HashWhale Crypto Weekly Report | Bitcoin Rebounds After a Short-Term Bottoming Out; Market Sentiment Shifts from Panic to Cautious Recovery (November 22-28)

- 核心观点:比特币经历深跌后成功突破关键阻力位。

- 关键要素:

- 价格从$81,000反弹至$92,000。

- ETF资金流出创纪录,市场承压。

- 巨鲸资金流入交易所,抛压风险仍存。

- 市场影响:短期情绪改善,但需观察资金持续流入。

- 时效性标注:短期影响

Author: Wang Tai | Editor: Wang Tai

1. Bitcoin Market

Bitcoin price movement (November 22, 2025 - November 28, 2025)

During this phase, Bitcoin's overall performance can be summarized as "deep drop to the bottom → low-level recovery → oscillating rebound → breakout reversal → stabilization at key resistance levels." The price rebounded steadily from the low of approximately $81,000 on the 22nd. A key reversal occurred on the 27th, with a significant acceleration in the price movement. The price quickly rose from around $88,000, successfully breaking through the $90,000 resistance level that had held for several days, reaching the $91,000–$92,000 range on the 28th. Market sentiment improved moderately from extreme panic, but liquidity remained cautious, and the rebound was mainly driven by oversold correction and short covering.

The deep decline and bottoming-out phase (November 22)

On the 22nd, Bitcoin continued its precipitous decline from the previous day, opening lower and quickly breaking through key price levels such as $85,000 and $83,000. It then fell further to a low of around $81,000, exhibiting a dramatic waterfall-like drop, with market panic reaching its peak for the month. Although there was a slight rebound before the close, the market remained deeply oversold, with huge volatility throughout the day indicating extreme capital contraction and a sharp decrease in liquidity.

Causes of the trend:

- The massive leverage liquidation accumulated from the continuous decline in the previous days erupted on the 22nd, causing a rapid drop.

- The fear index remains at extreme levels, and market perception of the short-term risks of crypto assets continues to deteriorate.

- With liquidity drying up, selling pressure dominated the market, causing prices to quickly break through multiple support levels.

Low-level recovery phase (November 23)

After the sharp drop on the 22nd, the market stabilized significantly on the 23rd. Prices gradually rose from the $81,000–$82,000 range, repeatedly testing this area without breaking below it, indicating that short-term selling pressure was beginning to ease. The afternoon rebound strengthened, reaching a high of around $85,000, and then fluctuated narrowly within this range. The overall performance showed that while bullish momentum was weak, the market had entered a phase of "technical correction + wait-and-see buffer," with the decline slowing significantly.

Causes of the trend:

- Low-price buying and short covering jointly drove the price recovery.

- Market panic has subsided somewhat, and sentiment has recovered slightly from extreme fear.

- Technically oversold conditions led to short-term funds rushing to buy on the dip.

A period of fluctuating recovery (November 24-25)

November 24

Bitcoin continued its rebound on the 24th, oscillating upwards within the $84,000–$86,000 range. It further climbed to $87,000 in the afternoon, but selling pressure remained significant, resulting in a relatively mild rebound. Funds showed a "buying on dips" approach, and the market gradually shed its panic selling dominance.

November 25

On the early part of the day, the price attempted to break through $89,000, briefly touching around $90,000, but strong resistance was encountered at this key level. After failing to break through, Bitcoin retreated to the $87,000 area for consolidation, with both upward and downward movements remaining very evident throughout the day. Although the price has continued to rise, it is still within a "correction window," and a trend reversal has not yet been confirmed.

Causes of the trend:

- The rebound momentum is entering the verification stage, with bulls and bears clearly tug-of-war around $90,000.

- Despite market stabilization, fear remains dominant, and there is a lack of long-term capital to drive a breakthrough.

- $90,000 serves as a significant resistance level, both technically and psychologically.

Breakout reversal phase (November 26–27)

November 26

On the 26th, Bitcoin continued to trade within a narrow range of $86,000–$88,000. This range exhibited a clear "rising bottom" pattern, with bulls gradually gaining a short-term advantage. However, overall trading volume remained limited, and the market has not yet shown a decisive breakout.

Key reversal on November 27

The price action accelerated significantly on the 27th, rising rapidly from around $88,000 and successfully breaking through the $90,000 resistance level that had held for several days. After the breakout, momentum strengthened considerably, reaching a high of $91,500–$92,000. This marks the first time since the recent sharp decline that a strong structure of "clear breakout + support at higher levels" has appeared.

Causes of the trend:

- Short covering triggered a concentrated surge, driving prices up rapidly.

- The technical breakthrough attracted short-term bulls and quantitative traders to enter the market.

- The market as a whole is transitioning from a phase of extreme panic to a cautious recovery phase, with pessimistic sentiment improving marginally.

The resistance level has been stabilized (November 28th)

On the 28th, Bitcoin maintained a high-level consolidation within the $91,000–$92,000 range, with the overall market trending towards stability. Although there were slight pullbacks, the lows did not break below the previous day's breakout level, remaining firmly above $91,000. This indicates that market support remains strong. Overall, the market is showing signs of natural consolidation after the breakout, and the market sentiment is significantly more stable than the previous week.

Causes of the trend:

- The momentum buying following the previous day's breakout continued to provide support.

- Short sellers were unwilling to expand their exposure further after the breakout, and the market entered a relatively balanced state.

- Some investors anticipate a potential "short-term bottom" and their risk appetite has slightly increased.

2. Market Dynamics and Macroeconomic Background

Fund Flow

1. ETF Fund Dynamics

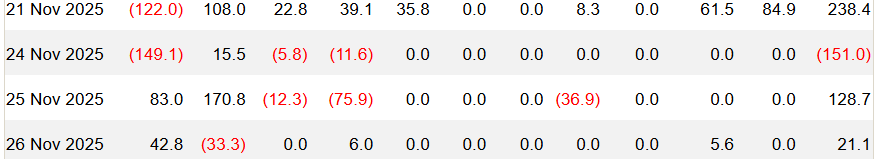

Bitcoin ETF fund flows this week:

November 21: +$238.4 million

November 24: -$151 million

November 25: +128.7 million USD

November 26: +0.211 billion USD

ETF Inflow/Outflow Data Image

On November 21st, Bitcoin spot ETFs saw a net inflow of approximately $238.4 million, a significant rebound after several days of outflows. However, on November 24th, a brief reversal occurred, resulting in a net outflow of $151 million. This followed a record single-day outflow of $523 million from BlackRock IBIT on November 19th and a net redemption across US stock Bitcoin ETFs for the week, indicating continued defensive sentiment among institutional investors. On November 25th and 26th, funds recovered to a slight net inflow, with bargain hunters re-entering the ETF market. The fund structure gradually shifted from a one-sided outflow to an alternating outflow and inflow pattern, but overall, the market remains in a volatile, sideways trading phase.

According to Farside Investors' BTC-ETF Flow tracking data, this initial outflow followed by a slight rebound reflects a potential structural reversal in market sentiment near the bottom. It's worth noting that despite the inflows, the overall amount is still far from offsetting the previous outflows of hundreds of millions of dollars, indicating continued tight market liquidity. In summary, the ETF funding logic this week can be summarized as follows: after strong redemptions in early to mid-November, ETFs saw a tentative rebound on November 25th, signifying cautious entry by institutions into the current low-price zone, potentially laying the groundwork for a medium-term bottom. However, in the short term, it remains to be seen whether the inflows can continue.

