Behind Limitless TGE: A secret launch to avoid sniping and inevitable market doubts

- 核心观点:Limitless因TGE操作引发信任危机。

- 关键要素:

- 团队关联钱包抛售500万代币获利。

- CEO回应称是回购计划引争议。

- 采用隐秘上线策略模糊资金流向。

- 市场影响:引发社区对项目透明性质疑。

- 时效性标注:短期影响

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

At 7:30 pm on October 22, the prediction platform Limitless suddenly posted : “Shall we TGE today?”

This sudden question sent the community into a frenzy, with most people assuming it was another intern who had accidentally posted something, and the comments section was filled with jokes. Even the project's CEO, CJ ( @cjhtech ), quickly commented: "Intern wtf?!" and "Who gave you this button?"

For a time, netizens speculated that this was a joke or a "scripted" marketing campaign. However, just an hour later, the plot took a turn: Limitless officially announced the launch of the TGE and simultaneously opened the LMTS token airdrop.

This series of "unexpected official announcements" caused the community to instantly switch from "joke mode" to "attention mode", and a more complex storyline gradually emerged behind TGE.

Who is Limitless?

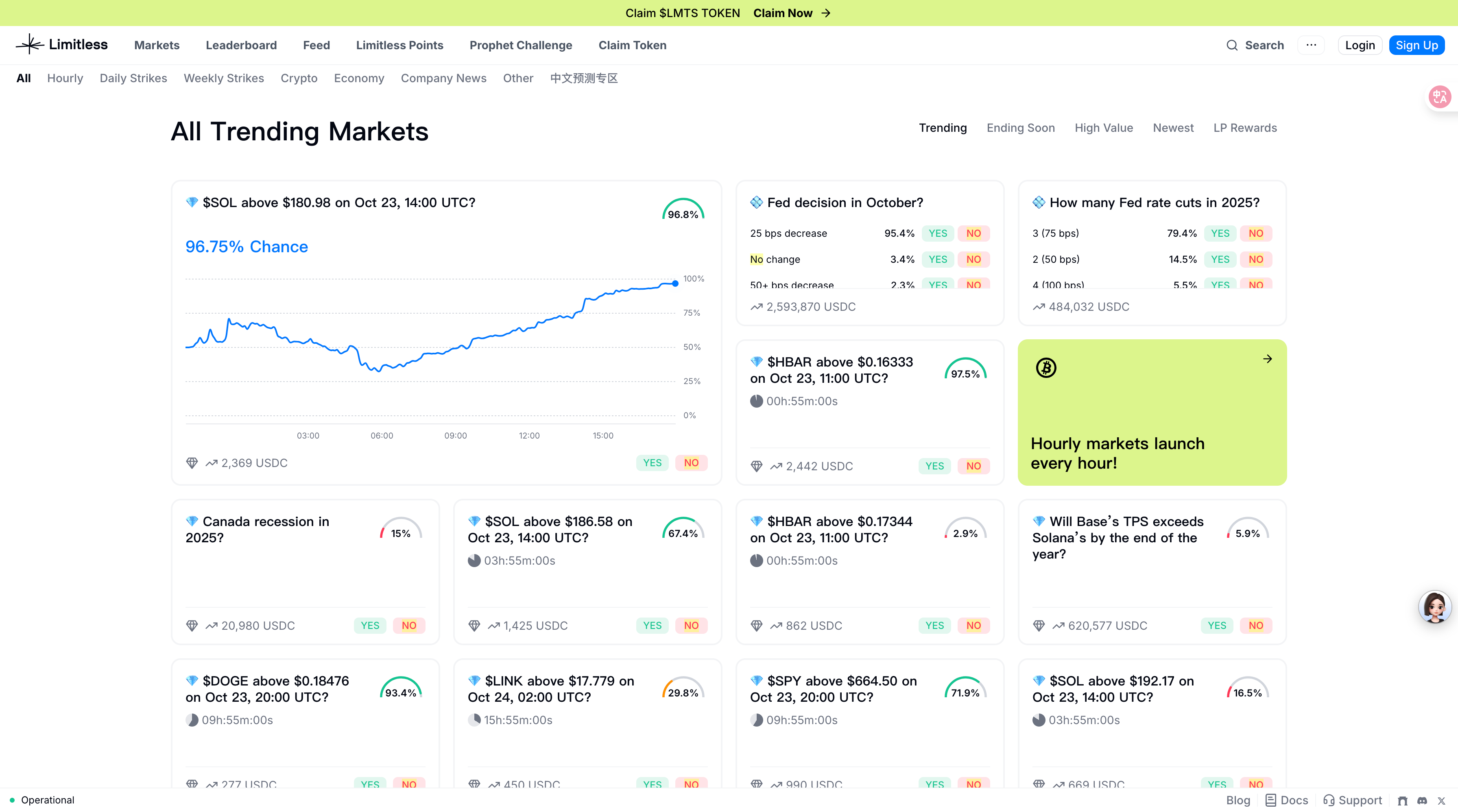

Limitless is a social prediction market protocol built on the Base Chain, allowing users to create and participate in prediction markets across a variety of sectors, including crypto assets, stocks, sports, and social culture. The project has completed three rounds of funding, totaling $17 million, from investors including Coinbase Ventures, 1confirmation, and Maelstrom.

In terms of mechanism, Limitless is similar to Polymarket : users participate in predictions by purchasing shares of a specific event outcome (usually "yes" or "no"). Winning shares are settled at $1 at maturity, and losing shares become invalid.

According to the project white paper , before the results are determined, one "yes" share and one "no" share in the same market can be combined to redeem one collateral token (usually USDC or Wrapped ETH), which is locked by the on-chain smart contract as the underlying security asset for the issued shares.

Unlike Polymarket, Limitless is trying to superimpose social scenarios and "short-term quick game" mechanisms on the basis of prediction markets to make speculative behavior lighter, faster and more shareable.

And this TGE officially brought it into the "public attention" stage.

