Stable's first round of $825 million in pre-deposits were sold out in seconds. Will it release $700 million first and then make a tweet?

- 核心观点:Stable预存款活动存在严重老鼠仓问题。

- 关键要素:

- 活动前7亿美元被10个地址提前包场。

- 官方公布时间与链上存款时间不符。

- 普通用户仅能参与0.13美元额度。

- 市场影响:引发社区负面情绪,损害项目公信力。

- 时效性标注:短期影响

Original | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

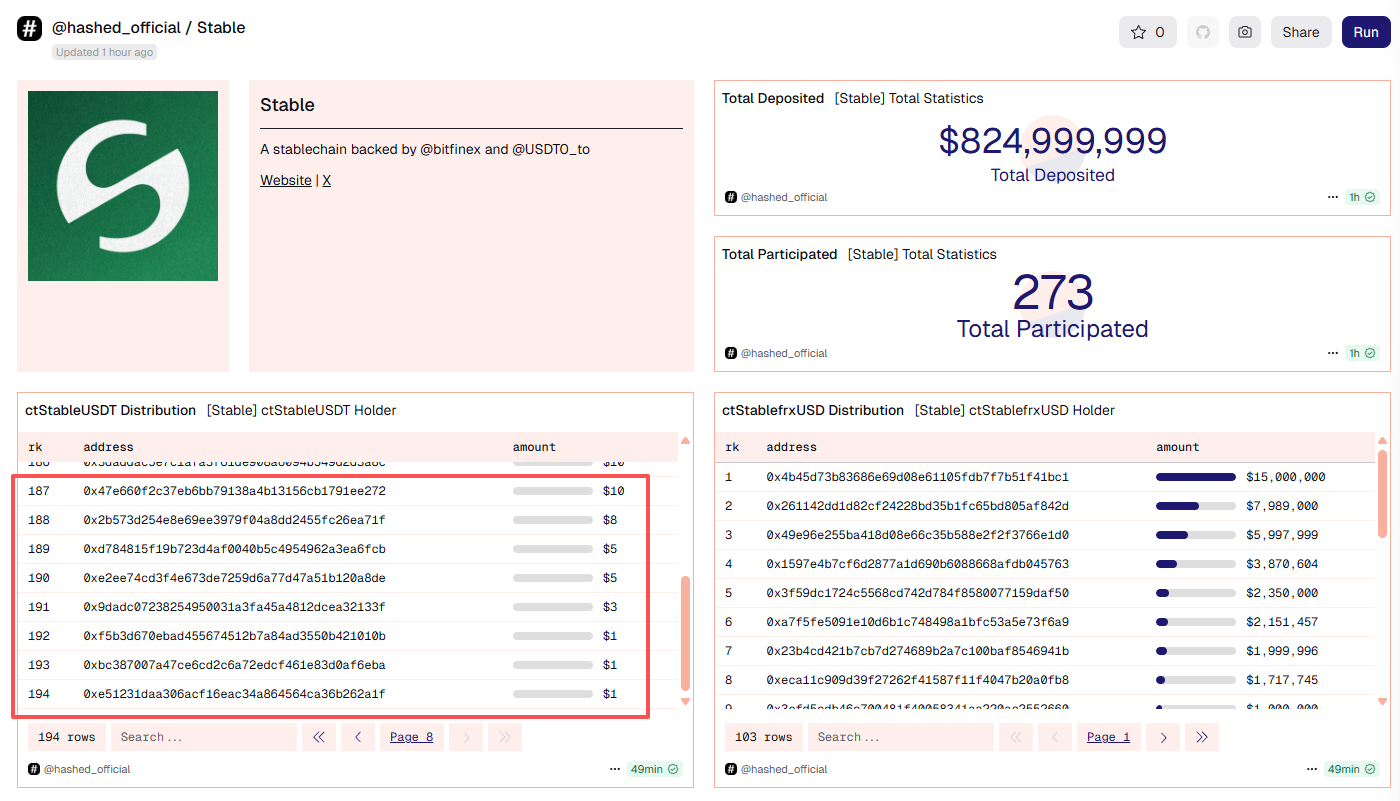

Stable, a project that has been hotly discussed in the community recently, announced on the X platform this morning that the first phase of its pre-deposit campaign has reached its cap of $825 million.