According to Cointelegraph, BlackRock's spot Bitcoin ETF (IBIT) holders have returned to profitability after Bitcoin rebounded above $90,000, suggesting a potential shift in sentiment among one of the key investor groups driving the market this year. Arkham data shows that holders of BlackRock's largest spot Bitcoin fund, IBIT, have accumulated profits of $3.2 billion. Arkham stated, "BlackRock IBIT and ETHA holders collectively profited nearly $40 billion at their peak on October 7th, before falling to $630 million four days earlier. This means the average cost of all IBIT purchases is almost break-even." With ETF holders no longer under pressure, the pace of selling in Bitcoin ETFs is likely to continue to slow. The situation has improved significantly since the $903 million net outflow recorded on November 20th.

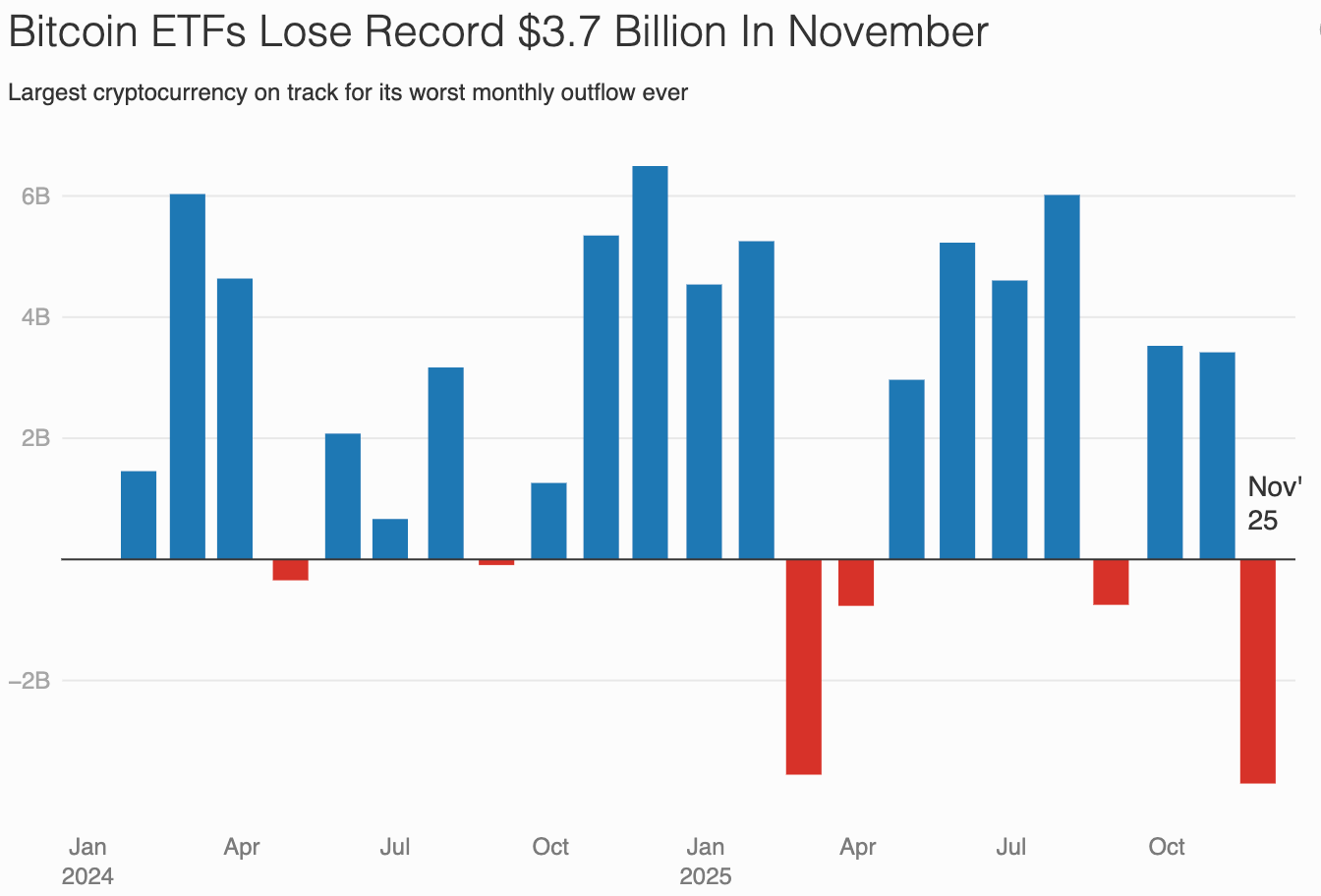

2. Bitcoin ETFs experienced record net outflows, putting significant pressure on the spot market.

On November 26, Forbes reported that Bitcoin spot ETFs continued their large-scale redemption trend, with a cumulative net outflow of $3.7 billion in a single month, breaking the record set in February of this year. As a result, Bitcoin has corrected by more than 35% from its all-time high of $126,000 in October, hitting a low of $80,000, its lowest point since April.

Ethereum-related ETFs also saw outflows of over $1.6 billion during the same period, and coupled with market panic, the total market capitalization of global crypto assets once fell below $3 trillion.

