Over 80% of new coins, including TGE, have already peaked; the root cause and solution to the Web3 false prosperity lie here.

- 核心观点:传统项目评估标准已失效,市场重炒作轻实质。

- 关键要素:

- 84.7%新代币FDV低于发行时,中位数跌71%。

- 融资额、社群规模与代币表现无统计学关联。

- 盈利项目代币价格反低于亏损项目,市场激励错位。

- 市场影响:促使行业反思价值评估体系,转向务实发展。

- 时效性标注:中期影响。

Original author: Solus Group , crypto researcher

Original translation by CryptoLeo ( @LeoAndCrypto )

Editor's Note: In a recent popular post, analyst Ash stated that among the over 100 new tokens issued during the 2025 Time Genesis (TGE), 84.7% had a lower FDV (Funds Delivered Value) than at the TGE. The median FDV of these tokens was down 71% from their issuance price (median market capitalization down 67%). Only 15% of the tokens saw an increase in FDV compared to their TGE . Overall, most of the new tokens issued in 2025 experienced a "TGE price peak."

Following this data, I found an even more interesting article (from Solus Group), which also started with project tokens (TGE) and analyzed the price movements of 113 tokens after their TGE in 2025, along with their fundraising status, community activity, and exchange listings. The study found that high fundraising amounts, active communities, and exchange listings—generally considered criteria for evaluating project quality—had little impact on token price movements. Previously, we often used these criteria to select good projects, but in 2025, this evaluation model had "failed." One set of data in particular is thought-provoking:

- Projects with transaction prices lower than IDO prices generated an average revenue of $1.36 million.

- Projects with transaction prices higher than the IDO offering price generated an average revenue of $790,000.

However, the fact that these projects all received venture capital funding indicates that the market values hype over actual performance, stories over data, and promises over the product itself . Web3 can no longer pretend "everything is fine," and can no longer call bot traffic "growth." Of course, these are just some statistical conclusions and not universally applicable. Good projects and large funding rounds still represent the direction of the crypto industry. Odaily Planet Daily has compiled the following:

With $2 million in funding, participation from top venture capitalists, 500,000 community followers, and listing on major exchanges, the launch day was a resounding success, with jubilation on Discord and a celebratory atmosphere across social media.

In a previous article, we revealed the true nature of the 0.96x ROI: by 2025, the average token was effectively dead on day one , proving the system ineffective. Now, we've analyzed 113 token issuance cases since 2025, providing concrete data to prove this—data that most founders dare not face.

The findings are startling: large amounts of funding are useless, large communities are irrelevant, and every variable you optimize is statistically worthless.

But beneath the surface lies something far more twisted, which continues to trouble many founders to this day:

Currently, the revenue situation of projects is a bearish sign, with the tokens of profitable projects trading at prices lower than those of unprofitable projects. This dynamic is a matter of life and death. If we continue to punish those who profit while rewarding speculators, the entire industry will not survive.

Odaily Planet Daily Note: Previously, Solus Group published an article disclosing relevant data, stating that in 2025, the average return on investment for TGE new project tokens, calculated from the first day after issuance, was 0.96%, meaning that its products were in a loss-making state from day one.

Entrepreneur Data Trap: The Funding Paradox – High Funding Does Not Equal Token Advantage

The correlation between funding and token performance is 0.04, which can be considered statistically zero.

Projects that raised $10 million and those that raised $1 million exhibited identical token performance. The chart above demonstrates this—regardless of the funding amount, the distribution of tokens within the range of returns is random. The top-performing projects—Myshell, B² Network, Bubblemaps, Mind Network, Particle Network, and Creator.Bid (whose valuation increased 10x to 30x at ATH)—raised between $300,000 and $3 million. Meanwhile, projects like Boundless and Analog, which raised over $10 million, only saw valuation multiples of approximately 1x.

Current token performance is even worse; regardless of funding size, most tokens have a return on investment (ROI) of less than 1x. For example, tokens that raised $5 million to $100 million have an ROI of 0.1x to 0.7x (e.g., Fleek, Pipe Network, Sahara AI), the same as tokens from projects with little or no funding.

The truth is: large-scale fundraising will accelerate the death of a project's token.

Projects with the least funding (US$300,000 to US$5 million) have a higher ROI for every dollar raised, execute faster, have lower turnaround costs, and are not overwhelmed by the quarterly VC token unlocking schedule, where a large number of unlocked tokens can undermine project earnings.

If you pursue $10 million in the name of "competition," you are preparing for failure.

