How to achieve a 1000% annualized return using DLMM in a volatile market?

- 核心观点:DLMM做市策略实现高收益。

- 关键要素:

- 27天盈利675 SOL,胜率100%。

- 选择SOL交易对,宽价格区间做市。

- 严选高市值、有收入代币。

- 市场影响:提供熊市稳健收益新思路。

- 时效性标注:中期影响

This article is from Tuuxx

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

Editor's Note: The cryptocurrency world has never lacked experts. Even during the tumultuous market conditions of the past month, some people were still able to achieve considerable profits through "unconventional" strategies.

On the evening of November 19, Tuuxx, an overseas KOL focusing on the DeFi market, disclosed his market-making strategy and practical details on Meteora DLMM. Tuuxx revealed that he made a profit of 675 SOL during this period, with a 100% win rate, corresponding to an annualized return of nearly 1,000%.

The following is the full text of Tuuxx's article, translated by Odaily.

The market environment has changed dramatically in recent weeks, so I have adjusted my Meteora DLMM strategy accordingly.

I only share strategies after testing them in a real environment. Below are the results after nearly a month (27 days) of execution:

- 100% win rate;

- Profit of 675 SOL;

- The period return was 19.35%;

- If this pace is maintained, the theoretical annualized return will be close to 1000%.

Let me start by sharing my personal insights based on real results—this is not financial advice—but I hope it can help you refine your own strategies.

Underlying asset selection

My core view remains unchanged: I am firmly optimistic about the Solana ecosystem, and my goal is to accumulate as much SOL as possible in the long term. Therefore, I only provide liquidity to SOL trading pairs, not stablecoins.

If you need more reasons:

- Most tokens will form trading pairs with SOL, rather than stablecoins , and using SOL trading pairs can naturally increase transaction fee opportunities;

- During market crashes, SOL trading pairs are generally less risky than stablecoin trading pairs – if the market collapses, various tokens and SOL may fall in tandem, thus reducing the probability of falling completely below the liquidity range – while pairing with stablecoins may expose you to more severe asymmetric volatility.

- Based on current yields, the dollar value of my DLMM market-making position will continue to grow even during a bear market—and this potential for appreciation will be even more significant if SOL returns to its historical highs.

Liquidity curve

I would choose a relatively wide trading range, rather than a narrow range or a position similar to spot trading. This approach offers the following advantages:

- Stronger capital protection;

- Less impermanent loss;

- Maintaining long-term resilience amidst volatility;

This may not seem exciting, but I prefer steady accumulation rather than treating liquidity strategies as gambling.

Market making token selection

Given the current market environment, my screening criteria have become more stringent, and I am now only focusing on tokens that meet all of the following conditions:

Protocols that can generate revenue (non-speculative Meme tokens);

- A strong and active community;

- Its market capitalization exceeds $50 million;

- Strong daily trading volume (over $5 million);

- A sufficiently attractive "fee/TVL" ratio;