Related images

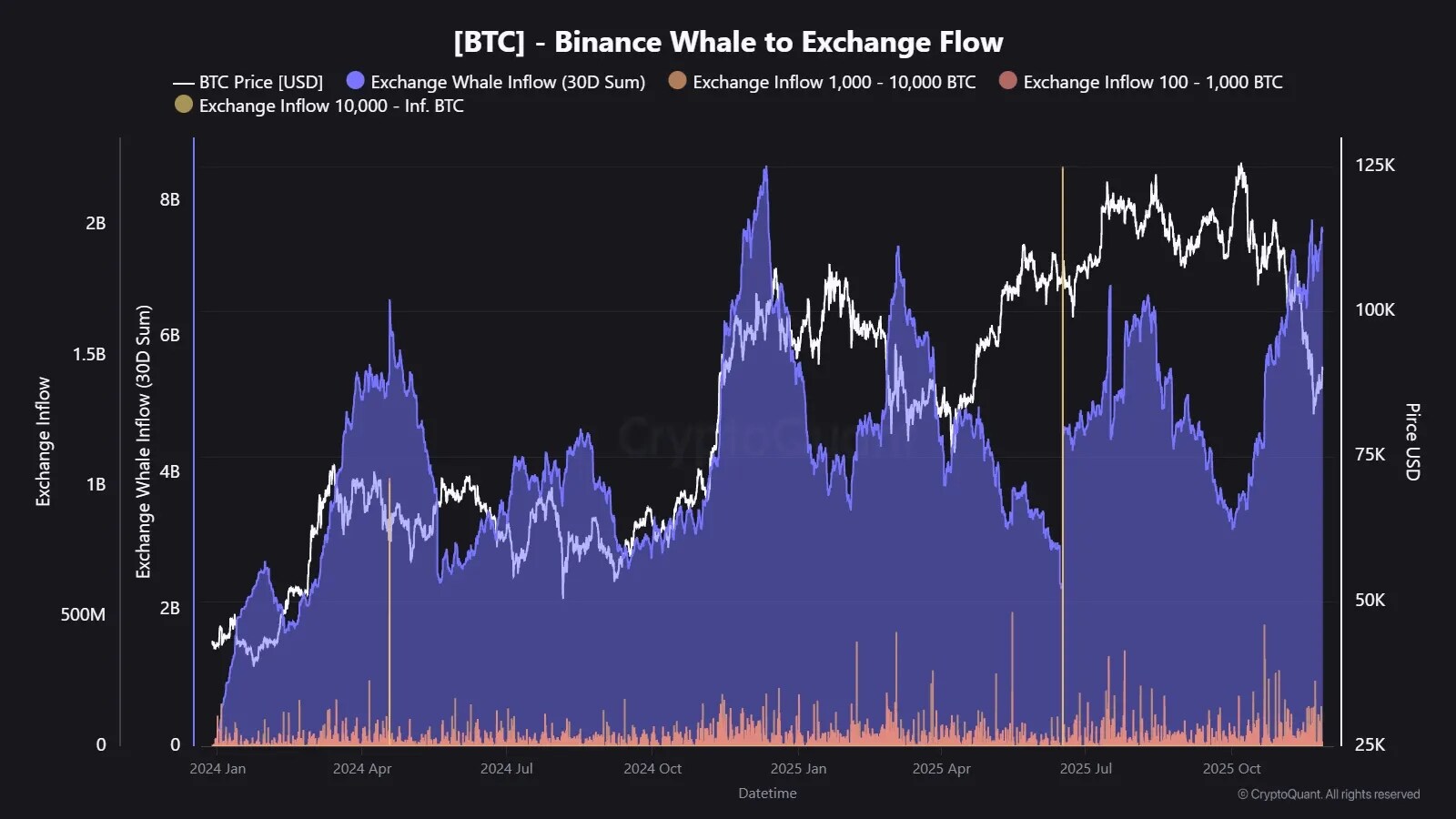

3. Significant inflows of large amounts of capital into the exchange indicate that potential selling pressure has not yet subsided.

CryptoQuant data shows that in the past 30 days, the amount of BTC whales flowing into Binance has reached $7.5 billion, a one-year high. This inflow structure is highly consistent with past periods of high volatility, which typically indicates:

Whales transfer assets to exchanges during periods of market weakness to take profits or hedge risks.

The 30-day moving average is still rising, and there are no signs of selling pressure stabilizing yet.

Historical experience shows that in similar situations, it often takes about a month for the market to form a bottom.

Related images

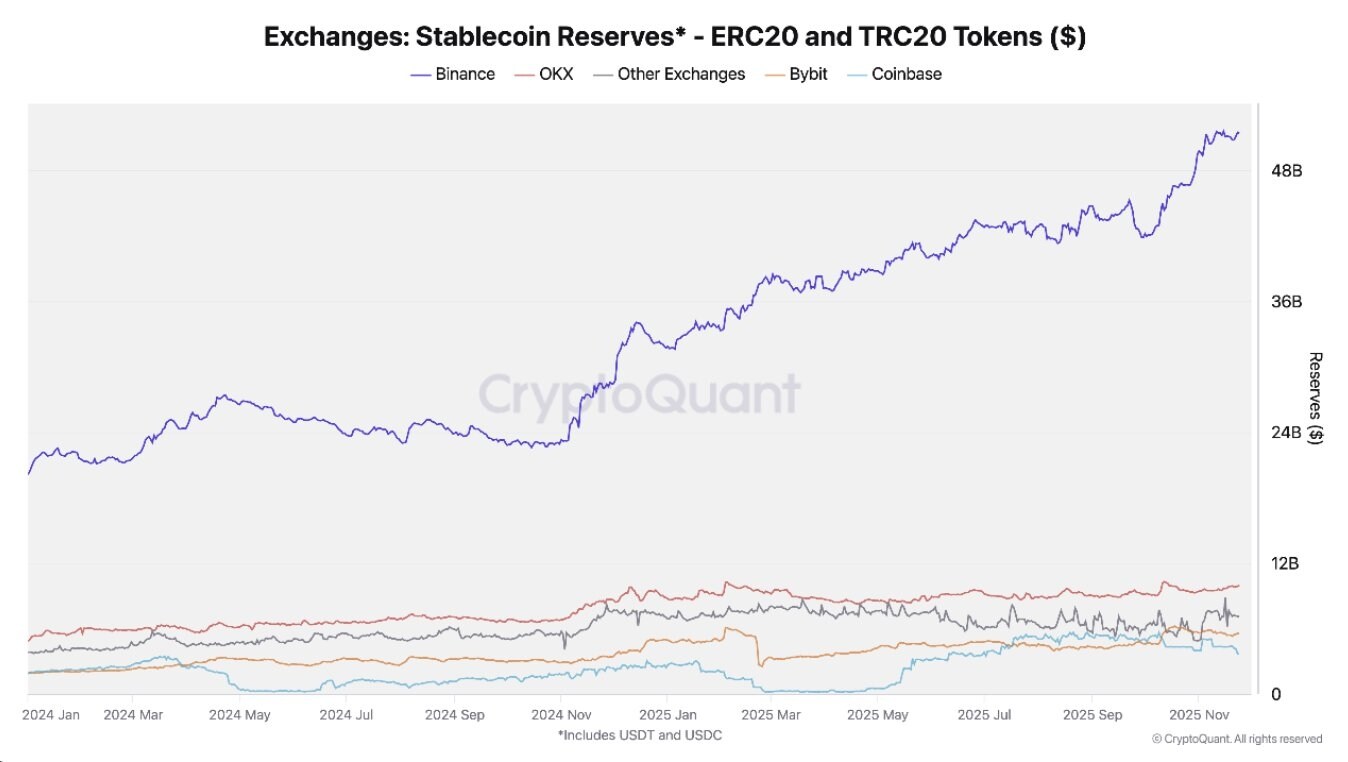

4. Stablecoin reserves hit a record high as safe-haven funds continue to flow in.

As the market experienced a rapid correction, overall fund inflows into exchanges increased significantly. Binance's stablecoin reserves rose to a record high of $51.1 billion this week, indicating strengthened risk aversion in the market. Meanwhile, Bitcoin and Ethereum saw combined inflows of approximately $40 billion, with Binance and Coinbase experiencing the most active inflows, reflecting a short-term concentration of liquidity migrating to leading institutional platforms.

