Bitmain's "Revenge": How Expelled Miners Stifled America's Energy Supply for AI

- 核心观点:中国矿企为美国AI提供电力基础设施。

- 关键要素:

- 美国AI缺电44吉瓦,等待期48个月。

- 中国矿企掌握电力配额与高效基建能力。

- 矿企将挖矿电力转租AI公司,价值35亿美元。

- 市场影响:缓解美国AI电力危机,加速算力发展。

- 时效性标注:中期影响

Original title: The Other Side of American AI: Working for Chinese Bitcoin Miners

Original author: Lin Wanwan, Beating

In late 2025, Bitmain, a Chinese encryption equipment company, was added to the U.S. national security review list.

On November 21, the U.S. Department of Homeland Security launched Operation Red Sunset, citing national security concerns, to put Bitmain under scrutiny. The charges were pointedly aimed at investigating whether its equipment contained remote backdoors and whether it could deliver a fatal blow to the U.S. power grid in an extreme situation.

Why is a Chinese mining company being accused of potentially jeopardizing the U.S. power grid?

This reflects America's extreme anxiety about core resources. Because right now, Silicon Valley is witnessing the most expensive "silence" in technological history.

In AI data centers, tens of thousands of NVIDIA H100 GPUs lie quietly on the floor, gathering dust. These chips, which cost $30,000 each and are called "industrial gold" by Jensen Huang, should be running at full speed, giving life to GPT-5 or Sora, but at this moment—they have no power.

Humanity's most valuable asset is now being stifled by the most fundamental physical limitations.

The power shortage in the United States has reached an incomprehensible level. The deficit is 44 gigawatts, equivalent to the entire power capacity of a moderately developed country like Switzerland. And in this nation touted as one of the most technologically advanced, the average waiting time to power a newly built AI data center has stretched to over 48 months.

The U.S. power grid is like an old man in his twilight years.

Just when AI giants were desperately looking for a way to access their billions of dollars, they discovered that their lifeline had appeared in the place they looked down upon the most—Bitcoin mining farms.

Wall Street suddenly realized that what this group of people held in their hands was the most scarce asset in the AI era—a massive amount of electricity that had already been contracted with energy companies.

But they are realizing that this survival rule of "computing power equals electricity" had already been perfectly demonstrated by a group of Chinese engineers on the other side of the ocean a decade ago.

The first "power training ground" that is now being built for the US AI era was completed in China ten years ago, and then moved to the US three years ago due to a ban.

The rivalry between the two sides of the ocean, seemingly accidental, contains an underlying inevitability. Just as the tide of history cannot be reversed, each generation has its own destiny, and every footnote tells us: greatness cannot be planned.

American power inherits "Chinese legacy"

History always tends to write down the answer first, and then wait for the person who asked the question to appear.

In June 2024, Core Scientific, an American Bitcoin mining company, announced a shocking piece of news to Wall Street: they signed a $3.5 billion agreement with CoreWeave, which is known as Nvidia's "son," to lease the power infrastructure originally used for Bitcoin mining to the latter for training AI models.

These news items caused a sensation in Silicon Valley, dubbed the "marriage of computing power." But in China, across the ocean, for the miners and officials who personally experienced the "5.19" storm, these news items had a different flavor.

Because a large part of the infrastructure used by mining companies like Core Scientific, IREN, and Cipher to house Nvidia's H100 actually has Chinese roots.

To some extent, the first layer of "power defense fortifications" in the US AI era was an industrial legacy that fully absorbed the massive diversion of computing power from China.

The person who unintentionally drew the blueprint was named Zhan Ketuan.

Zhan Ketuan, a typical science and engineering man who graduated from the Institute of Microelectronics of the Chinese Academy of Sciences, should have originally been writing code, drawing circuit diagrams, and becoming a quiet technical expert in a science park.

Until 2013, Jihan Wu and Micree Zhan founded Bitmain.

