Variant Researcher: Infographic of Hot Crypto Market Trends in 2025

Original author: Alana Levin

Original article translated by: Deep Tide TechFlow

Note: Images in this article have been translated for sections with more text. Please view the full report for more details.

I'm thrilled to release my 2025 Crypto Trends Report!

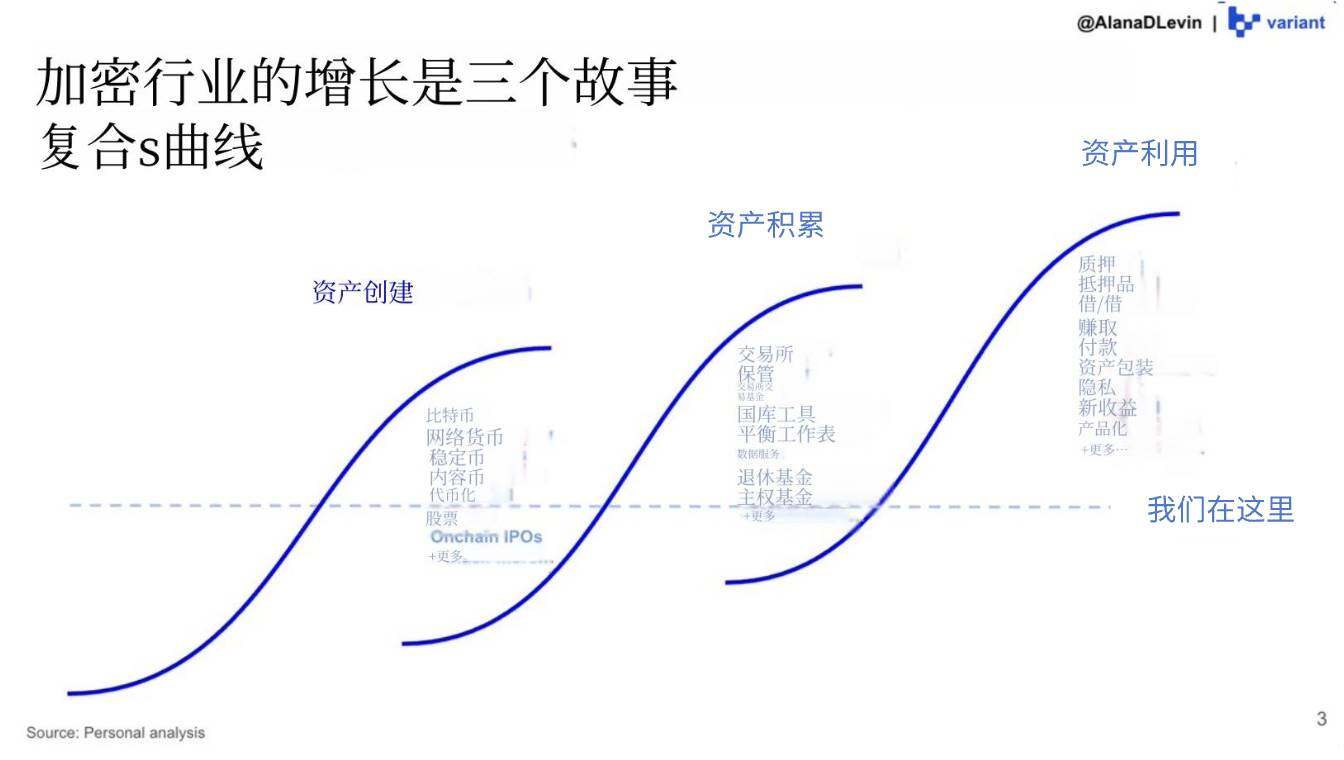

The report describes the growth of the crypto industry as a three-compound S-curve story: asset creation, asset accumulation, and asset utilization.

From this perspective, the report forecasts the future development of the industry by focusing on five key thematic areas: macroeconomics, stablecoins, centralized exchanges, on-chain activities, and cutting-edge markets.

Our position on each curve helps identify remaining startup opportunities and foreseeable favorable development trends.

