Carry trade enters its final chapter: Abnormal fluctuations in Japanese interest rates trigger global rebalancing.

- 核心观点:日本央行加息预期引发全球流动性收紧担忧。

- 关键要素:

- 日本长端国债收益率飙升,市场加息预期超八成。

- 日元套息交易平仓或抽离全球高收益资产流动性。

- 加密市场深度不足,对跨资产冲击敏感度提高。

- 市场影响:或引发全球风险资产连锁抛售。

- 时效性标注:短期影响。

On December 4, 2025, the Japanese government bond market suddenly entered an abnormal state. The 30-year yield broke through the historical high of 3.445%, the 20-year government bond yield returned to the level of the end of the last century, and the 10-year yield, which serves as a policy anchor, also rose to 1.905%, the first time it has reached this range since 2007.

Surprisingly, this runaway in long-term interest rates was not triggered by a sudden change in macroeconomic data, but rather by a sudden acceleration in market pricing of an interest rate hike at the Bank of Japan's meeting on the 18th and 19th of this month.

Currently, the implied probability of an interest rate hike by interest rate derivatives has climbed to over 80%, and market sentiment has entered "countdown mode" even before official policy statements.

YCC's Hidden Channel: The Yen Engine Behind Global Liquidity

To understand this round of turmoil, we still need to return to the Bank of Japan's core policy framework over the past decade—yield curve control (YCC). Since 2016, the Bank of Japan has been forcibly fixing the range of 10-year government bond yields in a very clear manner, keeping financing costs close to zero by continuously buying government bonds.

MSX Research believes that it is this "anchored" interest rate policy that has allowed global investors to borrow yen at virtually no cost for an extended period, then convert it into dollars through foreign exchange swaps and invest in high-yield assets such as US stocks, tech stocks, US long-term bonds, and even cryptocurrencies. The massive liquidity of the past decade did not come entirely from the Federal Reserve, but rather from this invisible funding channel provided by the Bank of Japan to the world.

However, the essence of YCC is "artificial stability" maintained only through continuous bond purchases by the central bank. Whenever there is any ambiguity regarding the central bank's willingness to buy, the scale of its purchases, or its policy stance, the market will attempt to test the strength of this "hidden interest rate anchor" in advance.

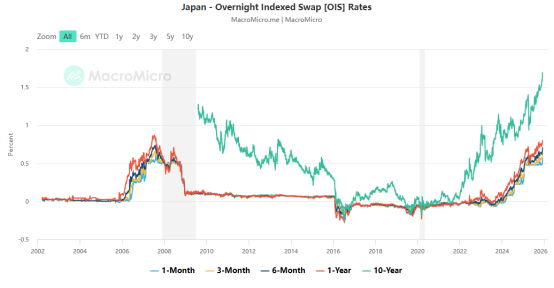

In recent weeks, changes in the yen interest rate swap market have revealed the direction of the policy even earlier than in government bonds: yen OIS rates with maturities ranging from 1 week to 1 year have continued to rise, and market expectations for the final value of the policy rate over the next year have rapidly increased from 0.20% to around 0.65%, reflecting that the signal of "policy change" has been widely accepted. The large amount of long-term assets held by Japanese life insurers and large domestic institutions also makes this policy change more structurally challenging—for government bonds with a duration of over 20 years, every 10 basis point increase in yield means a considerable paper loss.

Policy signals shifted forward, and fine-tuning of communication ignited selling pressure on long-term investments.

The market thus turned its attention to the details of the central bank's communication. On December 1st, Governor Kazuo Ueda, in a routine speech in Nagoya, unusually mentioned the next policy meeting, implying that policy would no longer remain in the observation phase by saying "a decision will be made as appropriate." For the Japanese market, which has always relied on the central bank's wording to judge the policy path, such a tone was enough to trigger a reaction. Given the already weak liquidity before the end of the year, any slight policy hint would be amplified by the market, and long-term government bonds naturally became the first outlet for the pressure.

Complicating matters further, the Japanese Ministry of Finance's ¥700 billion 30-year government bond auction held today is seen by the market as another "stress test." With declining participation from overseas investors and increasing sensitivity among domestic institutions to duration risk, a surprisingly low bid-to-cover ratio would further exacerbate technical selling pressure on long-term bonds. Unlike the mild market reaction when the yield curve (YCC) was first adjusted in December 2022, investors are now significantly more sensitive to policy exits, and the jump in long-term interest rates precisely reflects this unease.