It's said that Jihan Wu only spent two hours reading the Bitcoin white paper. He may not understand the future of currency, but he understood the essence behind the mathematics—it's an arithmetic game about hash collisions.

In 2016, Bitmain made a decision that shocked the industry: it placed a massive number of wafer orders with TSMC. The Antminer S9, equipped with TSMC's most advanced 16nm FinFET process, was born. This was not only a production capacity miracle in the history of chips, but also created an unprecedented "thermodynamic furnace".

In Jihan Wu's eyes, the S9 is a chip; but in the eyes of the State Grid Corporation of China, it is a purely industrial load.

Unlike factories that operate day and night, and unaffected by temperature fluctuations, it runs 24 hours a day with a smooth, linear power curve, indifferent to voltage and origin. From that moment on, a new system was born: electricity, from a public service, became a "B-end raw material" that could be priced, traded, and monetized instantly; electricity, an energy source that is difficult to store at low prices once generated, parasitized its value in strings of numbers in another form; Bitcoin mining began to become an industry: from hydropower in the mountains of Sichuan to wind power on the grasslands of Inner Mongolia, Bitcoin mining machines operated on every piece of land in China with surplus electricity.

Jihan Wu may not have realized at the time that the industrial standards he defined for Bitcoin mining machines inadvertently provided a perfect energy supply solution for the extremely hungry American AI a decade later.

In the most frenzied year of 2018, Bitmain alone swallowed up 74.5% of the global market share. But that's not the most terrifying part. The most terrifying part is that the remaining share was also entirely taken by Chinese companies. Whether it's Whatsminer, founded by Bitmain's former chief chip designer Yang Zuoxing, or Canaan Creative, the pioneer of ASICs, they are all Chinese companies.

This is not a global competition at all, but a "civil war among Chinese engineers" spanning 2,000 kilometers: from the Aobei Science and Technology Park in Haidian District, Beijing, to the Zhiyuan Science and Technology Park in Nanshan District, Shenzhen, the heart of 99% of the world's computing power beats with the pulse of China. An absolute closed loop completely locked by the Chinese supply chain, which Silicon Valley can only look up to.

Until May 2021, with a regulatory ban, the roaring sound that had lasted for several years along the Dadu River came to an abrupt end.

For the nation, this marks the end of an energy-intensive industry; but for the industry as a whole, it marks the beginning of an epic "technology migration." Thousands of containers are loaded onto cargo ships and sail across the ocean, carrying not only the latest generation of Antminer miners designed by Jihan Wu, but also a unique "energy survival philosophy" honed in China.

One of the destinations: Texas, USA.

This place boasts an independent ERCOT power grid and the freest and wildest electricity trading market in the United States. For these "computing refugees" from the East, this place is practically a giant version of "Sichuan + Inner Mongolia".

However, when this group of Chinese people actually landed, the American energy industry was surprised to find that they were not refugees at all, but a well-equipped "energy special forces".

Back in Sichuan, mine owners secured low-priced electricity by cultivating relationships with power plant managers through drinking lavish parties and signing tacit agreements based on personal connections. However, in Texas, this logic was quickly adapted into high-frequency trading algorithms.

Electricity prices in Texas fluctuate in real time, changing every 15 minutes, and in extreme cases can spike from 2 cents to $9. Traditional Silicon Valley data centers (such as Google and Meta) avoid such fluctuations like the plague, accustomed to living like greenhouse flowers on fixed rates.

But what was the reaction of Zhan Ketuan's "disciples"? They were excited.

They transformed their experience of manually controlling power on and off in China into an automated demand response program. When electricity prices are negative (as is the case in Texas, where there is too much wind power), they operate at full power, frantically consuming electron flow, to the point that the grid even has to pay them to use the electricity; when heat waves hit and electricity prices soar, they can cut off hundreds of megawatts of load within seconds, "selling" the electricity back to the grid and earning a much higher price difference than mining.

