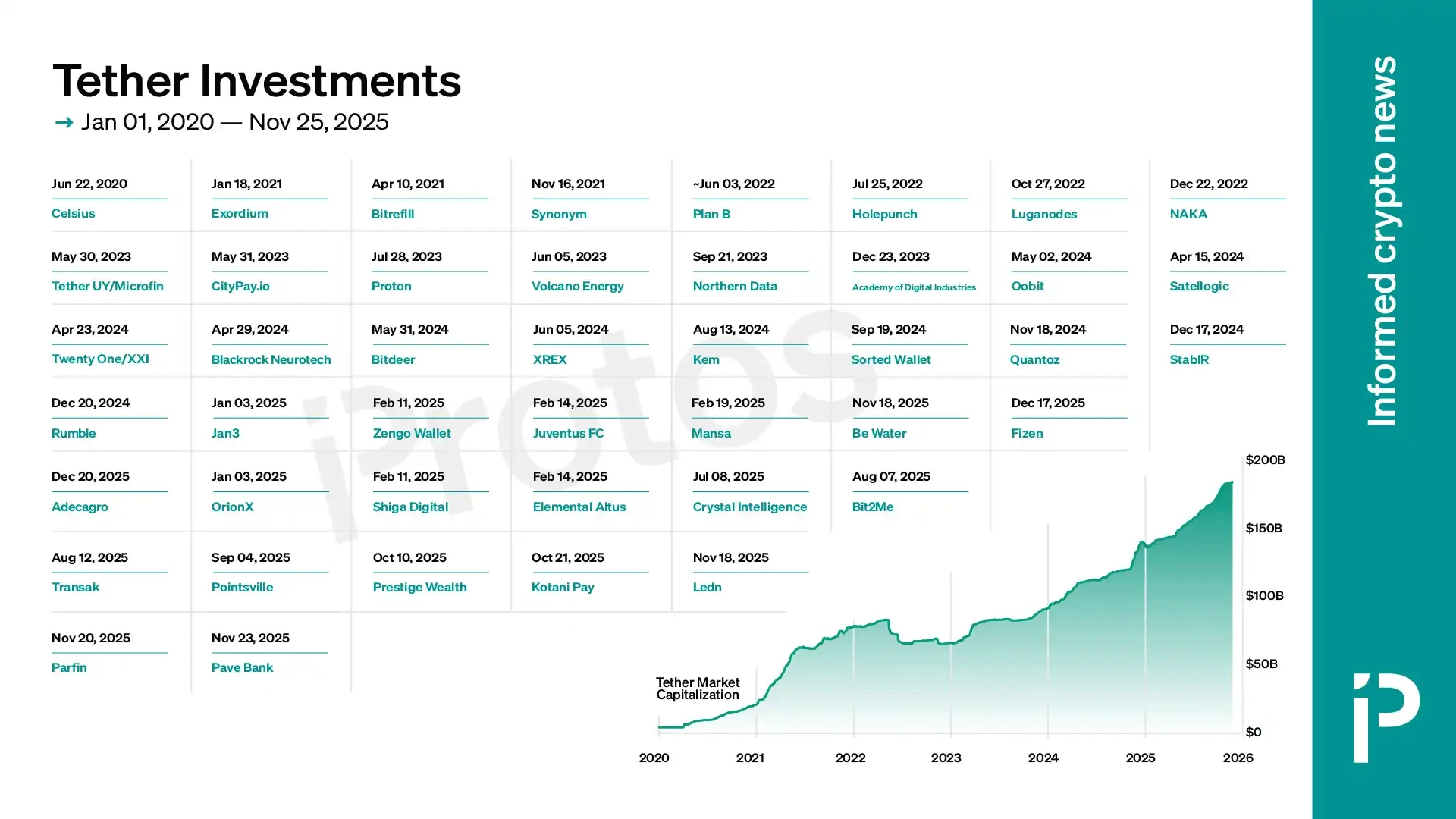

Tether's latest investment portfolio still shows that the crypto sector remains dominant.

- 核心观点:Tether投资版图广泛但透明度不足。

- 关键要素:

- 投资超120家公司,官网仅公开24家。

- 投资领域横跨AI、挖矿、支付、媒体等。

- 部分关键投资(如Celsius)未在官网披露。

- 市场影响:引发对其财务稳健性和市场影响力的担忧。

- 时效性标注:中期影响

Original title: Tether Investments: What a $100B stablecoin empire does with its profits

Original author: Bennett Tomlin, protos

Original translation by: Rhythm Worker, BlockBeats

Tether is now one of the world's most influential financial groups. It not only operates the world's largest stablecoin by market capitalization, but its investments also span multiple sectors, including cryptocurrency, payment processing, video streaming, artificial intelligence, brain-computer interfaces, agriculture, satellites, and football.

