Stablecoins are not stable: For the past five years, DeFi has only been creating more elaborate time bombs.

- 核心观点:DeFi高收益幻觉掩盖结构性风险。

- 关键要素:

- Stream Finance无抵押杠杆达7.6倍。

- 预言机操纵引发28.5亿美元连锁风险。

- 稳定币TVL单周暴跌40-50%。

- 市场影响:引发行业系统性信任危机。

- 时效性标注:中期影响

This article is from: @yq_acc

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Ethan ( @ethanzhang_web3)

Editor's Note: Every wave of DeFi prosperity shares a common illusion: as long as the returns are high enough, the mechanisms are novel enough, and the strategies are "complex" enough, the risks seem to automatically disappear. However, the series of collapses in November 2025 proved that complexity is never a guarantee of safety, and high returns are never a guarantee of capability. The collapse of xUSD, the deUSD going to zero, the oracle's failure again, and the indiscriminate exodus of on-chain assets—this series of events revealed the reality the industry least wanted to face: the so-called "decentralized stability" is mostly just a facade. This article uses this series of incidents as a starting point to try to bring back to the forefront the core logic that has been continuously ignored over the past five years.

The following is the original text, translated by Odaily Planet Daily. Enjoy!

The first two weeks of November 2025 exposed fundamental flaws in the DeFi space, flaws that academia had been warning about for years. First came the collapse of Stream Finance's xUSD, followed by the failures of Elixir's deUSD and numerous other synthetic stablecoins. These events were not simply due to mismanagement. They revealed structural problems within the DeFi ecosystem regarding risk management, transparency, and the construction of trust mechanisms.

In the Stream Finance collapse, what I observed was not a sophisticated exploitation of smart contract vulnerabilities in the traditional sense, nor an oracle manipulation attack. Instead, what was more worrying was a severe lack of transparency in underlying finance, disguised under the guise of "decentralization." When an external fund manager lost $93 million with virtually no effective oversight, triggering a $2.85 billion cross-protocol cascading risk; when the entire "stablecoin" ecosystem, even while maintaining its peg to its underlying assets, saw its TVL plummet by 40% to 50% within a week, we must acknowledge a fundamental fact about the current state of DeFi: the industry has not learned anything from past lessons.

More precisely, the current incentive mechanism suffers from a triple problem: it rewards those who ignore past lessons, punishes those who adopt conservative strategies, and forces the entire industry to share the losses when an inevitable crisis erupts. An old adage in finance is painfully proven here: " If you don't know where your returns come from, you are someone else's source of returns. " When certain agreements promise 18% returns with undisclosed strategies, while mature lending markets offer only 3% to 5%, the real source of these high returns is actually the depositors' principal.