This "energy arbitrage" tactic has left even veteran American power traders dumbfounded. The reason why American mining giants like Riot Platforms and Marathon are thriving and able to move into AI data centers is precisely because of this power algorithm brought from China.

Another major legacy of the Zhan Ketuan era is the extreme pursuit of speed in physical infrastructure construction.

Traditionally, the construction cycle for US data centers is 2-3 years, a period of meticulous work by elite engineers. But the mining industry doesn't operate on that model; their logic is that every second of downtime is a crime against profits.

Thus, in the Texas wilderness, a "Chinese speed" emerged that left local builders speechless: no exquisite glass curtain walls, no complex central air conditioning, only huge industrial fans roaring. This "modular, containerized, minimalist heat dissipation" infrastructure solution compressed the construction cycle to 3-6 months.

This rugged yet extremely efficient engineering capability was initially ridiculed in Silicon Valley as an "electronic junkyard," but it has now become highly sought after—because the explosion of AI computing power is too rapid, OpenAI and others cannot wait 3 years, they need this "plug-and-play" infrastructure capability now.

It's clear that in Silicon Valley, you can buy a graphics card if you have money, but you can't buy time.

These "times" are the legacy of that frenzy ten years ago. Back then, in order to mine Bitcoin, Chinese miners and their successors frantically acquired land and built substations in the United States, accumulating "grid-connected capacity" that is now worth a fortune.

Electricity quotas are the new hard currency of American capital. The so-called "inheritance" is not inheriting that pile of silicon wafer scrap, but inheriting the right to connect to the power grid.

The reason why mining companies were able to secure orders worth hundreds of millions of dollars is that, amidst the nationwide power shortage in the United States, they have the key to unlocking the AI era.

The Migration Night of "Hidden Champions"

These brutal pleasures will ultimately end in brutality.

2018 was a subtle watershed moment in business history. That year, Sam Altman, the founder of ChatGPT, was still struggling to keep his nonprofit organization afloat; Musk had just recovered from a near bankruptcy, and in their eyes, computing power was merely a docile server in a data center.

But across the ocean, Jihan Wu and his Bitmain have already transformed computing power into an industrial behemoth. They may not understand the future of AI, but that doesn't stop them from holding the key to that future: how to tame those greedy silicon chips, measured in gigawatts.

This is a story about a self-made hero, national will, and a historical irony. For seven years, China tacitly allowed and nurtured a behemoth that devoured electricity in the torrents and coal seas of the west; then, on a summer night in 2021, for the sake of greater financial security and dual-carbon goals, it uprooted it with its own hands.

To understand why the US is now so willing to bow down to mining companies and accept the electricity boom brought about by AI, one must understand the "energy training exercise" that took place on the banks of the Dadu River in Sichuan, China, ten years ago.

Let's rewind to August 2019.

That was Bitmain's most glorious period, and also a brief window of opportunity for China's mining industry to "turn from gray to white." At that time, in order to solve the long-standing problem of "water wastage during the high-water season" (i.e., water generated for electricity could not be transmitted and could only be released), the Sichuan Provincial Government introduced a policy called "Hydropower Consumption Demonstration Zone".

These are genuine official documents with red headers that exist in places like Ganzi and Aba in Sichuan.

According to a Caixin report at the time, under this policy, Jihan Wu's mining machines were no longer "illegal" machines hiding deep in the mountains, but became honored guests helping the local power grid to "shave peaks and fill valleys".

At the time, Bitmain effectively acted as a "supercapacitor" for China's western energy network. Jihan Wu was proud not only of the 7nm chips, but also of this ability to instantly convert excess electricity into digital assets.

At that time, China controlled 75% of the world's Bitcoin computing power. From Wall Street to the City of London, everyone who wanted to participate in this game had to be mindful of Jihan Wu's wishes and rely on the power supply from Sichuan and Xinjiang in China.

