CoinW Research Institute Weekly Report (November 10, 2025 - November 16, 2025)

CoinW Research Institute

Key points

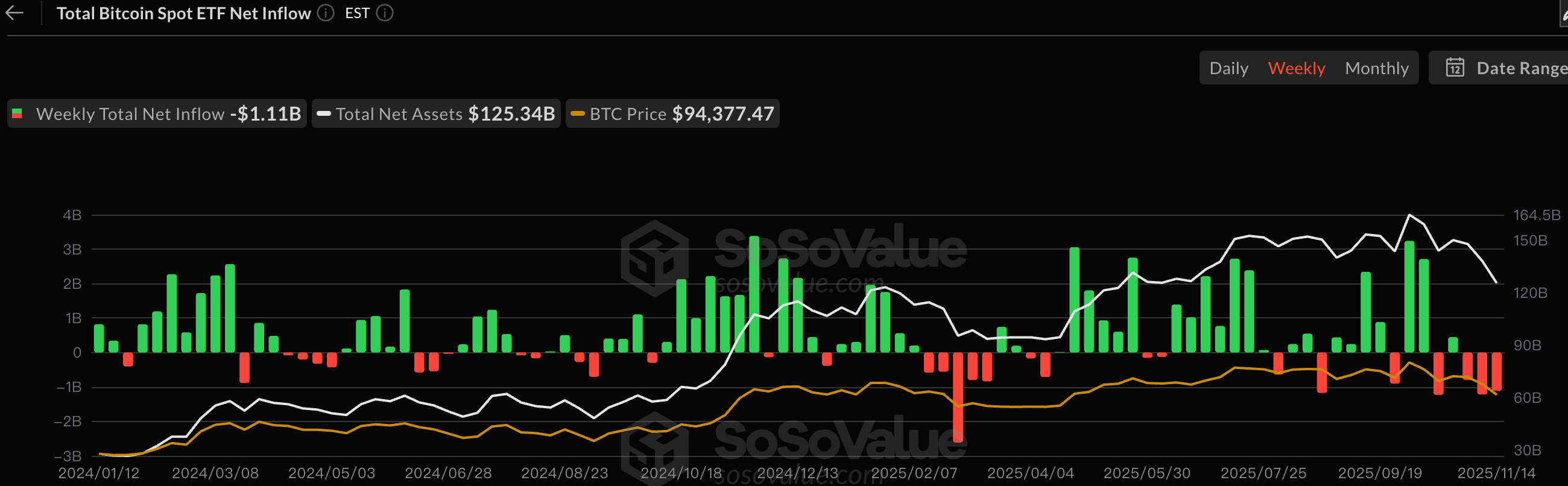

The global cryptocurrency market capitalization totaled $3.40 trillion, down 6.3% from $3.63 trillion last week. As of press time, the total net inflow into US Bitcoin ETFs was approximately $58.85 billion, with a net outflow of $1.11 billion this week; the total net inflow into US Ethereum ETFs was approximately $13.13 billion, with a net outflow of $728 million this week.

The total market capitalization of stablecoins is $304.7 billion, of which USDT has a market capitalization of $183.9 billion, accounting for 60.35% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $74.8 billion, accounting for 24.54% of the total stablecoin market capitalization; and DAI with a market capitalization of $5.36 billion, accounting for 1.76% of the total stablecoin market capitalization.

