Wallet Track Undercurrent Battle 2: Is Competing to Integrate Hyperliquid a Good Business?

- Core Viewpoint: Wallet integration with Hyperliquid is a low-ROI competition.

- Key Elements:

- Hyperliquid's open API and rebate mechanism attract integrations.

- The integration method (API/node) affects user experience and profit differences.

- Its user base exhibits a pyramid structure, with profits relying on whales.

- Market Impact: Drives internal competition in wallet features and promotes self-developed DEXs.

- Timeliness Note: Medium-term impact.

After the previous article on the wallet sector's covert battle over TEE underlying infrastructure, many readers have been urging for a follow-up. So, Fourteen is back in 2025 for another deep dive.

Hyperliquid is undoubtedly the hot topic of the year. This time, let's look at it from an insider's perspective, connecting the dots to see how wallets, exchanges, DEXs, and AI trading are all converging in this arena!

1. Background

In 2025, I've essentially researched all the major Perps (perpetual trading platforms) on the market, witnessing the hype market's 5x growth and its peak halving (9->50+->25).

Amidst the volatility, has it truly been left behind by competitors? Or are there underlying concerns about platform revenue being reduced due to the openness of its hip3 and builder fee mechanisms? The Perps sector itself is also seeing a surge of competitors. Recent entrants like aster, Lighter, and even Justin Sun stepping in with sunPerps—which shook the sector—have held promotional Twitter Spaces that even set new records for attendance in Web3 industry announcements.

The chart below illustrates this state of intense competition. Interestingly, this is also one of the rare ongoing processes where an established market is being carved up.

Recall the competition among all DEXs during the DeFi Summer, including Uniswap, Balancer, Curve, and numerous Uniswap forks like Pancakeswap.

The current moment for Perps is reminiscent of that DeFi Summer era. Some aim to build platforms, others want to aggregate, some seek to challenge the leader, and some just want to capture the tail-end profits.

Over the past year, various wallets have been racing to integrate perpetual trading capabilities at the DEX entry point. Metamask and Phantom led the charge, followed by news last week of Bitget's integration. Other startup-level products like axiom, basedApp, xyz (using hip3), and multiple AI trading platforms are also getting a piece of the pie through integrations.

Thus, the wallet sector is also engaged in a new round of covert warfare.

Everyone is scrambling to integrate Hyperliquid's perpetual trading capabilities. Is this driven by the红利 of technical openness, the allure of rebate mechanisms, or simply a reflection of genuine market demand? Why have some leading platforms remained inactive? Have the early integrators secured market dominance as a result?

For further reading: A Deep Dive into Hyperliquid's Path to Success and Its Hidden Concerns

2. Ecosystem Origins: Builder Fee and Referral Mechanisms

Hyperliquid's rebate mechanism primarily consists of the Builder Fee combined with Referrals.

I've always considered this a groundbreaking mechanism. It allows DeFi builders (developers, quant teams, aggregators) to charge an additional fee as service revenue when placing orders on behalf of users. The total fee for users placing orders on these platforms or the official site itself remains unchanged.

Its essence is similar to Uniswap V4's hook mechanism. Both treat their order book (or liquidity pool) as infrastructure, providing it for various upstream platforms to integrate. This makes it easier for them to attract user groups from different platforms, while different traffic platforms (wallets) gain a more comprehensive ecosystem of products to serve their users' diverse needs.

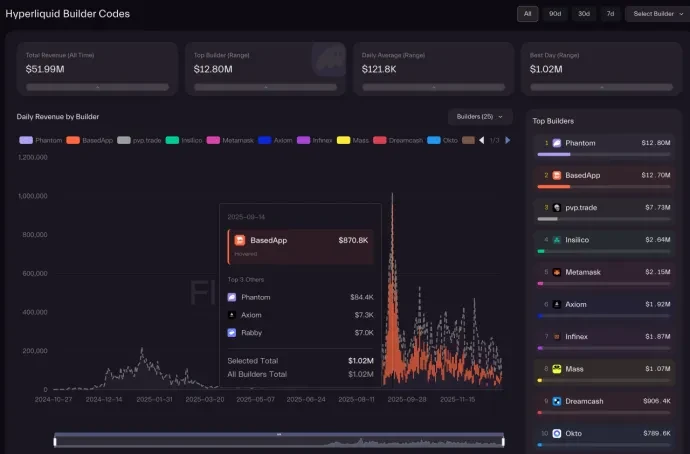

This mechanism, upon its initial launch, has already brought over ten million USD in dividend收益 to some projects, showing significant early effects, though it has declined subsequently.

