Original author: Fishmarketacad

Original translation: TechFlow

Seeing CT's focus on gold today, I've been following gold for a while and decided to share some quick thoughts (probably wrong).

Why does gold only rise and never fall?

Since the advent of QE infinity and the debasement of fiat currencies in 2020, I have started to look at precious metals as a store of value that is uncorrelated with the broader market.

Gold prices have surpassed $4,200, a 25% increase in less than two months. Let's explore the reasons for this:

1. De-dollarization/Central Bank Gold Bid

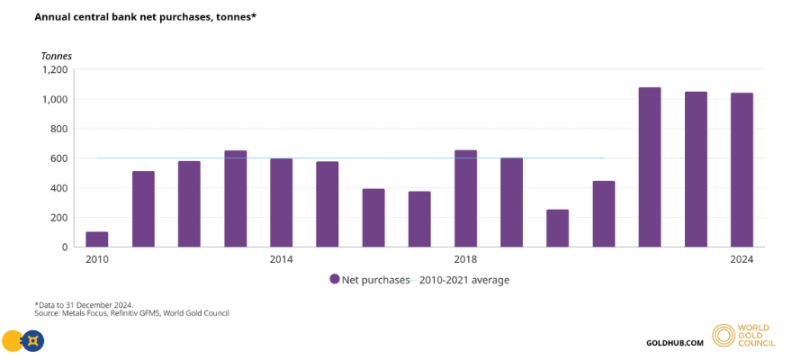

Central banks, especially China, are on a gold buying spree. I understand they are on track to purchase over 1,000 tonnes of gold for the fourth consecutive year, and surveys indicate they plan to continue buying.

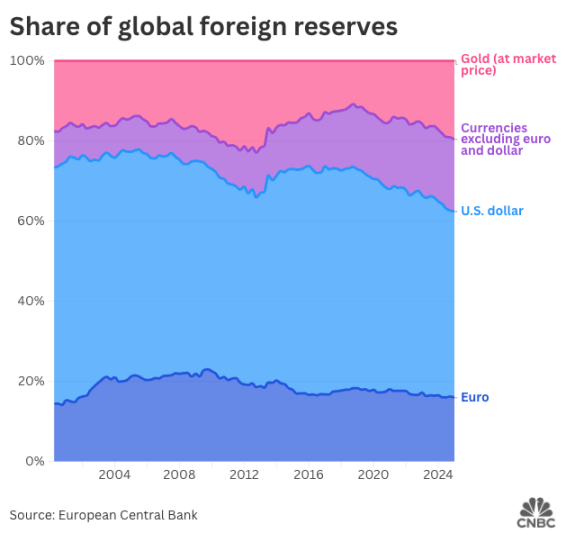

Why? The US national debt is projected to reach $37.5 trillion this year, with interest alone exceeding $1 trillion (tax revenue is about $4-5 trillion). There are only two ways to deal with such a large debt: default or devaluation, and the US will never need to default because they can devalue the debt by printing more money.

2. Stablecoins as a tool for socializing debt

The US devalues its debt through monetary inflation, essentially printing more money to make each dollar less valuable, thereby shrinking the real value of the debt. This has been going on for decades and should be familiar to you.

What’s new is that if the U.S. were to move some of this debt into crypto, like stablecoins, that could become very interesting because cryptocurrencies are much more accessible to the world.

Stablecoins are increasingly backed by loans. Dollar-pegged stablecoins like USDT and USDC are currently primarily backed by US Treasuries. What started as purely 1:1 instruments has evolved to over 90% backed by US Treasuries.

Therefore, every time people in other countries hold stablecoins, they are indirectly purchasing U.S. debt. This globalizes the U.S. "inflation tax." The higher the global adoption of U.S. stablecoins—which we know will reach trillions of dollars—the more the U.S. can export its debt and share its "losses" with the rest of the world.

If this is indeed part of the plan, then this goes back to the need to de-dollarize mentioned earlier, with gold being very important as a safe alternative store of value.

3. Physical gold shortage

Another important point is that this gold rally isn’t solely driven by non-physical gold or derivatives. If you’re familiar with the potential for a short squeeze in perpetual markets when open interest (OI) exceeds token liquidity, this is a similar concept.