These investments aim to expand the company's reach and influence, and if successful, they are likely to bring huge financial returns in the future.

Tether CEO Paolo Ardoino has revealed that Tether has invested in more than 120 companies, but only 24 of them are publicly listed on the "Tether Ventures" page of its official website.

This public list has changed over time. Screenshots and online archives posted by Ardoino confirm that OrionX was included on the list when Tether Ventures launched. Tether later referred to OrionX as "one of Chile's leading digital asset exchanges" in a deleted blog post.

Protos contacted Tether to inquire why the company was removed from the website, but had not received a response before publication.

In fact, there are many other investment projects that have been reported by the media—and sometimes even appear on Tether's own website—but for some reason, they are not included in this portfolio page.

Samson Mow's company

Samson Mow, former chief strategy officer of Blockstream, has had his company receive multiple investments from Tether.

The earliest of these deals involved Tether's participation in Exordium's Security Token Offering (STO). Exordium, the publisher behind the game Infinite Fleet, was founded by Mow. Exordium uses Holepunch technology, funded by Tether, to distribute its game client.

Exordium's website claims that its security token is still available on Bitfinex Securities (an affiliate of Tether). However, a check of Bitfinex Securities' website reveals that the token is not currently listed in the trading ticker.

Exordium is not the only company founded by Mow that Tether has invested in; Tether also invested in Jan3. Jan3 raised funds from Tether to "accelerate the development and expansion of the AQUA wallet."

In addition, Blockstream has also received funding from iFinex, one of the companies that operates the Bitfinex platform.

Celsius

Tether is also an equity investor in Celsius, a now-defunct cryptocurrency lending platform embroiled in a massive fraud.

Celsius founder and former CEO Alex Mashinsky was recently sentenced to 12 years in prison.

It's understandable that this investment wasn't listed on Tether Ventures' page, given that the equity became practically worthless after the fraudulent platform collapsed.

In addition to equity investments, Tether also provided loans to Celsius, the liquidation of which was a major point of contention in Celsius's bankruptcy proceedings. The lawsuit recently concluded with a $299.5 million settlement.

Volcano Energy

Volcano Energy is a Bitcoin mining project in El Salvador that initially planned to use geothermal energy from volcanoes to power a series of Bitcoin mining machines.

Tether describes its goal as "fulfilling its mission of investing in renewable energy to support and promote sustainable Bitcoin mining."

According to the project's website, Volcano Energy has since shifted its focus from volcanic geothermal energy to wind and solar power. Currently, the project has not yet begun mining any Bitcoin.

Tether Uruguay / Microfin

Tether also partnered with local company Microfin to invest in Bitcoin mining operations in Uruguay. Tether stated that this investment demonstrates its "commitment to energy innovation and the future of cryptocurrency."

In September of this year, reports surfaced that Tether was planning to abandon the project due to unpaid electricity bills. At the time, Tether told Cointelegraph, "Tether remains committed to these efforts and will seek a constructive path forward, reflecting our long-term commitment to sustainability opportunities in the region."

However, according to El Observador, Tether has since officially abandoned the project, citing excessively high energy costs and its lack of economic viability.

Tether's Special Projects Services

Tether also has several projects under its "Special Projects Service" division, which is led by Davide Rovelli.

This includes Plan B, a cryptocurrency conference based in Switzerland and operated by AltKey SA, led by Rovelli. Plan B's stated goal is to "establish a European crypto hub in Lugano."

Luganodes, a provider of "staking-as-a-service," claims to be one of the "masterpieces" of Plan B. This provider primarily focuses on the Tron network, founded by Justin Sun, which has the second-largest issuance of USDT tokens.

2040 Energy / Proton

2040 Energy was originally a joint project between Tether and Swan.

The project eventually escalated into litigation, with allegations that Tether misled consultants from 2040 Energy to launch the Proton Management project, which has closer ties to Tether. Both 2040 Energy and Proton Management are funded by Tether.

Recently, Proton Management successfully filed for compulsory arbitration in the Central District Court of California. These projects represent only a portion of Tether's growth into a major funder of the Bitcoin mining ecosystem.

Satellogic

Tether has even extended its investment reach into space, investing in Satellogic, a company that operates satellites and sells observational data.

In its press release announcing the investment, Satellogic stated that the funds "will help advance our mission as we continue to focus on strategic positioning in the United States, national security markets, and opportunities in global space systems."