Stream Finance's operating mechanism and risk transmission

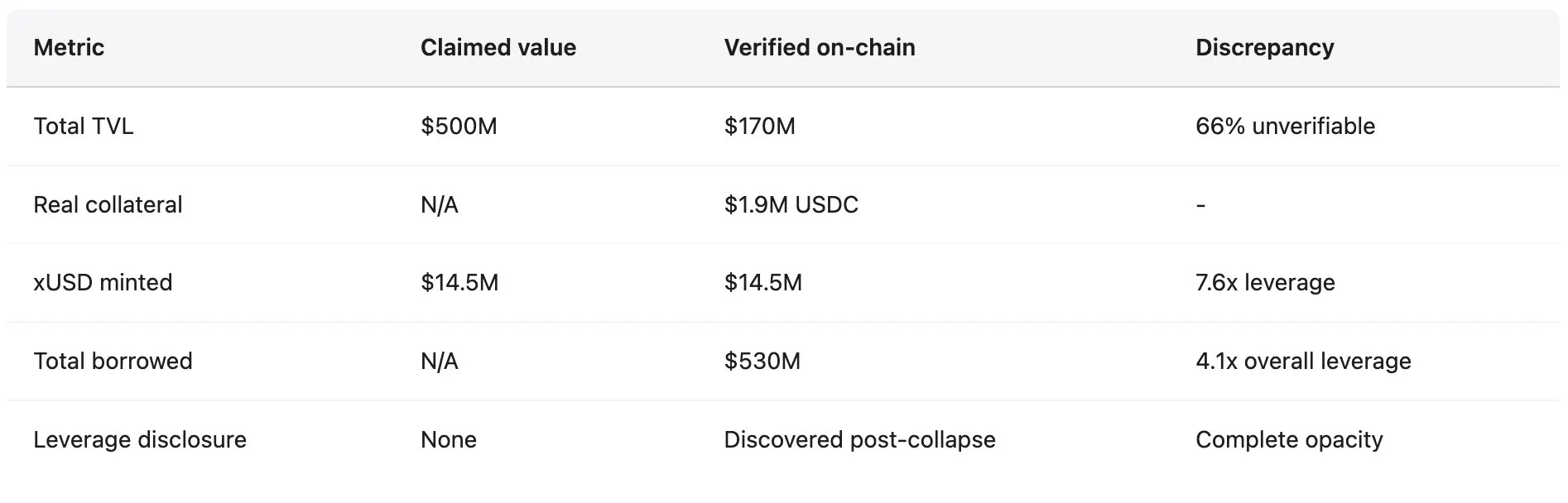

Stream Finance positioned itself as a yield-optimized protocol, offering an 18% APY for users' USDC deposits through its interest-bearing stablecoin, xUSD. The protocol claimed to employ strategies including "delta-neutral trading" and "hedged market making," terms that sounded complex and difficult to understand in practice. For comparison, established protocols like Aave offered a 4.8% APY for USDC deposits at the time, while Compound's yield was only slightly above 3%. Basic financial common sense dictates caution when faced with returns three times the market average, yet users still deposited hundreds of millions of dollars into the protocol. Before the collapse, 1 xUSD traded at 1.23 USDC, reflecting its claimed compound interest returns. xUSD claimed a peak asset management scale of $382 million, but DeFiLlama data shows its peak TVL was only $200 million, meaning that over 60% of the protocol's claimed assets were unverifiable off-chain holdings.

Schlagonia, a developer at Yearn Finance, revealed Stream's true operating mechanism after its collapse: it was essentially a systemic fraud disguised as financial engineering. Stream created uncollateralized synthetic assets through "revolving lending," the specific process of which is as follows:

- Users deposit USDC, and Stream converts these USDC into USDT via CowSwap;

- These USDT are used to mint deUSD on the Elixir protocol (Elixir was chosen precisely because of its high-yield incentives).

- The minted deUSD is crossed over to blockchain networks such as Avalanche and deposited into the lending market to lend out USDC, completing one cycle.

Up to this point, while the strategy involved complex cross-chain dependencies and had obvious risks, it still resembled a standard collateralized lending model. However, Stream did not stop there: instead of using the borrowed USDC merely to supplement collateral for more cycles, it reminted xUSD through its StreamVault contract, resulting in a xUSD supply far exceeding the actual collateral's capacity. At the time, Stream held only $1.9 million in verifiable USDC collateral but minted $14.5 million in xUSD, resulting in a synthetic asset size 7.6 times the underlying reserves. This is essentially a "partially reserved bank model without reserves," lacking both regulatory oversight and a lender of last resort (an institution providing liquidity support during crises).

The circular dependency between Stream and Elixir further exacerbated the system's instability. During the cycle of increasing the xUSD supply, Stream deposited $10 million worth of USDT into Elixir, leading to an increase in the deUSD supply. Elixir then exchanged these USDT for USDC and deposited them into Morpho's lending market. As of early November, the USDC supply on the Morpho platform exceeded $70 million, with over $65 million lent out. Elixir and Stream were the two dominant players on the platform. Stream held approximately 90% of the total deUSD supply (approximately $75 million), while Elixir's collateral primarily relied on Morpho loans to Stream. This "mutual collateralization" relationship between the two stablecoins destined them to collapse simultaneously. This "financial inbreeding" ultimately led to the fragility of the entire system.

