The lending market does not need a manager model

- 核心观点:CLOB借贷模式可消除对主理人的依赖。

- 关键要素:

- 分离风险定义与订单撮合。

- 策略层隔离风险,撮合层自动路由。

- 支持合规与免许可策略共享流动性。

- 市场影响:提升效率与透明度,重塑借贷市场结构。

- 时效性标注:长期影响

Original title: CLOB Lending: Markets Don't Need Curators

Original author: @0xJaehaerys, Gelora Research

Original translation: EeeVee, SpecialistXBT, BlockBeats

Editor's Note: Following the collapses of Stream Finance and USDX, the DeFi community is undergoing a painful disenchantment. The "Curator" model introduced by protocols like Morpho and Euler, intended to address liquidity fragmentation, has inadvertently brought the moral hazard of "human" agents back onto the blockchain. This article argues that current lending protocols flawedly conflate "risk definition" with "order matching." By drawing inspiration from the order book model of traditional finance, this paper constructs a new paradigm that eliminates the need for a Curator and allows for automatic algorithmic routing.

The Evolution of the Lending Market

Reviewing the evolution of on-chain transactions can provide insights into our understanding of the lending market.

AMMs based on constant functions (such as Uniswap) solve a fundamental problem: how to create a market without active market makers? The answer is to pre-define the "shape" of liquidity using invariant functions. Liquidity providers pre-agree on a set of strategies, which are then automatically processed and executed by the protocol.

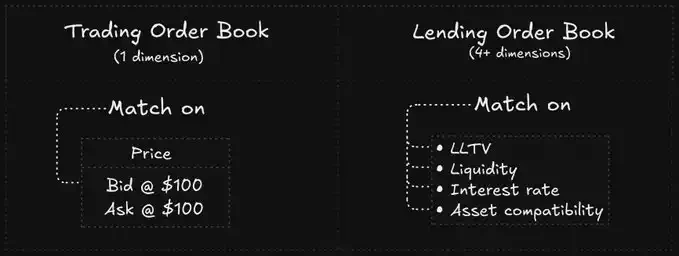

This works well in the trading field because trading is relatively simple: buyers and sellers simply meet at a certain price. But lending is far more complex. A loan involves multiple dimensions:

interest rate

Types of collateral

Loan-to-Value (LTV)

Term (Fixed vs. Flexible)

liquidation mechanism

The matching of loans needs to meet the constraints of all the above dimensions at the same time.

Early DeFi lending directly adopted AMM-like solutions. Protocols like Compound and Aave pre-defined interest rate curves, with lenders joining a shared liquidity pool. This allowed the lending market to function even without active lenders.

However, this analogy has a fatal flaw. In DEX trading, the shape of the constant function curve affects execution quality (slippage, depth); while in lending, the shape of the interest rate curve directly determines risk. When all lenders share a pool, they also share the risk of all the collateral accepted by that pool. Lenders cannot express their willingness to only take on a specific type of risk.

In the trading world, the order book solves this problem: it allows market makers to define their own "curve shape." Each market maker quotes at their preferred price, and the order book aggregates these quotes into a unified market, but each market maker still controls their own risk exposure.

Can lending be done using the same method? A project called Avon attempts to answer this question.

Liquidity Disconnection Problem

DeFi's first attempt at giving lenders control was market segregation.

Protocols like Morpho Blue and Euler allow anyone to create lending markets with specific parameters: specified collateral, loaned assets, a fixed liquidation loan-to-value (LTV) ratio, and an interest rate curve. Lenders deposit into markets that match their risk appetite. Bad debts in one market will never affect another.

This is perfect for lenders; they get the risk isolation they want.

But for borrowers, this creates a divide.

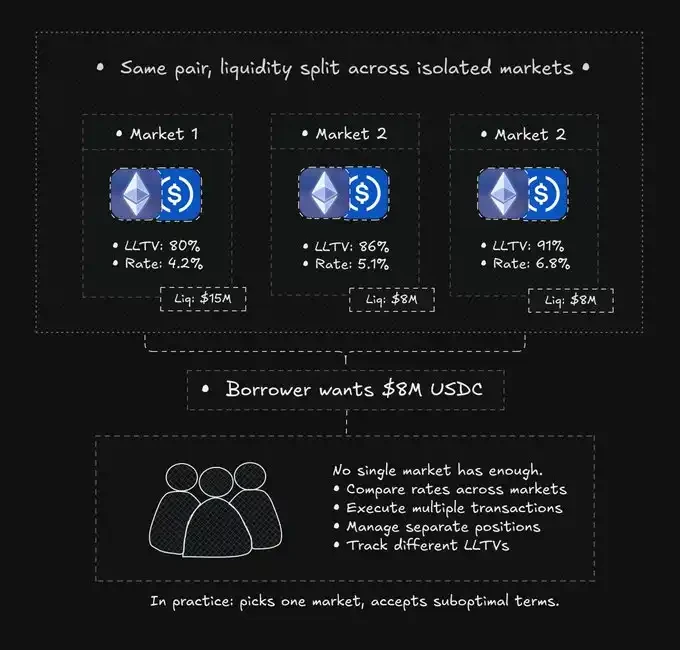

Taking ETH-USDC lending as an example, there may be more than a dozen different markets:

