With the liquidity crisis resolved, BTC has entered a weak equilibrium, and the return of active buying power is key to breaking the deadlock (December 1st to December 7th).

- 核心观点:BTC短期企稳但中期仍面临牛转熊风险。

- 关键要素:

- 超34%链上BTC亏损,ETF资金持续净流出。

- 宏观流动性拐点初现,但市场主动买力不足。

- EMC周期指标显示已进入“下行期”(熊市)。

- 市场影响:市场情绪谨慎,需宏观流动性或新配置热情驱动反弹。

- 时效性标注:中期影响。

The information, opinions, and judgments regarding markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice.

Amid the liquidity crisis and the "cyclical curse," BTC, after experiencing a tumultuous November, found a brief respite in December.

On the one hand, with the probability of a December rate cut returning to over 80%, the Federal Reserve halted QT and began releasing liquidity into the market in small amounts, and the Treasury's TGA account also began disbursement; on the other hand, panic selling and large-scale losses have come to an end. While panic selling pressure has decreased, the BTC price remains stagnant due to weak buying power.

More than 34% of on-chain BTC is in a loss-making state. DAT leader Strategy has reduced its purchases and signaled to the market that it is entering a defensive state. BTC ETF channel funds are still in a high-beta asset aversion period, with outflows exceeding inflows.

This week's economic and employment data maintained the baseline scenario of a "soft landing" for the US economy, transitioning from "overheating" to a "moderate slowdown." Although Nvidia's stock price remains significantly below its previous high, the three major stock indexes continue their upward recovery, approaching their previous highs.

The short-term macro liquidity inflection point has emerged. After the Fed cuts interest rates by 25 basis points next week, whether the Fed’s routine meeting releases a “dovish” or “hawkish” signal will have a significant impact on short-term market volatility, but the medium-term outlook remains stable.

In addition, the Bank of Japan is highly likely to raise interest rates in December, which will also have some impact on the US stock market, but the impact will not be comparable to the Carry Trade shock in 2024.

The situation is even more dire for the crypto market, which suffers from a severe lack of intrinsic value accumulation. While the long-term trend of increased asset allocation remains, short- to medium-term sentiment has already subsided. Greater macro liquidity or a surge in new allocation enthusiasm is needed to attract more capital inflows to absorb the selling pressure generated by long-term investors locking in profits.

The current balance is more of a respite after the impulsive sell-off. Until we see a further reversal in the buying and selling trends, we maintain our assessment that the probability of a "bull-to-bear" market shift is greater than a "mid-term correction."

Policy, macro-financial and economic data

The first major data release since the US government shutdown ended—the September PCE data—was released late on Friday.

Core PCE rose 2.8% year-on-year, slightly below the expected 2.9%, while nominal PCE remained in the 2.7%-2.8% range, reinforcing the narrative of "inflation slowly declining but still above the 2% target." Because October PCE data is permanently unavailable, and November data will not be released until after the Fed's December policy meeting, September PCE data becomes the only reference point before the December 10th policy meeting. The lower-than-expected inflation data strengthens expectations of a December rate cut, and even continued rate cuts until 2026.

On the employment front, the ADP report showed that U.S. private sector employment fell by 32,000 in November, a stark contrast to the previous month's (October) figure, which was revised upwards from +47,000. The market had previously expected a slight increase of around 10,000. Structurally, certain high-discretionary consumer sectors within the service sector significantly dragged down employment, consistent with the market's assessment that "marginal demand is slowing, but has not yet fully collapsed." For the FOMC, this signals a "cooling of employment rather than an out-of-control deterioration"—strengthening the case for interest rate cuts, but insufficient to justify aggressive easing.

Initial jobless claims fell to 191,000 this week, the lowest level since September 2022, but continuing claims rose to 1.94 million, a slow increase. Businesses are increasingly inclined to "hire fewer people and control new job openings" (long-term hawkish), but there have been no large-scale layoffs; the overall situation is a slow cooling-off phase of "no layoffs, no hiring" (short-term systemic risks are manageable). This also supports interest rate cuts, but there is no need for aggressive easing.

