Moat or Harvester, Are DAT Stocks Worth Investing in?

- 核心观点:DAT模式是创新但风险并存。

- 关键要素:

- DAT股票杠杆高但波动大。

- 债务融资放大收益与风险。

- 山寨币储备增加额外风险。

- 市场影响:推高加密估值但引发泡沫担忧。

- 时效性标注:中期影响。

Original author: Zhou, ChainCatcher

The digital asset treasury (DAT) model was once seen as an innovative path for crypto investment. Companies held crypto assets as reserves to drive up stock prices, forming a flywheel of "buying coins-financing-buying coins again."

But market sentiment seems to be shifting. On the one hand, DAT companies have raised over $20 billion in funding this year, leading some institutional investors to believe the peak has passed. On the other hand, with short-selling increasingly prominent, investors are questioning whether a collective front-running is underway and whether the treasury model is a long-term moat or a short-term speculative tool.

This article discusses topics that investors are most concerned about, and interviews and summarizes the views of some institutions on the current DAT trends.

Is DAT stock a good investment? Why not just buy the token or an ETF?

When evaluating DAT stocks, ordinary investors often struggle with whether they are better than directly holding cryptocurrencies or gaining indirect exposure through ETFs.

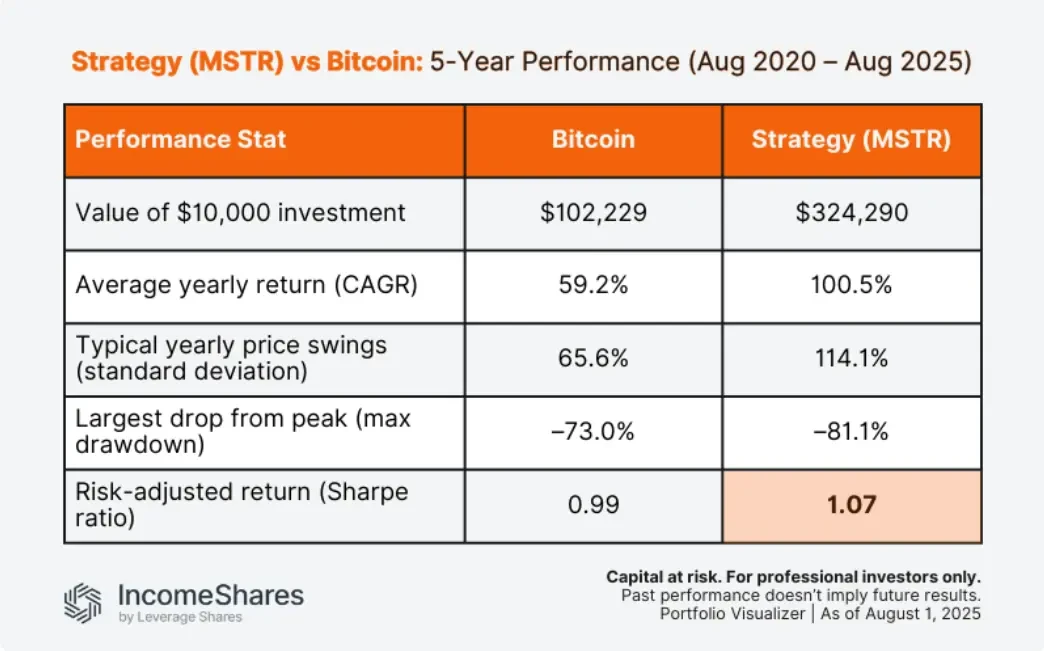

DAT company shares provide leverage . For example, according to Portfolio Visualizer, with a starting investment of $10,000, between August 2020 and August 2025, Bitcoin rose to $102,229, while MicroStrategy's stock soared to $324,290. MicroStrategy's higher volatility (114% vs. 65.6%) and higher annualized returns (100.5% vs. 59.2%) give it a higher Sharpe ratio than Bitcoin. This, of course, is due to the company's debt-financed leverage in its Bitcoin holdings .

