Meteora airdrop starts tonight. Which is more profitable, receiving tokens or receiving LP?

- 核心观点:Meteora启动MET空投,采用创新流动性分配机制。

- 关键要素:

- 盘前估值13.5-15亿美元,代币总量10亿枚。

- 48%代币TGE解锁,含10%流动性分配额度。

- 用户可选择直接领币或参与流动性挖矿。

- 市场影响:为Solana DeFi生态注入新流动性。

- 时效性标注:短期影响

Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

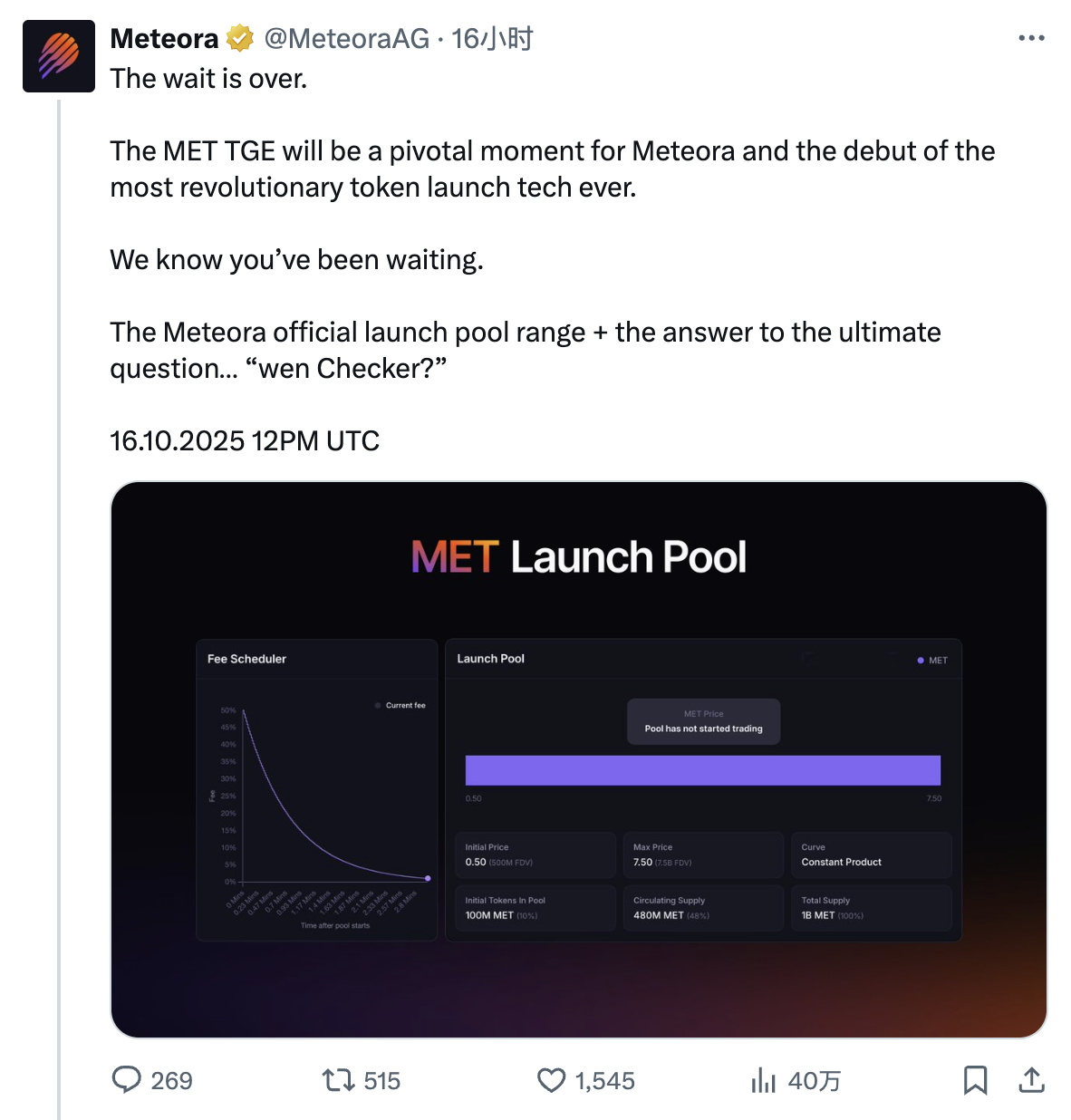

Meteora, a popular DeFi project in the Solana ecosystem, is about to officially launch the airdrop of the MET token.

According to Meteora's conference call last night, the protocol will officially open airdrop inquiries at 8:00 PM Beijing time tonight . However, from the latest official updates this morning, Jupiter's (Note: Meteora was incubated by Jupiter) terminal wallet Jupiter Mobile can now check airdrop qualifications in advance (only the qualifications, the amount cannot be seen). Users can import other wallet addresses into Jupiter Mobile for inquiries.