In 2025, open interest in COMEX gold futures typically numbered in the hundreds of thousands of contracts (each representing 100 troy ounces), while the total amount of physical gold available for delivery was only a small fraction of that.

This means that at any given time, there are far more requests for physical gold than can be delivered. This is why delivery times for gold have stretched from days to weeks. This indicates genuine physical demand (similar to spot demand), which doesn't typically come from short-term investors, thus forming a structural price floor.

4. Overall uncertainty

Gold has reaffirmed its safe-haven status in uncertain times. The current US-China rivalry, trade war concerns, domestic unrest in the US, Federal Reserve rate cuts, the US economy's reliance on AI infrastructure, and economic uncertainty have all contributed to a global flight from the US dollar and investment in gold.

In my opinion, the main scenario where gold will fall is when there is no need for safe havens. The following conditions would need to be met, but they are unlikely to happen in the short term:

- High employment rate: U.S. economic outlook is not good

- Money flows to risky assets: Stocks aren’t cheap (although they aren’t cheap now)

- Political stability: The United States needs to be friendly to China

- Rising interest rates, i.e., an increase in the cost of capital: the current situation is completely the opposite

Given Trump’s unpredictable nature, these conditions (or at least the market perception of them) can also change rapidly, so caution is warranted.

What does this mean for BTC?

Believe it or not, Bitcoin is down over 25% against gold so far this year.

I still believe that Bitcoin is not yet ready to become "digital gold," even though it is similar to gold in many ways and is getting closer every year (except for the fact that the solution to the quantum computing problem is still unclear).

However, if you try to buy gold, you will find that the price difference of physical gold is very high, so it is more suitable for buying and holding for a long time, which is not fun. Therefore, I think retail investors may choose to buy Bitcoin instead of gold, but the purchasing power of retail investors is low relative to central banks.

Bitcoin's current strong political correlation with the United States has hindered other central banks' willingness to purchase Bitcoin to de-dollarize the currency. As far as I know, US miners now account for approximately 38% of Bitcoin's hash rate, and US entities (ETFs, public companies, trusts, and governments) control approximately 15% of the total Bitcoin supply, a figure that is likely to continue to grow.

So, I don’t know what will happen to Bitcoin relative to gold, but I think in the short term (until the end of the year) Bitcoin will continue to weaken relative to gold.

What am I doing?

Please do not follow my instructions, this is not investment advice.

Long Bitcoin Dominance (BTC DOM): I believe de-dollarization has a greater impact on Bitcoin than other altcoins. With the recent Black Friday crash, it's clear that Bitcoin is the only asset with real order book liquidity and buying, and Bitcoin Dominance currently looks to be trending upwards. I might exit this trade if I see altcoins performing well, but this typically happens after Bitcoin reaches a new all-time high, which should further boost Bitcoin Dominance.

Going long on gold: This essentially involves buying paper gold, selling puts, or buying calls. However, the "not your keys, not your coins" principle applies here as well. I might just be holding onto a worthless piece of paper, but I'm fine with that for now.

Final Thoughts

In short, I think gold remains a good buy due to the structural changes mentioned above, but I would not be surprised to see a 20-30% pullback in the short term, which could be a good long-term buying opportunity, assuming the above uncertainties do not dissipate.

Additionally, gold is about to hit its resistance point relative to the S&P 500 (SPX) and is about to reach a $30 trillion market capitalization, so these two factors could be potential local tops that you may want to wait for before getting FOMOed.

Finally, here's another take on gold, and as a quick conclusion, I think it still has room to run:

- Gold rises if uncertainty about the U.S. economy or global stability persists

- Gold rises if the U.S. economy or global stability becomes more unstable

- Gold falls if the U.S. economy or global stability stabilizes

- 核心观点:黄金因结构性因素持续走强。

- 关键要素:

- 央行持续购金推动去美元化。

- 稳定币全球化输出美国债务。

- 实物黄金短缺支撑价格底部。

- 市场影响:强化黄金避险地位,比特币短期承压。

- 时效性标注:中期影响