"What? I already activated the little bell, and the balance is gone as soon as I opened the page?" — This was the honest reflection of many users who tried to participate this morning. Below, Odaily Planet Daily takes you through the Stable project and recaps the entire process of this morning's "$825 million pre-deposit disappearing in seconds."

Stable: A Layer 1 public chain designed specifically for USDT

Stable is a high-performance Layer 1 public blockchain built specifically for USDT, aiming to provide a high-speed, low-cost, and low-latency stablecoin trading network. Unlike general-purpose public chains, Stable focuses on USDT's payment and settlement functions, aiming to provide a cash-like experience for USDT on-chain, making it suitable for scenarios such as cross-border payments, e-commerce payments, and corporate clearing.

Stable utilizes an independent public chain architecture, supporting EVM compatibility and sub-second transaction confirmations. It also plans to launch a gas-free USDT0 transfer model and provide institutions with dedicated block space and compliant, private transactions. These features aim to lower the barrier to entry for businesses and end users to use blockchain payments and improve the efficiency of stablecoin transactions. The project's core technical framework is currently nearly complete, but the launch dates for the testnet and mainnet have yet to be announced.

It's worth noting that Stable has received investments from prominent institutions including Bitfinex, Hack VC, and Franklin Templeton, and has received official endorsement from Tether, with Tether CEO Paolo Ardoino publicly supporting the project. These funds will primarily be used to build network infrastructure and expand the global USDT payment ecosystem.

Stable's pre-deposit activity questioned

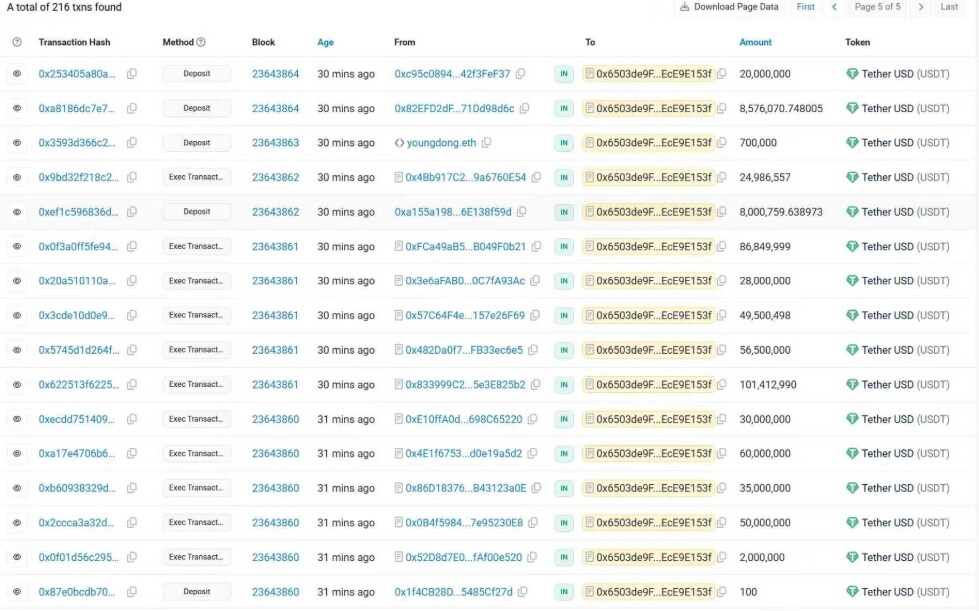

Stable's first phase of USDT pre-deposit activity quickly sparked controversy, with numerous community users questioning whether there was significant insider trading. According to the official timeline, Stable officially announced the opening of pre-deposits via Twitter at 9:10 AM Beijing time, but on-chain data showed that some people had already deposited funds as early as 8:48 AM, a significant discrepancy with the official timeline.

Before the official announcement of the pre-deposit activity, multiple addresses had already participated in the event with large funds.

