A Cruel Coming-of-Age Ceremony in the Crypto World: A Review of the Crypto Index in 2024-2025

- 核心观点:加密市场正经历结构性分化,资金向合规资产集中。

- 关键要素:

- BTC/ETH ETF确立资产边界,资金难溢出至山寨币。

- VC币(如Layer2)因供给过剩和流动性枯竭大幅下跌。

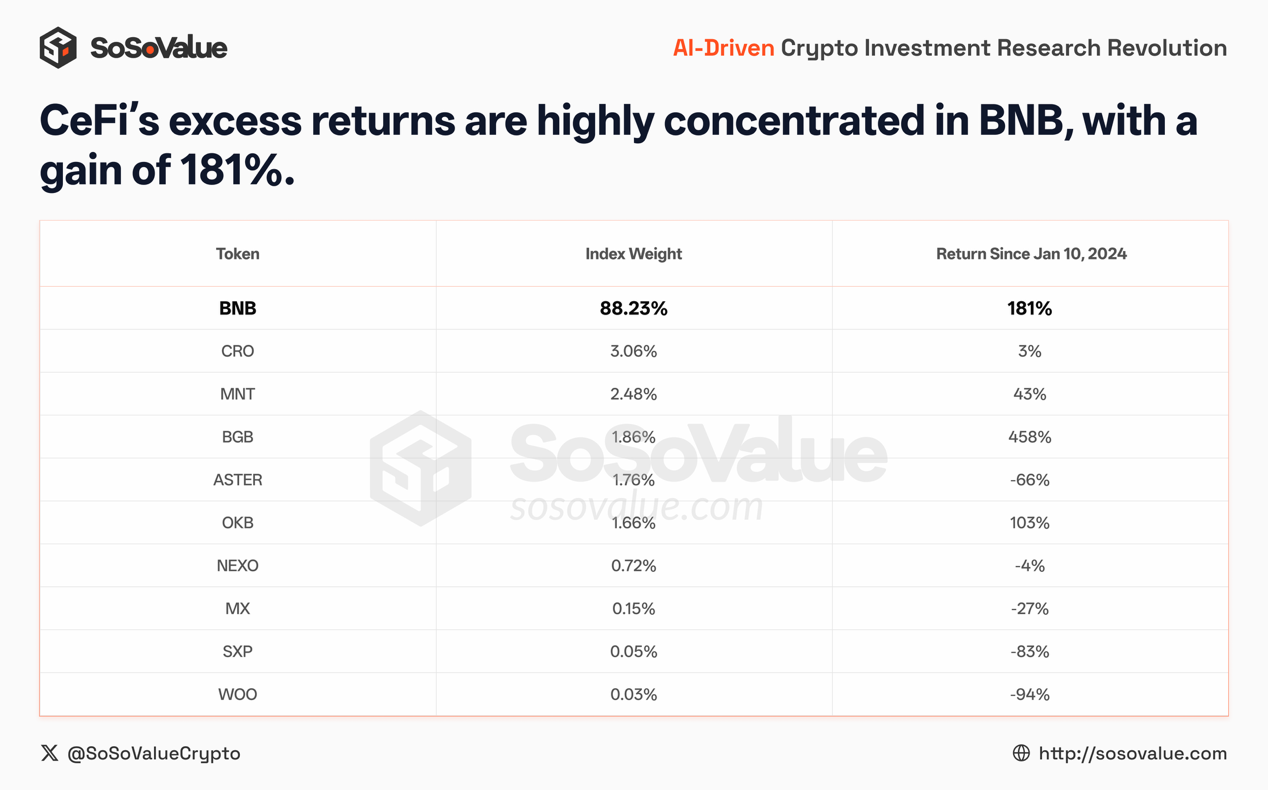

- CeFi指数暴涨,但收益高度集中于BNB等垄断巨头。

- 市场影响:行业加速去伪存真,投机叙事失效,合规与实用价值凸显。

- 时效性标注:长期影响

Original author: SoSoValue Research

The winter of 2025 will be colder than usual, not just in terms of temperature, but also in terms of the perceived temperature drop in the crypto market.

If you only look at the news, it's a hot topic: Bitcoin is hitting new highs with Wall Street's support, ETF size is soaring, regulatory trends in various governments seem to be warming up, and the US president's pardon for CZ even became a hot topic in global political news.

However, when you shift your gaze from Bitcoin to the broader "altcoin heartland," a suffocating silence descends. The unwavering certainty of "getting rich quick just by sitting on the bus" has vanished, replaced by the bewilderment of account balances shrinking in silence.

This is not an ordinary bull-bear cycle, but a belated "coming-of-age ceremony" for the crypto industry. In the long two years from 2024 to 2025, the market underwent a brutal process of weeding out the false and retaining the true: the bubble was burst by the mainstream players, and the old myths of getting rich were completely disproven.

