From Sahara to Tradoor, let's review the recent "creative price drops" in altcoins.

- 核心观点:币安Alpha新项目频现异常下跌。

- 关键要素:

- Sahara AI因合约清算致价格腰斩。

- aPriori六成空投被单一实体薅走。

- Irys两成空投遭女巫地址套现抛售。

- 市场影响:加剧市场对新项目信任危机。

- 时效性标注:短期影响。

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

Despite a recent market recovery, the crypto world remains shrouded in a persistent gloom since the "1011 crash." Particularly noteworthy is the apparent unanimous triggering of a series of crashes on newly listed altcoins, with various price swings: halving in a single day, drops exceeding 80%, initial surges followed by a continuous decline, and concentrated sell-offs of airdrops. It's worth noting that these anomalies are largely concentrated on new projects launched on Binance Alpha.

In just a few weeks, a series of bizarre price drops have occurred. On-chain fund flows, market maker operations, and the team's responses and silences piece together fragmented truths about this turmoil. Below, Odaily Planet Daily will summarize some of the most discussed and representative cases of these "creative price drops" recently.

Sahara AI: A short-term plunge of over 50% stemmed from massive liquidation of perpetual contracts coupled with concentrated short selling.

On the evening of November 29, Sahara AI's token SAHARA fell by more than 50% in a short period of time, and the price has not recovered significantly since then, currently trading at $0.03869.

The following day, the Sahara AI team quickly released a statement in an attempt to reassure the market, with three main points:

- There is no team or investor selling off : everyone is still under lock-up, and there is still a full year until the first unlock (June 2026).

- The smart contract is fine : it has not been hacked, tampered with, or had any inexplicable token transfers.

- The business is undergoing adjustments but nothing has gone wrong : internally, some resource integration is being done, with a focus on accelerating growth in areas where it can grow.

These all sound harmless, but the focus of the community discussion is completely elsewhere. KOL Crypto Fearless posted on the X platform that the abnormal price drop of SAHARA was caused by "a series of liquidations of a certain active market maker": a large market maker who operates multiple projects was targeted by an exchange because of a certain project, which led to all related positions being subject to risk control, and SAHARA was just one of the "collateral damage".

However, Sahara AI quickly denied this claim, emphasizing that their only market makers are Amber Group and Herring Global, both of which are operating normally, have not been investigated or liquidated. The team's version is that the crash was mainly due to large-scale liquidation of perpetual contracts combined with a concentrated amplification of short selling. In other words, "It's not our problem; it's a structural stampede within the market itself." Meanwhile, the team is still in direct communication with the relevant exchanges and will further disclose more verified information once obtained.

aPriori: 60% of the airdrop was snapped up; the token price has fallen by nearly 80% since its launch.

aPriori, a highly funded project within the Monad ecosystem, chose to "early" list its token, APR, on the BNB Chain via TGE before the Monad mainnet launch. On October 23, APR was listed on Binance Alpha and Binance Futures, initially surging above $0.70, but subsequently declining to its current price of $0.13. This initial weakness had already raised concerns within the community, but the real catalyst came a few weeks later.

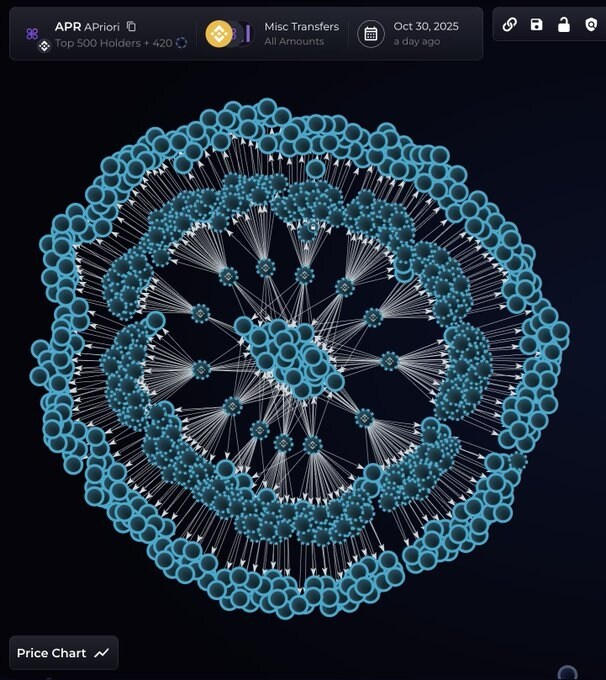

The most shocking news came on November 11: 60% of the project's airdrop was claimed by the same entity using 14,000 addresses. On-chain data disclosed by Bubblemaps on November 11 showed that 60% of the aPriori project's airdrop tokens were claimed by the same entity through 14,000 interconnected wallets. These wallets each deposited 0.001 BNB through Binance within a short period and then transferred the APR tokens to the same batch of new wallets.

APR "insider trading" address bubble chart

However, what angered the community even more than the data itself was the project team's complete lack of response. On November 14, Bubblemaps stated that they had already contacted the aPriori team seeking an explanation for the situation where "60% of the airdrops were claimed by the same entity through 14,000 addresses," but had yet to receive a response.

