Hydrex, the dark horse of the Base ecosystem, surged 40% against the market trend.

- 核心观点:Hydrex逆势上涨,展现生态韧性。

- 关键要素:

- HYDX单日逆势涨超40%。

- TVL达1300万美元,用户近2000。

- 100%手续费分配给质押者。

- 市场影响:增强Base生态DeFi吸引力。

- 时效性标注:短期影响

Original author: Nicky, Foresight News

On October 11, 2025, the cryptocurrency market experienced a significant decline, but the token HYDX of the Base ecosystem project Hydrex rose against the trend, with a single-day increase of more than 40%.

Hydrex is positioned as the MetaDEX and liquidity infrastructure for the Base ecosystem, aiming to guide liquidity incentives and protocol revenue distribution through community governance. According to protocol data, Hydrex currently has a total locked value of $13 million, supports over 250 assets, has a cumulative trading volume of $178 million, and has nearly 2,000 user accounts.

Project positioning and core functions

The core positioning of Hydrex is a "liquidity coordination system", which aims to drive token distribution and protocol revenue through community governance, and direct liquidity and trading volume to the most productive pool.

Its design integrates a voting lock (VE) mechanism with strategic optimization. Users can participate in governance by locking up tokens, influencing the direction of liquidity incentives, forming a positive cycle of "locking - voting - attracting liquidity - generating fees - redistribution" (the "Hydrex flywheel"). The protocol also distributes 100% of transaction fee revenue to participating liquidity providers, with cumulative transaction fee revenue currently exceeding $1.18 million.

In terms of specific functions, Hydrex provides three types of accounts to meet the needs of different users: Liquid Accounts (flexible) support immediate income and asset lending, Flex Accounts (long-term) require a 2-year lock-up and receive a 30% profit bonus (early exit has a penalty), and Protocol Accounts (permanent) obtain unlimited lock-up and stable income by converting oHYDX tokens.

The protocol incorporates a strategic reserve mechanism, requiring each circulating HYDX token to be backed by at least 0.01 USDC. This design ensures that token issuance is backed by real capital and prevents unchecked inflation. Users access HYDX liquidity through the option token oHYDX, requiring a corresponding USDC deposit to complete the conversion.

In addition, Hydrex emphasizes a "liquidity neutral" strategy. It is not limited to its own liquidity pool, but integrates external DEX on the Base chain (such as Uniswap V 4, Algebra, etc.) through routing technology to strive for the best transaction prices for users.

Team Background

The Hydrex team has chosen to remain anonymous, not disclosing the identities of its core members. This practice is common among Web 3 projects, often to mitigate regulatory risks or for privacy reasons. Twitter user @larrettgee revealed that the team recently added a new Business Development Lead and a Growth Consultant (Base OG).

The project's public advisory information shows that Coinbase senior software engineer Colin Johnson has joined the Hydrex advisory board.

Regarding funding, Hydrex emphasized that it did not raise traditional venture capital rounds, nor did it engage in pre-sales or influencer marketing campaigns. The project primarily secured funding through ecosystem partnerships, including $10,000 in seed funding from Peapods Finance and a Builder Grant from the Coinbase Developer Platform for embedded wallet integration and DeFi onboarding optimization.

Token Economics

The initial supply of HYDX tokens is 500 million, but approximately 90% of these tokens will be perpetually burned through the creation of protocol accounts (i.e., permanently locked positions, formerly known as veHYDX), leaving a total supply of approximately 34.38 million tokens. Of this initial distribution, 50% will be allocated to community and partner growth activities, 25% to the treasury, 20% to core contributors, 3% to protocol liquidity, and 2% to advisors and early supporters.

Its issuance and economic model revolve around "reserve constraints" and "long-term alignment". Key mechanisms include:

- Strategic Protocol Reserve: For every HYDX issued, at least 0.01 USDC must be deposited into the reserve to ensure that the token issuance is backed by real capital. Users must pay USDC or burn oHYDX to redeem liquid HYDX, which can be obtained directly from the market or through governance rewards.