Justin Sun has publicly stated that traditional ETFs provide exposure to cryptocurrency prices, but that's all. DATs go a step further; they put assets to work. Rather than sitting idle, these DATs stake, lend, and deploy capital in DeFi and yield farming protocols, earning real returns while maintaining full on-chain transparency. This model transforms digital assets from speculative holdings into efficient financial engines, significantly outperforming ETFs.

However, Forbes analyst Alexander Blume said that DAT companies use very complex financial products to take advantage of retail speculation, debt instruments, marketing, and legal and judicial arbitrage, hoping to outperform Bitcoin. Some of these strategies face black swan risks , where they appear to perform well until they suddenly fail.

CoinShares states that DAT stocks carry higher risk than ETFs because they are not only influenced by cryptocurrency prices but also by company operations and debt burdens. This emerging model carries some risks that may be masked by the current bull market. Companies that pursue altcoins or memecoins but lack sustainable core businesses expose investors to higher volatility and uncertainty. If prices stagnate or decline, these companies can quickly become overleveraged and vulnerable to sharp pullbacks.

In contrast, buying the coins directly offers full ownership but also comes with the complexities of custody and taxation. ETFs lower the barrier to entry for cryptocurrency investors, requiring a certain annual fee (typically 0.25%) and offering convenient trading, but lack leverage. The Halborn advisory team notes that while DATs are suitable for investors seeking high returns, ETFs are more suitable for risk-averse investors because they offer greater diversification and mitigate the risk of a single company going bankrupt.

According to rough estimates, in September 2025, DAT stock saw an average 150% increase in the 24 hours following the reserve announcement, attracting short-term capital. However, this trend carries risks. Since the second half of 2025, Metaplanet's stock price has plummeted by over 70%, its market capitalization has fallen below the value of its Bitcoin reserve, and its mNAV ratio has dropped to 0.99, demonstrating a clear lack of market confidence.

How long can the Treasury trend last? What is the value of the Treasury coin itself?

Since MicroStrategy started this treasury trend, many companies have followed suit. By 2025, over 160 publicly listed companies worldwide had included cryptocurrencies like Bitcoin and Ethereum on their balance sheets, with their total holdings exceeding $240 billion.

Among them, as of October 6, the total number of bitcoins held by global listed companies (excluding mining companies) in the statistics was 864,210, with a current market value of approximately US$107.43 billion, accounting for 4.34% of the total market value of bitcoin.

The influx of traditional money has pushed up valuations and sparked concerns about a bubble. Peter Chung, head of research at Presto, said that while the risks of a treasury company collapse are real, they are more subtle than the crash scenarios seen in the last boom-and-bust cycle of cryptocurrencies.

As premiums narrow and mainstream assets are covered, investors are shifting their focus to execution, scaling, and M&A. This is crowding out traditional crypto startup funding, raising questions about the sustainability of the DAT trend. Industry experts predict that large companies, including well-known tech giants, will begin building Bitcoin positions by the end of 2025. For small and medium-sized enterprises (SMEs) and large enterprises alike, the question has shifted from "if" to "when."

Patrick Pan, head of Web3 business at Huaxing Capital, told ChainCatcher that any emerging market will go through a cycle of " professional institutions taking the lead, small and medium-sized players entering the market, survival of the fittest, and then concentration" in its early stages. Currently, small and medium-sized DATs are still largely in the "experimental phase," which is positive for market education. Ultimately, however, only leading financial institutions with transparent compliance, clear capital structures, and stable return models will survive in the long term.

The trend this year has been a diversification of DATs, expanding from Bitcoin to include ETH, Solana, BNB, and even altcoins like XRP, AVAX, ENA, IP, and Dogecoin. Patrick PAN stated that this is a process of natural market selection. In the short term, some smaller currencies are being included to boost returns or test the waters, but in the long term, high-quality assets will continue to dominate.

