Crypto VC in the cracks: liquidity dilemma, ecological reconstruction and breaking through the new cycle

- 核心观点:加密VC影响力衰退,亚洲VC尤为严重。

- 关键要素:

- VC币遭投资者反感,流动性匮乏。

- 亚洲VC基金周期短,LP压力大。

- 欧美VC体系成熟,退出渠道多元。

- 市场影响:推动VC转向股权投资与二级市场。

- 时效性标注:中期影响。

Original author: Gu Yu, ChainCatcher

An indisputable and obvious fact is that crypto VC has been declining in the market cycle of recent years. The return rate, voice and influence of almost all VC institutions have decreased to varying degrees, and even VC coins have been "sneered" by many investors.

There are many reasons for this. For example, since most VCs are accustomed to selling tokens and there are too many capital-funded projects, users have begun to dislike VC coins. More funds have flowed into narratives with low VC content, such as memes and AI agents, resulting in a lack of liquidity for VC coins. For example, the token unlocking cycle of VCs is getting longer and longer, resulting in a slower exit cycle and a disadvantageous position.

Several veteran investors have offered their own explanations. Jocy Lin, founder of IOSG Ventures, believes that during the 2021 bull market, primary market liquidity was extremely abundant, allowing VCs to raise large amounts of capital in a short period of time. This excess capital led to generally inflated project valuations and inadvertently amplified narrative-driven investment models. Many VCs remain stuck in the easy money model of the first two cycles, believing that products and tokens are unrelated. They are obsessed with grand narratives and potential markets, while ignoring a project's true product-market fit (PMF) and sustainable revenue models.

Jocy Lin further explained that the dilemma facing cryptocurrency VCs stems from a mismatch between their ability to capture value and their risk-taking . They bear the longest lock-up periods and the highest risks, yet are at the weakest position in the ecosystem, exploited by exchanges, market makers, and influencers (KOLs). When the narrative-driven model collapses, native VCs, lacking industry resources, lose their foundation for survival. Money is no longer a scarce resource; liquidity and certainty are.

Will, a partner at Generative Ventures, believes that exchanges and market makers have become the true exploiters of all liquidity and premiums in this cycle. Most projects use VC funding for two main purposes: marketing and promotion, and exchange listing fees. These projects are essentially marketing companies, burdened with substantial payments to exchanges and market makers. Furthermore, VC-backed coins currently require a 2-3 year lock-up period after listing, which is longer than even in traditional securities markets. This results in very poor liquidity expectations for exits, making it difficult to profit.

Anthony Zhu, founding partner of Enlight Capital, believes that Asian VCs primarily focused on token strategies have fallen into a death spiral amid the current altcoin market downturn. The previous bull market's quick-win strategy has created a strong path dependency for both LPs and GPs. When this path becomes stretched or even eliminated, VCs are squeezed by both LPs' short-term profit expectations and projects' diverging fundamentals, ultimately leading to distorted strategies. The current situation is essentially a mismatch between LPs, GPs, and market opportunities.

