WealthBee Monthly Report: Fed Rate Cuts Overcome Triple Pressures, Crypto Assets Solidify Mainstream Foundation Amid Volatility

- 核心观点:加密资产在宏观波动中加速主流化。

- 关键要素:

- 美联储降息推动全球流动性宽松。

- 机构资金取代散户主导市场结构。

- 监管框架明确提升合规确定性。

- 市场影响:推动加密资产与传统金融加速融合。

- 时效性标注:中期影响

In October 2025, the world will find respite as the Federal Reserve embarks on a critical turning point, initiating its rate-cutting cycle. The injection of market liquidity will fuel a general rebound in risk assets. Cryptocurrencies, amidst this macroeconomic environment and their inherent high volatility, exhibit a striking "polar" characteristic. On one hand, the market experienced sharp short-term price fluctuations, with profit-taking and concerns about policy paths triggering several technical corrections. On the other hand, a deeper story is that the foundation for their mainstream adoption is being continuously strengthened amidst this volatility .

Amidst a triple whammy of uncertain data, internal disagreements, and external political pressure, the Federal Reserve, as expected, initiated its second interest rate cut of the year in October, lowering rates by 25 basis points. Although the market had largely anticipated this decision, the exceptionally difficult balancing act behind it still casts a shadow of uncertainty over future policy directions.

The federal government shutdown, which lasted for several weeks, resulted in a significant lack of key economic data, including the non-farm payroll report, forcing the Federal Reserve to navigate in a fog . Scattered pieces of information still outline a slowdown in economic growth: the unemployment rate rose to a recent high of 4.3% in August, and large companies such as Amazon and Target announced unprecedented layoffs. These signs reinforced the assessment that the labor market is cooling, providing a basis for interest rate cuts. Meanwhile, the consumer price index rose 3% year-on-year in September, approaching the 2% target after adjusting for tariffs, but still indicating that the fight against inflation is not yet complete , and the sustainability of the easing policy remains to be seen.

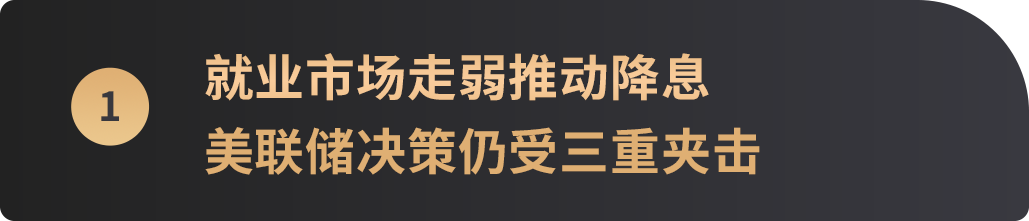

This complex situation has led to an unusual polarization within the Federal Reserve . While newly appointed Governor Milan advocated for a more aggressive 50-basis-point rate cut, Kansas City Fed President Schmid insisted on keeping rates unchanged. This two-way disagreement is unprecedented in this rate-cutting cycle, exposing a deep division within the policymakers between "preventing recession" and "preventing inflation." As Powell stated after the meeting, there was "significant disagreement" within the committee regarding the next move in December, and a rate cut was far from certain. This statement immediately triggered market volatility; CME Watch data showed that market expectations for a December rate cut fell sharply from 90% before the meeting to 67%.

Meanwhile, the ongoing political pressure from the White House is further testing the independence of the Federal Reserve. President Trump has repeatedly criticized Powell for his slow action, and the dissenting vote cast by his appointed Fed Governor Milan at this meeting is seen as a clear sign of political influence. With Powell's term ending next May, the selection process for his successor has been led by Treasury Secretary Bessant, adding another layer of uncertainty to the future path of monetary policy. Against this backdrop, the Fed also announced that it will officially end its three-and-a-half-year balance sheet reduction program on December 1st. This decision, symbolizing the end of the monetary policy normalization cycle, is interpreted by the market as the Fed reserving policy space to cope with a potentially more significant economic slowdown .

Looking ahead, the Federal Reserve's policy path will rely more heavily on clear data guidance, all of which depends on the resolution of the political deadlock in Washington and the restoration of key economic statistics.

