A Comprehensive Guide to On-Chain U.S. Stocks: Why Are Crypto Enthusiasts Turning to U.S. Stocks, While Wall Street Goes On-Chain?

- Core Viewpoint: U.S. stock tokenization represents a fundamental restructuring of finance.

- Key Elements:

- Enabling 24/7 trading and lowering investment barriers.

- Enhancing the resilience of the crypto ecosystem and converging global liquidity.

- Facing practical challenges such as compliance, custody, and de-pegging risks.

- Market Impact: Attracting traditional capital, potentially squeezing the space for alternative crypto assets.

- Timeliness Note: Long-term impact.

Original Author: Biteye Core Contributor Changan

Original Editor: Biteye Core Contributor Denise

Over the past year, a thought-provoking phenomenon has repeatedly emerged:

Driven by productivity dividends and the AI narrative, US stocks and precious metals have repeatedly hit new highs, while the cryptocurrency market has fallen into a cyclical liquidity drought.

Many investors lament that "the end of crypto is US stocks," and some have even chosen to exit the market entirely.

But what if I told you that these two seemingly opposing paths to wealth are undergoing a historic convergence through tokenization? Would you still choose to leave?

Why do global top-tier institutions, from BlackRock to Coinbase, unanimously express optimism about asset tokenization in their 2025 annual outlooks?

This is not simply about "moving stocks." This article delves into the underlying logic of the US stock tokenization track and provides a comprehensive analysis of the current landscape, including platforms tokenizing stocks and in-depth perspectives from leading KOLs.

01 Core: Beyond Just Going On-Chain

US stock tokenization refers to converting US stocks (such as shares of publicly listed companies like Apple, Tesla, NVIDIA) into tokens. These tokens typically have a 1:1 peg to the rights or value of the underlying real stocks and are issued, traded, and settled via blockchain technology.

Simply put, it moves traditional US stocks onto the blockchain, turning them into programmable assets. Token holders can gain the economic rights of the stock (such as price appreciation/depreciation, dividends), but not necessarily full shareholder rights (depending on the specific product design).

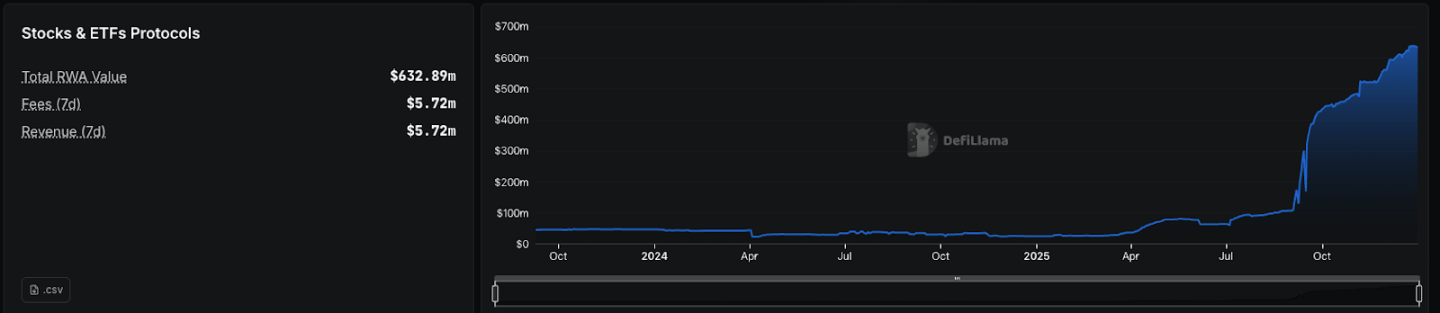

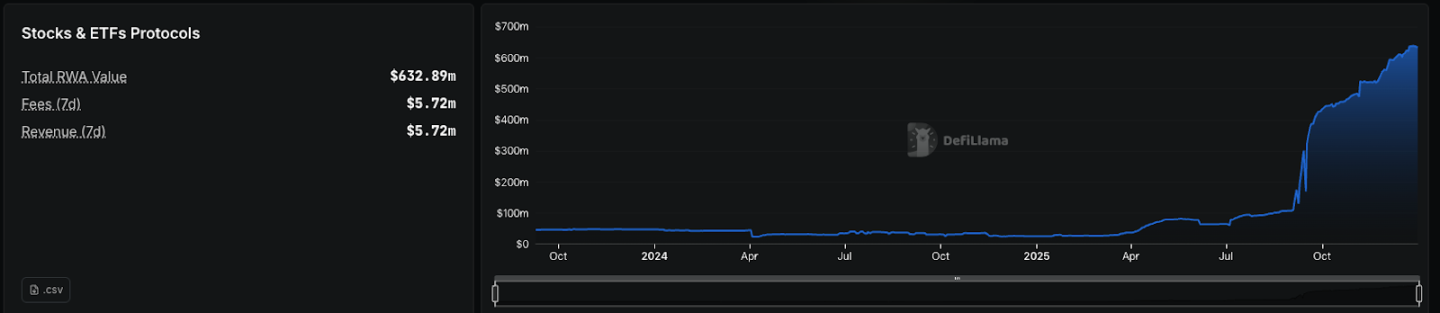

As shown in the chart, the TVL of US stock tokenization has experienced exponential growth since Q4 of this year.

