Gate Research Institute: Capitalized Crypto Beliefs and the Sustainability of Crypto Treasury Models

- 核心观点:DAT模式通过资本飞轮连接传统金融与加密资产。

- 关键要素:

- 融资-买币-再融资循环驱动增长。

- 以太坊/Solana DAT转向质押创收。

- 可持续性依赖资产质量与资本结构。

- 市场影响:加速机构资金流入,推动加密资产制度化。

- 时效性标注:中期影响

summary

• Strategy pioneered the concept of a crypto asset reserve treasury, with more listed companies following in its footsteps to transform and usher in a new chapter for DAT. In 2025, the scale of DAT experienced explosive growth, triggering a new wave of staking on Ethereum DAT.

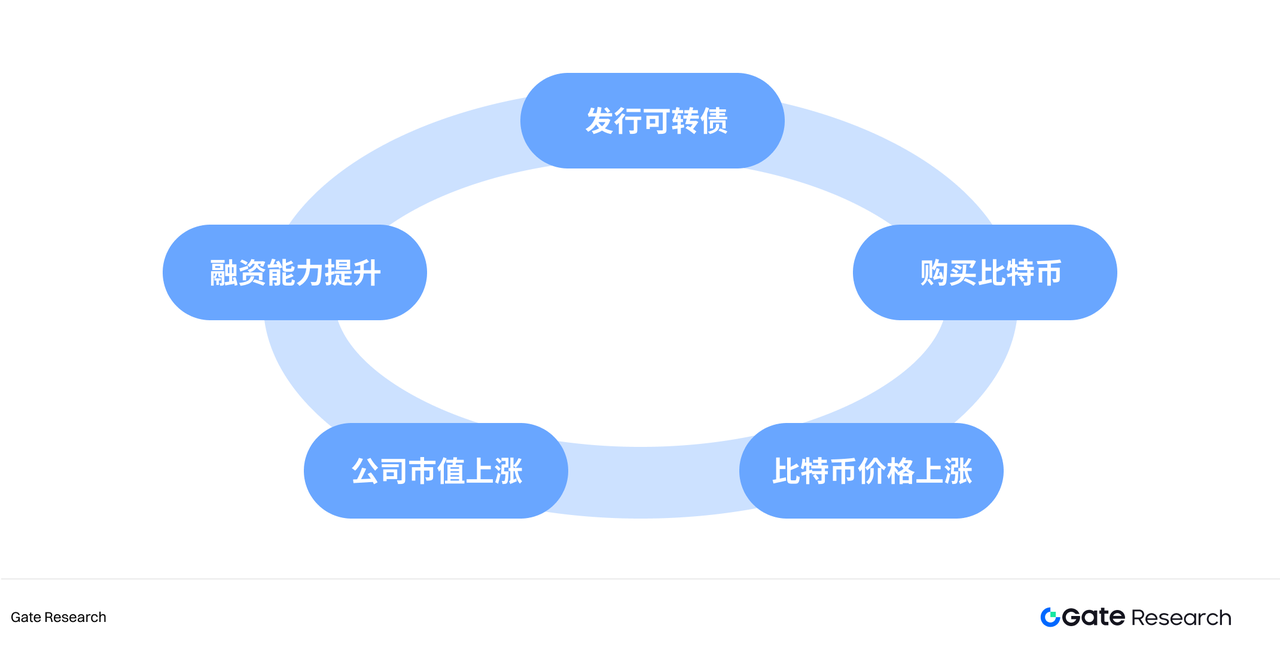

• The core logic of the DAT model is a capital cycle of "fundraising – buying tokens – refinancing," which binds traditional capital market financing methods with the price increase of crypto assets, forming a self-reinforcing flywheel. The market capitalization change of DAT is mainly determined by the growth in the number of tokens per share, the price of the underlying asset, and mNAV, which together determine its attractiveness and risk level in the capital market.

• As institutional funds continue to flow into the Ethereum ecosystem, DAT companies have evolved from simple token holders into network participants and yield creators. Their main entry paths include staking, DeFi, and on-chain operations. Solana DAT may become one of the fastest-growing and most dynamic sectors within the DAT model.

• By constructing a five-force model for DAT sustainability, we believe that Bitcoin DAT is evolving towards a long-term value store, focusing on an inflation-hedging narrative and institutional allocation. Ethereum and Solana, among other DATs, are developing into yield-generating treasuries, creating cash flow through on-chain operations. A DAT that can truly weather economic cycles must possess a robust capital structure, transparent financial disclosure, and a clear strategic positioning. Future winners will not be numerous shell companies lacking core businesses, but rather a few leading companies that can simultaneously generate a flywheel effect in both capital market financing and on-chain ecosystem participation.

I. Introduction

With increasing global attention on crypto assets, clearer regulatory policies in various countries, and the maturing development of blockchain underlying technology and ecosystem, Digital Asset Treasury (DAT) is becoming a new capital narrative in the traditional financial sector.

A DAT company refers to a publicly traded company that uses cryptocurrency as a core reserve asset on its balance sheet. Unlike "crypto-native companies," their primary valuation driver is not their main business revenue, but rather the value fluctuations of the crypto assets they hold. These companies raise funds from shareholders through equity financing, convertible bonds, and other means, then invest the proceeds in crypto assets. This boosts investor confidence and further drives up their stock price, creating a cycle of "financing-holding-valuation enhancement" in the capital market.

On the surface, the DAT model may seem like simply "listed companies buying cryptocurrencies," but in reality, it has evolved into several sub-forms: from a passive single-asset holding model represented by Strategy, to a multi-asset portfolio model that achieves active management through staking, liquidity mining, and DeFi yields. The emergence of DAT companies transforms the cryptocurrency risk exposure, previously limited to on-chain investors, into tradable investment targets in the traditional stock market, thus providing a bridge for a wider range of investors to enter the crypto market. In this process, DAT is no longer just a price follower in the beta market, but has the potential to become a source of alpha driving the continued growth of the on-chain ecosystem.

However, DAT is not a risk-free "model of financial innovation." Its sustainability largely depends on the market cycle of the underlying assets. When crypto prices plummet and liquidity tightens, DAT shell companies lacking core business and cash flow are often the first to be hit, struggling to withstand the double blow of asset devaluation and financing disruption, and even facing the risk of liquidation. In other words, DAT is an amplifier of bull markets, but also a magnifying glass of bear markets.

This report will evaluate the long-term sustainability of the DAT model from five dimensions and explore the impact of token price and treasury size on the stability of DAT's development.

II. Origin and Evolution of DAT

When discussing the origins of DAT, one cannot ignore the legendary company Strategy. A veteran of business intelligence software services and a pioneer in the Bitcoin wave, Strategy's journey from its trough to its peak both aligned with the trends of the times and pioneered the concept of a crypto asset reserve treasury. Now, as a classic case study in business history, it adds another dimension to discussions about the cryptocurrency industry.

1. Where did the DAT mode originate?

1.1 Strategy: Bitcoin Strategy

Strategy Inc. (NASDAQ: MSTR) pioneered the DAT corporate strategy, which uses Bitcoin as a corporate reserve asset for Strategy.

This is a North American software company founded in 1989. Initially focused on the development and sales of enterprise business intelligence (BI) software, it experienced rapid growth during the dot-com bubble of the 1990s and went public in 1998. However, in 2000, the company was investigated by the SEC for accounting fraud involving premature revenue recognition, causing its stock price to plummet by over 90%, becoming a classic example of a bubble bursting. For the next two decades, Strategy failed to make significant progress in competition with much larger software giants like Microsoft, and its market capitalization mostly fluctuated between $1 billion and $2 billion.

The turning point came in 2020 when the company's founder, Michael Saylor, reassessed the value of Bitcoin during the COVID-19 pandemic. Before that, Michael Saylor was a staunch opponent of cryptocurrencies. He thought Bitcoin was a mess and that investing in it was a stupid idea. However, during the pandemic, countries adopted loose monetary policies to stimulate the economy, which led to currency devaluation and increased inflation risks. Michael Saylor believed that when the money supply grows at a rate of 15% per year, people need a safe-haven asset that is not linked to fiat cash flow. After studying the underlying logic of blockchain in detail, he found that owning Bitcoin, which halves every four years, can not only resist inflation, but also, under the various restrictions of the cryptocurrency market, some individual investors and institutions cannot directly invest in or leverage Bitcoin. If they hold it indirectly through stocks, it will open up new markets. Therefore, Michael Saylor resolutely chose to challenge the traditional investment concept, abandon traditional high-quality assets, and when many companies only buy bonds and give up about 7% of shareholder equity, he made a breakthrough choice of "digital gold" Bitcoin[1].