In October, Satellogic announced that it would publicly offer a portion of its shares.

Parfin

In a blog post, Tether described Parfin as "a digital asset custody, tokenization, trading, and management platform in Latin America."

This investment is part of what Ardoino described as Tether's "firm belief that Latin America will become one of the world's leading centers of blockchain innovation."

Among other features, Parfin advertises that it offers "compliance-as-a-service" management tools for other financial institutions. Parfin has also launched a product called Rayls, described as a "blockchain for banks."

According to CoinMarketCap, the market capitalization of the tokens associated with the project is approximately $44 million.

Ledn

Ledn is a Bitcoin lending platform that Ardoino claims can "expand credit channels without requiring individuals to sell their digital assets."

Ledn was one of the smaller lenders to Alameda Research. Following the collapse of FTX and Alameda, Ledn claimed it had "fully absorbed the impact of its outstanding loans with Alameda," further noting that "Ledn also holds a small amount of assets on FTX, but this will not affect its clients' assets."

Ledn had previously relied on Genesis Global Capital as a partner, but reportedly terminated that relationship before Genesis collapsed. These issues all occurred before Tether invested in the company.

Kotani Pay

Tether describes Kotani Pay as "a deposit and withdrawal infrastructure that connects Web3 users across Africa with local payment channels."

It advertises its ability to convert various local currencies into cryptocurrencies. Furthermore, it offers so-called "stablecoin settlement solutions" designed to facilitate cross-border payments, claiming they are faster than banks.

Bit2Me

Bit2Me is described in Tether's blog as a "leading Spanish-language digital asset platform".

It offers exchange services, as well as "Earn" products, "Loan" products that allow users to take out cryptocurrency-backed loans, and a "blockchain securities exchange".

It owns a platform token called B2M. According to self-reported data on CoinMarketCap, its market capitalization has fallen from a peak of approximately $550 million to just $58 million.

Pave Bank

Tether's latest investment has been in Pave Bank, a Georgian-regulated bank that promises to provide "global, secure multi-asset banking" and "programmable banking".

The company claims that it is a "technology company" in terms of product design and construction, and a "fully regulated bank" in terms of risk, capital and regulatory management.

Prestige Wealth

Prestige Wealth (or Aurelion) is an unusual company. It is similar to other digital asset treasury (DAT) companies, except that it invests in Tether Gold, a tokenized version of so-called real-world assets (RWA).

Tether invested in the company when it was raising funds to purchase Tether Gold. A significant portion of its Private Equity Investment in Publicly Traded Companies (PIPE) funding was contributed in the form of Tether (USDT) tokens.

In the press release announcing the investment, Aurelion CEO Björn Schmidtke stated, "This is not just about returns or finance: it's about redefining how to hold, transfer, and preserve real wealth in the digital age."

The press release later claims that Aurelion offers "yields, transparency, regulatory compliance, and daily on-chain verification."

Pointsville

Pointsville is another company focused on tokenizing real-world assets (RWA) and offering loyalty programs.

The company is led by Gabor Gurbacs, whose LinkedIn profile shows him as Tether's chief strategy advisor.

In a press release describing the funding round, Ardoino stated, "Tokenization is rapidly becoming one of the most practical and impactful drivers of real-world asset adoption. Tether's Hadron platform is proud to support this transformation, partnering with the experienced team in Pointsville to provide the scale and availability needed to integrate real-world assets and loyalty programs into the digital economy."

Transak

Transak describes itself as a "global leader in fiat-to-crypto infrastructure," and Ardoino says it is "accelerating adoption in emerging and developed markets, bridging financial access gaps, and creating new opportunities for businesses and consumers."

It offers over-the-counter (OTC) trading services as well as deposit and withdrawal services.

Unlike the investments mentioned above, Tether does have some other significant investments listed on its website.

Rumble and Northern Data

When Tether initially invested in Northern Data, it was a data center and Bitcoin mining company.

Tether quickly became a major shareholder. Since then, Northern Data has spun off its mining business as Peak Mining and begun to focus heavily on artificial intelligence (AI).

Tether also invested in Rumble, a video streaming site popular among right-wingers, especially those banned by Twitch.

Subsequently, Rumble acquired Northern Data, a deal that gave Tether approximately a 30% stake in Rumble. In addition to incorporating cryptocurrency into its balance sheet, Rumble also brought in Tether as a major advertiser, with Tether agreeing to invest $100 million in advertising.

Rumble's recent earnings call discussed the company's intention to transform into an AI infrastructure company that it calls itself "freedom-first".

Ardoino was highlighted during the conference call, at one point claiming that "Rumble's vision is completely aligned with ours."

