From "Geek Toy" to "Standard Equipment": The Eight-Year Evolution of Web3 Phones

- 核心观点:Sei与小米合作,推动Web3手机向大众普及。

- 关键要素:

- 小米新机预装Sei钱包与DApp平台。

- 采用MPC技术,实现免助记词登录。

- 计划2026年试行线下稳定币支付。

- 市场影响:有望将亿级用户引入Web3生态。

- 时效性标注:长期影响。

Original author: Sanqing, Foresight News

On December 10th, the high-performance public blockchain Sei announced a partnership with Xiaomi, the world's third-largest smartphone manufacturer. The Sei Foundation will develop a new generation of crypto wallets and a decentralized application (DApp) discovery platform, which will be pre-installed directly on Xiaomi's new smartphones for the global market (excluding mainland China and the United States).

The two companies plan to utilize multi-party computation (MPC) technology to allow users to log in to their wallets directly using their Google or Xiaomi accounts, eliminating the daunting "mnemonic phrase" required by ordinary users. They also plan to pilot a stablecoin payment system in Hong Kong and the European Union in the second quarter of 2026, enabling users to directly purchase electronic products at Xiaomi's more than 20,000 offline retail stores using tokens such as USDC.

A Retrospective: The Seven-Year Evolution of Web3 Phones

First Attempt (2018–2020): Hardcore Security and Wild Imagination

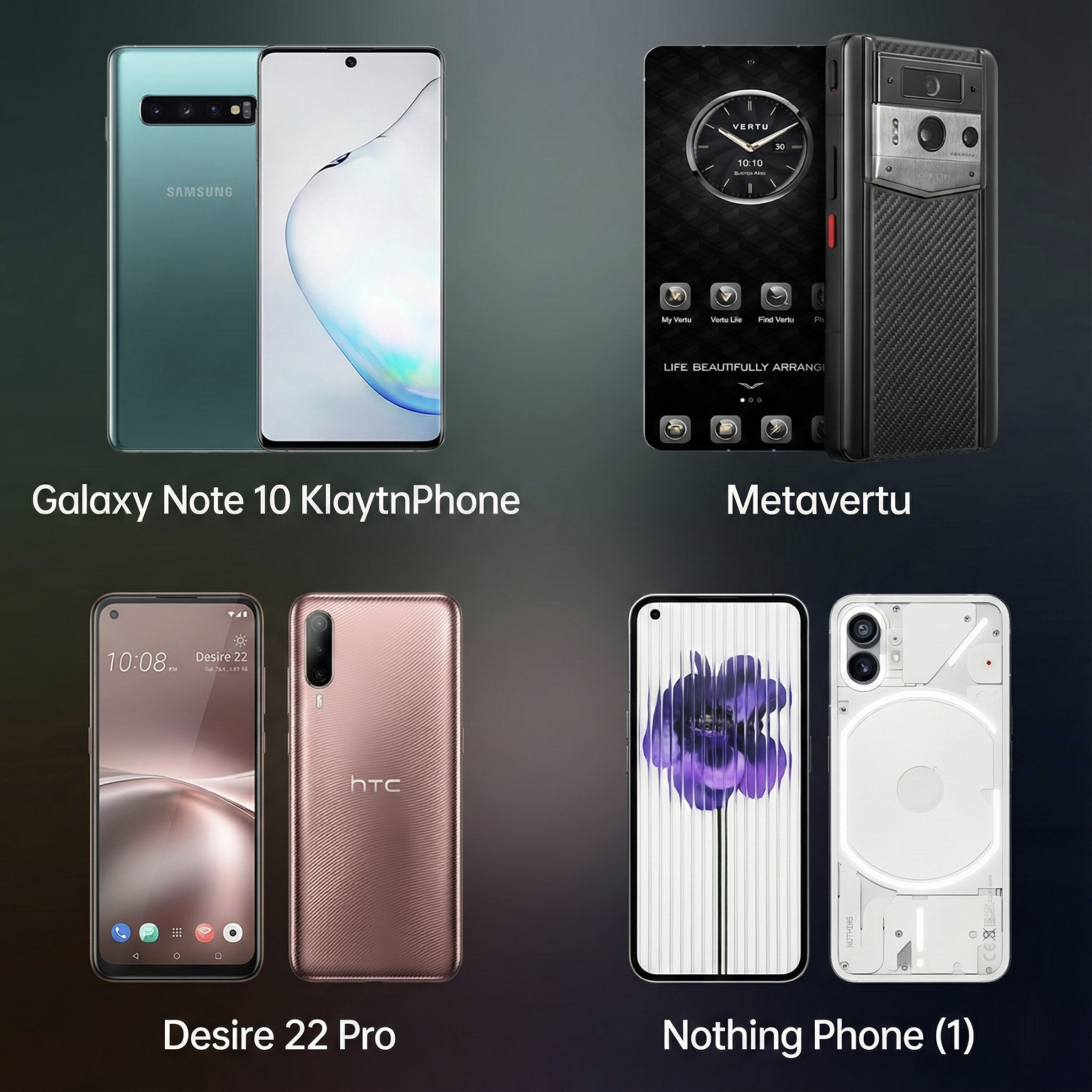

Image source: Internet; compilation created by AI.

Around 2018, coinciding with the first major bull market in the crypto market, the first batch of "blockchain phones" were born. Representatives of this period were Sirin Labs' Finney and HTC's Exodus 1, whose design philosophy was "hardware sovereignty" and "ultimate security".

For example, Sirin Labs' Finney phone features a unique sliding "secure screen" that uses physical isolation to display transaction details and password input, ensuring the safety of funds even if the main system is compromised. HTC and Binance collaborated to develop the Exodus 1, introducing "Zion Vault," which utilizes the phone's trusted execution environment (TEE) to store private keys.

Besides Sirin and HTC, another device worth mentioning is the SikurPhone, which represented an attempt at a "closed system" at the time. Developed by a Brazilian security company, the SikurPhone focused on "anti-hacking" and a built-in cold wallet. Its extreme feature was its highly closed SikurOS, which prohibited users from installing third-party applications (requiring manufacturer evaluation) to reduce the attack surface.