1.2 The Logic from "Corporate Reserve Assets" to "BTC Per Share"

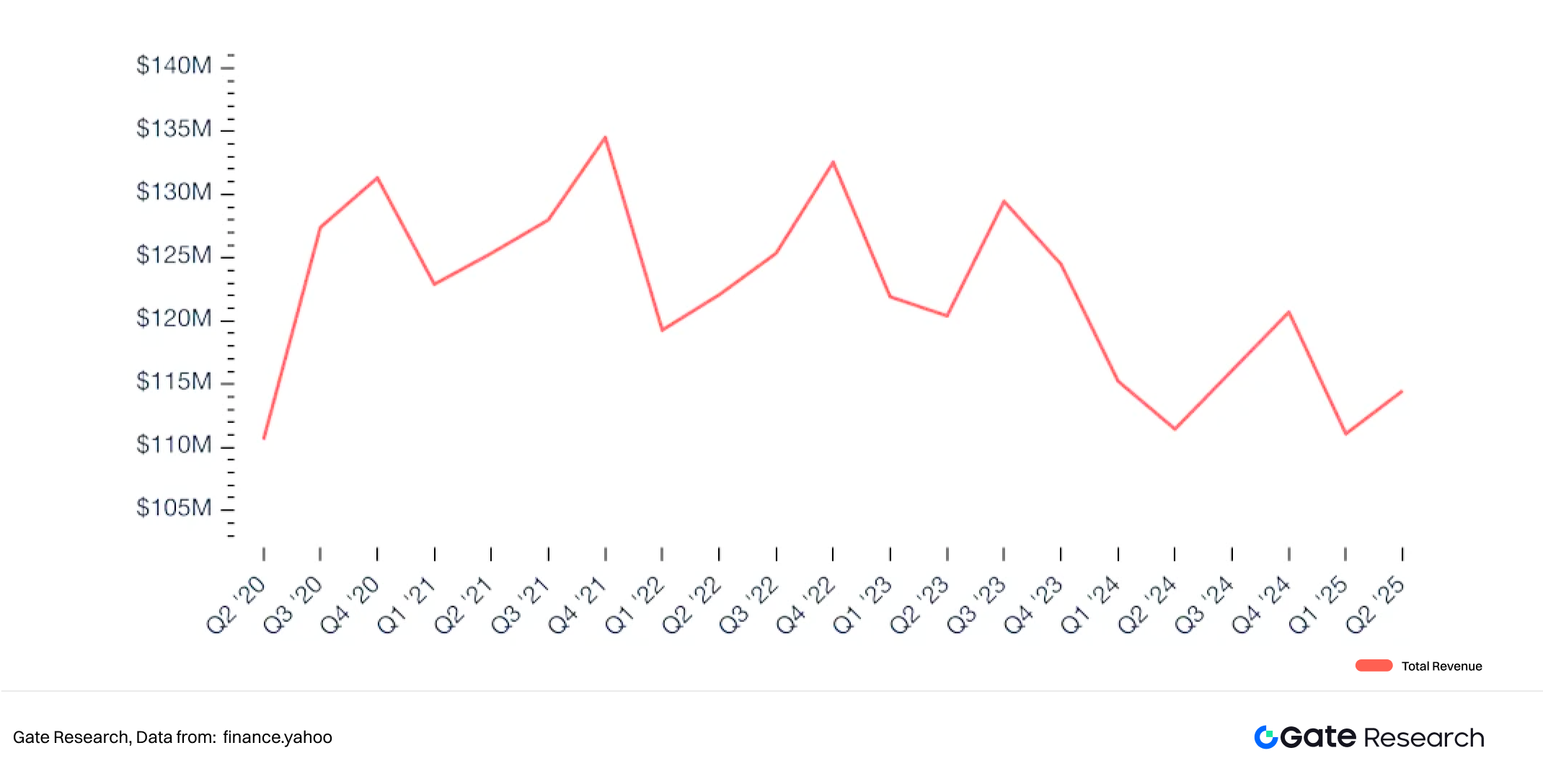

According to the 2020 financial report, Strategy Software's main business revenue was only tens of millions of US dollars, but with the accumulation of its original operations over the past 20 years, its total cash reserves were about $500 million. The initial Bitcoin investment was made by Strategy using its idle funds: in August 2020, it spent $250 million to buy 21,454 Bitcoins[2], which also marked Strategy's transformation from a traditional software company to a Bitcoin holding company.

Figure 1: Strategy's Quarterly Software Revenue

If Strategy relied solely on operating cash flow, it would be unable to rapidly expand its Bitcoin holdings. At that time, the market was in a zero-interest-rate environment, and investors were eager to pursue high-growth assets. Therefore, Michael Saylor thought of using the capital market to raise funds at low cost. Subsequently, Strategy implemented a Bitcoin flywheel centered on its own funds and debt financing (including convertible bonds, senior secured bonds, share issuance, etc.). In December 2020, Strategy issued $400 million in convertible bonds (0.75% interest rate, maturing in 2025)[3], and all the funds were used to buy Bitcoin. The advantage of issuing convertible bonds is that they are debt in the early stages and will not dilute equity, thus protecting the rights and interests of shareholders. The interest rates of the first few issues were mostly between 0% and 0.875%, and the exercise premium was usually 40-50%, which means that investors recognized Strategy's long-term growth and wanted to become its shareholders. By early 2021, the price of Bitcoin had surged to $60,000, making the book value of this new Bitcoin roughly five times the initial investment. This strategy dramatically altered how the market valued Strategy. As the Bitcoin strategy began to show results and the stock price continued to rise, Strategy also raised funds through a market-priced stock offering. To minimize shareholder concerns about stock dilution, Strategy created a unique metric—BTC Yield—which represents the change in the ratio between the company's Bitcoin holdings and the assumed diluted number of outstanding shares over a specific period. This metric helps assess whether the company has truly converted the raised funds into more Bitcoin without significantly diluting existing shareholders.

BTC Yield= Total BTC Holdings / Diluted Shares Outstanding

Since then, Strategy has become the largest institutional holder of cryptocurrency, with its stock price highly correlated with Bitcoin, reaching an all-time high of $473.83 in November 2024, a 3,734% increase from when it first purchased Bitcoin. Strategy's success has also reshaped the narrative of the capital markets, and since then, more listed companies have followed in Strategy's footsteps to transform and usher in a new chapter for DAT.

Figure 2: Strategy's stock price is highly correlated with BTC after 2020.