Industry analyst CBB publicly pointed out these problems as early as October 28th, writing, "xUSD had approximately $170 million in on-chain collateral, but borrowed about $530 million from lending protocols, resulting in a leverage ratio of 4.1x, mostly in illiquid positions. This is not yield farming at all, but degen gambling." Schlagonia had warned Stream's team 172 days before the collapse, stating that "just five minutes of analyzing their holdings would show that a collapse was inevitable." These warnings were public, specific, and accurate, yet they were ignored by users chasing high returns, "curators" seeking fee income, and the protocols supporting the entire system. On November 4th, Stream announced that an external fund manager had lost approximately $93 million in fund assets, and the platform immediately suspended all withdrawals. Unable to redeem, market panic spread rapidly, and xUSD holders sold their tokens in the illiquid secondary market. Within just a few hours, the price of xUSD plummeted by 77%, falling to approximately $0.23. This stablecoin, which had promised "stability" and "high returns," lost three-quarters of its value in a single trading day.

Risk Transmission from Data

According to data from DeFi research firm Yields and More (YAM), the direct debt risk exposure related to Stream across the entire ecosystem amounts to $285 million, distributed as follows:

- TelosC: Loans secured by Stream assets amount to $123.64 million (single largest “leader” exposure);

- Elixir Network: Lent out $68 million (65% of deUSD collateral) through Morpho private vault;

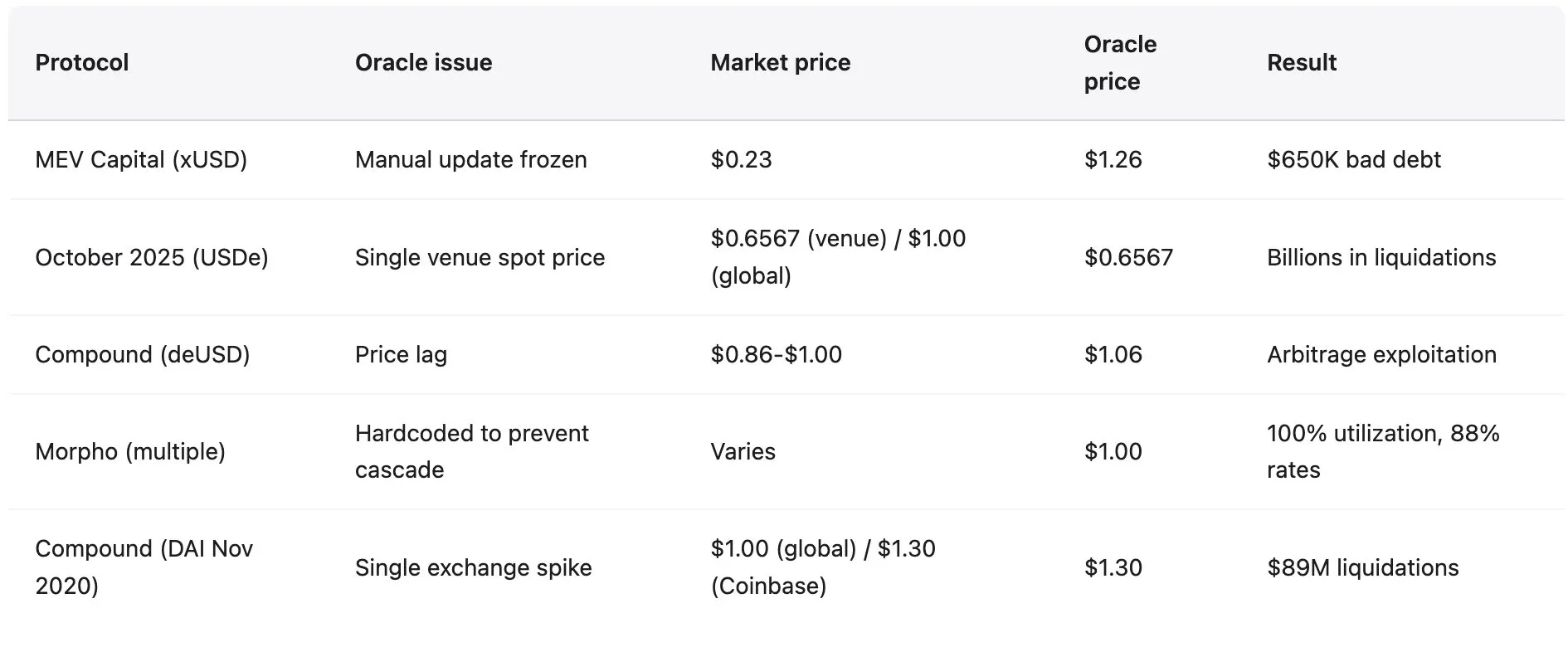

- MEV Capital: $25.42 million (of which approximately $650,000 became bad debt because the oracle froze the price of xUSD at $1.26 when the actual market price fell to $0.23).

