Cryptocurrency's Fork in the Road: Narrative vs. Pragmatism

- 核心观点:加密行业分为实用型与叙事型两大板块。

- 关键要素:

- 实用型项目注重产品与收入。

- 叙事型项目依赖宏大愿景吸引关注。

- 两者相互促进,构成行业生态。

- 市场影响:引导项目方与投资者差异化策略。

- 时效性标注:长期影响。

Original article by Yash Agarwal, founder of SendAI

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

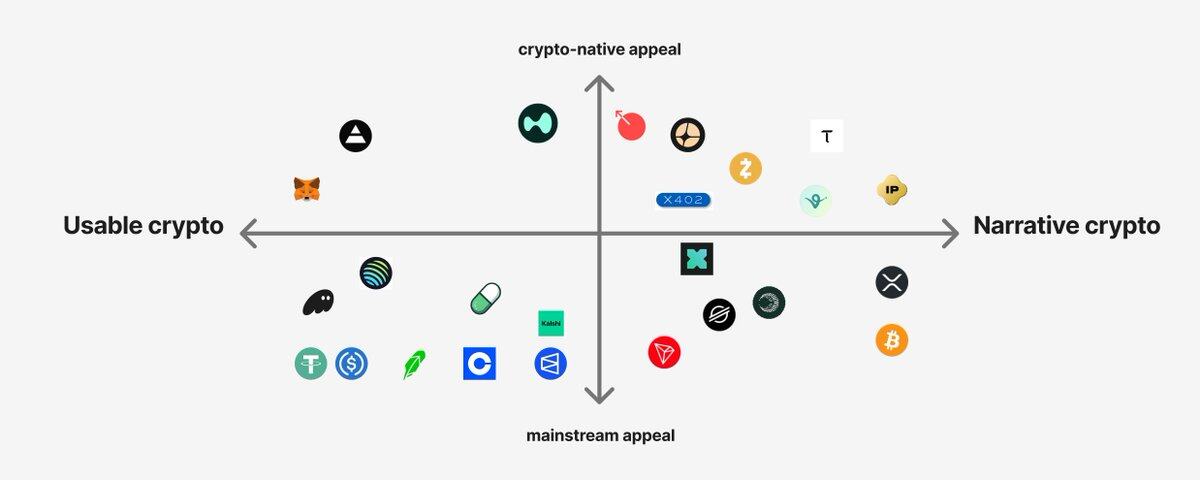

I used to think of the cryptocurrency industry as a whole, but recently my whole perspective has shifted — I now always divide the cryptocurrency industry into two main parts, especially from the perspective of builders, as shown on the left and right sides of the above image:

- Usable Crypto

- Narrative Crypto

Next I will explain how to look at them correctly and explain how to build projects or make money based on these two types.

pragmatism

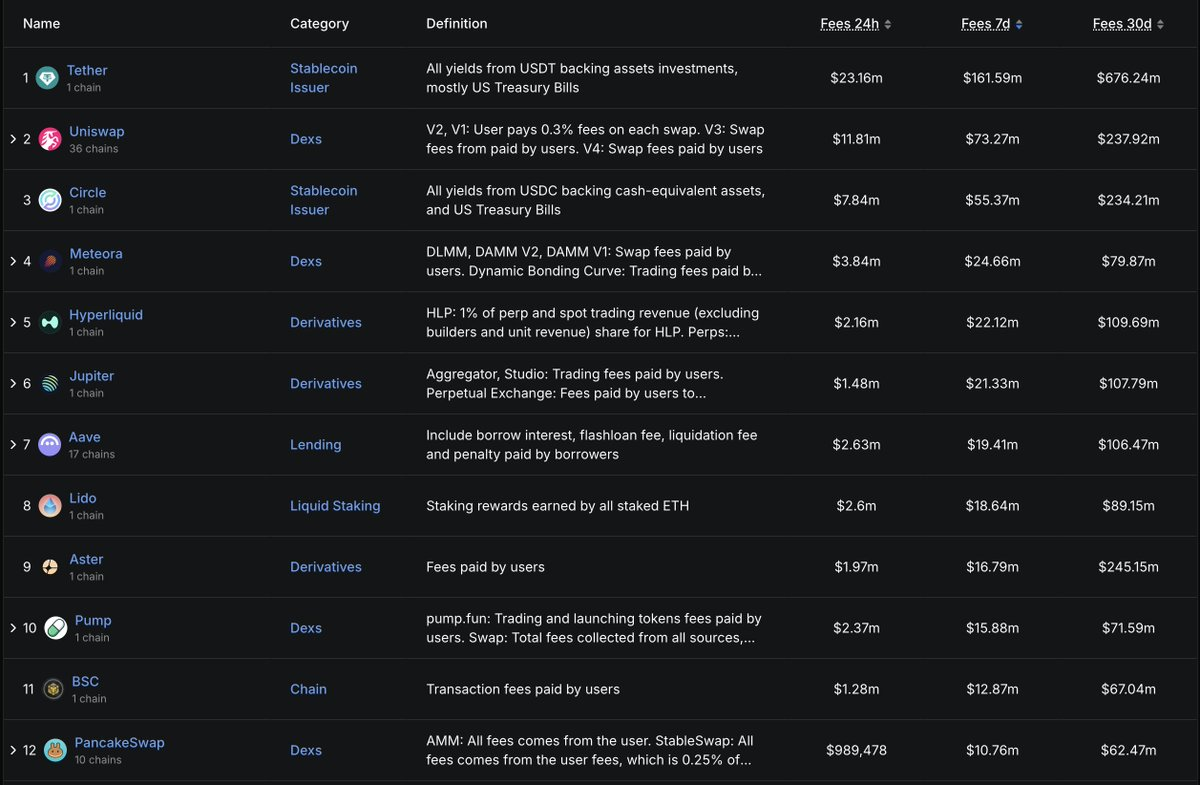

Utility cryptocurrencies, which are often “best-in-class businesses”, such as:

- Wallet: Phantom, MetaMask;

- Stablecoins: USDT, USDC;

- Trading platforms: Hyperliquid, Raydium, Jupiter;

- Distribution platform: pump.fun, and various LaunchPads;

- Bot tool or trading terminal: Axiom;

- DeFi protocols: Aave, Kamino, Lido;

These things work, are easy to use, and generate a lot of revenue. They are often the projects with the highest fee income in the cryptocurrency space.

Narrative

Narrative cryptocurrencies usually have a sufficiently grand story or vision (hundreds of billions of dollars) that is powerful enough to change the world. Here are some examples:

- Bitcoin: The story of “better money” or “digital gold”;

- AI x Crypto: involves GPU infrastructure and agent framework;

- DeSci or intellectual property projects: such as Story;

- Emerging Layer 1/Layer 2: such as stablecoin-driven Layer 1 or contract transaction-driven Layer 2

- Privacy coins: such as Zcash;

- Restaking or other various infrastructure;

- and the latest x402;

These projects generate little to no revenue, but are able to drive token prices up because their stories can attract both institutional and retail investors.

It should be made clear that narrative cryptocurrencies and utility cryptocurrencies are not mutually exclusive (in fact, both parties together constitute the complete industry landscape).

Consider that Zcash has a low actual user base (averaging 5,000-10,000 transactions per day), yet it has garnered significant attention thanks to its strong privacy narrative. This level of attention could potentially drive real-world adoption (see the recent surge). Similarly, the Coinbase development team's x402, which is currently largely unused but has recently become a hot topic of discussion, can also drive increased awareness and actual usage.

I always think of this situation as a relationship that's like a spectrum.

Both are equally important and can reinforce each other — narrative cryptocurrencies can drive speculation, which in turn drives the adoption of utility cryptocurrencies.

In the world of utility cryptocurrencies, product (users) comes first; in the world of narrative cryptocurrencies, community is king.

The Builder's Dilemma

Every builder will encounter a dilemma: should they build a narrative cryptocurrency or a practical cryptocurrency?

A simple rule of thumb is: if you’re better at grabbing attention and charismatic enough to lead a movement (or if you’re a “good storyteller” — that’s both a skill and a compliment), then you should build a narrative cryptocurrency.

For example, if you excel at token issuance, exchange listings, and capital market relationships, then you should focus on crafting a grand narrative and vision. Of course, if the momentum is strong enough, it will eventually become practical. Just like with blockchain projects like Solana, the accumulation of capital attracts talent, and talent, in turn, makes blockchains useful.

If you want to build a narrative-driven project with a market capitalization of over $1 billion, you must start from first principles and consider the unique possibilities that blockchain technology can truly enable. You need to ask yourself two questions.

- If this vision can be realized, does it have the potential to support a market worth hundreds of billions of dollars?

- Is it exciting enough to spark a craze among retail investors?

For example, Plasma had a narrative of "entering the trillion-dollar stablecoin market", so its valuation was as high as $14 billion at the time of TGE, even though there was no actual use case at the time.

On the other hand, if you’re better at building products, you should build utility projects that solve problems in a specific niche (like Axiom for meme traders, or developing a specific DeFi protocol).

Utility projects focus on building products that traders or crypto-native users need directly or indirectly—whether they're trading terminals, exchanges, or stablecoins. Furthermore, these products aren't necessarily solely for speculation—for example, stablecoins can also be used for non-speculative purposes like payments.

Of course, narrative remains important here. For example, Polymarket's "prediction market" narrative itself attracted a large number of users. You can think of "narrative" as a marketing tool.

You can definitely focus on both areas at the same time, but it’s best to start by focusing on one. It’s hard to identify your strengths, so find your core competitiveness.

Trader's Choice

As a trader, you must always bet on the narrative .

You bet on the narrative that you believe will be most forward-looking in the coming weeks, months, or even years. Everyone who trades tokens is actually playing the game of "attention arbitrage."

- Buy assets that are gaining attention;

- Sell assets whose popularity has faded.

For example, from the rotation of perpetual contract tokens to privacy coins and then to AI concept coins, within a specific narrative, you must bet on the projects that can attract the most attention and have the greatest potential to become leaders or followers.

If they can do it, your position will take off too.

Summarize

Utility cryptocurrencies and narrative cryptocurrencies are two equally important parts of the crypto industry.

For builders, you should choose one as your starting point and strive for perfection in at least one of these areas: narrative or practicality. Once you've mastered one direction, expand to the other—this is the ultimate breakthrough strategy.

Personally, I've learned this the hard way over the past year of full-time entrepreneurship. I used to be somewhere in between. But ultimately, it's a game—one you have to play by the market's rules.