From confronting the SEC to heading towards an IPO, Grayscale's ambitions for a $35 billion crypto empire

Original author: Eric, Foresight News

On the evening of November 13th, Beijing time, Grayscale filed for an IPO with the New York Stock Exchange, planning to list on the US stock market through Grayscale Investment, Inc. Morgan Stanley, Bank of America Securities, Jefferies, and Cantor are the lead underwriters for this IPO.

It's worth noting that Grayscale's IPO employed an umbrella partnership structure (Up-C), meaning that Grayscale's operating and controlling entity, Grayscale Operating, LLC, is not the listing entity. Instead, the IPO is conducted through a newly established listing entity, Grayscale Investment, Inc., which acquires a portion of the LLC's equity to achieve public trading. The company's founders and early investors can convert their LLC equity into shares of the listing entity, enjoying capital gains tax benefits and only needing to pay personal income tax. IPO investors, however, are required to pay taxes on the company's profits and personal income tax on dividends received from the shares.

This listing structure not only benefits the company's "veterans" in terms of taxation, but also allows them to maintain absolute control over the company after listing through the use of dual-class shares. The S-1 filing shows that Grayscale is wholly owned by its parent company, DCG, and Grayscale has explicitly stated that after the listing, DCG will still have decision-making power over major matters through its 100% ownership of the Class B shares with greater voting rights. The funds raised in the IPO will also be used entirely to acquire equity from LLC.

Grayscale is no stranger to anyone. It was the first to launch Bitcoin and Ethereum investment products. Through a hard-fought battle with the SEC, it successfully converted the Bitcoin and Ethereum Trust into a spot ETF. Its digital large-cap fund is also quite powerful, resembling a "cryptocurrency version of the S&P 500". During the last bull market cycle, every adjustment of the large-cap fund caused significant short-term fluctuations in the prices of the removed and newly added tokens.

According to the S-1 filing, as of September 30th of this year, Grayscale's total assets under management reached $35 billion, making it the world's largest cryptocurrency asset manager. It offers over 40 digital asset investment products, covering more than 45 cryptocurrencies. The $35 billion includes $33.9 billion in ETPs and ETFs (primarily Bitcoin, Ethereum, and SOL-related products) and $1.1 billion in private equity funds (mainly altcoin investment products).

