BTC Returns to $93,000: Four Major Macroeconomic Signals Resonate, Crypto Market May Be Entering a Structural Turning Point

- 核心观点:加密市场反弹源于多重宏观利好共振。

- 关键要素:

- 市场预期美联储12月将开启降息。

- 美联储结束QT并向市场注入流动性。

- 传统资管巨头开始接纳并配置加密ETF。

- 市场影响:推动加密资产从交易走向主流配置。

- 时效性标注:中期影响。

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

In the past 48 hours, the crypto market has once again reminded everyone in an almost dramatic way: here, a "crash" and a "bull run" are always separated by only one trading day. BTC rebounded strongly to around $93,000, with a 24-hour increase of nearly 7%; ETH returned above $3,000; and SOL also touched $140 again.

Following the opening of the US stock market, the crypto sector also saw a broad-based rally . BitMine, the ETH treasury company, saw its stock price rise by 11.6% in the past 24 hours, while Strategy, the largest corporate holder of BTC, saw its stock price rise by 6.2% in the past 24 hours.

In the derivatives market, the total amount of liquidations across the network in the past 24 hours reached $430 million, of which $70 million were long positions and $360 million were short positions, with short positions being the most liquidated. The largest single liquidation occurred in Bybit - BTCUSD, with a position value of $13 million.

In terms of market sentiment, according to data from Alternative.me, the cryptocurrency fear and greed index rose to 28 today. Although it is still in the "fear" range, it is significantly better than yesterday's 23 (extreme fear), and the market is showing signs of recovery.

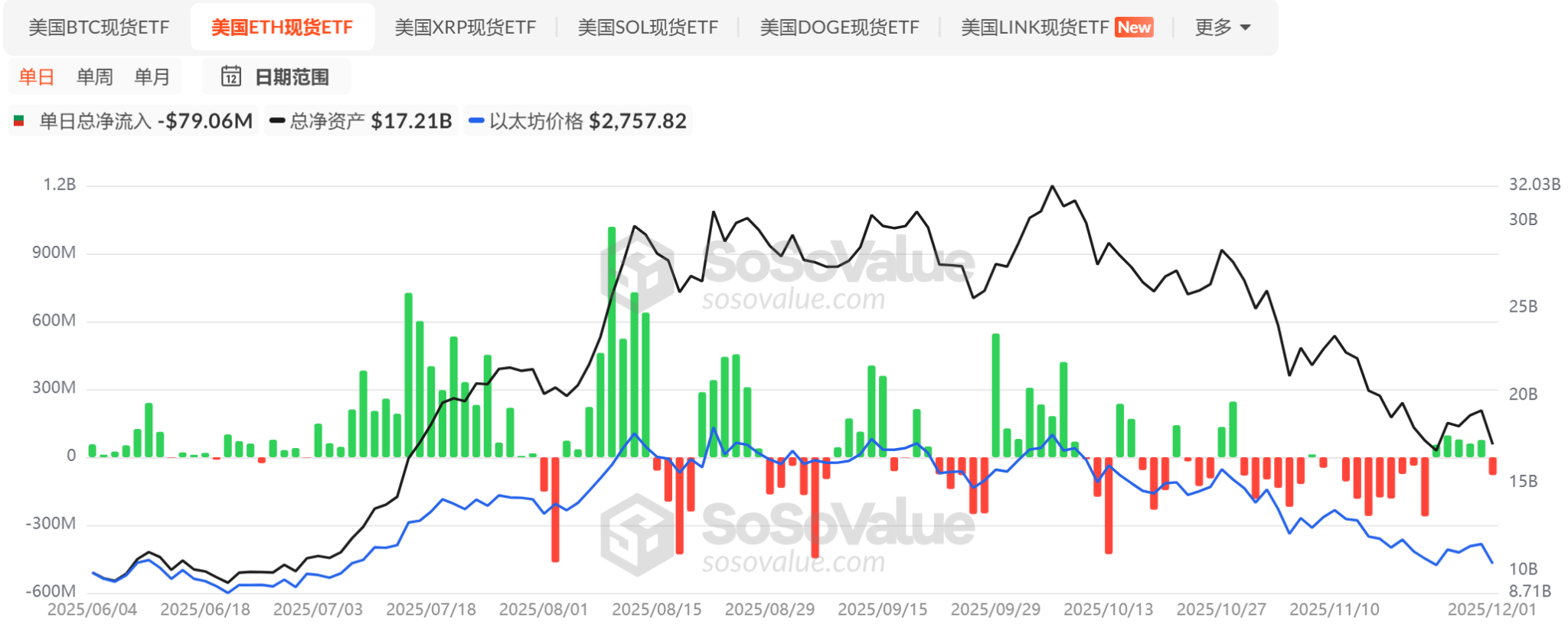

Regarding fund inflows, according to data from sosovalue.com , after four consecutive weeks of sharp outflows, the BTC spot ETF finally saw a slight inflow for four consecutive trading days; the ETH spot ETF, however, turned to a net outflow of $79 million after five consecutive days of inflows. Overall, the current momentum for fund inflows remains relatively weak.