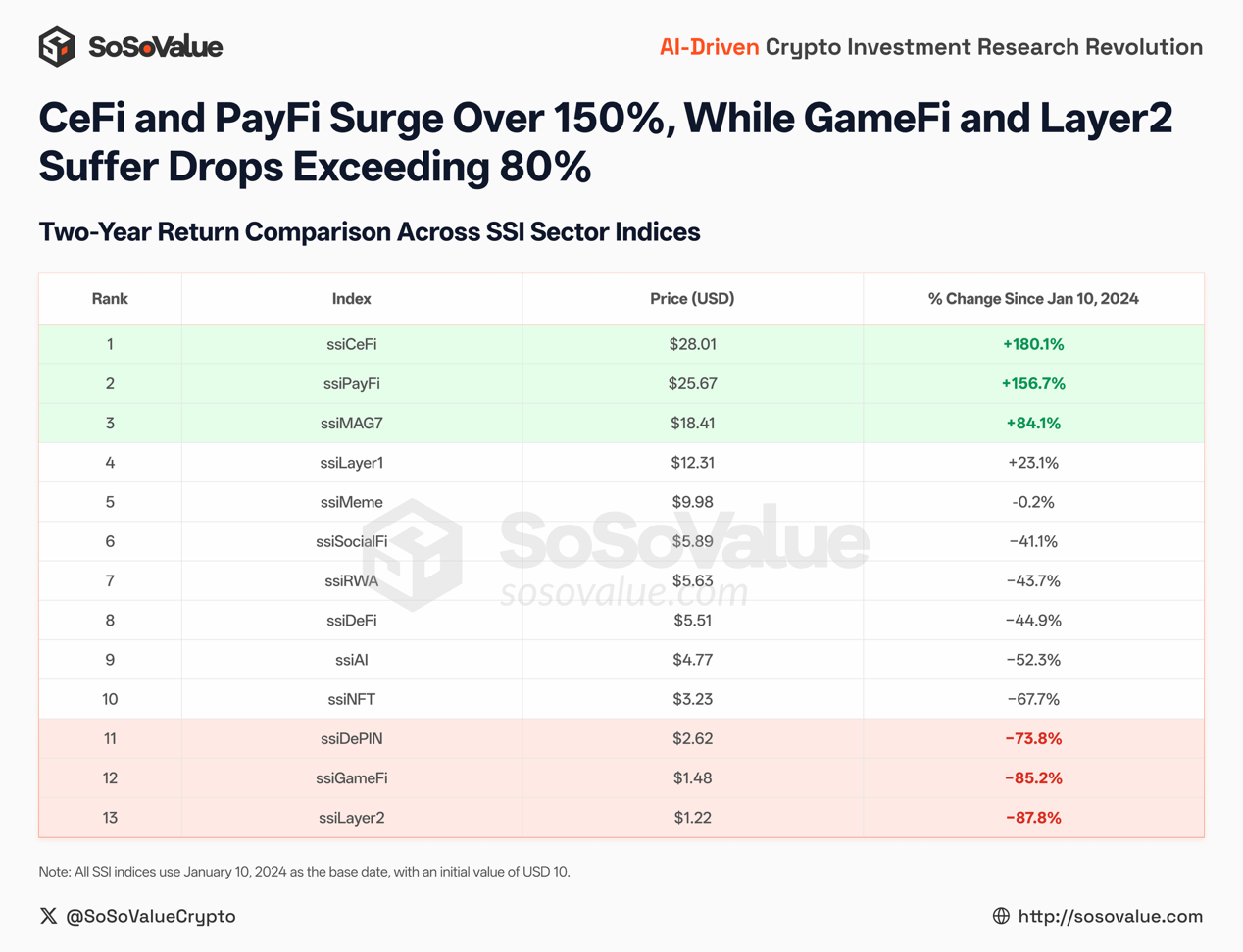

To see the truth, we conducted a simple and direct experiment in early 2024: Suppose you invested $10 in various sectors (L2, Meme, DeFi, etc.) in January 2024, what would happen by the end of 2025?

Two years later, the answer was clear: the same starting point of $10 had become $28 in some cases, while in others it had only become $1.20.

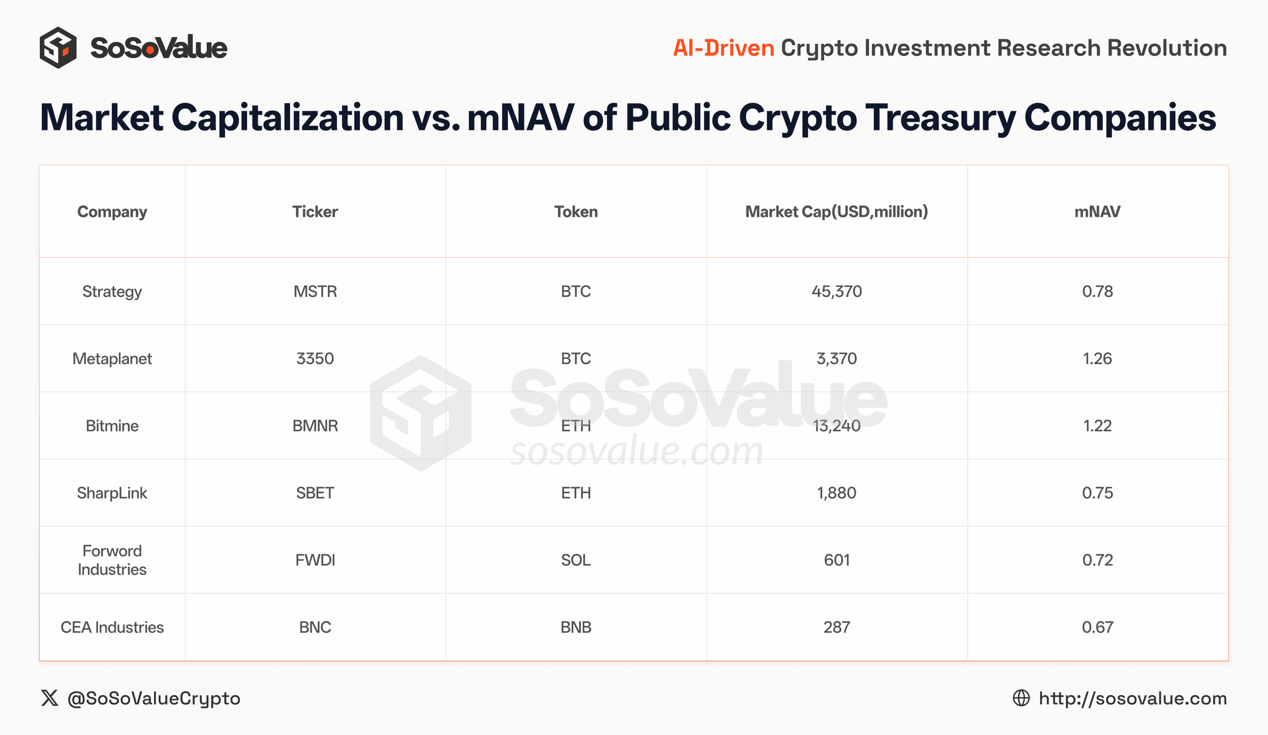

Figure 1: The SSI Crypto Index shows extreme divergence in two-year returns: CeFi and PayFi have risen by over 150%, while GameFi and Layer 2 have retreated by over 80% (Data source: SoSoValue)

Why did this happen? Because once that door opened, the crypto world began to split.

I. The Walls Are Up: The "Asset Boundaries" in the ETF Era

"Capital is no longer a blind flow of water; it is capital strictly constrained by pipelines."

To understand the current market, we must go back to January 10, 2024: On January 10, 2024, the U.S. SEC approved the listing and trading of a spot Bitcoin ETF.

At that moment, the cheers masked a harsh reality: the funds had been "isolated."

Before the ETF era, the flow of funds in the crypto market resembled a downstream waterfall. Funds entered the market through a channel of "fiat currency-stablecoin-exchange," all within the same native crypto account system. When Bitcoin's rise created a "wealth effect," funds could effortlessly flow to the riskier Ethereum, and then spill over into altcoins, forming a classic "sector rotation."

ETFs have altered this transmission chain. Traditional funds can now hold crypto exposure in brokerage accounts, which does indeed correspond to the continuous purchase and custody of spot Bitcoin; however, its trading, risk, and compliance boundaries are encapsulated within the product structure. Funds remain largely within the compliant closed loop of "buy-hold-rebalancing," making it difficult to naturally translate into a demand for redistribution across exchanges, stablecoins, and on-chain risk assets. As a result, Bitcoin has gained more stable marginal buying, while the old cycle of "Bitcoin profits spilling over and driving altcoin season" has clearly failed in this cycle.

1.1 Specialization within the Walls: ETFs Establish a Harsh "Asset Boundary"

The approval of spot BTC ETFs in 2024 signifies the formal entry of traditional financial funds into the crypto market; however, it also establishes a clear "boundary of configurable assets": only a very small number of assets can obtain the pass to enter the wall .

By 2025, the institutionalization of this barrier had been further strengthened. On September 18, 2025, the SEC approved exchanges to adopt the common listing standard of "Commodity-Based Trust Shares" to simplify the listing process for eligible commodity/digital asset ETPs.

Note: This does not mean "all cryptocurrencies can be ETFs," but rather that "categories that can be included in the ETF framework" are defined as financial products that can be standardized and listed—the boundaries are now clearer.