Beyond secure storage, entrepreneurs at the time had even more cyberpunk-like visions. Pundi X's Blok On Blok (BOB) phone attempted to solve the problem of decentralized communication. This modular phone allowed users to switch between "Android mode" and "blockchain mode," claiming to enable calls and data transfers via a decentralized network without relying on mobile carriers.

During this period, Electroneum released the M1 phone, priced at only $80. Targeting developing countries, it allowed users to earn tokens to pay for phone bills through "cloud mining" on their phones. Although it failed to gain traction at the time due to a poor user experience, it was actually the precursor to the later "phone as a mining machine" and JamboPhone models.

However, these devices ultimately failed commercially. Finney, priced at a hefty $999, sold poorly, while Pundi X's decentralized communication failed to gain traction due to a lack of user base. The technology at the time overemphasized turning mobile phones into "cold wallets" or "full nodes," which was too difficult for ordinary users, resulting in the products only circulating within the geek community.

Mainstream manufacturers' initial forays (2019–2022): Cautious exploration

Image source: Internet; compilation created by AI.

Seeing the attempts of early entrepreneurs, mainstream mobile phone manufacturers began to test the waters more cautiously. Samsung integrated the Samsung Blockchain Keystore into the Galaxy S10 series, which theoretically gave tens of millions of flagship phone users a hardware-level encrypted wallet.

It's worth noting that Samsung actually laid the groundwork for the "buy a phone, get tokens" strategy as early as 2019. With its Galaxy Note 10 "KlaytnPhone" special edition, Samsung partnered with South Korean internet giant Kakao, randomly including 2,000 KLAY tokens. This can be seen as the earliest prototype of the later successful Solana Saga model, although at the time it was limited to the South Korean market and did not cause a global sensation.

This period also saw attempts targeting specific market segments. For example, Vertu launched the Metavertu, priced at tens of thousands of dollars, emphasizing "dual-system" switching and luxury services, attempting to attract crypto millionaires. HTC also transformed itself by launching the Desire 22 Pro, which focused on the concept of the metaverse.

Although the involvement of major manufacturers has brought a better hardware experience, the limitations of this stage are still obvious: Web3 functions are often hidden in deep menus or used only as a marketing gimmick, failing to fundamentally change users' usage habits.