However, Elementus analysts have mentioned that companies investing in altcoin reserves face additional risks, as it is a less diversified bet . During market crashes, altcoins generally have a higher correlation with Bitcoin, but in some cases, they may not share equally in Bitcoin's "high-quality asset migration" status.

Is the Treasury a moat or a harvester? How should we view the risks of speculation?

At present, DAT's floating profits are huge. For example, Strategy's Bitcoin holdings still have a floating profit of over US$24.5 billion, with a return rate of 51.91% to date. Is there a possibility that these treasury companies will cash in their profits in advance?

Short-selling firm Kerrisdale Capital announced on the X platform that it had shorted the stock of Bitmine, the Ethereum treasury reserve company. The firm believes the so-called DAT model has become mediocre and uninspired . The firm stated that scarcity and meme-like enthusiasm once kept premiums high despite ongoing dilution, but these conditions have disappeared.

It is reported that since the 1011 crash, BitMine has continued to buy Ethereum, and has currently increased its holdings by nearly 380,000 Ethereum, worth approximately US$1.5 billion, and its total holdings have exceeded 3 million Ethereum.

At present, treasury companies still play the role of major buyers in the crypto market, but as their net assets shrink as prices fall, their ability to add funds is limited and the intensity of marginal buying decreases.

Institutions predict that new projects will still be launched by the beginning of next year, but the financing amounts will be smaller. As for the large-scale financing of DATs ranging from US$500 million to over US$1 billion, only a few participants with high market capitalization and volatility sufficient to support convertible bonds can actually raise these funds.

Bit Digital CEO Sam Tabar stated during the Token 2049 Summit in Singapore that digital asset treasury (DAT) companies should consider unsecured debt financing instead of secured debt to better withstand potential bear markets. Debt financing is the most efficient way to increase per-share crypto holdings. While increasing crypto holdings while maintaining equity is beneficial, the type of financing is crucial— the wrong leverage can destroy a business .

Presto data shows that only one-third of DATs' funding is debt-financed, and 87% of this debt is unsecured. Chung believes that even in a worst-case scenario, the underlying collateral ratio is far lower than the leverage levels seen during the 2021 cycle. Therefore, as long as this principle is adhered to, margin calls are unlikely to present systemic liquidation risks. He noted that this does not mean that cryptocurrency fund managers will never sell their cryptocurrency holdings. In unforeseen circumstances, if there is an urgent need for cash and no other funding sources, cryptocurrency fund managers may liquidate these assets.

How can treasury companies mitigate risks during a crypto market downturn? Vicky Wang, president of Amber Premium (NASDAQ: AMBR), a digital asset wealth management platform, stated in an interview with ChainCatcher that the key to a downturn isn't "betting on the direction" but rather a systematic approach of "defense, adjustment, and protection." This includes managing asset and liquidity volatility, maintaining a stable mNAV anchor through disciplined rebalancing and valuation deviation management, and implementing tiered custody and transparent disclosure to minimize operational risk and information asymmetry.

At the same time, DAT's strategy spectrum is also rapidly differentiating: single-currency exposure relies more on long-term narratives and pressure-bearing capabilities , multi-currency portfolios test correlation and rebalancing mechanisms, and strategies for more complex structures require a professional skill set that intersects derivatives, liquidity, accounting, and compliance.

Regarding short-term speculative risks, Vicky Wang stated that this is not a sustainable path. The success of a DAT depends on the long-term investment value of its underlying assets. The strong cyclical nature of the crypto market means that most DATs will experience ups and downs together. Navigating these cycles relies on a dual-track governance model of "cognition and mechanisms."

Conclusion

Overall, DAT stocks themselves are suitable for investors seeking high returns, while the trend of treasury financing for token purchases depends on the financing capabilities (cost and method) of each company. If they focus on long-term governance, DATs can serve as a defensive moat; otherwise, they can become a speculative trap. Excellent treasury companies don't simply chase coin price beta; rather, they maintain a long-term positive mNAV premium through operations and governance. Crypto investors should focus on companies with solid fundamentals and carefully evaluate drawdown and cash-out strategies.