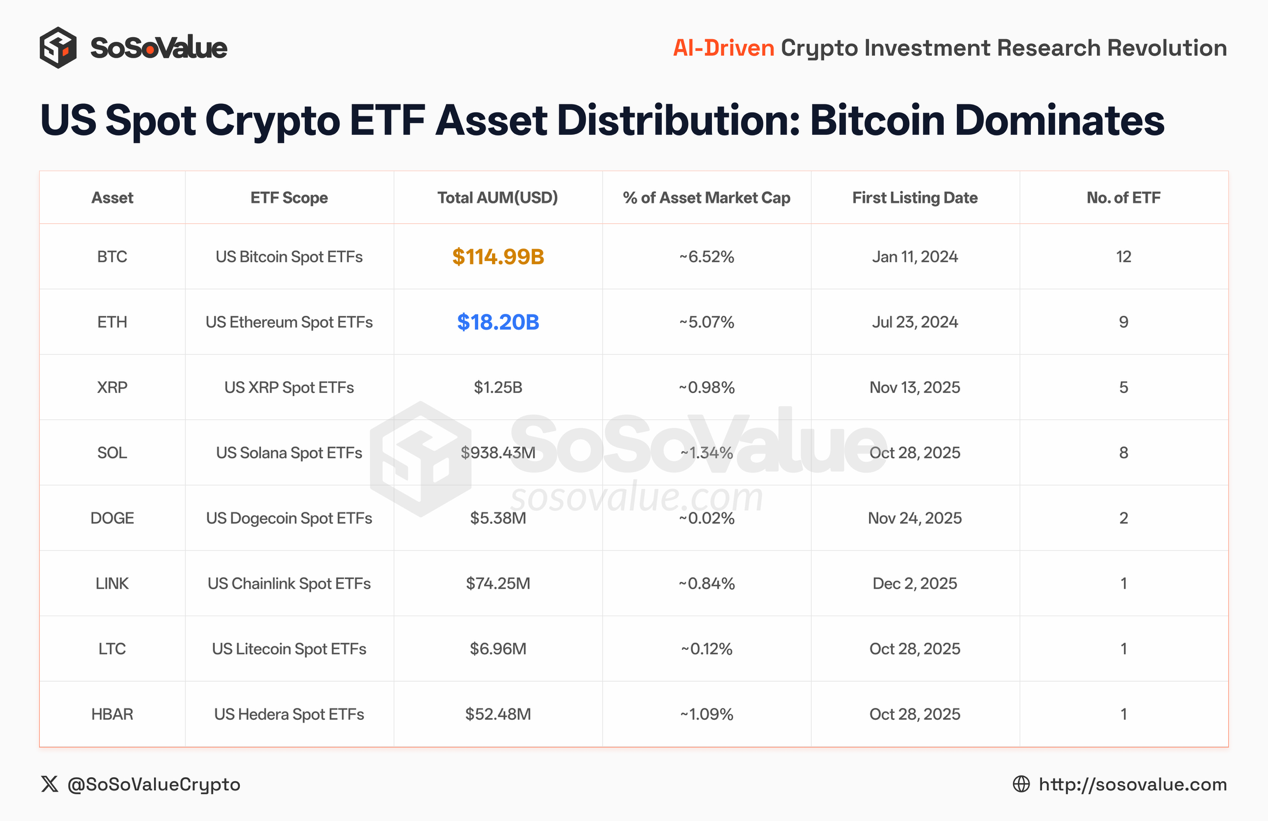

Even after obtaining the necessary permits, the voting by funds is extremely unbalanced: Wall Street money mainly only recognizes BTC, barely allocates to ETH, and mostly holds tentative positions in other assets .

The data displayed on the SoSoValue ETF dashboard precisely reveals this imbalance:

· BTC : With a total net asset value of approximately $115 billion , the ETF has become an absolute "macro asset" in the compliant channel.

• ETH : The total net asset value of the ETF is about $18.2 billion , which is a place for it, but the order of magnitude is significantly smaller.

Even as assets like SOL, XRP, and DOGE gradually enter tradable, compliant containers by 2025, the data remains cold and unresponsive: their entry into the "configurable asset pool" does not automatically equate to a "capital tsunami." The capital logic within the walls is not a "narrative," but rather a "risk weighting."

Figure 2: Clear Compliance Fund Preferences: Bitcoin Dominates, Other Assets Not Received Large-Scale Allocation (US Spot Crypto ETF Asset Distribution, Data Source: SoSoValue)

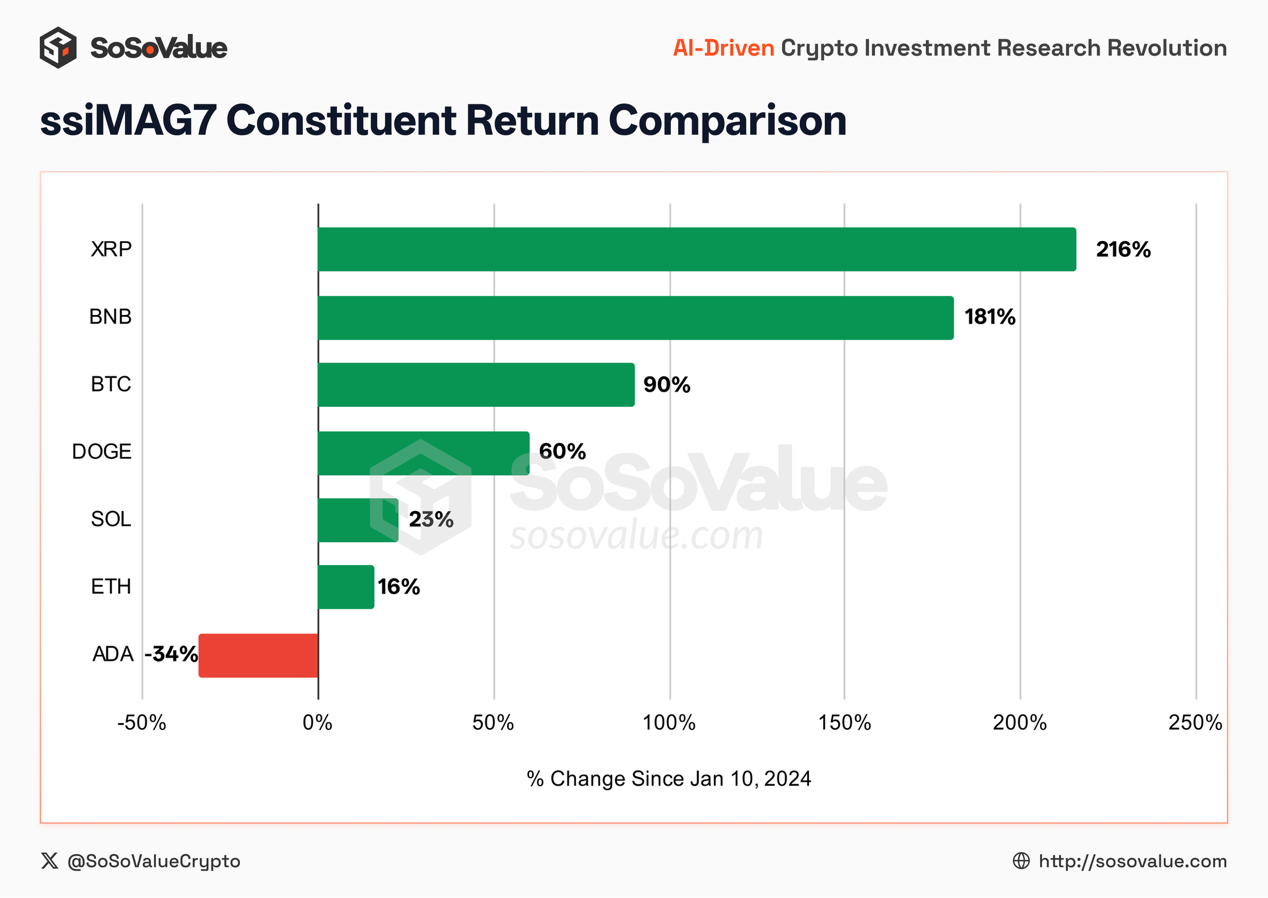

Let's take a closer look at the ssiMAG7 index (the top 7 cryptocurrencies). Although the index closed at $18.4, up 84% , a closer look reveals that it doesn't reflect a broad-based rally, but rather masks a deep structural divergence :