Pre-Market Valuation and Token Economic Model

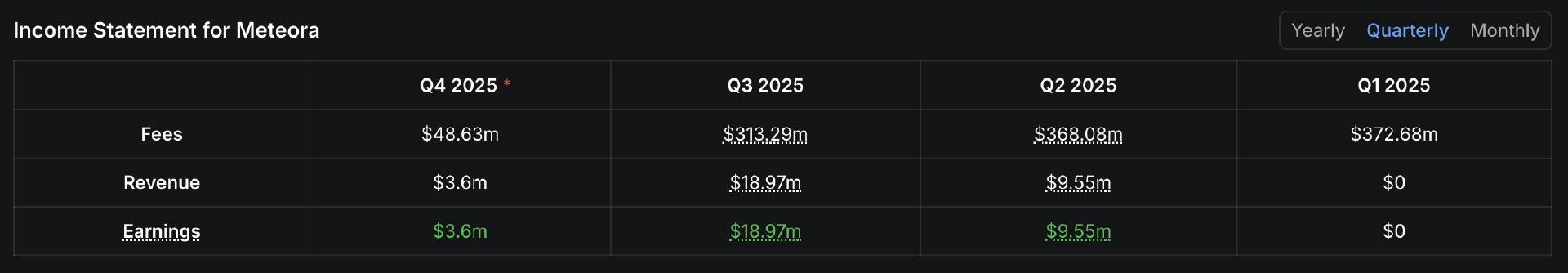

As one of the most profitable protocols in the entire DeFi world within the Solana ecosystem (DeFillama data shows that profits have exceeded US$32 million this year), the market has also given Meteora a relatively optimistic valuation.

As of around 11:30, the valuation expectations of Meteora in major pre-market trading markets are as follows.

- On Whales.Market, MET is currently trading at $1.5, corresponding to a $1.5 billion valuation for the protocol.

- Ranger's MET is currently trading at $1.39, corresponding to a $1.39 billion valuation for the agreement.

- MET is currently trading at $1.35 on MEXC, corresponding to a $1.35 billion valuation for the protocol.

