US Markets Open the Gates: Altcoin ETFs Usher in a New Era

- 核心观点:山寨币ETF集中上市,标志加密监管结构性放松。

- 关键要素:

- 通用上市标准缩短审批周期至60-75天。

- 政府停摆触发“8(a)条款”,加速默许上市。

- SOL、XRP ETF逆势获大额资金流入。

- 市场影响:推动加密资产全面机构化,重塑资金结构。

- 时效性标注:中期影响

I. A surge in the listing of altcoin ETFs

The fourth quarter of 2025 saw a surge in altcoin spot ETFs in the US market. Following the opening of ETFs for Bitcoin and Ethereum, altcoin ETFs such as XRP, DOGE, LTC, and HBAR were launched in the US, while ETFs for assets like AVAX and LINK entered a fast-track approval process. In stark contrast to the decade-long regulatory battle surrounding Bitcoin ETFs, these altcoin ETFs completed the entire process from application to listing in just a few months, demonstrating a significant shift in US regulatory attitudes. The emergence of altcoin ETFs is no longer an isolated event, but a natural consequence of the structural relaxation of crypto regulations.

The key factors igniting this wave of IPOs stem primarily from two points: the SEC's approval of the General Listing Standards for Commodity Trust Shares (GST) amendments on September 17, 2025, and Section 8(a) triggered during the US government shutdown in November. The GST establishes a unified admissions system for crypto asset ETFs, eliminating the need for eligible assets to undergo lengthy SEC reviews individually. This system applies to crypto assets that have a history of more than six months in a CFTC-regulated futures market with a monitoring-sharing mechanism, or that already have at least 40% exposure in an existing ETF, thereby shortening the exchange-side approval cycle from 240 days to 60–75 days.

Secondly, the triggering of Section 8(a) in November and the SEC's passive position accelerated the ETF listing process. During the US government shutdown, general standards were briefly interrupted, but on November 14th, the SEC issued guidance, allowing issuers for the first time to voluntarily remove delay amendment clauses from their S-1 registration statements. According to Section 8(a) of the Securities Act of 1933, a statement without this clause automatically becomes effective after 20 days unless the SEC intervenes. This created a de facto tacit approval channel for listing. At this time, due to the government shutdown, it was impossible to block applications one by one within the limited time. Issuers such as Bitwise and Franklin Templeton seized the opportunity, completing rapid registration by removing delay clauses, leading to a concentrated launch of altcoin ETFs in mid-to-late November, forming the current wave of crypto asset ETF listings in the market.

II. Performance Analysis of Major Altcoin ETFs (October–December 2025)

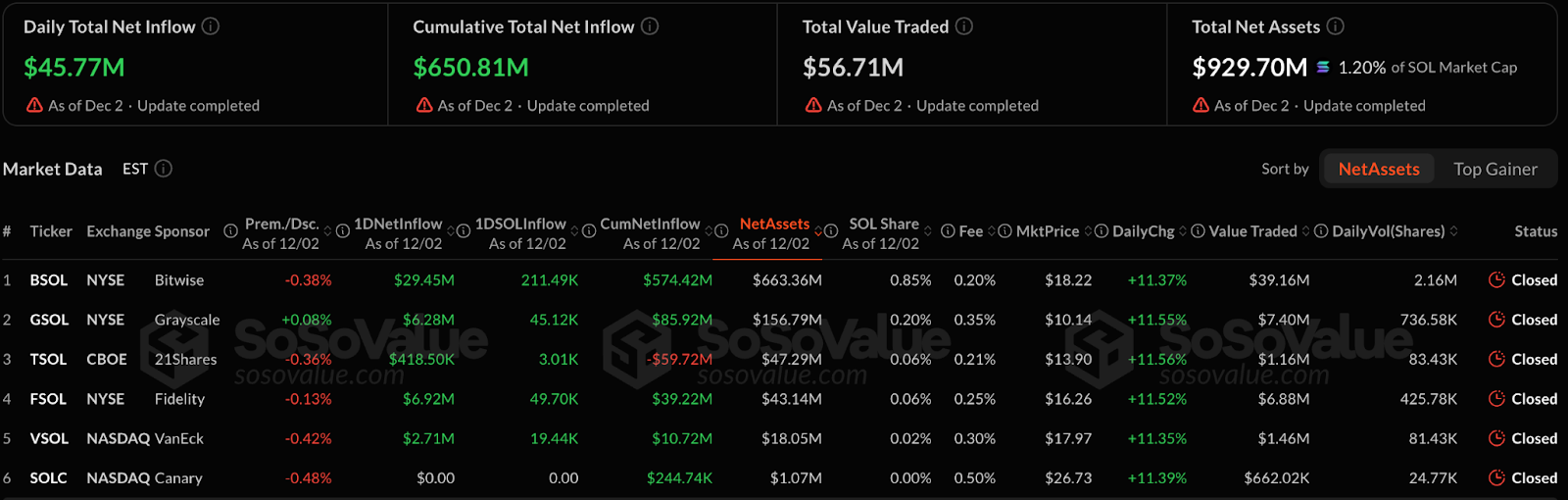

Solana (SOL)