2. DAT Pattern Diffusion and Wave

2.1 The scale of DAT will experience explosive growth in 2025.

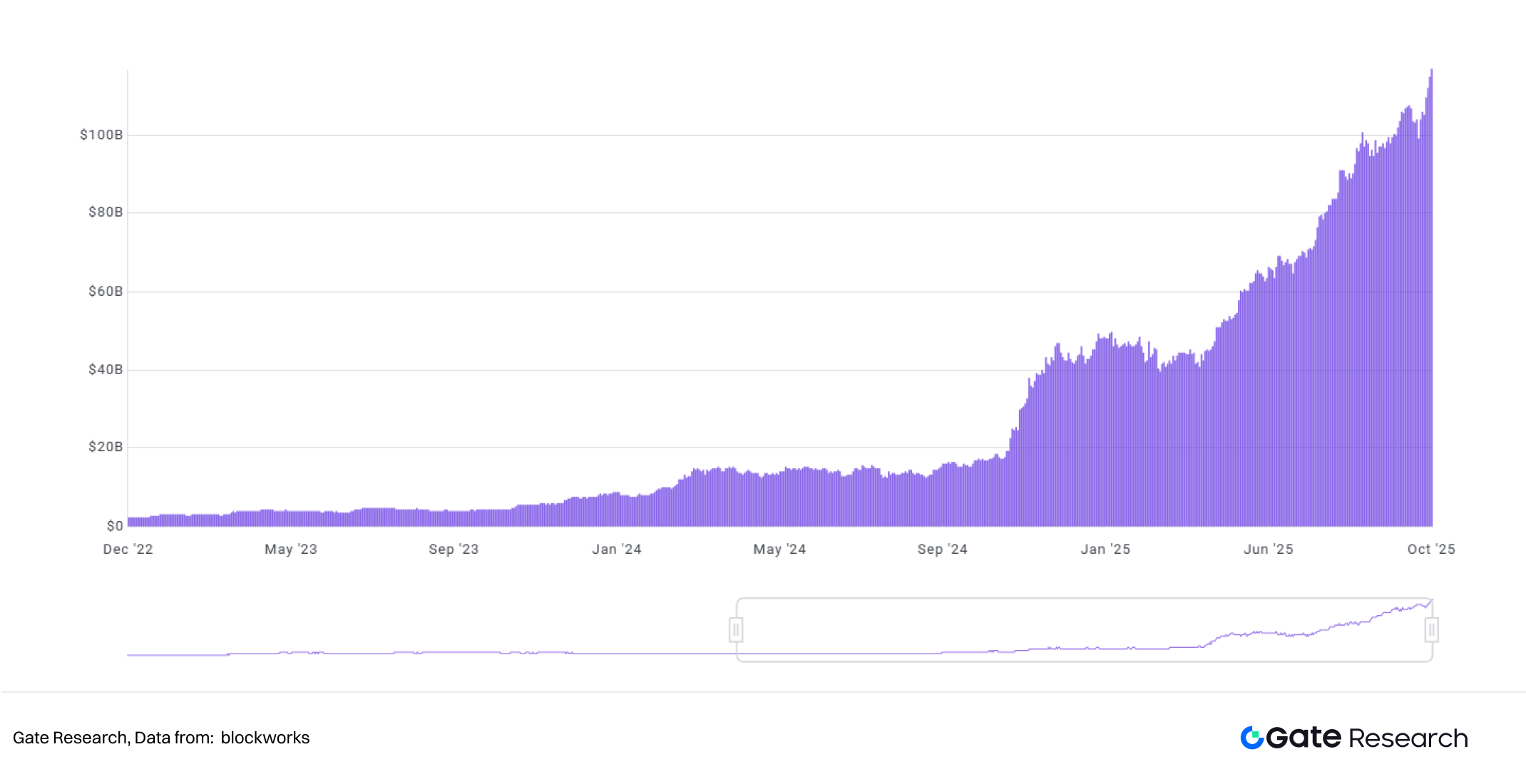

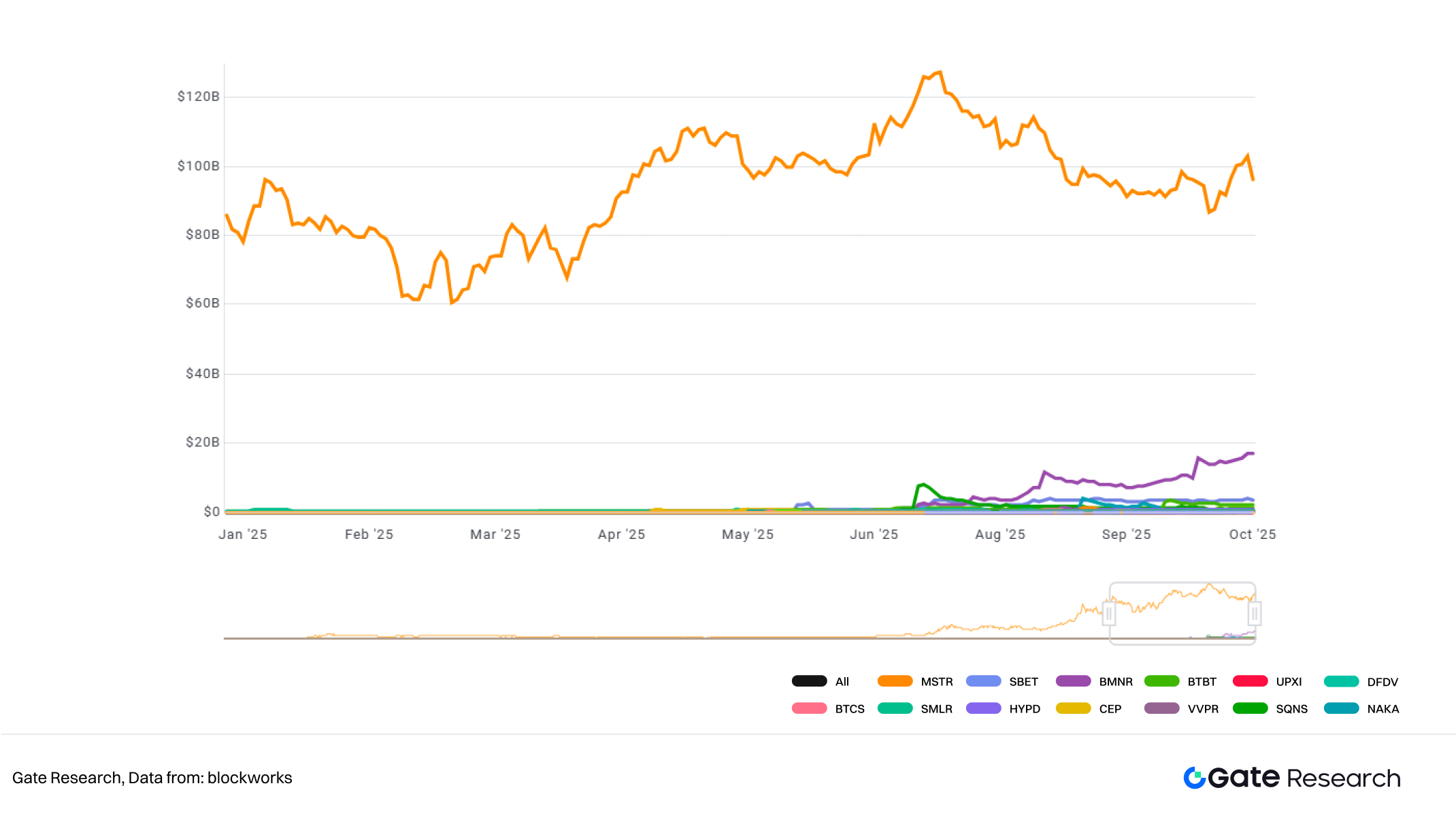

Taking Bitcoin, the most sought-after cryptocurrency, as an example, in 2020, listed companies worldwide held a total of 4,109 Bitcoins. This figure accounted for only 1.49% of all institutional holders (including governments, ETFs, and private foundations), having a very limited impact on the overall market. However, as the cryptocurrency ecosystem matured and Bitcoin prices continued to rise, coupled with the rise of the DAT (Digital Asset Acquisition) model, listed companies began to enter the Bitcoin market on a large scale. In 2021, the holdings of listed companies rapidly jumped to 155,196 Bitcoins, more than three times that of 2020, marking the initial formation of the DAT cryptocurrency trend. With the continued inflow of institutional funds, the holdings of listed companies further expanded to 306,765 Bitcoins in 2022. Although market volatility in 2023 led some companies to reduce their holdings, causing the total to fall back to 293,042 Bitcoins, it rebounded to 361,144 Bitcoins in 2024, indicating that the overall strategy of listed companies became more stable. By 2025, this trend saw explosive growth, with holdings exceeding one million in July and reaching 1,130,679 as of October 2nd. The proportion of Bitcoin in circulation also increased significantly, reaching 5.38% [4]. It can be seen that listed companies have gradually shifted from initial cautious exploration to strategic and long-term Bitcoin treasury layout. This not only reflects the capital market's recognition of Bitcoin as "digital gold" but also indicates that the DAT model is accelerating its spread and becoming a new narrative for corporate value management and capital operation.

Figure 3: DAT Company's Cash Holdings Increased Significantly Starting in 2025

2.2 The main force remains in North America, while the Asian market is rapidly catching up.

Currently, Bitcoin DAT companies are located in 199 countries and regions worldwide, but the dominant force remains concentrated in the North American market—holding a core position in terms of the number of companies, financing channels, and influence in the capital market. The United States has 71 DAT companies, and thanks to the mature disclosure mechanisms of Nasdaq and the stock market, these companies can smoothly incorporate crypto asset allocation into their financial strategies through equity, convertible bonds, and other tools. Canada follows closely behind with 33 DAT companies, becoming the second largest DAT hub due to its relaxed regulatory environment and tolerance for crypto funds.

Over the past year, the Asian DAT market has accelerated its catch-up, especially with the localization efforts in Hong Kong and Japan gradually taking shape. Japan has 12 companies, Hong Kong 10, and mainland China 9, showing a gradually decentralizing pattern. In the Japanese market, some companies related to companies listed on the Tokyo Stock Exchange or financial funds have begun allocating to crypto assets. The most representative example is the Bitcoin tracker Metaplanet Inc., which began publicly disclosing its Bitcoin holdings in 2024 and is considered "Japan's MicroStrategy," quickly becoming a benchmark case driving the spread of the Japanese DAT model. In Hong Kong, driven by the Hong Kong Stock Exchange and crypto trading platforms, DAT pilot programs have emerged, represented by crypto exchanges and fund companies, demonstrating the mutual promotion from both policy and market ends. It is worth noting that DAT companies are no longer limited to technology or finance backgrounds; their main businesses cover a wide range, from biotechnology and e-commerce to services and even nail salons. Companies are using the DAT model for capital operations, demonstrating the universality of this trend.

2.3 Ethereum DAT Sparks a New Wave of Staking

Meanwhile, the asset classes within the DAT (Digital Asset Transfer) model are also expanding. Initially, the focus was almost entirely on Bitcoin, but the capital market has never stopped seeking the next "Bitcoin-like" or even surpassing asset—an asset that possesses both store-of-value attributes and the potential to generate additional returns. Ethereum and Solana are prime examples: they not only boast active smart contract ecosystems and DeFi application scenarios, but also provide staking rewards for token holders under the PoS consensus mechanism, thus being seen as the next stop in the DAT field.

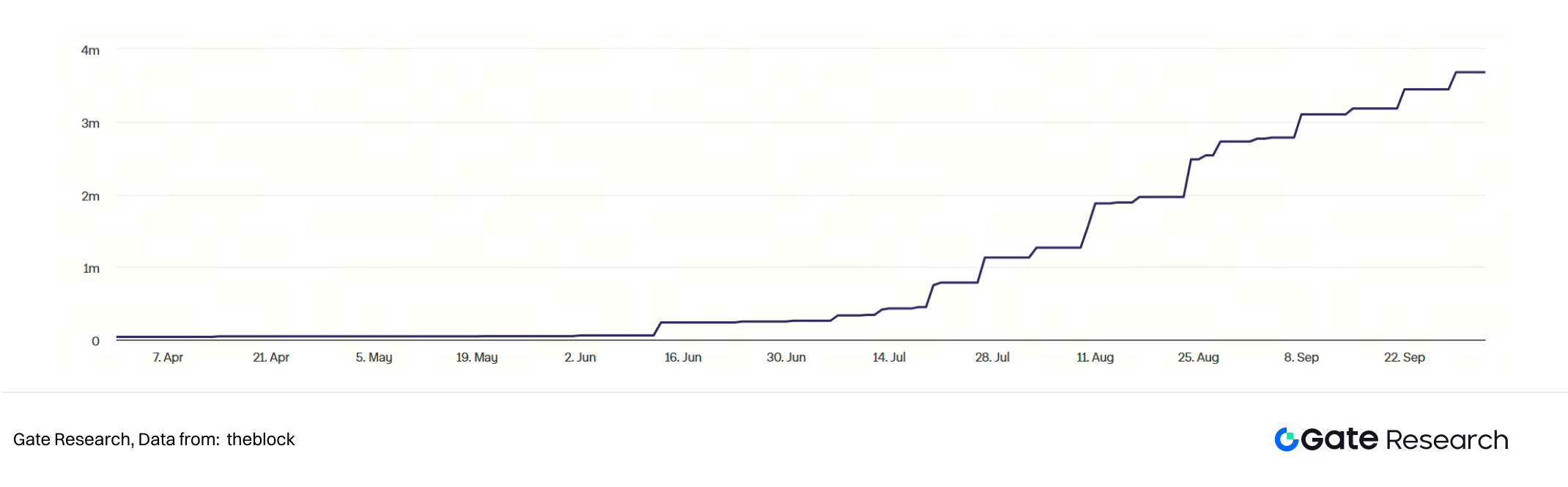

Figure 4: DAT Company's Ethereum holdings increased significantly in 2025

The narrative of Bitcoin reserves began to shift to Ethereum in mid-2025, with actions including ecosystem participation and staking, with BitMine Immersion Technologies and SharpLink Gaming being two key drivers.

BitMine (NYSE: BMNR) was initially a company focused on Bitcoin mining and infrastructure, with services such as crypto mining machine hosting and maintenance. In July, it transformed into an Ethereum reserve entity through a $250 million private placement (PIPE) [5]. BitMine stated that Ethereum's smart contract capabilities, stablecoin payments, and tokenized assets are the key reasons for its ETH reserves. With the release of an Ethereum reserve announcement, BitMine's stock price rose sharply in the short term, showing the market's enthusiasm and confidence in this model. As of October 3, 2025, its Ethereum reserves quickly reached 2,650,900, accounting for 2.2% of the total Ethereum supply, making it the largest Ethereum reserve company.

On the other hand, SharpLink Gaming (NASDAQ: SBET), the second-largest participant in the Ethereum Treasury, has primarily focused on online gaming, esports, gambling, and sports entertainment. While not a native crypto company, it operates flexibly in the capital markets. In June, SharpLink Gaming launched its Ethereum Treasury strategy, acquiring Ethereum (excluding Bitcoin) through ATM equity financing and staking over 95% of its Ethereum reserves to generate passive income. SharpLink maintains high-frequency disclosure, providing transparency and traceability to the market. As of October 3, 2025, SharpLink's Ethereum reserves reached 838,728, representing 0.7% of the total Ethereum supply. These two companies represent a leap from the concept of Ethereum DAT (Digital Asset Transfer) to large-scale capital market practice.