- Varlamore: $19.17 million;

- Re7 Labs: The two vaults involved $14.65 million and $12.75 million respectively;

- Enclabs, Mithras, TiD, and Invariant Group all have relatively small risk exposures.

Furthermore, the Euler protocol faces approximately $137 million in bad debt, with over $160 million frozen across various protocols. Researchers point out that this list is not exhaustive, warning that "more stablecoins/vaults may be affected" because the full picture of interconnected risk exposure remains unclear weeks after the initial crash. Elixir's deUSD, which concentrated 65% of its reserves in lending to Stream through the Morpho private vault, was affected, causing deUSD to plummet 98% from $1 to $0.015 within 48 hours, becoming the fastest-falling mainstream stablecoin since the Terra UST crash in 2022. Elixir redeemed approximately 80% of non-Stream deUSD holders (allowing redemptions at a rate of 1 USD to 1 USDC), thus protecting the majority of its community users. However, this protection came at a high cost, ultimately borne by the Euler, Morpho, and Compound protocols. Subsequently, Elixir announced the complete termination of all stablecoin products, acknowledging that its foundation of trust had been irreparably damaged. The broader market reaction revealed a systemic loss of confidence. According to Stablewatch data, although most interest-bearing stablecoins maintained their peg to the US dollar, Stream's TVL still fell by 40% to 50% in the week following the collapse. This means that even protocols without glitches or technical issues experienced approximately $1 billion in outflows. Users, unable to distinguish between compliant and fraudulent projects, ultimately chose a "complete withdrawal." By early November, the TVL of the entire DeFi sector had decreased by $20 billion; the market was not reacting to the failure of a specific protocol, but rather pricing in the risk of widespread contagion.

October 2025: A chain of liquidations triggered by $60 million

Less than a month before the Stream Finance collapse, the cryptocurrency market experienced a “non-market crash” revealed by on-chain forensic analysis—a precise attack targeting a known institutional-grade vulnerability. From October 10th to 11th, 2025, a precisely timed $60 million market sell-off triggered an oracle malfunction, leading to a massive chain of liquidations across the DeFi ecosystem. This was not a “liquidation of reasonably damaged positions due to excessive leverage,” but rather a result of an institutional-grade oracle design flaw, and the attack pattern was identical to patterns documented and publicly disclosed since February 2020.

The attack began at 5:43 AM UTC on October 10th: a $60 million sell-off of USDe occurred in the spot market of a single exchange. In a well-designed oracle system, the impact of such an event should be negligible, as the system uses multiple independent price sources combined with a time-weighted mechanism to prevent manipulation. However, the oracle system in question simply adjusted the valuation of the collateral (wBETH, BNSOL, USDe) in real time based solely on the spot price of the manipulated platform, triggering a massive liquidation. Infrastructure was instantly overloaded: millions of liquidation requests flooded in simultaneously, exceeding the system's processing capacity; market makers were unable to provide timely buy prices due to API data feed interruptions and withdrawal queues; market liquidity instantly dried up, and this chain reaction of liquidations created a self-reinforcing vicious cycle.

Attack methods and precedents

The oracle "faithfully" reported the manipulated price on a single platform, while prices remained stable across all other markets. The main exchange showed USDe at $0.6567 and wBETH at $430, while prices on other platforms deviated from normal levels by less than 30 basis points (0.3%), and on-chain liquidity pools were minimally affected. As Ethena founder Guy Young pointed out, "Over $9 billion in on-demand stablecoin collateral was readily available for redemption throughout the event," demonstrating that the underlying assets did not experience substantial devaluation. However, the oracle still reported the manipulated price, and the system executed liquidations based on these prices, ultimately leading to the forced liquidation of a large number of positions due to "valuations that did not exist in any other market."

This attack pattern is strikingly similar to the incident that occurred with the Compound protocol in November 2020: DAI surged to $1.30 on Coinbase Pro within an hour, while the price remained at $1.00 on all other platforms, ultimately leading to a liquidation of $89 million. Although the platforms targeted have changed in this incident, the fundamental vulnerability remains the same.

