HashWhale Crypto Weekly Report | Overall network hashrate steadily increases; net outflow from exchanges widens (11/15–11/21)

- 核心观点:比特币本周暴跌破关键支撑,市场情绪极度负面。

- 关键要素:

- 比特币跌破$90,000,创七个月新低。

- ETF资金单周净流出近25亿美元。

- 恐惧贪婪指数跌至11,处极度恐惧区间。

- 市场影响:短期抛压加剧,流动性持续收紧。

- 时效性标注:短期影响

Author: Wang Tai | Editor: Wang Tai

1. Bitcoin Market

This week, Bitcoin's overall performance can be summarized as "continuous downward movement → low-level consolidation → breaking through key support → sharp and volatile decline." The overall price range was approximately $86,000–$97,000. On November 18th, it plummeted below the key support level of $90,000, reaching its lowest level in seven months, and continued to decline, repeatedly testing lower levels. At the time of writing, the price was approximately $86,540. Bloomberg reported on November 19th that the market capitalization of crypto assets had evaporated by more than $1 trillion in six weeks. Market sentiment was extremely negative and continued to deteriorate, with selling pressure accumulating.

Continued downward trend (November 15)

The flash crash trend continued last week, with the price dropping from $97,000 to $94,117 on November 15, with an average trading price of approximately $95,000.

Causes of the trend:

- Market confidence has plummeted, and there is a strong sentiment to "withdraw from risky assets."

- Crypto market sentiment remains one of extreme fear.

- With bulls lacking support, long-term holders began selling, leading to a liquidity crunch.

Low-level consolidation phase (November 16-17)

On November 16, although the price fluctuated at a low level, it did not break down significantly and consolidated around $95,000.

On November 17, the price briefly dipped to $92,985 before recovering to around $95,000.

Causes of the trend:

- Although market sentiment is extremely poor, selling pressure has temporarily eased, and the bottoming mechanism may be starting.

- Technical indicators suggest that the bottom is near: for example, NUP (Unrealized Net Profit Margin) has fallen to 0.476, and historically, such values have been accompanied by short-term rebounds.

- A wait-and-see attitude is growing, and the market is awaiting new catalysts.

The price broke below a key support level (November 18).

On November 18, the price fell below $90,000 for the first time during trading, marking one of the deepest drops in this phase.

International media outlets have pointed out that Bitcoin has fallen to multi-month lows, causing a sharp decline in market confidence and extremely negative sentiment. It subsequently adjusted within the $90,000-$93,000 range.

Causes of the trend:

- Investor confidence has further weakened, and crypto assets are seen as a high-risk exposure.

- The macroeconomic environment remains biased towards tighter interest rates and rising funding costs, reducing the space for leverage and speculation.

The market continued to decline amid intense volatility (November 19 – November 21).

On November 19, the price fluctuated around $90,000, then rebounded quickly to $92,000 after testing lower levels. However, the rebound was weak, indicating limited buying pressure below.

On November 20, the price continued to fluctuate and decline, falling below $90,000 multiple times and approaching a low of $88,000.

The chart shows intense volatility throughout the day, with repeated attempts to break the lows only to be quickly pushed back down each time.

On November 21, the price broke through $87,000 in the early morning, falling to a new low of $86,057. At the time of writing, the price was around $86,540, with repeated tests of the bottom and increased volatility indicating that panic selling and liquidation are still ongoing.

Causes of the trend:

- Bearish sentiment intensified sharply, further pushing Bitcoin lower.

- Panic selling amplified market volatility, with the Greed and Fear Index remaining in the "extreme fear zone" for several consecutive days, as retail investors and short-term holders continued to cut their losses and leave the market.

2. Market Dynamics and Macroeconomic Background

Fund Flow

1. ETF Fund Dynamics

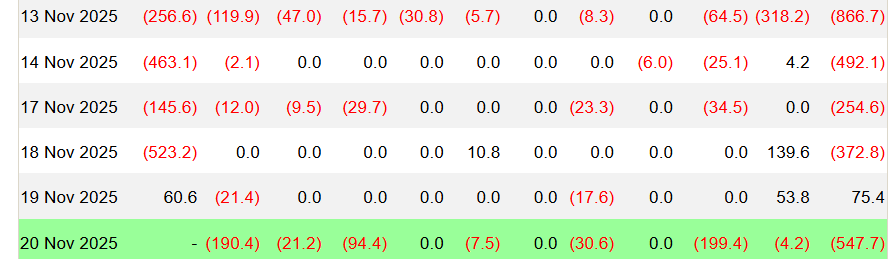

Bitcoin ETF fund flows this week:

November 13: -$866.7 million

November 14: -$492.1 million

November 17: -$254.6 million

November 18: -$372.8 million

November 19: +0.754 billion USD

November 20: -$547.7 million

ETF inflow/outflow data image

This week, ETFs exhibited a structural weakness characterized by "large-scale outflows → brief inflows → further outflows." On Thursday, November 13th, Bitcoin ETFs saw a net outflow of $866.7 million, the largest single-day outflow so far this month. From November 14th to 18th, outflows narrowed compared to the 13th, but the trend of capital withdrawal continued. A small inflow of $75.4 million occurred on the 19th, led by BlackRock's IBIT, bringing in $60.6 million. However, this rebound was insufficient to offset the over $500 million loss incurred the previous day. On the 20th, another significant outflow of $547.7 million occurred.