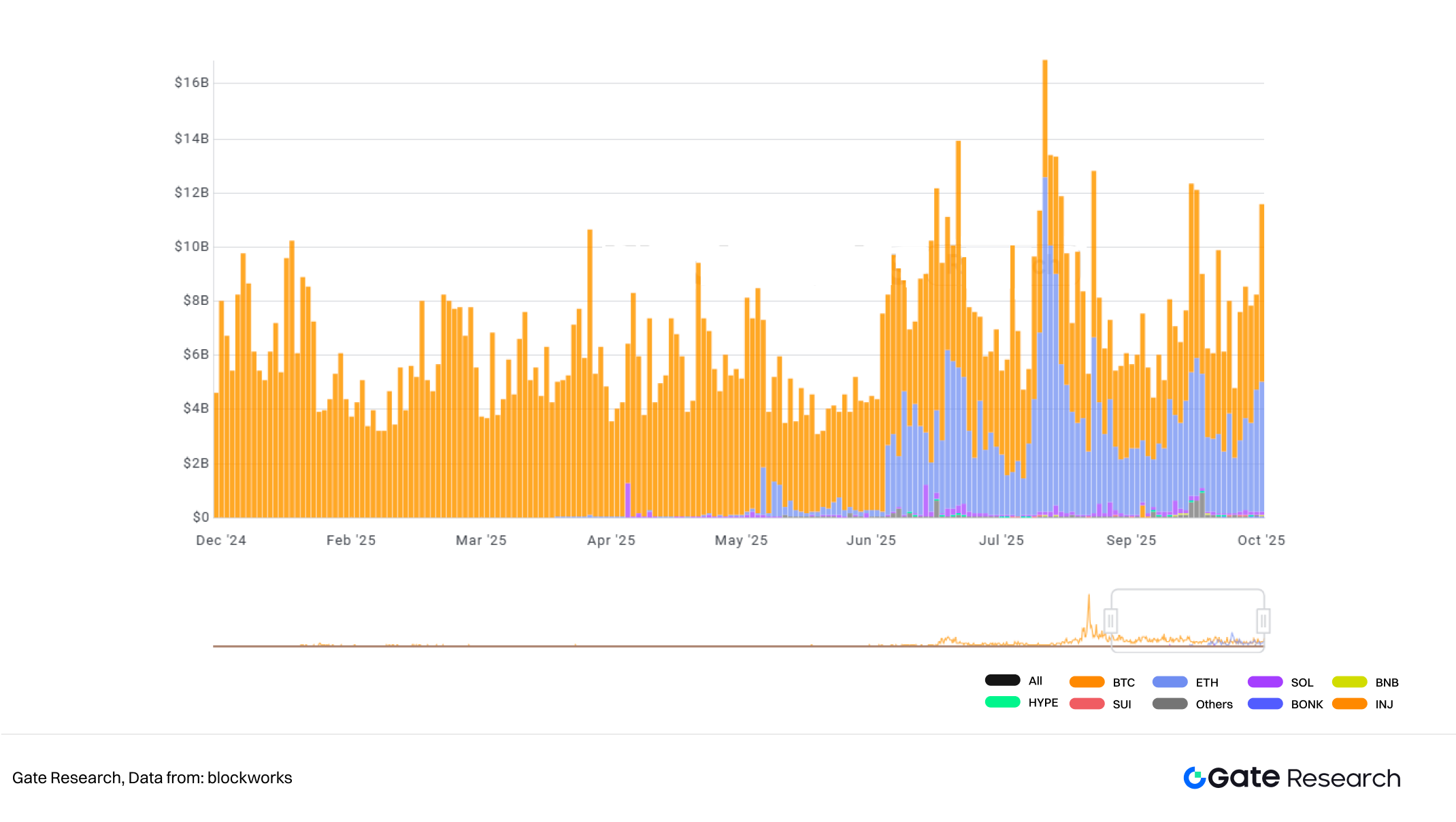

Figure 5: Bitcoin and Ethereum are the most popular targets for DAT companies.

More companies are now including other public chain tokens such as Ethereum, Solana, Dogecoin and Sui in their reserve assets to increase portfolio diversity and potential returns. As of October 2025, 13 companies disclosed holdings of Ethereum, totaling 4,029,665 tokens, equivalent to 3.33% of the total ETH supply. For Solana, 9 companies disclosed holdings, totaling 13,441,405 tokens, approximately 2.47% of the total SOL supply. For Dogecoin, 2 companies disclosed holdings, totaling 780,543,745 tokens, approximately 0.52% of the total DOGE supply. For Sui, 2 companies disclosed holdings, totaling 102,811,336 tokens, approximately 2.84% of the total SUI supply [6]. This multi-chain expansion means that DAT is no longer a story of "Bitcoin as a single asset," but has evolved into a cross-chain, multi-asset corporate capital strategy, laying the foundation for the future status of crypto assets in the global capital market.

Figure 6: Market Capitalization Comparison of Popular DAT Companies

III. The Operating Logic of DAT

Some crypto companies have used shell companies in the capital market to go public, opening up access to public market financing channels. They then complete the capital cycle through the core logic of the DAT model: "financing – buying crypto – refinancing." DAT companies link traditional capital market financing methods with the price increase of crypto assets, forming a self-reinforcing flywheel.

1. Operation Method

1.1 Acquisition of a listed company through a shell company

Some companies don't start from scratch; instead, they quickly gain access to the capital markets through special purpose acquisition companies (SPACs), business mergers, and reverse takeovers (RTOs). For cryptocurrency companies, backdoor listings offer an attractive alternative to navigating regulatory hurdles and lengthy IPO processes. Once the acquisition and listing are complete, these companies gain access to public market financing, allowing them to raise equity capital as "compliant publicly traded companies" and use the raised funds to directly purchase crypto assets such as Bitcoin and Ethereum.

Representatives of this type of operation are mainly concentrated in emerging North American DAT companies. For example, on July 8, 2025, the newly established crypto asset management company Reserve One announced that it would go public through a SPAC merger with M3-Brigade Acquisition V Corp. (NASDAQ: MBAV). The deal was valued at $1 billion, including $298 million in trust capital, and also attracted strategic investors such as Galaxy Digital, Pantera Capital and Kraken to commit $750 million. Reserve One aims to accumulate a reserve of crypto assets including Bitcoin, Ethereum and Solana, and plans to use these assets for staking and lending[7].

The logic behind this shell company acquisition is similar to a combination of "capital shell + crypto assets": although the shell resources of the capital market lower the entry barrier, this way of bypassing the traditional entrepreneurial cycle to achieve rapid expansion on the asset side is often accompanied by high risks, because it has almost no fundamental support. Shareholders may not only face dilution, but also amplify the company's dependence on the price fluctuations of crypto assets.

1.2 Financing cycles including rights issues, bond issuance, and convertible bonds

Strategy pioneered the flywheel of "fundraising - token purchase - valuation enhancement - refinancing," a model subsequently imitated by many traditional listed companies and public chains that went public through reverse mergers, forming the operating model of most DAT companies today. Specifically, DAT companies first utilize capital markets to raise funds, whether through issuing new shares (ATM/PIPE) or convertible bonds and corporate bonds, to obtain new cash inflows. These funds are then directly used to purchase crypto assets such as Bitcoin and Ethereum, thereby expanding their financial reserves. This cycle accelerates the binding of capital with crypto assets. Strategy's success demonstrates the amplifying effect of this model during bull markets and provides a template for subsequent DAT companies (such as BMNR, BitMine, and SharpLink).

Figure 7: Schematic diagram of DAT company flywheel

This model was particularly prominent among Ethereum-related DAT companies in 2025. BitMine's model was similar to Strategy's: continuously expanding its balance sheet through convertible bonds and PIPE financing, becoming a milestone in shaping the institutionalization of Ethereum. SharpLink adopted a more aggressive and frequent financing strategy. Since announcing the inclusion of Ethereum in its corporate treasury in June 2025, SharpLink has rapidly raised funds through ATM equity financing and public stock offerings, and has staked its Ethereum reserves in staking or liquidity staking, transforming Ethereum's "productive" characteristics into sustainable cash flow. While critics argue that "full staking" increases on-chain protocol risk exposure, supporters emphasize that it sets a new paradigm for DAT companies exploring Ethereum as a productive asset.

2. Classification of DAT Strategy Operation Models

DAT is not simply about "holding currency." Different models correspond to different management costs and requirements. Currently, DAT companies mainly operate under the following models:

1. Passive Single-Asset Holding Model: Focusing on a single crypto asset (usually Bitcoin or Ethereum) and holding it long-term without selling. This model is relatively simple, with low management and decision-making costs. It allows for consistent adherence to a predetermined strategy, and returns primarily come from capital gains on the appreciation of the crypto asset, regardless of price fluctuations. Strategy is the most typical example of a passive Bitcoin DAT, with the company publicly committing to "buying and never selling," treating Bitcoin as its primary asset and core strategy.

2. Proactive Single-Asset Trading Model: While still holding only one crypto asset, the company employs proactive trading or dynamic allocation strategies, such as market timing, hedging, and options trading. Because proactive trading requires predicting price movements, the trading capabilities of the managers need to be assessed. Some Ethereum reserve companies may proactively adjust, reduce, or switch positions during market fluctuations.

3. Multi-asset portfolio management model: The company is not limited to one crypto asset, but holds multiple currencies (such as BTC + ETH + SOL + BNB, etc.). Managers need to dynamically adjust the proportion of each asset portfolio according to market changes, so the management cost is higher and the requirements for asset allocation and risk control are greater. For example, Mega Matrix Inc. (NYSE: MPU) announced in 2025 that it would expand its DAT strategy from a single asset (such as ENA token or ETH) to a multi-asset portfolio, including multiple leading stablecoins and their governance tokens, and attempt to allocate risk and return across multiple chains or protocols [8].

4. Ecosystem Investment and Development Model: This is the most complex model. Besides holding cryptocurrency, the company invests funds in supporting ecosystem development, such as on-chain infrastructure, DeFi project investment, node/validator operation, protocol governance, ecosystem subsidies, and fund investment. This model makes the company both an asset holder and an ecosystem participant, potentially influencing the development direction of the ecosystem of the chain it holds. In the Ethereum context, some DAT companies use a portion of their Ethereum for staking, validator operation, participation in governance voting, or supporting the development of DeFi applications, which is itself a form of ecosystem investment, as exemplified by SharpLink mentioned earlier. Under this model, DAT companies often receive additional revenue beyond cryptocurrency appreciation, including staking, investment incubation, and transaction fees.

3. DAT Company's Market Pricing Logic

Unlike traditional companies that rely on revenue and profits, DAT's valuation fluctuations depend more on the market performance of its cryptocurrency holdings and its financial leverage strategy. From an investment perspective, DAT's market capitalization changes are primarily driven by three core variables: the growth in the number of tokens per share, the price of the underlying assets, and the mNAV (Market Value to Net Asset Value) premium/discount. These three factors together constitute DAT's "valuation triangle," determining its attractiveness and risk level in the capital market.

Stock price increase ≈ Currency volume growth rate × Currency price growth rate × Market premium factor

The market premium factor refers to the market sentiment and valuation premium relative to NAV, which can usually be directly quantified by mNAV, i.e., "market premium factor = mNAV − 1".

3.1 Growth in “Cash Content per Share”

As previously mentioned, Strategy created the "coins per share" metric to help assess whether the company truly converted its funding into more Bitcoin without severely diluting existing shareholders. Following Strategy's success, many DAT companies followed suit, with BitMine being a classic example—BitMine also increased the number of tokens represented by each share by raising funds and reinvesting profits to purchase Ethereum.

When the "coin content per share" increases, it indicates an increase in net asset value per share (NAV). Theoretically, if the market is efficient, DAT's stock price should rise in tandem with its NAV. Furthermore, assuming the prices of underlying assets like Bitcoin are also rising, the market will typically assign DAT a higher valuation multiple. This will create a triple leverage effect on DAT's stock price: "coin price × coin content × market premium," resulting in a price increase far exceeding the coin price itself.

3.2 The rise in the price of underlying assets

The most direct driver of DAT's valuation comes from the price fluctuations of its underlying assets. When the prices of core tokens such as BTC and ETH rise, the company's book asset size expands, and the market naturally gives it a higher valuation premium; conversely, a price drop directly erodes the book value.