Market B: 3 million in liquidity, 86% LTV, 5.1% interest rate

Market C: 2 million in liquidity, 91% LTV, 6.8% interest rate

...and nine other markets with lower liquidity

Users seeking an $8 million loan cannot obtain satisfaction from a single market. They must manually compare prices, execute multiple trades, manage diversified positions, and track varying liquidation thresholds. Theoretically, the optimal solution would require splitting the loan across more than four markets.

In reality, nobody does that. Borrowers typically choose only one market. Funds are underutilized in fragmented pools.

Market risk isolation solved the lender's problem, but created the borrower's problem.

Limitations of the curatorial treasury

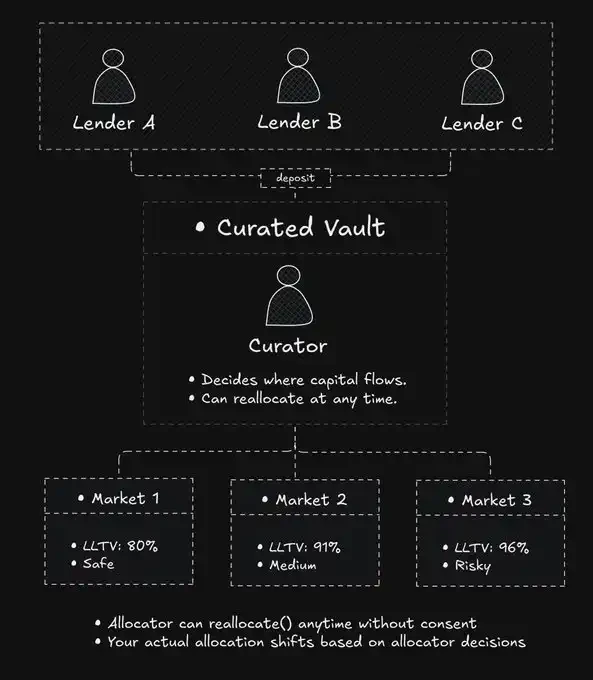

The curatorial treasury model attempts to bridge this gap.

The concept is that professional managers control the flow of funds. Lenders deposit their money into a vault, and the managers allocate the funds to various underlying markets, optimizing returns and managing risk. Borrowers still face a fragmented market, but at least lenders no longer need to manually adjust their portfolios.

This helped lenders who wanted to "lie flat," but it introduced something DeFi was supposed to eliminate: discretionary power.

The fund manager decides which markets receive funding and can reallocate it at any time. The lender's risk exposure changes based on the fund manager's decisions and is unpredictable and uncontrollable. As one Twitter user put it, "The fund manager is playing PvP with the borrower, but the borrower doesn't even know they're being exploited."

This asymmetry is reflected not only in the strategy but also in the accuracy of the basic interface. Morpho's UI sometimes displays "$3 million in available liquidity," but in reality, very little of the funds are at low interest rates, with the majority of the funds located in the high-interest rate range.

Transparency is compromised when liquidity coordination relies on human decision-making.

Fund allocators adjust market liquidity according to their own timelines, not to immediate market demand. Treasurys attempt to address borrower fragmentation through "rebalancing," but this requires gas fees, depends on the fund manager's will, and is often delayed. Borrowers still face suboptimal interest rates.

Separating risk from matchmaking

The lending agreement confuses two very different modules.

Users' definition of risk: Different lenders have different views on the quality of collateral and leverage ratio.

The protocol-based lending and borrowing method is mechanical. It does not require subjective judgment from the user, only efficient routing.

The fund pool model binds the two together, and the lender loses control.

The segregation pool model separates the definition of risk, but abandons matchmaking, requiring borrowers to manually find the optimal path.

The curatorial vault model reintroduces matchmaking through the role of the curator, but introduces an assumption of trust in the curator.

Is it possible to automate matchmaking without introducing discretion (human intervention)?

Order books in the trading world achieve this. Market makers define prices, order books aggregate depth, and matching is deterministic (best price priority). No one decides where orders go; the mechanism determines everything.