However, behind this "gray prosperity" always hang two swords of Damocles.

The first issue is "financial security." Regulators have long recognized that this is not just about technological innovation, but also about a massive financial channel operating outside of foreign exchange controls.

The second measure is "dual control of energy consumption." With the introduction of the "3060 dual carbon" target in 2020, the flow of every kilowatt-hour of electricity has become a political calculation. Mining, an industry that is "high in energy consumption, low in employment, and has no real output," is destined to be sacrificed on the scales of macro strategy.

The turning point in history was precisely set on May 21, 2021.

That evening, the State Council Financial Stability and Development Committee held its 51st meeting. The meeting's press release contained a very short but weighty sentence: "Crack down on Bitcoin mining and trading activities."

This is no longer a "risk warning" or "development restriction" as in the past, but the highest level of "zeroing out".

The following month was the most dramatic 30 days in the history of China's computing power industry. Inner Mongolia was the first to respond, directly cutting off power to coal-fired mining farms; Xinjiang followed closely behind, conducting a comprehensive investigation.

The climax occurred late at night on June 19, 2021.

On this day, the Sichuan Provincial Development and Reform Commission and the Energy Bureau issued a notice requiring the cleanup and shutdown of virtual currency "mining" projects. This is the infamous "Sichuan Shutdown Night" within the industry.

The actual video of that night still circulates online: In a super mine in Aba Prefecture, as the clock struck midnight, the on-duty personnel, with tears in their eyes, pulled down the switches of the high-voltage distribution cabinets row by row. The roar of the cooling fans, which had lasted for years and sounded like an airplane taking off, disappeared in an instant.

The indicator lights on millions of mining machines went out simultaneously. The world suddenly became eerily quiet, with only the ceaseless rushing of the Dadu River remaining.

At that moment, the global Bitcoin network's hashrate plummeted by nearly 50%. China, with the decisiveness of a warrior cutting off his own arm, forcibly separated this industry, which consumes hundreds of billions of kilowatt-hours of electricity annually, from the lifeblood of the State Grid.

We successfully defended the financial front and freed up precious energy resources. But in the gaps of this grand narrative, an unexpected foreshadowing was planted: we left electricity behind, but drove out the group of people who "knew best how to use electricity."

However, the machines that had their power cut off did not disappear; they began to wander.

In the second half of 2021, Shenzhen's Yantian Port experienced unprecedented congestion. According to freight forwarding companies at the time, tens of thousands of containers were piled up, all filled with S19 mining machines dismantled from Sichuan and Xinjiang.

This is a computing power version of the "Dunkirk evacuation".

The story returns to its beginning.

In 2024, when ChatGPT took the world by storm, AI giants suddenly discovered that there was a shortage of power, substations, and high-power data centers that could be deployed quickly.

While China eliminated outdated production capacity, it also shared its capabilities in "how to build and operate ultra-large-scale, high-energy-consuming computing centers" with the world.

This was a strategic choice concerning national financial sovereignty, a resolute abandonment of this high-risk digital high ground. From a macro-prudential perspective, it was an absolutely correct and necessary strategic action at the time. However, the irony and paradox of history lies in the fact that the enormous bubbles and excess computing power that were actively squeezed out and expelled ultimately solidified on the other side of the ocean, becoming the most unbreakable cornerstone of the rival's power grid and energy system.

However, if one believes that the final outcome of this massive migration of computing power is simply "the East loses and the West gains," then one is only seeing the chips on the table and not the table itself.

The AI arms race, in essence, is a relentless consumption of energy by computing clusters, ultimately turning into a war over electricity costs. In this war of attrition, no country possesses greater strategic depth than China.

The United States needs miners as a "flexible load" to patch up and extend the life of the power grid, treating them as a catalyst to cure the "old age disease" of the power grid.

But China is different, possessing the State Grid Corporation of China as its central brain. Utilizing ultra-high voltage (UHV) transmission, the cheapest clean energy from the west is continuously and with low loss, like blood being transfused into an artery, to the data center clusters in the east.