However, compared to traditional "asset-driven companies," DAT companies often amplify this price sensitivity. On the one hand, most DAT institutions do not have hedging mechanisms, and their asset exposure is almost synchronized with market prices; on the other hand, they amplify their cash positions through financing leverage and convertible bonds, which multiplies the elasticity of stock prices to the underlying asset prices. Therefore, the underlying asset prices not only affect book value, but also form a positive feedback loop through a chain reaction of "refinancing expectations - reserve expansion - valuation enhancement."

3.3 mNAV Flywheel Mechanism

mNAV is the core valuation metric in the DAT model, and its calculation method is as follows:

mNAV = P Market Cap / NAV Digital Asset Value

Where P represents the company's market capitalization, NAV represents the company's net assets in crypto assets valued at market capitalization, and mNAV refers to the market net asset value ratio.

When the stock price P is higher than the net asset value per share (NAV), i.e., mNAV > 1, it indicates that the market is giving the company a valuation premium exceeding its cryptocurrency holdings, reflecting investors' recognition of DAT's management capabilities, refinancing potential, or the strategic value of crypto assets. The company can continue to raise funds, and each share issuance increases the holdings per share and book value, further strengthening market confidence in the company's narrative and driving the stock price higher. Thus, a closed-loop positive feedback flywheel begins to turn.

However, mNAV is a double-edged sword. A premium can represent high market confidence, but it could also be a bubble created by speculative capital. Once confidence collapses and mNAV significantly converges or even falls below 1, the flywheel will shift from a positive to a negative cycle. The market will switch from a "book value enhancement logic" to a "net asset dilution logic," forming a negative feedback loop of "valuation decline - limited financing - shrinking reserves - further market capitalization decline." If this coincides with a decline in the price of cryptocurrencies themselves, it will undoubtedly exacerbate the negative flywheel, causing a double whammy of market capitalization and confidence losses. Theoretically, when mNAV < 1, a more reasonable option for a company is to sell its holdings to repurchase shares to restore balance.

With Strategy For example, during the Bitcoin bull market, MSTR's market capitalization once reached more than twice its book BTC holdings, i.e., mNAV ≈ 2.0. This means that investors not only bought "Bitcoin reserves" but also paid a premium for the company's future financing capabilities and capital efficiency. During the bear market, its mNAV once fell below 1, but the company did not choose to sell coins to buy back its holdings. Instead, it insisted on retaining all its Bitcoin through debt restructuring.

In summary, DAT's financing is built on a flywheel of mNAV premium. The mNAV premium not only serves as a barometer of DAT's market activity but also constitutes an important reference for investors to judge buying and selling opportunities. However, when mNAV remains at a discount for an extended period, the potential for further share issuance will be locked up. The businesses of small and medium-sized shell companies that are already stagnant or on the verge of delisting will be completely overturned, and the established flywheel effect will collapse instantly.

IV. The Shift of DAT from "Holding" to "Pledge"

In contrast to Bitcoin DAT's passive holding strategy, Ethereum DAT, which leverages Ethereum's staking and DeFi infrastructure, may eventually see some funds flow onto the blockchain. This allows DAT companies to not only complete their capital cycle flywheel but also earn additional interest through on-chain staking and other methods, enabling the "productive" use of their assets.

1. Ethereum's revenue-generating DAT model

As a blockchain operating system capable of running various DApps, Ethereum's three-layer architecture provides multi-layered profit and risk management space for the DAT model. DAT companies mainly participate in the L1 and DeFi layers (L2 is mainly crypto-native institutions, with DAOs being more active): putting their Ethereum reserves on the chain to create "on-chain interest income," transforming their holdings into productive assets.

Table 1: DAT Strategies Applying to the Ethereum Three-Layer Structure

1.1 Ethereum Staking: From Static Holding to Interest-Based Returns

As institutional funds continue to flow into the Ethereum ecosystem, DAT has evolved from a simple token holder into a network participant and yield creator. Staking is DAT's primary path into the Ethereum ecosystem, and it currently participates in staking mainly through two methods:

1. Self-operated validator nodes: The company locks its Ethereum in validator nodes to provide consensus security and transaction verification services for the network. Through the staking reward mechanism, it can obtain an annualized block reward of about 2.5-3.0%. However, this method has high operational complexity, poor liquidity, and node penalty risks.

2. Utilizing Liquidity Staking Protocols: Companies can delegate Ethereum to third parties for staking and receive tradable "credential tokens," such as Lido's stETH, or BTCS earning returns through Rocket Pool. Liquidity staking solves the problem of locked assets in traditional staking by issuing tradable tokens (representing staked ETH), allowing companies to maintain asset liquidity while earning staking rewards. This enables DAT companies to generate revenue without sacrificing operational flexibility.

Assuming the current corporate treasury holds approximately 1 million Ethereum, of which 50% is staked, based on the current nominal yield of approximately 3% and the Ethereum price of $4,000, it could generate approximately $60 million in staking income annually.

1.2 DeFi: Getting Ethereum "Dynamic"

Beyond staking Ethereum, DAT companies can further participate in DeFi protocols, using Ethereum or staking tokens (such as stETH) for DeFi lending or liquidity provision, thus achieving secondary use of funds. Common methods include:

1. Deposit stETH into DeFi lending protocols such as Aave to earn interest;

2. Collateralize stETH to borrow stablecoins for reinvestment;

3. Joining a liquidity pool can earn additional transaction fees, etc.

This approach can increase yields from 3% on a single stake to 5-10% and inject institutional-grade liquidity into the Ethereum ecosystem.

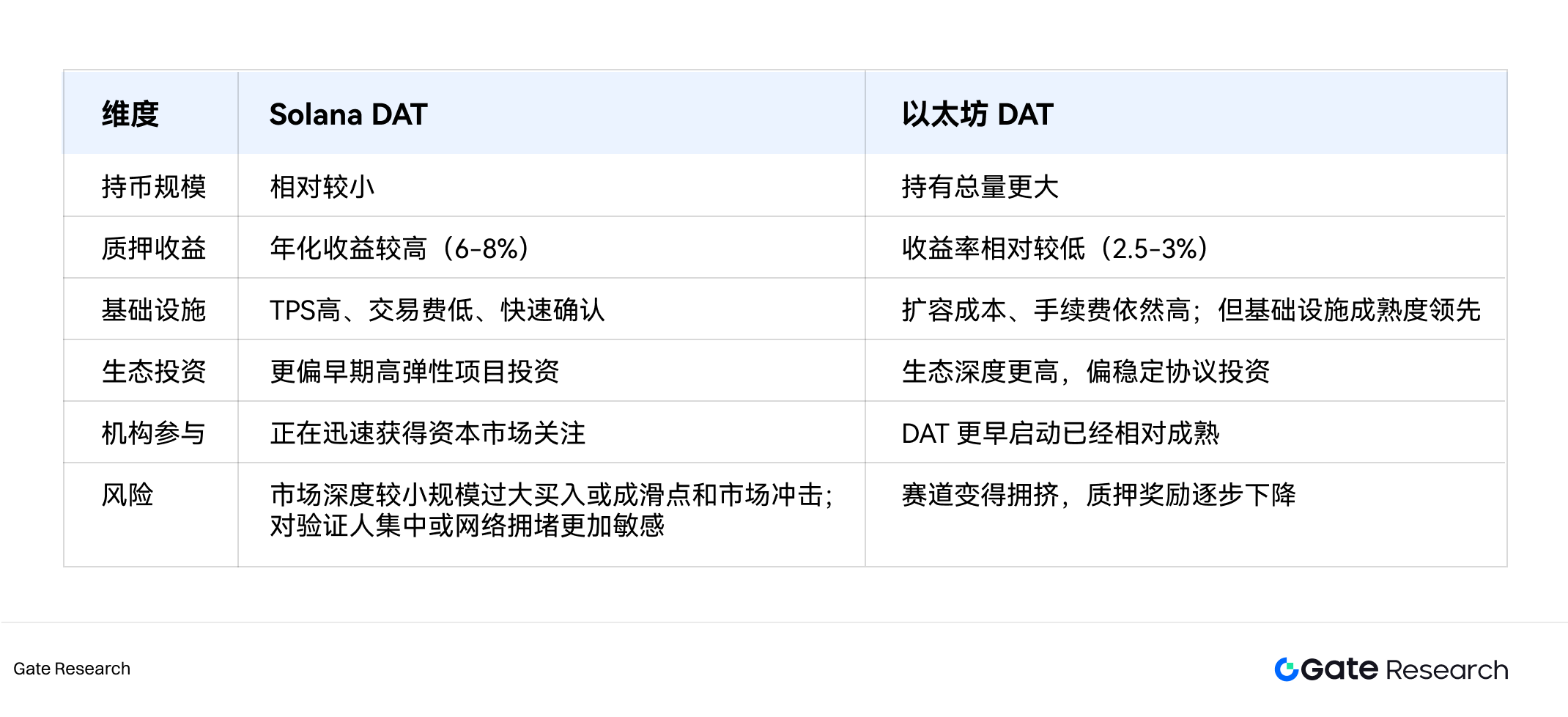

2. Solana's high yield provides a new option for DAT.

When Solana became the number one ecosystem for new developers in 2024, the potential of Solana DAT companies was also a significant new direction, with some institutions even believing it might surpass Ethereum to become the mainstream DAT model. The reasons for this can be summarized in the following three aspects:

1. Higher yield: Solana's staking yield is about 6-8%, which is generally higher than Ethereum's yield of about 3%, making it more attractive to DAT companies that seek passive income or cash flow.

2. Ecosystem network growth and infrastructure development: Solana's network activity and developer growth rate have exceeded ETH at certain times. In the second quarter of 2025, the Solana network processed more than 8.9 billion transactions, supported nearly $3 billion in daily DEX trading volume, and generated more than $1.1 billion in network revenue, which is more than 2.5 times that of Ethereum[9]. At the same time, Solana's transaction throughput (TPS), low fees, and fast confirmation features make it more attractive to companies seeking a DAT model that combines "fast on-chain + high-frequency interaction/low fees".

3. Market awareness is rising rapidly: Cantor Fitzgerald has given an “overweight” rating to several Solana DAT companies, citing reasons such as the rapid growth of Solana developers and the rapid expansion of the ecosystem[10]. Several PIPE or private/strategic investments are being made around Solana DAT, such as the $2.65 billion Solana DAT investment planned by Sharps, Pantera and Galaxy in August 2025[11].

Beyond simply holding tokens, Solana DAT is also involved in on-chain activities such as validator operations, infrastructure development, and ecosystem subsidies. For example, SOL Strategies (NASDAQ: STKE) has built its Solana treasury from scratch over the past year and is increasing its revenue streams by combining DAT with infrastructure operations such as validator revenue.