This attack method is completely consistent with the following historical events:

- February 2020 bZx incident: $980,000 was stolen through Uniswap oracle manipulation;

- The Harvest Finance incident in October 2020: $24 million was stolen through Curve manipulation, triggering a $570 million bank run;

- The Mango Markets incident in October 2022: $117 million was stolen through manipulation across multiple platforms.

Between 2020 and 2022, there were 41 oracle manipulation attacks, resulting in losses of $403.2 million. However, the industry's response to this was slow and fragmented, with most platforms still using oracles that are "overly reliant on spot prices and lack redundancy."

As the market expands, the importance of these historical lessons becomes increasingly apparent, with the "magnification effect" being a key reason: in the 2022 Mango Markets incident, $5 million in manipulated funds ultimately led to a loss of $117 million, a magnification factor of 23 times; and in the October 2025 incident, $60 million in manipulated funds triggered an even larger chain reaction. It is noteworthy that the attack patterns have not become more complex; the root of the problem lies in the fact that the underlying system retains the same fundamental vulnerabilities despite its expansion in scale.

Historical pattern: The crash events of 2020-2025

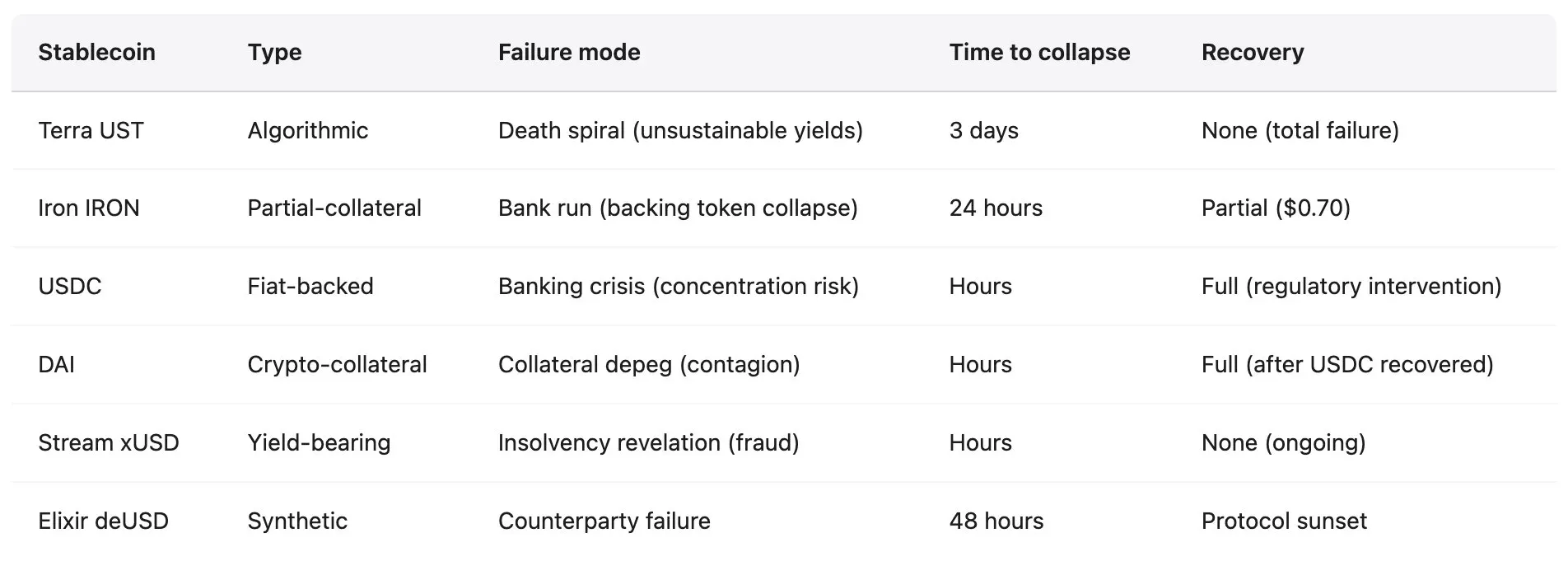

The collapse of Stream Finance is neither the first nor an isolated incident. The decentralized finance (DeFi) ecosystem has witnessed numerous stablecoin collapses, each exposing similar structural vulnerabilities. Yet, the industry continues to repeat these mistakes, with the scale of collapses constantly expanding. Recorded collapses over the past five years exhibit a highly consistent pattern: algorithmic stablecoins or partially collateralized stablecoins attract deposits by offering unsustainable high yields, which are not derived from actual revenue but rely on token issuance or subsidies for new user deposits; protocols operate with excessive leverage, opaque true collateral ratios, and a circular dependency where "protocol A provides collateral for protocol B, and protocol B in turn provides collateral for protocol A." Once a sudden shock exposes their potential insolvency or makes subsidies unsustainable, a run on the system erupts: users rush to exit, collateral values plummet, triggering a chain of liquidations, and the entire system collapses within days or even hours. The risk also spreads to protocols that accept the failed stablecoin as collateral or hold related positions within the ecosystem.

May 2022: Terra (UST/LUNA)

- Scale of loss : $45 billion in market value evaporated within three days.

- Background : UST is an algorithmic stablecoin backed by LUNA through a "minting-burning" mechanism. Its Anchor protocol provides an unsustainable annualized yield of 19.5% on UST deposits, with approximately 75% of UST deposited into this protocol to earn rewards. The entire system relies on a continuous inflow of funds to maintain its peg to the US dollar.