- Account Type and Revenue Distribution: All users who stake in the HYDX liquidity pool will have their transaction fees returned to their account holders via weekly distributions. The duration and size of your stake directly impact your voting weight and profitability, encouraging long-term participation.

- Anti-dilution and rebalancing: veHYDX holders initially receive a 26% share of the token issuance, which decreases over time to balance the rights of newly issued tokens with those of existing users. A penalty mechanism for early exit of Flex accounts (burning some HYDX) provides deflationary pressure.

The protocol employs an anti-dilution mechanism, with veHYDX holders' rebase shares starting at 26% of emissions and decreasing by 0.5% per week over the first year. This design aims to gradually reduce inflationary pressure and encourage long-term participation as the ecosystem matures.

Ecosystem integration

Hydrex is deeply adapted to the characteristics of the Base ecosystem, such as supporting the Base App, smart wallet, Farcaster platform DeFi entrance, Flashblocks fast transactions and other functions. It is officially called the "liquidity hub of the Base ecosystem."

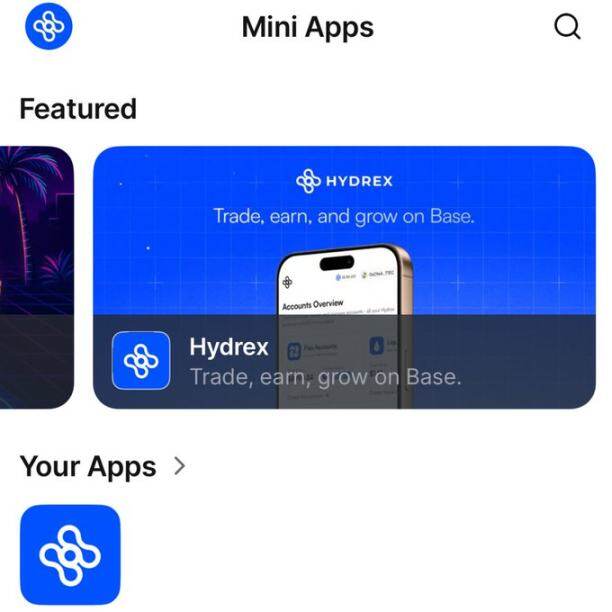

Hydrex has deeply integrated with Farcaster, launching a mini-app that allows users to stake over 30 Base ecosystem assets without leaving the social platform. This social DeFi experience, combined with Base ecosystem features like smart wallets, fee-free transactions, and EIP-7702, aims to provide a smooth on-chain onboarding for new users.

Community Performance

Hydrex recently launched the Anchor Club program to encourage long-term user participation in protocol governance. Through automated liquidity accounts or flexible account registration, users can accumulate Anchor Club points, which can be redeemed for governance rights and additional community benefits.

Its "no VC, no pre-sales, no KOL marketing" tagline has been mentioned repeatedly in community discussions, and its 100% distribution of revenue to holders has also attracted attention. During the market crash on October 11, 2025, HYDX bucked the trend and rallied, reflecting some investors' confidence in its liquidity coordination capabilities and the synergy with the Base ecosystem.

How to participate

Different users can set up Liquid Accounts (flexible), Flex Accounts (long-term) or Protocol Accounts (permanent) on Hydrex to obtain income according to their own needs.