This week, total ETF outflows have reached nearly $2.5 billion, marking the fourth consecutive period of net outflows this month. Notably, outflows exceeded $500 million on both November 13th and 20th, indicating that institutions are accelerating their withdrawal from risky assets amidst extreme panic. This concentrated outflow coincides with Bitcoin's price breaking through the $100,000 and $90,000 levels, creating a combined effect that has further tightened market liquidity. ETFs have failed to provide support, instead exacerbating selling pressure on Bitcoin and becoming a major driver of the short-term market decline.

However, in contrast to the short-term safe-haven buying, an extremely rare contrarian signal emerged on the blockchain. According to CryptoQuant monitoring, since October 6th, long-term holders' BTC holdings have surged from 159,000 to 345,000, a net increase of 186,000 within a month, marking the largest accumulation in this period. This "diamond hand" behavior of accumulating BTC against the trend stands in stark contrast to the continuous price decline and the market's state of billions of dollars in unrealized losses.

Historically, when long-term holders aggressively buy up supply at the bottom of a panic, prices often rebound after a delay, but eventually due to the deep lock-up of supply; however, the current macroeconomic environment and the scale of capital outflows may lead the market down two very different paths.

One scenario is that after retail investors are shaken out in extreme panic and the supply is absorbed by long-term holders, as long as ETF funds stop flowing out or even turn into net inflows, the market may quickly trigger a strong rebound, and institutions will also distribute funds to newly entered funds during the rebound.

Another scenario is that prices continue to bottom out, completing a more thorough cleansing. Even strong buyers will need to reassess the risks, laying the foundation for a more sustained trend in the future. Currently, the Fear & Greed Index is in the extreme fear zone, and sentiment is near the bottom of the cycle, while funding remains weak. These two forces together constitute the main contradiction in the current market.

Overall, the market may still face short-term pressure, but a bottoming structure is being quietly built by large holders. The key variable in the next one to two weeks will be whether there are signs of ETF funds stopping their outflows.

2. Net outflows from exchanges widened, indicating a deep accumulation of market activity, but momentum remained weak.

While no larger-scale exchange inflows were observed this week, on-chain data shows that exchange holdings have continued to decline after Bitcoin fell below $90,000, indicating that funds continue to withdraw from exchanges and move towards self-custody. A VanEck report states that since October 9th, Bitcoin open interest (OI) has decreased by approximately 20% in BTC terms, with declining exchange inflows and rising outflows reflecting a significant cooling of speculative activity.