• Specific catalysts drove the market: XRP (+216%) and BNB (+181%) recorded significant excess returns, outperforming BTC (+90%) by a large margin. The former benefited from the elimination of regulatory uncertainty, while the latter relied on the monopoly dividend of market share. These assets with clear "compliance" or "commercial barriers" have become the core driving force for the index's upward movement.

• Market benchmark established (dominated by compliant funds) : BTC (+90%) has acted as a "stabilizing force." As the absolute core of compliant fund allocation, it has established the "passing grade" for this bull market. Although its explosive power is not as strong as XRP/BNB, as the core component accounting for 32% of the index weight, it represents the basic level of the entire market.

• The premium for technology-driven assets has faded : SOL (+23%) and ETH (+16%), once considered the "two giants of public chains," have performed mediocrely over a two-year period, barely outperforming the risk-free rate; the established public chain ADA (-34%) even recorded negative returns.

Figure 3: Extreme divergence in returns among MAG7 components: Compliance and monopoly-advantage assets significantly outperformed, while public chain narratives lost excess returns (Data source: SoSoValue)

This divergence breaks the market convention of "blue-chip stocks rising across the board." This bull market is not a simple beta market, but a brutal "structural screening" : funds are showing extremely high selectivity, concentrating on assets with compliance certainty, market monopoly position or macro attributes, while public chain assets that rely solely on "ecosystem narrative" are losing the support for high valuations .

This is particularly evident in the performance of the ssiLayer1 index ($12.30, up 23%) . Excluding the boost from BNB, ETH, with its weighting of over half, actually dragged down the sector's performance. Data shows that the alpha returns of the infrastructure sector have significantly converged , and the simple logic of "infrastructure expansion" is no longer sufficient to generate excess premiums in the capital market .

This reveals a cold reality: the allocation logic of institutional funds is no longer "sprinkling pepper," but rather exhibits an extreme "selective admission."

Funds within the crypto space also exhibit a high degree of consistency: they heavily invest in core assets with compliance certainty or monopolistic barriers (such as BTC, BNB, and XRP), while maintaining only a "defensive allocation" to public chains that rely solely on "technical narratives" (ETH and SOL). As for those long-tail assets (the vast majority of altcoins outside the Great Firewall) that haven't even obtained this "logical entry ticket," they face a systemic depletion of liquidity .

II. The "Shadow Game" in the US Stock Market: Fire Inside the Wall, Ice Outside the Wall

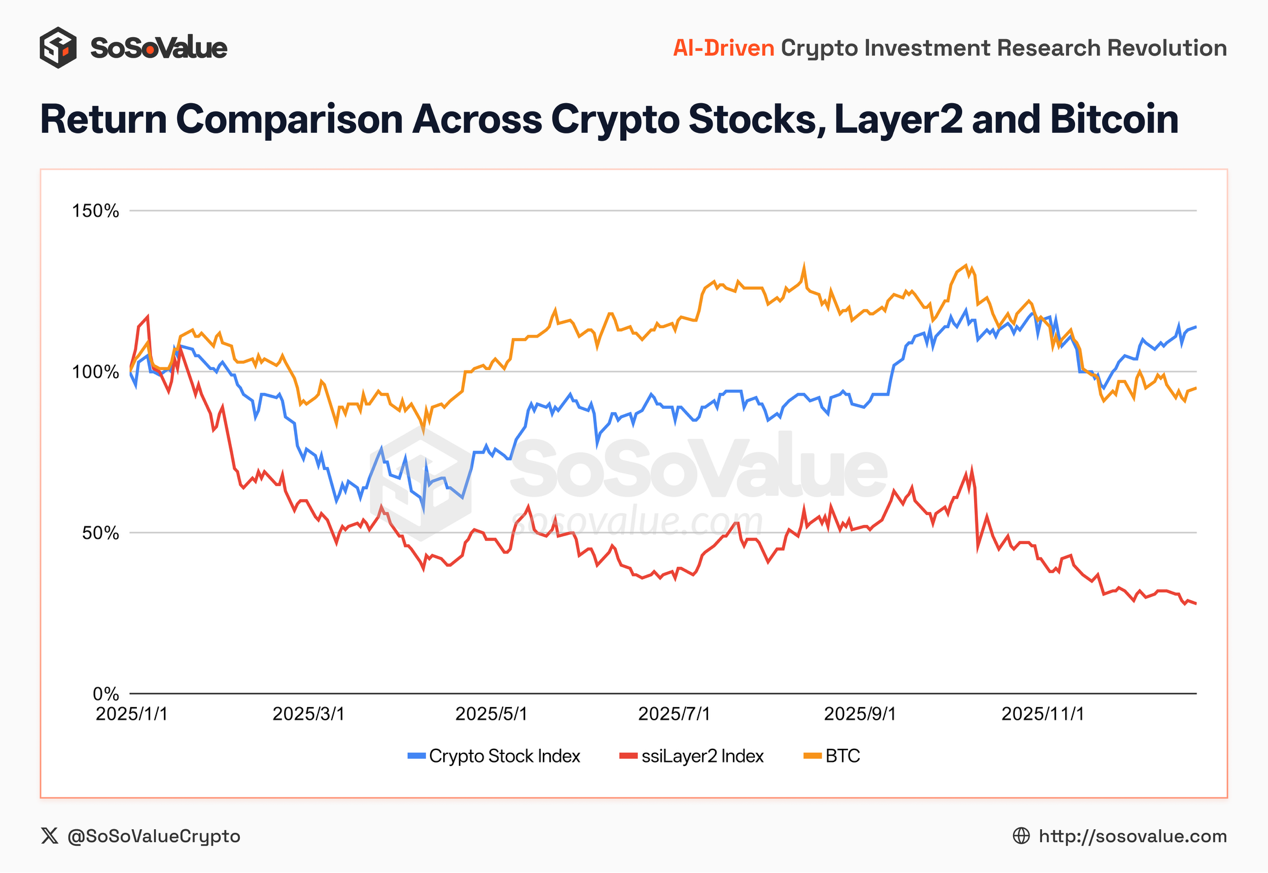

If ETFs have trapped stable, investment-oriented funds, then "crypto stocks" in the US stock market have drained active, risk-seeking funds.

Here's a phenomenon that's incredibly disconcerting for seasoned crypto investors: why is the crypto sector on Nasdaq so hot, while the on-chain world is so cold?