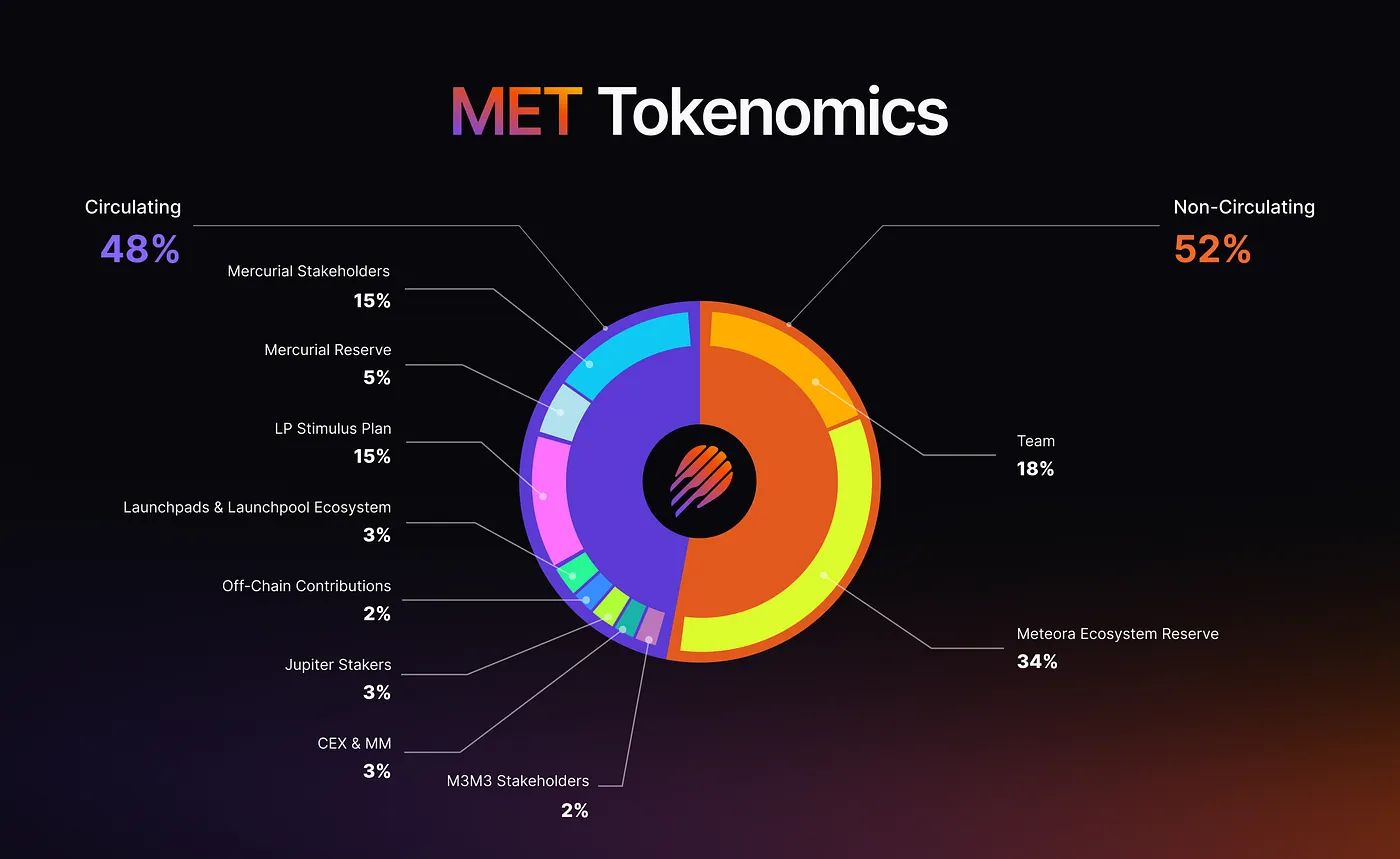

On October 7, Meteora officially announced the token economic model of MET. The total supply of MET is 1 billion, and the specific distribution is as follows.

48% of MET will be fully unlocked at TGE :

- 20% of MET was allocated to Mercurial stakeholders - later adjusted to 15% for Mercurial stakers, and another 5% was transferred to Mercurial reserves, which still counts towards the total circulation but will not be released immediately at the TGE.

- 15% of MET will be distributed to Meteora users through the LP incentive program;

- 3% of MET is allocated to the Launchpads & Launchpool ecosystem.

- 2% of MET is allocated to off-chain contributors, i.e. those who contribute to the development of the Meteora ecosystem.

- 3% of MET is allocated to Jupiter (JUP) staking users, aiming to expand the core LP camp 10 times. This part of the funds comes from TGE reserves.