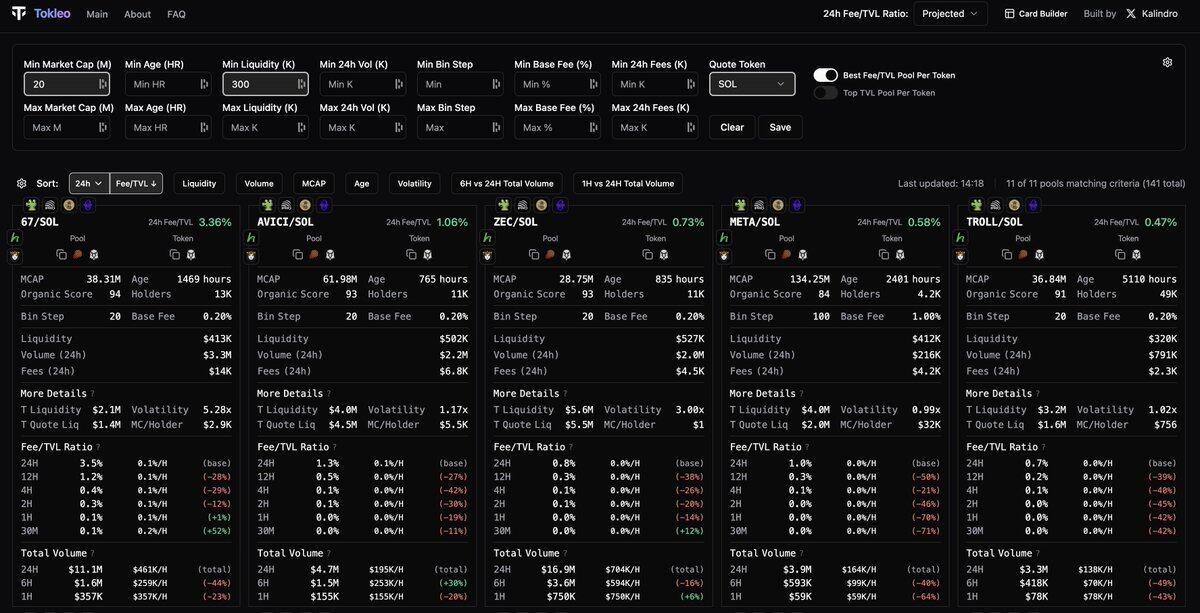

You can use Jupiter and Tokeo to track the above metrics: https://jup.ag/pro?tab=toptraded

Very few tokens meet all the requirements, which actually helps avoid frequent portfolio rebalancing. Over the past few weeks, I have focused on the following four trading pairs: MET/SOL, ZEC/SOL, ORE/SOL, and AVICI/SOL.

Fund pool selection

I use Tokeo ( https://tokleo.com/ ) to find the best performing pools, usually choosing pools with a Bin Step (used to define the width of each price range) of 20 and a Base Fee (i.e., the base transaction fee rate) of 0.2%.

Fund allocation

I don't strictly follow any formula; I only allocate funds according to my investment beliefs—and I prefer to round to the nearest whole number. The current allocation is as follows:

- MET/SOL: 36%;

- ZEC/SOL: 24%;

- ORE/SOL: 24%;

- AVICI/SOL: 16%;

Market making price range

My goal is to protect my principal; I'm not here to chase short-term speculation. Patience is key to the effectiveness of this strategy .

Therefore, I will set a relatively wide price range and use the support range of the K-line trend to help make the judgment, accepting a maximum of 70% downside within the range.

The price ranges I'm currently using for each trading pair are as follows (based on current prices):

- MET/SOL: Lower limit approximately -25%;

- ZEC/SOL: Lower limit approximately -63%;

- ORE/SOL: Lower limit approximately -69%;

- AVICI/SOL: Lower limit approximately -70%;

While a wide trading range may take longer to generate substantial returns, it provides stability and is the only reliable, stress-free way to withstand major market shocks.

Warehouse Management

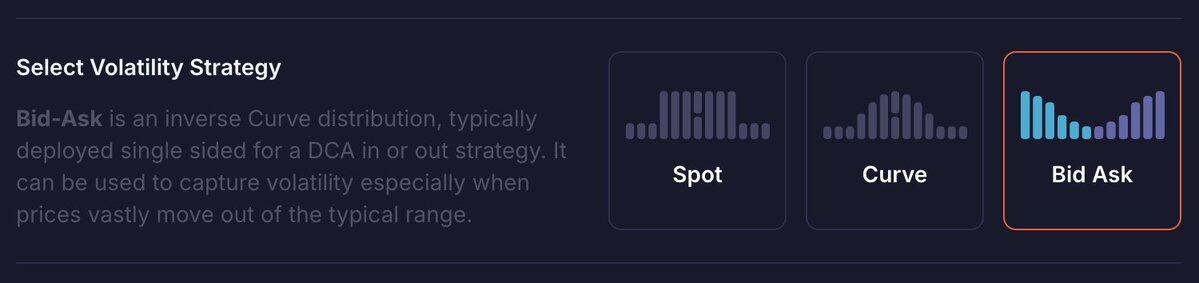

This is the part that has changed the most.