(Source: Dune)

After clarifying the basic definition of US stock tokenization and its distinction from traditional assets, a more fundamental question arises: Since traditional securities markets have operated for centuries, why go through the trouble of putting stocks on-chain?

The integration of stocks and blockchain brings numerous innovations and benefits to the traditional financial system.

1. 24/7 Trading: Breaks free from the trading hour constraints of the NYSE and NASDAQ, enabling 7x24 hour continuous trading in the cryptocurrency market.

2. Fractional Ownership Lowers Investment Barriers: Traditional stock markets typically require purchasing at least 1 lot (100 shares). Tokenization allows assets to be divided into tiny fractions, enabling investors to invest as little as $10 or $50 without paying the full price of a share. This allows ordinary global investors to equally share in the growth dividends of top companies.

3. Interoperability with Cryptocurrency and DeFi: Once stocks are tokenized, they can seamlessly interact with the entire decentralized finance ecosystem. This enables actions impossible (or difficult) with traditional stocks. For example: using tokenized stocks as collateral for crypto loans, or providing liquidity with tokenized stocks to earn trading fees.

4. Convergence of Global Liquidity: In the traditional system, liquidity for US stocks and other assets is somewhat fragmented, with macroeconomic positives often benefiting only one side. Once US stocks are on-chain, crypto capital can directly participate in global premium assets. This represents a leap in liquidity efficiency.

BlackRock CEO Larry Fink has also stated: The next generation of markets, the next generation of securities, will be tokenization of securities.

This also addresses the crypto market's cyclical dilemma - when US stocks and precious metals perform strongly, the crypto market often suffers from liquidity scarcity, leading to capital outflows. If "US stock tokenization" matures, bringing more high-quality traditional assets into the crypto world, investors would be less inclined to exit entirely, thereby enhancing the ecosystem's resilience and appeal.

Of course, putting US stocks on-chain is not a frictionless utopian solution. On the contrary, it exposes many issues precisely because it begins to genuinely interface with the real-world financial order.

1. On-Chain US Stocks Are Not Truly Decentralized Equities

Current mainstream US stock tokenization products mostly rely on regulated institutions to custody the real stocks and issue corresponding tokens on-chain. Users essentially hold a claim to the underlying stock, not full shareholder status. This means asset security and redemption capabilities heavily depend on the issuer's legal structure, custody arrangements, and compliance stability. If the regulatory environment changes or a custodian faces extreme risks, the liquidity and redeemability of the on-chain assets could be affected.

2. Price Vacuum and Depegging Risk During Non-Trading Hours

During US market closures, especially for perpetual contracts or non-1:1 pegged products, on-chain prices lack real-time reference from traditional markets and are more determined by internal crypto market sentiment and liquidity structure. When market depth is insufficient, prices can deviate significantly or even be manipulated by large capital. This issue is similar to pre-market and after-hours trading in traditional markets but is amplified in the 7x24 hour on-chain environment.

3. High Compliance Costs, Slow Expansion

Unlike native crypto assets, stock tokenization inherently operates within strong regulatory boundaries. From securities classification and cross-jurisdictional compliance to custody and clearing mechanism design, each step requires deep coordination with the real financial system. This makes it difficult for this track to replicate the explosive growth path of DeFi or memes; each step involves legal structures, custody, and licenses.

4. A Dimensional Blow to Altcoin Narratives

When assets like Apple and NVIDIA become directly tradable on-chain, the appeal of purely narrative-driven assets lacking real cash flows and fundamentals will be significantly compressed. Capital will re-evaluate between "high-volatility imagination" and "real-world returns." This change is positive for long-term ecosystem health but potentially fatal for some sentiment-driven altcoins.

In summary, putting US stocks on-chain is a slow, realistic, yet long-term certain path of financial evolution. It may not create short-term frenzy but could become a main thread within the crypto world that deeply integrates with the real financial system and ultimately settles as infrastructure.