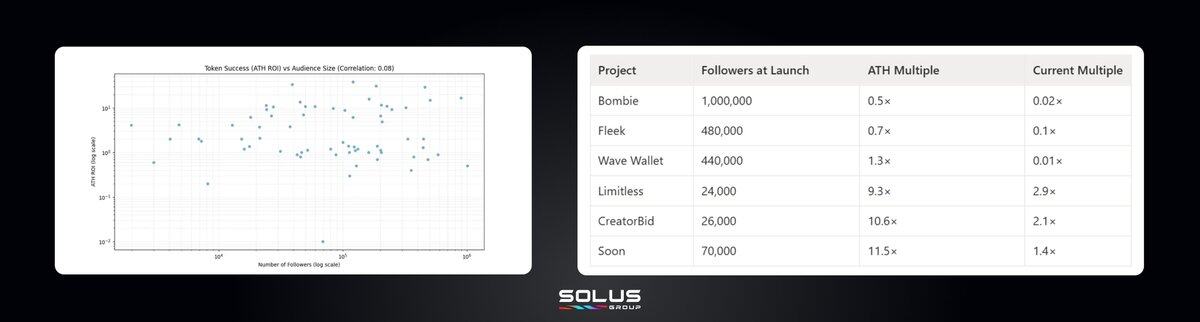

Fan Myth: Massive Project Communities Are Just a "Paper Tiger"

The statistical results are exactly the same for social media followers of 500,000 and 50,000.

Correlation coefficients: 0.08 (token ATH) and -0.06 (token current status)

Data shows that audience size has no predictive value for token performance. Projects with large fan bases perform inconsistently – some surge while others plummet. The same applies to projects with small audiences; there are no trends, no patterns, and no correlations.

The Discord group you're in isn't a community, but rather a speculative audience waiting to leave.

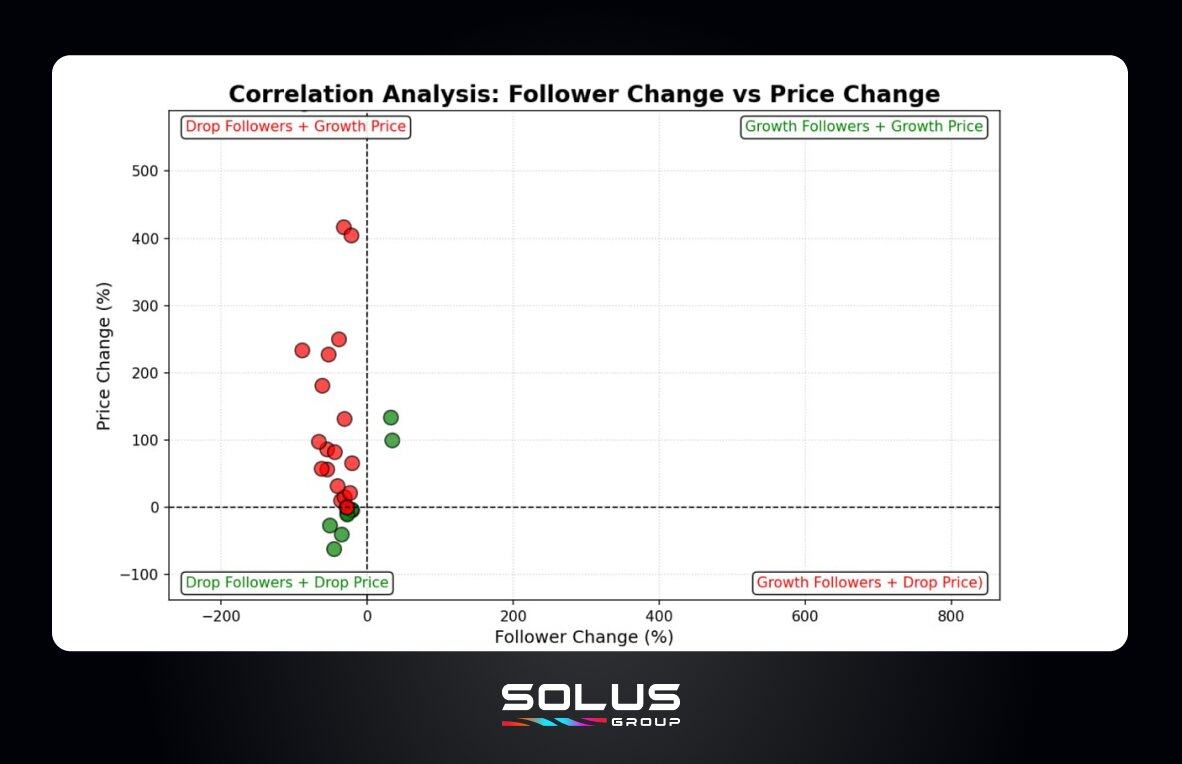

The reality is that prices determine community development, not the other way around.