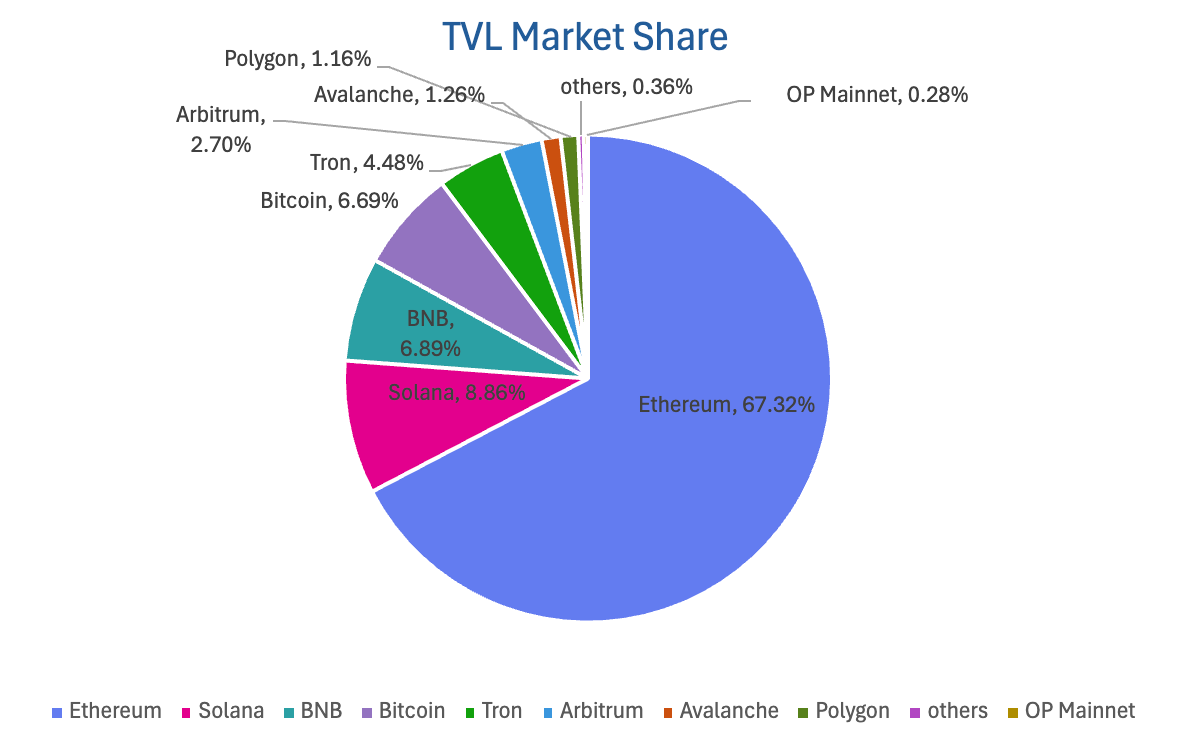

According to DeFiLlama data, the total TVL of DeFi this week was $122.4 billion, a decrease of approximately 8.92% from $134.4 billion last week. Breaking it down by public blockchain, the three blockchains with the highest TVL were Ethereum (67.32%), Solana (8.86%), and BNB Chain (6.89%).

This week, all six major public blockchains weakened, with daily trading volumes declining across the board. Sui (-1.32%) and Ethereum (-6.92%) saw the smallest drops, while Solana (-37.43%), Ton (-32%), BNB Chain (-31.25%), and Aptos (-27.98%) experienced relatively significant declines. In terms of transaction fees, BNB Chain and Ton remained largely unchanged from last week, while Sui surged by 121.88%, and the remaining chains generally declined (Ethereum -50%, Solana -35.56%, Aptos -1.89%). Daily active addresses showed divergence, with BNB Chain (+16%), Ton (+10.41%), and Sui (+7.32%) increasing, while Ethereum (-14.98%) and Aptos (-13.86%) decreased. TVL declined across the board, with Sui experiencing the largest drop of 41.39%. Ton (-20.32%) and Aptos (-12.62%) also saw significant declines, while the other public chains experienced relatively mild drops (Solana -8.58%, Ethereum -6.89%, BNB Chain -7.57%).

New Projects to Watch: Allo is a platform focused on blockchain-based real-world assets (RWAs). The platform allows users to add assets to the blockchain within 2 minutes, and its features include asset issuance, trading, and collateralized lending. Shodai Network is a crypto project funding platform focused on providing financing support for Web3 entrepreneurs, aiming to help projects access healthy and aligned capital. Kyuzo's Friends is an AI-driven Web3 social game built on the well-known IP DNAxCAT, dedicated to providing players with a highly interactive and rewarding gaming experience.

Table of contents

Key points

I. Market Overview

1. Total market capitalization of cryptocurrencies / Bitcoin market capitalization ratio

2. Fear Index

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD exchange rates

5.Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin Market Cap and Issuance Status

