A Contrarian in a Market Downturn: The Growth Secrets Behind Ju.com's October User Growth

- 核心观点:Ju.com在市场低迷中逆势增长。

- 关键要素:

- 月活用户89.1万,注册用户5190万。

- 新上币种80%交易量居前列。

- JuChain主网交易活跃,生态扩张。

- 市场影响:差异化策略增强平台竞争力。

- 时效性标注:中期影响。

Macroeconomic Environment: Selective Slump in the Crypto Market

Looking back at the cryptocurrency market in October 2025, it can be summarized as a high opening followed by a decline. Retail investor enthusiasm clearly cooled. Bitcoin failed to maintain its strength after breaking through $100,000, and major cryptocurrencies such as Ethereum performed poorly, leading to a downward trend in the entire spot market.

This downturn is even more pronounced in terms of trading volume. Spot trading volumes on major exchanges have generally decreased by 30%-50% compared to the peak at the beginning of the year, with some small and medium-sized exchanges even facing liquidity shortages. Market participants' risk appetite has significantly decreased, with funds flowing more towards traditional safe-haven assets, and the overall activity of the cryptocurrency market is at a low level for the year.

However, the market downturn is not a comprehensive recession, but rather a selective one. Behind the scenes, especially in the institutional sector, momentum is building. Some innovative and practical projects are still able to attract market attention, and platforms that launched these projects early have actually established a differentiated competitive advantage during this period.

Defying the trend to achieve growth: Ju.com's three core highlights

Against the backdrop of an overall market contraction, Ju.com's October data stands out:

Steady expansion of user base

With 891,000 monthly active users and 51.9 million cumulative registered users, these figures reflect the platform's continued user appeal. In an industry environment characterized by sluggish market sentiment and slowing new user growth, maintaining nearly 900,000 monthly active users signifies that Ju.com has not only retained existing users but is also continuously acquiring new ones.

More importantly, the 51.9 million registered users provide a solid foundation for the platform's future development. This user pool will translate into enormous transaction potential when the market recovers, becoming a reservoir for the platform's growth.

Improved accuracy of coin selection strategies

Among the tokens launched by Ju.com Research Institute in October, XNL performed the best, with excellent trading volume; AIXBT, as an AI concept token, occupied a mid-range position with stable trading activity. More importantly, while the overall spot trading volume on the platform declined, the trading volume share of tokens listed by the Research Institute actually increased against the trend.

This change reveals the effectiveness of Ju.com's coin selection strategy. In an environment lacking clear market trends, the platform has built a stable trading foundation through core projects such as Xpin, WLFI, BLESS, Aster, and EDEN. These projects consistently rank among the top in weekly trading volume, forming the cornerstone of the platform's trading activity.

It is worth noting that although the performance of some newly listed projects was relatively less affected by the market environment, overall, 8 out of the 10 newly listed cryptocurrencies maintained a position among the top in weekly trading volume, with a success rate of 80%. This is a remarkable achievement in the current market environment.

Rapid response and flexible layout

In October, Ju.com demonstrated another distinct advantage: its high sensitivity to market trends and rapid execution. Unlike some trading platforms with lengthy review processes, Ju.com employs a more flexible listing mechanism, enabling it to identify potential assets as soon as trends emerge and quickly bring high-quality projects to market.

This "small but elite" strategy is particularly crucial in today's rapidly shifting market trends and highly fragmented investor attention. Faced with an increasingly complex market rhythm, platforms that proactively position themselves in emerging sectors are often the first to gain user trust and traffic. Ju.com, leveraging its research institute's systematic screening mechanism, has made forward-looking investments in multiple cutting-edge fields such as AI, RWA, and DeFi innovation, providing users with more opportunities to participate in high-quality early-stage projects.

Building on this foundation, Ju.com further launched the Ju Selected Trading Zone , a listing system operated based on the logic of "professional buyers." Ju Selected strives to find the optimal balance between "speed" and "quality": it can quickly capture early-stage potential assets while controlling risks through multi-dimensional screening.

Its selection criteria cover key dimensions such as innovation, execution, economic model sustainability, community health, and compliance potential. The platform focuses on whether projects have the ability to solve practical problems, the determination to build long-term projects, and the ability to create real value for users while adhering to compliance.

The AI, RWA, and X402 protocol-related projects recently selected for the Featured Zone are chosen for their combination of structural innovation and clear application scenarios. This mechanism allows Ju's Featured Zone to gradually build a high-quality project pool, enabling users to find trustworthy investment opportunities even in volatile markets.

Ju.com understands that market risks cannot be eliminated, but what the platform can do is make users clearer about which opportunities are worth taking advantage of.