Meanwhile, altcoin ETFs are seeing accelerated approval processes driven by favorable policies, with ETFs for XRP, SOL, LTC, and DOGE among those being listed in quick succession. For details, see " Altcoin ETFs Usher in a Batch of Listings: How Have the First Batch of Projects Performed? ". Among them, the XRP ETF, although later than the SOL ETF, has performed even better. Its current total net inflow has reached $824 million, surpassing the SOL ETF, making it a "representative work" for altcoins in the short term.

On the surface, the recent surge in the crypto market seems to lack any major direct positive factors, but in fact, forces are accumulating beneath the surface—from interest rate expectations to liquidity shifts, and the restructuring of institutional allocation logic, each of which is enough to influence the market's direction.

Prediction Reversal: A December Rate Cut is Basically a Foregone Conclusion

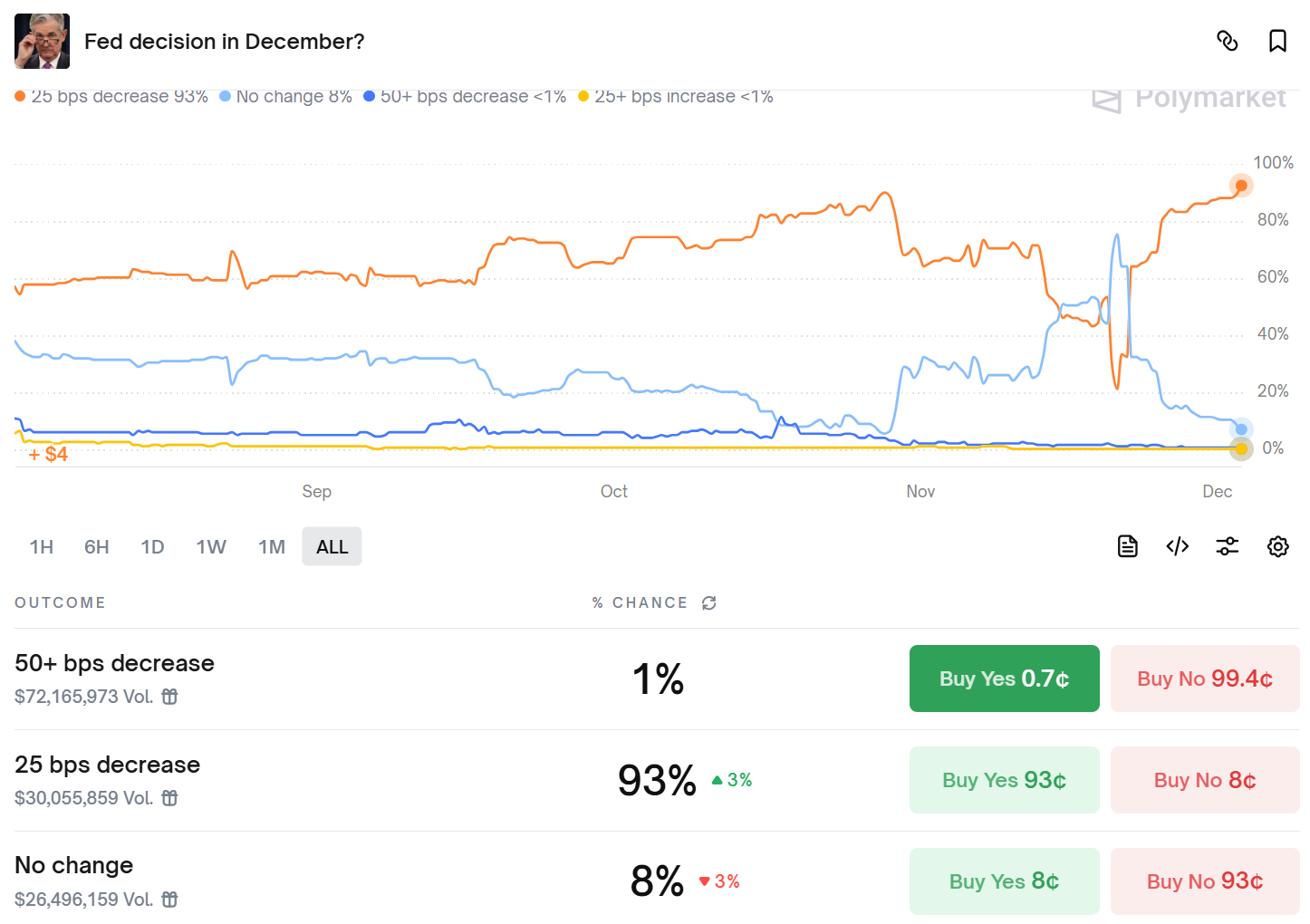

Analysts at Goldman Sachs' Fixed Income, Foreign Exchange, and Commodities (FICC) division believe a rate cut by the Federal Reserve at its upcoming December meeting is virtually certain. Bank of America Global Research also stated that, given the weak labor market and recent hints from policymakers about an earlier rate cut, they now expect the Fed to cut rates by 25 basis points at its December meeting . Previously, the bank had anticipated the Fed would keep rates unchanged at the December meeting. Furthermore, the bank now predicts further 25 basis point cuts in June and July 2026 , ultimately bringing rates down to a range of 3.00%-3.25%.

According to Polymarket data, the probability of the Federal Reserve cutting interest rates by 25 basis points next week has risen to 93%, and the total trading volume in the prediction pool has reached $300 million.

Liquidity Shift: QT Ends and $13.5 Billion Injection

A more crucial signal comes from the Federal Reserve's balance sheet operations. Quantitative tightening (QT) officially ended on December 1st. Prior to this, QT withdrew more than $2.4 trillion in liquidity from the system, stabilizing the Federal Reserve's balance sheet at around $6.57 trillion.

More notably, on the same day, the Federal Reserve injected $ 13.5 billion in liquidity into the market through its overnight repurchase facility, the second-largest single-day injection since the pandemic began, aimed at easing banks' short-term funding needs. However, this was not quantitative easing (QE), but rather temporary liquidity support.

Powell's successor: A political variable before Christmas