II. Hot Money Flows This Week

1. The top five gainers this week: VC coin and Meme coin

2. New Project Insights

III. New Industry Trends

1. Major Industry Events This Week

2. Major events that will happen next week

3. Key Investment and Financing Activities Last Week

IV. Reference Links

I. Market Overview

1. Total market capitalization of cryptocurrencies / Bitcoin market capitalization ratio

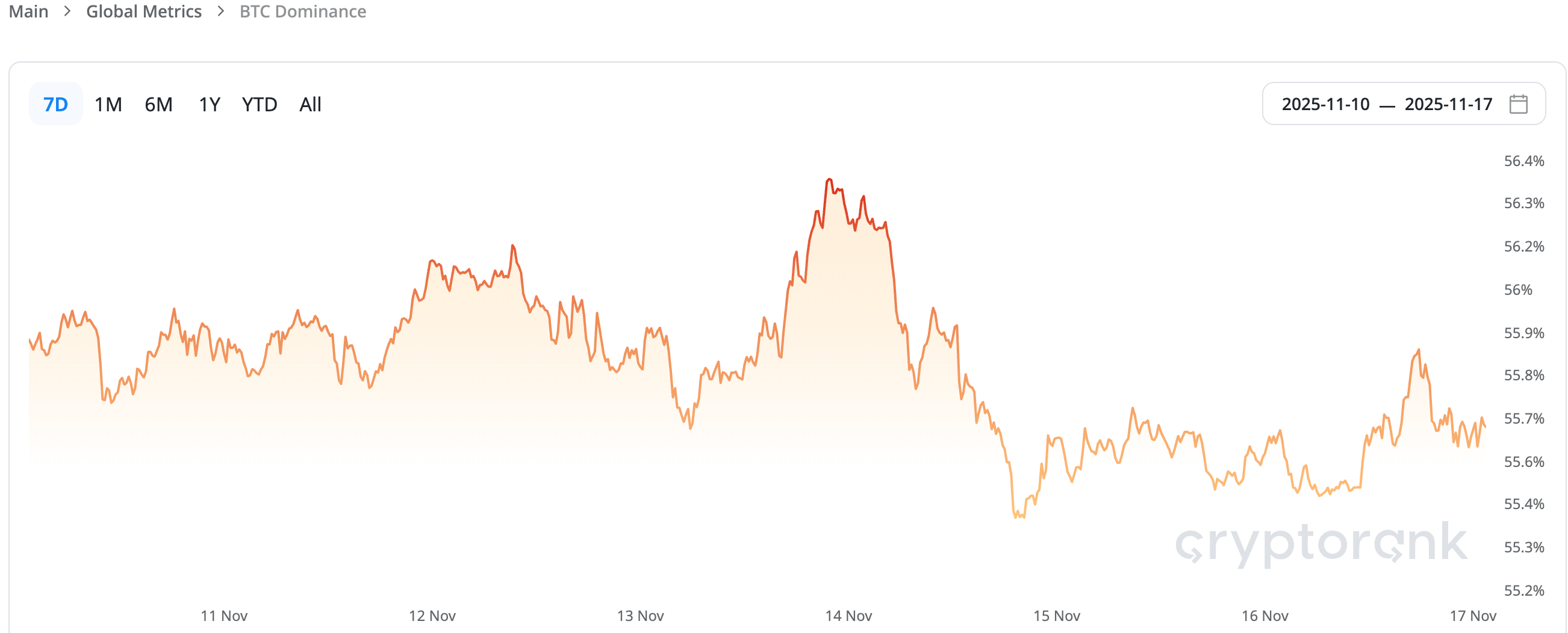

The global cryptocurrency market capitalization totaled $3.40 trillion, down 6.3% from $3.63 trillion last week.

Data source: cryptorank

Data as of November 16, 2025

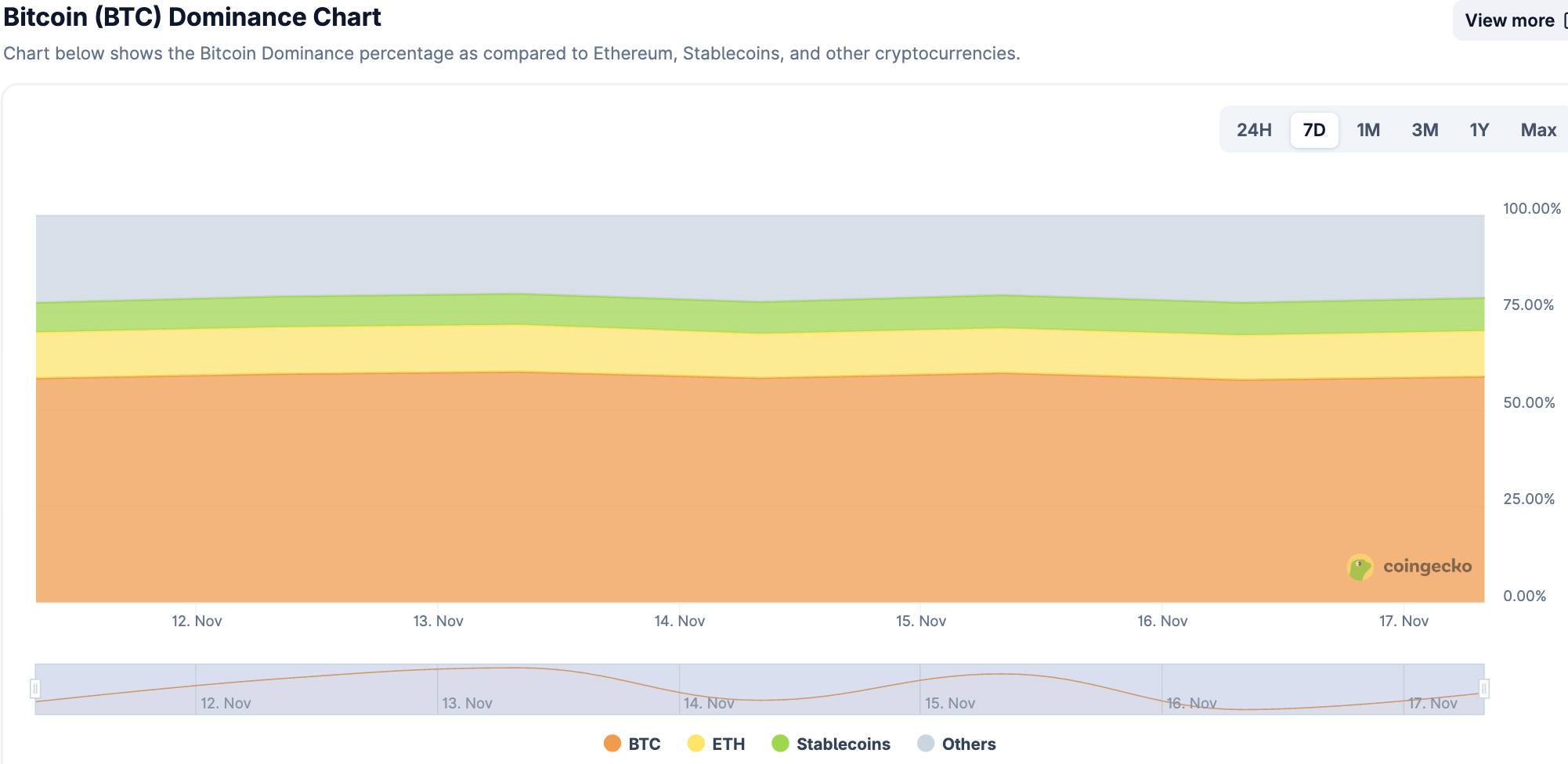

As of press time, Bitcoin's market capitalization was $1.89 trillion, accounting for 55.5% of the total cryptocurrency market capitalization. Meanwhile, stablecoins had a market capitalization of $304.7 billion, representing 8.96% of the total cryptocurrency market capitalization.