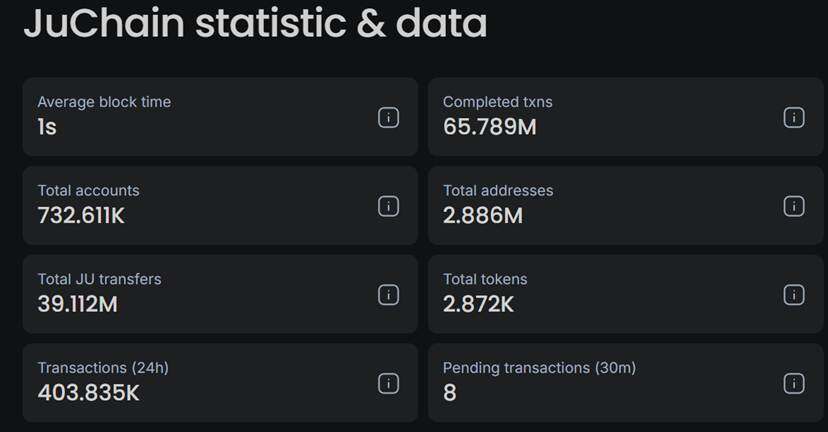

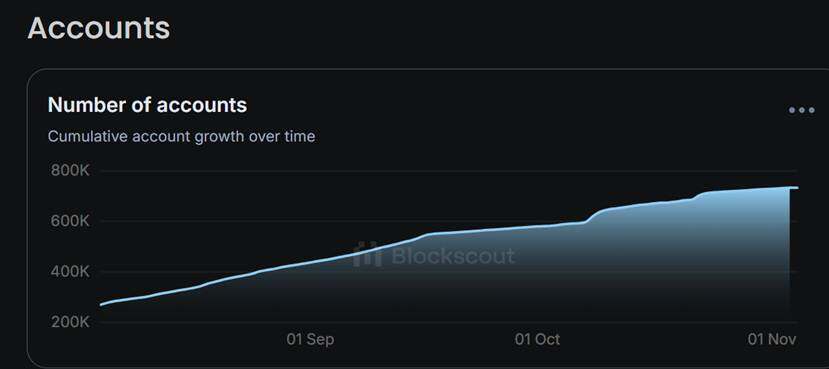

Internal driving force: The steady growth of the JuChain ecosystem

Beyond its flexibility in project selection and deployment, Ju.com's underlying ecosystem, the JuChain mainnet, is also demonstrating strong momentum. Network activity continues to rise, ecosystem integration is accelerating, and on-chain interactions maintain a smooth experience with low latency and ultra-low fees. With the addition of new partners and ongoing community activities, JuChain's ecosystem is constantly expanding.

Between October 27 and November 2, JuChain maintained robust network confidence, reflecting market recognition of the long-term value of its infrastructure. The total number of transactions reached 3.31 million, of which 1.05 million were $JU-related; the average daily active accounts were 32,800, with 12,200 new accounts created; and 160 new contracts were deployed on the mainnet during the same period.

These data not only demonstrate JuChain's efficiency and activity but also confirm its crucial role as the underlying support for the Ju.com ecosystem. Against the backdrop of global market liquidity contraction, JuChain has maintained high-frequency trading and sustained development activity, becoming a key internal driving force for Ju.com's counter-trend growth.

Underlying logic: Why was it able to break through the harsh winter?

Ju.com's growth against the trend is not accidental; it has a clear strategic logic behind it:

User experience first : Continuous optimization in product design and feature iteration, lowering the barrier to entry for users and improving ease of use. Behind the 890,000 monthly active users is the platform's continuous investment in user experience.

Precise differentiation through targeted positioning : Instead of directly competing with leading platforms on mainstream cryptocurrencies, it focuses on emerging projects and small-cap tokens, providing users with opportunities to "discover undervalued assets." This positioning is more likely to attract investors seeking high-yield opportunities during market downturns.

Research-Driven Cryptocurrency Selection : Our research institute has established a systematic project evaluation system that goes beyond simply chasing trends. Instead, it uses a multi-dimensional approach, considering factors such as technological innovation, team background, and community activity. While some projects may underperform in the short term due to market fluctuations, this method ultimately identifies truly valuable projects in the long run.

Looking to the future: The energy storage value of 51.9 million users

The cryptocurrency market exhibits clear cyclical characteristics, and historical experience shows that every bull market is preceded by a period of quiet. During this time, truly capable platforms choose to strengthen their internal capabilities, optimize their products, accumulate users, and strategically position themselves within the market.

Ju.com's current user base and transaction structure are actually preparing for the next market boom. A registered user base of 51.9 million means that when market sentiment recovers, the platform can quickly activate these dormant users, converting existing users into new transactions.

From an industry trend perspective, the period from the end of 2025 to 2026 will be crucial, with breakthroughs and progress likely shaping the long-term development trajectory of the crypto industry for decades to come. The deep integration of AI and crypto, the tokenization of RWA assets, and the innovative iterations of DeFi protocols—these emerging sectors all hold immense opportunities. Ju.com's early investment in these areas through its research institute mechanism is precisely a way of building momentum for the next phase of explosive growth.

Market downturns are often the period when high-quality platforms differentiate themselves. When most participants choose to wait and see or scale back, platforms that can maintain growth momentum, continuously optimize services, and accurately seize opportunities will occupy a more advantageous position in the next cycle. Ju.com's performance in October may be the initial manifestation of this differentiated competitive advantage.