From the chart, we can also see many points worth pondering.

• Why is there a 5x difference in integration收益 between Metamask and Phantom, despite Metamask's user base being no smaller?

• Why is there such a vast difference in收益 here between basedApp and axiom? Where is Jupiter?

• Is the 12M dividend收益 considered high or low? Is it short-term or long-term?

• Are platforms that only lightly integrate with HypeEVM or the native coin at a disadvantage?

• Why are Bn, OKX, etc., not on the list?

3. PerpDex's Open Strategy

To answer these questions, we must first understand how various platforms integrate.

3.1 Open API Integration Method

In fact, most Perps platforms offer their APIs, which are very comprehensive. Almost every platform has its own definitions, but the provided modules are generally as follows: Query类 (account status, positions, orders, market data, K-lines, etc.), Trading类 (place order, cancel, modify, adjust leverage, withdraw, etc.), Subscription类 (WS real-time推送 for price, order book, position changes).

Because this system itself needs these APIs to provide market makers, the user side merely changes the trading direction. However, users cannot be contacted like market makers, necessitating additional control measures.

Hence, rate-limiting mechanisms are essential. Hype's is based on a dual rate limit of address + IP, which can dynamically adjust thresholds based on trading volume. High concurrency may face rate-limiting challenges.

The advantage of this official API solution is rapid integration and implementation, no need to build nodes, low data latency, and good state consistency.

But the disadvantages are also obvious: potential IP/geographic restrictions, susceptibility to rate-limiting impacts. Rate-limiting is less of an issue for individual users, but for platform providers, it's difficult to manage as user volume can increase at any time, making dynamic scaling challenging.

There's also the update issue. App code modifications have release constraints. If the official API upgrades or changes, or gets rate-limited, the app provider loses control. Besides being a traffic provider, they also bear additional customer complaints and risks.

3.2 Read-Only Node Integration Method

Hyperliquid has a dual-chain structure with EVM and core chains, integrated into one program and closed-source/encapsulated. It's difficult for external parties to decipher the specific content. The官方 only supports project deployment of this read-only node (which can obtain order, K-line, and成交 data but does not support sending transactions).

Moreover, it doesn't开放全部历史数据. The data volume here is massive: approximately 1T+ of data is added in just 2 days. Over a year, without archiving historical data, the cost itself is hard to cover with收益.

If a project deploys a read-only node to reduce the frequency of reading the official API and thus mitigate rate-limiting issues, this is currently the官方推荐的做法.

Adopting this方案 comes with significant technical challenges: occasional block落块现象, massive storage requirements, missing historical data. And the node's data methods must be modified.

I believe the biggest problem is the consistency issues brought by this half-open mechanism.

For example, if I use K-line data from a read-only node to place an order, but the node itself is delayed (this inherently happens probabilistically), yet I must use the official API to place the order, which has no delay. The data between the two might be inconsistent, so my market order could be filled at an undesirable price.

Whose responsibility is it? Does the platform earn enough to cover compensation here? What cost would the platform incur to improve stability? Is it appropriate to simply shift blame?

3.3 Market Choices

This is where分歧 emerges; different players have different approaches.

• Metamask, as a typical representative of a tool-oriented定位, directly adopts frontend integration with the open API, even open-sourcing the integration code. This simple,粗暴的方式带来快速的上线效率. It's rare to see such a conservative头部 wallet platform move so quickly in the market.

• Rabby, Axiom, and BasedApp also follow this approach.