Figure 4: Venture capital moves to US stocks: Crypto stocks rise, while on-chain assets such as Layer 2 continue to lose capital (Data source: SoSoValue)

The answer is the substitution effect: Wall Street has turned "crypto trading" into a "shadow game of code (Ticker)." Funds are speculating within a closed loop of USD → Nasdaq, rather than flowing into the on-chain ecosystem.

2.1 The targeted siphoning of “Digital Asset Treasurys (DATs)”: Only drawing BTC, without spilling over downstream.

Publicly listed companies, exemplified by MicroStrategy (MSTR) , have collectively woven a narrative of "Bitcoinization of the balance sheet." For retail investors, buying MSTR is essentially buying a "leveraged Bitcoin option ." This money does indeed become on-chain purchasing power, but it's an extremely exclusive one. Every penny of MSTR's financing in the US stock market flows precisely into Bitcoin (BTC). This mechanism acts like a giant "one-way pump," continuously driving up Bitcoin's price while completely cutting off any possibility of funds spilling over downstream (L2, DeFi).

Even more brutal is the fate of imitators: when more companies try to replicate the "micro-strategy myth" and put ETH/SOL into their coffers, the US stock market often gives them a cold shoulder: the market votes with its feet to prove that, in Wall Street's eyes, what can be written into the balance sheet as "digital gold" is still mainly BTC and ETH, while most altcoins' DAT is more about announcing a huge financing plan, transferring it from the stock market to the cryptocurrency market, taking advantage of information asymmetry, and having a bunch of KOLs describe the impossible financing amount as an upcoming altcoin buying frenzy, a path to take the opportunity to sell off their holdings.

Figure 5: Market Capitalization vs. mNAV of Listed Crypto Asset Reserve Companies (Data Source: SoSoValue)

2.2 The Compliance Frenzy and the Fall of Circle (CRCL): The Excitement Remains on Nasdaq

Circle's IPO reflects the strong demand from traditional funds for "compliant crypto exposure." Public trading data shows that CRCL reached a high of $298.99 in June 2025, corresponding to a market capitalization of $70.5 billion .

Figure 6: Circle's peak market capitalization exceeded $70 billion at the time of its IPO (Data source: SoSoValue)

This shows that Wall Street is indeed eager for a "compliant stablecoin narrative." However, the subsequent sharp decline (shareholder reduction) and high turnover also indicate that the market is using it as a bargaining chip for US stock speculation, rather than "transferring" this hot money into the on-chain PayFi protocol.

Similarly, Coinbase (COIN) is often given a "scarcity premium" because it is one of the few fully compliant "crypto exposure containers" that can be bought in the US stock market.

Whether it's ETFs or DATs/crypto stocks, they form two huge "breakwaters." Funds flow in a closed loop of USD -> Nasdaq -> BTC .

The hotter the US stock market is, the more intense the one-sided accumulation of BTC becomes, and the more the other ecosystems (Alts) on the chain resemble a forgotten wasteland— people watch the "Bitcoin" big fish revel on the shore, but no one is willing to jump into the water to feed the other small fish.

III. The Collapse of the Old Narrative and the Twilight of "VC Coins"

"When the tide goes out, we find that not only speculators are swimming naked, but also the infrastructure of those grand narratives."

If Nasdaq's "crypto shadow stocks" are enjoying a liquidity feast, then the collapse of the on-chain "infrastructure" sector is a silent disaster caused by a lack of water.

In the past two cycles, the most foolproof business model in the crypto market was " VC backing—technology narrative—high-valuation fundraising—coin issuance on exchanges ." This was also the foundation for the past prosperity of Layer 2, GameFi, and NFTs. However, the SoSoValue SSI index has coldly declared the bankruptcy of this model with a set of data.

3.1 A Naked Humiliation: The Return of Value to Layer 2

Let's first look at a set of alarming data (based on a base of $10 in January 2024):

• SSILayer2 Index: $1.22 (down approximately 87%)

• ssiGameFi Index: $1.47 (down approximately 85%)

• ssiNFT Index: $3.2 (down about 68%).

Figure 7: Layer2, GameFi, and NFT have experienced a 68%–88% pullback over two years, indicating that narrative-driven tracks have collectively failed.

In two years, it has fallen from $10 to $1.20, which means that if you believed the narrative of the "Ethereum Layer 2 network explosion" in early 2024 and held on until now, your assets would be almost worthless.

Why?

Most of these projects launched with extremely high FDV (Full Float Market Cap), but their initial circulating supply was extremely low. Between 2024 and 2025, the massive unlocking of tokens hung like a Damocles' sword over their heads. Every day, millions of dollars worth of tokens were released from VCs and teams and dumped into the secondary market.

In the context of a lack of new capital, these tokens are no longer "stocks" but have become "liabilities." Crypto "investors" have finally realized that they are not buying the future technology ecosystem, but rather paying for the liquidity exit from the primary market .

The $ 1.22 price of the SSI Layer 2 index is the most ruthless pricing for "air infrastructure"—an infrastructure with "only supply and no demand." Just how oversupplied is this? According to L2BEAT data, by 2025, there will be over 100 active Layer 2 networks. Excluding the top few projects, the remaining 90-plus chains resemble deserted ghost towns, yet still bear a diluted valuation of tens of billions.

This signifies that the VC-driven "low liquidity, high valuation" harvesting model has completely lost the market's trust.

IV. The Illusion of Memes: A Safe Haven or a Meat Grinder?

"People fled the complex scythe, only to leap into a bloodier arena."

Against the backdrop of the collapse of VC coins, Meme seems to have become the only bright spot in 2024-2025. Amidst the cries of countless communities, Meme has been portrayed as a "people's asset" against Wall Street and VCs .

The SoSoValue SSI Meme index reading at the end of 2025 seems to confirm this: $9.98 .

Figure 8: From January to December 2024, the ssiMeme index rose by over 350%, but then fell by nearly 80% from its peak, returning to its original level. (Data source: SoSoValue)

It appears to be the only sector that has "outperformed" altcoins and preserved its principal over a two-year period. But don't be fooled. Behind this $9.98 lies the most brutal truth of the game in this cycle.

4.1 Survivor bias and 80% retreat

A deeper analysis of the data reveals that the ssiMeme index has retreated nearly 80% from its peak.

what does that mean?

This means that the "boom" in the Meme sector was mainly concentrated in the first half of 2024. At that time, funds, driven by aversion to VC coins, poured into the fully circulating Meme market, pushing up the index. However, by 2025, the story had taken a turn for the worse.

With the rise of political memes sparked by the Trump concept and the proliferation of cryptocurrencies issued by various celebrities and politicians, the meme market has rapidly degenerated from a "rebellious zone" into a highly efficient "harvesting machine."

4.2 Politics and Celebrities: A Water Pump

In January 2025, political memes became the focus of the market. This was no longer a spontaneous celebration of community culture, but a direct monetization of political influence and attention. Public reports show that the token structure of many such tokens is highly concentrated, and price fluctuations depend entirely on a single political event or tweet.

At the same time, celebrity-issued tokens have compressed the "pump and dump" cycle to the extreme. Funds are no longer entering the market for long-term holding, but for completing a game within hours or even minutes.

The $9.98 price point that guarantees the ssiMeme index's return was offset by the losses of countless investors who entered at the peak in 2025. This reveals a structural dilemma: Memes are not value assets; they are a "suboptimal container" during periods of limited liquidity.