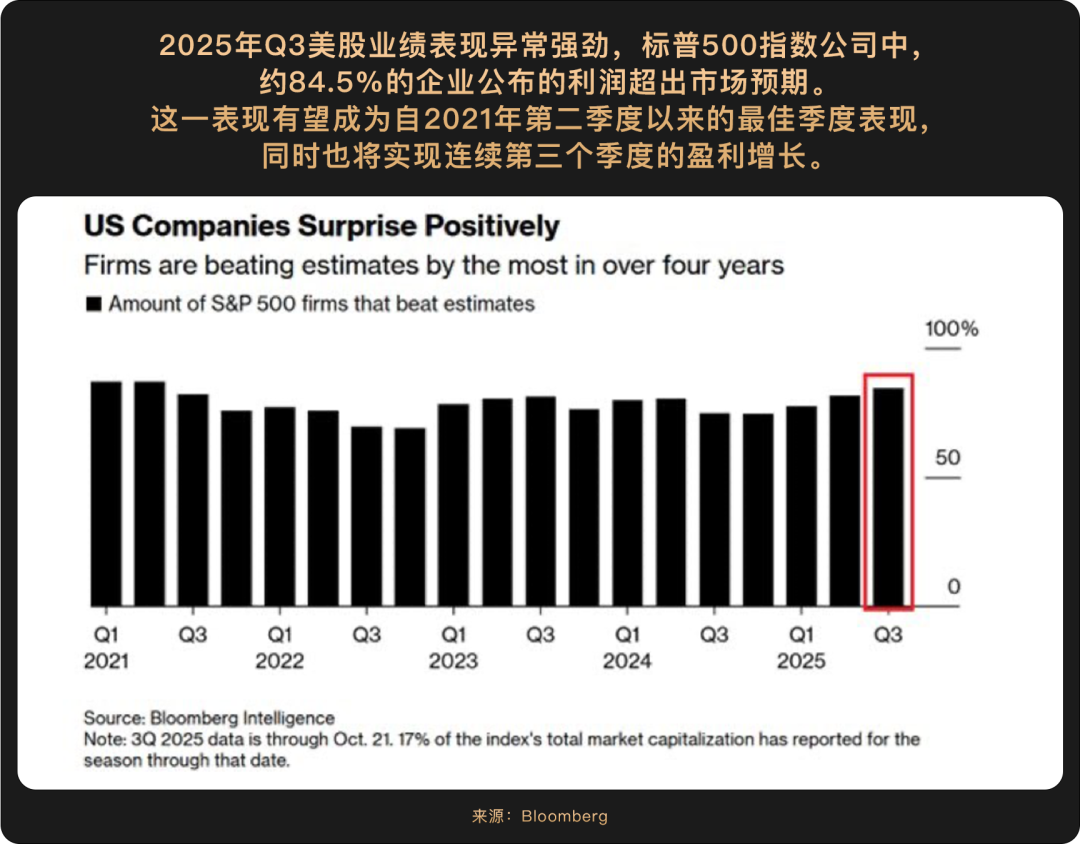

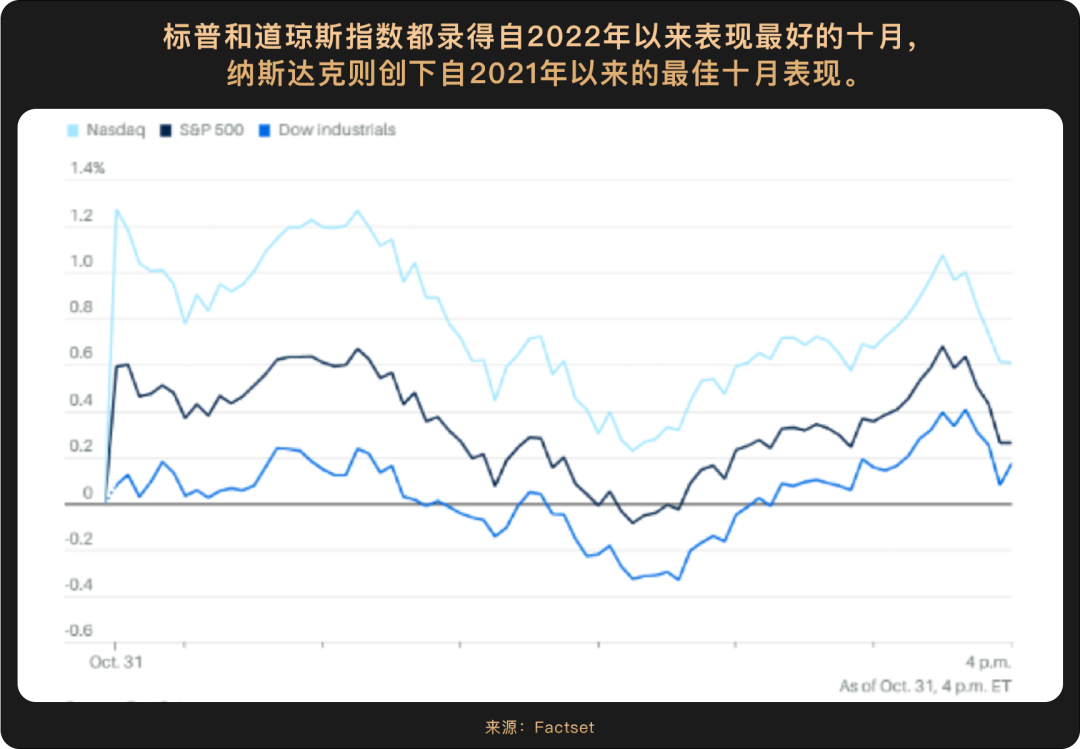

Wall Street's frenzied October saw extreme swings between fear and euphoria, with the US stock market exhibiting a pattern of significant volatility and structural gains driven by a confluence of factors. Despite a sharp 3.56% drop in the Nasdaq at the beginning of the month due to Trump's threats to cut Democratic projects and the ongoing government shutdown, the market gradually recovered and repeatedly challenged new highs, supported by increased expectations of a Federal Reserve rate cut and positive corporate earnings. Technology stocks and the semiconductor sector became the main drivers of this rally, their performance fully reflecting the interplay of policy, earnings, and industry trends.

The Federal Reserve's monetary policy direction is key to the shift in market sentiment. New York Federal Reserve Bank President Williams explicitly supports further interest rate cuts this year to address the risk of a sharp slowdown in the labor market. Meanwhile, lower-than-expected September CPI data alleviated inflationary pressures to some extent, while the government shutdown, which delayed economic data releases, reinforced market expectations that the Fed would maintain an accommodative stance. This expectation pushed the dollar index down, further stimulating the valuation recovery and rise of growth assets, particularly technology stocks.