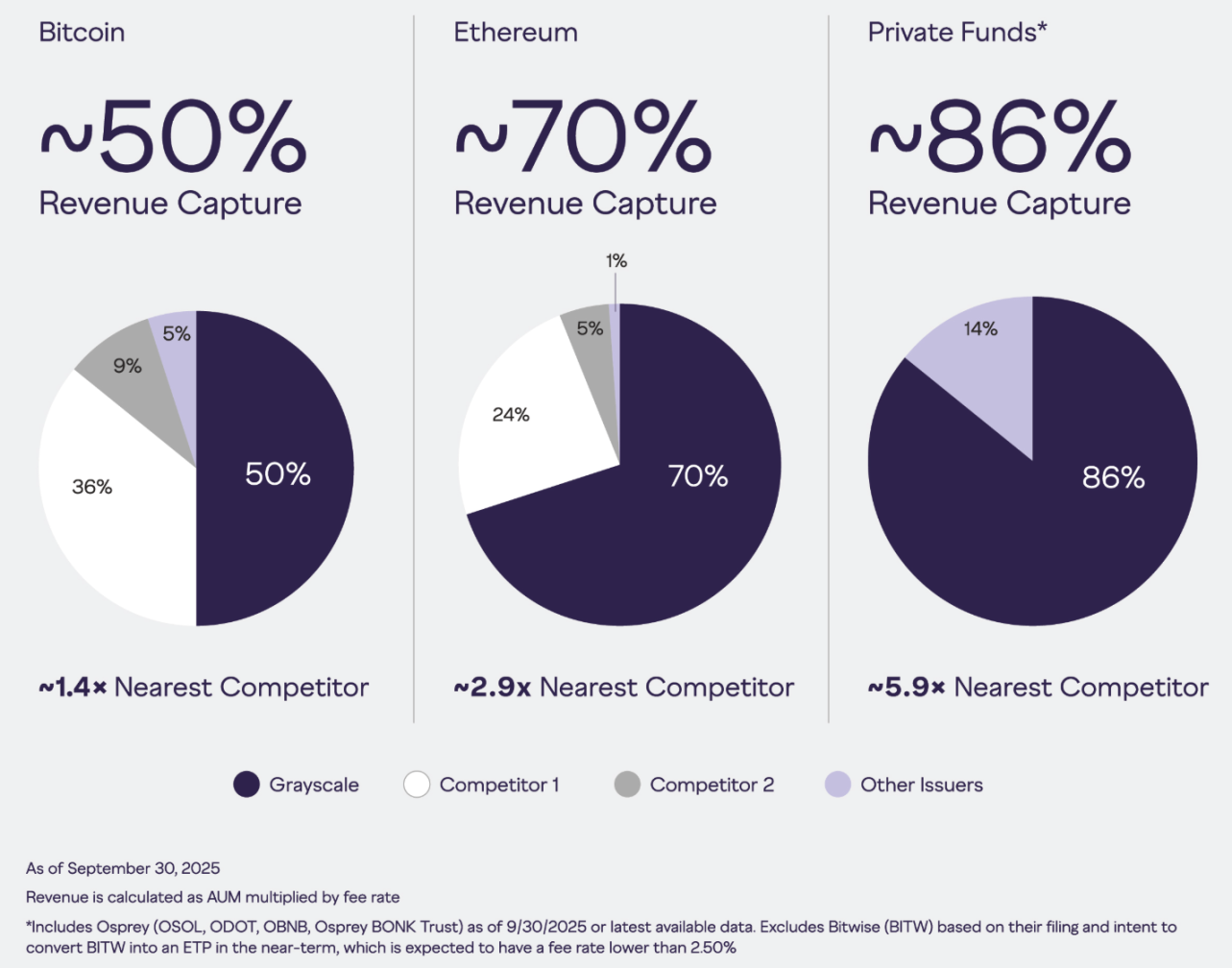

In addition, in terms of revenue alone, Grayscale's main investment products have stronger revenue capabilities than its main competitors, but this is mainly due to the AUM accumulated from previous non-redeemable trusts and management fees that are higher than the industry average.