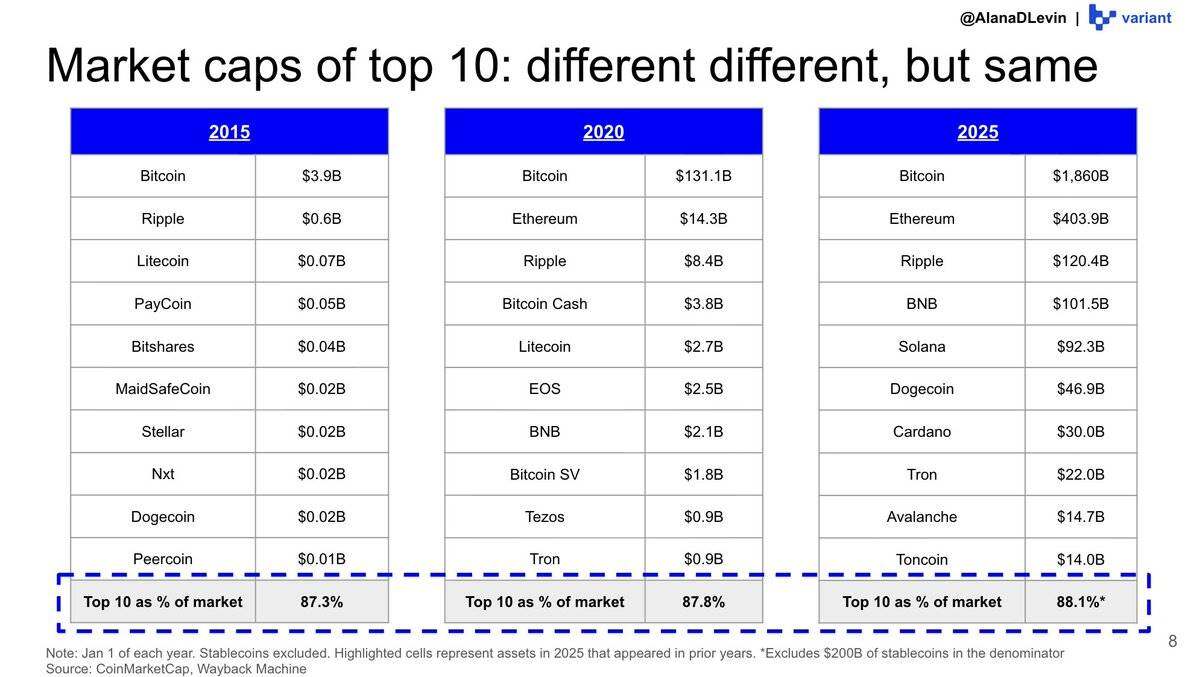

From a macro perspective, the size of major crypto assets continues to expand. Despite record numbers of tokens in the market, the value concentration of the top ten crypto assets has remained remarkably stable.

Asset accumulation is a self-reinforcing cycle: the more people who hold an asset, the faster its value grows, and the more likely it is to become a beneficiary of the "Lindy Effect" (which refers to the fact that the longer something exists, the greater its chances of survival in the future).

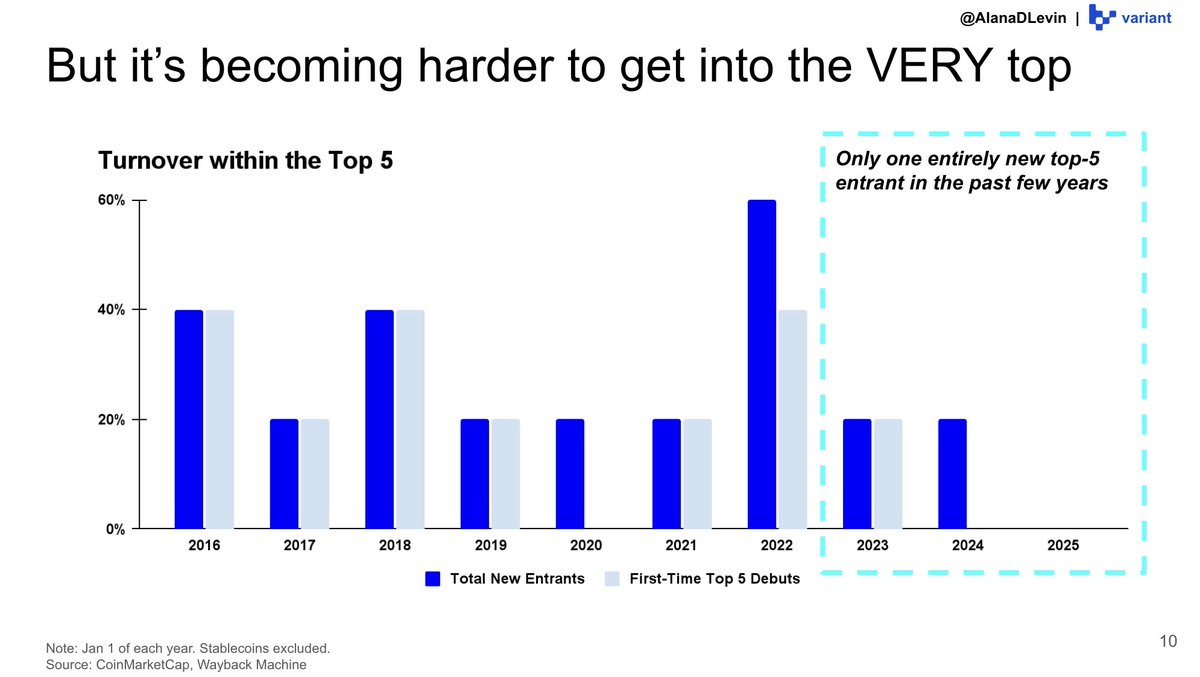

This trend is particularly evident among the top five crypto assets—almost no new assets have entered this tier in the past few years.