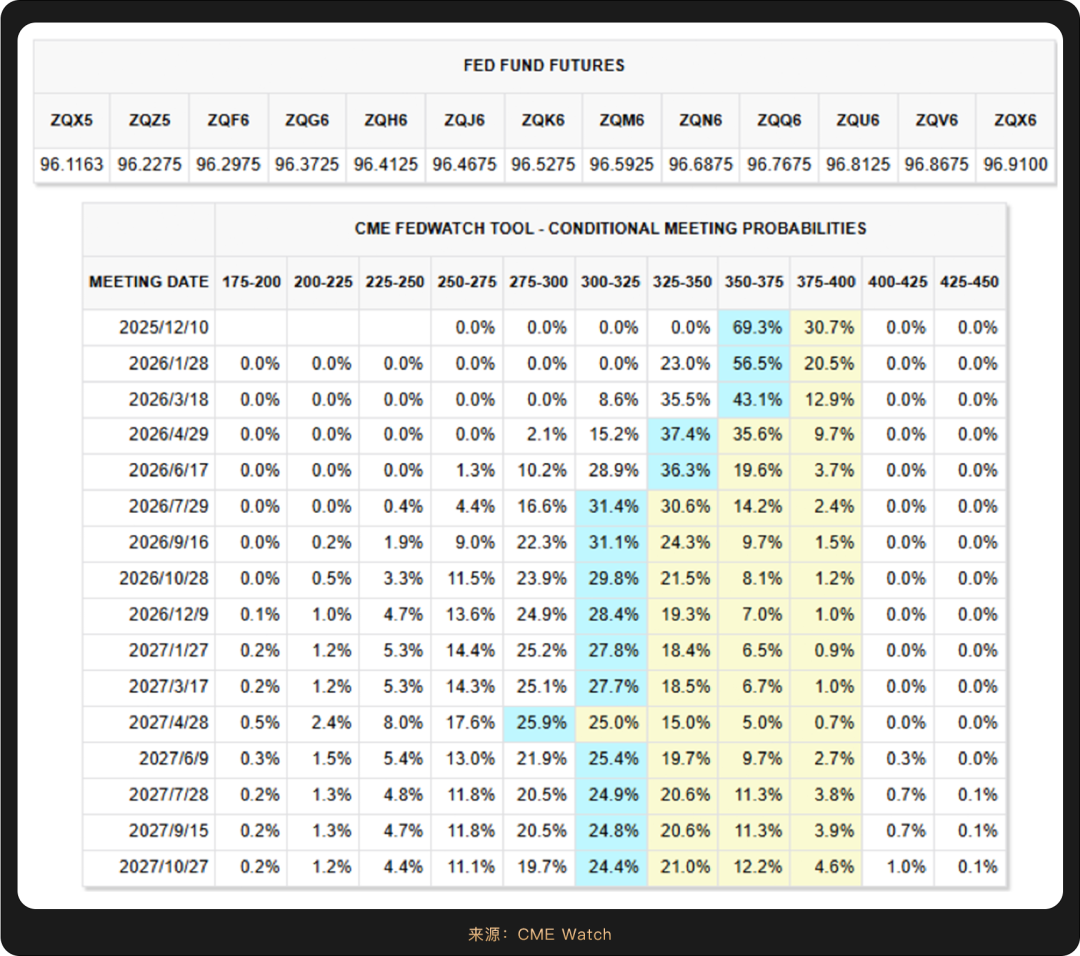

From a corporate profitability perspective, the third-quarter earnings season has become a crucial litmus test for evaluating the commercial value of AI. While Tesla's net profit declined by 37% year-on-year, its energy business revenue surged by 44%, and its AI infrastructure assets reached $6.621 billion, demonstrating a deepening strategic layout in the energy and artificial intelligence sectors. The market's mild reaction to Tesla confirms investors' understanding and patience regarding long-term investments in AI .

Silicon Valley tech giants reported strong overall results, exceeding analysts' expectations. For example, Alphabet, Google's parent company, saw revenue grow by 17.3% year-over-year, while Microsoft's revenue increased by approximately 18%. AI and cloud services were the core drivers of this earnings season. A prominent feature of this earnings season was that cloud services and AI-related revenue became the fastest-growing engines for all the giants. For instance, Alphabet's Google Cloud revenue surged by 33.5% year-over-year; Microsoft's Intelligent Cloud segment also saw revenue increase by approximately 28%. This clearly demonstrates that strong corporate demand for AI infrastructure and solutions is directly translating into financial growth for these giants.

To seize the commanding heights of the AI era, tech giants are significantly increasing capital expenditures to invest in AI infrastructure. Microsoft's capital expenditures in the third quarter surged by more than 74% year-on-year, reaching $34.9 billion; Alphabet also raised its full-year capital expenditure guidance to $91 billion to $93 billion. Behind this "arms race" lies the giants' optimistic expectations for the future demand for AI and their strategic determination to establish a long-term advantage.

This earnings season, Silicon Valley giants have clearly outlined a new development landscape: leveraging their deep investments in cloud and AI to achieve strong growth, and betting heavily on an AI-driven future through unprecedented capital investment.