However, swept along by the tides of history, Bitmain, the epitome of power management in China's computing power era, inadvertently became a strategic force reshaping the global energy landscape. They unwittingly offered the skills honed on the banks of the Dadu River to the other side of the ocean, building the first power fence for the coming AI era in the United States.

The fate of mining companies "recruited"

So, have these "former Bitcoin miners" who were recruited truly risen to the top in one fell swoop and are now sitting at the table of the AI era?

The answer may lie in the calculations of these giants. Have you ever wondered why Microsoft and Google, with their billions in cash flow, would actually hand over their lifeline of electricity to mining companies? Is it simply because building their own infrastructure would take too long?

Of course not. The fundamental reason is that they are more wary of the lessons of history than anyone else.

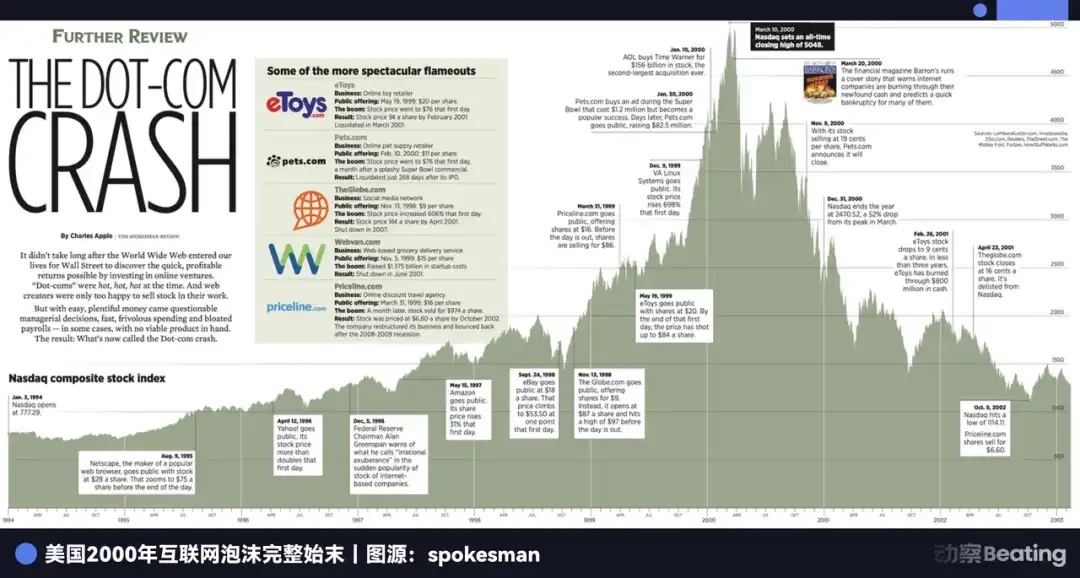

Looking back at business history, on the mahogany desks of Silicon Valley tycoons, there is actually an invisible tombstone, engraved with a name that once resounded throughout the world: Global Crossing.

This is the infrastructure giant that suffered the most during the dot-com bubble of 2000. At the time, American elites firmly believed that the whole world would enter the internet age within a few years, and people would need increasingly faster internet speeds. In this religious fervor, founder Gary Winnick borrowed tens of billions of dollars in just a few years, laying hundreds of thousands of kilometers of fiber optic cables in the deep sea like a madman, connecting the Americas, Europe, and Asia.

When the dot-com bubble burst, .COM websites simply shut down their servers and laid off employees to complete their bankruptcy liquidation. Infrastructure providers, however, faced a massive asset burden: those fiber optic cables buried at the bottom of the Pacific Ocean, capable of transmitting trillions of bytes per second, suddenly became the most terrifying "dead assets" in the eyes of shareholders—unsellable, unmovable, lying quietly on the dark seabed, slowly rotting on the balance sheet.