3. Comparison of the advantages of Ethereum and Solana DAT

In the medium to long term, Solana DAT will continue its rapid growth and may become one of the fastest-growing and most dynamic sectors within the DAT model. However, in terms of absolute scale and institutional maturity, Ethereum still holds a leading advantage. Ethereum DAT's influence is relatively mature in terms of quantity, asset size, and frequent participation in the DeFi ecosystem and on-chain activities. If certain key factors continue to improve, such as Solana's mainnet stability, infrastructure security, and regulatory clarity, Solana DAT may become a major trend alongside Ethereum in the future, especially favored by DAT companies that require high speed and low gas consumption.

Table 2: Comparison of advantages between Solana DAT and Ethereum DAT

V. Discussion on the Sustainability of the DAT Model

1. The Evolution and Risks of DAT's Growth Logic

From its outward appearance to its essence, DAT's core has never been profitability from its main business. Instead, it's about achieving a cyclical growth in market capitalization and assets through holding and operating crypto assets. DAT's growth logic can be divided into three points: First, narrative-driven growth. DAT "securitizes" crypto assets, allowing traditional capital to obtain crypto beta in the stock market, providing a valuation premium through indirect holdings. Second, asset appreciation. The rising price of the underlying coin drives balance sheet expansion, increasing mNAV and ultimately triggering market revaluation. Finally, the funding flywheel. High valuations support the company issuing more coins to buy more tokens, expanding holdings and boosting market confidence, further pushing up valuations. Therefore, during bull markets, DAT rapidly accumulates attention and valuation premiums by relying on "narrative + asset appreciation + funding flywheel," thereby attracting more capital injection.

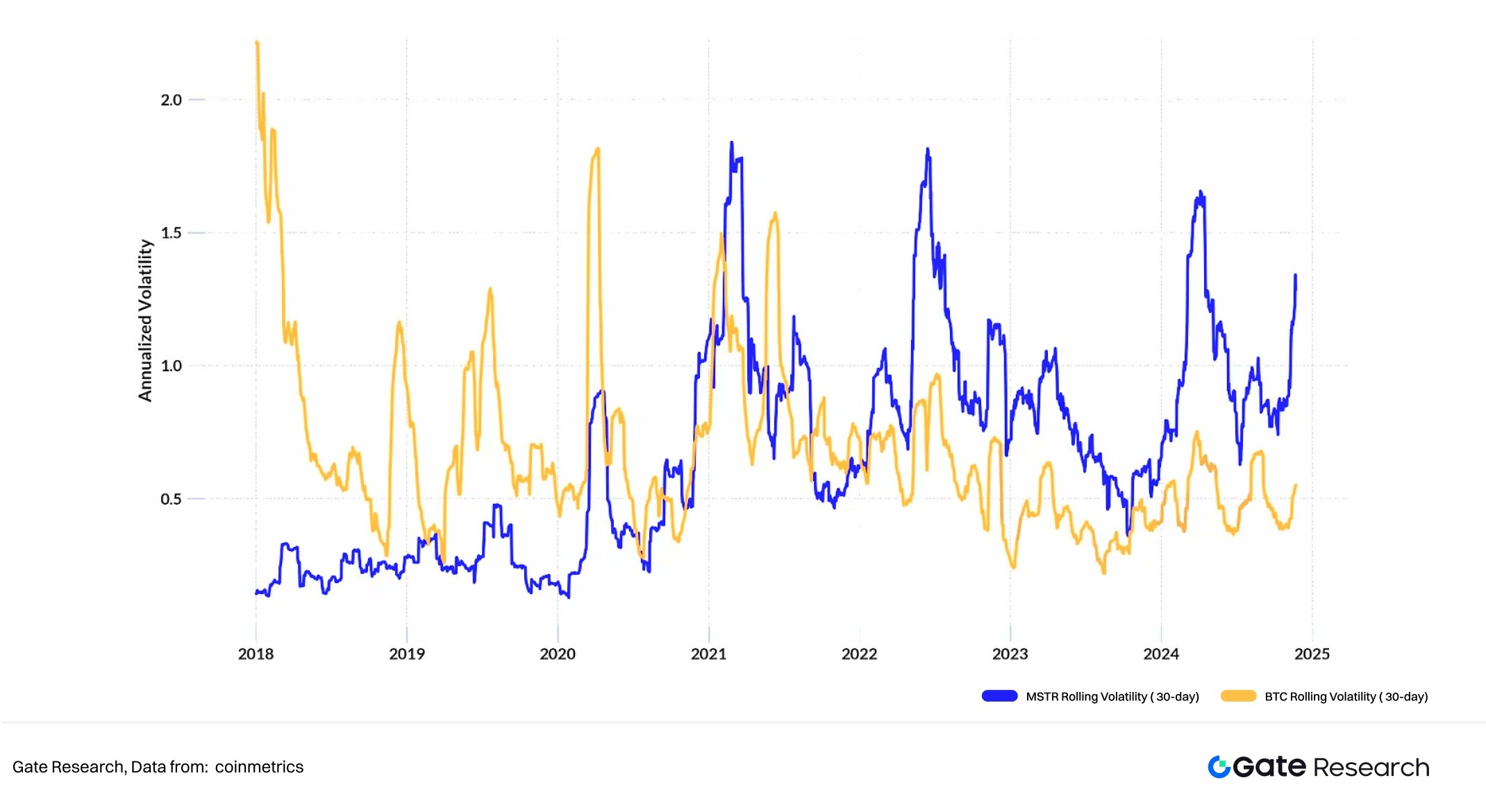

However, entering 2025, the market began to re-examine the sustainability of the DAT model. While Strategy, a star stock that once rose from a fringe software company to one of the top Nasdaq-listed companies by market capitalization, seemed to have lost its magic after reaching a new high at the end of 2024. The market began to criticize the DAT strategy as merely a magnifying glass in a bull market, while in a bear market, the "cryptocurrency content per share" would become worthless. At the same time, Michael Saylor's belief in Bitcoin also became controversial—was refusing to cash out in order to maintain the cryptocurrency content per share truly in the best interests of shareholders? Meanwhile, more and more companies began to replicate Strategy's model, rapidly crowding the DAT sector and gradually weakening the "market capitalization amplification effect" that originally relied on scarcity and narrative tension. In other words, as DAT ceased to be scarce, the marginal effect of its "asset-driven + valuation premium" model was diminishing.

Figure 8: Strategy's stock price fluctuations in 2025

Against this backdrop, the rise of the Ethereum ecosystem has brought about the second phase of the DAT model—active DAT participation in the on-chain economy. Unlike the passive holding of Bitcoin treasuries, Ethereum DAT can generate compound returns through staking, DeFi protocols, and on-chain liquidity operations, thus forming a second growth curve of "asset yield." However, this trend has also sparked new controversies: Will the large-scale staking of institutional treasuries lead to a decline in the overall network staking return rate and an increase in systemic risk? Does DAT participation ultimately promote ecosystem prosperity or accelerate bubble formation?

Therefore, the sustainability of the DAT model depends not only on the performance of a single asset, but also on its interaction with the blockchain ecosystem, the company's own operational quality, financing structure, and investor trust. Below, we will systematically analyze the challenges and evolutionary direction of DAT from both "endogenous" and "exogenous" perspectives.

2. DAT Five Forces Model of Sustainability

The intrinsic dimension refers to the company itself, specifically whether it possesses sufficient fundamentals and financial resilience to weather cyclical fluctuations in cryptocurrency prices. The exogenous dimension refers to the ecosystem and market, specifically whether the participating crypto ecosystem and market environment can provide stable sources of income and liquidity for the treasury assets. Based on the market pricing logic of DAT mentioned in the previous article—"coin content per share, underlying asset price, and mNAV"—and combined with the new on-chain revenue generation model, we have constructed a "DAT Sustainability Five-Force Model." This model will systematically evaluate DAT's long-term viability from five dimensions: asset value, asset operation, company fundamentals, regulatory compliance, and investor liquidity.

2.1 Valuation of the Target Asset

As the foundation of the DAT (Dead-End Asset) model, the nature of the underlying asset determines its long-term value. Currently, there are three main types of DAT models in the market:

1. Bitcoin Type: As the earliest and most widely accepted cryptocurrency, Bitcoin holds the status of "digital gold," and its limited supply ensures scarcity and provides resistance to inflation. Furthermore, global institutional and national holdings enhance its reserve attributes, making Bitcoin a value anchor during macroeconomic cycles. However, risks also exist. Bitcoin's limitation lies in its lack of returns, relying entirely on price increases for book value appreciation. In addition, in recent years, Bitcoin has become linked to political maneuvering, gradually evolving from a simple financial asset into a symbol of policy stances and ideologies. Its price fluctuations are increasingly influenced by election cycles, regulatory attitudes, and expectations of party policies.

2. Ethereum-type: Compared to Bitcoin, Ethereum has a more complete internal economic cycle. Ethereum's PoS mechanism brings additional comprehensive returns, making it an asset that can both appreciate in value and generate interest. However, the rise of competing chains may threaten its market share in the future, and the complexity of the protocol may also bring technical and security risks.

3. Emerging Public Chains: New public chains like Solana, with their high performance and strong developer ecosystem, have become new "growth-oriented Layer-1" chains sought after by capital. Furthermore, Solana's high staking yield and ecosystem expansion potential also offer DAT potentially high-return opportunities. However, at the same time, the technology and ecosystem stickiness of emerging public chain tokens may be less mature, leading to significantly higher volatility than Bitcoin and Ethereum. Narrative shifts or ecosystem security incidents could cause substantial pullbacks in asset value, and their long-term risk resistance remains to be seen.

The long-term sustainability of DAT depends on factors such as market acceptance, use value, technological maturity, ecosystem network effects, security, and market capitalization stability. Overall, Bitcoin represents a strong consensus-based store of value, but its passive holding characteristic amplifies volatility; Ethereum embodies an ecosystem and yield logic, providing a "safety margin" for DAT; while emerging public chain tokens like Solana represent a high-growth, high-risk logic.

2.2 Operational Capabilities of Cash-Holding Assets

The rise of ecosystems like Ethereum and Solana has provided DAT with a new model for on-chain revenue generation. This means that DAT's strategy no longer depends on "whether to hold tokens," but rather on "how to manage the token assets." Transforming from a passive beneficiary of the market to an active participant in the ecosystem, the stability of asset operations, governance capabilities, and risk management will become crucial to long-term sustainability.

For companies, compared to Bitcoin DAT which involves "passive holding," Ethereum and Solana-like DATs that participate in staking and on-chain financial activities offer a certain safety margin. When the price of the coin is stable or slightly lower, as long as the on-chain revenue exceeds the cost of capital, the DAT model can generate its own revenue; conversely, it needs to rely on the price of the coin to rise to maintain its valuation.