When prices plummet, followers disappear. The chart demonstrates this—the lower left quadrant (decreasing followers + price drop) is very dense. When prices surge, followers sometimes increase, but this is not consistent.

This means:

Your "active community" has never truly focused on the product —they're focused on the token price movement. They'll disappear once the token's performance disappoints. Community growth is a lagging indicator, not a leading one.

This is not just theory, but a view publicly expressed by @belizardd (researcher, trader/KOL):

Most people come here purely for speculation, not for the product itself. We've found that very few protocols have performed well since TGE, and those that did were mainly those with low initial token FDV, small fundraising amounts, and generous airdrops. Frankly, I'm not blindly following trends and investing in anything right now. The risk/reward isn't worthwhile; I'm just waiting for the market to improve.

Speculators knew the game had failed. They were taking a wait-and-see approach. Meanwhile, the founders continued to pour 60% of the budget into Discord bots, Twitter giveaways, and KOL promotions—burning money on statistically insignificant metrics.

The real question is: "If the token price plummets by 50% tomorrow, how many people will stay?"

Answer: Almost none.

Token price traps: Beware of overpricing/underpricing.

Median return on investment calculated based on the token's listing price:

Below $0.01: 0.1x (90% loss)

$0.01 to $0.05: 0.8x (survivable zone)

$0.05 to $0.50: 0.5x (50% loss)

Above $0.50: 0.09x (91% loss)

Let me explain again:

Offering a price below $0.01 doesn't make your token "easier to buy," it just makes it a cheap coin that attracts profit-driven capital; they rise quickly and fall quickly.

Pricing your token above $0.50 won't make it a "premium token"; it will only make it seem overpriced. Overpriced tokens will stifle the retail market, and whales won't buy them either.

The $0.01 to $0.05 price range is the only viable pricing range; it's high enough to justify a project's legitimacy, yet low enough to allow for upside potential. Within this price range, only 42 out of 97 projects had a positive median performance for their tokens.

If your token economic model values your project at $0.003 or $1.20, then stop rebuilding the model; the data indicates that the project has failed.

Industry Status Quo: Construction Halted in 2021

Loser: Gaming

Average ATH ROI: 4.46x (lowest)

Current median return on investment: 0.52 times

GameFi tokens are like lottery tickets; you play them once and then forget about them forever.

Trap: DeFi

Average ATH ROI: 5.09x (looks good)

Current median return on investment: 0.2x (catastrophic)

DeFi experienced an early price surge, followed by a crash that was more dramatic than in any other sector, highlighting the stark contrast between hype and reality.

Winner: AI

Average ATH ROI: 5.99x (maximum increase)

Current median ROI: 0.70x (optimal retention rate)

AI token prices surged and remained stable. This trend is persistent, attracting a continuous influx of funds.

If you're developing GameFi, your execution needs to be 10 times better than average to achieve even moderate results. If you're in DeFi, be prepared for rapid rises and falls. If you're in AI, the market will offer opportunities, but only if you can deliver tangible results. The infrastructure sector is even more demanding: you'll consume significantly more time and resources compared to standard decentralized applications (like AI agents), yet your current median ROI is slightly lower than in the much-anticipated GameFi sector.

The data doesn't care about the projects you're interested in.