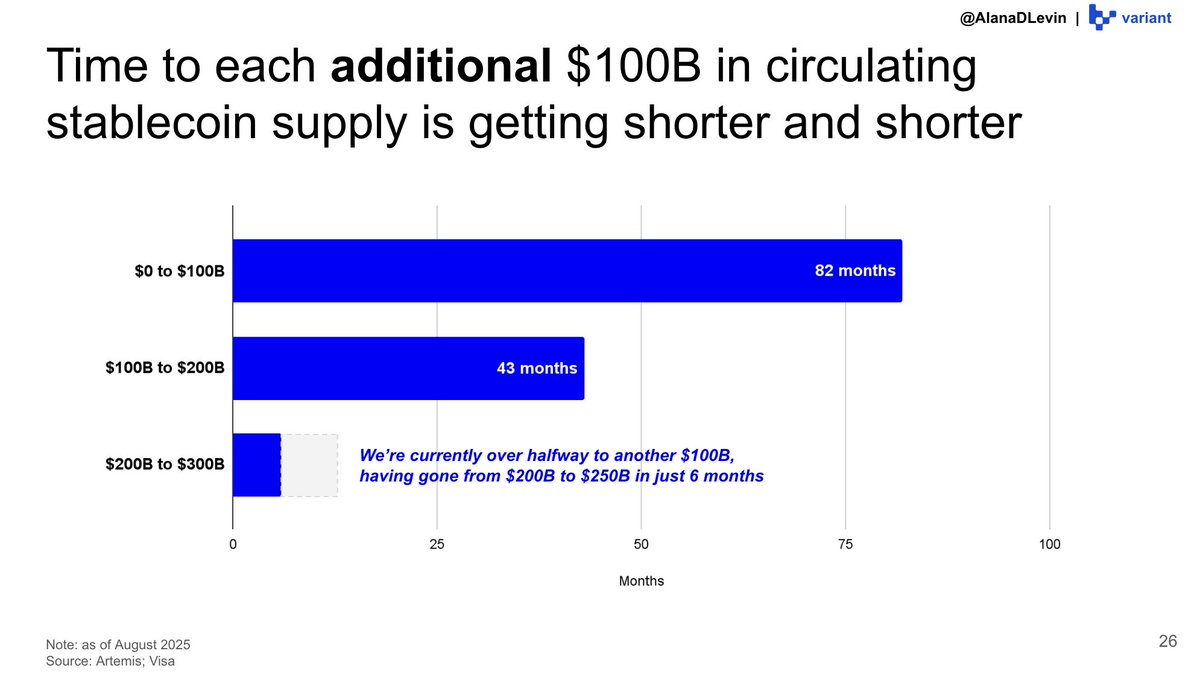

However, one asset class is not included in the chart above: stablecoins.

New stablecoins are emerging at a record pace.

The first $100 billion supply took more than 80 months, and the second $100 billion took more than 40 months. Now, we expect the third $100 billion supply to be achieved in less than 12 months.

Creation → Accumulation + Utilization

Stablecoins are being widely used in various products and scenarios, including payments, lending protocols, exchanges, and even as a store of wealth.

Stablecoin adoption remains a huge opportunity for startups.

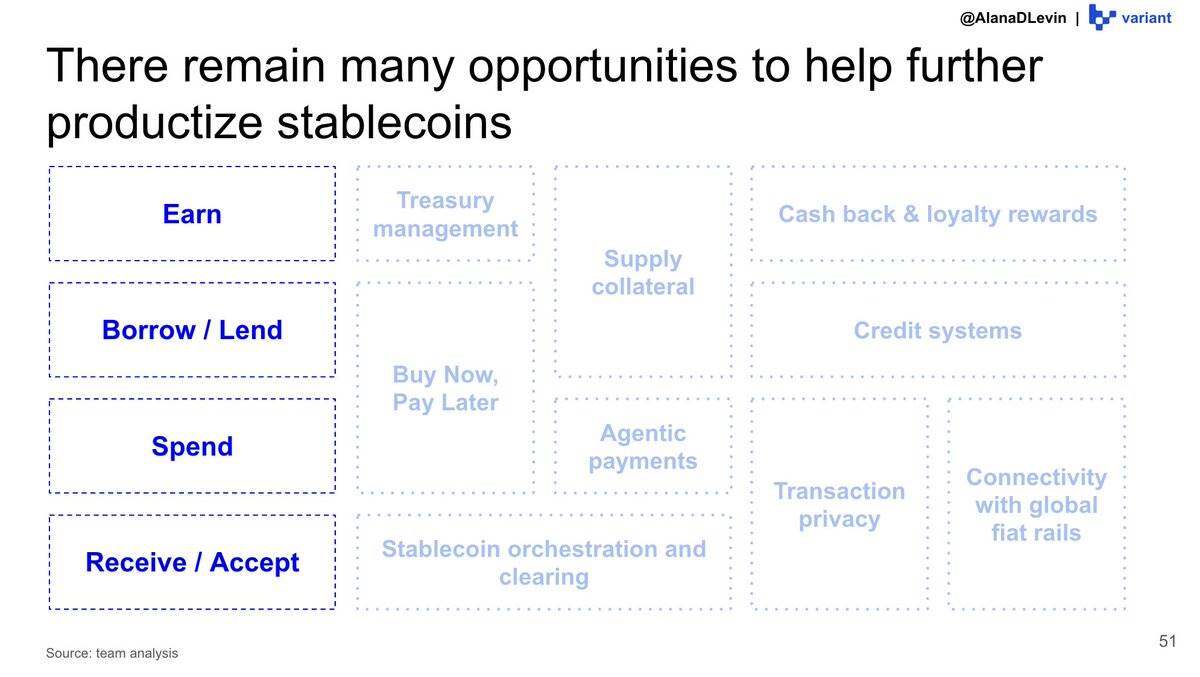

We've already started to see some early signs of productization, such as revenue-generating products, lending, consumer payments, and receiving/receiving payments, but this is just the beginning!

In the future, the productization of stablecoins will also include more areas such as credit systems, privacy transactions, fund coordination, and "buy now, pay later" (BNPL).