Related images

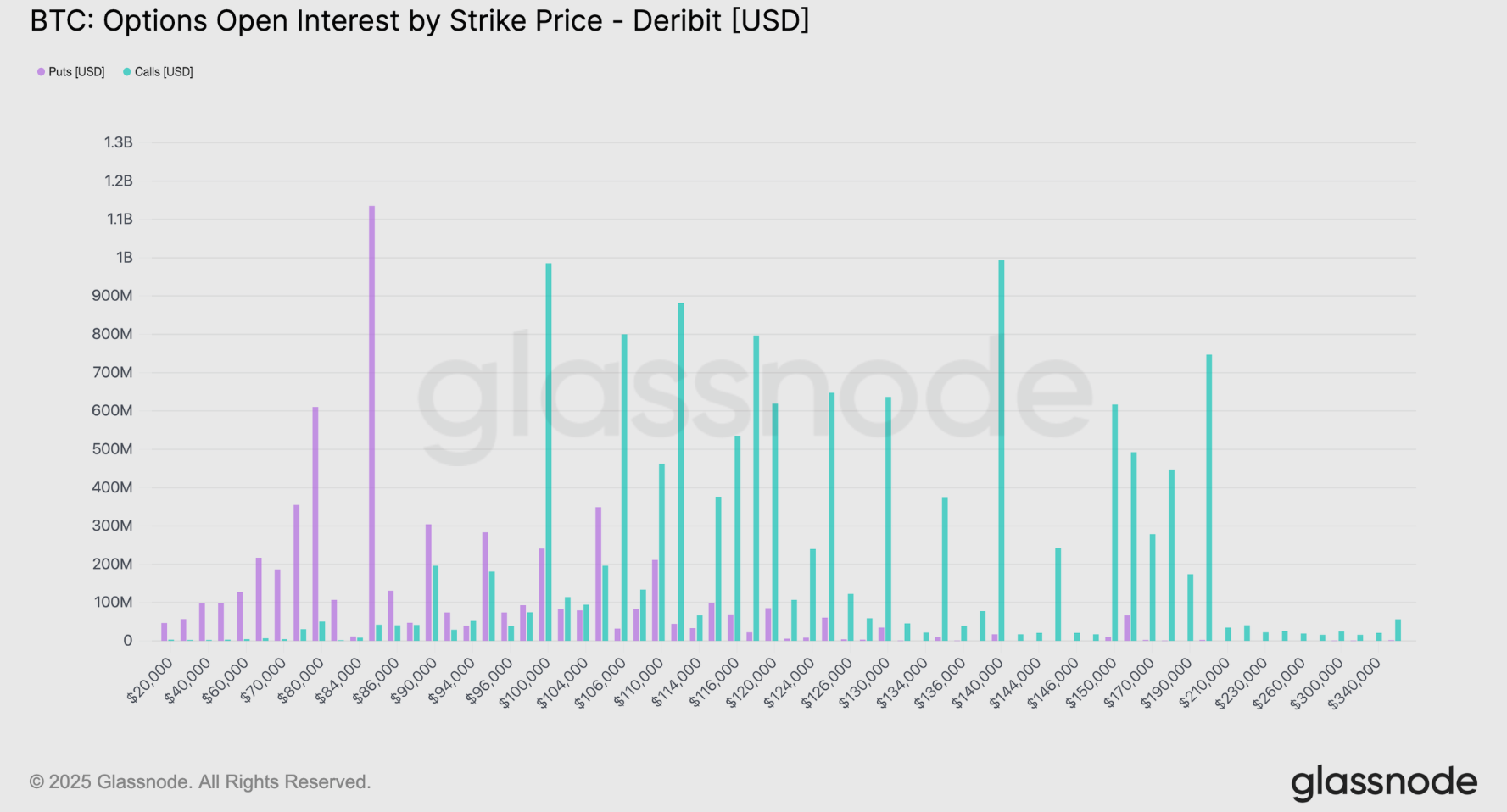

5. The upside and downside risks in the options market have not been eliminated.

With the year's most important expiry date approaching, the influence of the options market is expanding. Large clusters of open contracts and the surrounding hedging flows help shape which price levels attract liquidity. As the gamma index rises, hedging demand also increases, and the gamma value typically peaks near expiry and when spot trading is close to the strike price. This makes the end of December a period where volatility may pick up significantly.

The strike price distribution shows that put options are concentrated around $84,000, while call options are growing around $100,000. The relatively narrow range between these attacks creates room for sharper moves within that range. Traders are shorting gamma on put options and shorting gamma on call options, suggesting that upside potential may remain limited in the coming weeks, while downside risks have not been fully eliminated. In short, the recent rally is likely to continue struggling below key resistance levels.

Bitcoin Options Open Interest Strike Price Distribution

Technical indicator analysis

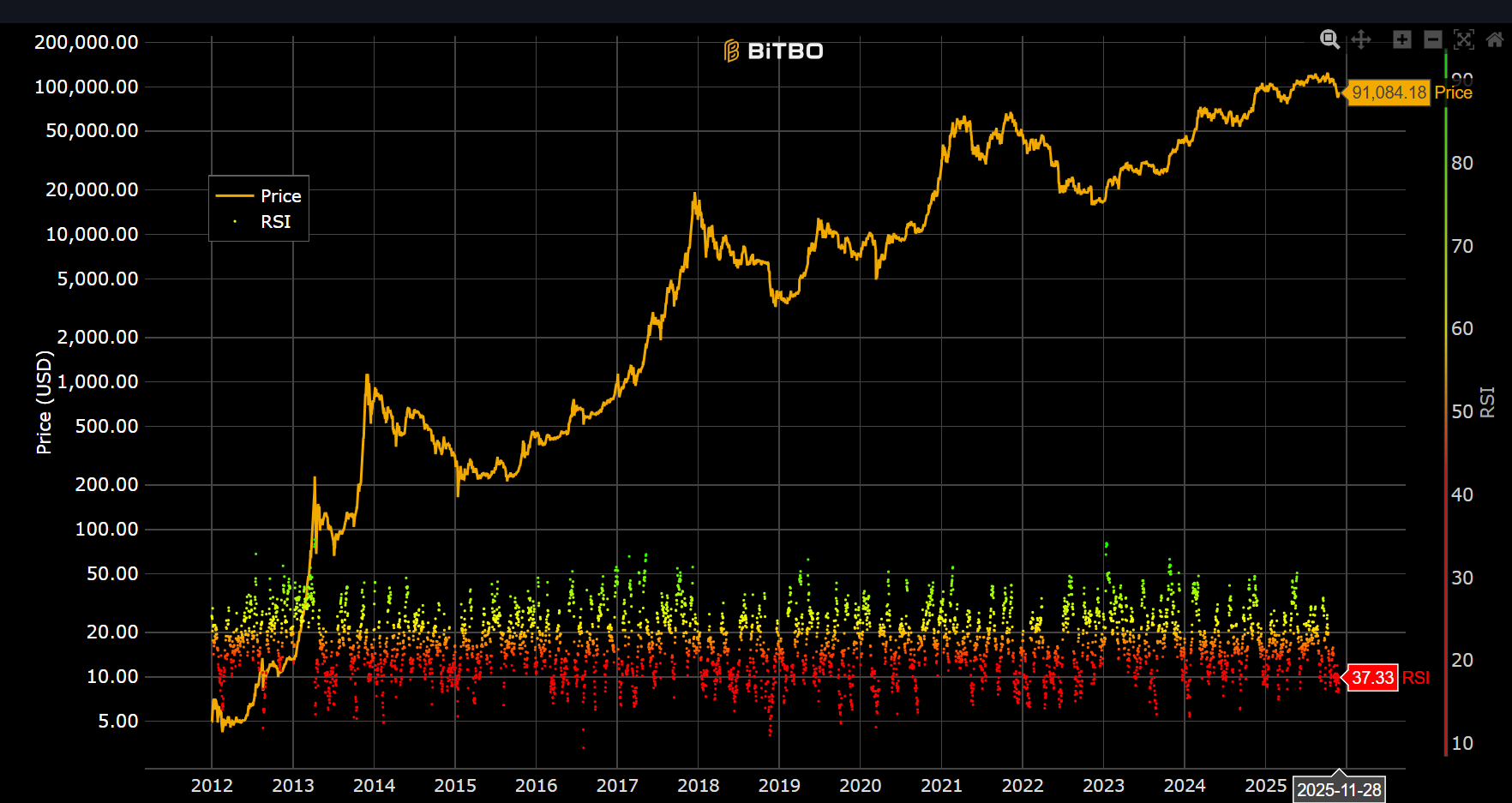

1. Relative Strength Index (RSI 14)

Bitcoin 14-day RSI data image

As of the end of this period, Bitcoin's 14-day RSI was 37.33, not reaching oversold territory (RSI < 30), slightly lower than last week's 40, but still within a clearly weak range. The RSI remaining in the 30–45 range indicates the market remains weak; short-term oversold pressure has eased somewhat, but rebound momentum is currently insufficient.