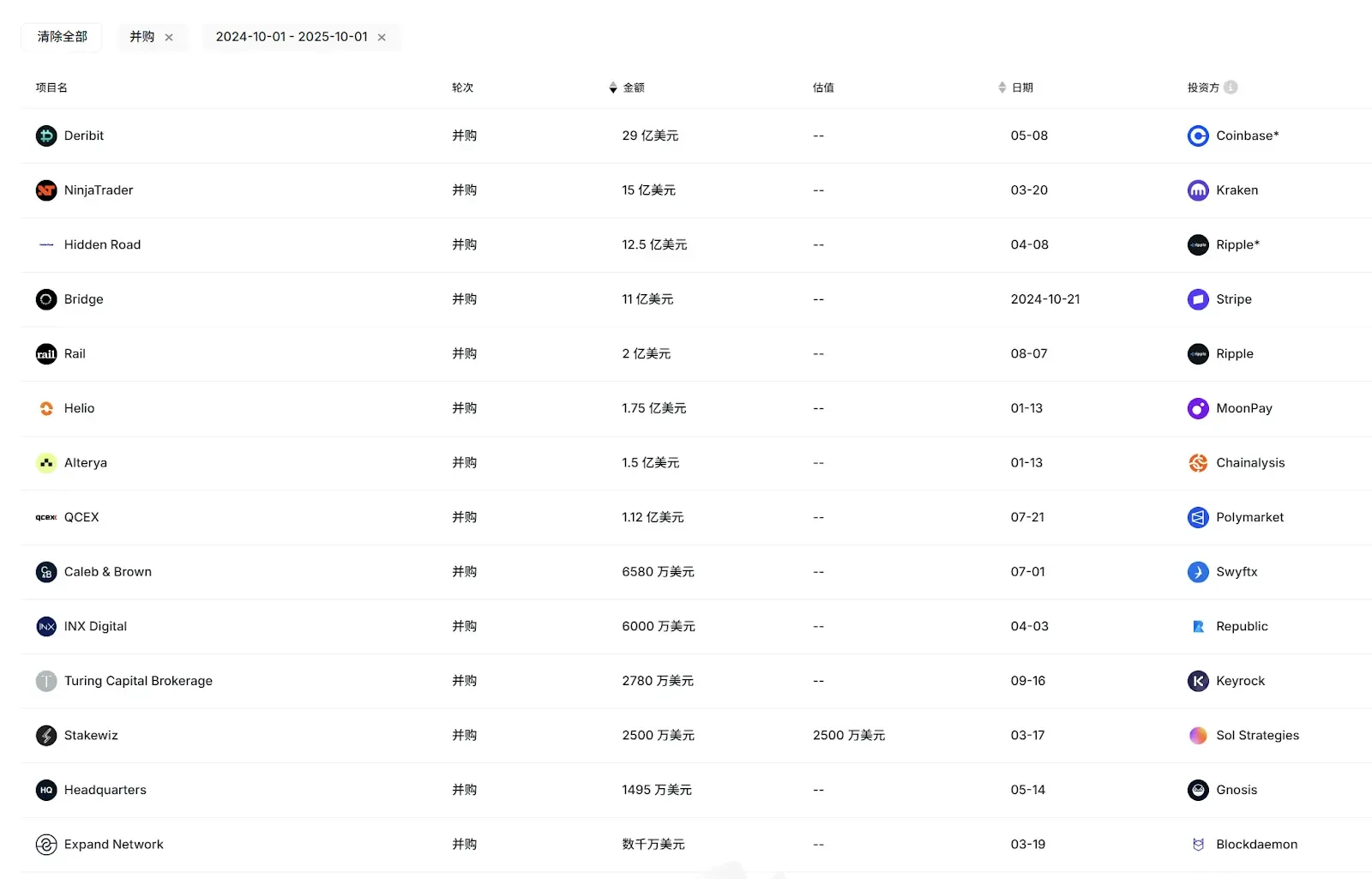

Beyond the overall decline of VC, a more noteworthy phenomenon and issue is that the overall activity and influence of Asian VC firms appear to have declined even more significantly this cycle. In RootData's 2025 Top 50 VCs list, compiled this month based on activity and exit performance, only two or three Asian VCs, including OKX Venture, made the list. Furthermore, during the recent IPO boom and major M&A exits (Circle, Gemini, Bridge, Deribit, etc.), only IDG Capital achieved significant returns thanks to its early investment in Circle, while other Asian VCs were largely absent.

Looking further, once very active and well-performing Asian VC institutions such as Foresight Ventures, SevenX Ventures, Fenbushi Capital, NGC Ventures, and NGC Ventures have made no more than 10 or even 5 investments this year, and have made very little progress in fundraising.

From once being a force to be reckoned with, to now being in a state of silence, why has Asian VC become so predicament?

