Ethereum's "second-level" evolution: From fast confirmation to settlement compression, how does Interop eliminate waiting time?

- 核心观点:以太坊Interop路线图旨在通过系统性重构实现秒级跨链。

- 关键要素:

- 快速确认规则:15-30秒内提供协议级强确认信号。

- 缩短L1 Slot时间:目标从12秒压缩至6秒,加速共识。

- 缩短L2结算周期:优化挑战期,结合经济模型保障安全。

- 市场影响:极大提升跨链效率与资金利用率,降低用户成本。

- 时效性标注:中期影响

If you frequently cross-chain between Base, Arbitrum, or Optimism, you've probably experienced a subtle sense of "disconnection."

While a single L2 transaction yields results almost instantly, transferring assets from chain A to chain B often requires several minutes or even longer. This isn't because L2 itself is slow, but because in traditional processes, a transaction involving cross-layers and cross-chains must follow a lengthy and rigorous path:

The L2 sorter sorts the data, which is then submitted to L1. L1 reaches consensus and finalizes the data. In short, under the current Ethereum architecture, the finalization of L1 usually takes two epochs (about 13 minutes). This is undoubtedly necessary for security, but it is too slow for interoperability.

After all, if Ethereum's grand vision is to have hundreds or thousands of L2 instances in the future, they should not be isolated execution islands, but should work together as a whole. The key question is whether this waiting time can be shortened as much as possible.

It is against this backdrop that the Ethereum Interop roadmap, in its Acceleration phase, explicitly proposed three highly coordinated improvement directions: Fast L1 Confirmation Rule, Shorter L1 Slots, and Shorter L2 Settlement.

This is not a piecemeal optimization, but a systemic restructuring centered around "confirmation, rhythm, and settlement".

I. Quick Confirmation Rule: Before determining the finality, provide the system with a "credible answer".

As is well known, under the current Ethereum architecture, the block interval on the mainnet is about 12 seconds. Validators vote on the current chain state in each slot, while finality is delayed after several slots.

In short, even if a transaction has been packaged into a block, the system still needs to wait a considerable amount of time to be certain that it will not be reorganized or rolled back. Currently, it takes about two epochs (approximately 13 minutes) before a transaction is finally considered unrollable, which is undoubtedly too long for most on-chain financial scenarios.

Before finality arrives, can we provide applications and cross-chain systems with a confirmation signal that is "fast enough and reliable enough"? This is what Ethereum's Project #4, Fast L1 Confirmation Rule, explicitly outlined in the Interop roadmap, aims to do.

Its core objective is very straightforward: to enable applications and cross-chain systems to obtain a "strong and verifiable" L1 confirmation signal within 15–30 seconds, without having to wait the 13 minutes required for full finality.

From a mechanistic perspective, the fast confirmation rule does not introduce a new consensus process, but rather reuses the attester voting that occurs in every slot of the Ethereum PoS system. When a block has accumulated enough validator votes in an early slot, it can be considered "extremely unlikely to be rolled back under a reasonable attack model" even if it has not yet entered the final confirmation stage.

In short, this level of confirmation does not replace finality, but rather provides a strong confirmation that is explicitly acknowledged by the protocol before finality. This is especially crucial for Interop: cross-chain systems, Intent Solvers, and wallets no longer need to wait blindly for finality, but can safely advance the next step of logic within 15–30 seconds based on protocol-level confirmation signals.

Currently, preconfirmation, which is being heavily promoted by Based Rollup narratives, plays an important transitional role in this direction at this stage. Its logic is very simple, just as the name suggests. Imagine this:

When we buy train tickets on 12306, once we select our itinerary and place an order (signing the transaction), the booking system will first provide a pre-confirmation message, informing you that the purchase (corresponding to each transaction) has been accepted and is entering the subsequent confirmation process. At this time, we can start planning our itinerary, preparing our luggage, etc. Only when the ticket is finally confirmed with the carriage and seat (the transaction is released to L1) can we officially complete the ticket purchase and seat reservation transaction.

In short, in Based Rollup, pre-confirmation means promising to include a transaction in a block before it is formally submitted to L1 for confirmation. This is equivalent to giving the user an initial confirmation signal, letting the user know that the transaction has been accepted and is being processed.

"I'll give you a strong verbal commitment first, and the final confirmation will be made later." Through this layered confirmation logic, the Ethereum Interop roadmap actually finely distinguishes different levels of trust between "security" and "speed," creating a smoother interoperability experience.