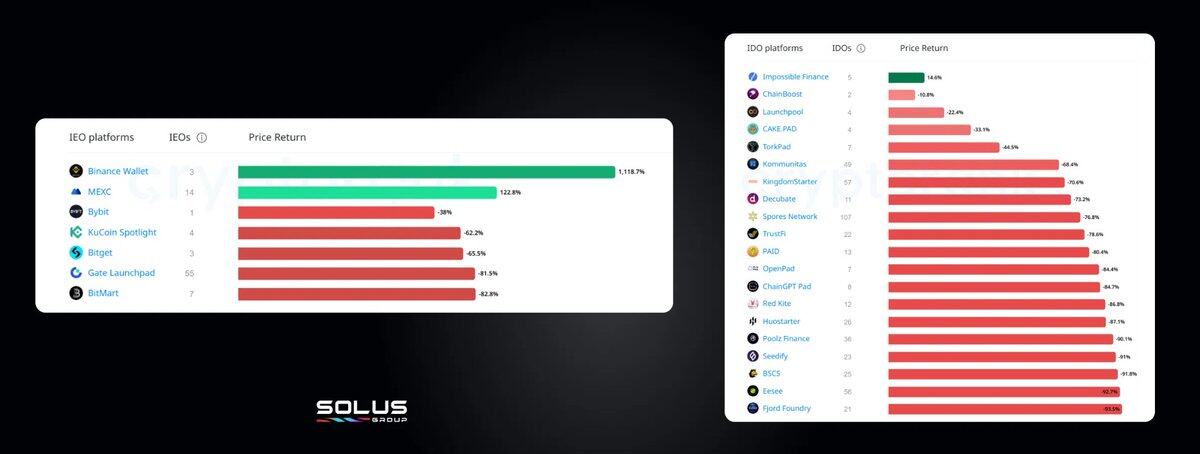

IDO/IEO Data Overview: A Good Platform Cannot Save a Project

You spend months building connections, hoping to secure a seat on Binance Launchpad or a spot in a Level 1 IDO allocation, assuming that passing the platform's screening means you're protected. However, the data shows otherwise.

IDO platform: Almost all projects are operating at a loss.

Only one project achieved a return of +14.6% across the five IDO platforms, and that was it. All other projects saw returns ranging from -70% to -93%.

The so-called "premium Launchpad" does not provide protection for buyers; it simply offers them a way to lose money.

IEO Platform: The Ultimate Manifestation of Survival Bias

Binance Wallet shows a yield of 11x. It seems incredible, but with only 3 issuances, the sample size is too small. MEXC shows a yield of +122.8% across 14 issuances—a larger sample size, but still an outlier. All other projects? Poor performance. Bybit's IEO token suffered a 38% loss, and the losses for other projects were even more severe.

This proves that:

Choosing a platform is like a lottery with a stronger brand. A few outliers can distort the average, and a large number of tokens will likely fall after issuance. The “curatorial services” you pay—whether through relationships, listing fees, or token allocation—cannot reliably protect your token’s ROI.

The platform cannot save junk tokens, nor can it help good tokens.

Reflecting on 2025, looking forward to 2026

The project development based on 2025 failed at every level.

Level Zero: Foundation

The problem: "Speculative Token Economics." This involves the unrestrained dumping of tokens into an illiquid market without an organic revenue model to absorb shocks.

First level: Financing

The problem lies in: "Make changes on the PDF first, then process the data."

Second layer: Marketing

Problem: In the KOL model, users hired by paid online trolls disappear without a trace once the payment stops.

Third layer: Liquidity

Problem: It is assumed that liquidity will increase with speculation, but this is not the case, and institutional investors will wait for evidence.

Fourth layer: User retention

Problem: Zero-retention infrastructure. The "project community" consists of 10,000 Telegram users who will abandon you within 90 days.

We shouldn't be playing the same old games in 2026. Behind all this lies a deeper issue: while infrastructure is indeed crucial, even with the most advanced infrastructure, timing is everything. As Ivan Paskar (Head of Growth at Altius Labs) said:

Tokens can't fix what's broken—they amplify reality. Right timing = increased momentum. Wrong timing = years of effort wiped out in an instant. Most teams don't fail because of their token design; they fail because they misjudge the stage and the macro environment. Timing isn't a detail; it determines everything.

How should the project be implemented in 2026?

Survival is not about following the old script, but about building a new one.

1. Meticulously designed

The target amount is $300,000 to $5 million, and these are the projects with the highest return on investment per dollar. More money = more problems.

2. Cost of living

The initial offering price was between $0.01 and $0.05. Any other price would have made it difficult to survive. If your token's economics doesn't fall within this range, then there's something wrong with it.

3. Product is paramount, tokens are secondary.

If you can't explain why your token exists in a single sentence, then it doesn't exist. Profits come before speculation.

4. Ignore vanity metrics

The number of followers is a distracting factor; wallet activity, retention rate, and revenue per user are the key metrics.

5. Industry Realism

Before you start coding, understand the failure rate in your industry. GameFi needs twice the execution efficiency to break even. AI, on the other hand, has a tailwind—as long as you can deliver results.

6. Integrate, or perish.

The era of mergers and acquisitions is coming. If you can't expand independently, find an acquirer. Acquisition is not a failure, but a wise move.

These six principles are important. But the truth is: standard scripts are outdated, and there is no longer a standard model that works for everyone.