After a significant price fluctuation between the market-making token and SOL, I will:

- Withdraw all liquidity (SOL + market-making tokens), but do not close market-making positions.

- Redeploy within the same area:

- 100% of the SOL returns to the buy-sell (Bid-Ask) range;

- 50% of market-making tokens are returned to the bid-ask trading range;

- The remaining 50% of tokens are returned to the spot liquidity curve;

After a period of time, your position will likely look like this:

- Sell at high prices and buy at low prices;

- Earn more commission through volatility;

- Gradually accumulate more and more SOLs;

This compounding mechanism is key to long-term growth, even when starting with a wide range. I usually close a market-making position when the return reaches around 10-20%.

Practice Feedback

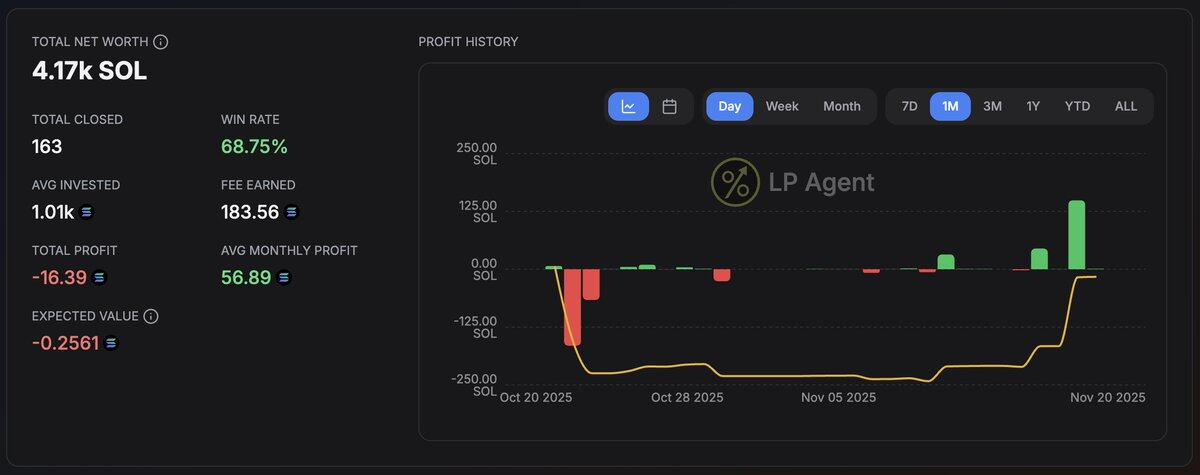

During the 27-day test of this strategy:

• I have never closed out a position due to a loss;

• We have never seen a price drop below the target price range;

I only check the pool of funds 2–3 times a day and rebalance only after significant price fluctuations (up or down) – I don’t overtrade and there’s little pressure.

Whether you are trading 10 SOLs or 10,000 SOLs, sustainability and the effect of compound interest are far more important than the initial size.

To reiterate, this is not financial advice, but simply sharing a method that aligns with my value-added goals and risk appetite.

Regarding strategy replication and address tracking

This strategy cannot be automated or replicated at present —I need to tell you this in advance so you don't waste your time or money.

Even portfolio tracking tools cannot accurately read position changes. For example, an LP Agent might show that I incurred losses on certain days—but that's simply because current tools cannot recognize such rebalancing operations.

Strategy guidance

I'm happy to directly respond to feedback and answer questions in the comments section (original post: https://x.com/Tuuxxdotsol/status/1991158752452489477 ). The most valuable aspect of sharing these strategies is exchanging ideas with peers who are also testing, optimizing, and learning in the real market.

In addition, due to recent inquiries from several members regarding how to deploy large DLMM portfolios in a customized manner, I will provide one-on-one guidance through LP Army (@met_lparmy: https://www.lparmy.com/coaching ).

This service is for those who want to build strategies in a professional way—not by providing signals or shortcuts, but by offering a clear framework based on real-world execution.

I hope your profits become increasingly stable. Good night.