• Trust Wallet has also integrated Perps, but it connects to the BN-affiliated aster platform,显然还是自家产品给绿灯. However, the internal profit-sharing arrangement is uncertain.

• Phantom, rising from the Solana Meme wave, here shows more pursuit of experience. It adopts the read-only node integration method, even routing order placement operations through a backend relay instead of the client directly calling the official API.

Actually, there are some神奇的产品 in the market with different angles and choices.

For instance, Trade.xyz is currently the platform with the highest trading volume on Hip3, not seeking the red ocean battle of existing markets but directly开拓股票交易的能力.

VOOI Light is also quite capable (engineering-wise). It's an intent-based cross-chain perpetual DEX. Its core lies in simultaneously integrating multiple perps DEXs, essentially using engineering effort to pursue multiple paths of the aforementioned platforms. However, the shortcoming is getting stuck in the complexity of multi-integration reserve funds, leading to a less smooth experience.

Finally, I recently experienced several AI trading platforms. Almost all use open API integration + backend integration with multiple perps. The experience feels cutting-edge. Some are纯 LLM大模型文字交互, others are AI决策+follow交易员的方式 (here the底层 can also link with TEE托管方案 like Privy), enabling AI-assisted perps trading without transferring private keys to the project.

For details on the private key custody battle, see: What Exactly Are Blockchain Wallets Competing Over in Their 2025 Covert War?

Different方案带来不同的体验, which can somewhat explain the differences in the final rebate effectiveness data.

4. Reflections

The aforementioned social logins can only solve recovery problems, not automated trading issues.

4.1 Reserve Fund Complexity

This is actually the most easily overlooked aspect. Hyperliquid's complexity far exceeds imagination; it's not a simple "plug-and-play" integration.

Various platforms initially optimistically approached it with an aggregator DEX mindset but overlooked that it's not a Lego model. After integrating Hyperliquid, if the market declines later, will the functionality remain? How many wallets are now下线曾经的铭文协议? And if removed, will users who opened positions on the platform go to the official platform to find them?

Furthermore, if Hyperliquid's popularity wanes and perhaps aster or lighter gains traction, will migration to new platforms occur? APIs differ across platforms; how to migrate, how to run in parallel?

Smoothing out these issues inevitably increases体验的复杂性.

Ultimately, if a user wants an all-in-one入口, why not use the official platform itself?

Frontend integration带来快速的体验和覆盖, but Metamask seems to have taken a哑巴亏, not earning much money while白白提供了自己的用户流量.

Backend integration带来的优质体验 is the core reason Phantom earns the highest收益, but it also comes with巨大成本. The final ROI收益 is perhaps only known to them.

4.2 Why Can't Total收益 Break Through to Higher Levels?

Reflecting on our own preferences (focusing on advanced Perps players) for using platforms like Hyperliquid, we still prefer the complete official入口, mostly operating on PC. The main reasons are直观看到止盈/止损设置, chart monitoring, margin modes, and other advanced features. After all, this赛道 itself has many高端玩家.

The demand for using mobile端 is "monitoring and responding to market changes anytime, anywhere, managing position risks and prices, not conducting complex analysis."

Therefore, Phantom's advantage in bringing new users for initial体验后持续下行, as its focus remains on移动端.

Platforms like BasedApp, which have both App and web端入口, cater to both demands. However, due to competition from the official入口 on the web端, their上限也不大.

But Hyperliquid's own App will launch soon, so this market itself will become increasingly局限.

It can only be said that architectural differences determine the value of integration, but the magnitude of that value depends on the depth of integration. Ultimately, the ceiling of this model本质上还是圈内竞争; users contributed by入口 platforms很难维持在原有平台中.

If wallets can provide mobile端的高级功能 (advanced charting, alerts and notification systems, auto trading), that indeed has differentiated value. We can see Phantom updating rapidly,推出各种高级功能, precisely to retain这部分用户.