For the on-chain ecosystem, the on-chain deployment of DATs like Ethereum and Solana has increased network transaction volume and security, contributing to long-term price stability. The large-scale inflow of institutional funds into the Ethereum ecosystem has not only expanded the scale of financial activities such as lending and trading but also enhanced the liquidity of DeFi protocols, further propelling Ethereum towards becoming the "standard for on-chain collateralized assets." Taking Aave v3 as an example, ETH and wrapped stETH form a deep liquidity pool, and the participation of DAT companies can further enhance the pool's depth, achieving compound interest returns while improving market liquidity. Furthermore, through staking, DeFi, and LP mechanisms, more Ethereum is locked and staked, reducing market circulation and improving network decentralization and security. Long-term fund locking also contributes to price stability and de-speculation.

Figure 9: Ethereum staking liquidity has tended to stabilize since the second half of 2025.

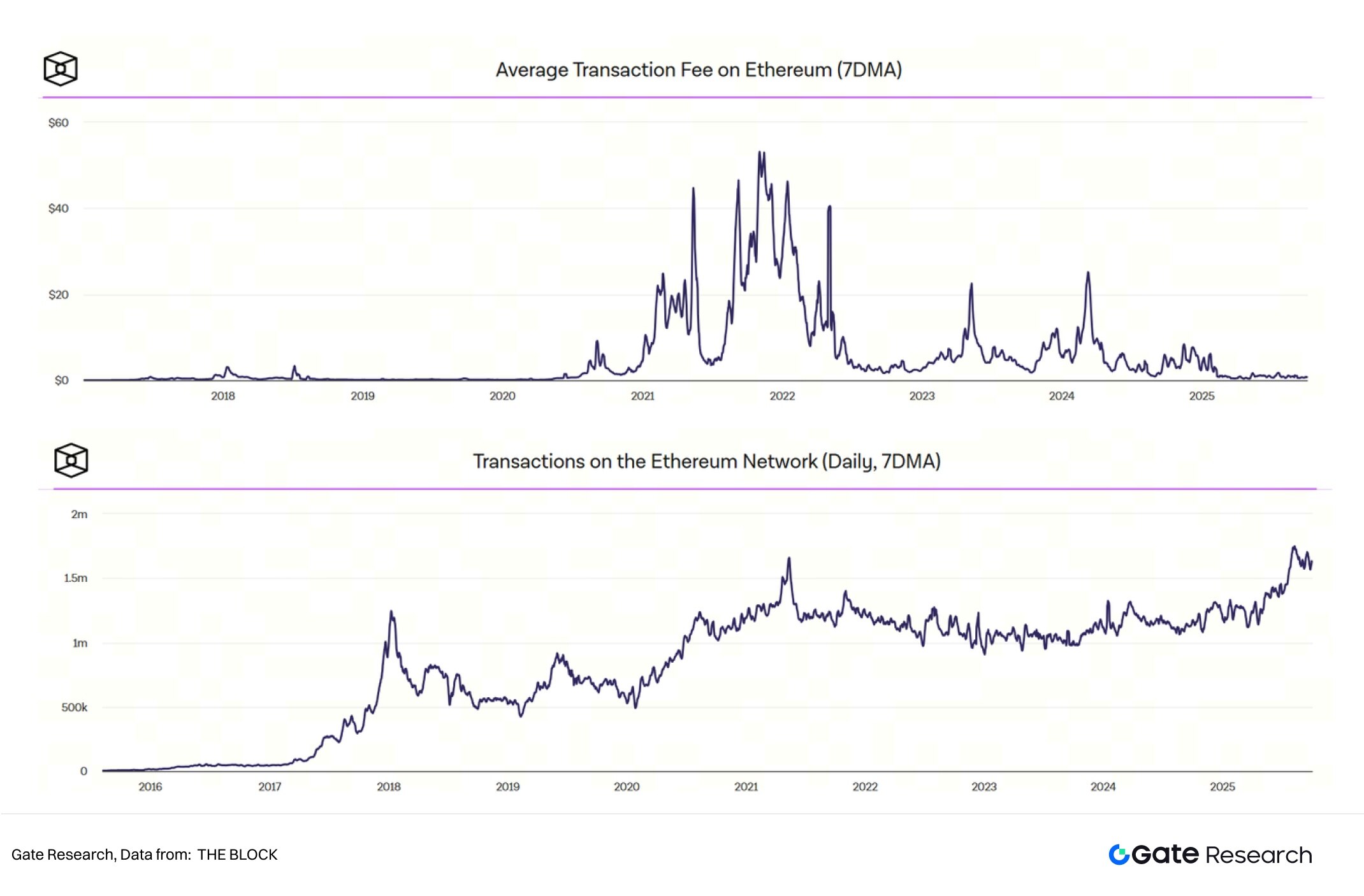

With the rise of the DAT model, the number of daily transactions on the Ethereum mainnet reached a new high in August 2025 (currently slightly lower at 1.55-1.7 million transactions/day). However, thanks to the migration of most transactions to L2 and blob scaling, total transaction fees remain at a low level compared to the past three years. If corporate treasury capital enters the blockchain on a large scale, its high-value transactions on the Ethereum mainnet (L1) could drive up overall block space demand and transaction fee revenue, thus forming a positive cycle of "treasury activity - enhanced liquidity - increased on-chain usage".

Figure 10: ETH Transaction Volume vs. Transaction Fees

In summary, the "on-chain" implementation of DAT has the following ecosystem feedback mechanisms:

1. Increased demand for blockchain space → Increased validator income → Enhanced cybersecurity;

2. Increased liquidity → Reduced risk in DeFi protocols → Improved user retention;

3. Increased on-chain transparency → Enhanced trust among institutional investors → Increased capital inflow.

However, the potential for returns from decentralization always coexists with systemic risks. Large-scale institutional staking and leveraged participation may intensify competition for on-chain returns, causing staking rewards to decline as the overall network participation rate increases. Meanwhile, DeFi protocols still face potential threats such as smart contract vulnerabilities and liquidation risks. In a bear market, if institutional treasuries withdraw liquidity en masse, the depth of decentralized exchanges may be insufficient to support large-scale sell-offs, potentially triggering an "on-chain stampede."

Therefore, a sustainable DAT model needs to establish a risk diversification and return balance mechanism. This could include: reducing exposure to a single coin through multi-asset portfolios; implementing a tiered staking strategy (partially locking up long-term assets while retaining liquidity); or collaborating with CeFi platforms to build a hybrid on-chain and off-chain return structure. These measures will be key guarantees for DAT to achieve robust "asset operation capabilities" within the on-chain ecosystem.

2.3 Company's fundamental support

The sustainability of DAT also depends on its sound operational foundation, which determines whether the company can "generate revenue to survive" during crypto market downturns and the long-term establishment of investor confidence. We categorize DAT into two types: strong-support and weak-support.

1. Strongly resilient DATs, such as Strategy, possess stable cash flow from its software business, enabling them to maintain debt repayment capacity even during a crypto bear market. Similarly, if SOL ecosystem DATs rely on staking yields as a long-term cash flow source, they can also partially mitigate the risks of asset price volatility.

2. Weakly Supported DAT refers to pure shell companies or SPAC structures that, if lacking a core business and with insufficient cash flow, are highly susceptible to falling into a cycle of "relying on bond issuance to survive." Once the market cools down or financing is interrupted, these companies often become high-risk targets for default.

When conducting fundamental analysis of a company, the following key points should be carefully evaluated: First, does the company have non-crypto-related cash flow sources? Second, can it cover financing interest and operating expenses? Third, is the financial structure sound (leverage ratio, cash position)? If DAT lacks fundamental support and relies solely on asset price increases or capital narratives, its fragile "shell" is unlikely to withstand market fluctuations and may even face liquidation risks in a bear market.

2.4 Regulation and Compliance

As publicly traded companies, DATs face the same stringent regulations regarding investor protection and transparency as other publicly traded companies. The evolution of the regulatory framework is gradually becoming a key variable for the sustainability of the DAT model.

With increased compliance acceptance of crypto assets in recent years, some jurisdictions have begun to recognize the legality of holding crypto assets, providing a more stable disclosure and auditing environment for DAT companies. Since 2024, updates to FASB accounting standards have changed the strategic significance for DAT companies—allowing them to measure crypto assets at fair value, directly improving financial statement transparency and asset valuation space. Prior to this change, companies like Strategy classified their cryptocurrency holdings as intangible assets, meaning that a drop in Bitcoin's value would permanently reduce their holdings, with gains only recognized upon the sale of tokens (though Michael Saylor vowed never to do so). This change means that DAT companies using GAAP can identify unrealized changes in the value of their cryptocurrency holdings. However, the change in accounting standards is a double-edged sword; significant price fluctuations in cryptocurrencies can lead to substantial increases in quarterly earnings, but also potentially huge losses.

Some market analysts believe that the formation of DAT companies in the future may no longer be through SPAC, but through mergers with legitimate companies. However, the “de-SPAC” process may be chaotic and requires efforts from all parties, including shareholder voting and regulatory filing.[12] As more and more DAT companies continue to enter the market, consolidation has begun. In September 2025, Strive (NASDAQ: ASST) announced the acquisition of Semler Scientific (NASDAQ: SMLR) in an all-stock transaction. This was the first merger of two publicly traded Bitcoin treasury companies. After the merger, the new entity will integrate the Bitcoin assets of both parties, increase the “coin content per share”, and enhance its financing capabilities in the capital market. This transaction is seen as a landmark event in the DAT field entering the “consolidation period”, which means that DAT may usher in the next stage of development.[13]