1. Why can’t Asian VCs compete with European and American VCs?

Under the same environment, Asian VCs cannot compete with European and American VCs. According to some interviewees, this is mainly due to many reasons such as fund structure, LP type, and internal ecology.

Jocy Lin, founder of IOSG Ventures, believes this is partly due to a lack of mature LP groups in Asia . Consequently, many Asian VC funds primarily rely on high-net-worth individuals and entrepreneurs from traditional industries, as well as some idealistic OGs from the crypto industry. Compared to the US and other Western markets, the lack of support from long-term institutional LPs and endowment funds has led Asian VCs to favor thematic, speculative investments over systematic risk management and exit strategies under pressure from LP exits. This results in shorter fund lifecycles and, therefore, greater pressure during market contractions.

"In comparison, most European and American funds have a lifespan of more than 10 years, and their overall systems are more mature in terms of fund governance, post-investment empowerment, and risk hedging, allowing them to maintain more stable performance in downturns. " In response to this, Jocy Lin also tweeted on X, calling on various exchanges to launch rescue funds worth hundreds of millions of dollars. If they cannot do it themselves, then they can invest in VCs to allow them to complete the role of capital feeding back to entrepreneurs.

Jocy Lin also said that Western funds tend to pursue people-oriented investment values. Founders who can operate projects in the crypto industry for a long time and maintain the fundamentals of a project through cycles are very entrepreneurial and resilient. Such founders are also a minority in the industry. Some Western investors have succeeded, but the success rate of their investment model in the crypto industry is very limited.

Furthermore, the subsequent inflated project valuations by US funds impacted many participating Asian funds . Due to shorter fund cycles and a focus on short-term cash returns, Asian funds began to diverge. Some invested in riskier sectors like gaming and social media, while others aggressively entered the secondary market. However, both approaches struggled to achieve outperformance in the volatile altcoin market, and some even suffered significant losses. "Asian funds are a very loyal and committed group, but the industry has let them down during this cycle," lamented Jocy Lin.

Anthony Zhu holds a similar view. He said that European and American funds are generally larger in size and have deeper pockets, so their investment strategies are more flexible and they perform better in a market environment that is not one-sidedly rising.

Another key factor is that European and American projects offer a wider range of exit options, rather than relying solely on a single exchange listing. During the recent M&A boom, the primary acquirers were leading European and American crypto companies and financial institutions. Due to various geographical and cultural factors, Asian crypto projects have not yet become a high-priority target for these acquirers. Furthermore, the majority of current IPO projects are European and American in origin.

Source: RootData

Due to smoother equity exit channels, European and American VCs tend to have more diversified investment targets. However, many Asian VCs are limited by factors such as team background, fund structure and exit channels, and usually stay away from equity investments. As a result, they miss out on many project opportunities with returns of ten or even a hundred times the original investment.

However, Anthony also emphasized that while Asian crypto VCs focused on token investments have generally underperformed since the last cycle, some Asian dollar-denominated VCs investing in equity projects have performed exceptionally well. "Mainstream institutional VC investors are more patient, and their performance will only be reflected over the long term. Asia is home to some of the world's best crypto entrepreneurs, dedicated to developing innovative products. In the future, more and more Asian projects will enter mainstream exit channels in Europe and the United States. Asia also needs more long-term funding to support outstanding early-stage projects."

Will offered another unconventional perspective. He believes the poor performance of Asian VCs stems from their proximity to Chinese exchanges. The closer they are, the worse their performance actually is, as they pin their exit hopes on exchanges listing, yet exchanges are the biggest exploiters of liquidity in this cycle. "If these VCs had seen the situation more clearly, they should have bought exchange tokens like BNB, OKB, and BGB, rather than investing in so many small projects that rely heavily on exchanges for listing, ultimately locking themselves in."