In 2002, Global Crossing collapsed with a debt of $12.4 billion. The most ironic ending was that Li Ka-shing's Hutchison Whampoa later tried to acquire these assets for less than 1% of their value, like picking up scrap metal.

Global Crossing proved a cruel truth with its own failure: in the early stages of technological change, whoever shoulders the burden of irreversible heavy assets becomes the first scapegoat when the cycle declines. They thought they held the data arteries of the future world in their hands, but ended up making themselves a sacrifice for infrastructure.

Today, Microsoft CEO Satya Nadella and Google CEO Sundar Pichai surely remember this tombstone more than anyone else.

Therefore, when you look at their financial reports for the past two years, you will find that their core risk control strategy can be summarized in just four words: asset isolation.

AI giants are seeing their capital expenditures skyrocket, but every penny is carefully calculated: on one hand, there are GPUs and custom servers, relatively "general-purpose" assets that are quick to adapt to and can be sold at a discount if things go wrong; on the other hand, there are data center buildings, cables, and cooling systems, which are typical "specialized heavy assets," and they try to get rid of these most difficult-to-exit assets as much as possible.

Their real plan is this: they want to share that "pitfall" with others.

Major AI companies are trying to use long-term computing power contracts, electricity contracts, and park leases to create a chain that "looks like OpEx operating expenses, but actually shifts the risk of CapEx to others."

For the miners who were recruited and the infrastructure players eager to transform, the giants' pitch was tempting: "You're responsible for investing money to build the factory, you're responsible for handling the liquid cooling upgrade, and I'll be responsible for securing electricity contracts. As long as AI becomes a major industry trend, you collect rent according to the contract, and I'll take the business growth and stock price returns."

It sounds like a risk-sharing arrangement, but upon closer inspection, it's more like the popular saying: "Better to die for your fellow Daoists than for me."

But what if AI ultimately proves to be just another Global Crossing-style illusion?

The giants can simply pay a penalty and record an asset impairment, then gracefully exit the market and move on to the next story. But the ones who truly face the banks' demand letters and have to explain to creditors how to dispose of those factories specifically designed for high power density that can only accommodate H100 pipes—these are the infrastructure companies that thought they had finally "gotten on the table."

Going a step further, some might ask: what if the AI bubble bursts, can't mining companies just unplug the GPUs and plug them back into the mining machines to continue mining?

More realistically, most "AI-enabled" mining farms don't simply switch hardware: AI server rooms use GPUs and liquid cooling, while Bitcoin requires ASIC containers with extremely low costs—the two systems are almost incompatible. The capital market has already given you a premium as an "AI infrastructure stock," and announcing a return to mining is like throwing the valuation anchor back from AI to "high-energy-consuming miners." The factory is still there, but the story and market value are liquidated first.

So history doesn't repeat itself, but it always rhymes. Back then, fiber optic cables were buried underwater; today, server rooms stand in the wilderness. The people who foot the bill have changed, but their roles remain the same.

Greatness cannot be planned.

In the current AI competition between China and the US, computing power and electricity are two key factors that determine the outcome.

While the United States lost out to China in terms of the speed of its ultra-high-voltage power grid construction, it unexpectedly gained a huge "shadow inventory." When Silicon Valley's data center construction was hampered by environmental regulations and supply chain constraints, these mining farms could immediately step in, providing power for GPT-5 and GPT-6 training.

The allure of the business world lies in its unpredictability. All strategic planning is essentially about seeing the road through a rearview mirror.

This was a strategic aid effort that no one anticipated. It wasn't planned by White House policymakers, nor was it devised by the Pentagon; rather, it was inadvertently constructed by a group of wandering Chinese engineers and a group of profit-seeking speculators amidst the chaotic market competition.

The world is always full of "precise mistakes" and "vague correctness." This may be a parable left by business history: greatness can never be planned.