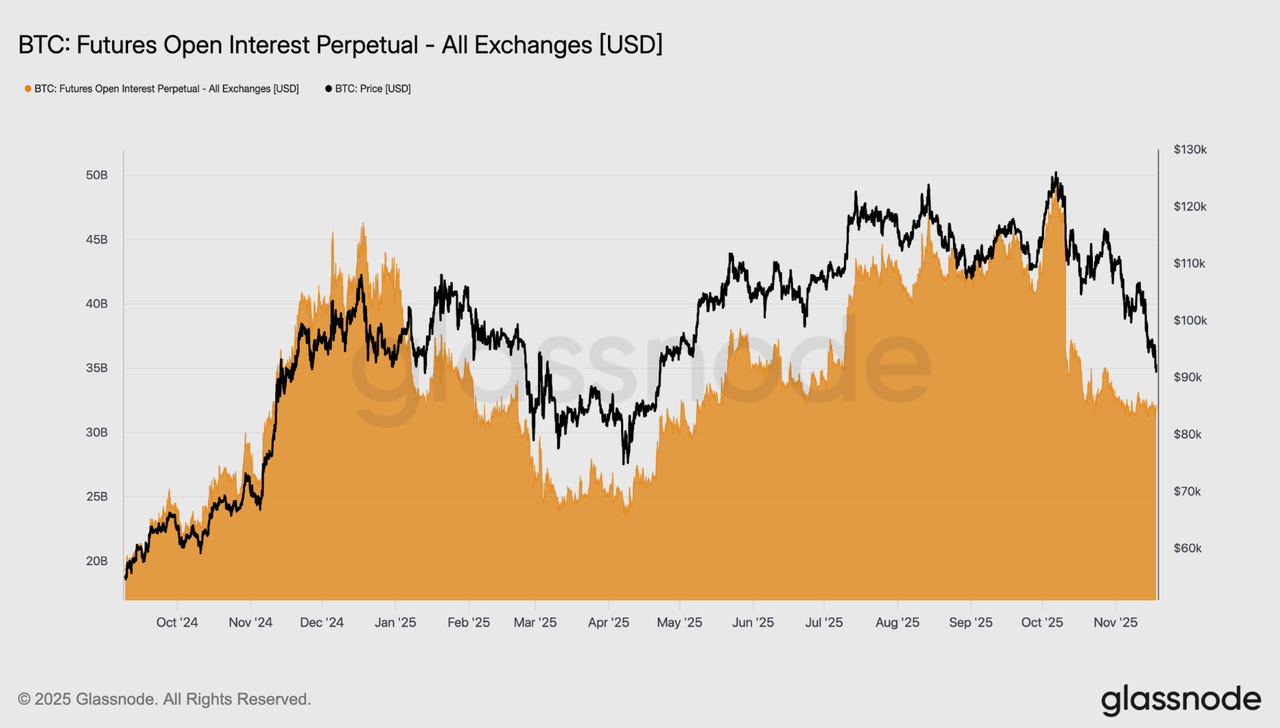

3. Open interest continues to shrink, indicating market risk aversion.

Bitcoin perpetual contract open interest across all exchanges

Bitcoin perpetual contract open interest across all exchanges

Futures open interest continued to decline this week, mirroring the price drop and indicating a continued decrease in speculative activity. Instead of increasing exposure to weakness, traders systematically decoded the market, leaving the derivatives market significantly undervalued compared to previous pullbacks. This lack of incremental leverage highlights the cautious attitude of market participants and aligns with the broader theme of diminishing demand from risk-taking groups. The continued contraction in futures positions underscores the market's reluctance to commit capital, further emphasizing a lack of confidence in the current price action.

As open interest in futures contracts continued to decline, speculative positions in the derivatives market decreased significantly. Traders opted to mitigate risk rather than increase exposure to weakness, resulting in open indices showing significantly less leverage compared to previous pullbacks.

This dynamic is also reflected in the financing market, where the interest rates of the top 500 assets have clearly shifted to a neutral to negative range. The departure from the aggressive premium seen at the beginning of the year highlights a general cooling of demand for leveraged short selling, with a shift towards defensive positioning. The current decline in holdings and negative margin jointly confirm that speculative leverage is being systematically drained from the market, reinforcing the risk-averse environment.

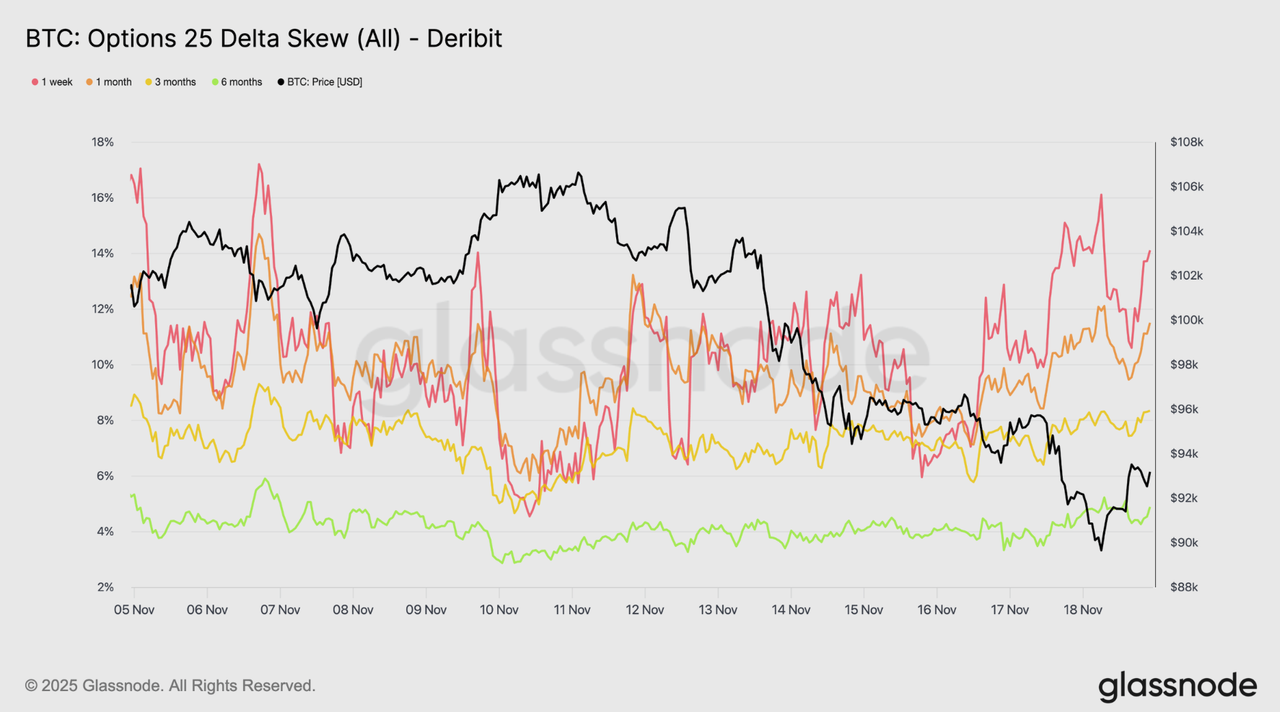

4. The options market rapidly amplifies the pricing of short-term risks.

After Bitcoin briefly dipped below $90,000, the options market immediately repriced risk, with implied volatility across all maturities rising significantly, particularly at the short end. This reflects two main drivers: first, a surge in demand for downside protection; and second, a large number of short-term gamma positions were forced to be covered and rolled upwards, passively pushing up short-term volatility. Current implied volatility levels are approaching the highs seen during the October 10th liquidation event, indicating that traders are rapidly increasing their assessment of short-term risk. The 25-delta skew remains negative across all maturities, with the one-week term approaching extreme bearish levels. The premium for one-week put options is approximately 14%, suggesting a willingness to significantly increase downside protection costs. This type of buying leads market makers to short delta, further selling futures or perpetual contracts for hedging, potentially creating a self-reinforcing downward pressure. While the medium- to long-term skew is also bearish, it is less pronounced than at the short end, with the six-month term slightly below 5%, indicating that pressure is primarily concentrated in the short term.