Besides the "hardware wallet" attempts by major companies (Samsung) and "luxury gimmicks" (Vertu) during this phase, there was also a lightweight path of "software-defined membership," namely Nothing Phone. Nothing Phone partnered with Polygon to establish a decentralized membership loyalty program through the "Black Dot" NFT.

The Next Wave (2023–2025): Ecosystem Bonding and Infrastructure Development

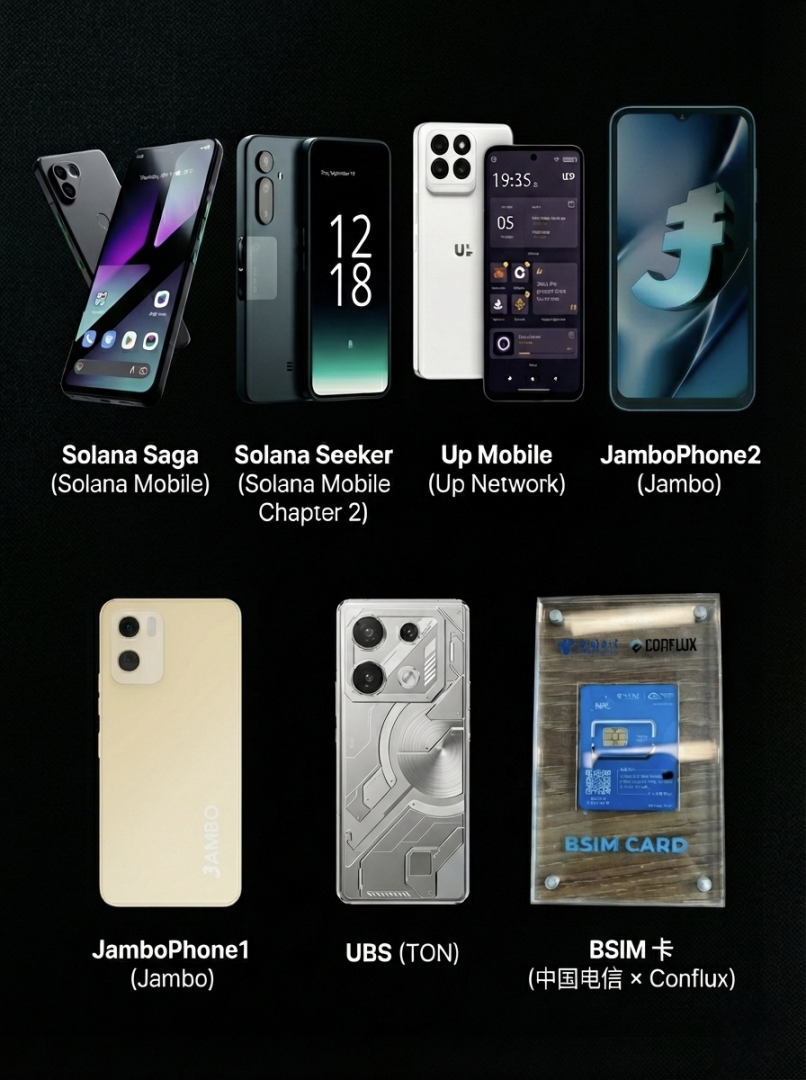

Image source: Internet; compilation created by AI.

In 2023, the Web3 phone market was completely revitalized by Solana Saga, ushering in a new era of "ecosystem binding" and "token incentives." Solana Saga's sales initially stagnated due to its low cost-performance ratio, but with the bonus BONK tokens airdropped and their value exceeding the phone's price, the phone sold out instantly and was dubbed the "dividend phone."

The subsequent Solana Seeker (Chapter 2) continued this airdrop logic, preventing scalpers from reselling by binding "Soul-Bound Tokens" (SBT), and introduced the TEEPIN architecture to support the decentralized infrastructure network.

Meanwhile, competition within the ecosystem is intensifying. The TON ecosystem launched the Universal Basic Smartphone (UBS), also priced at $99, directly challenging JamboPhone. Leveraging Telegram's massive user base, the TON phone emphasizes "data dividends," allowing users to earn money not only by completing tasks but also by selling their own data. Binance Labs' Coral Phone has also joined the fray, aiming to create a dedicated hardware entry point for the BNB Chain ecosystem, focusing on multi-chain aggregation and AI capabilities.