- 3% of MET is allocated to CEX, market makers and other ecological partners, constituting the remainder of the TGE reserve.

- 2% of MET is allocated to M 3 M 3 stakeholders.

The remaining 52% of MET will remain locked at the time of TGE :

- 18% of METs are allocated to teams, to be released linearly over 6 years.

- 34% of MET is allocated to the Meteora Protocol Reserve, which is also released linearly over 6 years.

Airdrop design: Get coins or get liquidity positions

After sorting out the basic information, it’s time to talk about the most important content, which is Meteora’s unique airdrop design.

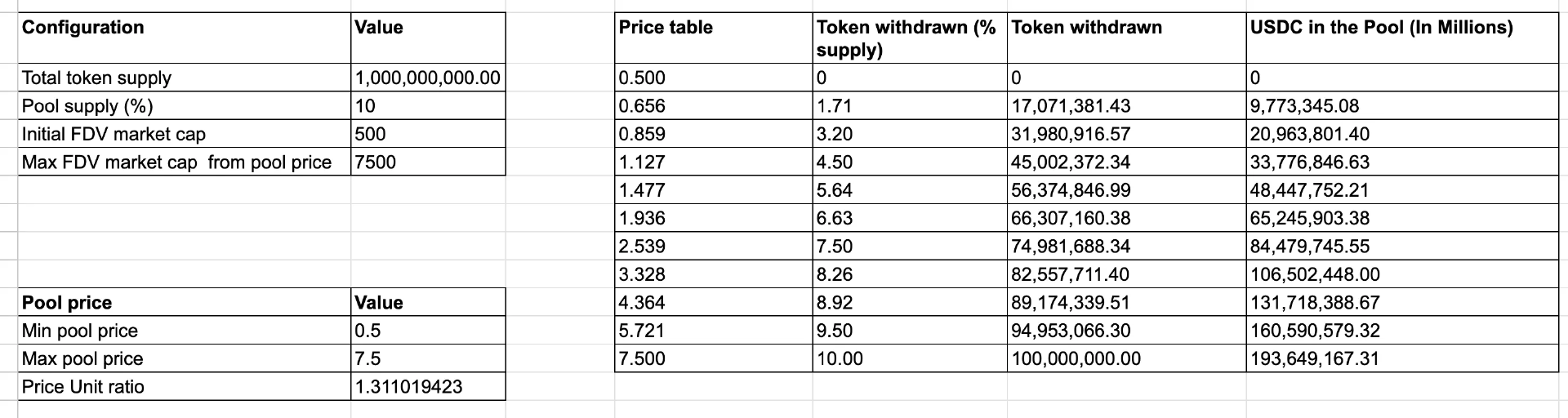

According to information disclosed by Meteora last night, 10% of the 48% initial token supply will be distributed through the Liquidity Distributor mechanism to guide the initial liquidity of MET. The Liquidity Distributor allows users to claim airdrops in the form of liquidity positions (the carrier is an NFT representing the liquidity position). At the same time as the TGE, their original airdrop allocation will be directly invested in a one-sided DLMM pool ranging from US$500 million to US$7.5 billion.

- Odaily Note: A brief explanation of the DLMM pool is needed here. This is one of Meteora's core products. DLMM allows liquidity providers (LPs) to dynamically adjust liquidity depth within a specific price range. Like placing a "limit order," they can place orders within different price ranges to provide liquidity. In tonight's airdrop, the DLMM range was $500 million to $7.5 billion, so the corresponding "limit order" price range for MET was $0.5 to $7.5.

To put it simply, Meteora allows users to claim the airdrop in two ways. One is to claim the tokens directly. With this option, you don't need to do anything; just wait for the claim window to open and claim them. The other is to claim a liquidity position. This option requires registration tonight. The advantage is that you can earn anti-sniping fees and transaction fees immediately after the TGE launches, but the disadvantage is that there is a certain amount of impermanent loss. After claiming a liquidity position, users can withdraw liquidity at any time. The funds withdrawn will be a combination of MET and USDC (as some MET will be sold due to market fluctuations).