Data source: coingeck

Data as of November 16, 2025

2. Fear Index

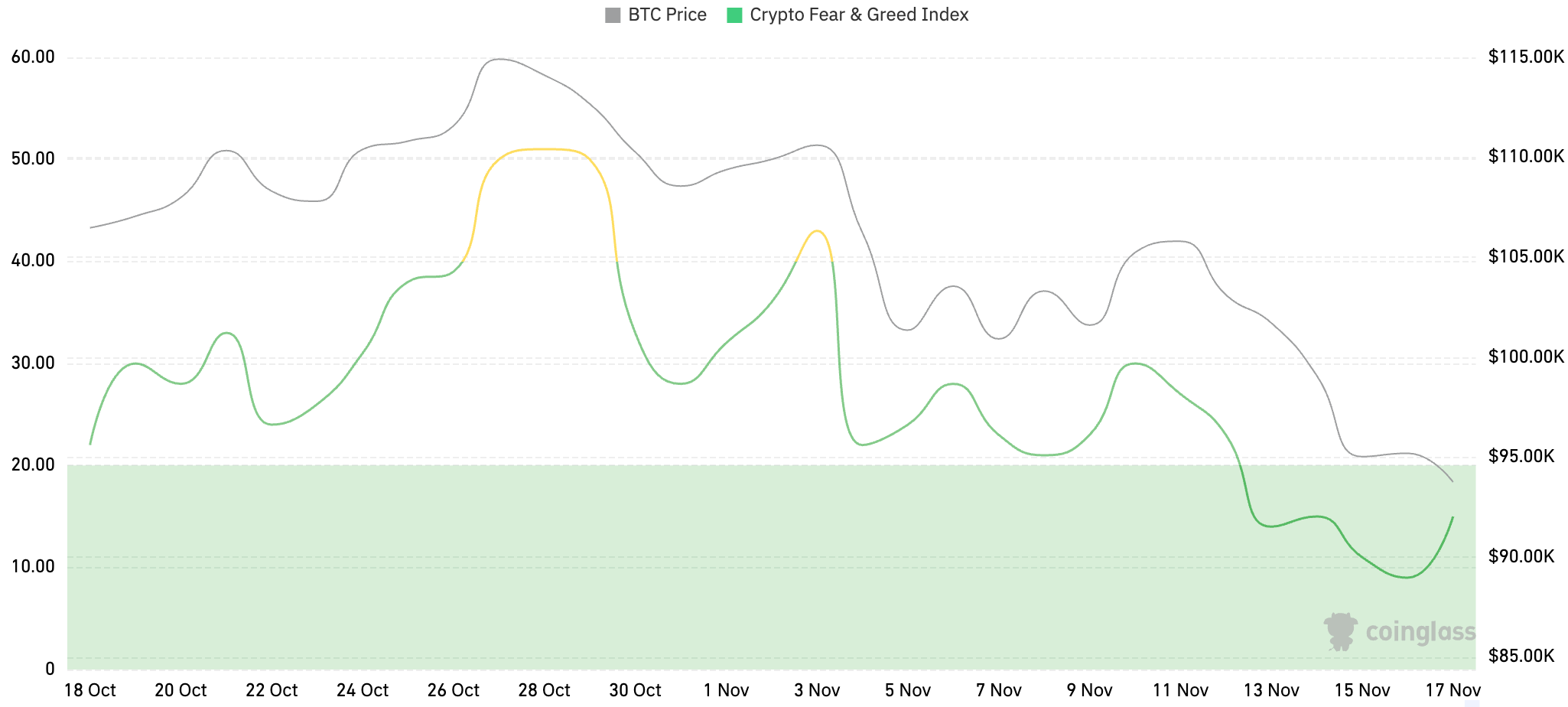

The cryptocurrency fear index is 15, indicating extreme fear.

Data source: coinglass

Data as of November 16, 2025

3. ETF Inflow and Outflow Data

As of press time, the total net inflow into US Bitcoin spot ETFs was approximately $58.85 billion, with a net outflow of $1.11 billion this week; the total net inflow into US Ethereum spot ETFs was approximately $13.13 billion, with a net outflow of $728 million this week.

Data source: sosovalue

Data as of November 16, 2025

4. ETH/BTC and ETH/USD exchange rates

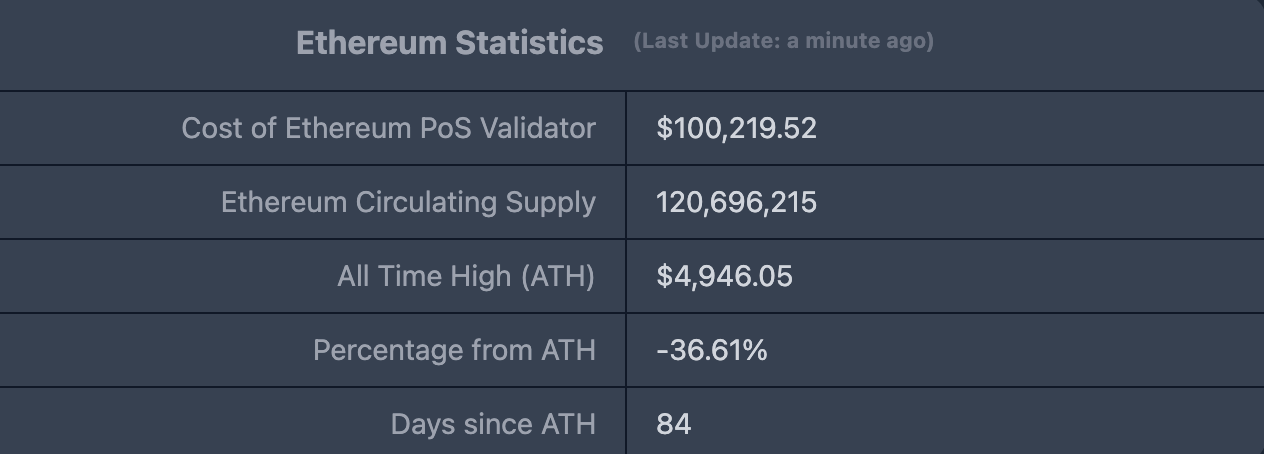

ETHUSD: Current price $3,130.35, all-time high $4,878.26, down approximately 36.61% from the high.