In the low-end market, JamboPhone entered the fray with an ultra-low price of $99, serving as an entry point for "super apps" and attracting users in Africa and Southeast Asia through a "Learn to Earn" model. New players like Up Mobile are also starting to combine AI and Move language technology to gain a share of the market. Jambo has already launched its second-generation product. While maintaining the $99 price, it has upgraded the memory to 12GB of RAM (although the processor is still entry-level), but it is now able to meet the demands of running more Web3 tasks and "super apps" in emerging markets.

The BSIM card launched by China Telecom and Conflux demonstrates another approach: a SIM card with a built-in high-performance security chip. Users can transform any ordinary Android phone into a higher-security Web3 device simply by replacing the SIM card. This "Trojan horse" strategy provides a completely new approach for the large-scale adoption of compliance in the market.

Trends: Shifts in Five Directions

Looking back at the past eight years of development, we can clearly see five key changes taking place in Web3 mobile phones.

Hardware capabilities and security architectures are being upgraded. Early security relied primarily on software or simple TEE isolation, but now, technology is evolving towards greater complexity. Solana Seeker introduced the TEEPIN (Trusted Execution Environment Platform Infrastructure Network) architecture, enabling mobile phones to participate in DePIN network construction as trusted nodes. China Telecom and Conflux's BSIM card directly integrates private key generation and storage into the SIM card, achieving carrier-grade hardware security. Xiaomi's collaboration with Sei utilizes MPC technology, allowing users to log in with their Google accounts with a single click, achieving secure management without the need for mnemonic phrases.

Ecosystem integration has become standard practice. Today's Web3 phones are not only general-purpose encrypted devices, but also entry points to specific public blockchain ecosystems. Saga is integrated with Solana, Up Mobile with Movement Labs, and JamboPhone, based on Aptos, further aggregates the Solana and Tether payment ecosystems, becoming a super application entry point in emerging markets. Mobile phones have become a channel for public blockchains to distribute applications and retain users.

Airdrops or incentives are driving user growth. Users' motivation for buying Web3 phones has shifted from "secure storage" to "earning rewards." Saga's success demonstrates that hardware can be used as a tool for "loss-leader acquisition," with subsequent token airdrops or other incentives used to compensate users. This "phone as a mining rig" or "phone as a gold shovel" economic model has become the strongest driving force in the current market.

Application scenarios take precedence over technical concepts. Early products were obsessed with geeky features like "running a full node," but the focus has now shifted to practical applications. Xiaomi's collaboration with Sei centers on stablecoin payments, while JamboPhone focuses on monetizing traffic generated by its built-in applications. Solving practical payment and application distribution problems is more attractive than simply piling on technology.

The effects of distribution channels and economies of scale are beginning to emerge. Selling 20,000 Solana Saga units was considered a huge success, but compared to Xiaomi's annual shipments of 168 million units, it's a drop in the ocean. When major manufacturers like Xiaomi begin pre-installing wallets in system updates, the growth in Web3 users will leap from tens of thousands to hundreds of millions. This scale effect is unmatched by any other encrypted phone manufacturer in any vertical market.

Conclusion: Tear down the walls and integrate into the masses

Over the past eight years, we have attempted to build security fortresses by creating expensive, closed Web3 phones. However, reality has shown that the real "walls" hindering the widespread adoption of Web3 are not security, but rather the complexity of mnemonic phrases and the disconnect in user experience.

A truly valuable Web3 phone will eventually no longer need to label itself as a "Web3 phone." It should be like today's 5G phones, where you don't need to understand the underlying communication protocols, but simply enjoy the ultra-fast experience it brings.

Solana Mobile proved that profit-driven expansion is feasible, while SEI, in partnership with Xiaomi, is attempting to demonstrate that experience-driven integration is the long-term solution. In this evolution from "hardcore toy" to "mass tool," whoever can lower the technical barriers of Web3 the most, and whoever can completely dismantle this cognitive barrier, will hold the ticket to the next wave of hundreds of millions of users.