Small-cap token crash: Is it the end of the altcoin bull market or a liquidity migration?

- 核心观点:山寨币投资价值存疑,风险收益远逊于主流资产。

- 关键要素:

- 山寨币指数暴跌,小盘指数跌至多年新低。

- 与主流资产高相关,但回报为负且波动巨大。

- 流动性向比特币、以太坊等头部资产集中。

- 市场影响:加剧资金向主流加密资产和美股集中。

- 时效性标注:中期影响。

Original author: Gino Matos

Original translation by Luffy, Foresight News

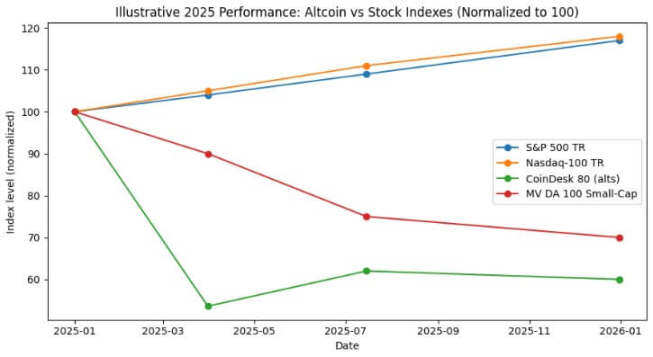

Since January 2024, a comparison of the performance of cryptocurrencies and stocks shows that the so-called new "altcoin trading" is essentially just a substitute for stock trading.

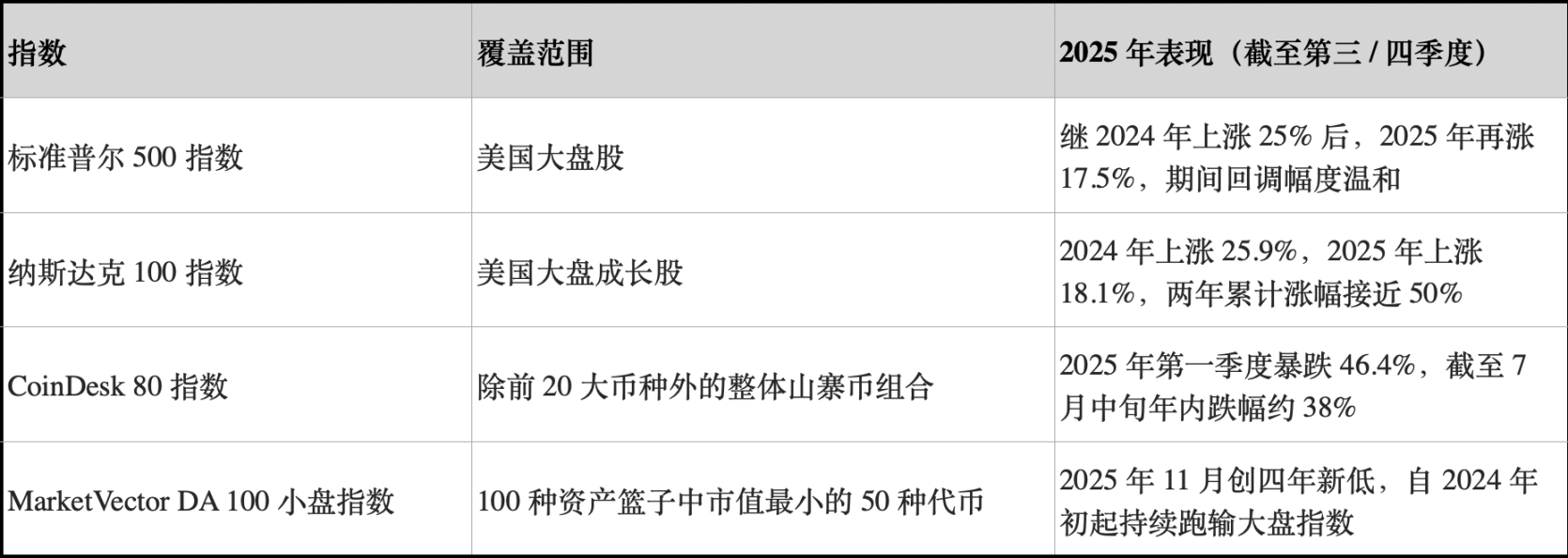

In 2024, the S&P 500 index returned approximately 25%, and in 2025 it reached 17.5%, a cumulative increase of about 47% over two years. During the same period, the Nasdaq 100 index rose by 25.9% and 18.1% respectively, with a cumulative increase of nearly 49%.

