage fees), voting fees, etc., which constitute a small percentage.

In the overall distribution mechanism, approximately 50% of fees indirectly benefit all SOL holders through the burn mechanism (deflation); approximately 50% is directly distributed to validators and stakers, incentivizing network security. Unlike the Ethereum ecosystem where protocol fee revenue primarily goes to validators, Solana's burn mechanism gives its network revenue greater long-term value capture capability, which is also key to maintaining low fees despite high transaction volume.

Review of Crypto Cash-Generating Business Models: Public Chains, Perp DEXs, Launchpads Remain the Most Profitable Sectors, Second Only to Stablecoins

Finally, synthesizing existing market information, public chains (Solana, Ethereum, TRON), on-chain perp DEXs (like Hyperliquid, Aster, etc.), and on-chain Launchpads (like Pump.fun) remain the most profitable sectors in the crypto industry, second only to stablecoin projects that earn interest and steadily increase supply.

Although we previously analyzed the awkward survival state of current public chain projects in an article titled 《Only 10 Public Chains Have Weekly Revenue Over $100k: Swimming Naked After the Tide Recedes》, the existence of public chains like Solana, Ethereum, TRON, and Base tells us: public chains are still the most profitable crypto sector today, perhaps even without equal.

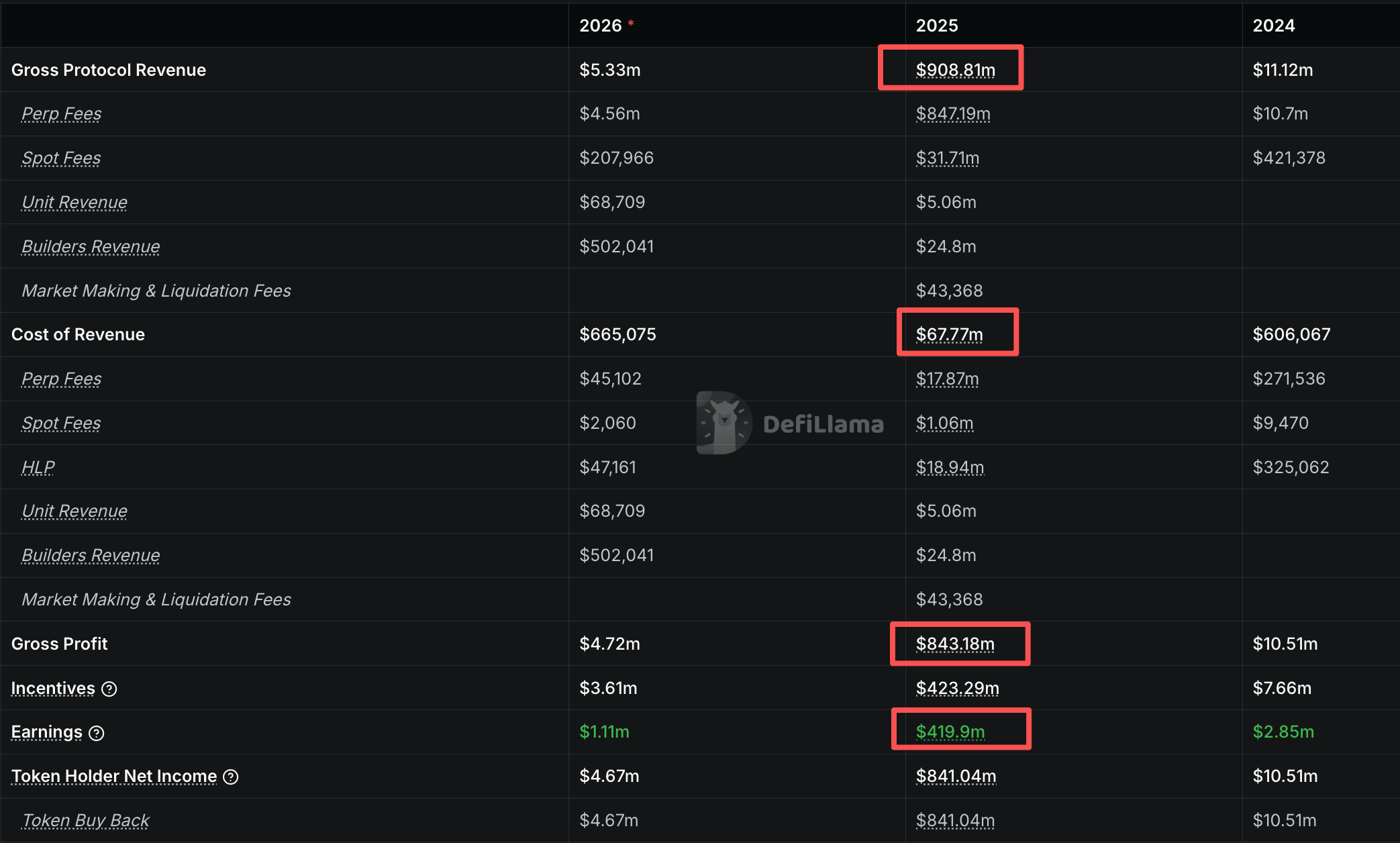

According to DefiLlama data, Hyperliquid's 2025 revenue was $908 million; cost of revenue was approximately $67.77 million, with an annual net profit of approximately $843 million. Excluding incentive-based expenses, the net profit attributable to the platform in 2025 was as high as approximately $420 million.

According to DefiLlama data, Pump.fun's 2025 annual revenue was approximately $550 million. Unlike on-chain perp DEX platforms like Hyperliquid, as a "one-click token launch platform," Pump.fun does not incur incentive expenses. Therefore, its platform's annual net profit is approximately equal to its annual revenue, i.e., $549 million.

Based on the above information, the industry's mainstream revenue-generating machines are still leading applications like public chains, on-chain Perp DEXs, and Launchpad token platforms, second only to stablecoins (e.g., Tether's stablecoin-related net profit alone reached $7.43 billion in 2025).