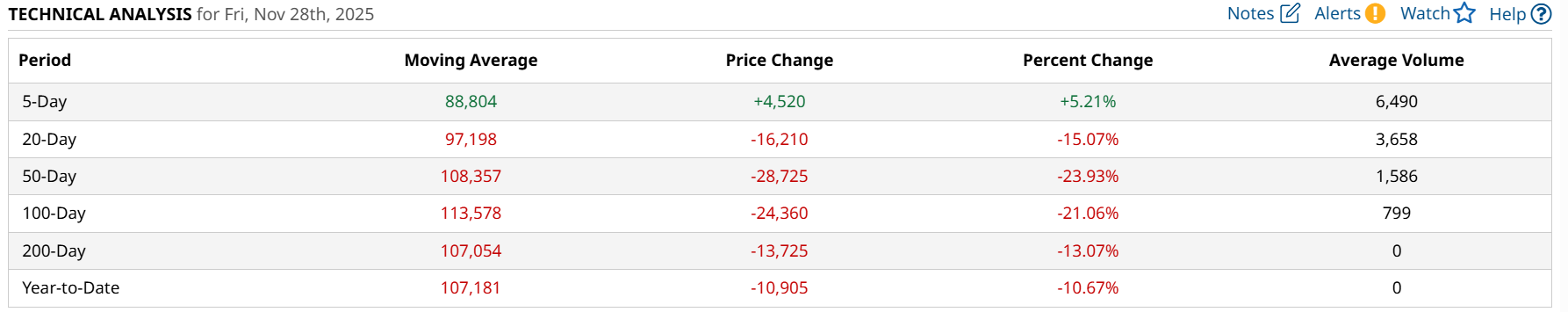

2. Moving Average (MA) Analysis

MA5, MA20, MA50, MA100, M200 data images

The latest moving average data shows:

- MA5 (5-day moving average): $88,804

- 20-day moving average (MA20): $97,198

- MA50 (50-day moving average): $108,357

- 100-day moving average (MA100): $113,578

- Current price: Approximately $91,325

Overall, Bitcoin is currently trading below all moving averages except the MA5, and the structural downtrend remains intact, with only a short-term correction possible. Unless the price can regain a foothold above the MA20 and MA50 and receive sustained volume support, a valid reversal is unlikely.

3. Key support and resistance levels

Support level: $90,000, while the previous resistance level of $86,000 still needs to be carefully monitored.

Resistance level: $92,000 is the main resistance area for recent price increases.

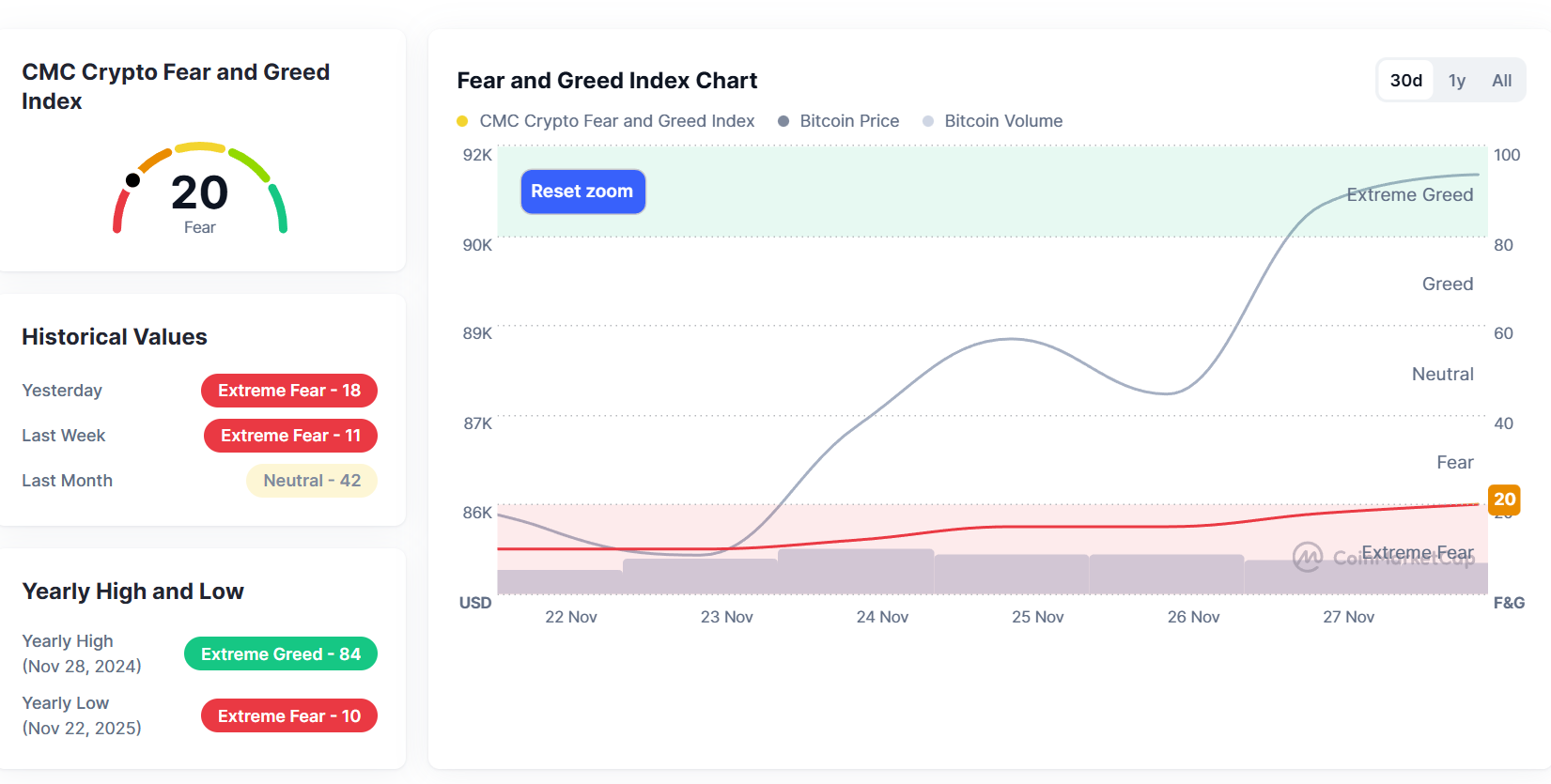

Market sentiment analysis

Fear and Greed Index Data Image

As of November 28, the "Fear and Greed Index" was approximately 20 points, placing it in the "extreme fear" range.

Looking back at this week (November 22nd to November 28th), the Fear and Greed indices were 10 (extreme fear), 10 (extreme fear), 12 (extreme fear), 15 (extreme fear), 15 (extreme fear), 18 (extreme fear), and 20 (extreme fear), respectively. The overall range was between 20 and 10, remaining within the "extreme fear" zone.