- Triggering event : On May 7, the Anchor protocol experienced a $375 million redemption, followed by a massive sell-off of UST, causing it to de-peg. Users exchanged UST for LUNA to exit, causing the LUNA supply to surge from 346 million to over 6.5 trillion within three days, forming a "death spiral," with both tokens eventually falling to near zero.

- Subsequent impacts : This collapse resulted in significant losses for numerous individual investors and triggered the closure of several leading cryptocurrency lending platforms, including Celsius, Three Arrows Capital, and Voyager Digital. Terra founder Do Kwon was arrested in March 2023 and faces multiple fraud charges.

June 2021: Iron Finance (IRON/TITAN)

- Scale of loss : TVL plummeted from $2 billion to almost zero in 24 hours.

- Background : IRON is a partially collateralized stablecoin, with 75% collateralized by USDC and 25% by its native token TITAN. The protocol attracts deposits through an unsustainable "yield farming" incentive that offers an annualized yield (APR) of up to 1700%.

- Triggering event : When large holders began redeeming IRON for USDC, the selling pressure on TITAN created a self-reinforcing effect. The price of TITAN plummeted from $64 to $0.00000006, causing the collateral supporting IRON to become completely invalid.

- Lessons learned : Under stress, some staking models struggle to maintain stability; when the staking tokens themselves fall into a "death spiral," arbitrage mechanisms can completely fail under extreme stress.

March 2023: USDC

- De-pegging scenario : With $3.3 billion in reserves tied up in the near-bankrupt Silicon Valley Bank, the USDC price fell to $0.87, a 13% drop from its peg. This should have been "impossible" for a fully collateralized fiat-backed stablecoin that regularly issues certificates of assets.

- Restoration of peg : The USDC will only be restored to its peg to the US dollar after the Federal Deposit Insurance Corporation (FDIC) invokes the "systemic risk exception" mechanism and provides full guarantees for Silicon Valley Bank's deposits.

- Risk transmission : This incident triggered the de-pegging of DAI (USDC accounted for more than 50% of DAI collateral), resulting in more than 3,400 automatic liquidations on the Aave platform, totaling $24 million.

- Lessons learned : Even well-intentioned and regulated stablecoins face the risk of collateral concentration and rely on the stability of the traditional banking system.

November 2025: Stream Finance (xUSD)

- Scale of losses : direct losses of US$93 million, and total risk exposure related to the entire ecosystem of US$285 million.

- Mechanism background : Uncollateralized synthetic assets are created through "revolving lending" (the size of the synthetic assets is 7.6 times that of the actual collateral); 70% of the funds are operated through opaque off-chain strategies, managed by anonymous external fund managers, and no proof of reserves is provided.

- Current status : xUSD trading price remains in the $0.07-$0.14 range (down 87%-93% from the pegged price), liquidity is almost exhausted; withdrawal function is frozen indefinitely; multiple lawsuits have been filed; Elixir protocol has completely ceased operations; a "wave of withdrawals from interest-bearing stablecoins" has emerged across the industry.