The fragile closed loop of carry trades: This December is different.

More than the policy changes themselves, global markets are concerned about the potential chain reaction from carry trades. Borrowing yen, exchanging it for dollars, and investing in high-beta assets has been the largest cross-asset strategy of the past decade. If the Bank of Japan widens its trading band, reduces its government bond purchases, or directly raises interest rates, yen funding costs will rise rapidly. Carry trade positions will be forced to close prematurely, buying back yen, causing a sudden appreciation of the yen. This yen appreciation will then put pressure on unclosed yen short positions, further triggering more forced stop-loss orders. The result of this entire chain is a rapid withdrawal of liquidity and a synchronized decline in highly volatile assets.

The events of August 2024 remain vivid in memory. At that time, a seemingly mild remark by Ueda was interpreted by the market as a signal of a shift, causing the yen to surge by over 5% in a week, while tech stocks and cryptocurrencies almost simultaneously plummeted. CFTC's short yen positions were liquidated by 60% in just three days, marking the fastest leveraged liquidation in the past decade. And this year, the negative correlation between the yen and risk assets has further strengthened. Whether it's Nasdaq tech stocks, the crypto market, or Asian high-yield bonds, all have exhibited unusual sensitivity to yen fluctuations over the past year. The funding structure is changing, but vulnerability is increasing.

Here, MSX Research Institute also reminds readers that in January 2025, the Bank of Japan also raised interest rates, but the policy action was a "fine-tuning" within a controllable range. It neither touched the market's core judgment on the interest rate spread structure nor triggered the traumatic memory of the August 2024 event. However, the situation this month is completely different. The market is worried that the Bank of Japan may move from a symbolic adjustment to a real interest rate hike cycle, which would reshape the funding structure of global carry trades. Increased duration exposure, more complex derivative chains, and narrowing interest rate spreads are all factors that combined make the market much more sensitive to the policy path in December than at the beginning of the year.

It is worth noting that the structural vulnerability of crypto assets has increased since the beginning of the year. The flash crash on October 11th led leading market makers to significantly reduce their exposure, with both spot and perpetual market depths at historically low levels. With market-making capabilities yet to recover, the crypto market's sensitivity to cross-asset shocks has increased significantly. If yen volatility triggers a passive deleveraging of the global leverage chain, crypto assets may experience a magnified reaction due to a lack of support.

Confounding variables and future prospects of the Federal Reserve meeting

Furthermore, this year's situation is compounded by another uncertainty: the misalignment of the Federal Reserve and the Bank of Japan's meeting dates. The Federal Reserve will hold its meeting first on December 11th. If it sends a hawkish signal and weakens expectations of a rate cut in 2026, the interest rate differential will temporarily shift back to support the dollar. Even if Japan raises interest rates as expected, the yen may depreciate instead of appreciate. This would not only leave carry trades without direction for closing out their positions but also disrupt what could have been an orderly deleveraging process. Therefore, the policy pace over the next two weeks is more worthy of attention than the apparent market fluctuations.

From a longer historical perspective, Japan's policy shifts exhibit a high degree of path dependence. December 2022 was the turning point, August 2024 the tipping point, and December 2025 seems more like a prelude to the final chapter. Gold prices have quietly broken through $2,650/ounce, and the VIX continues to climb in the absence of major events. The market is preparing for some kind of structural change, but is not yet fully psychologically ready.

According to MSX Research Institute, if the Bank of Japan raises interest rates by 25 basis points at its December meeting, the global market may experience a three-stage reaction: (1) in the short term, the yen will appreciate rapidly, US Treasury yields will rise, and volatility will jump; (2) in the medium term, arbitrage funds will systematically withdraw from high-beta assets; and (3) the long-term impact will depend on whether Japan establishes a clear path for interest rate hikes or whether this is just a symbolic adjustment. In such an environment, the global liquidity structure supported by "cheap yen" is unsustainable, and more importantly, investors need to re-examine the degree of implicit dependence of their portfolios on the yen funding chain.

Conclusion

The storm may be unavoidable, but whether the chaos can be managed will be determined by two key dates: the Federal Reserve meeting on December 11 and the Japanese government bond auction on December 18.

The global market is on the verge of a transition from an old to a new order, and the dramatic fluctuations in Japan's long-term interest rates may just be the beginning.