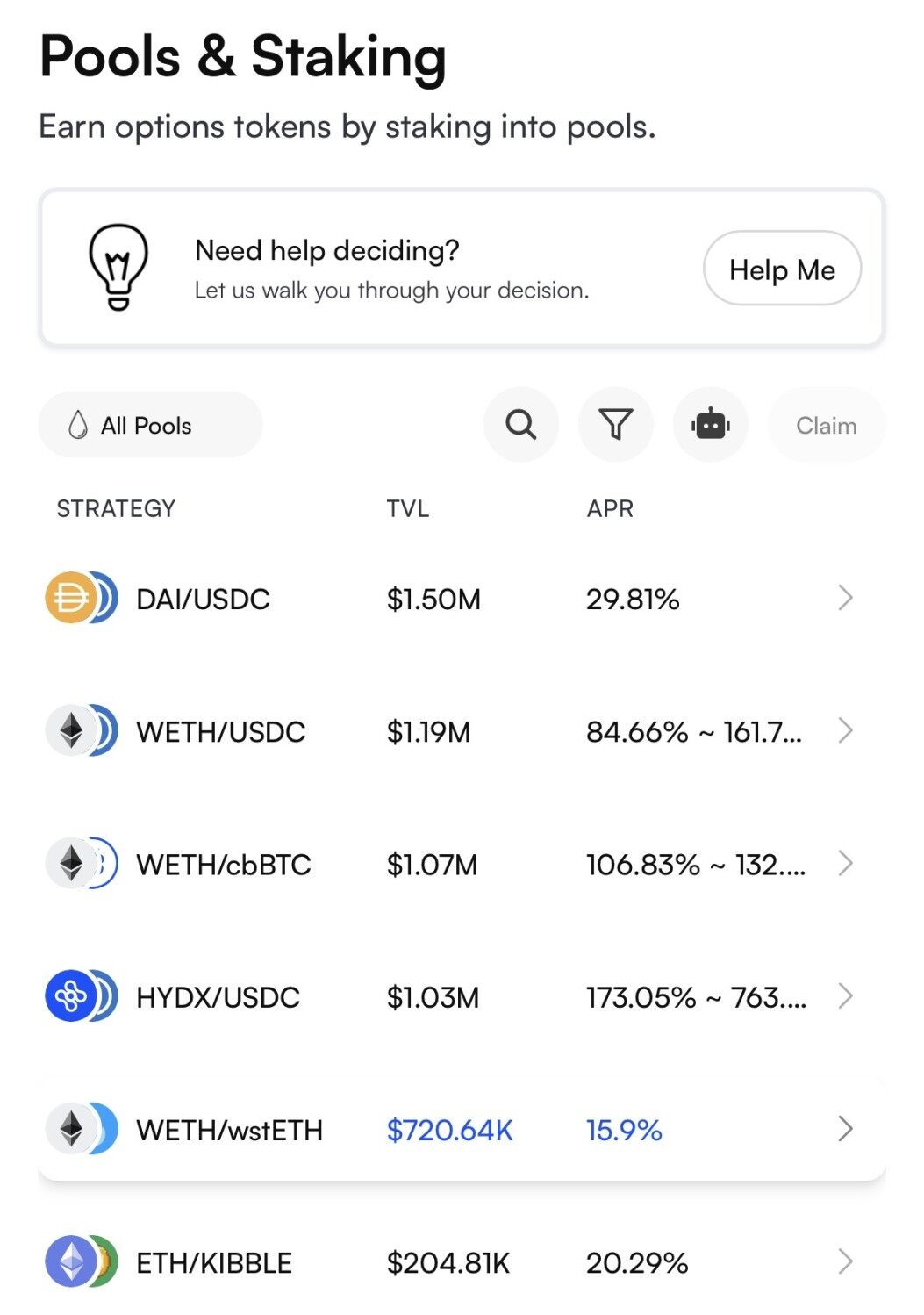

You can also earn annualized returns by staking in liquidity pools through the Base app and wallets. The stablecoin strategy for DAI/USDC has a TVL of $1.5 million and an annualized yield of 29.81%. The TVL for USDC/HYDX exceeds $1 million, with an annualized yield of up to 774%.

Risk Warning

As expectations for the Base network's token launch grow, native protocols like Hydrex may garner more attention. However, investors should remain mindful of the potential risks associated with anonymous teams and complex mechanisms. Whether Hydrex can achieve its stated goal of becoming a "sustainable liquidity hub" remains to be seen, as core functionality is further implemented and ecosystem collaboration deepens.