What happened that caused the biggest single-day drop in US stocks in a month?

Original title: "US stocks and cryptocurrencies plummeted overnight! What happened?"

Original author: Wall Street Insights

The brief optimism following the end of the US government shutdown quickly dissipated, and market focus shifted to a large amount of delayed economic data, uncertainty surrounding the prospect of a Federal Reserve rate cut, and concerns about overvalued tech stocks, triggering a broad sell-off in overvalued tech stocks and risk assets.

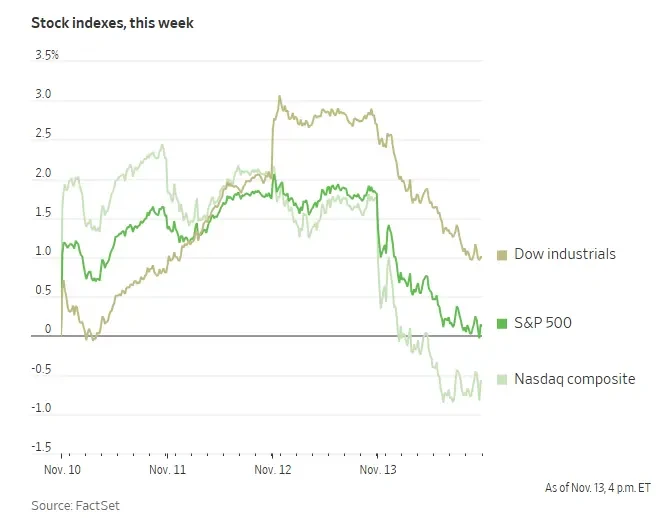

On Thursday, October 13, the three major U.S. stock indexes all fell during the day's trading, with the Nasdaq Composite Index, dominated by technology stocks, closing down 2.29%.

The deteriorating risk sentiment also spread to the cryptocurrency market, with Bitcoin falling below the $100,000 mark and Ethereum dropping by more than 10% at one point.

The immediate catalyst for this sell-off was cautious comments from several Federal Reserve officials, suggesting that interest rate cuts should be approached with caution. According to data from the CME Group, the probability of a rate cut in the interest rate futures market has plummeted from over 70% a week ago to around 50%.

This shift has exacerbated the market rotation that has been underway this month. Investors are reportedly taking profits from this year's hottest stocks and moving into lower-valued, more defensive sectors, a "risk-averse mode" that was on full display in Thursday's trading.

US stocks suffered their biggest single-day drop in a month

With the US government shutdown over and economic data releases delayed, investors reassessed the prospect of a Federal Reserve rate cut in December, resulting in the biggest one-day drop in US stocks in a month on Thursday.

US benchmark stock indexes:

The S&P 500 index closed down 113.43 points, or 1.66%, at 6737.49.

The Dow Jones Industrial Average closed down 797.60 points, or 1.65%, at 47,457.22, retreating from its record closing high.

The Nasdaq Composite Index closed down 536.102 points, or 2.29%, at 22,870.355. The Nasdaq 100 Index closed down 536.102 points, or 2.05%, at 24,993.463.

The Russell 2000 index closed down 2.77% at 2382.984 points.

The VIX fear index rose 14.33% to 20.02. It had risen as high as 21.31 at 04:23 Beijing time before giving back some of its gains.

The Seven Tech Giants:

The Magnificent 7 index fell 2.26% to 203.76 points.

Tesla fell 6.64%, Nvidia fell 3.58%, Google A fell 2.84%, Amazon fell 2.71%, Microsoft fell 1.54%, while Meta rose 0.14%.

Chip stocks:

The Philadelphia Semiconductor Index closed down 3.72% at 6818.736 points.

AMD fell 4.22%, and TSMC fell 2.90%.

Oracle fell 4.15%, Broadcom fell 4.29%, and Qualcomm fell 1.23%.

Several Federal Reserve officials have made hawkish remarks, causing "centrists" to waver.

Several Federal Reserve officials made hawkish remarks, expressing concern about inflation and taking a cautious approach to future interest rate cuts.

Cleveland Fed President Hammack (a 2026 FOMC voting member) stated that he expects inflation to remain above the 2% target for the next two to three years. With a weak labor market, the Fed's employment target (the employment aspect of its dual mandate) is facing challenges. Tariffs are expected to push up inflation and continue into early next year. The Fed needs to maintain a degree of policy restraint to cool inflation.

Minneapolis Fed President Neel Kashkari said on Thursday that he opposed last month's interest rate cut due to the resilience of the economy and is taking a wait-and-see approach to the December decision. St. Louis Fed President Alberto Musalem also reiterated his view that monetary policy needs to "hold back" inflation.

Due to concerns about inflation and the view among some officials that the labor market remains robust, a growing number of policymakers, including some previously staunch supporters, are hesitant to further ease monetary policy.

The latest development is that Boston Fed President Susan Collins and San Francisco Fed President Mary Daly—both officials who voted for rate cuts this year—have issued their clearest signals of caution to date. Collins stated bluntly that the "threshold" for further policy easing in the near term is "relatively high," while Daly said it's too early to draw conclusions about a December decision and that she remains "open-minded."

The massive amount of data to be released soon (which may bring more, not less, uncertainty), coupled with the recent flurry of hawkish statements from officials, has pushed market bets on a December rate cut back below 50%.

Two possibilities for the December meeting

Looking ahead to the December meeting, the outcome seems to be leaning towards "two options": either keep interest rates unchanged or cut them again by 25 basis points. According to Nick Timiraos of the Wall Street Journal, another possibility is that the Fed, while cutting rates in December, will also use policy guidance to set a higher threshold for further easing in the future.

Regardless of the final decision, Powell is likely to face more dissenting votes than at the October meeting (where both sides disagreed). Krishna Guha, vice president of Evercore ISI, wrote in a report on Thursday that Collins' explicit opposition to a December rate cut "exacerbates our concerns about Powell's ability to manage divisions within the FOMC."

Guha's analysis suggests that if the Federal Reserve decides to cut interest rates, Kansas City Fed President Jeffrey Schmid may receive support from Collins and Musalem, among others; if the Fed decides to hold rates steady, then Stephen Miran, who previously advocated for a larger rate cut, may join Christopher Waller and Michelle Bowman, who also support easing policies, in voting against it.

This further highlights the deep divisions within the committee, making the December decision highly uncertain.

- 核心观点:美联储鹰派言论引发全球风险资产抛售。

- 关键要素:

- 美联储官员密集释放谨慎降息信号。

- 美股纳指暴跌2.29%,比特币跌破10万。

- 市场对12月降息预期骤降至50%。

- 市场影响:加剧资金从高估值资产向防御板块轮动。

- 时效性标注:短期影响