02 Implementation Logic: Custody-Backed vs. Synthetic Assets

Tokenized stocks are created by issuing blockchain-based tokens that reflect the value of specific equities. Based on different underlying implementation methods, current market tokenized stocks are typically created using one of two models:

- Custodial-backed Tokens: Regulated institutions hold real stocks as reserves in traditional securities markets and issue corresponding tokens on-chain at a certain ratio. The on-chain tokens represent the holder's economic claim to the underlying stock. Their legal validity depends on the issuer's compliance structure, custody arrangements, and information disclosure transparency.

This model is closer to the traditional financial system in terms of compliance and asset security, making it the mainstream implementation path for current US stock tokenization.

- Synthetic Tokens: Synthetic tokens do not hold real stocks. Instead, they use smart contracts and oracle systems to track stock price movements, providing users with price exposure. These products are closer to financial derivatives, with core value in trading and hedging, not ownership transfer.

Due to the lack of real asset backing and inherent compliance and security flaws, early pure synthetic models represented by Mirror Protocol have gradually faded from the mainstream.

As regulatory requirements tighten and institutional capital enters, the real asset custody-backed model has become the mainstream choice for US stock tokenization in 2025. Platforms like Ondo Finance and xStocks have made significant progress in compliance frameworks, liquidity access, and user experience.

However, at the execution level, this model still requires coordination between the traditional financial system and on-chain systems, and its operational mechanisms bring noteworthy engineering differences.

1. Execution Detail Differences Due to Batch Settlement Mechanisms

Platforms commonly use net batch settlement methods to execute real stock trades in traditional markets (e.g., Nasdaq, NYSE). While this inherits the deep liquidity of traditional markets, resulting in extremely low slippage for large orders (typically <0.2%), it also means:

1) During non-US market hours, minting and redeeming may experience brief delays;

2) During extreme volatility, the execution price may have minor deviations from the on-chain pricing (due to platform spread or fee buffers).

2. Custody Centralization and Operational Risk

Stocks are centrally held by a few regulated custodians. If a custodian experiences operational errors, bankruptcy, settlement delays, or extreme black swan events, it could theoretically affect token redemption.

Similar issues are common in US stock-focused Perpdex platforms. Unlike the 1:1 peg of spot trading, contract trading faces the following extreme situations during US market closures:

1. Depegging Risk

On normal trading days, contract prices are forcibly pegged to Nasdaq prices via funding rates and oracles. Once non-trading days begin, external real-world prices are static, and on-chain prices are driven entirely by crypto market capital. If the crypto market experiences剧烈 volatility or large sell-offs during this time, on-chain prices can rapidly deviate.

2. Poor Liquidity Leading to Susceptibility to Manipulation

Open Interest (OI) and depth are often thin during non-trading days. Large players can manipulate prices with high-leverage orders, triggering cascading liquidations. This is similar to pre-market contracts, akin to situations seen with $MMT and $MON, where when investor expectations are highly aligned (e.g., collective hedging/shorting), large players can violently pump prices to trigger cascading liquidations.

03 Three Major Tracks for On-Chain US Stocks: Spot, Contracts, and Pre-IPO

For most investors, the most critical question is: Among the diverse crypto ecosystem, which projects have already turned this vision into tangible reality?

The current tokenization market is no longer a single experimental field but has evolved into three mature tracks: Spot, Contracts, and Pre-IPO. Below is a map of the most noteworthy projects in the current market and their core progress:

1. Spot

(1) Ondo @OndoFinance (Official XHunt Rank: 1294)

Ondo Finance is a leading RWA tokenization platform focused on bringing traditional financial assets onto the blockchain. In September 2025, it launched Ondo Global Markets, offering 100+ tokenized US stocks and ETFs (for non-US investors), supporting 24/7 trading, instant settlement, and DeFi integration (e.g., collateralized lending).

The platform has expanded to Ethereum, BNB Chain, and plans to launch on Solana in early 2026, supporting over 1,000 assets. TVL has grown rapidly, exceeding hundreds of millions of USD by the end of 2025, making it one of the largest platforms in the tokenized stock space.

Ondo has raised over hundreds of millions USD cumulatively (including early rounds). While there were no new major public fundraises in 2025, TVL surged from hundreds of millions at the start of the year to over $1 billion by year-end, with strong institutional support (e.g., partnerships with Alpaca, Chainlink).

On November 25, 2025, Ondo Global Markets was officially integrated into the Binance Wallet, directly listed in the app's "Markets > Stocks" section with 100+ tokenized US stocks. This deep collaboration with the Binance ecosystem allows users to trade on-chain (e.g., Apple, Tesla) without additional brokerage accounts and supports DeFi use cases (e.g., collateralized lending).

Ondo has become the world's largest tokenized securities platform, with TVL exceeding $1 billion by year-end, directly challenging traditional brokers.

