Bull market "pin": is it a crisis or a good opportunity to buy at the bottom?

- 核心观点:加密市场剧烈去杠杆后显现结构性风险与机遇。

- 关键要素:

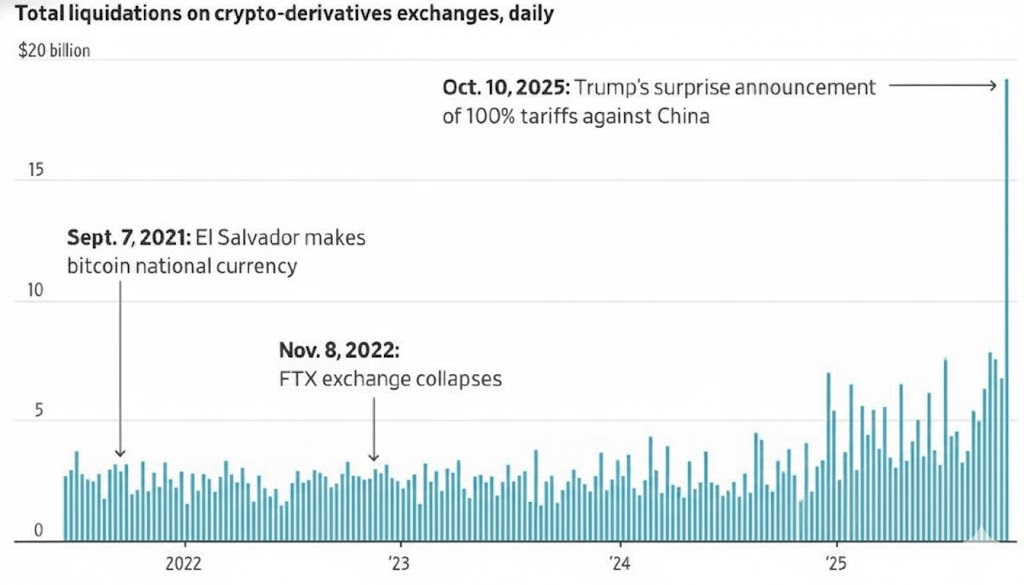

- 193.5亿美元爆仓,波及160万交易者。

- BitMEX凭风控框架稳健运行。

- SNX、TAO、ZEC三大代币强势反弹。

- 市场影响:推动行业重视风控与价值叙事。

- 时效性标注:中期影响。

On October 11, 2025, the crypto market experienced one of the most dramatic deleveraging events in its history. What began as a geopolitical shockwave—Trump's threatening tweets about trade tariffs—rapidly escalated into a systemic contagion. The result was a record $19.35 billion in liquidated positions, affecting over 1.6 million traders.

This wasn't just a simple price crash; it was a catastrophic failure that highlighted the limitations of trading infrastructure across multiple major platforms. The illiquid price oracles in Binance's internal spot markets created a death spiral. Assets like wbETH were tokenized at a fraction of their actual value, triggering unfair liquidations. The damage cascaded throughout the ecosystem, with over 1,000 wallets on the derivatives DEX Hyperliquid being wiped out, totaling a staggering $10.31 billion.

BitMEX weathered the storm with remarkable stability. The platform recorded $38.5 million in liquidations—a mere 0.2% of the total market—and operated exactly as designed. This resilience was no accident; it was the direct result of a robust risk management framework, which includes:

- Fair Price Marking : Using a composite index comprised of 16 major spot exchanges prevents localized de-anchoring spirals that have occurred elsewhere.

- Operational robustness : The trading engine maintained 100% uptime and full performance, and withdrawal operations were uninterrupted.

- Human Oversight : An intentionally designed “human-in-the-loop” system prevents automated chaos caused by flawed oracles on other exchanges.

This event served as a powerful litmus test not only for the assets but also for the exchanges they traded on. The assets that rebounded most strongly after the crash were those traded in environments where true price discovery could still occur.

If the recent flash crash was just a pinprick and the broader bull market still has momentum, the strategy remains clear: buy the dip . Every major market correction since the bull market began in 2023 has consistently reinforced this lesson. Historically, every correction of approximately 20% has served as a powerful catalyst, igniting a new narrative that propels the market into the next leg of its upward trajectory, such as:

- May 2023: Telegram bot narratives

- June 2023: Bitcoin ETF + GambleFi

- July 2023: Friend.tech

- August 2023: China Concept Coin

- November 2023: Memecoin

- December 2023: DEX + GameFi

- January 2024: LSD + L2

- March 2024: AI Meme Coin

- …

Source: BitMEX

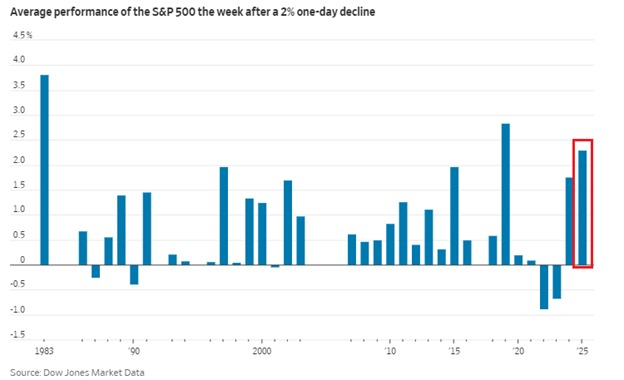

In fact, a "buy the dip" strategy is also highly effective in traditional markets like the S&P 500. In 2025, the S&P 500 returned an average of +2.3% in the week following a -2% drop. If you're looking to buy the dip, choosing the strongest narrative after a crash is your best bet.