ETHBTC: Currently at 0.032976, with an all-time high of 0.1238.

Data source: ratiogang

Data as of November 16, 2025

5.Decentralized Finance (DeFi)

According to DeFiLlama data, the total TVL of DeFi this week was $122.4 billion, a decrease of approximately 8.92% from $134.4 billion last week.

Data source: defillama

Data as of November 16, 2025

Based on public blockchains, the three public blockchains with the highest TVL are Ethereum (67.32%), Solana (8.86%), and BNB Chain (6.89%).

Data source: CoinW Research Institute, defillama

Data as of November 16, 2025

6. On-chain data

Layer 1 related data

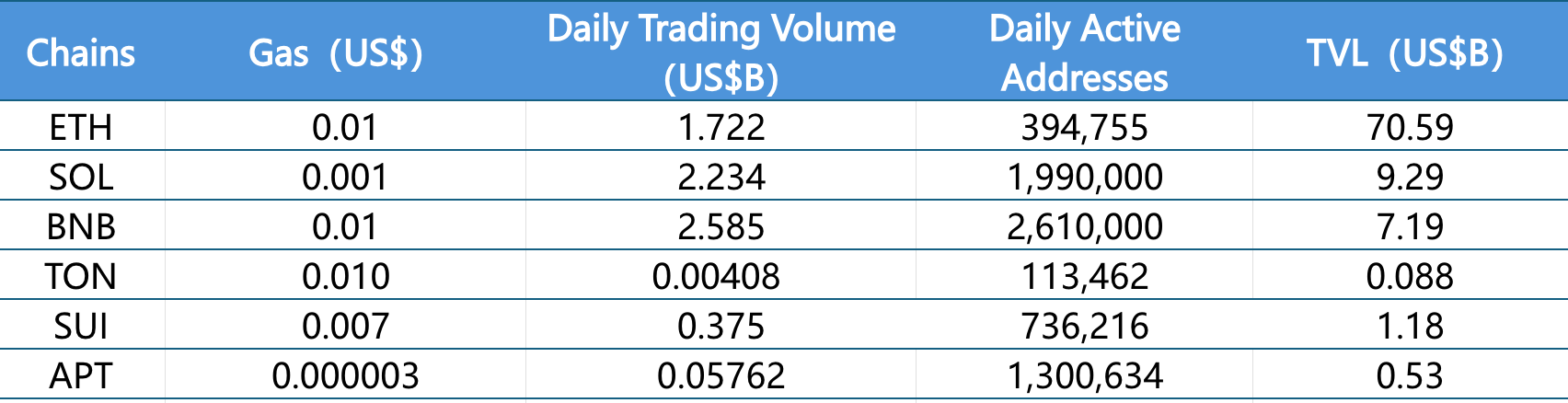

The analysis primarily focuses on daily transaction volume, daily active addresses, and transaction fees, currently covering Layer 1 data including ETH, SOL, BNB, TON, SUI, and APTOS.

Data source: CoinW Research Institute, defillama, Nansen

Data as of November 16, 2025

Daily trading volume and transaction fees: Daily trading volume and transaction fees are core indicators for measuring the activity and user experience of public chains. In terms of daily trading volume, all six public chains experienced a decline, with Sui (-1.32%) and Ethereum (-6.92%) showing the smallest drops and remaining relatively resilient. The remaining chains saw significantly larger declines: Solana fell 37.43%, Ton fell 32%, BNB Chain fell 31.25%, and Aptos fell 27.98%. Regarding transaction fees, BNB Chain and Ton Chain remained flat this week compared to last week; Sui Chain rose 121.88%; the remaining chains saw some declines, namely Ethereum (-50%), Solana (-35.56%), and Aptos (-1.89%).

Daily Active Addresses and TVL: Daily active addresses reflect a public chain's ecosystem participation and user stickiness, while TVL reflects users' trust in the platform. Regarding daily active addresses, Solana remained largely unchanged from last week; BNB Chain (+16%), Ton (+10.41%), and Sui (+7.32%) all saw slight increases, showing relatively stable performance; while Ethereum (-14.98%) and Aptos (-13.86%) experienced some decline. As for TVL, all six major public chains saw a decrease this week, with Sui experiencing the deepest drop of 41.39%; Ton (-20.32%) and Aptos (-12.62%) also saw significant declines; the remaining public chains saw relatively mild declines, namely Solana (-8.58%), Ethereum (-6.89%), and BNB Chain (-7.57%).