Bitcoin Options 25-Delta Skewness

Bitcoin Options 25-Delta Skewness

Technical indicator analysis

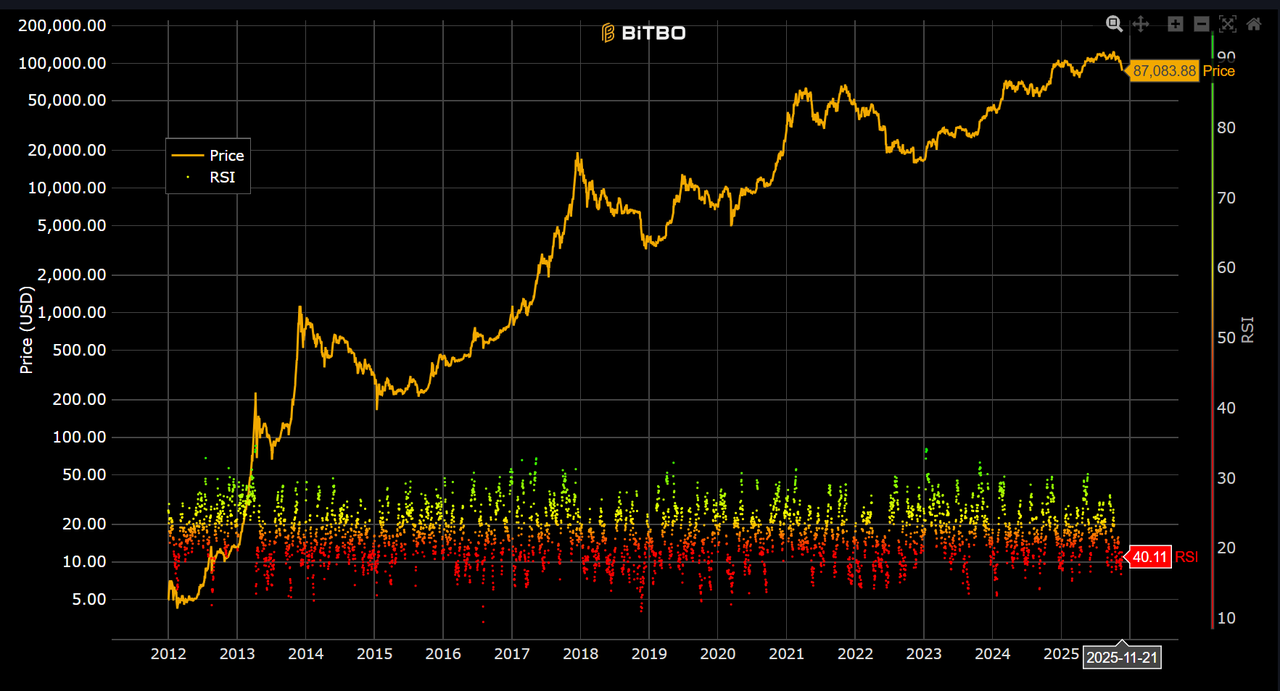

1. Relative Strength Index (RSI 14)

Bitcoin 14-day RSI data image

Bitcoin 14-day RSI data image

As of the end of this period, Bitcoin's 14-day RSI was 40.11, not reaching oversold levels (RSI < 30), showing a slight recovery from the previous few days, but still within a clearly weak range. The RSI remaining in the 30–45 range indicates that the market remains weak; short-term oversold pressure has eased somewhat, but the rebound momentum is currently insufficient.

2. Moving Average (MA) Analysis

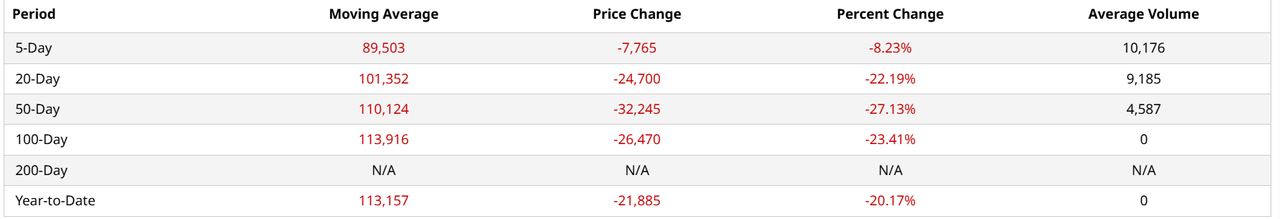

MA5, MA20, MA50, MA100, M200 data images

MA5, MA20, MA50, MA100, M200 data images

The latest moving average data shows:

● MA5 (5-day moving average): $89,503

● MA20 (20-day moving average): $101,352

● MA50 (50-day moving average): $110,124

● MA100 (100-day moving average): $113,916

● Current price: Approximately $87,083

The price is significantly below several key moving averages, indicating that the short-to-medium-term trend remains weak. If the price fails to break through the 20-day moving average (MA20) quickly, the correction may continue.