When the market offers no better alternatives, funds opt for MEMEs, which have simpler rules (full circulation) and more decisive wins and losses (no lock-up). However, when sentiment fades, MEMEs lacking fundamental support will fall more sharply than any other asset. For most retail investors who enter the market later, this remains a dead end.

V. The Shadow of Giants: Systemic Importance and Responsibility Vacuum

"They have the power of a shadow central bank, yet they still want to preserve the freedom of pirates."

If asset price fluctuations are a form of market self-regulation, then the frequent systemic shocks of 2025 exposed the extreme fragility of the industry's infrastructure. That year, the crypto market experienced multiple cascading liquidations triggered by macroeconomic fluctuations (such as trade war panic and geopolitical friction). Under stress tests, the three giants of trading, payments, and settlement (Binance, Tether, and Tron) remained standing, but the underlying concerns transformed from rumors into concrete evidence.

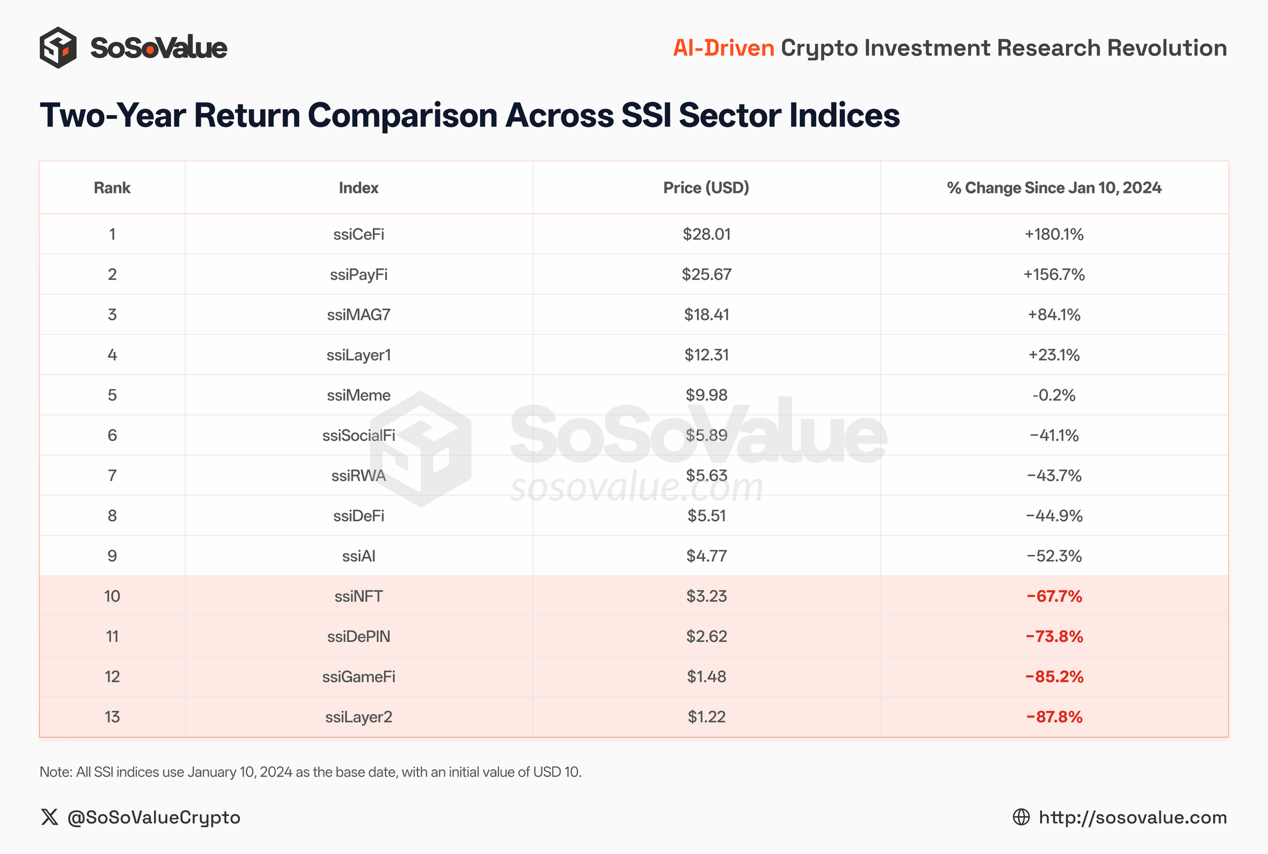

5.1 The casino took all the money from the table.

Of all the indices, only the CeFi (Centralized Finance) index surged to $28 . Does this mean the exchanges have superior technology and service? Wrong. If you look at the constituent stocks, BNB accounts for 88% of the weighting . The truth is cold: this $28 represents confirmation of "channel monopoly." In the gold rush, those who mined all died; only those who ran casinos and sold shovels made a fortune.

Figure 9: CeFi's excess returns are highly concentrated in BNB, with a gain of 181%. (Data source: SoSoValue)

5.2 The alienation of infrastructure: bloodsucking, black box operations, and political gambles

When we focus our attention on these three giants, we find a common and dangerous tendency: they are maintaining their crumbling empires by sacrificing neutrality (bloodsucking) and seeking political asylum (gambling).

1. Binance: From "Waitress" to "Vampire"

As the king of liquidity, Binance began to sacrifice its neutrality as infrastructure in 2025 in order to maintain high profits.

The Degeneration of Listing Logic (Meme Transformation): In response to the liquidity crunch of VC coins, Binance aggressively shifted to a "meme economy," listing a large number of highly volatile assets lacking fundamentals. The exchange transformed from a place for value discovery into a distribution channel for "toxic assets," training users to be high-frequency speculators to maximize transaction fees.

The Black Box of Technology (The 10.11 Great Liquidation): During the crash on October 11th, Binance's margin engine, relying on internal prices rather than external oracles, caused the prices of assets like USDe to decouple, triggering billions of dollars in erroneous liquidations. Although a $300 million compensation fund was subsequently established, this "pay-to-lose" attitude and refusal to acknowledge legal responsibility exposed the arrogance of its privatized central bank—when the referee makes a mistake, users can only pray for its "mercy," rather than rely on the fairness of the rules.

Market maker collusion risk: Investigations into projects such as GPS and SHELL revealed that market makers on the Binance platform were suspected of manipulating the prices of new coins multiple times. Although the authorities have punished them, this has exposed only the tip of the iceberg of internal conflicts of interest.

2. Tether: An Unregulated "Private Empire" Tether (USDT) remains the "shadow dollar" of the crypto world, its dominance unshakeable. But this dominance is built on an increasingly opaque foundation.

The Audit Mystery: Despite profits surpassing those of Wall Street investment banks, Tether refuses to undergo a thorough statutory audit, providing only snapshot-style "assurance reports." This means that the possibility of misappropriation of funds before and after the snapshot date cannot be ruled out.

The "weaponization" of the balance sheet: Tether established the "Tether Evo" division, using interest from users' reserves to build a private business empire spanning neurotechnology, agriculture, and even a football team (the Juventus acquisition). It is leveraging the privileges of public infrastructure to circumvent the regulatory risks of a single stablecoin business; this "too big to fail" structure itself poses a significant moral hazard.

3. Tron: The "Settlement Highway" of the Gray Economy

If Binance is an exchange and Tether is a central bank, then Tron is the de facto "underground SWIFT".

