How can I participate in Monad public offerings? Are Monad public offerings worth participating in?

On November 17th, Monad, a next-generation high-performance Layer 1 public blockchain, officially launched its MON public sale as the first project on Coinbase's new token offering platform. The public sale will run until November 22nd, with tokens expected to be distributed simultaneously on November 24th, the day of Monad's mainnet launch. As Coinbase's first token issuance case after launching its new public sale platform, Monad is also seen as an important experiment for Coinbase in exploring a public, transparent, and compliant token issuance path.

It's worth noting that Monad's public offering launched during a period of overall correction in the crypto asset market, with generally weak market sentiment. The VIX (fear index) had fallen to single digits, Bitcoin had dropped to around $90,000, and Ethereum was fluctuating around $3,000. In this environment, Monad's public offering price of $0.025 and approximately $2.5 billion in FDV (Free-to-Vend) quickly sparked discussions about its valuation and liquidity. Against this backdrop, CoinW Research Institute will provide a systematic analysis of its public offering mechanism, actual subscription progress, and project development below to present a more comprehensive perspective.

I. How to participate in Monad public offerings

This public sale will offer 7.5 billion MON tokens at a fixed price of $0.025, raising a total of $187.5 million. Eligible participants are located in over 80 countries/regions, including Hong Kong. Below is the complete process and important notes for investors participating in the Monad public sale on the Coinbase platform:

The first step, account and identity verification: Investors must have a Coinbase account and complete KYC.

Mainland China residents are not eligible to participate. Participants can use identities from Hong Kong or Singapore (bank statements or utility bills, and a photo of the holder holding their ID are required). This public offering only accepts USDC as the payment method. The minimum subscription amount per user is 100 USDC, and the maximum is 100,000 USDC. Additionally, Coinbase One members can apply for 1.5 to 5 times the amount of additional tokens during this Monad token sale and in each subsequent sale, depending on their membership level.

The second step is to understand the allocation mechanism: Monad's public offering period is one week (November 17th to November 22nd).

1. Algorithmic allocation based on "small amount priority"

Coinbase employs a bottom-up algorithmic allocation mechanism that emphasizes fairness. It prioritizes smaller user requests to ensure more retail investors have the opportunity to participate; larger requests are then processed gradually until all tokens have been allocated. This rule prevents large holders from concentrating their allocations on a single large amount, reducing the concentration of token distribution at the institutional level and making the token sale more equitable and retail-friendly.

2. Zero-fee participation mechanism

Throughout the entire token sale process, users do not need to pay transaction fees or purchase platform tokens; they only need to hold USDC to participate.

3. Restrictions on the sale of projects by developers

Coinbase has set strict compliance and disclosure requirements for issuers. In addition, issuers and their affiliates are prohibited from selling tokens within six months of the token's listing.

4. Restrictions on user sell-offs

Coinbase has also introduced restrictions on user behavior. If a user chooses to sell within 30 days of the token's listing, their priority in participating in similar token sales events on Coinbase in the future may be reduced.

The third step is token distribution: after the public offering ends.

Coinbase will determine each user's final allocation based on the algorithm. If a user's subscription amount exceeds their allocated amount, the system will return the unallocated portion in USDC. The Monad mainnet will launch on November 24th, and MON tokens will be distributed to participants simultaneously. These MON tokens will be deposited into users' Coinbase wallets.

Source: coinbase

II. Current Status of Monad Public Offerings

Judging from current market participation, investor sentiment is relatively cautious. In contrast, MegaETH raised approximately $300 million in the first hour after its launch, bringing its total fundraising to $1.39 billion, an oversubscription of 27.8 times. Six hours after Monad's public sale began, the subscription rate was only about 45%, with a cumulative fundraising of only $90.05 million, a significantly slower pace. However, as of press time, its total subscription amount has exceeded $100 million. Some believe this difference is related to the current overall market being in a correction cycle; with Bitcoin prices now around $90,000, risk appetite naturally tends to be conservative, thus the relatively moderate participation in the Monad public sale in its initial stages is understandable.