3. Key support and resistance levels

Support level : $86,000; a break below this level could test $82,000–$84,000.

Resistance levels : $90,000 and $95,000 are the main resistance areas for upward price movement.

Market sentiment analysis

Fear and Greed Index Data Image

Fear and Greed Index Data Image

As of November 21, the "Fear and Greed Index" was approximately 11 points, placing it in the "extreme fear" range.

Looking back at this week (November 15th to November 21st), the Fear and Greed indices were 16 (extreme fear), 18 (extreme fear), 17 (extreme fear), 15 (extreme fear), 16 (extreme fear), 15 (extreme fear), and 11 (extreme fear), respectively. The overall range was between 18 and 11, remaining within the "extreme fear" zone.

The index has fallen from 18 to 11, reflecting a gradual deterioration in market sentiment as prices decline. The overall trend shows a shift from weak to weaker; with the Fear & Greed Index dropping to 11, short-term sentiment is likely to remain low. If Bitcoin continues to hover at low levels or continues to decline, fear may accumulate further, causing the index to linger near the extreme fear level for an extended period. Conversely, if prices stabilize at key support levels accompanied by capital inflows, sentiment may experience a phase of recovery, rising from extreme fear to a fear or neutral range.

Macroeconomic Background

1. Federal Reserve Vice Chairman: Economic trade-offs provide a basis for gradual interest rate cuts.

On November 17, it was reported that Federal Reserve officials are divided on how to set interest rates, and with little new economic data to guide them in making difficult judgments, resolving these differences is a challenge for them.

Federal Reserve Vice Chairman Philip Jefferson’s remarks on Monday provided a prime example of the central bank’s predicament, acknowledging the coexistence of persistent inflation and weakening employment—two opposing threats that require diametrically opposed countermeasures.

2. Investors are shifting to a risk-averse mode, comprehensively reducing their risk exposure. The Federal Reserve meeting minutes and Nvidia's earnings report will influence short-term trends.

On November 18th, Cryptoquant analyst Axel posted on social media that the current simultaneous rise in stock market volatility and interest rate/credit market volatility indicates a full-scale shift to a risk-averse mode in the market. In this environment, funds and institutional investors are beginning to significantly reduce their portfolio risk exposure.

Gold prices have fallen for four consecutive trading days, currently trading around $4,033. Investors are closely watching several delayed U.S. economic data releases scheduled for this week.

The Federal Reserve meeting minutes showed that short-term funding markets tightened and reserves approached ample levels. Furthermore, the artificial intelligence sector is putting additional pressure on the market.

Related pictures

Related pictures

3. Political factors contributing to the uncertainty of monetary policy

On November 19, at a forum in Washington, Trump strongly criticized Federal Reserve Chairman Jerome Powell, calling him "extremely incompetent" and saying he had "psychological problems," and publicly stated that he "very much wants to fire him." Trump also pressured Treasury official Scott Bessent to "resolve the Powell issue as soon as possible," further reinforcing his implication that the White House intends to intervene in monetary policy. The market widely believes that this move could interfere with monetary policy, challenge the Fed's independence, and increase policy uncertainty.

For Bitcoin and related assets, "political interference + monetary policy uncertainty" have a two-way impact: on the one hand, potentially faster liquidity easing is generally positive for crypto assets in the medium to long term, but short-term political risks and unclear interest rate paths may increase market demand for safe-haven assets, leading to increased volatility.

4. Bank of Japan Governor Hints at Unchanged Interest Rate Hike Path

On November 19, Bank of Japan Governor Kazuo Ueda stated after his first bilateral meeting with Prime Minister Sanae Takaichi that the central bank is continuing to gradually adjust the pace of monetary easing, demonstrating its firm intention to raise interest rates. Ueda told reporters after the meeting, "The mechanism of inflation growing in tandem with wages is being restored. Therefore, I explained to the Prime Minister that we are gradually adjusting the extent of monetary easing." This meeting comes as investors are focused on Takaichi's stance on monetary policy and awaiting details of the economic stimulus package to be announced this week. Ueda said, "We discussed foreign exchange issues. The central bank will closely monitor its impact on the economy while working closely with the government." He also emphasized that the Bank of Japan will make appropriate policy decisions based on economic data.

5. The minutes of the Federal Reserve meeting showed that the short-term funding market tightened and reserves approached ample levels.

On November 20th, according to Jinshi News, the minutes of the Federal Reserve's October meeting showed that short-term funding market conditions in the United States tightened significantly during the break, but remained orderly. Near the end of the break, the spread between the effective federal funds rate and the reserve balance rate narrowed to its narrowest level since the Fed began its balance sheet reduction in 2022. The guaranteed overnight funding rate repeatedly fell below the minimum bid rate of the Standing Repo Facility, leading to frequent use of this tool. The average usage of the overnight reverse repo facility fell to its lowest level since 2021. These changes indicate that reserve balances are gradually approaching ample levels.