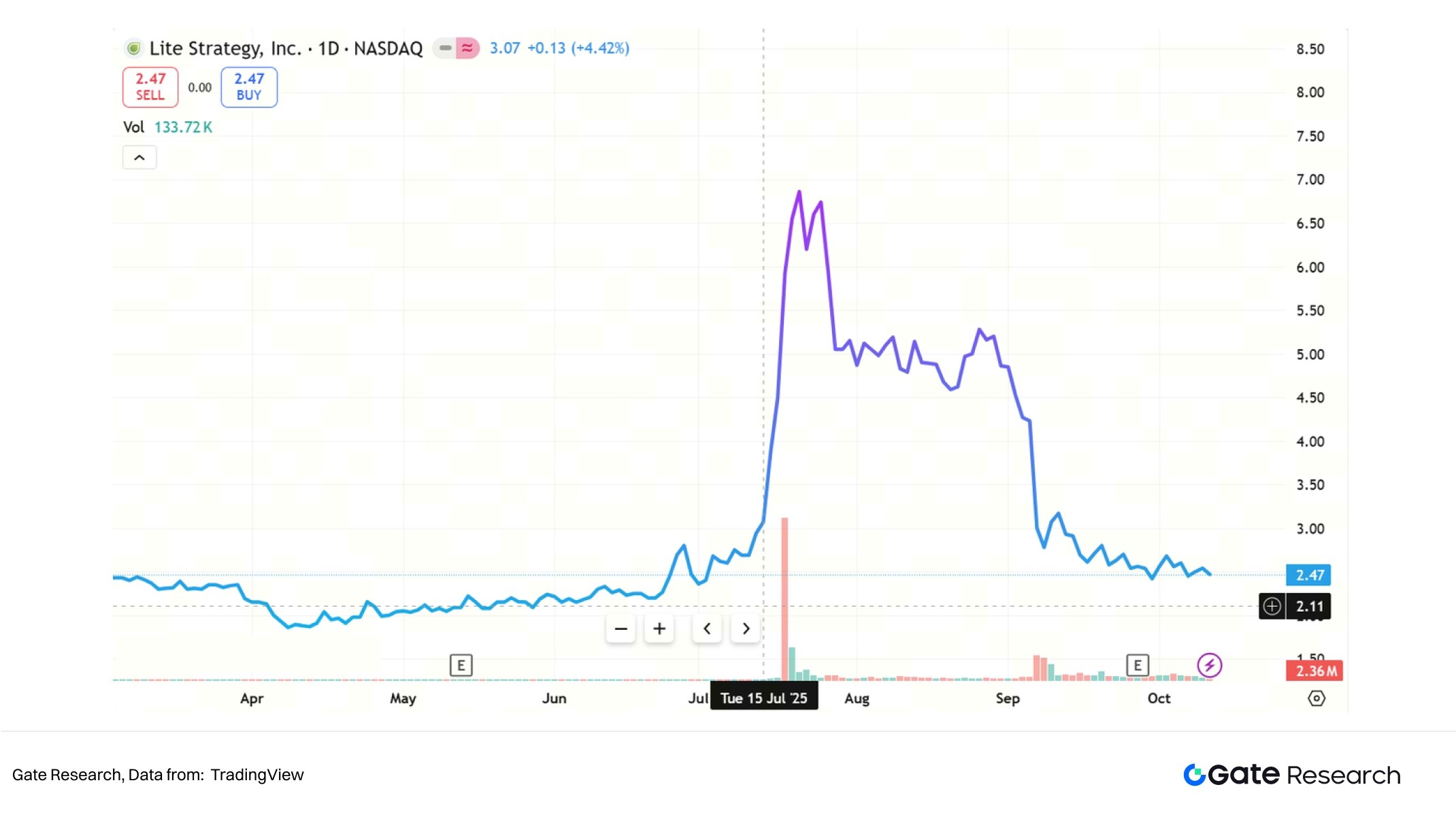

However, announcing a strategic reserve of crypto assets is not the key to unlocking wealth. Nasdaq or the NYSE have high requirements for market capitalization and information disclosure. If shell companies like DAT do not meet the standards, they may eventually be forced to delist. For example, the stock price of BNB Treasury company Windtree Therapeutics fell by more than 90% in one month and no longer met the minimum price of $1.00 per share on Nasdaq, thus facing delisting[14]. In addition, there are also many questions about asset bubbles and insider trading in DAT companies. On September 24, 2025, the SEC and the Financial Industry Regulatory Authority (FINRA) jointly announced that they would investigate more than 200 listed companies that had announced crypto Treasury plans, because these companies generally experienced "abnormal stock price fluctuations" before releasing the relevant information[15]. Similarly, the possibility of insider trading has also led to the collapse of some investors' trust in DAT. For example, MEI Pharma (later renamed Lite Strategy Inc.) announced the launch of a $100 million Litecoin treasury strategy on July 18, 2025, but its stock price had already experienced an abnormal rise around July 16 before the announcement.

Figure 11: Abnormal stock price fluctuations of Lite Strategy

Despite over 200 companies announcing crypto treasury strategies by 2025, covering multiple chains including BTC, ETH, SOL, BNB, and TRX, capital and valuations are rapidly concentrating on a very small number of companies and assets, with a rapidly forming head effect. We believe that while Bitcoin DAT and Ethereum DAT account for the majority of DAT companies, ultimately only one or two companies in each asset class may truly succeed, and the remaining projects may struggle to compete on scale.

2.5 Investors and Liquidity

DAT's valuation ultimately depends on market liquidity and investor structure. Looking at the current investor structure, while some larger DAT companies attract institutional buyers by including their shares in tracking funds, the majority of DAT buyers are retail investors. For retail investors, buying DAT shares allows them to indirectly participate in the crypto market and avoid the risks of directly holding the cryptocurrency, but this could also be a factor contributing to greater trading volatility.

Strategic capital such as crypto funds and family offices also have a need to allocate Web3 assets through DAT to obtain leveraged returns, but the proportion of these institutional investors varies greatly among different DAT companies. Specifically, large-cap companies with good liquidity are more likely to be allocated by public funds, pension funds and quantitative funds. Taking the leading Bitcoin DAT Strategy as an example, its institutional shareholding ratio is relatively high. As of October 8, 2025, institutional investors accounted for 58.84% [16]. Before Ethereum and other public chain ETFs are fully open, institutional investors often use DAT as a compliant crypto asset exposure. However, relatively speaking, the institutional share of some Ethereum DAT and small-cap DAT is still generally low. For example, the institutional investor share of Sharplink is 13.75%, and the institutional investor share of BTCS is only 3.48%.

From a liquidity perspective, the liquidity of DATs depends not only on the size of their on-chain assets but also on differences in investor structure. Institutionally-dominated DATs typically possess stronger funding stability and trading depth. Their institutional investors are mostly focused on long-term allocation or asset substitution, making them less sensitive to short-term market fluctuations. Therefore, they can, to some extent, buffer against concentrated asset selling pressure. During market volatility, these DAT companies are more likely to manage risk through off-exchange transactions or hedging, thereby maintaining a more stable market capitalization during periods of volatility.

Conversely, retail-dominated DAT companies have more dispersed circulating shares, but their trading sentiment is highly volatile. When market expectations shift or token prices fall, they are prone to synchronized sell-offs. Therefore, once these retail-dominated DAT companies collectively reduce their holdings, their on-chain positions can be rapidly amplified through illiquid decentralized exchanges, leading to a "step-like" price decline. Especially in assets with relatively tiered liquidity, such as Ethereum, the on-chain release of large treasury holdings often triggers non-linear price reactions—even if the sell-off represents only a tiny percentage of the circulating supply, it can still trigger sharp fluctuations due to insufficient market absorption capacity.

Overall, the sustainability of DAT's future fundraising depends on its ability to attract institutional, long-term investors (such as ETFs, family offices, and sovereign wealth funds) to reduce its sensitivity to market volatility. We believe that as compliance and regulatory mechanisms for crypto assets and DAT further improve, the liquidity structure of institutional funds entering DAT is expected to shift from sentiment-driven to asset allocation-driven, and market volatility will tend to converge.

VI. Conclusion

As a new trend combining crypto and traditional finance, the DAT model is essentially a "mapping mechanism between capital markets and on-chain assets." During bull market cycles, rising underlying assets, smooth financing, and increased investor risk appetite make DAT a typical amplifier of both valuation and sentiment. However, historical experience shows that this model is highly susceptible to the dual pressures of financing disruptions and asset devaluation in bear market environments, potentially causing the flywheel to shift from a positive feedback loop to a negative one.

The sustainability of DAT ultimately depends on five key pillars: 1. Whether the crypto assets chosen by the DAT company possess long-term value and sustainable returns; 2. Whether DAT is passively held or actively managed to generate cash flow; 3. Whether the DAT company has a core business and stable cash flow to buffer against asset volatility; 4. Policy changes in compliance disclosure, accounting standards, and fair value measurement will determine whether DAT can be accepted by mainstream capital in the long term; 5. Whether the concentration and professionalism of the DAT company's investor structure can withstand significant fluctuations in liquidity.

Despite over 200 companies announcing crypto treasury strategies by 2025, covering multiple chains including BTC, ETH, SOL, BNB, and TRX, capital and valuations are rapidly concentrating on a very small number of companies and assets, with a head effect accelerating. Looking ahead, the winners in DAT will not be numerous speculative "shell companies," but rather those enterprises capable of creating stable flywheels in both ecosystem building and capital markets. These companies will not only effectively allocate capital and generate on-chain revenue, but also win the trust of institutional investors through transparent governance and sound finances. Similarly, in each mainstream asset class, there may ultimately only be one or two winners.

DAT is still in the early stages of financial innovation, and its path is destined to be accompanied by high volatility and uncertainty. However, from a longer-term perspective, the value of DAT lies not in short-term price leverage, but in its ability to become a stable bridge connecting the crypto economy and traditional capital markets.

References

• [1] YouTube, https://www.youtube.com/watch?v=b0KU4cJgj6g

• [2] Cointelegraph, https://cointelegraph.com/news/worlds-biggest-business-intelligence-firm-buys-21k-btc-for-250m

• [3] Bloomberg, https://www.bloomberg.com/news/articles/2020-12-07/microstrategy-to-raise-400-million-to-buy-even-more-bitcoin

• [4] Bitcointreasuries.net, https://bitcointreasuries.net/

• [5] PR Newswire, https://www.prnewswire.com/news-releases/bitmine-immersion-now-holds-approximately-500-million-of-ethereum-to-advance-its-ethereum-treasury-strategy-302504282.html

• [6] Coingecko, https://www.coingecko.com/zh/treasuries/%E4%BB%A5%E5%A4%AA%E5%9D%8A/companies

• [7] CoinDesk, https://www.coindesk.com/business/2025/07/08/crypto-treasury-firm-reserveone-going-public-in-1b-spac-deal

• [8] NASDAQ, https://www.nasdaq.com/press-release/mega-matrix-announces-diversify-dat-strategy-basket-leading-stablecoins-and

• [9] AInvest, https://www.ainvest.com/news/solana-news-today-institutional-capital-shifts-public-companies-turn-solana-digital-treasury-standard-2508

• [10] Yellow, https://yellow.com/news/cantor-fitzgerald-sees-dollar250-million-potential-in-solana-treasury-companies

• [11] Coinrank, https://www.coinrank.io/crypto/2-65-billion-solana-dat-plan/

• [12] CoinDesk, https://www.coindesk.com/markets/2025/09/28/from-spacs-to-cash-flow-buys-how-dats-are-plotting-the-next-growth-phase

• [13] Yahoo!Finance, https://finance.yahoo.com/news/strive-semler-scientific-merge-stock-145427057.html

• [14] The Block, https://www.theblock.co/post/367721/nasdaq-to-delist-bnb-token-treasury-company-windtree-therapeutics-for-noncompliance

• [15] Cryptopolitan, https://www.cryptopolitan.com/sec-finra-probe-crypto-treasury-stock-spikes/

• [16] MarketBeat, https://www.marketbeat.com/stocks/NASDAQ/MSTR/institutional-ownership/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, insights into hot topics, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risks. Users are advised to conduct independent research and fully understand the nature of any assets and products they intend to purchase before making any investment decisions. Gate assumes no responsibility for any loss or damage arising from such investment decisions.