Source: Dow Jones Market Data

The three most noteworthy strong recovery tokens

1. SNX (Synthetix): The DeFi OG Awakens with the New Perp DEX

Synthetix demonstrated a typical "high-beta" market reaction, launching a fierce 284.73% rebound from a low of $0.51 to a new high of $2.58 after a deep 58.77% pullback. The immediate catalyst for this strong recovery was a highly anticipated perpetual swap trading competition, which galvanized the community and attracted top traders, driving trading volume and speculative interest. This short-term momentum was based on the upcoming launch of its perpetual swap DEX and the relatively low valuation of a former blue-chip OG DeFi protocol.

From a trading perspective, SNX remains a high-risk, high-reward asset. Its price action is known for its volatility, and market makers are known for creating wild swings that trigger stop-loss hunting. Once the hype surrounding the trading competition fades, market attention will turn to the project's ability to generate sustainable real returns and expand market share. For traders with a high risk tolerance, SNX presents an interesting long opportunity, especially given the anticipated launch of its perpetual swaps DEX. Its $500 million fully diluted valuation (FDV) still leaves significant room for growth compared to other perpetual swaps DEXes like Hyperliquid and Aster, which boast $10 billion in FDV.

2. TAO (Bittensor): AI and the impact of the mining reward halving merge

TAO's market performance is a case study in extreme volatility, with a remarkable 162.98% recovery following a punishing 59.77% crash. This resilience is driven by a potent combination of near-term catalysts and a strong long-term AI narrative. Recent fundamental developments, such as the launch of asset management functionality on the Yuma subnet and Grayscale's public filing for the TAO Trust, have provided strong institutional support. However, the most significant driver is undoubtedly the upcoming December halving event. By algorithmically reducing token issuance, the event is designed to create supply scarcity, and the market is pricing in the potential for a "BTC-style" post-halving rally, creating a strong speculative floor.

Bittensor's fundamental value lies in its ambitious goal of creating a decentralized, open AI marketplace. By incentivizing participants to contribute and rank machine learning models, it fosters a permissionless environment for AI innovation, a stark contrast to the closed ecosystems of tech giants. With the AI narrative accelerating in traditional finance and a major supply shock looming, TAO's upside potential is significant for those who can withstand its volatility.

3. ZEC (Zcash): The Ultimate Insurance for Digital Privacy

After a relatively controlled 32.28% pullback, Zcash staged a powerful 213.96% rally, solidifying its position as the market's premier privacy asset. Its recovery demonstrates a clear and growing market demand for its core functionality. The core catalyst remains its unwavering value proposition: " Bitcoin is insurance for fiat. Zcash is insurance for Bitcoin. " In an era of increasing on-chain surveillance and regulatory scrutiny, the "privacy premium" is becoming a de facto factor in asset valuations. This isn't a cyclical trend, but a secular one, driven by a fundamental need for financial confidentiality that transparent ledgers like Bitcoin cannot provide.

Zcash's fundamental advantage lies in its pioneering use of zero-knowledge proofs (zk-SNARKs), which remains the gold standard for achieving fully shielded, untraceable transactions. Recent developments, including the launch of the Zashi wallet to improve user experience and ongoing research into a potential shift to a Proof-of-Stake consensus mechanism, demonstrate the project's continued innovation. The strong post-crash rebound demonstrates that sophisticated capital is flowing into ZEC during uncertain times, viewing it not as a speculative instrument but as necessary digital insurance. For traders, this makes ZEC a unique portfolio hedge and a long-term investment in the enduring demand for on-chain privacy.

Conclusion: "Pin-insertion" can be a crisis, but it can also be an opportunity

The October 11th flash crash was a brutal event. It served as a stark reminder of the critical importance of counterparty risk in a market defined by leverage and volatility. The catastrophic outages of several major exchanges highlighted a key fact: the excess returns (alpha) you capture are only truly realized if the platform you trade on is stable.

The explosive rallies of some altcoins during this largest-ever liquidation event may be a bullish signal, with capital also flocking to assets with clear catalysts, enduring narratives, and essential roles in the crypto ecosystem. From DeFi infrastructure to AI innovation and privacy, the performance of some coins demonstrates that even in the face of panic, the market's underlying conviction remains strong.