BitMart Weekly Market Report (November 24 - December 1)

- 核心观点:加密市场温和修复,但流动性仍偏紧。

- 关键要素:

- 总市值下降2.38%,但多数代币反弹超5%。

- 资金集中于BTC,多数山寨币仍深跌。

- Altcoin ETF成亮点,政策与安全事件并存。

- 市场影响:市场分化延续,资金向主流资产集中。

- 时效性标注:短期影响。

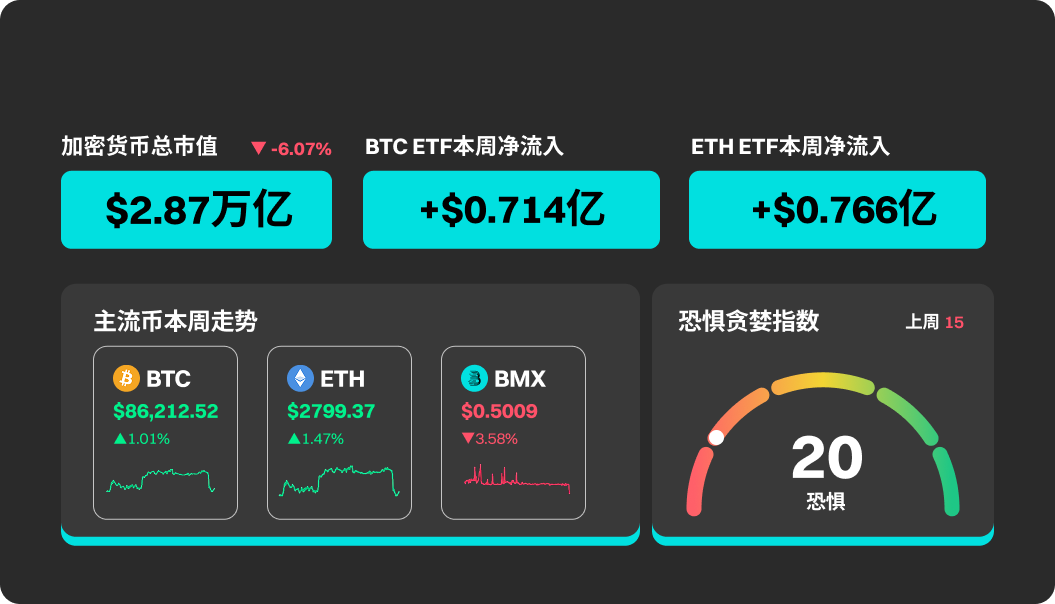

According to BitMart's market report on December 1st, the total market capitalization of cryptocurrencies was $2.87 trillion over the past week, a decrease of 2.38% from the previous week.

This Week's Crypto Market Updates

This week, the crypto market saw a slight recovery, with selling pressure easing after several weeks of consolidation. Driven by expectations of a December rate cut rising to approximately 85%, most tokens rebounded by over 5%. However, this recovery remains structurally distinct: 79 of the top 100 tokens are still down more than 50% from their all-time highs, with funds continuing to concentrate on BTC and mainstream assets. Established altcoins performed weakly due to a lack of structural buying. In contrast, exchanges/DEXs, DeFi, and privacy-related sectors showed relative resilience.

Liquidity remains tight, with stablecoin growth, ETF inflows, and DAT issuance all slowing, inhibiting broader market rotation. Altcoin ETFs have emerged as one of the few bright spots, consistently attracting net inflows and potentially reshaping the demand structure for altcoins. On the fundamental front, policies such as Texas's treasury purchases of BTC and lawmakers pushing for BTC-based tax payments are driving adoption; however, the brief CME shutdown, the Upbit hack, and an $11 million crypto heist highlight security risks. Overall, the market is recovering moderately in a weak liquidity environment, but volatility remains constrained by macroeconomic factors and liquidity conditions.

Popular cryptocurrencies this week

Among popular cryptocurrencies, MYX, KAS, SPX, QNT, and SKY all performed well.

QNT prices rose 26.03% this week. SKY prices rose 19.40%. KAS prices rose 16.20%. MYX and KAS rose 9.09% and 9.03% respectively this week.

US Market Overview and Hot News

This week, risk sentiment improved in US stocks, leading to a market rally—the S&P 500 rose 2.8%, and the NYFANG+ index approached 3%, primarily driven by high expectations of a December rate cut by the Federal Reserve. The US dollar index fell 0.54% due to weak employment data, while USD/JPY edged lower, and the yen strengthened on safe-haven demand. In commodities, gold rose 2.88%, driven by rate cut expectations; crude oil prices fluctuated, with supply-side signals remaining unclear. The yield on 10-year US Treasury bonds fell on weak data, but large-scale issuance still exacerbated interest rate volatility. Market volatility decreased significantly—the VIX and MOVE both declined, influenced by thin trading and improved sentiment during the Thanksgiving holiday. Overall, market sentiment leaned towards cautious optimism, macroeconomic uncertainty eased somewhat, but liquidity remained low.

On December 3, Pandu, a licensed virtual asset management service company, officially announced that its Ethereum ETF will be listed on the Hong Kong Stock Exchange on December 3, directly holding Ethereum.

The Dubai Blockchain Week 2025 will be held from December 3 to December 4, 2025 at the Coca-Cola Stadium in Dubai.

On December 4 at 10:00 AM (Eastern Time), the SEC Investor Advisory Committee will hold an online meeting to discuss corporate governance and stock tokenization.

The release date for the US September PCE data was rescheduled to December 5, while the preliminary Q3 GDP report was cancelled.

Project unlock

Sui (SUI) will unlock approximately 55.54 million tokens at 8:00 AM Beijing time on December 1st, representing 0.56% of the total supply, worth approximately $85 million.

The Santos FC Fan Token (SANTOS) will unlock approximately 5.7 million tokens at 8:00 AM Beijing time on December 1st, representing 19% of the total supply and worth approximately $12.7 million.

Walrus (WAL) will unlock approximately 32.7 million tokens at 8:00 AM Beijing time on December 1st, representing 0.65% of the total supply and worth approximately $5.5 million.

Ethena (ENA) will unlock approximately 95.31 million tokens at 8:00 AM Beijing time on December 2nd, representing 0.64% of the total supply, worth approximately $27.2 million.

Jito (JTO) will unlock approximately 11.31 million tokens at 8:00 AM Beijing time on December 7th, representing 1.13% of the total supply and worth approximately $5.4 million.

Risk warning:

Using BitMart services is entirely at your own risk. All cryptocurrency investments (including returns) are inherently highly speculative and involve a significant risk of loss. Past, assumed, or simulated performance is not indicative of future results.

The value of cryptocurrencies may rise or fall, and there may be significant risks involved in buying, selling, holding, or trading cryptocurrencies. You should carefully consider whether trading or holding cryptocurrencies is right for you, based on your individual investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.