The index has rebounded slightly from its year-to-date low of 10 to 20, and market sentiment has also improved slightly as Bitcoin climbed above $90,000. However, it remains in a state of extreme panic, indicating that investor confidence is still extremely fragile. Historically, this kind of sentiment, characterized by "persistent low levels for several days," often appears in the bottoming-out phase, but it can also last for weeks or even months. A comprehensive assessment combining fund flows and fundamentals is necessary.

Macroeconomic Background

1. US officials say the US will take new action against Venezuela, a geopolitical "black swan" event facing the impact of price increases.

On November 24th, US officials stated that the US would launch new operations against Venezuela. If the situation escalates, oil prices will face a supply-side shock and surge, directly pushing up global inflation. The rapid rise in oil prices will not only directly impact global inflation rates but may also disrupt the Federal Reserve's interest rate policy expectations, causing anticipated rate cuts or a peak in the oil cycle to fail. Macro investors generally believe this will prompt funds to flow into gold to hedge against risk.

More notably, this uncertainty simultaneously reinforces Bitcoin's narrative as "digital gold" and the ultimate decentralized safe-haven asset. As the traditional financial system faces the dual pressures of oil price inflation and geopolitical tensions, institutions and high-net-worth individuals may accelerate the transfer of some funds to major cryptocurrencies such as Bitcoin (BTC), seeking hedging tools outside the dollar system.

Related pictures

2. Expectations for a December rate cut by the Federal Reserve surged dramatically.

On November 24th, Barclays Research pointed out that uncertainty remains regarding the Federal Reserve's interest rate decision next month, but Chairman Powell is likely to push the FOMC to make a rate cut decision. Based on recent speeches, Barclays believes that Governors Milan, Bowman, and Waller are likely to support a rate cut, while regional Fed Presidents Mussallem and Schmid prefer to keep rates unchanged. Recent statements from Governors Barr and Jefferson, as well as Goolsby and Collins, indicate that their stance is not yet clear, but they are more inclined to maintain the status quo. Governors Cook and Williams rely on data but seem more supportive of a rate cut. Expectations for a Fed rate cut have been hit by multiple factors, coupled with the weakness of non-US currencies such as the yen, causing the dollar index to rise above 100.3. On Friday, Fed President Williams' dovish remarks reignited expectations of a December rate cut, and the yen also reversed its decline after Japanese authorities discussed the possibility of currency intervention. The dollar index closed the week at 100.18, up 0.87%.

Barclays stated, "This means that before considering Powell's position, there are likely six voters who would favor keeping rates unchanged and five who would favor cutting rates." Powell will ultimately lead the decision because the threshold for governors to publicly oppose his position is very high.

3. Hassett becomes the leading candidate to take over the Federal Reserve, and the Fed may be about to usher in a historic turning point.

On November 26, it was reported that with the selection of a new Federal Reserve chairman entering its final weeks, Kevin Hassett, director of the National Economic Council, has become the leading candidate to take over the Fed in the eyes of White House advisors and Trump's allies.

Sources who requested anonymity said that if Hassett is appointed, Trump will place a close ally he knows and trusts at the independent central bank. Some pointed out that Hassett is seen as the person who can bring Trump's interest rate-cutting philosophy to the Federal Reserve—an institution Trump has long sought to influence—and is now facing a historic turning point.

However, they also cautioned that Trump is known for his unpredictable personnel decisions, and everything remains uncertain until the official nomination is announced. White House Press Secretary Karoline Leavitt stated in a statement, "No one can predict President Trump's decisions before he takes action." Fox News White House correspondent Edward Lawrence also stated that there is currently no frontrunner in the selection of the next Federal Reserve Chair.

A senior U.S. official confirmed that the final list of candidates has not yet been submitted to the White House. The selection of the Federal Reserve Chairman and Governors has historically been the most direct way for a president to influence the central bank. During his first term, Trump nominated current Chairman Jerome Powell, and the president deeply regretted his decision when Powell failed to advance interest rate cuts at the expected pace. Hassett is highly aligned with Trump on economic policy, and both believe further interest rate cuts are necessary.

4. The United States will extend some tariff exemptions on Chinese goods until November 10, 2026.

On November 27, the Office of the United States Trade Representative announced that it will extend the tariff exemptions imposed under Section 301 investigations concerning technology transfer and intellectual property rights from China until November 10, 2026. The existing exemptions were originally scheduled to expire on November 29 of this year.

From the perspective of the crypto industry, the US decision to extend the tariff exemption period for Chinese goods is essentially a game of rule certainty versus policy continuity. The crypto market is extremely sensitive to changes in global macroeconomic policies, and adjustments to tariff policies directly reflect subtle shifts in geopolitical relations. These changes can then impact asset liquidity, market sentiment, and even cross-border capital flows. Extending the exemption period signifies a short-term easing of trade tensions, which is generally beneficial for risk assets, including cryptocurrencies.

5. The US has cancelled the release of October CPI inflation data; the PCE data will also be rescheduled.

On November 27, the U.S. Bureau of Labor Statistics announced on its website that it had canceled the October Consumer Price Index (CPI) release, originally scheduled for November 7, due to the inability to retrospectively collect some survey data during the U.S. government shutdown. The Bureau stated that the November CPI, originally scheduled for release on December 10, will be postponed to December 18, meaning that both the CPI and non-farm payroll data will be released after the Federal Reserve's policy meeting next month. The U.S. Bureau of Economic Analysis also announced that it will reschedule the release of another key inflation indicator, the Personal Consumption Expenditures Price Index (PCE), but did not announce a new date. The PCE, originally scheduled for release on November 26, is a preferred measure of inflation by the Federal Reserve.