2. VC and Industry Transformation

Crisis breeds change, and a major reshuffle of the crypto VC landscape is inevitable. If 2016-2018 marked the rise of the first generation of crypto VCs, and 2020-2021 marked the rise of the second, then we are likely entering the third generation of crypto VC cycles.

In this cycle, in addition to the aforementioned renewed focus on US dollar equity investments, some VCs are shifting their strategies to focus more on the more liquid secondary market and related OTC sectors. For example, LD Capital has fully pivoted to the secondary market over the past year, acquiring significant positions in tokens like ETH and UNI, generating significant discussion and attention, and establishing itself as one of the most active players in the Asian secondary market.

Jocy Lin said that IOSG will not only pay more attention to primary market equity and agreement investment, but will also expand on its past basic investment research capabilities. In the future, it will consider some OTC or passive investment opportunities and structured products and other strategies to better balance risks and returns.

However, IOSG will remain active in the primary market. "In terms of investment preferences, we will pay more attention to projects with real income, stable cash flow and clear user needs in the future, rather than relying solely on narrative-driven projects. We hope to invest in products and sustainable business models that can still have endogenous growth momentum in an environment lacking macro liquidity," said Jocy Lin.

When it comes to cash flow and revenue, the most notable project of this cycle is undoubtedly Hyperliquid, which, according to DeFillama data, has generated over $100 million in revenue in the past 30 days. However, Hyperliquid has never received VC investment. This VC-independent, community-driven project development model has set a new path for many projects. Will more and more high-quality projects follow Hyperliquid's example, further diminishing the role of crypto VCs? Furthermore, with the increasing number of KOL and community-funded rounds, to what extent will they replace the role of VCs?

Anthony believes that for some DeFi projects, such as Perp, a model similar to Hyperliquid may persist due to the small team size required and strong monetization potential, but this may not be the case for other projects. In the long run, VC will remain a key force in driving large-scale development in the crypto industry and connecting institutional funding with early-stage projects.

"Hyperliquid's success is largely due to the self-circulating nature of its product—as a perpetual contract, it naturally has the ability to generate revenue and drive market growth. However, this doesn't mean the "VC-free" model can be universally replicated. For most projects, VC remains a key source of early-stage product development funding, compliance advisors, and long-term capital." Jocy Lin stated that in every traditional TMT segment and industry, there is no sector without VC and capital participation (such as AI or healthcare), and an industry without VC is absolutely unhealthy. VC's moat hasn't disappeared, but rather has shifted from providing money to providing resources and patience.

Jocy Lin also shared a statistic: For projects backed by top VCs, the three-year survival rate is 40%. For projects driven entirely by the community, the three-year survival rate is less than 10%.

Discussing KOL and community funding rounds, Jocy Lin believes their rise is indeed changing the structure of early-stage financing. They can help build consensus and community momentum in the early stages of a project, offering advantages particularly in marketing and GTM. However, this model's capabilities are primarily limited to narrative communication and short-term user mobilization, with limited support for a project's long-term governance, compliance, product strategy, and institutional expansion.

Today, Asian crypto VCs are facing their lowest point in years. Rapid changes in internal and external ecosystems and narrative logic have led VCs to different trajectories. Some VCs' names have fallen into the dust of history, some VCs are still hesitating, and some VCs are already making drastic adjustments to explore how to form a healthier and more lasting relationship with projects.

However, the bloodsucking behavior of market makers and exchanges continues, and Binance Alpha's high frequency of listings has even exacerbated this situation. How to break free from this negative ecological relationship and find breakthroughs in exit paths and investment strategies will remain one of the biggest challenges for the new generation of VC models.