Rumble CEO Chris Pavlovski also stated in the conference call that Rumble will roll out its cryptocurrency-based wallet to all its user base this month. 1789 Capital, a venture capital firm with Donald Trump Jr. as a partner, has also invested in Rumble.

Bitdeer

Jihan Wu has a long history in the Bitcoin mining industry; he is the co-founder and former CEO of Bitmain.

He now leads Bitdeer, a company spun out of Bitmain and publicly listed on Nasdaq. Tether invested in Bitdeer, holding over 20% of the company at its peak, before reducing its stake to approximately 18%.

CityPay.io

CityPay.io is a Georgian-based company that focuses on helping merchants accept cryptocurrency payments.

When Tether invested in the company, it stated that it would be part of its efforts to "expand its influence in Georgia." Ardoino said that Tether is "excited to partner with CityPay.io to bring greater innovation and efficiency to Georgia's payments industry."

Fizen

Fizen is described in a Tether blog post as a "company focused on self-custodied crypto wallets and digital payments".

Fizen's website advertises that it allows you to "earn money on the go" and promotes its ability to "earn money anytime, anywhere."

Ardoino stated that this investment "underscores our commitment to expanding global access to efficient and reliable digital financial solutions, thereby promoting the intelligent and responsible use of digital assets in everyday life."

Kem

Kem is described in a Tether blog post as "a platform designed specifically for remittances and financial management," primarily operating in the Middle East and North Africa. Ardoino stated that this investment strengthens "Tether's commitment to promoting financial inclusion and stability."

Kem's website describes itself as "the first cryptocurrency bank." While this makes it seem like Kem isn't actually a bank, and it's certainly not the first bank to attempt to serve the cryptocurrency industry.

However, its website does state that "Kem operates through Kemfinity sro (company number: 221 62 194), an entity holding a VASP (Virtual Asset Service Provider) license in the Czech Republic."

Sorted Wallet

Sorted Wallet is described by Tether as a platform that “provides secure and convenient cryptocurrency transactions, bridging the gap between unbanked and underbanked populations in developing regions.”

In addition to providing a wallet, it also advertises that it can help users "withdraw USDT to bank, phone bill, or mobile money accounts".

Ardoino stated, "By supporting Sorted Wallet, we are unlocking new opportunities for individuals with basic feature phones to participate in the financial system. Our goal is to ensure that everyone, regardless of where they are or what kind of phone they use, can securely manage and use cryptocurrencies, empowering them to build a safer financial future and actively participate in the evolving digital economy."

Synonym

Synonym is a Bitcoin wallet provider that includes Lightning Network functionality, and its website states that it is "a Tether company".

In addition to its wallet, the company is also the driving force behind Pubky, whose website describes Pubky as an application "powered by a new decentralized protocol and featuring social tagging and social curation features."

In addition, it offers Atomicity, described as a "P2P mutual trust system" designed to enable "business and collaboration beyond big bank credit cards".

Shiga

In a Tether blog post, Shiga Digital is described as "a modern platform providing access to pan-African blockchain financial solutions that are usable and easily accessible in the real world. Shiga Digital offers virtual accounts, OTC services, treasury management, and foreign exchange services to African businesses."

Its website claims to "empower your business with decentralized banking solutions." Shiga claims to be an EU-licensed virtual asset service provider, but does not appear to be a bank in the literal sense.

XREX

XREX is described on Tether Ventures' page as an "emerging market USDT-based cross-border B2B payment provider," while on its official website it is described as "changing the future of banking."

Its website claims it is a FinCEN-regulated money services company, a licensed major payment institution in Singapore, and a licensed VASP (Visa Application Service Provider) in Taiwan. The website does not appear to mention any banking license.

Tether's article regarding the investment claims that it will enable XREX to "facilitate compliant, USDT-based cross-border B2B payments in emerging markets." Furthermore, the article states that "XREX will partner with the Unitas Foundation to launch XAU1, a unitized stablecoin pegged to the US dollar and backed by excess reserves of Tether Gold (XAUt)."

StablR and Quantoz

StablR is launching a stablecoin in Europe, aiming to comply with the Crypto Asset Markets Regulation (MiCA) framework and relying on the Hadron tokenization platform created by Tether.

Quantoz is another company planning to launch a MiCA-compliant stablecoin in Europe using Tether's Hadron platform. Tether previously offered its own euro-pegged stablecoin, EURT, but that project has been shut down.

Blackrock Neurotech

Perhaps Tether's strangest investment is Blackrock Neurotech, a company dedicated to developing brain-computer interfaces.