The following sections will focus on centralized exchanges (CEXs):

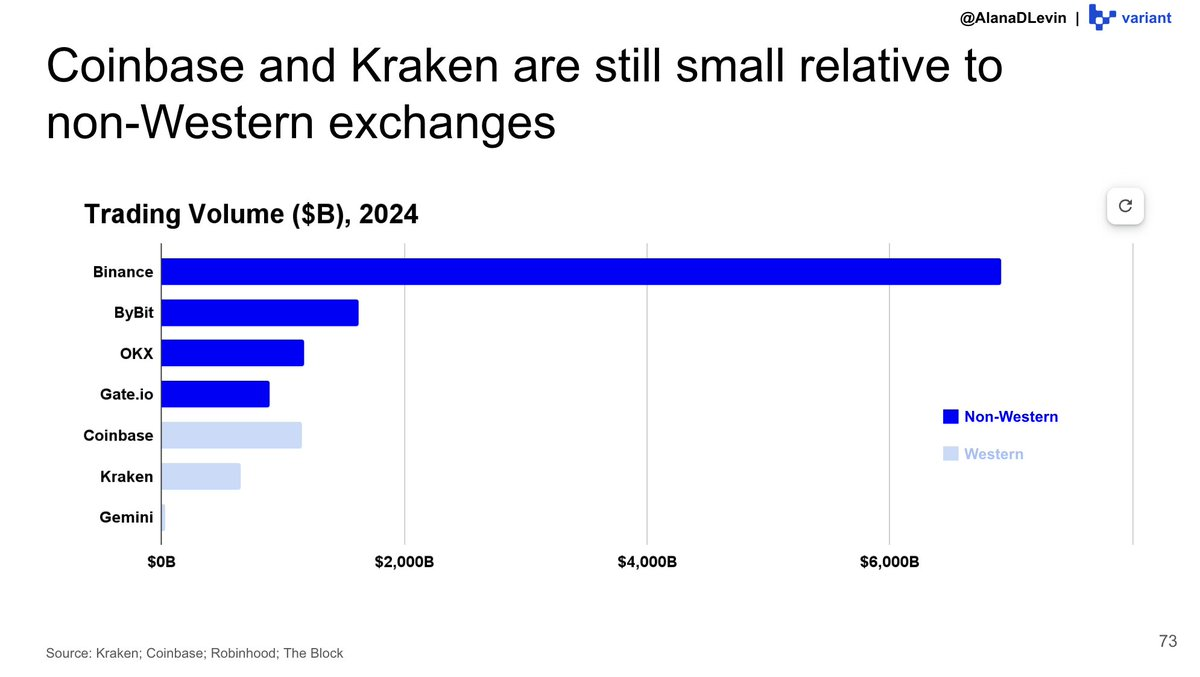

Centralized exchanges have benefited immensely from this "accumulation" trend. As more people seek to buy, sell, and hold crypto assets, they tend to choose centralized exchanges, which has generated trillions of dollars in trading volume for them.

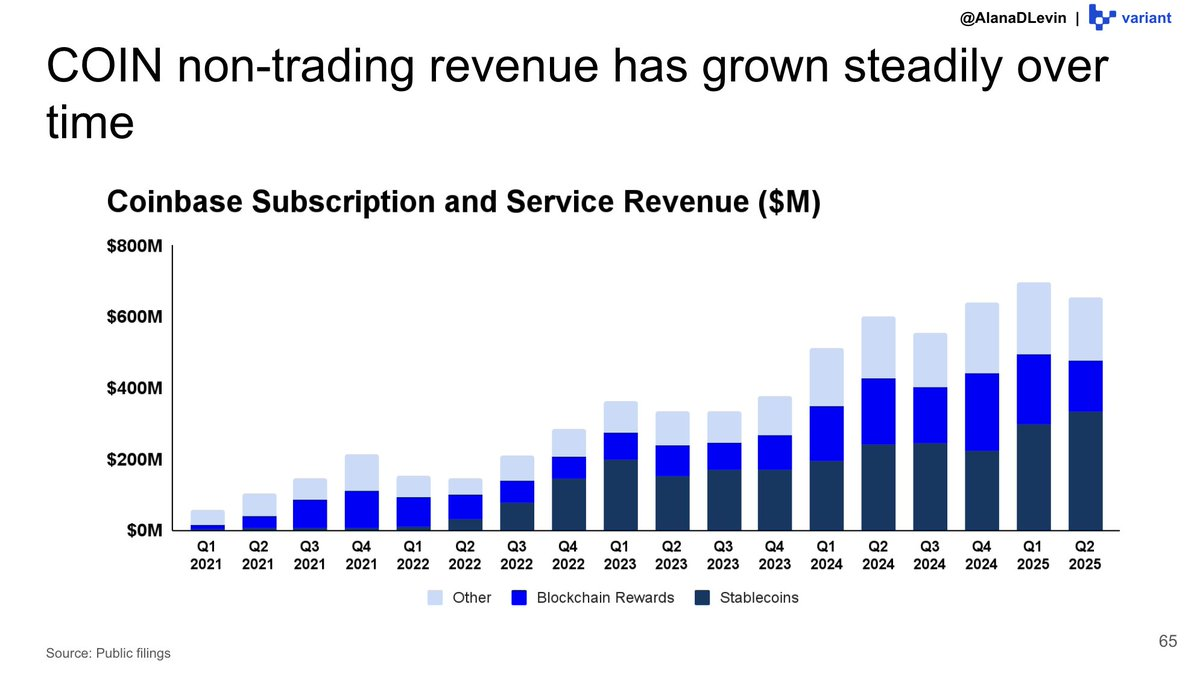

Exchanges are diversified businesses. Companies like @Coinbase have built strong business lines around users' secondary needs, such as custody services, staking services, and yield products.