Related pictures

Related pictures

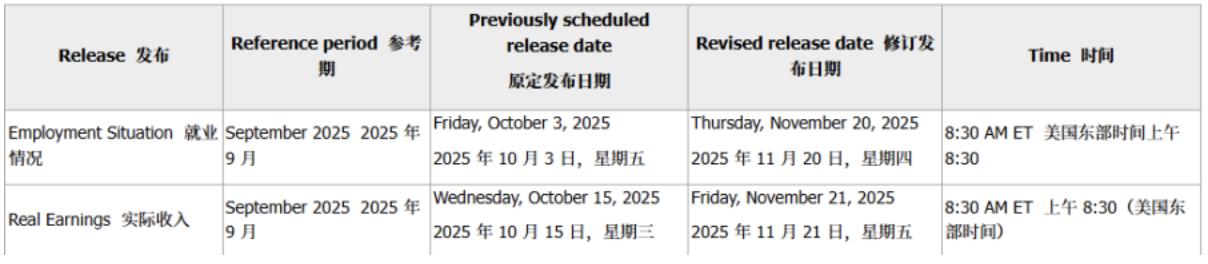

6. US employment data (delayed release)

On November 20th, official data showed that non-farm payrolls increased by 119,000 in September, exceeding market expectations by approximately 50,000. The unemployment rate rose slightly to 4.4% during the same period (previous value 4.3%). The report also indicated that October's employment data would be canceled (due to a suspension of household survey data collection) or incorporated into the November data release. Following the data release, the US dollar index strengthened and performed actively against major currencies (such as the Japanese yen), indicating continued market focus on the resilience of the US labor market.

3. Mining Dynamics

Hash rate change

Over the past seven days, the Bitcoin network hashrate has steadily increased, remaining at a relatively high level this week, ranging from 905.54 EH/s to 1195.00 EH/s.

From a trend perspective, the network hashrate remains high, with frequent but limited fluctuations, showing an overall strong trend. Influenced by the stabilization of power supply in North American mining areas, the hashrate of many mining companies has gradually resumed operation, maintaining strong support for the network hashrate. This week's main hashrate fluctuations remained synchronized with cryptocurrency price movements: during the Bitcoin price correction on November 18th, the network hashrate briefly dipped, falling to a low of approximately 905.54 EH/s; subsequently, with a rapid price rebound, the hashrate also recovered in tandem, approaching its previous high by the weekend. Against the backdrop of continuously increasing difficulty and high energy consumption, miner profits have been squeezed, causing a short-term adjustment in the hashrate within the high range, but the overall trend remains stable.

Weekly Bitcoin network hashrate data

Weekly Bitcoin network hashrate data

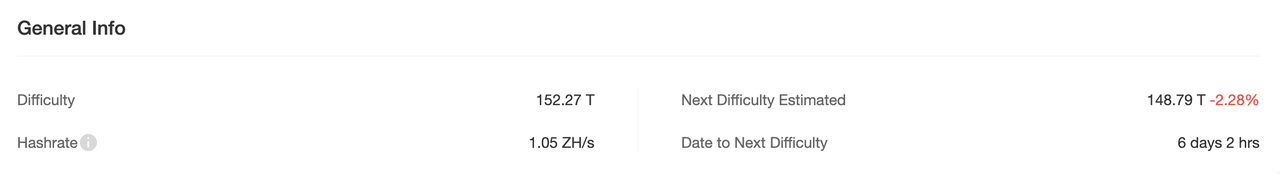

As of November 21, the total network hashrate reached 1.05 ZH/s, and the mining difficulty was 152.27T. The next difficulty adjustment is expected to take place on November 27, with an estimated decrease of 2.28%, bringing the difficulty to approximately 148.79T.

Bitcoin mining difficulty data

Bitcoin mining difficulty data

Bitcoin Hash Price Index

From the perspective of daily revenue per unit of computing power (Hashprice), Hashrate Index data shows that as of November 21, 2025, Hashprice was $36.19/PH/s/day. This week, Hashprice largely mirrored the price movement of Bitcoin, exhibiting a recovery trend after a pullback from its highs.

● November 14: This week's high was $41.37/PH/s/day

● November 21: This week's low of $35.99/PH/s/day

Hashprice's volatility is primarily driven by Bitcoin prices and transaction demand. Affected by Bitcoin price corrections and cooling on-chain demand, miner profits have repeatedly failed to rebound. The continued rise in network hashrate has further compressed the profit margin per unit of hashrate. Although there was a slight recovery over the weekend, it has not yet returned to the levels at the beginning of the week. Short-term profit pressure on miners remains, and the mining ecosystem is entering a phase that places greater emphasis on efficiency and cost control. Overall, it has shown some resilience. Looking at Hashprice's trend, miner profits have fluctuated in the short term, showing an overall downward trend, and miner profit margins are being compressed to some extent.

Hashprice data

Hashprice data

4. Policy and Regulatory News

Japan is considering new cryptocurrency rules to promote crypto trading.