Related pictures

3. Mining Dynamics

Hash rate change

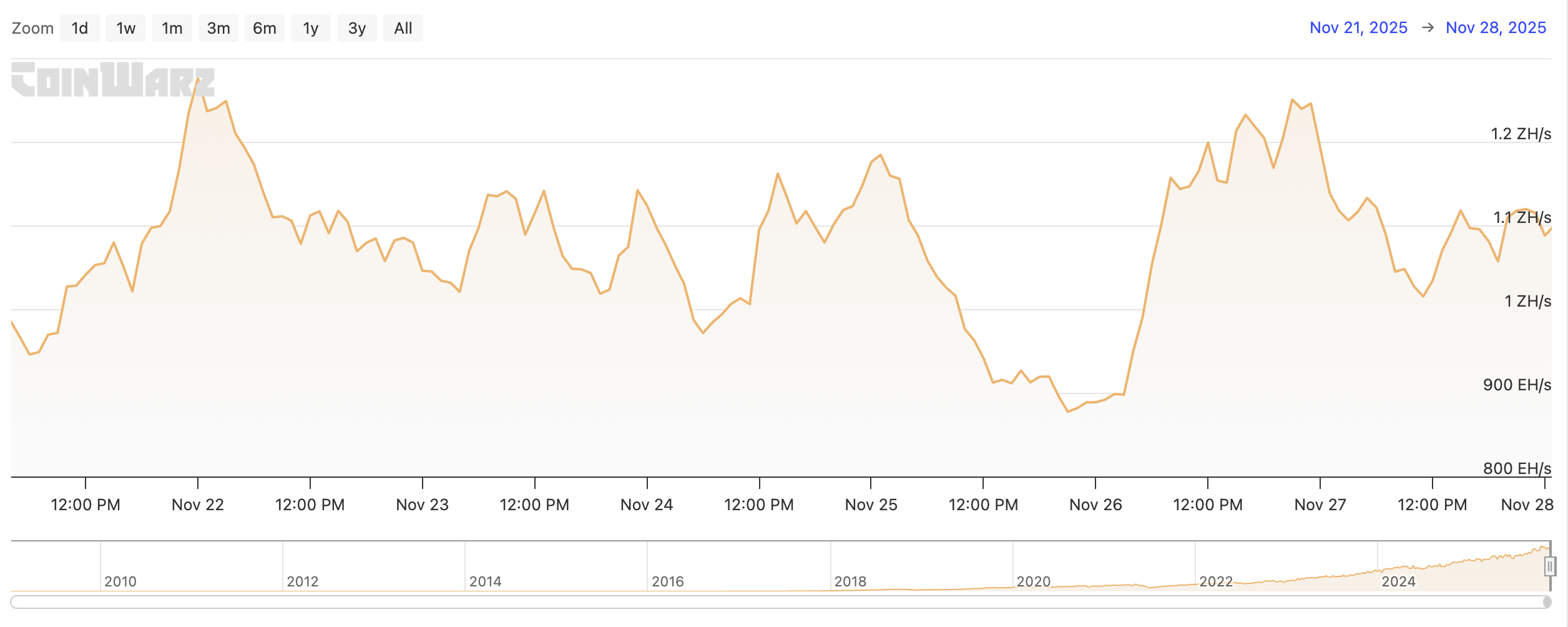

Over the past seven days, the Bitcoin network hashrate has steadily increased, remaining at a relatively high level this week, ranging from 877.41 EH/s to 1275.60 EH/s.

From a trend perspective, the Bitcoin network hashrate has consistently remained at a high level around 1 ZH/s, maintaining a strong overall structure. Although short-term fluctuations have been frequent, they have all been high-level oscillations without a clear downward trend, indicating that the hashrate base remains solid. This week's main changes were still clearly correlated with Bitcoin prices. When BTC experienced a phase of correction around November 25th, the hashrate simultaneously saw a sharp drop, reaching a low of approximately 877 EH/s. Subsequently, as prices quickly recovered, the hashrate also rebounded rapidly, approaching a phase high of 1.15 ZH/s on November 27th-28th, demonstrating the mining industry's rapid hashrate recovery and resilience in a high-cost environment.

Weekly Bitcoin network hashrate data

As of November 28, the total network hashrate reached 1.09 ZH/s, and the mining difficulty was 149.30T. The next difficulty adjustment is expected to take place on December 10, with an estimated decrease of 0.24%, bringing the difficulty to approximately 148.94T.

Bitcoin mining difficulty data

Bitcoin Hash Price Index

From the perspective of daily revenue per unit of computing power (Hashprice), Hashrate Index data shows that as of November 28, 2025, Hashprice was $38.56/PH/s/day. This week, Hashprice largely mirrored the price movement of Bitcoin, exhibiting a pattern of pullback followed by a sharp rise to higher levels.

- November 27: This week's high was $38.85/PH/s/day

- November 21: This week's low was $34.20/PH/s/day

Hashprice's core drivers remain Bitcoin price and on-chain transaction demand. Recent BTC price corrections coupled with a cooling of on-chain activity have repeatedly hampered miners' profit rebounds. Meanwhile, the continuous rise in network hashrate has further compressed the profit margin per unit of hashrate. However, the rapid surge over the weekend was significantly stronger than the week's levels, indicating a degree of resilience amidst high-level fluctuations.

Based on the latest industry data, the mining economy is entering a more intense phase. The payback period for mining rigs has lengthened to over 1,200 days, and financing costs continue to rise, forcing mining companies to accelerate their transformation towards AI and high-performance computing (HPC). However, current revenue from these areas is insufficient to offset the decline in mining profits. Despite the pressure on the mining side, capital market sentiment has improved in stages. Overall, miners' profits will remain under pressure in the short term, and the mining ecosystem is gradually entering a phase that emphasizes efficiency improvements, cost control, and business diversification. However, against the backdrop of record-high computing power and renewed institutional attention, the industry still demonstrates a certain degree of resilience and structural growth opportunities.

Hashprice data

4. Policy and Regulatory News

Trinidad and Tobago passes crypto regulatory bill in preparation for FATF assessment

On November 24, Crowdfund Insider reported that the Trinidad and Tobago Parliament passed the Virtual Assets and Virtual Asset Service Providers Act by a vote of 25 to 11, establishing a regulatory framework for cryptocurrency activities in the Caribbean nation.

The bill aims to meet the anti-money laundering and counter-terrorist financing standards of the Financial Action Task Force (FATF) in the Caribbean in preparation for a planned FATF on-site assessment in March 2026. The bill's passage was marred by controversy, with the opposition accusing the government of violating parliamentary procedure by submitting a 48-page document containing over 200 amendments just minutes before the debate began.

Critics worry the bill is too strict and could stifle innovation, but the government insists the amendments are based on extensive consultations with the central bank, securities regulators and industry participants.

Bank of England proposes to relax stablecoin rules

On November 25, the Bank of England proposed new rules: stablecoin issuers will be allowed to invest up to 60% of their reserve assets in short-term government bonds, instead of keeping 100% at the central bank as previously proposed.

This represents a significant softening of its regulatory stance, intended to support the stablecoin regulatory mechanism scheduled to launch in 2026.

At the same time, the Bank of England is considering providing liquidity support to issuers of systemic stablecoins when market stress is high.

Related pictures

Global banking rules on crypto assets need to be reviewed – Basel Committee Chairman proposes.

On November 26, Erik Thedéen, chairman of the Basel Committee on Banking Supervision, said that the current capital requirements for banks holding crypto assets (such as stablecoins and Bitcoin) are too stringent and need to be reassessed.

He pointed out that as the stablecoin market grows rapidly (currently worth hundreds of billions of dollars), its risks need to be addressed in a “different way.”

If the current rules are strictly enforced, they will discourage banks from participating in crypto asset business and may hinder the integration of crypto assets such as stablecoins with the traditional financial system.

The Central Bank of the UAE is incorporating crypto and blockchain technology into its traditional financial regulatory framework.

On November 27, the UAE passed a new federal financial decree, bringing services including cryptocurrency and blockchain activities under the central bank's regulation. This means that all crypto/blockchain-related services will be subject to the same regulation as traditional financial institutions.

As a major financial center in the Middle East, this step by the UAE represents a shift from the "grey area" to a "formal and regulated financial system," which will promote the legalization of crypto assets and institutional participation globally.

Related pictures

5. Bitcoin-related news

Collection and compilation of information related to "Global Corporate and National Bitcoin Holdings (This Week's Statistics)"

1. Bitwise CEO: Has increased Bitcoin holdings again at the $85,000 price level.

On November 24, Bitwise CEO Hunter Horsley posted on the X platform that he "couldn't resist" buying more Bitcoin at the $85,000 price point and felt great. He had previously disclosed on Monday that he had purchased Bitcoin at the $89,000 price point.

2. El Salvador has increased its holdings by 1,098.19 BTC in the past 7 days, bringing its total holdings to 7,478.37 BTC.