All cases exhibited a common failure pattern, as detailed below:

- Unsustainable high returns : The promised returns of Terra (19.5% annualized), Iron (1700% annualized), and Stream (18% annualized) are all out of sync with actual revenue generation capabilities.

- Circular Dependencies : UST and LUNA, IRON and TITAN, xUSD and deUSD all exhibit “mutually reinforcing failure modes”, where the collapse of one inevitably leads to the collapse of the other.

- Lack of transparency : Terra concealed the subsidy costs of the Anchor protocol; Stream hid 70% of its operations off-chain; and Tether has been repeatedly questioned due to issues with the composition of its reserve assets.

- Partial collateral or self-issued collateral : Relying on volatile assets or self-issued tokens as collateral can trigger a "death spiral" when the market is under pressure, because the value of the collateral will fall sharply precisely when it is most needed to provide support.

- Oracle manipulation : When price data is frozen or manipulated, the clearing mechanism cannot function properly, turning "price discovery" into "trust discovery," leading to a continuous accumulation of bad debts and ultimately causing the system to become insolvent.

The conclusion is obvious: stablecoins are not stable. They are merely "stable before they become unstable," and the transition from stability to collapse can take only a few hours.

Oracle failures and infrastructure collapses

The oracle problem became immediately apparent at the outset of the Stream crash. When the actual market price of xUSD fell to $0.23, many lending protocols hard-coded their oracle prices to $1.00 or higher in an attempt to avoid cascading liquidations. While this move was intended to maintain system stability, it created a fundamental disconnect between "market reality" and "protocol behavior." It's important to note that this price hard-coding was a deliberate policy choice, not a technical glitch.

Many protocols avoid triggering liquidations during periods of temporary volatility by manually updating oracle prices. However, this practice can have disastrous consequences when price declines reflect actual insolvency rather than short-term market stress.

The protocol faces an unsolvable dilemma, with all three mainstream approaches having fatal flaws:

- Using real-time prices : As demonstrated by the October 2025 event, this approach carries the risk of manipulation and cascading liquidations during market volatility, with potentially severe consequences.

- Using delayed pricing or time-weighted average pricing (TWAP) fails to reflect true insolvency, leading to the accumulation of bad debts. As seen in the Stream incident, the oracle showed xUSD at $1.26, while the actual price was only $0.23, resulting in $650,000 in bad debts for MEV Capital alone.

- Manual updates introduce centralized risks and room for subjective intervention, and may even cover up the fact that the company is insolvent by freezing oracle prices.

All three methods mentioned above have resulted in losses of hundreds of millions or even billions of dollars.

Infrastructure carrying capacity during periods of stress

In October 2020, Harvest Finance suffered a $24 million attack, leading to a massive user exodus and a dramatic drop in its TVL (TVL) from $1 billion to $599 million. The lessons learned from this incident should have been clear: oracle systems must consider the infrastructure's capacity under stress; clearing mechanisms must include rate limits and circuit breakers; and exchanges must have the redundancy to handle 10 times the normal load.

However, the events of October 2025 proved that this lesson had not been learned even at the institutional level. When millions of accounts faced simultaneous liquidation, billions of dollars in positions were forcibly closed within an hour, and the order book went blank because all buy orders were consumed and the system was overloaded and unable to generate new buy orders, the extent of the infrastructure collapse was no different from the failure of oracles.

Technical solutions have existed for a long time, but they have never been implemented because these solutions would reduce the efficiency of the system under normal circumstances, and the funds required could have been converted into profits.

If you can't identify the source of your profits, you're not earning profits; you're paying the cost of someone else's profits. This isn't a complicated concept. Yet, hundreds of millions of dollars are still being poured into "black box strategies" simply because people prefer reassuring lies to unsettling truths. The next "Stream Finance" might be in operation right now.

Stablecoins are not stable; DeFi is neither truly decentralized nor secure; returns from dubious sources are not profits, but "theft with a countdown." These are not subjective opinions, but verifiable empirical facts verified at a huge cost.

The only question is: will we ultimately act based on the lessons we've learned, or will we pay another $20 billion to repeat the same mistakes? Historical experience suggests the latter is more likely.