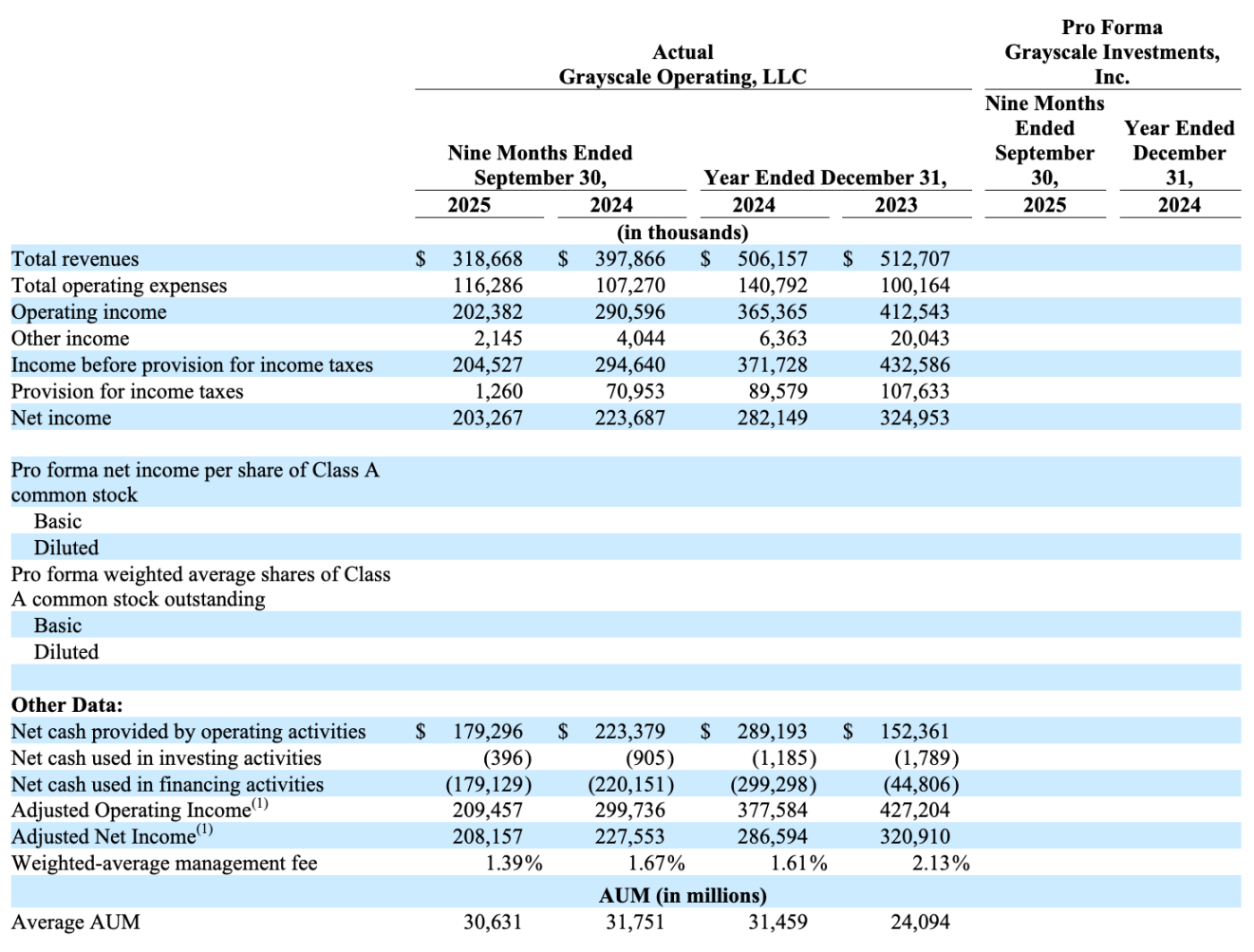

In terms of financial performance, for the nine months ended September 30, 2025, Grayscale's operating revenue was approximately $319 million, a 20% decrease year-over-year; operating expenses were approximately $116 million, an 8.4% increase year-over-year; and operating profit was approximately $202 million, a 30.4% decrease year-over-year. Net profit, including other income and excluding income tax provisions, was approximately $203 million, a 9.1% decrease year-over-year. Furthermore, average assets under management data suggests that assets under management this year may be lower than last year.

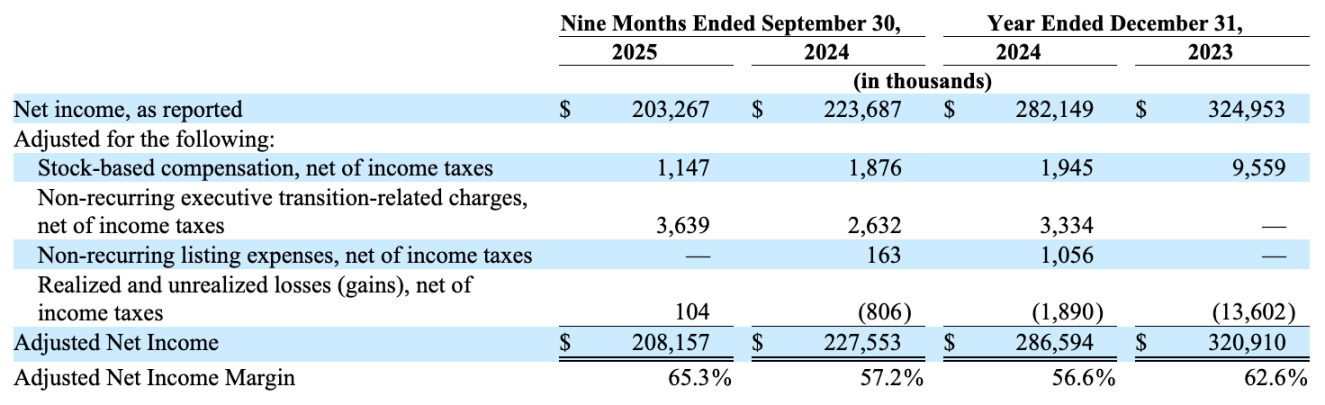

Excluding non-recurring items, the adjusted net profit for the reporting period was approximately US$208 million, with a net profit margin of 65.3%. Although the former decreased by 8.5% year-on-year, the net profit margin increased compared to 57.2% in the same period last year.