USDT Monopolist: Data from 2025 shows that the Tron network carries 50% of the global USDT circulation , making it the preferred settlement layer in Southeast Asia and even sanctioned regions.

A breeding ground for money laundering: This efficiency comes with a huge compliance black hole. Investigations show that although Huione Group was sanctioned, its related wallets still processed nearly $1 billion in funds on the Tron network. The larger Tron's scale, the more pronounced its characteristics as a highway for illicit finance become.

5.3 The Political Gamble of "Industry Leaders"

The most unsettling trend is not the gray areas in business operations, but the fact that industry "leaders" are starting to try to "buy the rules."

Justin Sun's "pledge of allegiance": Faced with the potential "nuclear button" of secondary sanctions against Tron and its supernodes, Justin Sun demonstrated an extremely high level of political opportunism. He not only attempted to package Tron as a US-listed company through a reverse merger to seek procedural protection, but also invested $75 million in World Liberty Financial (WLF), a project of the Trump family, in 2025. This blatant political donation attempted to tie the fate of a public blockchain to US political power.

• CZ's "Century Pardon": While Justin Sun was still experimenting, CZ has already proven the feasibility of this path. On October 23, 2025 , the White House officially announced that President Trump had exercised his presidential pardon power, pardoning Changpeng Zhao. This news caused a shockwave in the cryptocurrency world that even surpassed Bitcoin's record high. It marked the culmination of years of compliance efforts by the DOJ, ultimately thwarted by the intervention of top-level political power.

Is it a talisman or a death warrant?

Justin Sun and CZ's actions essentially turned what should have been a technologically neutral crypto infrastructure into a bargaining chip in partisan politics . They staked their entire fortunes on the Trump family. This deep entanglement of interests may have secured them a four-year "get-out-of-jail-free card," but it also meant placing themselves in stark opposition to the Democratic Party and the establishment. The political pendulum always swings back. When the tide turns, this fragile balance built on "political protection money" is highly likely to face a more severe reckoning and backlash than ever before.

The lesson of 2025 is that the market is beginning to realize that simply being "big" is not enough.

With ETFs entering the market, Circle going public, and traditional financial capital eyeing the market, crypto-native giants that cannot address the issues of "transparency" and "public responsibility" will ultimately be replaced by more compliant competitors (such as stablecoins issued by Wall Street investment banks and compliant exchanges).

The surge in the ssiCeFi index may represent the end of the "wild growth" dividends of the past decade, but it certainly does not represent the direction of crypto for the next decade.

VI. The New World After the Great Divergence: Reconstructing Value Amidst Certainty

"The foundations of the old world are crumbling, while the outlines of the new world are yet to be clearly defined."

Faced with the fragmented landscape at the end of 2025, a sharp question arises for all practitioners: Outside the Great Firewall, traditional funds, though eager, are being diverted to ETFs and US-listed stocks, and no matter how much Nasdaq rallies, on-chain liquidity remains exhausted; Inside the Great Firewall, the infrastructure we depend on is either frantically sucking blood from retail investors or engaging in high-risk political gambles.

Has this industry reached its end?

For those accustomed to the early days of cryptocurrencies—raising funds with a white paper and manipulating prices with a story—the end of that era is truly suffocating. The so-called "cryptocurrency," as a speculative symbol, is receding.

But for observers of financial history, this is precisely the darkest hour before dawn. Every "death" is for "rebirth." Standing at the end of 2025, that experiment that started at $10 has helped us shed the noise. We see that the term "cryptocurrency" is disappearing, replaced by "on-chain finance."

Two years of upheaval and divergence have completely reshaped the entire framework of the crypto industry. As the bubble bursts, we see that future value is no longer defined by narratives, but rather reconstructed by two dimensions of "certainty": usable money (stablecoins) and honest ledgers (on-chain finance) .

6.1 The Rise of Stablecoins: From "Deposit Channels" to "Borderless Cash"

In the past, we understood stablecoins as "tickets to enter the crypto world": fiat currency was exchanged for USDT/USDC, traded on exchanges, and a round of speculation was completed. By 2025, the significance of stablecoins gradually shifted from "crypto tools" to "digital representations of the US dollar." Its core is not blockchain, but rather the re-entry of the US dollar into the world in a different way.

If Bitcoin was the first "digital gold" in the crypto world to be accepted by mainstream finance, then stablecoins are more like the second "digital cash" to be truly accepted by the public. They do not require users to understand decentralization, but only require users to feel a simple advantage: faster, cheaper, and less hassle than banks.

The rise of the PayFi sector proves this point: it doesn't rely on storytelling to inflate valuations, but rather on solving pain points in traditional finance to command a premium. In countries with inflation or foreign exchange controls, the growth of stablecoins is driven by reality: traditional bank transfers are slow, have high fees, and can even freeze funds without cause. Stablecoins offer an alternative path without these "artificial roadblocks."

Therefore, this is a competition about the "efficiency of dollar distribution." Whoever can deliver dollars to those who need them globally with lower barriers and lower costs will become the new infrastructure. Stablecoins "unpack" the dollar from the walls of banks, turning it into a universal component that can circulate 24/7 . You don't have to see it as a Trojan horse, but you must understand its practical implications: stablecoins represent a digital-age upgrade of the dollar, and their expansion isn't based on slogans, but on solving real-world inefficiencies and obstacles .

6.2 De-opaqueization of On-Chain Finance: Rewriting Risk from "Credit" Back to "Rules"

If stablecoins have solved the problem of "efficiency of capital flow", then on-chain finance and prediction markets are reshaping the two core dimensions of finance: credit and information .

Over the past two years, the systemic risks of centralized financiers (CeFi) have essentially stemmed from the abuse of discretionary power. When matching, clearing, and custody all take place within an opaque database, administrators possess an unparalleled, god-like perspective, capable of altering the ledger. Under this mechanism, so-called "risk control" often becomes a fig leaf for specific interest groups.

The value of on-chain finance lies not in the ideological concept of "decentralization," but in the "certainty at the execution level." Taking leading protocols like Hyperliquid as examples, they solidify liquidation logic and risk parameters into immutable smart contracts. This means that financial rules are no longer playthings in the hands of regulators, but rather rigidly enforced physical laws. Market participants no longer need to pray that the platform "behaves well," but only need to verify that the code "operates according to the rules." This marks the evolution of financial risk management from "credit-based game theory" to "code-based engineering."

The same logic extends to the information field. Prediction markets underwent a key identity transformation in 2025: they shed the label of "online gambling" and evolved into "event derivatives exchanges".

- Information pricing mechanisms: From "opinion inflation" to "efficient markets"

- In an era where AI generates endless noise and media is rife with bias, opinions are the most heavily inflated asset, while truth is a scarce hard currency. The core mechanism of Polymarkets is not simply "voting," but rather "arbitrage based on information advantage ." Take the 2024 election as an example: while traditional polling agencies still relied on inefficient telephone surveys, traders with exclusive data (such as the well-known "French whales") hired professional teams to conduct neighborhood surveys and placed heavy bets in the market. This mechanism forces participants to pay "information verification costs ." In a pool of billions of dollars, the principal becomes a sieve filtering noise—emotional outbursts are instantly swallowed up, and only "signals" tested by real money can determine prices. This makes the prediction market the information discovery tool with the highest signal-to-noise ratio in human society today .