On November 17, according to the Asahi Shimbun, Japanese regulators plan to allow banks and insurance companies to sell cryptocurrencies to depositors and policyholders through their securities subsidiaries, while reducing the tax rate on cryptocurrency trading proceeds to approximately 20%.

Related pictures

Related pictures

US senators urge the IRS to reconsider its cryptocurrency staking rewards tax policy.

On November 19, Indiana Republican Senator Todd Young sent a letter to Treasury Secretary Scott Bessant, urging the Internal Revenue Service (IRS) to review and reconsider the 2023 guidance on the tax treatment of cryptocurrency staking rewards.

As a member of the Senate Finance Committee, Senator Yang questioned the rationale behind current regulations requiring cryptocurrency holders to pay taxes upon "receiving" staking rewards, rather than upon "selling" them. Staking refers to the process by which cryptocurrency holders lock up their assets to support the operation of a blockchain network and verify transactions. Bessant, who also serves as Acting Commissioner of the IRS, has direct oversight authority over this policy. The regulatory environment may become clearer.

The UK and the Basel Committee are pushing for a re-ruling of bank capital rights for stablecoins.

On November 20, it was announced that the Basel Committee on Banking Supervision (BCBS) plans to impose a 1250% risk weight on digital assets held by banks, including stablecoins, starting from January 1, 2026.

The Bank of England has revised its stablecoin regulatory scheme to allow certain assets to be short-term sterling government bonds, in an effort to ease stringent requirements.

Compliance costs related to stablecoins in the banking system may rise significantly; stablecoin issuers and crypto platforms need to pay attention to the risk profile of their banking partners.

Related pictures

Related pictures

5. Bitcoin-related news

Collection and compilation of information related to "Global Corporate and National Bitcoin Holdings (This Week's Statistics)"

1. Avenir Group's Bitcoin ETF holdings rose to a new record high of $1.189 billion.

On November 15, according to SEC 13F filings, Avenir Group, the family office of Li Lin, held 18.297 million shares of BlackRock iShares Bitcoin Trust (IBIT) in the third quarter of 2025, with a market value of $1.189 billion, an increase of about 18% from the previous quarter, and has remained the largest institutional holder in Asia for five consecutive quarters.

2. German listed company aifinyo increased its holdings by 2 BTC, bringing its current Bitcoin holdings to approximately 30.9 BTC.

On November 16, German-listed Bitcoin treasury company aifinyo announced that it had acquired 2 more Bitcoins at an average price of €90,075, bringing its total Bitcoin holdings to approximately 30.9. The company's Bitcoin yield in Q4 was 7.01%, and it stated its intention to purchase 10,000 Bitcoins by 2027.

3. Institutional purchases hit a new high, indicating that institutional funds are actively entering the Bitcoin market.

On November 17, Bitcoin Magazine reported that in the third quarter of 2025, institutions purchased approximately 944,330 Bitcoins, bringing their total holdings to over 3.8 million Bitcoins, worth approximately US$435 billion.

4. Data: Institutional BTC holdings increased by over $500 million in the past 30 days.

On November 17, according to data from Bitcoin Treasuries, institutional holdings of BTC increased by more than $500 million in the past 30 days.

5. The founder of Equation News increased his BTC holdings and is bullish on market performance in the coming months.

On November 17th, Vida, founder of Equation News, posted on his personal channel that he had increased his BTC holdings as a long-term investment and also increased his holdings of a small-cap meme coin for short-term speculation over the next few months. Vida stated that he is bullish on the crypto market in the coming months because he believes the US stock market won't fall too drastically. He feels the current crypto market decline is an overreaction to the panic. BTC is currently supported by the 1-week Supertrend indicator, which is arguably the most effective support level in this bull market.

6. El Salvador increased its holdings by 1090 BTC, bringing its total holdings to 7474.37 BTC.

On November 18, according to data from the Salvadoran Ministry of Finance website, El Salvador increased its holdings by 1,090 BTC (US$100 million), bringing its total Bitcoin holdings to 7,474.37 BTC, worth over US$686 million.

7. UK-listed company B HODL increased its holdings by 2 Bitcoins, bringing its total holdings to 155 Bitcoins.

On November 18, according to BitcoinTreasuries.NET, UK-listed company B HODL (stock code: HODL) increased its holdings by 2 Bitcoins, bringing its total holdings to 155 BTC.

8. Hyperscale Data increased its Bitcoin holdings to approximately 332.2 BTC and allocated $41.25 million for further purchases.

On November 19, Hyperscale Data, listed on NYSE America, a subsidiary of the New York Stock Exchange, announced that it has acquired 332.2516 bitcoins through its subsidiary Sentinum (including 283.3468 bitcoins acquired on the open market and approximately 48.9048 bitcoins obtained from its bitcoin mining operations), and has also allocated $41.25 million in cash to continue purchasing bitcoins on the open market.

9. Trump ally Brandon Gill further increases his holdings of Bitcoin and IBIT.

On November 19th, it was reported that U.S. Representative Brandon Gill (a Texas Republican and Trump ally) has again significantly increased his Bitcoin holdings. According to the latest Congressional Transactions disclosure, he purchased between $100,000 and $250,000 worth of BTC on October 20th, and added between $15,000 and $50,000 in BlackRock Bitcoin ETF IBIT at the end of October. Gill is one of the most active BTC buyers in Congress this year, having accumulated a total of $2.6 million in Bitcoin purchases since taking office in January.