SOL's first batch of products was listed on October 28th. Although the price of SOL has continued to fall by about 31% since its listing, funds have shown a counter-trend inflow, buying more as the price drops. As of December 2nd, the entire SOL ETF sector had accumulated a net inflow of $618 million, with total assets reaching $915 million, accounting for 1.15% of SOL's total market capitalization. Achieving such a scale in less than two months also reflects, to some extent, the market's widespread recognition of SOL's positioning as the "third largest public blockchain."

Bitwise's BSOL stood out, attracting approximately $574 million in inflows alone, making it the largest single fund among SOL ETFs. BSOL's leading position is key to its staking reward mechanism—all SOL holdings are directly staked, and the staking rewards are not distributed to investors but are automatically reinvested to increase the fund's net asset value. This method of linking staking returns to the fund's net asset value provides a compliant, convenient, and profitable alternative for institutions/investors who wish to participate in the SOL ecosystem but do not want to manage their private keys and nodes themselves.

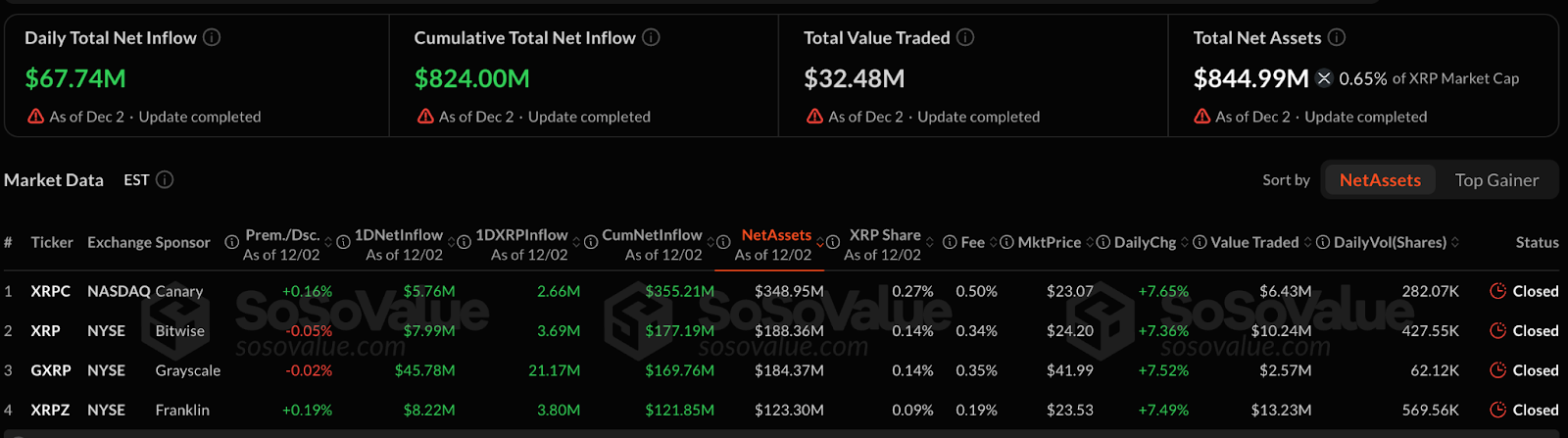

Ripple (XRP)

XRP ETFs began launching gradually on November 13, 2025, during which time the price of XRP fell by approximately 9%. Similar to SOL, XRP ETFs also exhibited a buying trend as prices fell. As of December 2nd, cumulative net inflows reached $824 million, with total assets valued at approximately $844 million, representing 0.65% of XRP's total market capitalization. The size difference among major issuers in XRP ETF products was not significant, with multiple institutions exhibiting a relatively balanced market share.

Doge (DOGE)

The DOGE ETF has been met with a complete market backlash, confirming the significant gap between Meme coins and institutional funding channels. Products like Grayscale's GDOG (listed on November 24th) have performed extremely poorly, with a cumulative net inflow of only $2.68 million and assets under management of less than $7 million, representing a mere 0.03% of Doge's total market capitalization. Even more concerning is Bitwise's similar product, which saw zero inflows, and its low daily trading volume (approximately $1.09 million) indicates that traditional investors remain skeptical of Meme assets like Doge, which lack fundamental support and rely heavily on community sentiment.

