BitMart Weekly Market Report 11.17–11.23

- 核心观点:加密市场因技术性去杠杆大幅回调。

- 关键要素:

- 两日爆仓28亿美元,杠杆清洗。

- 市场蒸发近万亿,资金转稳定币。

- 基本面稳健,但波动加剧。

- 市场影响:短期高波动,长期逻辑未变。

- 时效性标注:短期影响。

Crypto Market Updates This Week

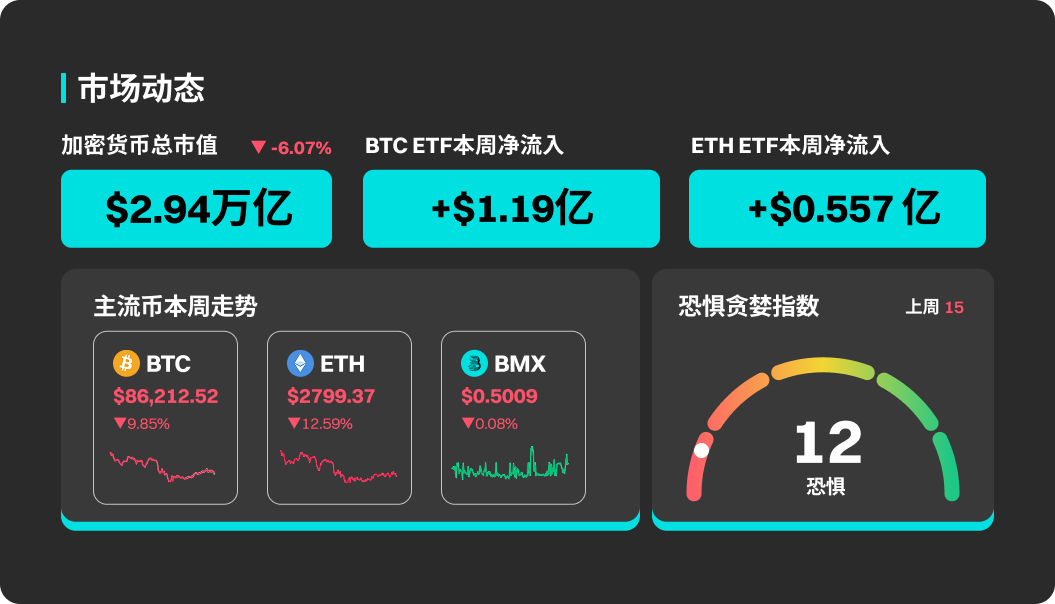

The crypto market continued its decline, with sentiment weakening further. Following last month's leverage-driven correction, this week saw another large-scale deleveraging, with liquidations reaching $1.2 billion and $1.6 billion respectively over two consecutive days. BTC fell 6.4%, while ETH, SOL, and major altcoins turned negative for the year, with high-beta assets experiencing particularly significant declines, indicating continued capital outflows from risk assets. The market lost nearly $1 trillion in market capitalization, but the correction was primarily driven by technical deleveraging rather than a deterioration in fundamentals. The industry fundamentals remain robust: adoption rates are at record highs, regulatory support continues, and technological innovation is accelerating. However, extremely high leverage amplified volatility, making the market more sensitive to macroeconomic and news events. This wave of liquidations pushed BTC down from approximately $126,000 to around $100,000, triggering systemic risk aversion in the market. Stablecoin data shows that although leveraged positions were cleared, funds remained within the crypto ecosystem and did not flow out in large quantities, instead shifting to stablecoins. The long-term logic remains unchanged, but the market will maintain high volatility in both directions during the short-term leverage reset.

Popular cryptocurrencies this week

Among popular cryptocurrencies, SPX, WLFI, BCH, MYX, and XDC all performed well. SPX's price rose 24.86% this week. WLFI's price rose 14.46%. BCH's price rose 11.90%. MYX and XDC rose 9.97% and 7.87% respectively this week.

US Market Overview and Hot News

Amid significant market uncertainty, US risk assets were under pressure, with major stock indices generally declining. Although Nvidia's strong earnings boosted AI sentiment and Google's stock price hit a new high after the release of Gemini 3, the S&P 500 still closed slightly lower, reflecting that optimistic expectations for the technology sector were insufficient to offset macroeconomic pressures.

The US dollar index strengthened moderately, supported by rising US Treasury yields and safe-haven demand, while the US unemployment rate continued to rise to 4.4%, exacerbating concerns about a slowdown in economic momentum. Gold prices retreated slightly after several weeks of historic gains, while oil prices fluctuated narrowly amid a large increase in inventories and conflicting demand expectations. Japanese 10-year government bond yields weakened due to market concerns that new fiscal spending could further worsen Japan's fiscal outlook.

Market volatility has risen significantly, with both the VIX and MOVE indices surging, reflecting investors' tendency to increase hedging positions amid multiple uncertainties, including AI valuation controversies, hawkish signals from the Federal Reserve, and delayed releases of key economic data. Overall, short-term momentum in the US stock market is weakening, with funds shifting back to defensive positions and risk appetite cooling noticeably.

The European Union will ban the trading of the stablecoin A7A5, which is pegged to the Russian ruble, starting November 25. The EU announced its 19th round of sanctions against Russia, which includes A7A5, a stablecoin issued by A7 Corporation and pegged 1:1 to the Russian ruble.

Project unlock

Plasma (XPL) will unlock approximately 88.89 million tokens at 9 PM Beijing time on November 25th, representing 0.89% of the total supply and worth approximately $18.1 million.

WalletConnect Token (WCT) will unlock approximately 10.06 million tokens at 8:00 AM Beijing time on November 25th, representing 10.07% of the total supply and worth approximately $11.6 million.

Sahara AI (SAHARA) will unlock approximately 133 million tokens at 8:00 AM Beijing time on November 27th, representing 1.33% of the total supply and worth approximately $10.4 million.

Jupiter (JUP) will unlock approximately 53.47 million tokens at 12:00 PM Beijing time on November 28th, representing 0.76% of the total supply and worth approximately $12.5 million.

Hyperliquid will begin unlocking core contributor tokens on November 29 at 15:30 UTC+8, with approximately 9.92 million tokens, worth about $333 million, being unlocked via a cliff-like event.

Risk warning:

Using BitMart services is entirely at your own risk. All cryptocurrency investments (including returns) are inherently highly speculative and involve a significant risk of loss. Past, assumed, or simulated performance is not indicative of future results.

The value of cryptocurrencies may rise or fall, and there may be significant risks involved in buying, selling, holding, or trading cryptocurrencies. You should carefully consider whether trading or holding cryptocurrencies is right for you, based on your individual investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.