10. Texas Senator Brandon Gill increases his holdings of BTC and Bitcoin ETF by approximately $300,000.

On November 20, according to Bitcoin News, Texas Republican Congressman Brandon Gill disclosed that he had increased his holdings of Bitcoin and Bitcoin ETFs by up to $300,000 in his portfolio.

CryptoQuant founder: Funds are still flowing into Bitcoin, and the market could rebound at any time.

On November 15th, CryptoQuant founder and CEO Ki Young Ju posted on the X platform, stating that as long as funds continue to flow in, Bitcoin is not in a bear market, and funds are currently still flowing into Bitcoin. If OG whales stop selling and macro market sentiment reverses, Bitcoin could rebound at any time.

Ki Young Ju previously pointed out that the cost basis for investors who entered the Bitcoin market 6-12 months ago is close to $94,000, and unless the price falls below that level, he does not believe that a bear market cycle has begun.

Bitcoin transaction volume surged, with extremely high market participation.

On November 17th, on-chain data from analytics firm IntoTheBlock showed that Bitcoin trading volume surged to $45.6 billion on November 15th, reaching a one-month high. Approximately 516,000 Bitcoins moved during the same period, indicating high market participation despite the price decline.

Institutional Bitcoin buying surges: $405 million in bargain hunting indicates strong confidence.

On November 17th, recent data showed a significant institutional buying spree of Bitcoin during the market downturn, with over $405 million worth of BTC being transferred from major exchanges to custody solutions. This strategic move demonstrates strong confidence in Bitcoin's long-term value proposition despite short-term market volatility.

Author of "Rich Dad Poor Dad": I don't believe in Wall Street; real money and Bitcoin are the only true assets.

On November 18th, Robert Kiyosaki, author of "Rich Dad Poor Dad," posted on social media that Warren Buffett called Bitcoin a speculative activity rather than an investment, and predicted that a bubble burst would severely impact Bitcoin investors. However, the stocks, bonds, and other Wall Street assets sold by Buffett also face the risk of collapse. Currently, the central banks of Japan and China are selling off US Treasury bonds, considered the "safest investment."

Kiyosaki claims to own gold mines, gold and silver coins, as well as Bitcoin and Ethereum, due to his distrust of the Federal Reserve, the U.S. Treasury, and Wall Street. He categorizes real gold and silver as "God's money," Bitcoin and Ethereum as "people's money," and currencies issued by the Federal Reserve and governments as "fake money." He emphasizes that he trusts blockchain technology more than traditional accounting firms and states that he will never invest in "fake assets" such as gold ETFs, silver ETFs, or Bitcoin ETFs. Kiyosaki believes that because the total supply of Bitcoin is limited to 21 million, while government currency can be printed indefinitely, the value of Bitcoin will rise as the purchasing power of the US dollar declines.

Related pictures

Related pictures

The Czech central bank becomes the world's first central bank to directly hold Bitcoin.

On November 19, the Czech National Bank announced the purchase of Bitcoin and other digital assets, launching a $1 million experimental digital asset portfolio. This makes it the world's first central bank to publicly include Bitcoin on its balance sheet. This move, intended to test relevant financial procedures, is of great symbolic significance and reflects the government's approval of cryptocurrency exploration.

Bitcoin ATMs appear in Nairobi shopping malls after Kenya's first cryptocurrency law came into effect.

On November 20, according to Cointelegraph, days after Kenya implemented its first comprehensive cryptocurrency law, ATMs branded "Bankless Bitcoin" appeared in several large shopping malls in Nairobi, providing local residents with a service to exchange cash for cryptocurrency.

It is reported that Kenya implemented the Virtual Asset Service Providers Act 2025 on November 4, which is the country's first formal licensing framework for crypto platforms such as wallet operators, exchanges, and custodians.

Related pictures

Related pictures

UAE sovereign wealth fund Al Warda stated that Bitcoin is as important as gold and expects to hold it for the long term.

On November 20, The Bitcoin Historian, citing Bloomberg, reported that the UAE sovereign wealth fund Al Warda stated that Bitcoin is "playing an important role alongside gold" and that it "expects to hold" Bitcoin assets for the long term, demonstrating its strategic allocation approach.

Nvidia's earnings report beat expectations, sending Bitcoin mining stocks soaring in after-hours trading.

On November 20th, according to The Block, Nvidia reported third-quarter revenue of $57 billion, and fourth-quarter revenue expectations exceeded analysts' forecasts, boosting its stock price by 5% in after-hours trading. This strong performance helped Bitcoin prices recover to around $91,000, while also driving a significant rise in cryptocurrency mining stocks.

Cipher Mining led the gains, rising over 13% in after-hours trading; IREN followed closely, rising approximately 10%; Bitfarms, TeraWulf, and CleanSpark also saw significant increases. Notably, several Bitcoin miners are actively transitioning to AI infrastructure businesses, such as IREN signing a $9.7 billion AI cloud agreement with Microsoft, and Cipher Mining reaching a $5.5 billion AI hosting agreement with AWS.