• Deepening of financial functions: Macro hedging and parametric insurance

The more profound change lies in the fact that prediction markets standardize "uncertain events" that were originally untradeable in the real world into tradable financial assets.

- A new benchmark for macro risk management : Institutional investors are beginning to utilize forecasting markets to manage macro risk. For example, in response to Federal Reserve interest rate decisions (FOMC), investors are no longer limited to high-barrier Treasury futures, but are instead engaging in more precise cross-market arbitrage through forecasting market contracts. This not only improves capital efficiency but also provides the market with more sensitive indicators of macroeconomic expectations than traditional questionnaires.

- Inclusive "parametric insurance" : As Robinhood demonstrates to retail investors, purchasing a "Houston Rain" contract is essentially a form of disintermediated micro-insurance . It breaks down the high claims costs and opaque terms of traditional insurance—users make contrarian bets on specific long-tail risks such as extreme weather, flight delays, and policy changes. Once the event is triggered, the smart contract automatically pays out. This marks the move of risk hedging from Wall Street into the everyday lives of ordinary people.

The progress of human financial history is essentially a process of continuously reducing transaction costs. On-chain finance eliminates "trust intermediaries," and prediction markets eliminate "information noise." In the future financial world, the black box will be broken by code, and the truth will be priced by capital.

In conclusion

“Coming of age is never a celebration; it is a forced process of growing up.”

This cycle didn't see a broad-based rally, but rather a process of selection. For every investor involved, the significance of 2024-2025 lies in the fact that it shattered the illusion that "being present guarantees a win." For those relics of the old era still stuck in PowerPoint presentations and unlocking curves, the $1.20 index is their final epitaph.

While we are still debating the rise and fall of cryptocurrency prices, a more profound and fundamental transformation is quietly underway in the heart of Wall Street: According to Bloomberg, the U.S. Securities and Exchange Commission (SEC) has granted a license to the Depository Trust and Clearing Corporation (DTCC) in the form of a no-action letter, allowing the company to host and recognize tokenized stocks and other real-world assets (RWA) on the blockchain .

DTCC is not a “crypto company”; it is the infrastructure hub of the U.S. capital markets. DTCC disclosed that it processed approximately $3,700 trillion in securities transactions in 2024.

This may be the ultimate fate of crypto technology. Regulation is not about eliminating the crypto world, but about issuing it a ticket to a new world. It filters out scams that try to print counterfeit money through cryptocurrency; it preserves technologies that improve the efficiency of asset circulation and enhance trust.

Just as the internet has ultimately permeated every pore of commerce, blurring the lines between "online" and "offline," the future of finance will also transcend the distinction between "on-chain" and "off-chain." All financial transactions will operate on the more efficient ledger of blockchain.

"If you don't believe me or don't get it, I don't have time to try to convince you, sorry." - Satoshi

Whether BTC will restart its bull market in 2026 remains to be seen!

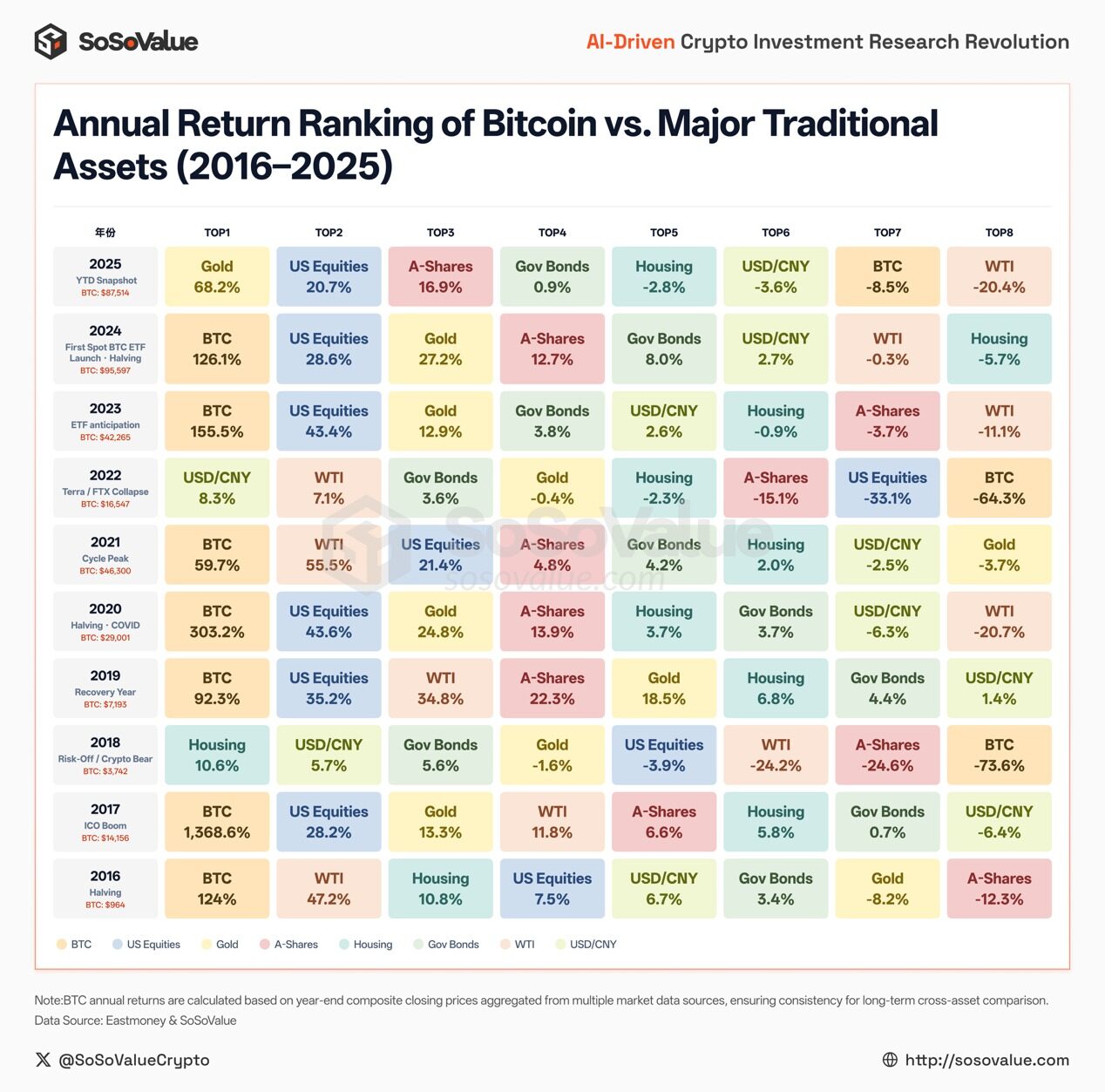

Figure 10: Comparison of annual returns of Bitcoin and major traditional assets (2016–2025) (Data source: SoSoValue, compiled from public data)

Note: The data analysis in the charts above was based on the SoSoValue index compilation tool. This tool simplifies and visualizes the expensive professional backtesting systems previously used by fund companies, allowing ordinary investors to build their own crypto asset tracking framework and validate every intuition with data. If you also want to build your own quantitative framework for continuous observation and tracking of crypto assets, you can try SoSoValue's index compilation tool. Its backtesting filtering function is similar to the expensive professional tools I used to work with at fund companies, but it's much easier to use.