Given Meteora's scale, the Liquidity Distributor's total allocation is 10% of the total token supply (or 100 million MET). However, since Jupiter stakers are required to allocate 3% of their airdrop to the Liquidity Distributor, this leaves a 7% allocation for other airdrop holders to choose from on a first-come, first-served basis. In other words, if your airdrop isn't entirely from JUP staking, you need to carefully consider which method of claiming will maximize your returns.

Which option is more profitable?

To figure out whether to "select coins" or "select liquidity positions", you need to first understand the logic of gains and losses when claiming liquidity positions.

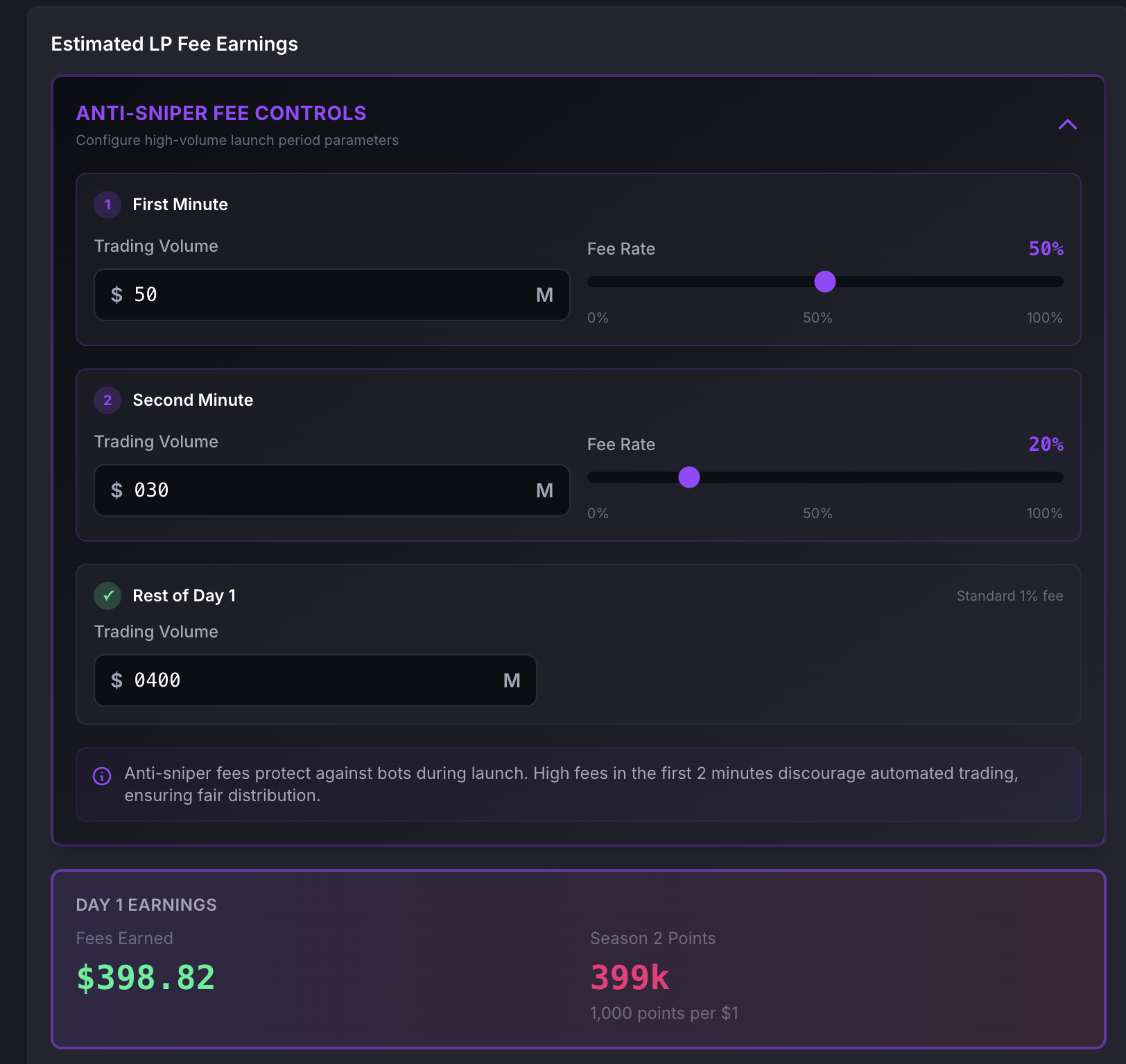

First, let's look at the revenue. The main revenue streams from participating in the Liquidity Distributor come from anti-sniper fees and transaction fees. As the name suggests, the anti-sniper fee is intended to mitigate the possibility of sniping during MET issuance. Meteora's MET anti-sniper fee is designed to start at 50% on the first block, then decay rapidly, expected to drop to 1% in approximately three minutes. This revenue stream is expected to be the primary source of revenue on the first day. Transaction fees are self-explanatory; if you don't plan to withdraw liquidity and sell MET on the first day, this revenue stream will be a continuous source of revenue for participating in the Liquidity Distributor.

Next, let's talk about losses. It's important to emphasize that the losses here refer to the "impermanent loss" relative to directly receiving MET, not actual losses. Simply put, since the DLMM price range for MET is $0.5 to $7.5, some MET will be sold starting at $0.5. Assuming the MET price subsequently rises to $1, compared to selling all of the MET at that time, these MET sold at a lower price will incur a certain amount of "impermanent loss."