II. Shortening L1 Slots: Accelerating Ethereum's "Heartbeat" Cycle

Accompanying this "logical restructuring at the consensus level" of the fast confirmation rule is a more fundamental and physically significant change—shortening the size of the slot.

If rapid confirmation is like "signing an IOU" before reaching a final consensus, then shortening the L1 Slot time is like directly shortening the ledger's "settlement cycle." In the Interop roadmap, Project #5's phased goal is very clear: to reduce the Ethereum mainnet's Slot time from the current 12 seconds to 6 seconds.

This seemingly simple "halving" will actually trigger a chain reaction throughout the entire chain. This is easy to understand: the shorter the slot, the faster the transaction is included in the block, distributed for verification, and observed for confirmation, resulting in lower latency at the overall protocol layer.

The impact on the user's real-world experience is also very direct, including faster confirmation of L1 interactions (such as ETH transfers), a more compact pace of L2 state submissions to L1, and even shorter slots combined with fast confirmation rules, which basically form "near-real-time on-chain feedback". This also means that DApps, wallets and cross-chain protocols in the ecosystem can better build a "second-level confirmation experience".

For cross-chain interoperability protocols, the reduction in time also means a leap in capital utilization. Currently, cross-chain bridges or market makers must bear the risk of "funds in transit" for several minutes or even longer when handling asset transfers between different chains. To hedge against the volatility risk during this period, they have to charge higher transaction fees.

When L1 settlement cycles shorten and cash flow doubles, this capital tied up in transit will be significantly reduced. The results are obvious: lower transaction costs, lower user fees, and shorter settlement delays will greatly incentivize developers and users to return to the secure L1 settlement layer, rather than relying on vulnerable third-party relays.

Of course, doubling the "heartbeat" frequency is no easy feat. Multiple working groups within the Ethereum Foundation are simultaneously advancing this complex project:

- Network Analysis: The research team (including researchers such as Maria Silva) is conducting rigorous data analysis to ensure that shorter slots do not lead to severe reorg risks due to network latency, or put centralized pressure on home nodes with poor bandwidth;

- Client-side implementation: This involves a comprehensive underlying refactoring of both the consensus and execution layers. It's worth noting that this work is independent of EIP-7732 (native staker-builder separation ePBS), meaning that the heartbeat acceleration program can proceed independently regardless of the progress of ePBS.

Overall, when the 6-second slot is combined with the fast confirmation rule, Ethereum is expected to truly have "near-real-time on-chain feedback," enabling dApps and wallets in the ecosystem to build an unprecedented second-level confirmation experience.

III. Shorten the L2 settlement cycle: Enable assets to be "withdrawn immediately".

In the Interop roadmap, Project #6: Shorter L2 Settlement is the most controversial, but also the most imaginative.

In the current architecture, Optimistic Rollups typically rely on a challenge period of up to 7 days, and even ZK Rollups are limited by the pace of proof generation and verification. Realistically speaking, this design is impeccable in terms of security, but it brings a real problem at the interoperability level:

Assets and states are "time-locked" between chains. This not only increases cross-chain costs but also significantly increases the rebalancing burden on the Solver, ultimately reflected in higher user fees. Therefore, shortening the settlement cycle is considered one of the key levers for Interop's scalable deployment. Current major engineering directions include (further reading: " ZK Route 'Dawn': Is the Ethereum Endgame Roadmap Accelerating? "):

- ZK Real-Time Proofs: With the maturity of hardware acceleration and recursive proofs, proof generation time is being compressed from minutes to seconds.

- Faster settlement mechanisms: for example, introducing a secure 2-out-of-3 settlement model;

- Shared settlement layer: Enables multiple L2 transactions to complete state changes under a unified settlement semantics, instead of "withdrawal - waiting - deposit";