TGE: From the opening of the amazing chart to the cracks in trust

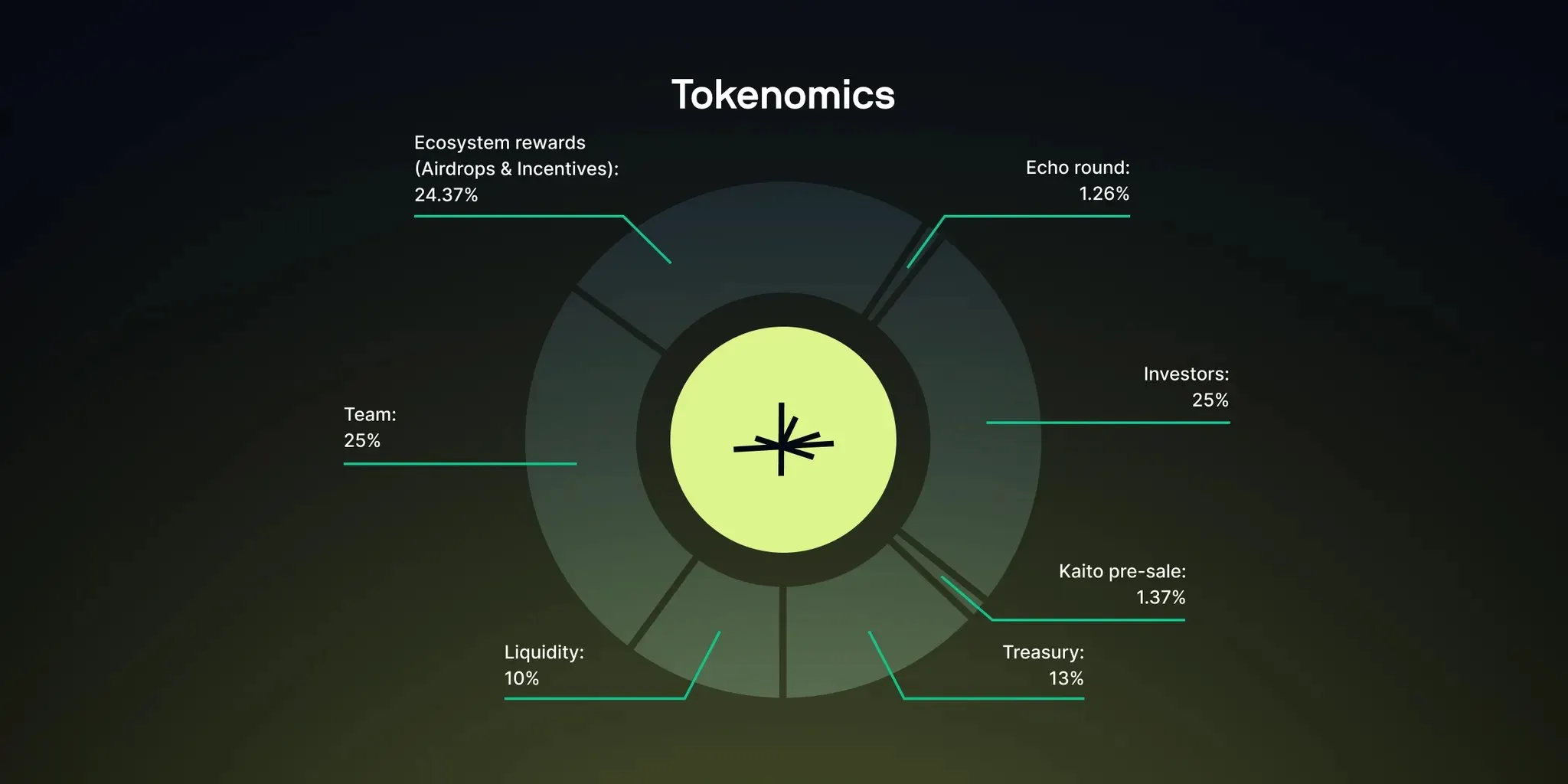

According to the official blog , Limitless' total LMTS token supply is 1 billion, with 13.159868% of the TGE circulating supply. The specific distribution is as follows:

- Kaito Presale: 1.37%

- Investors: 25%

- Echo Round: 1.26%

- Team: 25%

- Ecosystem rewards (airdrops and incentives): 24.37%

- Treasury: 13%

- Liquidity: 10%

At the same time, Limitless announced that the airdrop is now open, and both Limitless Points Season 1 traders and Wallchain Epoch 1 Quackers users may receive the airdrop.

In the half hour after TGE, the trend of LMTS made people think that it was a "magic opening".

The buying sentiment brought by the popularity pushed the price directly from below $0.2 to $0.8, an increase of more than 400%. However, the good times did not last long. The market quickly turned downward, falling to a low of $0.196. The current price has rebounded to $0.313.

Honestly, this kind of rhythm is all too common among new coin launches: a surge followed by a pullback, even with nearly identical timeframes. Logically, such fluctuations aren't enough to raise suspicion, given the abundance of short-term capital in the market and the prevalence of price fluctuations.

But this decline still makes some people feel that something is not right.

At 22:58 on October 22, KOL @ManaMoonNFT published an on-chain tracking record on X, pointing out that the Limitless team was suspected of continuous selling. The monitoring data showed:

The team's associated wallet (0x3c583Be48D2796534f8FC8EA214674Ff055d01d7, initially holding 40 million tokens) transferred 5 million LMTS to a sales address (0xBF3132977d9801506deF8E927c4Ff06E5b0801d1) and sold all of them within a few hours, with a cumulative profit of approximately US$2.3 million.

After a brief rebound, another approximately 10 million tokens were transferred to the same wallet for further sale.

The market began to grow cautious. This looked too much like a carefully planned cashing-out. At this point, public opinion began to clearly crack.

CJ's response: Explanation, or declaration of war?

