TAO surges 50% this week, Bittensor sees institutional momentum

- 核心观点:TAO信托合规化推动AI加密资产机构化。

- 关键要素:

- 灰度提交TAO信托Form 10注册申请。

- TAOX公司获1100万美元私募融资。

- TAO周内价格暴涨超50%。

- 市场影响:加速机构资金入场,提升AI加密资产认可度。

- 时效性标注:中期影响

On October 10th, Grayscale Investments submitted a Form 10 registration statement for the Bittensor Trust (TAO) to the U.S. Securities and Exchange Commission (SEC), paving the way for this AI-focused crypto asset trust to move toward regulatory compliance and public market access. If approved, the private placement holding period for trust units will be shortened from 12 months to 6 months, meaning early investors will gain faster access to liquidity and paving the way for institutional investors to enter the market.

A few days later, TAO Synergies Inc. (NASDAQ: TAOX), a US-listed company, announced the completion of an $11 million private equity round. Investors included James Altucher, TAO's strategic advisor, and Grayscale's parent company, DCG. This news quickly ignited market confidence—over the past week, TAO's price has climbed from $290 to $457, an increase of over 50%.

As AI becomes one of Wall Street's most powerful narratives, TAO is increasingly seen as a bridge between regulated finance and decentralized AI networks. With market sentiment surging and trading activity rising, TAO has become a "new AI target" in the eyes of institutions and is expected to reach a record high since April 2024.

What does Form 10 mean?

Form 10, also known as the General Form for Registration of Securities, is a registration document under Section 12(g) of the Securities Exchange Act of 1934. Once a trust or fund product submits Form 10 to the SEC and is accepted, it upgrades from a "private trust" to an "SEC reporting company," subject to the same disclosure obligations as publicly traded companies—including the regular filing of Forms 10-K (annual reports), 10-Q (quarterly reports), and 8-K (interim reports). In other words, once Form 10 becomes effective, TAO trusts will be formally incorporated into the mainstream US securities regulatory system for the first time.

Similar to Grayscale's Bitcoin Trust (GBTC) and Ethereum Trust (ETHE), TAO Trust aims to be listed on the OTC Markets, allowing traditional investors to directly allocate this asset through their brokerage accounts. Looking back at Grayscale's path: GBTC filed Form 10 in 2019, followed by ETHE in 2020, and both subsequently transitioned to spot ETFs. TAO's current actions follow the same trajectory.

For TAO, this action has three meanings:

Shorten the liquidity cycle. The holding period is shortened from 12 months to 6 months, which means that previously locked-up private placement shares can be circulated in the secondary market more quickly, freeing up funds for early investors and activating trading depth.

Opening a compliance portal. Once registration takes effect, the trust can be listed and quoted on the OTC Markets, allowing traditional brokerages and family offices to invest in TAO as securities without having to directly access crypto wallets or custodial services.

Laying the foundation for ETFs. Grayscale has already verified the "Form 10 → ETF" path with its BTC and ETH trusts. Form 10 is the starting point, paving the way for future applications for exchange-traded products (ETPs).

"TAO Micro Strategy" strikes again

On October 14, TAO Synergies Inc. (NASDAQ: TAOX), a U.S.-listed company, announced the completion of a private placement financing of US$11 million. Investors included TAO strategic advisor James Altucher and Digital Currency Group (DCG), an early supporter of Bittensor.

Formerly the biotech company Synaptogenix, TAOX purchased 29,899 TAO tokens for the first time after completing its strategic transformation in July of this year, totaling approximately $10 million. TAOX has become the world's largest TAO holder, with all of its holdings now incorporated into the company's treasury. TAOX plans to stake its tokens on the Bittensor mainnet to participate in network computing and model training, generating long-term returns. Since the July transformation, the company's stock price has more than tripled, maintaining its strong performance despite a general pullback among DAT companies.

James Altucher, Strategic Advisor to TAO, stated, "This financing further solidifies TAO Synergies' long-term strategy, encompassing not only the holding and management of TAO tokens, but also the opportunity to generate revenue and build influence within the Bittensor ecosystem. We welcome DCG, a leader in the crypto industry and one of Bittensor's earliest supporters. We are confident in the future of decentralized intelligence and believe Bittensor's network model will be a key driver of innovation and value creation in the years ahead."

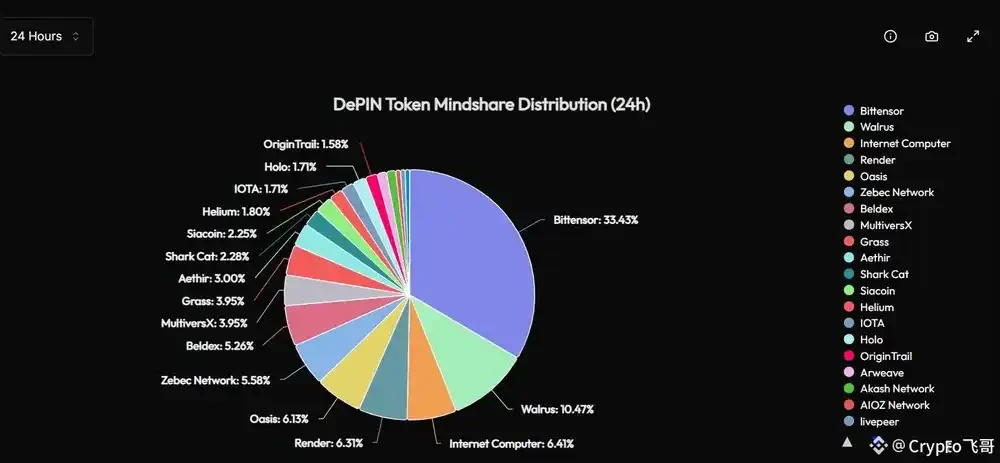

On-chain data shows that Bittensor's market share in the DePIN (decentralized physical infrastructure) sector has exceeded 33%. With the accelerated investment of institutional funds, TAO is gradually transitioning from a simple "AI concept coin" to a foundational asset with real network value and a cash flow model. The market generally believes that the dual actions of TAOX and Grayscale are becoming a significant watershed in the institutionalization of the AI sector.

Summarize

As Wall Street's enthusiasm for the AI narrative continues to grow, from Nvidia to OpenAI to Bittensor, this AI wave is rapidly spreading to the crypto market, and TAO is becoming a key beneficiary. With dTAO's reshaped incentive mechanism and its first halving approaching, TAO is expected to challenge its all-time high of $1,247 again. After Bitcoin's golden decade, the AI narrative may become the next capital consensus, and TAO stands at the starting point of this new era.