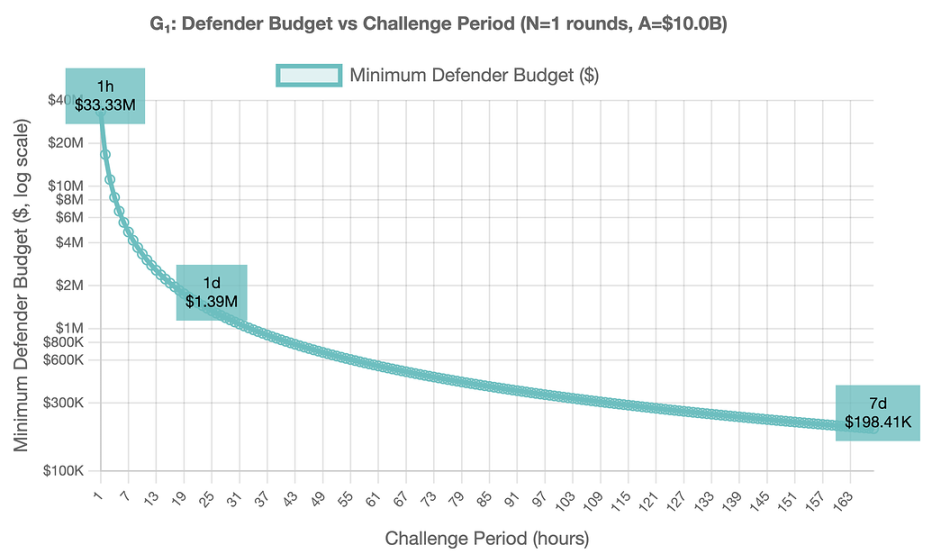

Of course, a core question that cannot be avoided in the Interop discussion is whether compressing the settlement challenge period from the traditional 7 days to 1 hour in order to achieve faster cross-chain confirmation will leave room for attackers to do evil.

Theoretically speaking, the concerns here are not unfounded. Unlike "strong censorship" (verifiers collectively committing evil), what is more alarming in reality is this kind of soft censorship attack led by the block builder: the attacker does not need to control the consensus, but only needs to continuously suppress the defender in bidding, preventing key transactions from being recorded on the chain.

Interestingly, the only systematic economic analysis of this scenario to date comes from Offchain Labs' paper "Economic Censorship Games in Fraud Proofs," published in February 2025. This paper constructs three models, ranging from the most pessimistic to relatively optimistic, assuming the following:

- G¹ model: The content of a block is entirely determined by the highest bidder;

- G¹ₖ Model: Some validators always build blocks locally;

- Gᵐ Model: Multiple validators jointly decide the block content, and only one party needs to choose the defender transaction.

In real-world engineering, since verifiers may choose to miss slots, some designs may even degenerate into the more pessimistic G¹ case. Therefore, this paper chooses to start the analysis from the worst case.

Based on this premise, researchers have proposed a defense approach with great practical significance—a "small investment, big return" time-delay defense mechanism. Its core logic is that the defender has the right to "delay with one click," meaning that the defender does not need to complete all the complex error checking processes in a short period of time, but only needs to successfully submit a key transaction.

The purpose of this crucial transaction is very clear: once it's recorded on the blockchain, it automatically extends the challenge period from 1 hour back to the traditional 7 days. For example, when a defender discovers an anomaly in the L2 state, they don't need to complete all the complex error-checking processes within 1 hour. They only need to successfully submit a special transaction to L1. This transaction is like sounding an air raid siren, instantly extending the challenge period back to the traditional 7 days.

This also means that attackers will be forced into a highly asymmetric war of attrition. In order to prevent the transaction from being recorded on the blockchain, attackers must continuously pay a higher priority fee than defenders in each block, and this confrontation needs to be maintained throughout the entire challenge period.

The paper presents very intuitive quantitative results. According to the calculations, if a powerful attacker were prepared to spend $10 billion on a persistent censorship attack, then:

- During the one-hour window, the defender only needs a $33 million gas budget to launch a counterattack;

- If the delay mechanism is successfully triggered, extending the challenge period to 7 days, the cost of the defender's counterattack could even plummet to around $200,000.

In other words, this is a crucial structural advantage: the cost to the attacker is linearly cumulative, while the defender only needs to complete one successful on-chain operation.

It is this stark difference in the cost to attack versus cost to defend that ensures Ethereum remains robust in terms of economic security, even with a significantly compressed settlement cycle.

This is also crucial for Interop, as rapid confirmation and shorter settlement cycles do not necessarily come at the expense of security. It also means that, under a reasonable institutional design, second-level cross-chain and economic security can coexist, at least providing Interop with the most solid underlying confidence to achieve second-level cross-chain.

In conclusion

Some people might wonder, why bother optimizing a few seconds or minutes of latency?

In the geeky era of Web3, we became accustomed to waiting, even believing that "waiting" was a necessary premium to pay for decentralization. However, as Web3 moves towards the masses, users should not, and need not, care about which chain they are operating on, let alone calculate the finality logic of L1.

Rapid confirmation, a 6-second heartbeat, and asymmetric defense mechanisms are essentially doing one thing—erasing the variable of "time" from the user's perception.

As I've been saying before: the best form of technology is one that allows complexity to completely disappear in the process of rapid confirmation.