The CoinDesk 80 index, which tracks 80 assets outside the top 20 cryptocurrencies by market capitalization, plummeted 46.4% in the first quarter of 2025 alone, and as of mid-July, it was down about 38% year-to-date.

By the end of 2025, the MarketVector Digital Assets 100 Small Cap Index will have fallen to its lowest level since November 2020, resulting in a loss of over $1 trillion in the total market capitalization of cryptocurrencies.

This divergence in trends is by no means a statistical error. The overall altcoin portfolio not only has negative returns, but its volatility is also comparable to or even higher than that of stocks; in contrast, the US stock market index has achieved double-digit growth with manageable drawdowns.

For Bitcoin investors, the core question is: can allocating to small-cap tokens actually generate risk-adjusted returns? Or, does this allocation simply maintain a similar correlation with stocks while simultaneously incurring a negative Sharpe ratio risk exposure? (Note: The Sharpe ratio is a core indicator for measuring the risk-adjusted return of a portfolio, calculated as: annualized portfolio return - annualized risk-free rate / annualized portfolio volatility.)

Choose a reliable altcoin index

For the purpose of the analysis, CryptoSlate tracked three altcoin indices.

One is the CoinDesk 80 Index, launched in January 2025. This index covers 80 assets in addition to the CoinDesk 20 Index, providing a diversified investment portfolio beyond Bitcoin, Ethereum, and other leading tokens.

Secondly, there is the MarketVector Digital Assets 100 Small Cap Index, which selects the 50 tokens with the smallest market capitalization from a basket of 100 assets and can be regarded as a barometer for measuring the market's "junk assets".

Thirdly, there is the small-cap index launched by Kaiko. This is a research product, not a tradable benchmark, which provides a clear sell-side quantitative perspective for analyzing small-cap asset groups.

These three perspectives depict the market landscape from different dimensions: the overall altcoin portfolio, high-beta small-cap tokens, and quantitative research. However, they all point to highly consistent conclusions.

In contrast, the benchmark performance of the stock market presents a completely different picture.

In 2024, major US stock market indices rose by approximately 25%, and in 2025, the gains were also in double digits, with relatively limited pullbacks during this period. The S&P 500's largest annual drawdown was only in the mid-to-high single digits, while the Nasdaq 100 maintained a strong upward trend throughout.

Both major stock indices achieved compound annual growth without significant profit retracement.

The overall altcoin index, however, showed a completely different trend. A report from CoinDesk Indexes showed that the CoinDesk 80 index plummeted by 46.4% in the first quarter alone, while the CoinDesk 20 index, which tracks the broader market, fell by 23.2% during the same period.

As of mid-July 2025, the CoinDesk 80 index had fallen by 38% year-to-date, while the CoinDesk 5 index, which tracks Bitcoin, Ethereum, and three other major cryptocurrencies, had risen by 12% to 13% over the same period.

In an interview with ETF.com, Andrew Baehr of CoinDesk Indexes described the phenomenon as "completely identical correlations, yet wildly different profit and loss outcomes."

The correlation between the CoinDesk 5 Index and the CoinDesk 80 Index is as high as 0.9, meaning that the two move in the same direction. However, the former has achieved a small double-digit increase, while the latter has plummeted by nearly 40%.

As it turns out, the diversified benefits of holding small-cap altcoins are negligible, while the performance costs are extremely high.

The performance of small-cap assets has been even worse. According to Bloomberg, as of November 2025, the MarketVector Digital Assets 100 Small Cap Index has fallen to its lowest level since November 2020.

Over the past five years, the small-cap index has returned approximately -8%, while the corresponding large-cap index has surged by around 380%. Institutional funds clearly favor large-cap assets and avoid tail risks.

Looking at the performance of altcoins in 2024, the Kaiko Small Cap Index fell by more than 30% throughout the year, and mid-cap tokens also struggled to keep up with Bitcoin's gains.

Market winners are highly concentrated in a few top cryptocurrencies, such as SOL and Ripple. Although the total trading volume of altcoins rebounded to the high point of 2021 in 2024, 64% of the trading volume was concentrated in the top ten altcoins.

Liquidity in the cryptocurrency market has not disappeared; rather, it has shifted towards higher-value assets.

Sharpe ratio and drawdown

When comparing risk-adjusted returns, the gap widens further. The CoinDesk 80 index and various small-cap altcoin indices not only have returns deeply in negative territory, but their volatility is also comparable to or even higher than that of stocks.

The CoinDesk 80 index plummeted 46.4% in a single quarter; the MarketVector small-cap index fell to its lowest level since the pandemic in November after another round of declines.