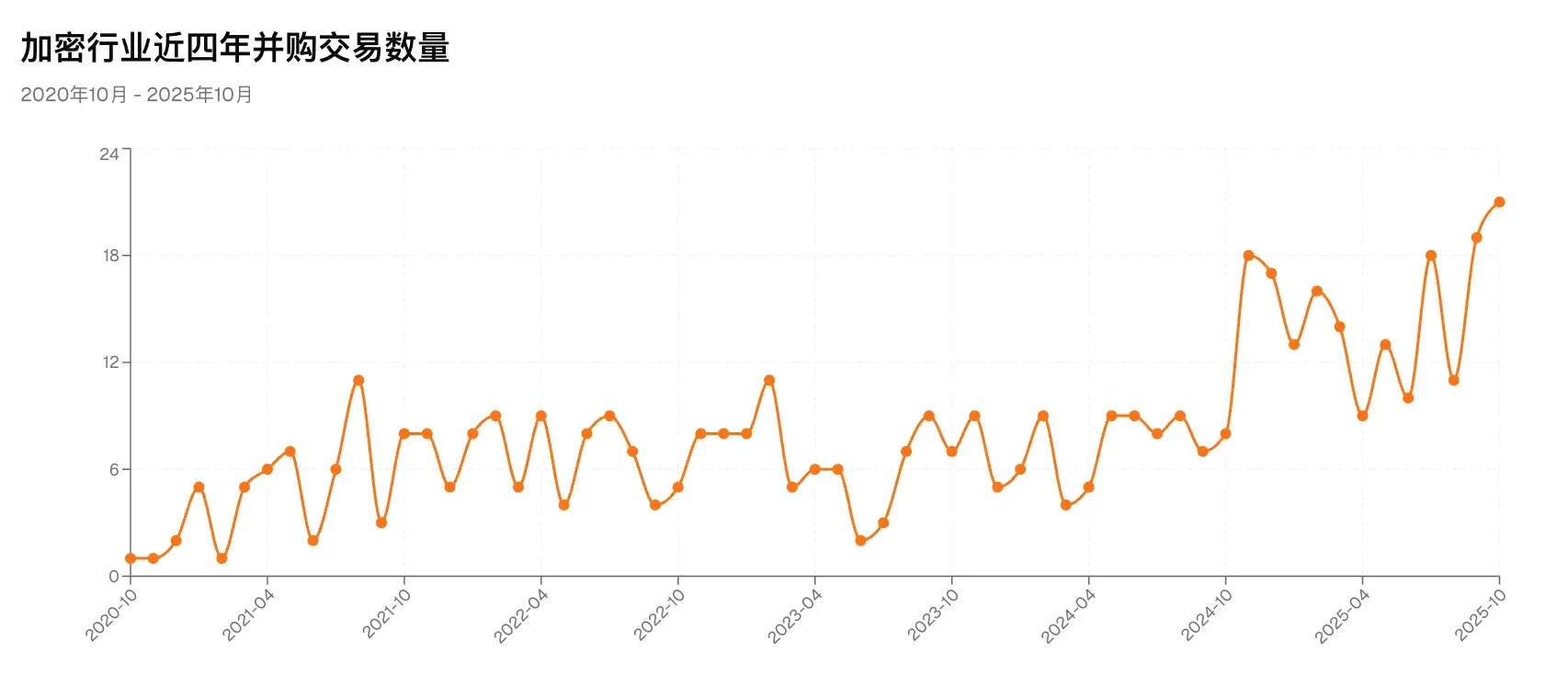

Crypto giants like Coinbase have recently significantly accelerated their mergers and acquisitions. According to RootData, over 130 mergers and acquisitions have occurred in the first ten months of this year. At least seven crypto companies have gone public, and total fundraising for crypto-related listed companies (including DATs) has exceeded $16.4 billion, all of which are record highs . According to reliable sources, a well-known traditional Asian VC firm has established an independent fund focused on equity investments, with a lifespan of approximately 10 years. More and more VCs are aligning with the "old rules" of the equity investment market.

This is probably one of the strongest signals that the market is sending to VCs about a new cycle: there are still many opportunities in the primary crypto market, and the golden period for equity investment may have arrived.