Besides liquidity and interest rates, another clue influencing market sentiment comes from politics. With Powell's term ending next May, the search for his successor as Federal Reserve Chairman is in full swing, with five candidates vying for what is arguably the most important position in the U.S. economy. The shortlist includes Federal Reserve Governors Christopher Waller and Michelle Bowman, former Federal Reserve Governor Kevin Warsh, Rick Rieder of BlackRock, and White House National Economic Council Director Hassett. Treasury Secretary Bessant, who oversees the selection process, said last week that Trump might announce his nominee before the Christmas holidays.

Sources familiar with the matter said Trump trusts Hassett and believes he shares Trump's desire to push for more aggressive interest rate cuts by the central bank. Hassett has indicated he would accept the position if invited.

Asset management giants are loosening their grip: Crypto ETFs are officially entering "mainstream wealth management".

For the past few years, traditional giants like Vanguard and Merrill Lynch have maintained a distance from crypto ETFs—not because they didn't understand them, but because they were "unwilling to take risks." But this week, with Vanguard and Merrill announcing expanded client access to crypto ETFs and Charles Schwab planning to open Bitcoin trading in the first half of 2026, this pattern is finally beginning to loosen.

Importantly, traditional institutions have always maintained a "better to miss out than to take a loss" approach. Their easing of restrictions is not a short-term trading signal, but rather a long-term strategic shift. If these institutions allocate even just 0.25% of their funds to BTC, it would imply approximately $75 billion in structural incremental buying over the next 12–24 months. Coupled with easing monetary conditions, strong growth is expected in 2026.

Furthermore, Bank of America, one of the largest financial institutions in the United States, has allowed wealth advisors to recommend allocating 1%–4% of their assets to crypto assets to clients starting in January 2025. The initial recommendations include IBIT, FBTC, BITB, and BTC—meaning that BTC has officially entered the "standard option" list of traditional wealth management in the United States. This move aligns Bank of America with the wealth management platforms of major institutions such as BlackRock and Morgan Stanley. For Wells Fargo and Goldman Sachs, which have been slow to act, industry pressure is rapidly accumulating.

Conclusion

This market rebound is not driven by a single positive factor, but rather by the convergence of multiple macroeconomic factors at the same time: clear expectations of interest rate cuts, liquidity inflows, impending political uncertainties, and easing of restrictions by asset management giants. More importantly, crypto assets are moving from being "permitted to trade" to being "recognized for asset allocation," which will propel crypto assets into a more sustainable cycle of capital inflows.