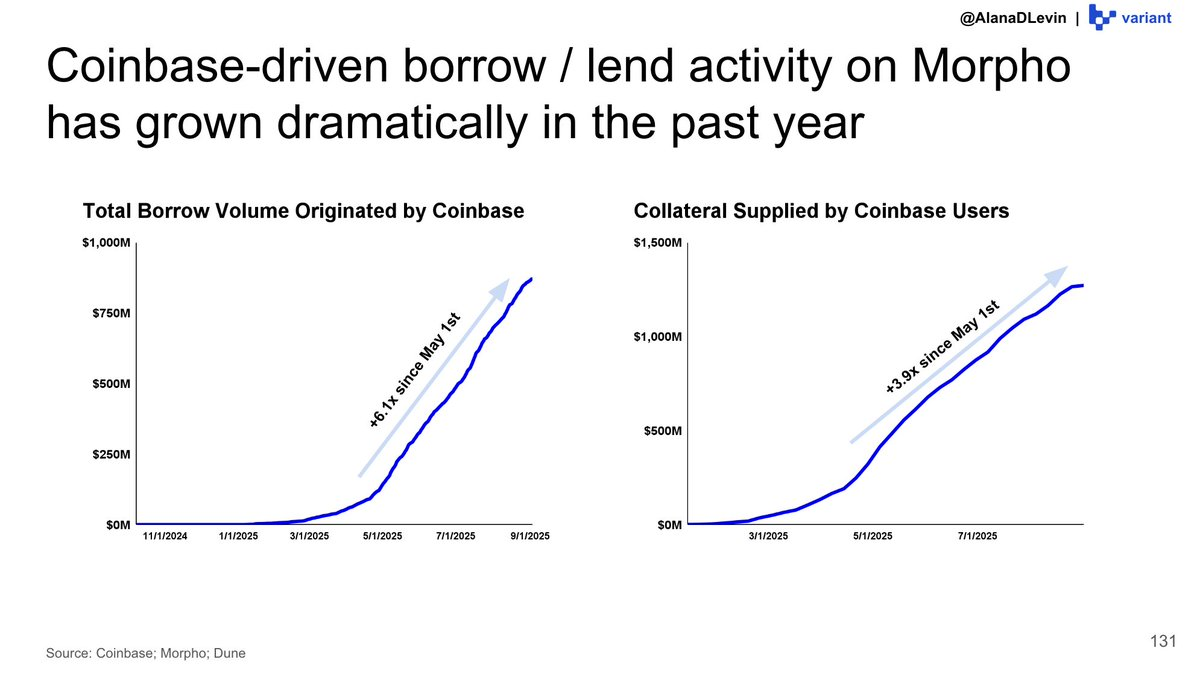

Many new ways to utilize crypto assets will be built directly on-chain, but may achieve strong distribution capabilities through centralized exchanges such as @Coinbase , @RobinhoodApp , and @krakenfx .

So why would the future of asset utilization be built on the blockchain?

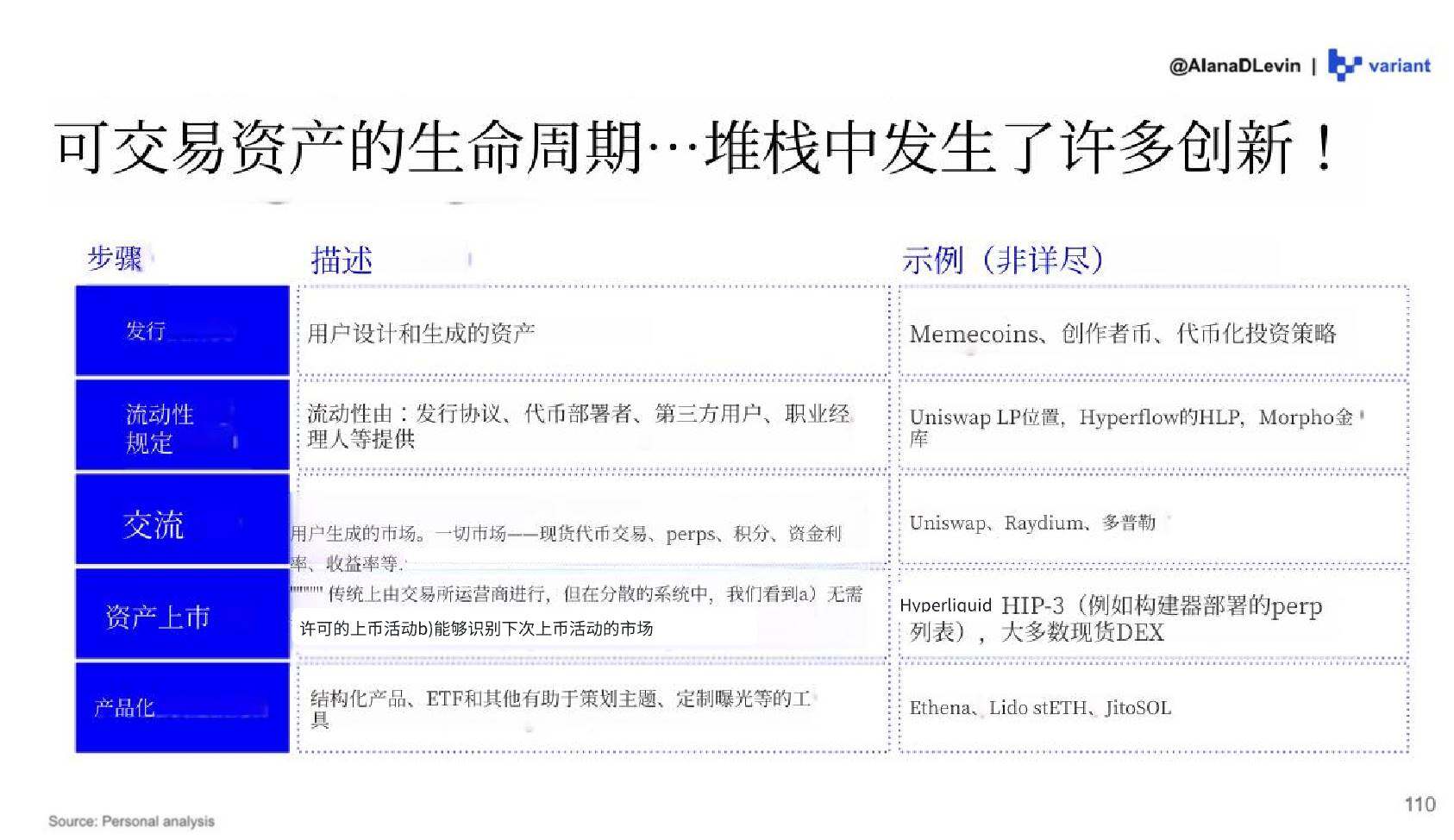

On-chain activity is a breeding ground for innovation. Every stage of an asset's lifecycle can be experimented with on-chain, whereas in traditional finance these steps are often subject to restrictions and permission constraints.