The破局之道 lies in ai trading, auto trading (trading modes not offered官方), and multi-perps aggregation—paths similar to those taken by DEXs. However, there are issues like难以解决的多平台储备金调度 and the high efficiency of AI亏钱. Even with industry通用私钥托管方式 (prvy, turnKey)加持, it still falls into the category of: users who know how will know, those who don't can't learn.

4.3 User Growth and Niche Supplementation

Of course, the初衷 for many platforms is that they can accept it not being profitable. After all, relying on fee sharing is like捞渣 from soup. But if it can attract Perps users or satisfy existing users' perpetual trading needs, it's also good生态位补充.

We can draw conclusions by抓点 HL on-chain data for analysis, as this群体其实很小.

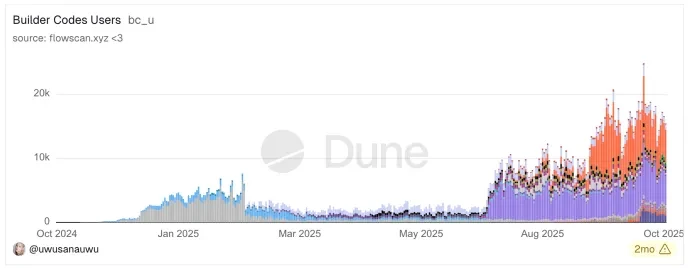

From the chart below, the user体现 from various integrations is only a few thousand daily active users, totaling just over 10-20k.

Moreover, looking at Hyperliquid's own monthly active users, its收益的本质 is based on a巨鲸服务模型, typical of the contract trading market's Matthew Effect and inverted pyramid fund structure.

Currently, HL has a total wallet address count of around 1.1 million, with 217k月活 and 50k日活. But the key here—the top 5% contribute 90%+ of OI and Volume, forming a typical pyramid structure.

The top-tier users (fund range $1M+, about 500+ people), accounting for only 0.23%, control 70% of the Open Interest ($5.4B). Among them, the top 100+ users have an average position高达$33M, their OI占比 is 920 times their user占比.

In contrast, the底层用户 (150k users),占据 72.77%, contribute only 0.2% of contract volume, with an average position of仅$75.

This structure indicates that the contract market is essentially a博弈场 for professional institutions and high-net-worth individuals. The大量散户, while构成用户基数和活跃度, are almost negligible in terms of capital体量.

This structure actually体现一种很反人类的直觉: indeed, Hyperliquid itself is highly profitable, becoming one of the most profitable exchanges within a year.

But its收益本质来源于高端玩家巨鲸们, motivated by抗审查,开放透明度, or量化交易驱动.

However, the意义 of various platform integrations primarily brings常规用户. Therefore, there needs to be a长线的用户教育过程 to potentially shift those playing Perps on CEXs to the homogenously competitive Web3 Perps.

5. Final Thoughts: Is Integrating Perps Really a Good Business?

Generally, projects must adapt to the market, but when a platform's热度 reaches its peak, the market adapts to it. Hyperliquid currently enjoys such待遇, but it未必能守得住这个待遇. Although one can explain the陡增 in trading volume of other competitors as driven by new airdrop expectations, resulting in非真实交易结果.

Moreover, many of HL's举措 are relatively correct. Compared to many past platforms that often wanted to do everything themselves and reap all the红利 (I点名批判 opensea, which折腾出一套强制版税的东西, forcing the market to follow the leader), HL is different. Each intervention had fixed高额成本,干预了商品的流动, affected真实的市场定价, ultimately leaving countless NFTs as传家宝.

With HL, it开放了 evm and all various dex peps APIs, so the market quickly saw a bunch of衍生品.

RWA assets, particularly US stocks and gold, are becoming new流量入口与差异化增长点 in the current Perp DEX领域. TradeXYZ's累计 perp volume of $19.1B, weekly average of $320m, daily average of $45.7m, is the best proof.

Hyperliquid's generosity is also evident in its airdrops and buybacks. Often, staking HYPE for ADL利润 also holds promising收益.

兜兜转转, the龙头之争 is for those few platforms to烦恼.