Layer 2 related data

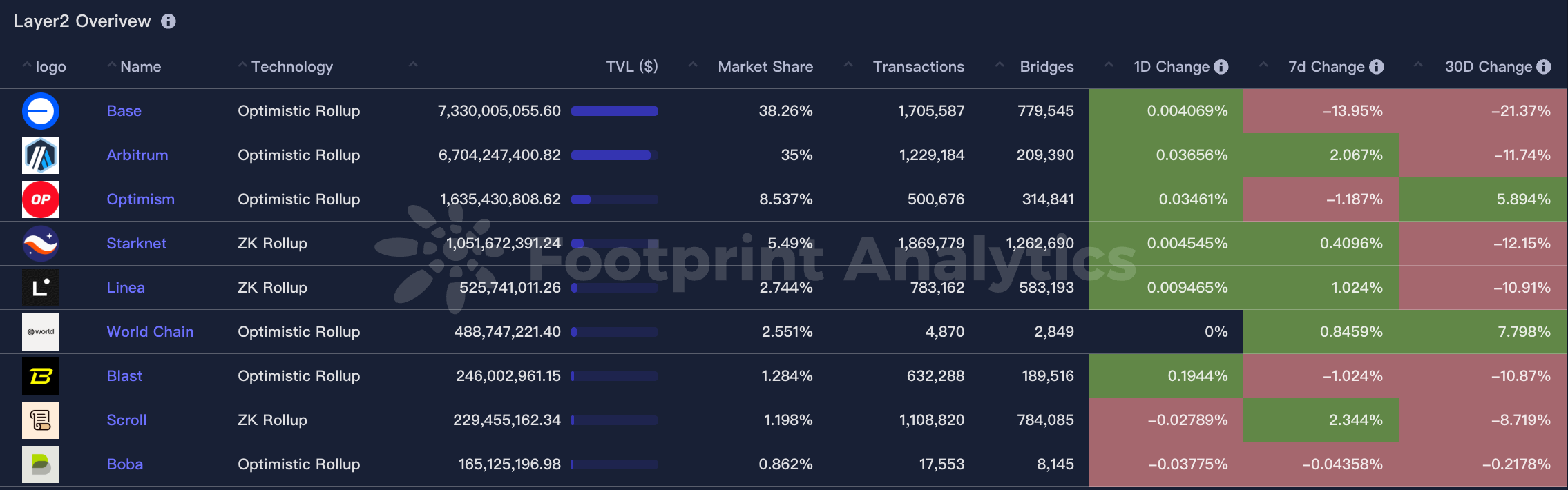

According to L2Beat data, the total TVL of Ethereum Layer 2 is $36.9 billion, a decrease of 8.1% this week compared to last week ($40.14 billion).

Data source: L2Beat

Data as of November 16, 2025

Base and Arbitrum occupy the top positions with market shares of 38.26% and 35% respectively. Base's market share has slightly decreased in the past week, while Arbitrum's has slightly increased.

Data source: footprint

Data as of November 16, 2025

7. Stablecoin Market Cap and Issuance Status

According to Coinglass data, the total market capitalization of stablecoins is $304.7 billion, of which USDT has a market capitalization of $183.9 billion, accounting for 60.35% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $74.8 billion, accounting for 24.54% of the total stablecoin market capitalization; and DAI with a market capitalization of $5.36 billion, accounting for 1.76% of the total stablecoin market capitalization.