This investment belongs to Tether Evo. The Tether Evo website states: "Tether stands at the intersection of innovation and human potential, committed to propelling humanity into a future where technology and human capabilities merge in unprecedented ways."

Academy of Digital Industries

Tether also invested in the Academy of Digital Industries, a Georgia-based online training and education platform. This investment reportedly led to the addition of courses on "Bitcoin, stablecoins, peer-to-peer technology, and artificial intelligence" to the platform.

Be Water

Be Water was described in Tether's blog post announcing the investment as "an innovative media company focused on producing and distributing audio, video, film, and live content." Ardoino stated that the investment aligns with Tether's belief in "the importance of independent media in shaping informed societies."

Crystal Intelligence

Tether's investment in blockchain analytics firm Crystal Intelligence appears to align with its desire to "combat the illicit use of stablecoins by supporting law enforcement and building a safer, more resilient digital asset ecosystem." Tether has also partnered with Crystal Intelligence's competitor, Chainalysis, to integrate it into the Tether Hadron platform.

Elemental Altus

Tether also invested in Elemental Altus, a precious metals royalty company. Ardoino stated that this investment aligns with Tether's "long-held belief that tangible assets like Bitcoin and gold will underpin the most enduring forms of digital value."

Holepunch

Tether and its sister company Bitfinex are also behind Holepunch, an encrypted peer-to-peer communications platform that provides the Keet video chat application. Ardoino also serves as Holepunch's Chief Strategy Officer.

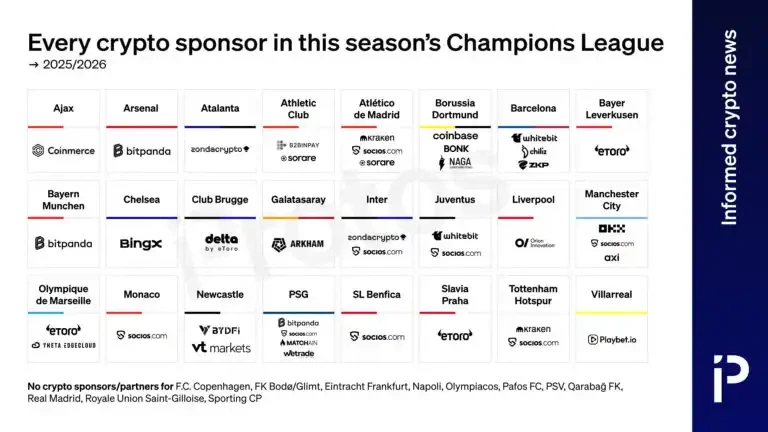

Juventus Football Club

One of the most perplexing investments is Juventus Football Club, which Tether attempts to describe as an opportunity to "integrate its futuristic portfolio into the sports industry." This also suggests that Tether hopes to use this opportunity to "integrate stablecoins, digital assets, and human-centric technology into everyday life."

Zengo Wallet

Tether describes Zengo as "a leading self-custodied crypto wallet known for its focus on security and ease of use," and further claims that Zengo has served 1.5 million users and "has never experienced a wallet being hacked, phished, or taken over."

Zengo is a multi-party computation (MPC) wallet that secures your cryptocurrency key shards stored between your own mobile device and Zengo's servers.

Mansa

Mansa claims to offer revolving credit lines to payment companies to help facilitate transaction settlements and rapid cash flow for customer accounts. Furthermore, its website describes other services it offers, including over-the-counter forex trading and "virtual card processing."

Oobit

Tether describes Oobit as "a mobile payment application." Ardoino stated that Tether's investment is part of a shared vision between Tether and Oobit to drive the widespread adoption of cryptocurrency globally.

Adecoagro

Adecoagro is an agricultural group that also invests in energy production. Following Tether's acquisition of a majority stake in the company, it announced a memorandum of understanding "to explore a strategic partnership focused on Bitcoin mining."

NAKA

NAKA is a company that claims to be dedicated to developing "self-custodied payment cards." Crunchbase data indicates that Tether has invested in it.

Twenty One

Finally, there's Twenty One, a Tether-owned digital asset treasury (DAT) company led by Jack Mallers, launched in partnership with Cantor Fitzgerald, Tether's most important custodian.

Twenty One's website claims to currently hold 43,514 bitcoins.

Conclusion

Protos can only confirm about a quarter of the investments made by Tether (assuming Ardoino's "120+" figure is still accurate).

The confirmed investments demonstrate that this is a far-reaching financial company with interests both inside and outside the cryptocurrency industry, while the vast majority of the remaining investments remain unknown, making it almost impossible for outsiders to assess Tether's full influence and reach.