The Other Side of Moore Threads' IPO Frenzy: The Unresolved Dispute Over 1,500 Bitcoins Founder

- 核心观点:摩尔线程上市引发财富效应,创始人李丰币圈往事引争议。

- 关键要素:

- 摩尔线程上市首日暴涨469%,市值破3000亿。

- 创始人李丰曾涉足争议ICO项目“马勒戈币”。

- 李丰被指借款1500枚比特币未还,现价值超1亿美元。

- 市场影响:凸显科技股投资风险与创始人背景重要性。

- 时效性标注:长期影响。

Original author: 1912212.eth, Foresight News

On December 5, Moore Threads, touted as the "first domestic GPU stock," debuted on the STAR Market with an opening price of 650 yuan per share, a surge of 468.78% from its issue price of 114.28 yuan, bringing its total market capitalization to over 300 billion yuan.

This capital frenzy, where winning a single lot (500 shares) could net a profit of over 267,000 yuan, ignited enthusiasm in the A-share technology sector. It's worth noting that the online lottery winning rate was approximately 0.03635%, meaning only one in about 2,750 lots could win.

What is little known is that Li Feng, co-founder of Moore Threads and dean of Moore Academy, is a serial entrepreneur who has emerged across fields such as chips and AI. He was once pushed to the forefront of controversy due to a cryptocurrency incident.

Moore's Thread Wealth Myth

The rise of Moore's Threads is a microcosm of China's efforts to overcome the "bottleneck" in AI computing power. Since its establishment in 2020, the company has completed eight rounds of financing, raising a total of over 9.498 billion yuan. It has gathered more than 80 institutions, including Sequoia China, Shenzhen Capital Group, Tencent, and ByteDance, forming a golden combination of "market-oriented VC/PE + state-owned venture capital + industry CVC".

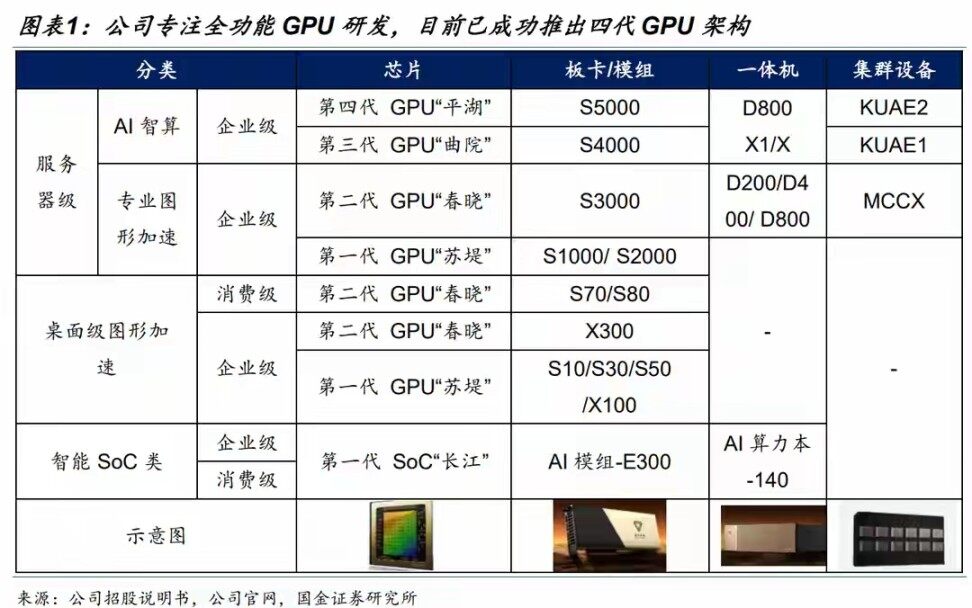

Its core products, the "Sudi" and "Chunxiao" full-featured GPU chips, have been applied to national-level projects such as the Gui'an AI Intelligent Computing Center, and have formed deep collaborations with industry chain partners such as Heertai and Weixing Intelligent.

Despite the company's cumulative losses of 5.939 billion yuan from 2022 to 2025 and its gross profit margin not yet turning positive, the capital market still has high hopes for it.

On its first day of trading, E Fund Management saw a paper profit of nearly 1.9 billion yuan, while early investors such as Tencent and ByteDance saw returns of over 35 times. Peixian Qianyao, with a return of 6200 times, became famous overnight and became the biggest winner of Moore Threads' IPO.

Behind this wealth feast lies the market's strong expectation for China's GPU industry to leap from "domestic substitution" to "global competition." Li Feng stated at the listing ceremony: "Moore's Threads' mission is to enable China to possess its own core technologies in the field of graphics processing."

Li Feng is not only the co-founder of Moore Threads, but has also been involved in multiple fields, including the cryptocurrency industry.