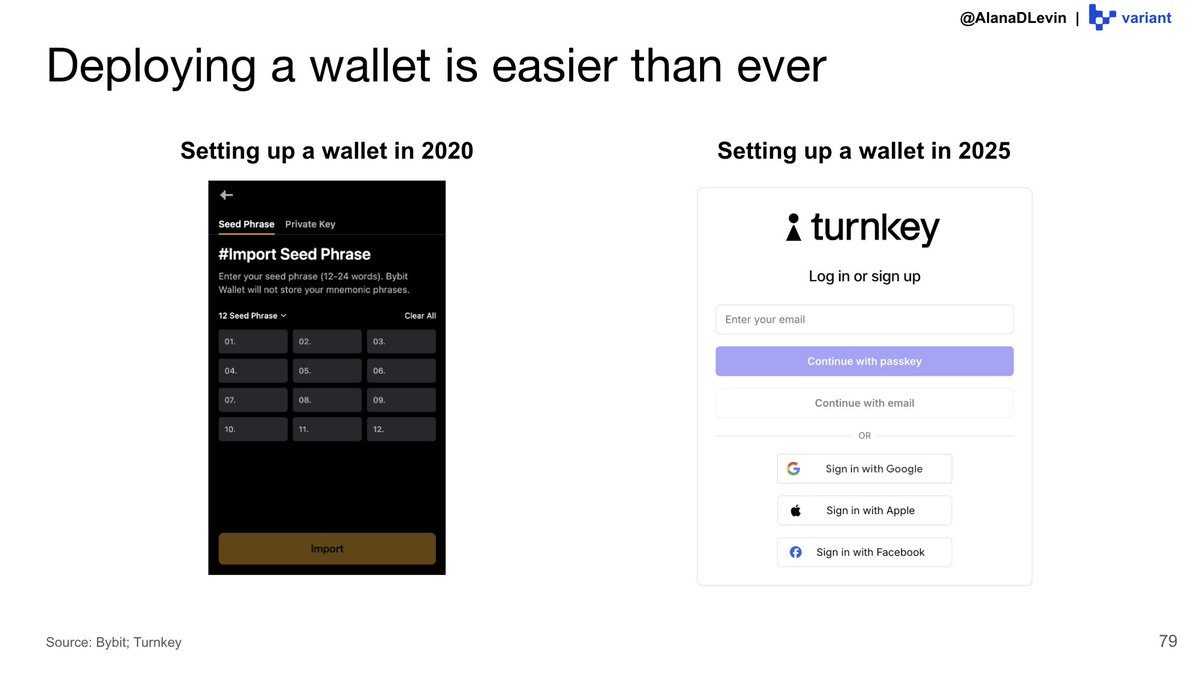

Furthermore, it is now easier than ever for new users to begin on-chain exploration – meaning that anyone, regardless of location or age, can start creating, accumulating, and utilizing crypto assets.