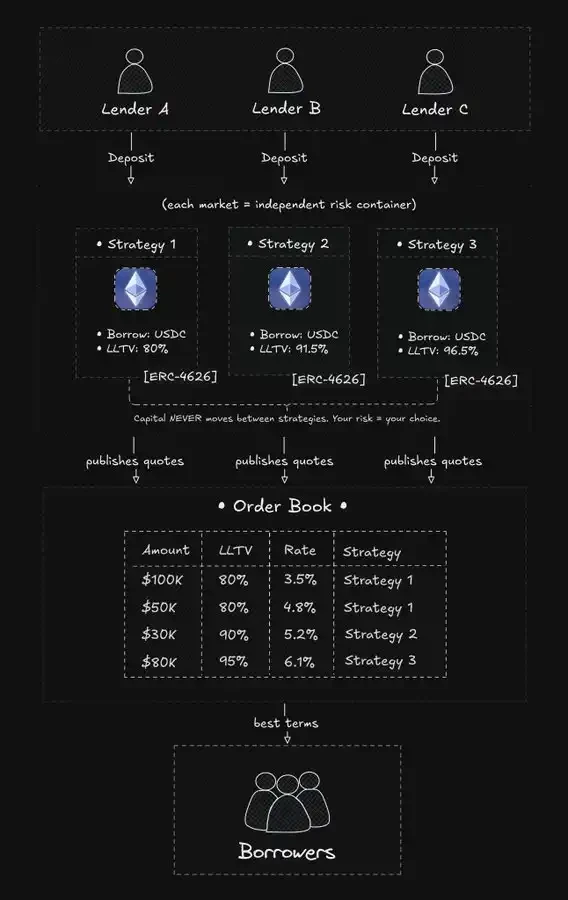

CLOB lending applies the same principles to the credit market:

Lenders define risk through segregation strategies.

The strategy publishes quotes to the shared order book.

Borrowers interact with a unified liquidity mechanism.

Matching occurs automatically, without the need for manager intervention.

The risk remains with the lender, and coordination becomes mechanized. No third party needs to be trusted at any stage.

Two-layer architecture

Avon implements order book lending through two unique tiers.

Strategy layer

A "strategy" is a segregated lending market with fixed parameters.

The strategy creator defines the following parameters: collateral/loaned assets, liquidation LTV, interest rate curve, oracle, and liquidation mechanism.

Once deployed, the shape of the yield curve cannot be changed. Lenders know the rules exactly before depositing money.

Funds never move between different strategies.

If you deposit into Strategy A, your money stays in Strategy A until you withdraw it. There is no manager, no rebalancing, and no sudden changes in risk exposure.

While there are still people (strategy managers) setting parameters, they are fundamentally different from the principal: the principal is the fund allocator (deciding where the money goes), while the strategy manager is the true risk manager (defining the rules but not handling the money), see Aave DAO. The decision-making power for fund allocation always rests with the lender.

How does a system adapt to market changes? Through competition, not parameter modifications. If the risk-free interest rate surges, it forces old strategies to be phased out (funds outflow) and new strategies to be created (funds inflow). "Discretion" shifts from "Where should the funds go?" (manager's decision) to "Which strategy should I choose?" (lender's decision).

Matching layer

The strategy does not directly serve borrowers, but instead publishes quotes to a shared order book.

The order book aggregates quotes from all strategies into a unified view. Borrowers see a comprehensive depth of all strategies that accept their collateral.

When a borrower places an order, the matching engine will:

Filter quotes by compatibility (collateral type, LTV requirements).

Sort by interest rate.

The deal will start with the cheapest one.

Settlement occurs in an atomic transaction.

If a strategy can satisfy the entire order, it covers it all; otherwise, the order is automatically split into multiple strategies. The borrower only perceives one transaction.

Important Note: The order book only reads the policy status and cannot modify it. It is only responsible for coordinating access and has no authority to allocate capital.

The Gospel of RWA

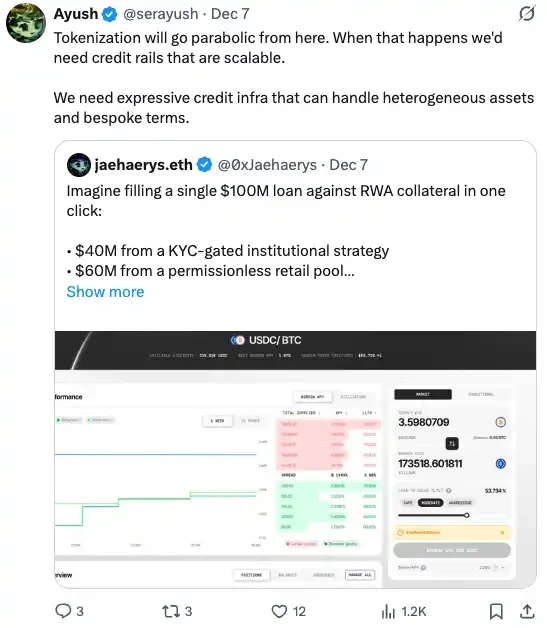

DeFi has always faced a structural contradiction in institutional adoption: compliance requirements require segregation, but segregation stifles liquidity.