In its official announcement, Meteora listed the percentage of MET that would be sold at various price points (up to 10%, corresponding to a price of $7.50). For example, using the figure closest to the pre-market valuation ($1.477) as an example, the FDV of MET after issuance would be approximately $1.477 billion, and approximately 5.64% of MET would be withdrawn from the pool and sold. This means that if your airdrop share is 100 MET, 56.4 MET will be sold in advance at a price of 48.4 USDC. Compared to the $147.7 that can be obtained by selling all at $1.477, if the liquidity is withdrawn at this time, the value of the airdropped MET will only be $64.4 (33.6 * 1.477), plus the total value of USDC is about $112.8, which is expected to result in an impermanent loss of 23.6% after conversion. However, in actual circumstances, users who participate in Liquidity Distributor can also share the anti-sniping fees and transaction fee income mentioned above. The estimation of benefits and potential losses here is the core game point of whether to participate in Liquidity Distributor.

In summary, whether to participate in Liquidity Distributor depends largely on your judgment of whether the gains from market trading volume (especially trading volume at the opening) can cover potential impermanent losses (especially around a pre-market valuation of $1.5 billion, which is about 23% impermanent loss).

Overseas KOLSwishi.eth (@swishi_eth) has created a very intuitive loss and gain calculator for MET's opening ( https://met-calculator.swishi.xyz/ ). You can directly estimate whether it is worth choosing Liquidity Distributor based on your own valuation expectations for MET and your forecast of the first-day trading volume.