Overall, US stocks in October exhibited a pattern of "rising amid volatility, led by technology stocks," supported by both accommodative policies and resilient earnings. Despite fluctuations caused by political uncertainty and diverging corporate earnings, the capital expenditure cycle driven by the AI technology revolution and the growth of cloud businesses continue to inject sustained momentum into the market.

However, these aggressive expansion strategies may clash sharply with macroeconomic risks such as geopolitics and government shutdowns. The US government shutdown has now lasted over 30 days, and estimates suggest that the continued shutdown could cause losses of $7 billion to $14 billion per week, losses that would be irreparable once the government reopens. The IMF has issued a rare warning of a US stock market crash, and Goldman Sachs has also pointed out that the risk of a market decline outweighs the risk of an upside.

The much-anticipated "Uptober" seasonal rebound in the crypto market was abruptly halted in October 2025 by a double whammy of geopolitical tensions and a sharp sell-off. Bitcoin closed down 3.69% that month, far below its historical average return of 21.89% for the same period. The main reason was that the marginal tightening of global liquidity, coupled with the concentrated clearing of excessive leverage in the previous period, jointly suppressed the potential for price increases.

It should be noted that the market's short-term weakness has not shaken the foundation of Bitcoin's long-term value. Every market fluctuation serves as a touchstone for testing the asset's worth . The deep structure of the current Bitcoin market is undergoing a fundamental transformation : the era of retail investor dominance is fading, and the flow of funds and decision-making logic of institutional investors are reshaping the price formation mechanism.

This shift is particularly evident in fund flows. When DATs and ETFs experience temporary weakness in their fund flows, funds instead accelerate their flow into core assets like Bitcoin, which have strong compliance requirements and high technological barriers. MicroStrategy's firm stance of adding 388 Bitcoins in a single week during a market correction demonstrates that institutional capital is still casting its vote of confidence with concrete actions.