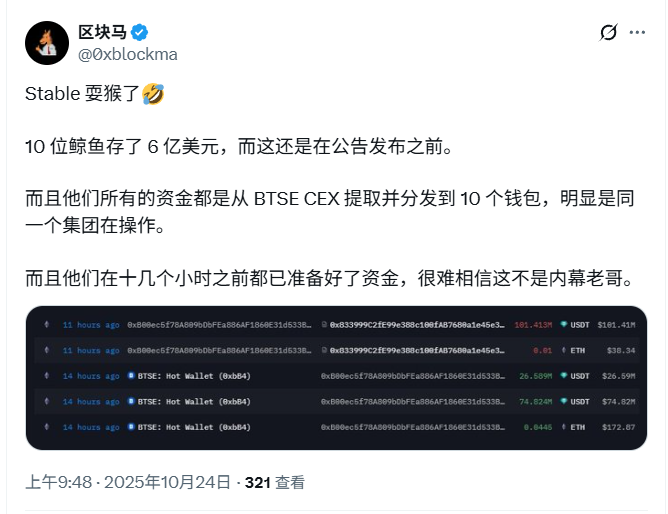

On-chain data shows that $700 million of the $825 million pre-deposit quota was already reserved before the public announcement. Ten major whale addresses deposited a total of approximately $600 million in USDT, all from a single wallet address. After being split, the total amount was fully allocated within 10 seconds. Further analysis revealed that these funds were withdrawn from BTSE CEX and then dispersed into various wallets for pre-deposits, suggesting a unified operation by a single capital group. Furthermore, the funds in these addresses were prepared and allocated over a dozen hours before the event, further fueling community dissatisfaction.

Before the pre-deposit activity, 10 whale addresses with the same funding source deposited a total of 600 million USDT

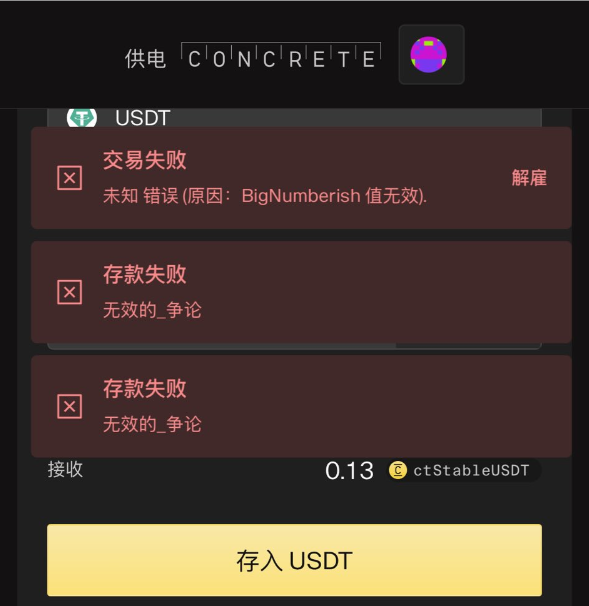

Relatively speaking, there's little room for ordinary users to participate. Numerous users reported that upon first logging into the official website, authorization either failed or transactions were delayed. By the time they saw the official tweet, only 0.13 USDT remained. While this might seem like a small amount of funds, in reality, it's practically impossible for retail investors to participate.

Community feedback: After the official announcement, only 0.13 USDT was left on the deposit page.

According to Dune data, only 273 addresses actually participated in the $825 million pre-deposit event, representing a negligible participation rate among average users. More notably, nearly 40 of the participating addresses deposited less than 500 USDT, with even tiny deposits of 1, 3, 5, or even dozens of USDT. The community sarcastically claimed that these small addresses were merely used to inflate the number of participants, lacking a sense of genuine participation.

Overall, the $825 million pre-deposit campaign for Stable’s first phase quickly reached full capacity, but community sentiment was extremely negative, with the campaign being described as an “epic insider trading” and a “pre-determined pre-sale.”

summary

“No matter how much you criticize, you still have to make money.” Although the first phase of Stable’s deposit program has been controversial due to serious “insider trading” issues, considering its official endorsement by Tether and the support of top-tier capital, the project still has strong market influence and is worth tracking.

What's more worthy of attention next is the pre-deposit activities related to centralized exchanges, particularly whether Binance will launch deposit or participation programs for Stablecoins. Previously, Binance launched a Plasma (XPL) deposit program, with an initial individual deposit limit of up to $100,000 USD, and subsequent tranches of up to $50,000 USD. Because participation involves depositing stablecoins, there's no loss of principal. Selling XPL immediately after its launch generated an annualized return of 79%, making it one of the highest-yielding CEX projects this year.

From this perspective, Stable is still a high-priority project. On-chain activities may have been eaten up by big funds, but the CEX stage may be the right window for ordinary retail investors to participate.