The overall altcoin index has experienced several exponential halvings: the Kaiko Small Cap Index fell by more than 30% in 2024, the CoinDesk 80 Index plummeted by 46% in the first quarter of 2025, and the Small Cap Index fell back to its 2020 low at the end of 2025.

In contrast, the S&P 500 and Nasdaq 100 indices achieved cumulative returns of 25% and 17% respectively over two years, with maximum drawdowns of only mid-to-high single digits. While the US stock market experienced volatility, it remained generally manageable; whereas the cryptocurrency index, on the other hand, exhibited highly destructive volatility.

Even if we consider the high volatility of altcoins as a structural characteristic, their unit risk return in 2024-2025 is still far lower than that of holding the US stock market index.

Between 2024 and 2025, the overall altcoin index had a negative Sharpe ratio; while the S&P 500 and Nasdaq indices already showed strong Sharpe ratios without adjusting for volatility. After volatility adjustment, the gap between the two widened further.

Bitcoin Investors and Cryptocurrency Liquidity

The first takeaway from the above data is the trend of liquidity centralization and migration towards high-value assets. Both Bloomberg and Whalebook reports on the MarketVector Small Cap Index indicate that since the beginning of 2024, small-cap altcoins have consistently underperformed, with institutional funds flowing into Bitcoin and Ethereum ETFs instead.

Based on Kaiko's observations, although the total trading volume of altcoins has rebounded to 2021 levels, funds are concentrated in the top ten altcoins. The market trend is clear: liquidity has not completely withdrawn from the cryptocurrency market, but rather is shifting towards high-value assets.

The altcoin bull market of the past was essentially just a basis trading strategy, not a structural outperformance of assets. In December 2024, the CryptoRank altcoin bull market index once soared to 88 points, and then plummeted to 16 points in April 2025, completely erasing the gains.

The altcoin bull market of 2024 ultimately turned into a typical bubble burst; by mid-2025, the overall altcoin portfolio had almost given back all its gains, while the S&P 500 and Nasdaq indices continued to grow at a compounded rate.

For financial advisors and asset allocators considering diversifying their portfolios beyond Bitcoin and Ethereum, CoinDesk's data provides a clear case study.

As of mid-July 2025, the CoinDesk 5 index, which tracks the broader market, achieved a slight double-digit increase this year, while the diversified altcoin index CoinDesk 80 plummeted by nearly 40%, with a correlation of 0.9 between the two.

Investors who allocated their funds to small-cap altcoins did not achieve substantial diversified returns. Instead, they suffered returns and drawdown risks far exceeding those of Bitcoin, Ethereum, and US stocks, while remaining exposed to the same macroeconomic drivers.

Currently, capital treats most altcoins as tactical trading targets rather than strategic asset allocations. From 2024 to 2025, Bitcoin and Ethereum spot ETFs are expected to offer significantly better risk-adjusted returns, while US stocks will also perform strongly.

Liquidity in the altcoin market is increasingly concentrated in a few "institutional-grade coins," such as SOL, Ripple, and other tokens with independent positive factors or clear regulatory prospects. Asset diversity at the index level is being squeezed by the market.

In 2025, the S&P 500 and Nasdaq 100 indices rose by approximately 17%, while the CoinDesk 80 Crypto Index fell by 40%, and small-cap cryptocurrencies fell by 30%.

What does this mean for liquidity in the next market cycle?

The market performance from 2024 to 2025 tested whether altcoins could achieve diversified value or outperform the market in an environment of rising macroeconomic risk appetite. During this period, US stocks achieved double-digit growth for two consecutive years, with manageable drawdowns.

Bitcoin and Ethereum have gained institutional recognition through spot ETFs and have benefited from a more relaxed regulatory environment.

In contrast, the overall altcoin index not only has negative returns and larger drawdowns, but also maintains a high correlation with major crypto tokens and stocks, yet fails to provide corresponding compensation for the additional risks borne by investors.

Institutional funds have always pursued performance. The MarketVector Small Cap Index has a five-year return of -8%, while the corresponding large-cap index has risen by 380%. This gap reflects that capital is constantly migrating to assets with clear regulations, ample liquidity in the derivatives market, and well-established custody infrastructure.

The CoinDesk 80 index plummeted 46% in the first quarter and recorded a 38% year-to-date decline by mid-July, indicating that the trend of capital migrating to high-value assets has not only not reversed, but is accelerating.

For Bitcoin and Ethereum investors who are evaluating whether to allocate to small-cap crypto tokens, the data from 2024 to 2025 provides a clear answer: the absolute returns of the overall altcoin portfolio underperformed US stocks, and the risk-adjusted returns were lower than those of Bitcoin and Ethereum; despite a high correlation of 0.9 with large-cap crypto tokens, it failed to provide any diversification value.