Data source: CoinW Research Institute, Coinglass

Data as of November 16, 2025

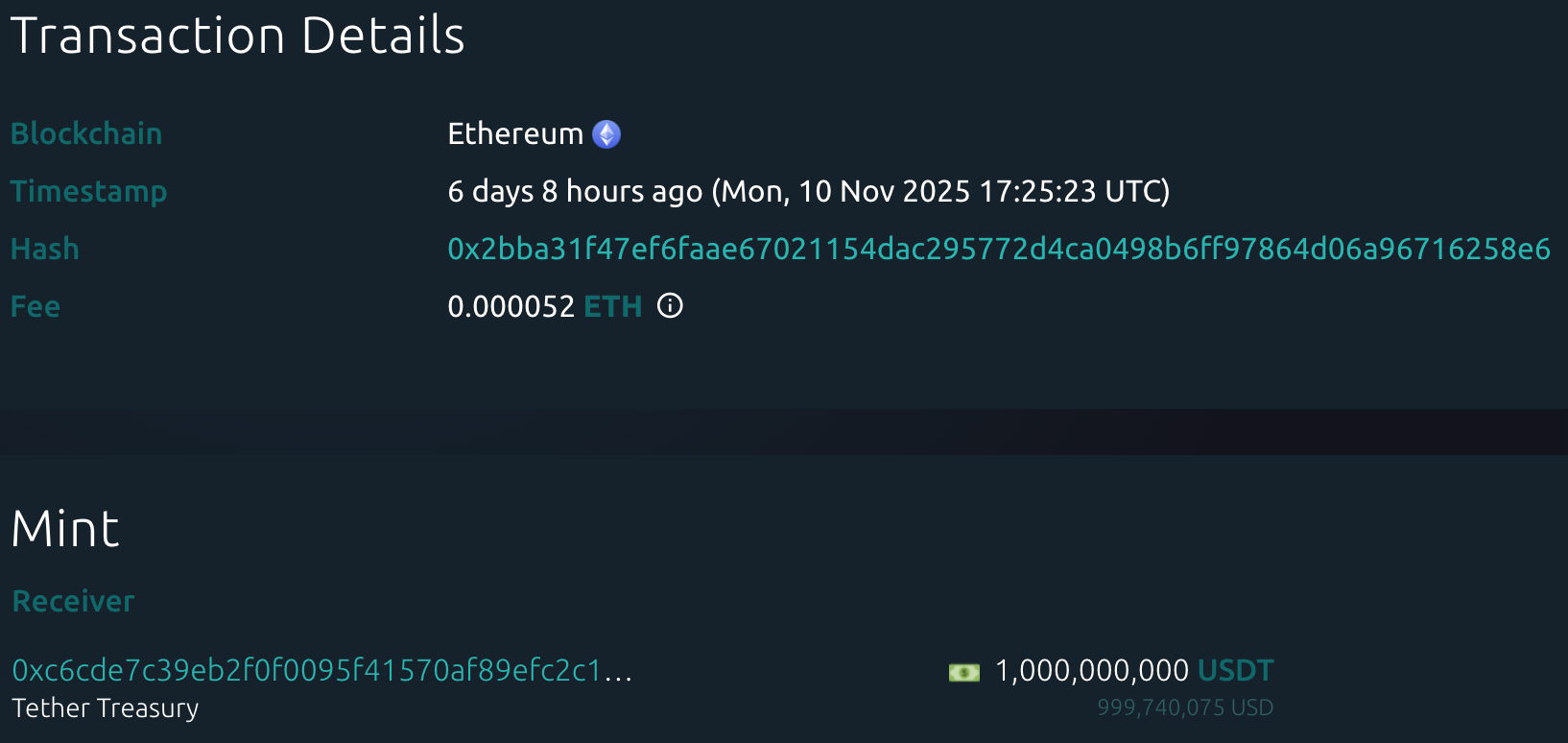

According to Whale Alert data, the USDC Treasury issued a total of 2.698 billion USDC this week, while the Tether Treasury issued a total of 1 billion USDT. The total stablecoin issuance this week was 3.698 billion, a 78.05% increase compared to last week's total stablecoin issuance (2.077 billion).

Data source: Whale Alert

Data as of November 16, 2025

II. Hot Money Flows This Week

1. The top five gainers this week: VC coin and Meme coin

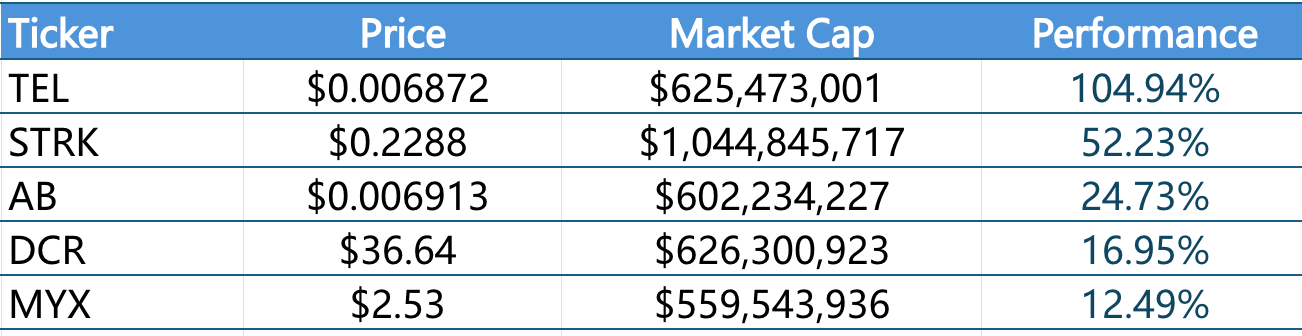

The top five performing VC coins in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of November 16, 2025

The top five gainers in the past week: Meme coins

Data source: CoinW Research Institute, coinmarketcap

Data as of November 16, 2025

2. New Project Insights

Allo is a platform focused on digitizing real-world assets (RWAs) on the blockchain, with a mission to digitize over $1 trillion in real-world assets by 2030. The platform allows users to add assets to the blockchain within two minutes. Its features include asset issuance, trading, and collateralized lending, and it has already achieved a scale of over $2.4 billion in on-chain assets. By converting traditional assets such as private equity, real estate, and Bitcoin-backed lending into tokens that can circulate on the blockchain, Allo bridges the gap between traditional finance and blockchain, making assets more liquid and easier to invest in.

Shodai Network is a crypto project funding platform focused on providing financing support to Web3 entrepreneurs, aiming to help projects access healthy and aligned capital. Through customized support and solutions, the platform assists founding teams in connecting more efficiently with suitable investors, promoting the sustainable development of the Web3 ecosystem.

Kyuzo's Friends is an AI-powered Web3 social game built on the popular IP DNAxCAT, aiming to provide players with a highly interactive and rewarding gaming experience. As one of the first projects officially supported by the LINE Dapp Portal, it leverages LINE's vast ecosystem to offer highly social gameplay. Players can explore maps, build and upgrade structures, and interact cooperatively or competitively, collectively driving game progress and growth through rich social mechanisms.

III. New Industry Trends

1. Major Industry Events This Week

On November 11th, the AI decentralized network project Allora officially launched its mainnet and completed the ALLO token generation event (TGE). The total supply of the project's tokens is 1 billion, of which 9.3% (approximately 93 million) is allocated to the community and ecosystem, with approximately 5% released as airdrop rewards on the launch day. Airdrop eligibility was determined through snapshots taken between October 23rd and 25th, and was open to early testnet participants, node contributors, model trainers, and active community members. At the time of the mainnet launch, approximately 200 million ALLO tokens (20.05%) entered circulation for ecosystem incentives and community development.

On November 10th, Janction (JCT), an AI and data-driven platform, completed its token generation event (TGE) and launched its first airdrop. The total token supply is 50 billion, with approximately 1.15 billion (22.99% of the total) entering circulation upon launch. The first airdrop distributed approximately 2.85 billion tokens (5.7%). The remaining tokens were primarily allocated to the ecosystem fund (34.29%), the team (21.34%), the foundation (18%), and investors (10%), with a lock-up and linear release mechanism in place to ensure the project's long-term stable development.