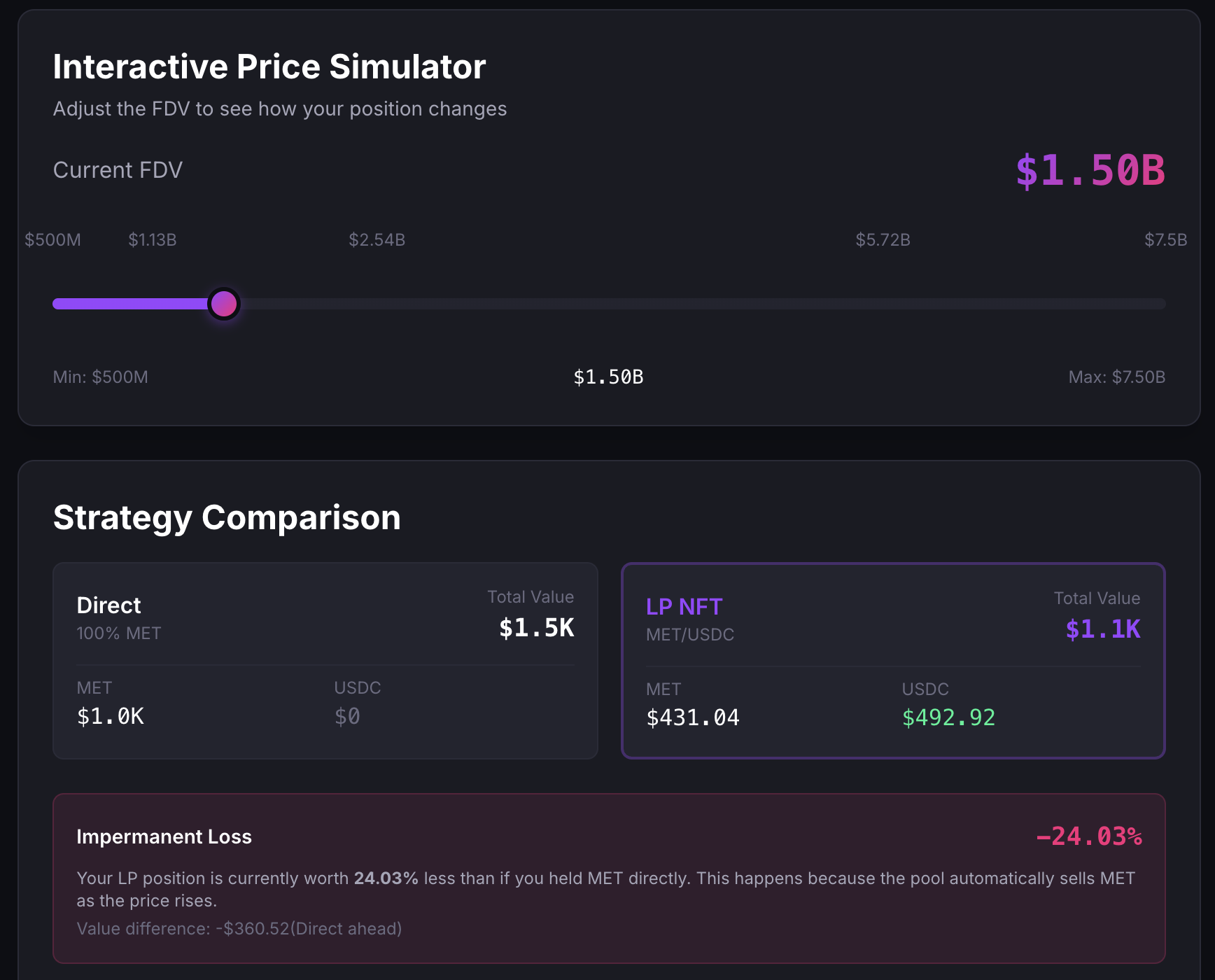

Let's take another example using this calculator. Assuming your airdrop quota is 1,000 MET, and the estimated post-listing price is $1.50, if you choose to claim the tokens directly, the selling value is approximately $1,500. If you choose Liquidity Distributor, the estimated residual value of your position, ignoring returns, is approximately $1,100.

Assuming that the trading volume of MET in the first minute after opening is US$50 million; the trading volume in the second minute is US$30 million, and the remaining trading volume on the first day is US$4 million, the corresponding mining income on the first day is approximately US$398, which is basically the same as the impermanent loss in the previous period.

All you need to do is use your own judgment to estimate MET's opening price and trading volume on the first day, and then make the best decision based on that judgment. The algorithm is transparent, but the decision is yours.