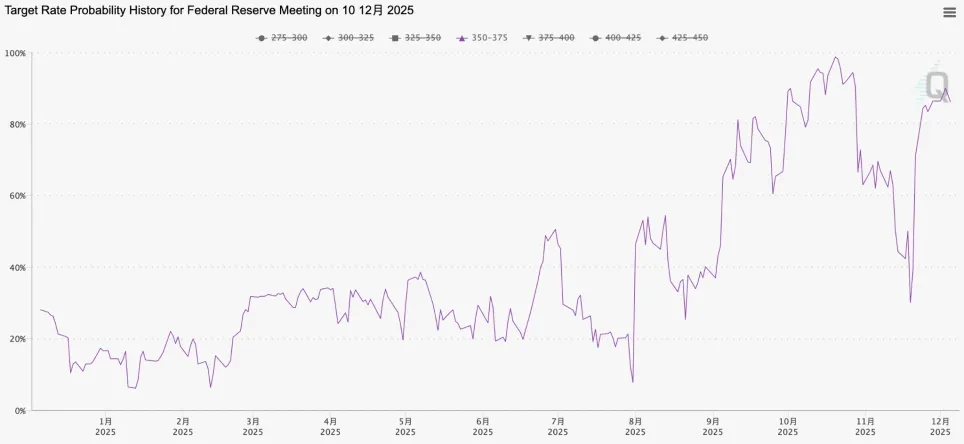

FedWatch Tool: Change in Probability of a 25 Basis Point Rate Cut in December

After a month of rollercoaster trading, based on economic and employment data and statements from Federal Reserve officials, the market widely expects the Fed to cut interest rates by 25 basis points at the FOMC meeting on December 10th. The impact on the market will primarily be reflected in the subsequent dovish/hawkish statements. If the guidance is dovish, it will provide an upward boost to high-beta assets like the Nasdaq and Bitcoin. If the guidance is hawkish, significantly downplaying expectations of further easing, then the current pricing of risk assets based on "continuous rate cuts + soft landing" will need to be adjusted downwards. The impact on Bitcoin, which already has a high leverage structure and a high proportion of unrealized losses, is likely to be significantly greater than on traditional assets.

Crypto Market

This week, BTC opened at $90,364.00 and closed at $94,181.41, up 0.04% for the week, with a volatility of 11.49%, and trading volume was the same as last week.

BTC daily chart

Based on the "EMC Labs BTC Cycle Analysis Model", we believe that the main reason for this round of BTC adjustment is the exhaustion of short-term liquidity + fluctuations in medium-term liquidity expectations, coupled with long-term selling driven by cyclical patterns.

On November 21st, following Federal Reserve Chairman John Williams' statement that "there is room for further interest rate cuts in the near term," US stocks and Bitcoin rebounded from their lows. Subsequently, the three major US stock indices gradually recovered their losses, approaching their previous historical highs. However, after rebounding 4.1% last week, Bitcoin lost momentum again and entered a period of fluctuation. The fundamental reason lies in the continued extreme shortage of liquidity, and the failure of both buyers and sellers to truly reverse their behavior.

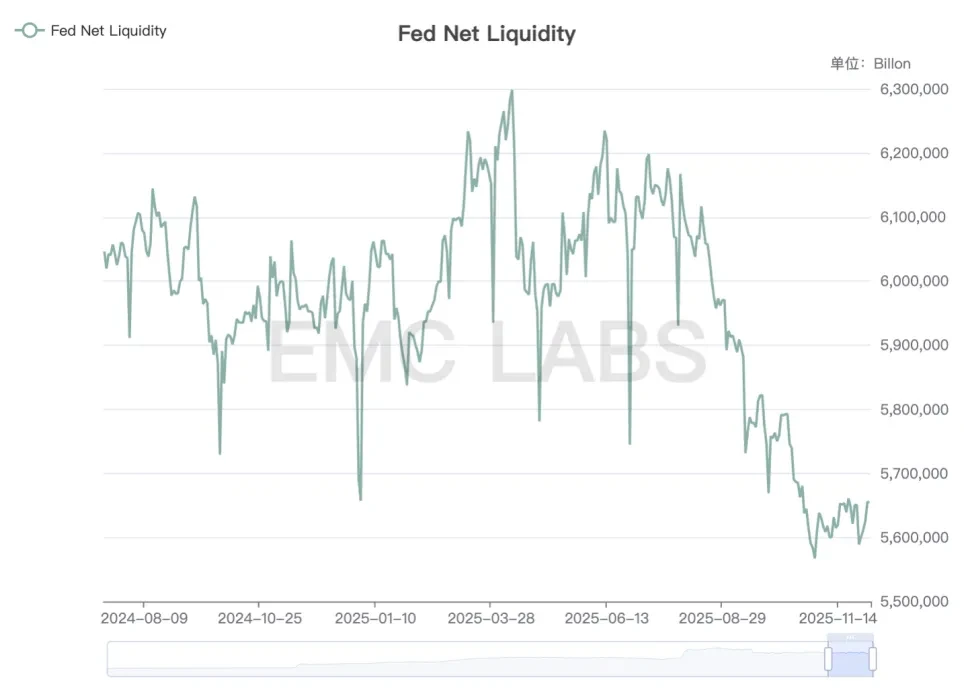

On December 1st, the Federal Reserve suspended QT and provided approximately $16.5 billion in short-term liquidity through temporary repurchase agreements (Repo). The U.S. Treasury conducted two U.S. Treasury repurchase operations, totaling $14.5 billion. This slightly alleviated short-term market liquidity, but was insufficient to promote inflows into high-beta assets like BTC.

FedNet Liquidity

While the Fed Net Liquidity index has rebounded somewhat, it remains at a low level, and its suppression of high-beta assets has not fundamentally improved.