On November 12th, Planck Network (PLANCK) completed its Token Generation Event (TGE), with a total token supply of 500 million and an initial circulating supply of approximately 17.66%. The project has not yet announced specific plans for a large-scale airdrop. Planck Network is a network protocol focused on providing high-performance data transmission and cross-chain communication infrastructure for Web3, aiming to improve inter-chain interoperability and data synchronization efficiency through modular design.

On November 14th, Play Solana (PLAYSOLANA) launched its first airdrop event, revealing that 56% of its tokens will be allocated to the community to incentivize early participants and drive ecosystem growth. Play Solana is an on-chain gaming platform based on the Solana ecosystem, dedicated to creating an interactive experience that integrates entertainment, social interaction, and rewards.

2. Major events that will happen next week

Monad's mainnet and its native token MON are scheduled to launch on November 24th at 9:00 AM Eastern Time. On November 10th, Monad officially announced its token economic model and airdrop and TGE plans. Previously, the foundation had opened a token claim portal from mid-October to November 3rd for users to check and claim their allocations. The total supply of MON is 100 billion, with 7.5% allocated to the public sale (sold at $2.5 billion FDV), 3.3% to the airdrop, and the remainder distributed to ecosystem development (38.5%), the team (27%), investors (19.7%), and the treasury (4%). On the mainnet launch day, approximately 10.8% of the tokens (public sale + airdrop) will be in circulation, and another 38.5% of the ecosystem fund will be unlocked, resulting in a total unlocking rate of 49.4% on the first day. The team and investor shares will be locked for at least one year to ensure long-term incentives.

Finsteco (FNST) will hold its Initial Public Offering (IDO) from November 11th to 18th, with a token price of $0.09 and a planned fundraising of approximately $1.3 million. The total token supply is 1 billion. The project is expected to hold a Token Generation Event (TGE) on November 18th, at which time approximately 10% of the tokens will be released, with the remainder unlocked linearly over approximately 9 months.

Kain, founder of the cross-chain DeFi aggregation platform Infinex, announced that Infinex will soon launch its TGE (Token Generation Event), with a total supply of 10 billion INX, 100% of which will be allocated to Patrons. There will be a total supply of 100,000 Patron NFTs, with each Patron NFT yielding 100,000 INX. Users holding µPatron NFTs will receive INX tokens at a 1:10 ratio. The Infinex Treasury will retain approximately 33% of the token supply, with a portion used for Patrons sales, a portion for future incentives, and the remainder held by the Treasury. Patron NFTs will be converted to the classic PFP format after the TGE. On the first day of the TGE, Infinex will integrate and be compatible with all tokens and decentralized applications on the Monad, MegaEth, and Fogo chains.

Solomon Labs (SOLO) will conduct a public sale on the MetaDAO platform from November 14th to November 18th, aiming to raise $2 million and issue 10 million SOLO tokens (approximately 38.76% of the total supply, with a total supply of 25,800,000 tokens). The public sale price is set at approximately $0.20 per token, with no additional lock-up period.

3. Key Investment and Financing Activities Last Week

Decentralized perpetual contract trading protocol Lighter announced the completion of a $68 million funding round, led by Peter Thiel's Founders Fund and Ribbit Capital, with participation from Haun Ventures and Robinhood. This funding round values Lighter at approximately $1.5 billion. Lighter is a decentralized perpetual contract trading protocol based on Ethereum, employing a dedicated zk-rollup architecture to provide a scalable, secure, transparent, and verifiable order book trading infrastructure. (November 11, 2025)

Crypto startup Seismic announced the completion of a $10 million funding round, led by a16z crypto, with participation from Polychain, Amber Group, TrueBridge, dao5, LayerZero, and others, bringing its total funding to $17 million. Seismic aims to build blockchain infrastructure that implements encryption at the protocol layer, providing enhanced security and privacy by encrypting global state, memory access, and data streams. (November 12, 2025)

AgentLISA has raised $12 million in funding, led by Redpoint China and NGC Ventures, with participation from UOB Venture Management, Signum Capital, Hash Global, and LongHash Ventures. This round of funding will primarily be used to accelerate platform technology development, improve its AI security agent system, and expand the global deployment of its "Agent-to-Agent Economy." AgentLISA is a Web3-based AI security platform focusing on automated auditing and risk analysis of smart contracts and autonomous AI agents. The project is based on a multi-agent large-scale model framework, enabling real-time monitoring of on-chain contracts and smart agents. (November 13, 2025)

Acurast announced the completion of an $11 million funding round, with backers including Ethereum co-founder and Polkadot founder Gavin Wood, MN Capital founder Michael van de Poppe, and GlueNet founder Ogle. Acurast will launch its mainnet and issue its native token, ACU, on November 17th. As a decentralized confidential computing network, Acurast utilizes globally distributed consumer mobile phones as trusted hardware to provide tamper-proof and verifiable confidential computing capabilities. Through hardware endorsement and key authentication mechanisms, it ensures that only manufacturer-certified systems can participate in computation, preventing data tampering. (November 13, 2025)

IV. Reference Links

1. ALLO: https://allo.xyz/

2.Seismic: https://www.seismic.systems/

3.Shodai Network: https://shodai.network/

4.Kyuzos Friends: https://kyuzosfriends.com/

5.Lighter: https://lighter.xyz/

6.AgentLISA: https://agentlisa.ai/

7.Acurast: https://acurast.com/

- 核心观点:加密货币市场本周全面回调。

- 关键要素:

- 总市值下降6.3%至3.40万亿美元。

- 美比特币ETF本周净流出11.1亿美元。

- DeFi总TVL下降8.92%至1224亿美元。

- 市场影响:短期市场情绪转向极度恐慌。

- 时效性标注:短期影响