In addition, blockchain detective ZachXBT also posted on the X platform that he had sent a private message to the co-founder of the aPriori project to explain the "insider trading" issue, but had not received a reply as of November 18.

Meanwhile, the official X account stopped updating, Discord administrators almost disappeared, and community sentiment gradually shifted from disappointment to anger.

- "Has the project team already absconded?"

- "Has the team moved on to the next project?"

- "A highly funded project doing this kind of thing?"

On November 21, the team finally spoke out, but the content did not truly address the core questions. They only stated that "no evidence has been found that the team or foundation received the airdrop," and attempted to shift attention to the Monad mainnet airdrop, claiming that they would give the Monad community "a large amount of unlocked APR airdrops." This statement did not quell the doubts, but was instead interpreted by many community members as "avoiding the important issues."

Worse still, on the day Monad launched its mainnet, aPriori's token airdrop went almost unnoticed, and subsequent official channels fell silent again. From a high-profile, well-funded project to a rapid loss of community trust, this process took less than a month.

Irys: An entity claimed 20% of the token airdrop through a cluster of 900 wallets and has already sold $4 million worth.

Irys is an L1 public chain that has raised nearly $20 million in funding and focuses on "data intelligence". However, its airdrop and on-chain behavior before the mainnet launch have raised questions in the market about "insider trading" and dumping of shares to cash out.

The day before launch: 900 addresses were flooded with deposits.

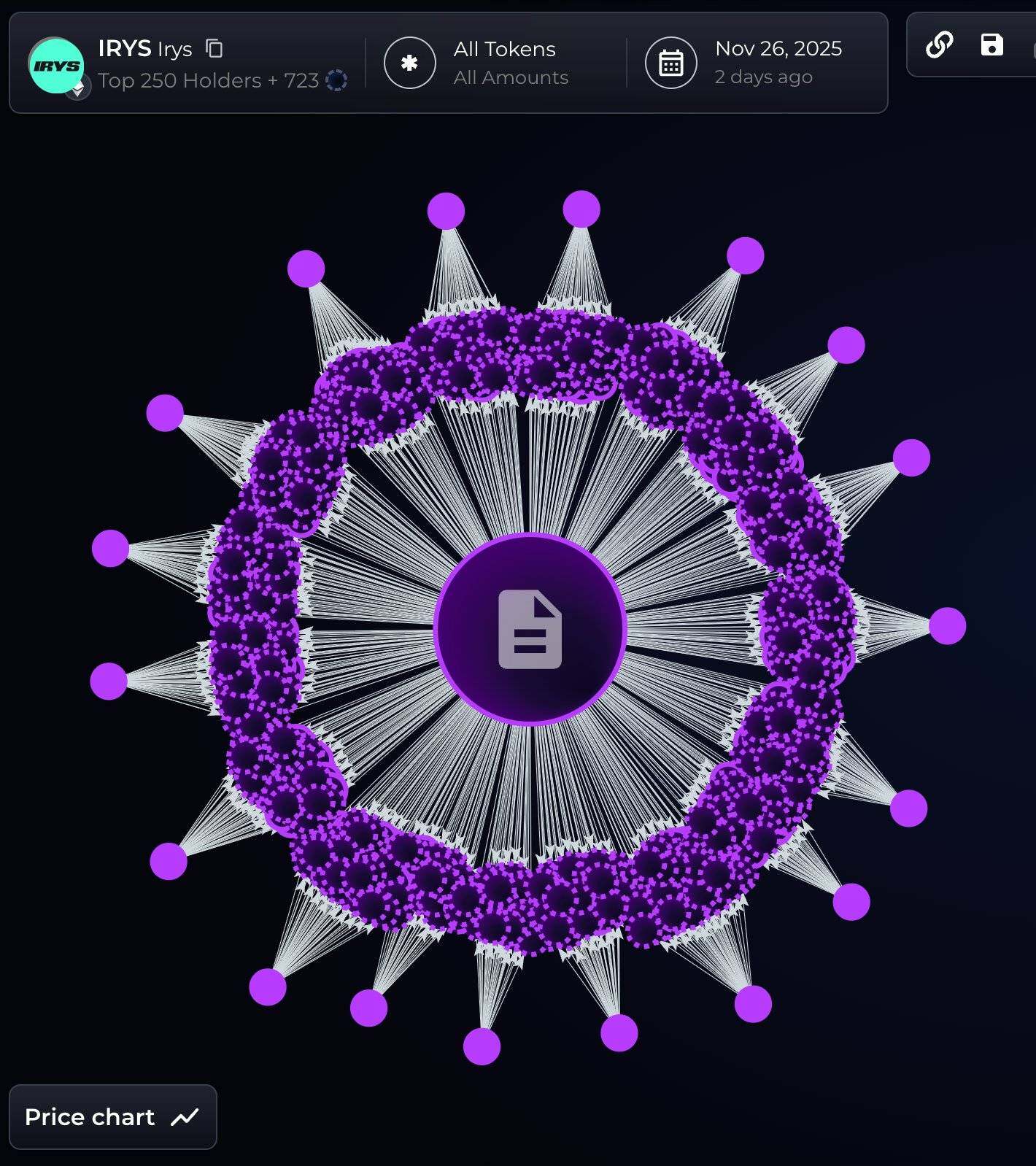

On November 28th, Bubblemaps, an on-chain data analytics platform, disclosed that the day before the IRYS mainnet launch, a total of 900 addresses received ETH transferred from the Bitget exchange within several time windows . These addresses shared highly consistent characteristics:

- No prior on-chain history (brand new wallet);

- The amounts of ETH received were similar;

- Everyone received an IRYS airdrop on the day of launch.

These addresses ultimately claimed approximately 20% of the IRYS airdrop quota.

Further analysis: Typical witch clusters

Bubblemaps divided these 900 addresses into 20 batches of top-ups, with approximately 50 addresses in each batch. The survey showed that:

- Time: From November 21st to 24th, Bitget launched a total of 20 rounds of top-ups;

- The pattern is highly consistent: each batch of small ETH transfers follows almost identical address generation, activation, and operation paths;

- Characteristics: Addresses are active simultaneously within a short period of time, and their behavioral paths are similar.

This behavioral pattern is consistent with typical "Sybil" characteristics, indicating that it is a planned and organized operation.

Transaction path: From airdrop to exchange

Further investigation of 500 addresses revealed that they followed an identical process:

- Claim your IRYS airdrop;

- Transfer all tokens to a brand new address (“address wash” step);

- The new address then transferred IRYS to the Bitget exchange;

- It is highly likely that the shares will be sold directly on the exchange.

To date, approximately $4 million worth of IRYS tokens have flowed into the Bitget exchange through this route.

IRYS "insider trading" address bubble chart

Irys' official response: The airdrop of the witch horde does not involve the team or investors.

Regarding the recent on-chain analysis showing the IRYS Sybil airdrop cluster incident, the project team conducted an internal investigation and verified the situation with partners and exchanges through multiple channels. The official response indicates:

- Unrelated to the team or investors: Investigations show that the Witch Cluster wallets used to receive the airdrops are not affiliated with the team wallets, foundation wallets, or investor wallets. The IRYS tokens held by the team, foundation, and founders have not been sold and remain subject to lock-up and unlocking rules.

- Reflections on the airdrop design and anti-Sybil measures: The project employed various anti-Sybil mechanisms before launch, successfully filtering out some obvious arbitrage opportunities, but still failing to completely prevent Sybil clusters. The team stated that these vulnerabilities were inherent to the airdrop design itself, rather than due to errors in execution by partners, and promised future improvements.

- Future plans: The team will regularly update project progress, including network growth, ecosystem development, and major company news. At the product and ecosystem level, we will continue to optimize protocols, expand integration scenarios, promote data applications, and support long-term users and developers.

The official statement emphasizes that this incident will not affect the operation of the IRYS mainnet, nor will it change the project's long-term development goals. The team will earn the community's trust through continuous development and transparent communication, rather than just verbal explanations.

Tradoor: The top ten holding addresses account for 98% of the total supply, causing a short-term plunge of nearly 80%.

On December 1, the token TRADOOR of Binance Alpha project Tradoor surged to a record high of $6.64, but then plummeted by nearly 80% in the following 24 hours, falling to $1.47; it is currently priced at $1.39.

On-chain data shows that Tradoor has extremely low decentralization: only 10 addresses control 98% of the total supply, with one address holding as many as 75% of the tokens . The remaining circulating supply is negligible, with the total DEX liquidity pool amounting to less than $1 million, meaning even a small large order can cause the price to crash.

Furthermore, the delayed airdrop and issues with the staking mechanism exacerbated the crisis of user trust: the originally promised airdrop was delayed from "soon" to February 2026, and coupled with loopholes in the staking mechanism, retail investors had virtually nowhere to hide when the market crashed. It's worth noting that the TRADOOR crash occurred during the hours of 4 to 5 AM in China, when most retail investors were asleep; by the time they woke up, their losses were already irreversible.

Knowing when to stop is the key.

As crypto trader Ansem previously wrote on the X platform, the main value accumulation phase of the crypto industry is "basically over," and the vast majority of tokens ("95% junk") will struggle to gain sustained value in the future. The real value-capturing assets in the future will be stablecoins and the blockchain infrastructure built on the proprietary chains of traditional fintech companies like Stripe, Coinbase, and Robinhood, rather than most token projects currently on the market.

Therefore, even with the current significant recovery in the crypto market, highly sought-after altcoins may experience a brief rebound, potentially allowing investors to "make a quick profit." However, this does not mean complacency or blindly pursuing exorbitant profits of several times or even ten times the initial investment—altcoins experiencing dramatic price drops will continue to appear. In the current environment, "taking profits when they are available" remains the safest strategy.