Aave Arc experimented with a "walled garden" model, where compliant participants had their own pools. The result was shallow liquidity and wide interest rate spreads. Aave Horizon experimented with a "semi-open" model (RWA issuers required KYC, but lending was permissionless), which was progress, but institutional borrowers still couldn't access the $32 billion in liquidity in Aave's main pool. Some projects explored permissioned rollups. The KYC process was completed at the infrastructure level. This approach works for certain use cases but leads to fragmented liquidity at the network layer. Compliant users on chain A cannot access liquidity on chain B.

The order book model provides a third path.

The policy layer can implement any access control (KYC, geographic restrictions, accredited investor checks). The matching engine is only responsible for matching.

If both a compliant strategy and a license-free strategy offer compatible terms, they can both fill the same loan.

Imagine a corporate treasury collateralizing tokenized government bonds to borrow $100 million:

The 30 million comes from a strategy requiring KYC verification from institutions (pension fund LPs).

20 million comes from strategies requiring accredited investor certification (family office LPs).

$50 million comes from a completely license-free strategy (retail LPs).

Funds are never mixed at the source, institutions maintain compliance, but liquidity is uniform globally. This breaks the deadlock of "compliance equals segregation".

Multidimensional matching mechanism

The order book matches orders on only one dimension: price. The highest bid is matched with the lowest ask price.

The loan order book must match orders simultaneously across multiple dimensions:

Interest rate: Must be lower than the maximum acceptable to the borrower.

LTV: The borrower's collateral ratio must meet the policy requirements.

Asset compatibility: Currency matching.

Liquidity: The market has ample liquidity.

Borrowers can access more strategies by providing more collateral (lower LTV) or accepting higher interest rates. The engine will then find the cheapest path within this constrained space.

For large borrowers, there's something to be aware of. In Aave, $1 billion in liquidity is a single pool of funds. However, in order book lending, $1 billion might be spread across hundreds of strategies. A single $100 million loan can quickly deplete the entire order book, starting with the cheapest strategy and gradually filling it up to the most expensive. Slippage is obvious.

Slippage also exists in pooled systems, but it manifests differently: a surge in usage can drive up interest rates. The difference lies in transparency. In an order book, slippage is visible in advance. In a pooled system, slippage only becomes apparent after the trade is executed.

Floating rates and repricing

DeFi lending uses floating interest rates. As utilization changes, the interest rate also changes.

This presents a synchronization challenge: if strategy utilization changes but the quotes on the order book are not updated, borrowers will close at the wrong price.

Solution: Continuously requote.

Once the strategy state changes, a new quote is immediately published to the order book. This requires extremely high infrastructure performance.

Extremely fast block generation time.

Extremely low transaction costs.

Atom state reading.

This is why Avon chose to build on top of MegaETH. On the Ethereum mainnet, this architecture is not feasible due to excessively high gas fees.

Existing friction:

If market interest rates change, but the strategy's fixed curve is not adapted, a "dead zone" will occur—borrowers will not lend because the rates are too high, and lenders will not profit. In Aave, the curve will adjust automatically, but in CLOB mode, this requires lenders to manually withdraw funds and migrate to the new strategy. This is the price paid for gaining control.

Multi-strategy position management

When a loan is filled by multiple strategies, the borrower is actually holding a multi-strategy position.

Although it appears to be a loan on the interface, the underlying structure is independent:

Independent interest rates: The interest rate of component A may increase as the utilization rate of strategy A increases, while that of component B remains unchanged.

Independent Health Ratio: When the price of the coin drops, components with stricter LTV restrictions will be partially liquidated first. You won't be liquidated all at once, but rather experience a series of partial liquidations as if you are being "nibbled away" at.

To simplify the experience, Avon offers unified position management (one-click addition of collateral, automatic allocation by weight) and one-click refinancing (automatic borrowing to repay old debts via flash loans, always locking in the best market interest rate).

in conclusion

DeFi lending has gone through several stages:

Pooled agreements: Give borrowers depth but deprive lenders of control.

Isolated markets: Give lenders control, but fragment the borrowing experience.

Curatorial Vaults: Attempts to bridge the gap between the two, but introduces the risk of human decision-making.

Order Book Lending (CLOB): This model decouples from the above-mentioned model. The right to define risk returns to the lender, and matching is achieved through the order book engine.

The design principle is clear: when matching can be achieved through code, human intervention is no longer needed. The market can self-regulate.