Significant changes are also brewing at the macro level. The Federal Reserve's further interest rate cut in October, coupled with the global broad money supply (M2) surpassing $96 trillion to a record high, signals the start of a global liquidity easing cycle . This macroeconomic backdrop creates an ideal breeding ground for risk assets such as Bitcoin. Positive developments are also emerging on the political front: the Trump administration's clear support for crypto assets, and revelations from family members about increased holdings by central banks in multiple countries, provide the market with unprecedented policy certainty.

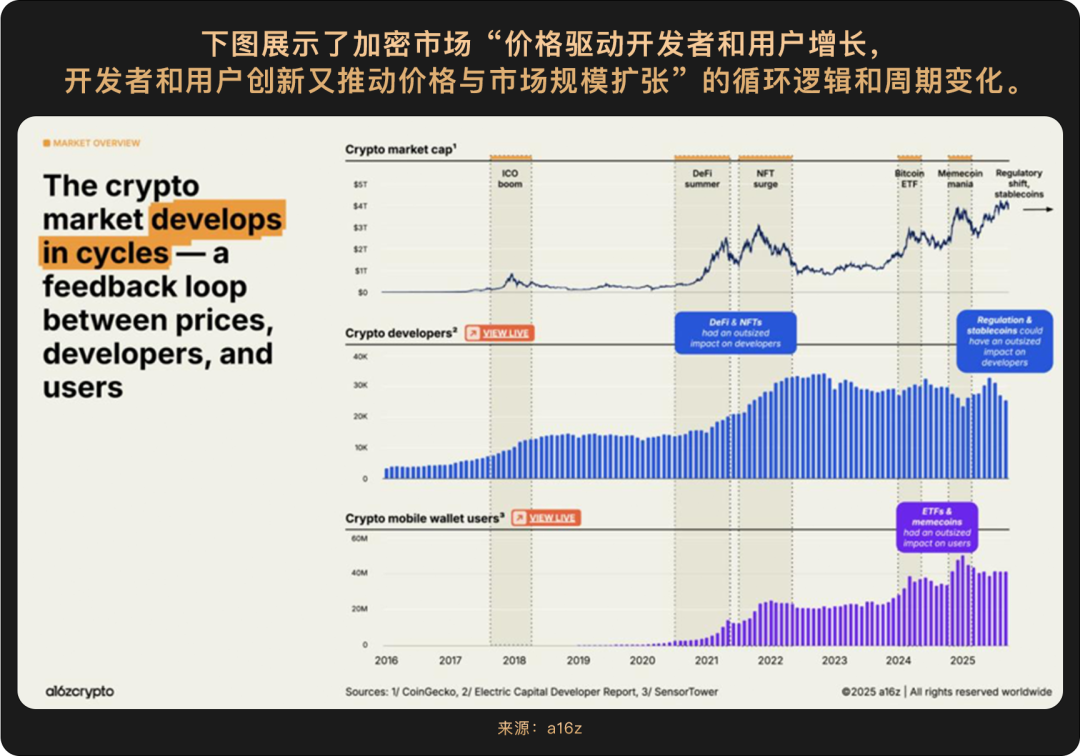

As a16z's "2025 Cryptocurrency Status Report" succinctly concludes: " Cryptocurrencies have left adolescence and officially entered adulthood ." This report defines 2025 as the inaugural year of cryptocurrencies and points out four significant characteristics of industry maturity : First, regulatory attitudes have shifted from hostility to support, with the GENIUS Act establishing a clear compliance framework. Second, in terms of market structure , institutional funds have replaced retail investors as the dominant price force, as evidenced by the $7.8 billion net inflow into Bitcoin spot ETFs in the third quarter. Third, in terms of fund flows , institutions have continuously increased their holdings amidst volatility, driving funds towards high-quality assets. Fourth, in terms of technology , Bitcoin is continuously enhancing its core value as a settlement layer by strengthening its resistance to censorship.

In conclusion, the crypto world in 2025 is at a critical turning point: it enjoys the institutional funding, regulatory clarity, and technological upgrades brought about by mainstreaming , but it must also face new challenges—changes in cyclical patterns, adjustments in market structure, and inevitable high volatility.

As the year draws to a close, a wait-and-see attitude is inevitable in the market. However, short-term panic will eventually be digested over time . We can still expect that assets with genuine technological value and compliance advantages will demonstrate resilience through cycles in the wave of accelerated integration between traditional finance and the crypto world.