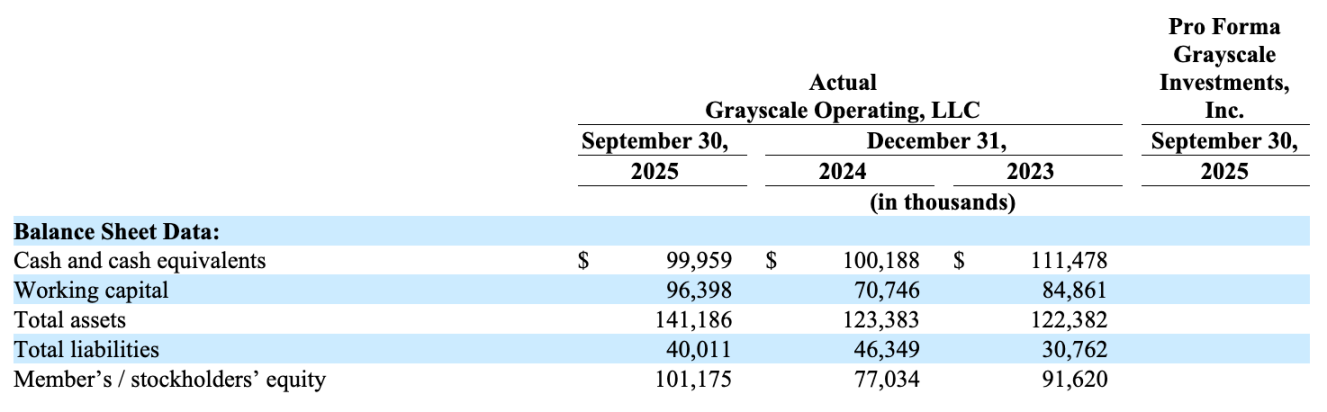

Currently, Grayscale's debt ratio is quite healthy. Although both revenue and profit have declined, Grayscale's operating conditions are continuously improving, judging from the increase in the company's asset value, the decrease in debt, and the increase in profit margin.

The S-1 filing also disclosed Grayscale's future development plans, including expanding the types of private funds (launching more altcoin private investment products); launching actively managed products to supplement passive investment products (ETFs, ETPs); and making active investments, including its own investment products, cryptocurrencies, or other assets.

Regarding expanding its distribution channels, Grayscale disclosed that it has completed due diligence on three brokerages with a total AUM of $14.2 trillion, and this month launched Bitcoin and Ethereum mini-ETFs on the platform of a large independent brokerage firm with over 17,500 financial advisors and over $1 trillion in advisory and brokerage assets. In August, Grayscale partnered with iCapital Network, a network of 6,700 advisory firms. Under the agreement, Grayscale will provide digital asset investment channels to companies within the network through its actively managed strategies.

Overall, the information disclosed by Grayscale indicates that it is a relatively stable asset management company, with its main source of revenue being management fees from investment products, leaving little room for further growth. However, given the precedent of listed traditional asset management companies, there are predictable projections for Grayscale's market capitalization, price-to-earnings ratio, etc., making it a relatively predictable investment target.

- 核心观点:灰度递交美股IPO申请,采用Up-C结构上市。

- 关键要素:

- 总资管规模350亿美元,全球第一。

- 采用Up-C结构,实现税收优惠与控制权保留。

- 未来计划拓展私募基金与主动管理产品。

- 市场影响:为传统投资者提供合规加密货币投资渠道。

- 时效性标注:中期影响