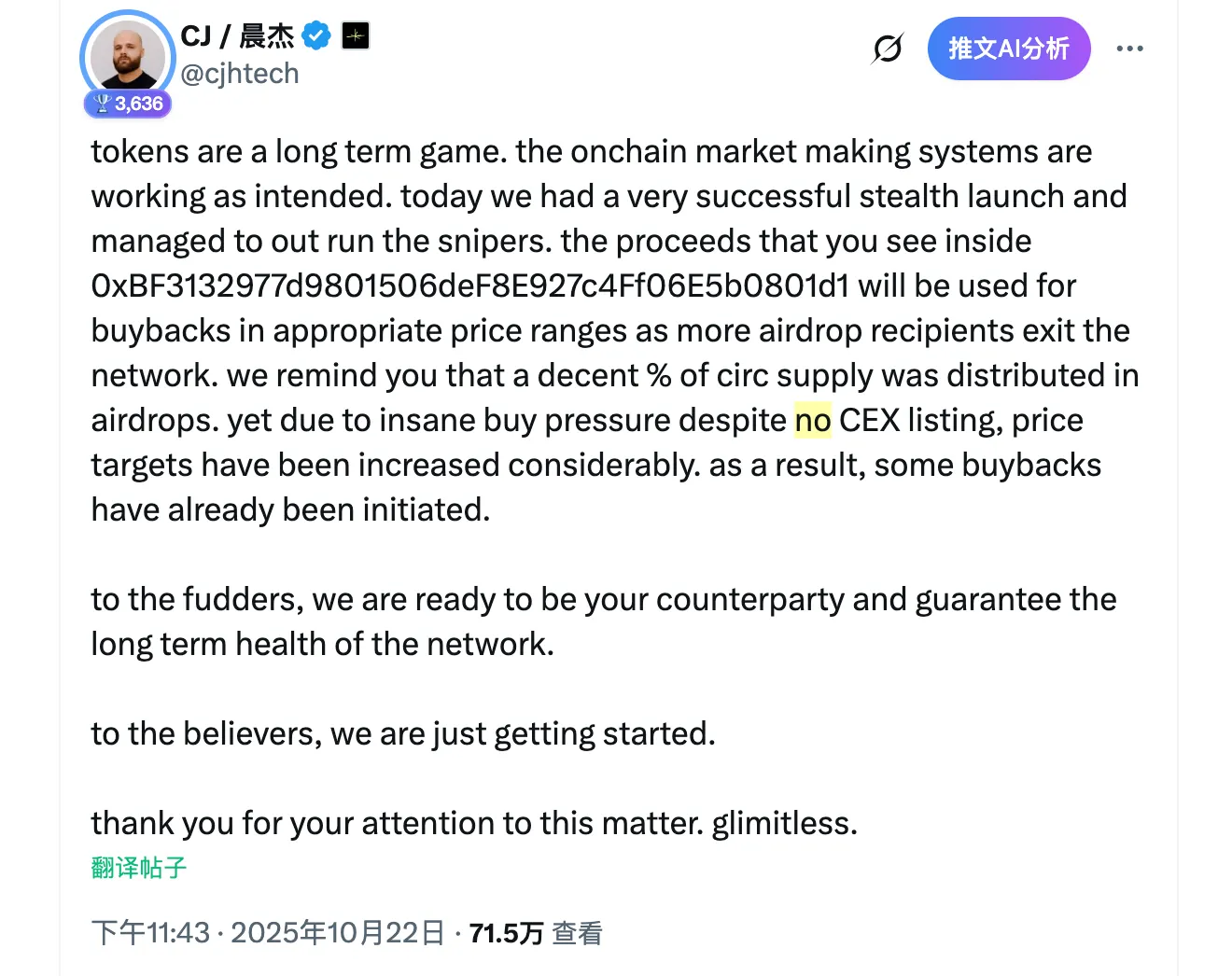

As FUD sentiment spread, Limitless CEO CJ finally responded.

At 11:43 PM on October 22, he wrote on X, “Tokens are a long-term game, and the on-chain market mechanism is operating as designed.”

CJ explained that the capital flow seen by the market came from the team's buyback plan , especially during the sell-off phase by airdrop recipients; and emphasized that the project has not yet been listed on centralized exchanges, but buying is strong and the price target has been raised.

The tone of the last sentence is quite tough: "For those who spread FUD, we are ready to serve as your counterparty. For believers, we are just getting started."

This response seems like an "explanation" and also like a "declaration of war."

This makes the course of events even more subtle: on the surface, the team is stabilizing the situation, but in reality, the community's trust has begun to split.

What is Secret Online?

The term "stealth launch" may be unfamiliar to many. Simply put, it's a defensive mechanism employed by projects to prevent sniper bots from preempting token sales and causing significant price fluctuations.

The usual practice is to quietly deploy the contract first, conduct small-scale testing, and after confirming that there is no risk of large-scale buying or arbitrage, publicly disclose the token contract address and allow free trading in the market.