Cryptocurrency Chronicles: The Absurdity and Controversy of Malego Coin

Li Feng claims that after graduating from Tsinghua University, he has been involved in multiple fields such as chips, 3D engines, artificial intelligence, games, smart hardware, VR/AR, digital agriculture, and biomedicine, and has founded or co-founded several technology companies.

At Moore Threads, he is not only a co-founder but also the dean of Moore Academy.

Before achieving fame and success, Li Feng was embroiled in controversy due to his project "Malgocoin" (MGD).

In 2017, during the ICO (Initial Coin Offering) frenzy, Li Feng, together with cryptocurrency bigwigs such as Li Xiaolai and Xue Manzi, launched the project, using the gimmick of "the first modern performance art based on blockchain in human history" to raise 5,000 ETH through crowdfunding.

The project's white paper was rife with absurdities, claiming it would develop an AI cloud system, with each token linked to a self-learning "alpaca" robot. Value appreciation was to be achieved through the system's remaining computing resources. The token distribution plan even reserved 10% for the year 2100. The team's background was packaged as "composed of a CEO, CTO, CFO, PhDs, returnees, and investment bankers," but this was largely fabricated. Despite this, fueled by endorsements from industry leaders and the perceived industry bubble, MGD completed its fundraising within a week of its launch.

However, the project was soon summoned by relevant departments due to its sensitive name (containing vulgar words) and was forced to change its name to "Alpaca Coin MGD".

As regulations become stricter and project popularity fades, cryptocurrency prices remain sluggish for an extended period.

Finally, this farce came to an end.

1,500 bitcoins were borrowed but never returned; they are now worth $135 million.

If Malegocoin was an absurd footnote to Li Feng's career in the cryptocurrency world, then his debt dispute with OKX founder Star pushed him into a vortex of moral controversy.

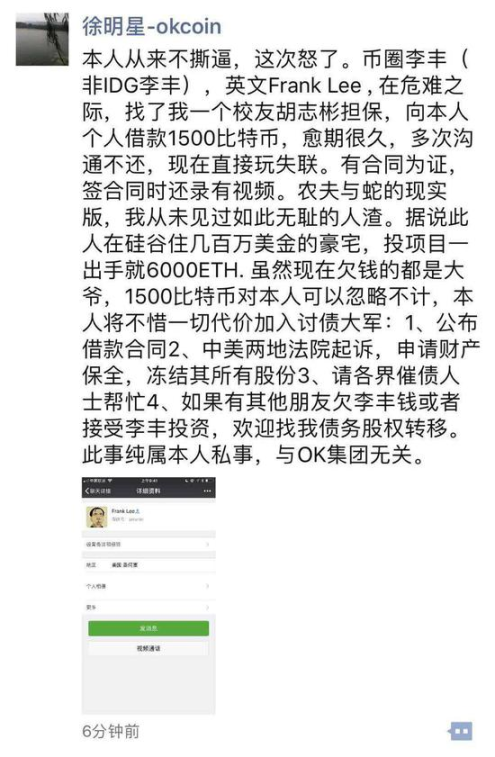

In June 2018, Star publicly accused Li Feng on his WeChat Moments of borrowing 1,500 bitcoins (worth approximately 80 million yuan at the time) and then refusing to repay them, even disappearing from his contacts. (According to sources who spoke to Foresight News, Li Feng has since returned part of the funds). He posted the loan agreement and video evidence, calling Li Feng a "shameless scumbag," and announced that he would file lawsuits in courts in both China and the United States, applying for asset preservation.

NEO Wang Zhenfei, founder of Charging Network, commented in the comments section: "I chased him for three years and only got a portion of the money back. This guy is an absolute piece of trash and a scoundrel."

In mid-2018, BTC was only around $7,000. These 1,500 BTC were worth about $10 million at the time. By December 2025, the price of BTC was around $90,000, and the total value had reached $135 million.

Li Feng responded via group chat, stating that the loan was actually Star's investment in the MGD project, and because the project had not yet been launched, Star regretted it and wanted the funds back.

Both sides have their own version of events.

Chinese law defines Bitcoin as a "specific virtual commodity," and enforcement of civil loan disputes remains a challenge. Star's debt collection efforts ended inconclusively due to Li Feng's "disappearance" and jurisdictional issues.

References:

1. [Xu Mingxing pursues 1500 bitcoins from "Malgocoin founder," a cryptocurrency defaulter]. https://www.528BTC.com/bitcoin/17002.html

2. [Blockchain Figures | 52 Blockchain "Big Shots" You Should Know, All Printed on This Set of Playing Cards]. https://baijiahao.baidu.com/s?id=1590938812870735934&wfr=spider&for=pc