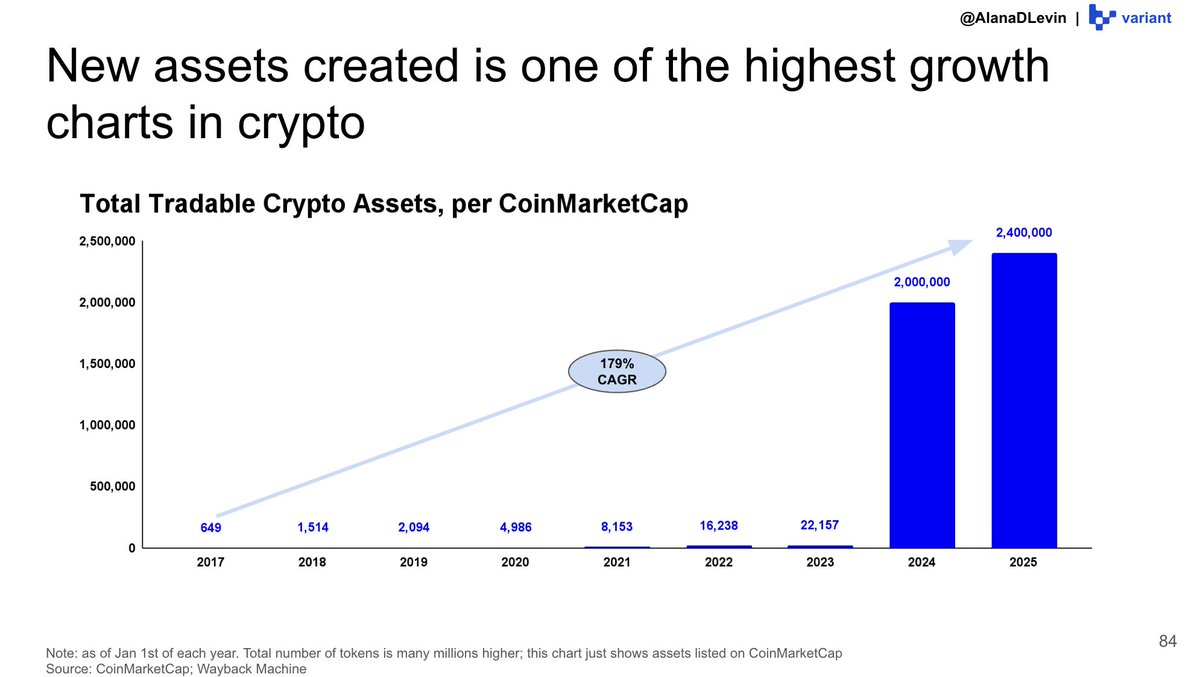

Regarding creation: The number of new tokens created is one of the fastest-growing charts in the crypto space.

As a result, total trading volume surged, and the development of decentralized exchanges (DEXs) continued. The market share of DEXs in the first six months of 2025 exceeded the total for 2021-2023.

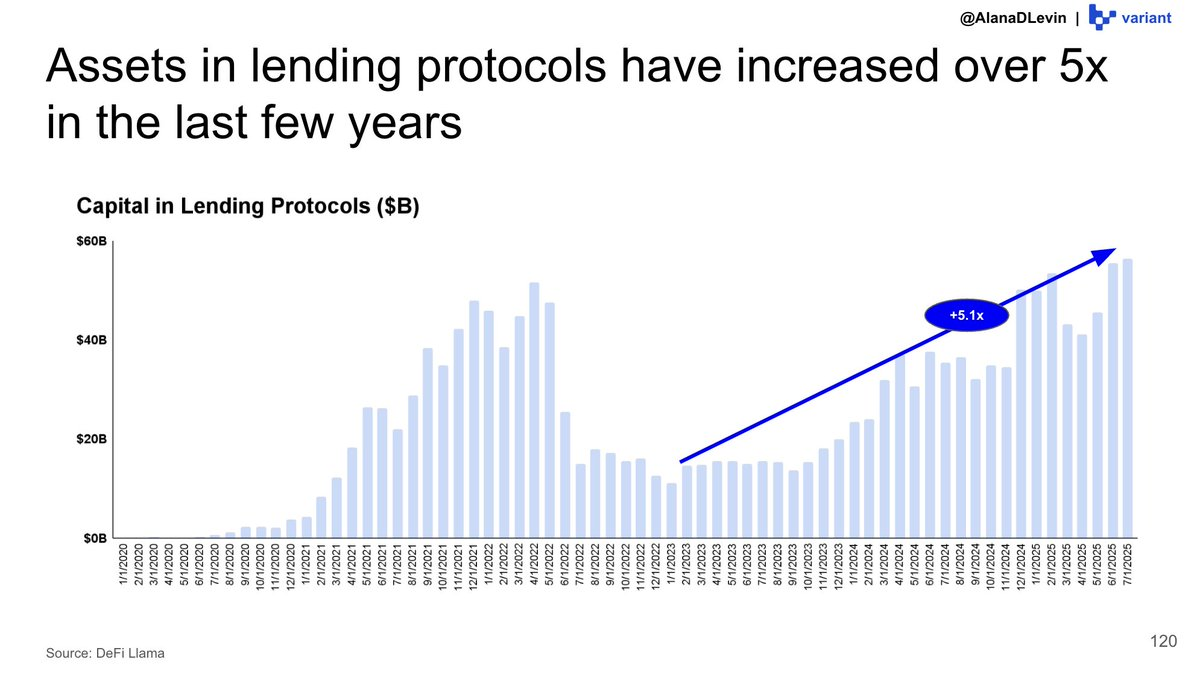

Another area where early signs of asset utilization can be observed is on-chain lending. Assets in lending protocols (such as @Morpho ) have grown more than fivefold in the past few years and continue to grow!

@Morpho is also a great example of the emerging trend of "building on-chain, distributing globally, and utilizing".

It's worth noting that the S-curve of asset creation still has room for growth. So, where can we find these opportunities? On-chain, of course!