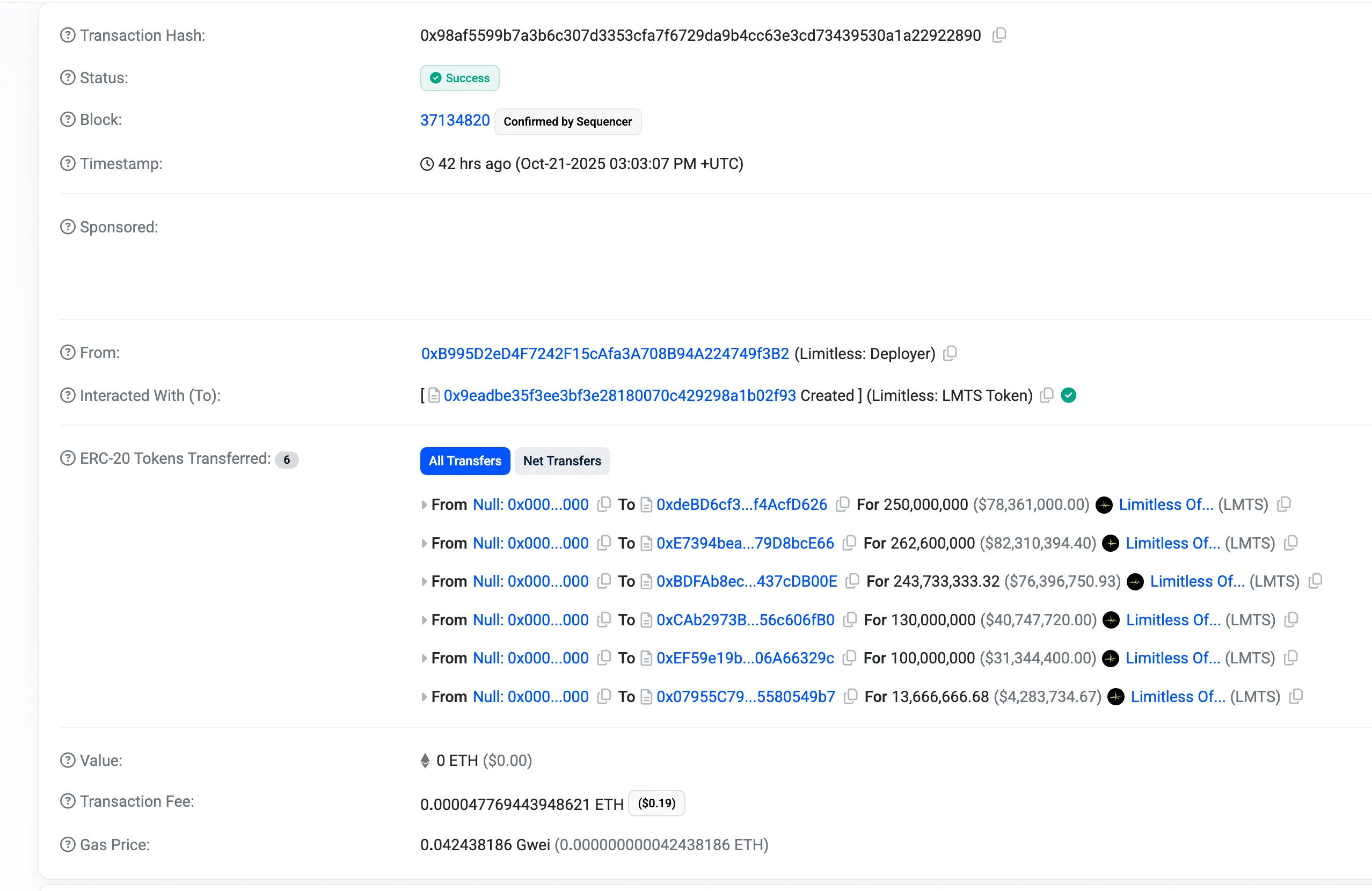

During Limitless's TGE, the team claimed to have employed this strategy. According to on-chain data, the LMTS token was created only approximately 21 hours after its official announcement . During this time, the project completed token distribution and contract deployment, and only officially announced the contract address after confirming that everything was secure.

From the results, this approach did help Limitless avoid technical sniping, but it also made it more difficult for outsiders to trace the flow of early funds.

The defensive intention and the consequences of opacity now overlap to become a new point of contention.

summary

As of now, this incident is still fermenting and many doubts have not been clarified.

For example, the wallet allegedly associated with the team doesn't appear to hold tokens within the officially disclosed 25% team share (according to on-chain analysis, the wallet's initial 40 million tokens came from "ecological incentives"). Why is there no lock-up period for these tokens ? In the token economics model, only the 2.45% airdrop and early incentives are unlocked immediately. Furthermore, why weren't these so-called "internal buybacks" disclosed in advance?

There are no answers to these questions yet.

Market sentiment also gradually cooled, and the price of LMTS seemed to have sunk to the bottom of a lake – calm, yet with a hint of depression .