On November 24, it was reported that El Salvador added 1,098.19 Bitcoins in the past 7 days, bringing its total Bitcoin holdings to 7,478.37, with a total value of $632 million.

3. OranjeBTC increased its holdings by 7.3 BTC, bringing its total holdings to 3720.3 BTC.

On November 25, Brazilian listed company OranjeBTC announced that it had increased its holdings by 7.3 BTC at an average price of approximately $95,000, bringing its total holdings to 3,720.3 BTC. The company's Bitcoin return year-to-date is 2.2%.

4. Japanese listed company Value Creation increased its holdings by 7.057 Bitcoins.

On November 25, Value Creation Co. Ltd. (Tokyo Stock Exchange code: 9238.T), a Japanese listed company, announced that it used surplus funds to purchase 7,057 bitcoins, with a total value of approximately 100 million yen (approximately US$670,000), at an average purchase price of 14.17 million yen per bitcoin.

5. Texas Crypto Reserve takes a key step by allocating $5 million to BlackRock Bitcoin Spot ETF.

On November 26, Coindesk reported that Texas has taken a key step in building a state-level crypto reserve. Officials revealed that the state has invested $5 million in BlackRock's Bitcoin ETF, although the Texas Strategic Bitcoin Reserve plan is still in the planning stages.

Texas recently solicited industry input on a compliance plan for establishing a Bitcoin reserve and earlier this year passed legislation allocating $10 million. After completing the final steps, Texas is poised to become the first U.S. state to seriously launch a long-term cryptocurrency investment program. A spokesperson for the state auditor general confirmed on Tuesday that $5 million has been allocated to the BlackRock iShares Bitcoin Trust as a transitional measure before establishing a custody agreement.

6. DDC Enterprise increased its holdings by 100 BTC, bringing its total holdings to 1183 BTC.

On November 27, according to BusinessWire, digital asset management company DDC Enterprise Limited announced that it has increased its holdings by 100 BTC at an average price of $106,952, bringing its total Bitcoin holdings to 1,183. Its Bitcoin return rate for the first half of this year is 122%.

7. South Korean listed company Bitplanet launches daily Bitcoin accumulation plan.

On November 27, according to Decrypt, South Korean listed company Bitplanet has launched its first daily Bitcoin accumulation program as part of a broader effort to build a substantial reserve of funds using the world's largest cryptocurrency. In addition, the company purchased 93 Bitcoins last week.

8. Japanese company ANAP increased its holdings by 20 BTC, bringing its total holdings to 1,145.6951 BTC.

On November 28, Japanese fashion company ANAP announced an investment of $2.08 million to acquire 20.4422 bitcoins at a price of $101,906.6 per bitcoin, bringing its total holdings to 1,145.6951 bitcoins.

9. Hong Kong-based Prenetics increased its holdings by 7 BTC, bringing its total holdings to 501 BTC.

On November 28, it was reported that Prenetics, a Hong Kong-based genetic testing and health technology company, invested $620,000 last week to purchase 7 bitcoins, bringing its total holdings to 501,0341 bitcoins.

10. Japanese company Convano increased its holdings by 97 BTC, bringing its total holdings to 762 BTC.

On November 28, Convano, a Japanese nail salon operator and franchise company, announced that it had invested $1.05 million to acquire 97.6775 bitcoins at a price of $107,888.2 per bitcoin, bringing its total holdings to 762.6776 bitcoins.

Michael Saylor's post "Will Not Give Up" hints at continued Bitcoin accumulation.

On November 24, Strategy founder Michael Saylor posted "I will not give in," possibly hinting at continuing to increase his Bitcoin holdings.

Previously, Saylor's "Hold on this week" poll ended: 77.8% did not sell.

Related pictures

An options trader bets that Bitcoin will break 100,000 before the end of the year, but does not expect it to reach a new high.

On November 25th, Coindesk reported that a trader opened "call vulture" options on Deribit with a notional value of 20,000 bitcoins ($1.76 billion). This net position allows the trader to profit if Bitcoin's price closes between $106,000 and $112,000 by the end of the year. This implies the trader expects Bitcoin's price to continue rebounding before the end of the year, breaking the $100,000 mark, but not setting a new high.

The report states that Bitcoin has rebounded from a low of nearly $80,000 last week to approximately $88,000. This rebound is primarily driven by renewed market expectations of a 25 basis point rate cut by the Federal Reserve in December.

Bitcoin is considered one of the most noteworthy "blue-chip crypto assets" with an excellent risk/reward ratio.

On November 26th, according to cryptonews, among the cryptocurrencies currently worth buying, Bitcoin and Ethereum are relatively mature choices, while higher-risk options include Solana and Binance Coin. For investors seeking investments in practical applications or artificial intelligence, Bittensor and Hyperliquid stand out because they connect blockchain with real-world applications and high transaction volumes.

Strong positive factors are expected in the fourth quarter of 2025: Bitcoin's historical average gain in the fourth quarter is 79%, and over $18 billion in funds will flow into US spot Bitcoin and Ethereum ETFs. By 2029, the market capitalization of tokenized real-world assets could reach approximately $5.25 trillion.

Analysts: The Bitcoin sell-off is nearing saturation, and now may be a relatively strong buying opportunity.

On November 27th, according to The Block, Vetle Lunde, Head of Research at K33, stated in a new report that Bitcoin underperformed the Nasdaq index on 70% of trading days over the past month, and is currently 30% weaker relative to the index than it was on October 8th. The recent Bitcoin sell-off is nearing saturation, evidenced by panic selling signals in the spot market and ETP trading streams.

Bitcoin's severe underperformance relative to stocks and its significant disconnect from fundamentals present a strong long-term relative buying opportunity.

Analysts predict Bitcoin's median price could reach $201,000 after the halving.

On November 28th, according to BraveNewCoin, multiple crypto/financial analysts have compiled their views, suggesting that the median price of Bitcoin could reach $201,000 after this halving cycle, reflecting the market's optimistic expectations for its long-term future trend. Why are halvings so important: a historic boost, and the subsequent headwinds. Historical returns after halvings: Bitcoin halvings—that is, reducing the new supply of Bitcoin for miners—have historically often foreshadowed significant price increases. For example, after the 2012 Bitcoin halving, driven by widespread adoption and media attention, Bitcoin surged over 8,000% in a year. The 2016 halving led to a slow price increase, but ultimately peaked during the 2017 bull market cycle, with the price rising approximately 30 times from the halving date to its peak. After the 2020 Bitcoin halving, driven by favorable macroeconomic conditions and stimulus policies, Bitcoin rose approximately 567% in the first year. Supply-side constraints, coupled with demand, can generate excess returns.

Related pictures

Bitcoin (BTC) Price Forecast: After breaking below the support level, Bitcoin's target price is $1.2 million; the Fed's interest rate cut is expected to drive the price up.

On November 28th, according to BraveNewCoin, X technical analysis shows that Bitcoin broke through $117,000 after two retracements to $116,000. This bullish signal aligns with a 2023 study published in the *Journal of Risk and Financial Management*, which found that such retracements typically foreshadow further gains. This breakout has fueled market optimism, with traders now eyeing $120,000 as the next short-term target.

Bitcoin whale/big spender wallets have recently accumulated BTC again.

On November 28, on-chain data/market analysis indicated that institutions and large investors began to "restock" after the last correction, suggesting that they may believe the current price presents a buying opportunity.