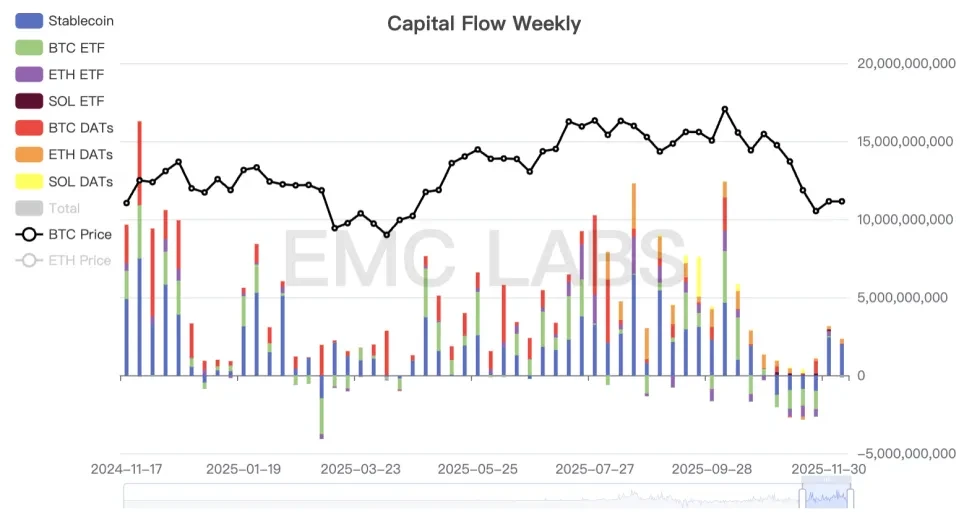

In terms of funding, the overall cryptocurrency market has shifted from outflows to inflows over the past two weeks, with $3.146 billion flowing in last week and $2.198 billion this week. This is the fundamental reason why BTC has been able to shift from a downward trend to a sideways movement.

Crypto Market Fund Inflows and Outflows Statistics (Weekly)

However, looking specifically at the BTC ETF channel, which plays a greater role in BTC pricing, we can see that it still recorded an outflow of $0.84 billion this week.

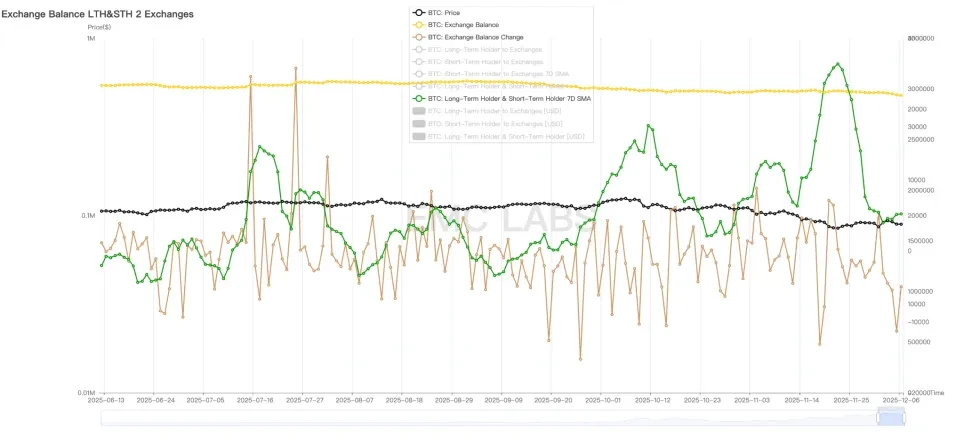

On the selling front, the scale of both long and short position selling has decreased rapidly, but long position selling is still ongoing this week. This indicates that although the phase of clearing is nearing its end, long position profit-taking selling has not stopped under the "curse of cyclical laws".

Long and short position selling and CEX inventory statistics

The pause in long-term selling may offer a possibility for a market rebound. Looking at on-chain data from the past two weeks alone, passive buying pressure remains, with over 40,000 BTC transferred out of exchanges. This ebb and flow of selling and buying power provides a possibility for market stabilization and a rebound. However, a true market turnaround requires the return of active buying power. This necessitates a substantial improvement in macro liquidity and a genuine recovery in demand for BTC.

One piece of good news in this regard is that in November, Texas made its first purchase of about $5 million worth of BTC ETF products through spot ETFs to replenish its BTC reserves. Although this is not enough to offset ETF redemptions, it has a positive demonstration effect on market sentiment.

Cyclical Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is 0, indicating that it has entered a "downtrend" (bear market).

about Us

EMC Labs was founded in April 2023 by crypto asset investors and data scientists. Focusing on blockchain industry research and Crypto secondary market investment, EMC Labs leverages industry foresight, insights, and data mining as its core competencies. It is committed to participating in the booming blockchain industry through research and investment, driving the benefits of blockchain and crypto assets to humanity.

For more information, please visit: https://www.emc.fund