Hedera (HBAR)

As a representative of small-to-mid-cap projects, the HBAR ETF has achieved a relatively successful market penetration effect relative to its size. Launched on October 29th, the ETF has attracted a net inflow of $82.04 million despite a nearly 28% drop in HBAR's price over the past two months. This has brought the HBAR ETF's assets under management to 1.08% of HBAR's total market capitalization. This penetration effect is far greater than that of altcoins like Doge and LTC, which may indicate that the market has a certain degree of confidence in mid-cap assets like HBAR with clear enterprise-level applications.

Litecoin (LTC)

The LTC ETF serves as a classic example; traditional assets lacking a new narrative struggle to find revitalization even with ETF access. Since its listing on October 29th, its price has been weak, falling approximately 7.4%, with minimal investor attention and a cumulative net inflow of only $7.47 million, including several days with zero inflows. Daily trading volume of only about $530,000 highlights its insufficient liquidity. This demonstrates that the outdated narratives currently relied upon by LTC, such as digital silver, are no longer appealing in today's market.

ChainLink (LINK)

Grayscale's GLINK ETF officially launched on December 3rd, attracting nearly $40.9 million on its first day. Currently, its total asset value is approximately $67.55 million, representing 0.67% of Link's total market capitalization. Based on the first day's trading results, GLINK has achieved a strong start in terms of both liquidity and investor appeal.

III. Major Participants and Funding Sources of Altcoin ETFs

Since the launch of altcoin ETFs, the crypto ETF market has seen a clear divergence: while Bitcoin and Ethereum prices have continued to fall and related ETFs have experienced continuous outflows, altcoin ETFs such as SOL, XRP, HBAR, and LINK have bucked the trend and attracted inflows. This means that some funds withdrawn from BTC and ETH ETFs have not left the crypto market but have instead moved to assets with higher growth potential. This also indicates that the funding sources for altcoin ETFs exhibit a two-tiered structure, involving both existing fund reallocation and new fund entry.

The incremental funds primarily come from traditional financial giants participating in this offering, including BlackRock, Fidelity, VanEck, Franklin Templeton, and Canary. These institutions' funding sources encompass pension funds, insurance funds, wealth management accounts, 401(k) retirement plans, asset management clients, and family offices. Previously, they were restricted from directly purchasing altcoins due to compliance hurdles; now, through ETFs, they have achieved legal allocation for the first time, resulting in a substantial inflow of new funds. In other words, the mass launch of altcoin ETFs has provided traditional funds with a new opportunity to enter the cryptocurrency market.

IV. Future Outlook: The Next Round of Expansion for Altcoin ETFs

The successful launch of the first batch of products, including SOL, XRP, and HBAR, has clearly established the institutionalization path for altcoin ETFs. Next, public chains with larger ecosystems and higher institutional attention will be the focus, including AVAX, ADA, DOT, BNB, TRX, SEI, and APT. Once approved for listing, these assets are expected to further attract compliant funds, bringing a new round of liquidity expansion to the multi-chain ecosystem. Looking ahead, the altcoin ETF market will exhibit three major trends:

First, the concentration of leading companies and product differentiation are intensifying in parallel.

Assets with clear fundamentals and long-term narratives will continue to attract capital, while projects lacking ecosystem drivers will struggle to improve their performance even after listing. Meanwhile, competition among ETF products will increasingly revolve around fees, collateralized returns, and brand strength, with leading issuers attracting the majority of funds.

Secondly, product forms will shift from simple tracking to strategic and combined approaches.

Index-based, multi-asset basket, and actively managed products will emerge one after another to meet the professional needs of institutions in risk diversification, return enhancement, and long-term allocation.

Third, ETFs will become a key force in reshaping the funding structure of the crypto market.

Assets included in ETFs will receive a "compliance premium" and stable capital inflows, while tokens not included in the compliance framework will face a continuous loss of liquidity and attention, further strengthening the market stratification structure.

In other words, the focus of competition among altcoin ETFs is shifting from "whether they can be listed" to "how to continuously attract funds after listing." With AVAX, ADA, DOT, BNB, TRX, and others nearing the final approval stage, the second expansion cycle of altcoin ETFs has quietly begun. 2026 will be a crucial year for the full institutionalization of crypto assets, not only in terms of the continued expansion in the number of listings, but also in bringing about a profound reshaping of the pricing logic and competitive landscape of the ecosystem.

Risk warning:

The information above is for reference only and should not be considered as advice to buy, sell, or hold any financial assets. All information is provided in good faith. However, we make no representations or warranties, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of such information.

All cryptocurrency investments (including financial products) are inherently highly speculative and carry a significant risk of loss. Past performance, hypothetical results, or simulated data are not indicative of future outcomes. The value of cryptocurrencies may rise or fall, and buying, selling, holding, or trading cryptocurrencies may involve significant risks. Before trading or holding cryptocurrencies, you should carefully assess whether such investments are suitable for you based on your investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.