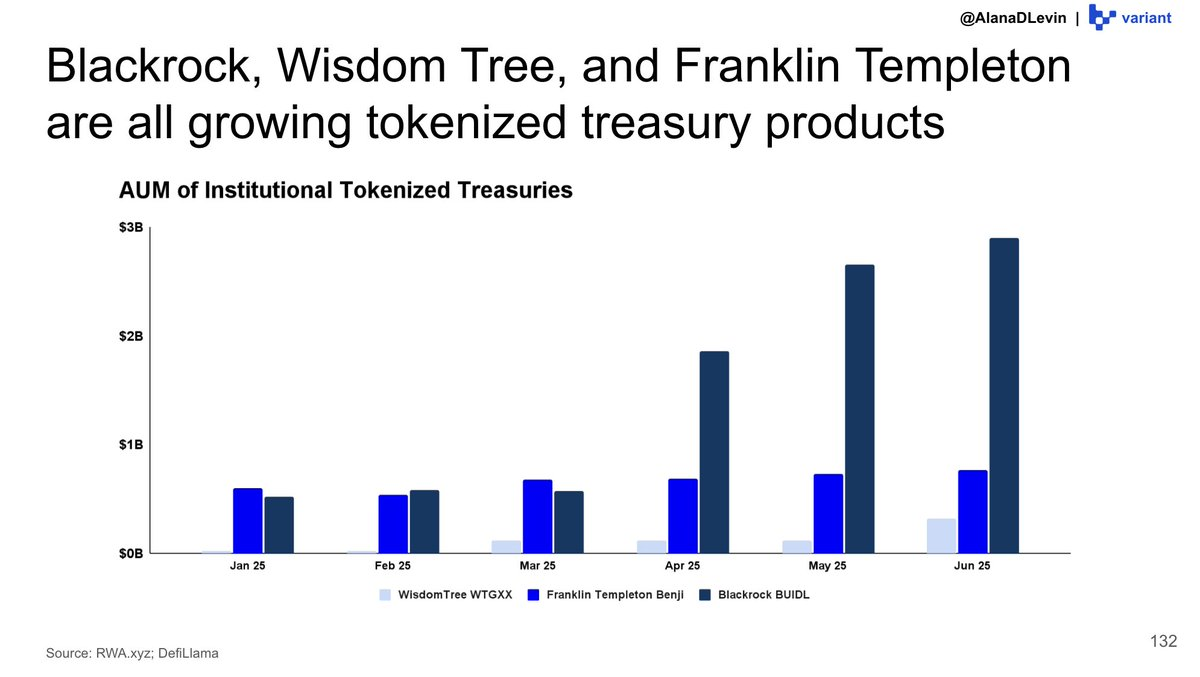

An important new category of tokens is tokens created by institutions. Tokenized treasuries are among the first representatives of this emerging category.

Similarly, we are beginning to see experimental explorations of on-chain equity. Many designs are being tested and may lead to a diverse spectrum of tokenized equity products in the future.

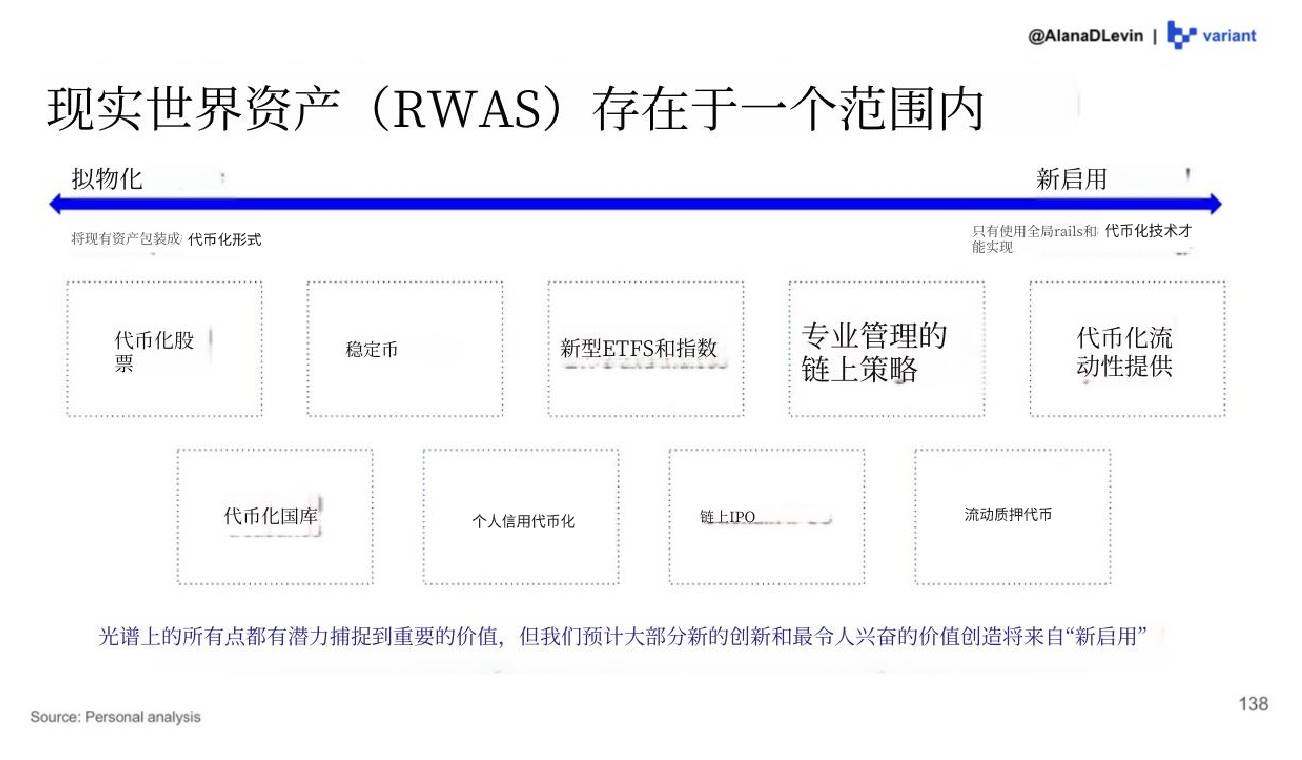

Ultimately, the term "RWA" (Real World Assets) will expand to encompass a wider range of product types and token construction methods than it does today. These new assets will not only have intrinsic value but will also catalyze a new wave of demand for asset accumulation and utilization.

The final section of the report focuses on cutting-edge markets, using the Forecasting Market as a prime example to demonstrate how encryption technology can transform products into platforms.

The ability of cryptography to transform products into platforms is not new. We have already seen this in perpetual contracts (like @HyperliquidX) and lending protocols (like @Morpho).

So if you're wondering where the future lies, why not start exploring on the blockchain? :)

- 核心观点:加密行业增长呈现三条复合S曲线。

- 关键要素:

- 稳定币供应量加速增长。

- 中心化交易所主导资产积累。

- 链上活动驱动资产利用创新。

- 市场影响:推动链上金融产品多样化发展。

- 时效性标注:中期影响