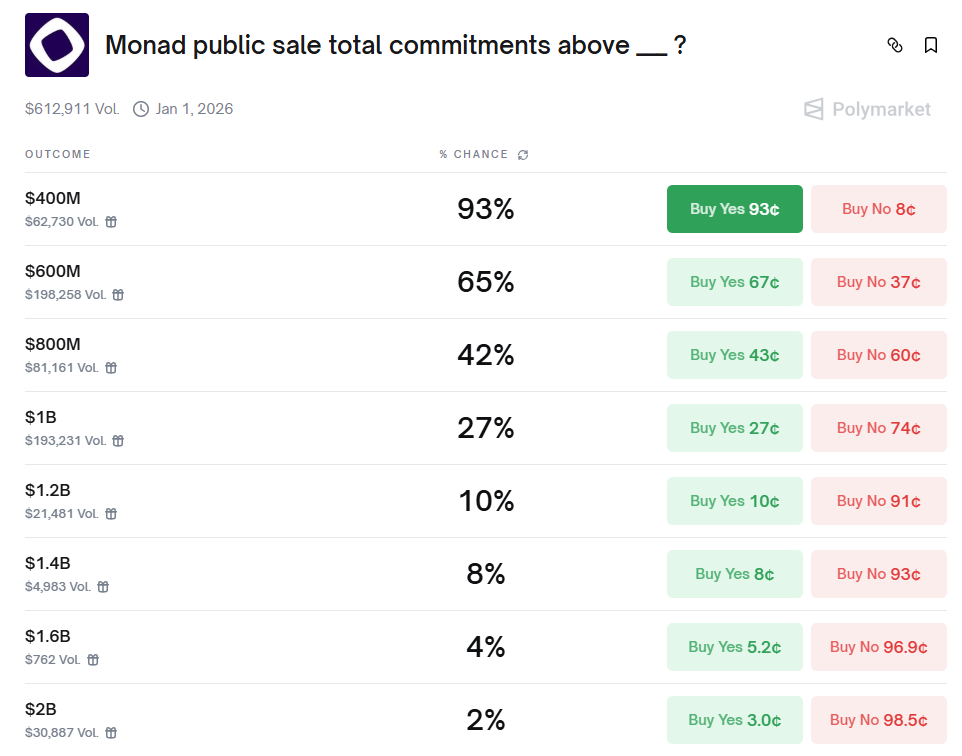

Data from Polymarket, a market forecasting firm, provides a more direct reflection of current market sentiment. Currently, the majority of funds are betting that the mutual fund size will exceed $400 million, with a 93% probability; the probability of it ultimately exceeding $600 million is 65%. As the target subscription amount range increases, market confidence rapidly declines, with the probability of exceeding $1 billion at approximately 27%, and the probability of exceeding $2 billion at only 2%. Overall, the market generally believes that the Monad mutual fund will most likely fall within the $400 million to $1 billion range.

Source: polymarket

Another interesting observation is that prediction markets, to some extent, reflect the true risk appetite and expectations of public offering participants. Many users use Polymarket's market predictions as a trading strategy and hedge their positions on Polymarket after participating in an IPO. For example, based on Monad's current predictions, some users believe that the total public offering amount will not exceed $1 billion, so they will buy $1 billion worth of No contracts in advance and sell the corresponding positions near the end of the public offering. Meanwhile, because Monad's token MON has been listed for pre-market trading, some users also choose to hedge pre-market; this is a standard trading strategy and will not be elaborated upon here.

III. Current Status of the Monad Public Chain

Monad is an EVM-compatible Layer 1 public blockchain aiming to improve transaction processing efficiency and confirmation speed. Official data shows that Monad supports approximately 10,000 transactions per second and reduces block confirmation time to approximately 0.8 seconds. According to gmonads data, the Monad testnet covers 25 countries and 53 cities, running a total of 174 validator nodes. Its token, MON, reached a pre-market high of $0.07, but has since fallen back to around $0.04.

Source: gmonads

In terms of ecosystem development, Monad has already attracted over 300 projects, 78 of which are exclusive to its ecosystem. Its ecosystem covers DeFi, Gaming, consumer applications, AI, and NFTs. With the mainnet launch approaching and the number of projects continuing to increase, the subsequent user activity, developer retention rate, and actual performance after the mainnet launch will determine the continued expansion of the Monad ecosystem.

IV. Summary

Monad's public offering is still underway, and market opinions are clearly divided. Discussions mainly focus on the token distribution structure, initial liquidity arrangements, and investor participation during the public offering phase. Some users believe Monad's token structure leans towards a traditional VC model, with ecosystem development accounting for 38.5%, the team for 27%, and investors for 19.7%, while the public sale accounts for only 7.5%. The team and investors combined account for over 46%, leading some investors to be cautious about the expected selling pressure after token unlocking, especially given the current weak market sentiment.

Liquidity is another concern. According to public information, Monad has partnered with five market makers, four of whom offer one-month loans with monthly renewals, while only Wintermute provides a full-year commitment. Of the total supply of 100 billion tokens, only 160 million have been lent out for market making, and the Foundation will provide a maximum of 0.2% for initial DEX liquidity. This overall scale is lower than the industry average of approximately 2% for market making. Therefore, some users believe that such a cautious market-making scale may not be sufficient to absorb significant selling pressure in the early stages of launch, thus affecting price stability.

However, despite the relatively slow pace of initial public offering subscriptions, Monad still holds special significance within the broader industry context. Since the ICO model was forced to withdraw from the US market due to stringent SEC regulations in 2018, the US has virtually no open, transparent, and publicly accessible token issuance channels. After acquiring the Echo platform founded by Cobie, Coinbase has been attempting to rebuild a compliant public offering framework and plans to launch new projects monthly. Notably, Coinbase's X account bio has been updated to December 17th, leading to market speculation that Base might be the next token issuer. Monad's selection as the initial offering project represents Coinbase's first step in rebuilding the US public offering market and is seen by some industry insiders as a signal that compliant token issuance is returning to the mainstream. For the market, Monad is more than just a new token issuance; it's an exploration by Coinbase to restart the public offering market and push the industry back to compliance, thus being seen as the beginning of a new cycle.

- 核心观点:Monad作为Coinbase首发公募项目引发市场关注。

- 关键要素:

- 采用小额优先算法确保分配公平性。

- 公募期间认购金额突破1亿美元。

- 团队与投资者代币占比合计超46%。

- 市场影响:推动合规代币发行回归主流市场。

- 时效性标注:中期影响