(2) Robinhood @RobinhoodApp (Official XHunt Rank: 1218)

Traditional brokerage giant Robinhood is breaking down financial barriers through blockchain technology, bringing US stock trading into the DeFi ecosystem. In the EU market, it offers tokenized stocks as derivatives built under MiFID II regulations, operating as an efficient "internal ledger."

In June 2025, it officially launched Arbitrum-based tokenized stock and ETF products for EU users, covering over 200 US stocks, supporting 24/5 trading on weekdays with zero commission. Future plans include launching its own Layer 2 chain "Robinhood Chain" and migrating assets to it.

Driven by innovations like prediction markets, crypto business expansion, and stock tokenization, $HOOD stock price surged over 220% cumulatively in 2025, becoming one of the best-performing stocks in the S&P 500.

(3) xStocks @xStocksFi (Official XHunt Rank: 4034)

xStocks is the core product of Swiss-compliant issuer Backed Finance, issuing tokens 1:1 backed by custodied real US stocks (60+ types, including Apple, Tesla, NVIDIA). Primarily traded on Kraken, Bybit, Binance, etc., supporting leverage and DeFi use (e.g., collateral). Emphasizes EU regulatory compliance and high liquidity.

Backed Finance raised several million USD in early funding, with no new public rounds in 2025, but product trading volume exceeded $300 million, with strong partnership expansion.

Large-scale launches on Solana/BNB Chain/Tron in H1 2025 led to激增 cumulative trading volume; considered the most mature custody model, with future plans for more ETFs and institutional-level expansion.

(Source: Dune)

2. Contracts

Unlike the spot model, the contract track for tokenized stocks does not require 1:1 physical custody of the underlying asset. Its core logic is: relying on oracles to fetch real-time成交 prices from exchanges like Nasdaq and using them as the mark price for the on-chain protocol. During non-trading hours, contract prices are driven by on-chain market liquidity, similar to after-hours trading.

(1) @StableStock @StableStock (Official XHunt Rank: 13,550)

StableStock is a crypto-friendly neobroker supported by YZi Labs, MPCi, and Vertex Ventures, committed to providing borderless access to financial markets for global users through stablecoins.

StableStock deeply integrates licensed brokerage systems with a stablecoin-native crypto financial architecture, enabling users to directly trade real stocks and other assets using stablecoins without relying on traditional banking systems, significantly lowering the barriers and friction of cross-border finance. Its long-term goal is to build a global trading system centered on stablecoins, serving as an entry layer for tokenized stocks and broader real-world assets. This vision is gradually materializing through specific product forms.

It publicly launched its core brokerage product StableBroker in August 2025 and partnered with Native in October to launch 24/7 tradable tokenized stocks on BNB Chain. The platform currently supports over 300 US stock tickers and ETFs, with active users in the thousands. Daily US stock spot trading volume approaches one million USD, with asset规模 and various metrics持续 growing.

(2) Aster @Aster_DEX (Official XHunt Rank: 976)

Aster is a next-generation multi-chain perpetual contract DEX (formed from the merger of Astherus and APX Finance), supporting stock perps (including US stocks like AAPL, TSLA), leverage up to 1001x, hidden orders, yield staking. Cross-chain on BNB Chain, Solana, Ethereum, etc., emphasizing high performance and institutional-grade experience.

Seed round led by YZi Labs. After its TGE in 2025, $ASTER market cap peaked over $7 billion.

Trading volume exploded post-TGE in September 2025, with cumulative annual volume exceeding $500 billion; launched stock perps, mobile App, and Aster Chain Beta; users exceeded 2 million, TVL surpassed $400 million by end of 2025, becoming the second-largest perps DEX platform.

Notably: CZ publicly stated he bought $ASTER tokens on the secondary market, highlighting Aster's strategic position on BNB Chain.

3. Pre-IPO

The Hyperliquid team did not directly develop a stock-on-chain product. Instead, through the HIP-3 protocol, it completely decentralized asset issuance rights, attracting third-party projects like Trade.xyz and Ventuals to autonomously build Pre-IPO trading markets within the HL ecosystem.

(1) Trade.xyz @tradexyz (Official XHunt Rank: 3,843)

Trade.xyz is an emerging Pre-IPO tokenization platform focusing on unicorn company equity (e.g., SpaceX, OpenAI), issuing tokens via SPV custody of real shares, supporting on-chain trading and redemption. Emphasizes low barriers and liquidity.

No public record of large funding rounds; an early-stage project relying on community and ecosystem growth.

Launched部分 markets on testnet in 2025, integrated perps with Hyperliquid HIP-3; moderate trading volume, plans to expand to more companies and DeFi integration in 2026.

(2) Vent