Odaily Exclusive Interview with 1inch Co-founder: Earning an Extra $200,000 in a Single Transaction: The Secret to the Team's High Win Rate Trading

- 核心观点:1inch品牌重塑聚焦业务发展。

- 关键要素:

- 启用极简新LOGO强化专业形象。

- 拓展Coinbase等机构API合作。

- 推出原子跨链兑换专利技术。

- 市场影响:增强机构合作吸引力与竞争力。

- 时效性标注:中期影响

Original | Odaily Planet Daily ( @OdailyChina )

By Wenser ( @wenser 2010 )

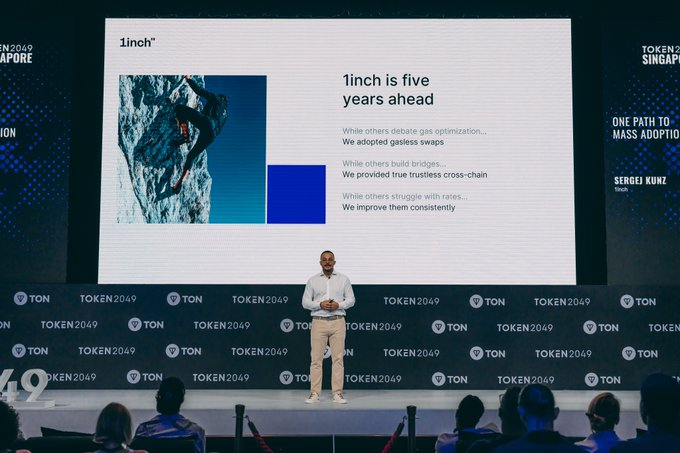

Editor's Note: During Singapore's Token 2049 event, the established DeFi project 1inch launched a rebranding campaign , replacing its unicorn logo with a new identity centered around the symbol "1." This wasn't just a cosmetic change; it also revealed 1inch's commitment to branding and marketing, not just technology. Odaily Planet Daily interviewed 1inch co-founder Sergej Kunz, gaining insights into the thinking, plans, and anecdotes behind 1inch's "brand unification." The discussion also included topics such as the 1inch team's high trading success rate.

(Odaily Note: 1 Inch co-founder Sergej Kunz is a senior developer with nearly 20 years of development experience. The project originated from a hackathon in New York in 2019. Currently, the 1 Inch team has approximately 60 members spread across the globe.)

Odaily Planet Daily: What is the core purpose of 1inch's brand rebranding campaign? How do you understand the "1" and "Unite" concepts in the new logo?

Sergej: The key to rebranding is removing the noise. Steve Jobs once said, "If you want to focus on building great products, you need to stop doing unnecessary things." Refreshing our logo and other visual elements does just that—it clarifies our brand image and focuses our business objectives on building better products. Innovation and technological advancement are always our priorities.

Over the past year, we've begun supporting the Solana ecosystem and enabled cross-chain swaps from the EVM chain to Solana. We plan to add the Bitcoin network in the future, and we're constantly moving forward. At the same time, we want to focus more on business development. A direct, no-frills brand can better convey business information and value.

As for our logo, the previous unicorn image has undergone several changes. Originally, it was a cartoon-style unicorn. Now, the new logo has a more cyberpunk feel. This simple, solemn "1-inch" graphic is easy to recognize and remember, and it also conveys our seriousness, continuous innovation, and strong execution. The color scheme is limited to black and white, conveying the meaning clearly and intuitively. In fact, this logo was conceived and designed by our internal team at our software development facility in Dubai. They produced the first concept draft within two weeks, and the logo itself did not undergo many major revisions (approximately two or three times).

Furthermore, I see the brand refresh as a fresh approach to product definition, much like Steve Jobs introducing the iPhone, replacing a keyboard with a simple touchscreen. Our website now features minimalist functionality, and uses AI-generated, relevant, and clear imagery. We use hard, direct, rectangular frames instead of softer, rounded ones. We began the rebranding project this spring, and several months later, we've finally finalized all content and marketing.

Odaily Planet Daily: Under the new brand positioning, who are 1inch's institutional clients? Will it evolve into a global presence?

Sergej: 1inch's current goal is to become a key connection point between the TradFi and DeFi ecosystems. Therefore, we are actively expanding our institutional partnerships. A recent example is Coinbase, which has begun using our API to provide token swap services for its clients. We are also conducting pilot projects with traditional commercial banks in Switzerland and other regions to facilitate direct cryptocurrency exchange transactions. 1inch's commercial API clients also include MetaMask, Trust Wallet, OKX, and Coinbase's non-custodial wallet.

Regarding global market expansion, we are considering setting up a project office in Singapore, as its industry environment, sandbox mechanism, and talent pool are very significant. We are also considering Hong Kong.

Odaily Planet Daily: For institutional clients, what are the safeguards to improve transaction efficiency and security?

Sergej: Currently, commercial clients such as institutions and banks are looking to access Web 3 and leverage on-chain liquidity. Previously, they typically used centralized exchanges like Kraken and Coinbase, which involved relatively complex processes. However, using 1inch's SDK or API allows them to complete transactions with a single call, significantly simplifying and automating their previously complex workflows. With the 1inch platform, they can exchange assets and execute trades within a single block time. To enhance the user experience for institutional users and facilitate product integration, 1inch has received international SOC II and ISO certifications, highlighting its compliance with enterprise-grade standards.

As for technological enhancements, cross-chain transactions have always been a pain point in the DeFi space, especially for institutions needing to transfer assets between blockchains. Due to the various security risks associated with cross-chain bridges, institutions need to consider additional factors when transferring assets. Therefore, we have launched Atomic Cross-Chain Swaps technology and have applied for related patents. Simply put, this is a trustless technical solution for EVM-compatible chains and ecosystems like Solana. Intent protocols are also a key step in improving the user experience: users simply sign an intent, such as "I want to sell ETH on the Ethereum chain and buy TRUMP tokens on Solana," to achieve their desired goal. In a multi-chain environment with fragmented liquidity, 1inch's technical solution offers greater operability and trading advantages.

Odaily Planet Daily: In the current competitive landscape of stablecoins, where hundreds of them are being launched simultaneously, how does 1inch view the numerous emerging stablecoin projects? Will this have an impact on 1inch's liquidity aggregation business and user growth?

Sergej: Yes, after coming to Singapore, I feel like almost everyone is in the stablecoin issuance business. In fact, it's only been about three years since the algorithmic stablecoin Luna collapsed, which fully demonstrates the market's short memory. Of course, unlike algorithmic stablecoins, stablecoins with sufficient qualified collateral are relatively safe. So, although the market share of stablecoins has further fragmented, this is also healthy competition to a certain extent. And competition is always a good thing for ordinary users, such as more profit opportunities. For 1inch, more stablecoin projects have almost no impact because we aggregate everything - 1inch accepts all compliant stablecoins.

Of course, in order to avoid illegal activities such as money laundering, we have a dedicated team responsible for on-chain monitoring to prevent malicious actors from using our API for illegal profit.

Odaily Planet Daily: Looking ahead, will 1inch introduce AI-driven smart routing tools to further reduce gas fees or optimize transaction costs in a multi-chain environment?

Sergej: At present, our routing algorithm is good enough and there is no need to use AI-related technical solutions to optimize routing to save gas fee costs.

In my opinion, AI's greater value lies in serving as a user guide or educational assistant. For example, we could create an AI assistant that allows new or average users to manage their assets through voice control . Users could say, " 1inch , open my asset homepage. I want to transfer my Ethereum assets to the Bitcoin network." Furthermore, based on industry trends or asset management principles, AI could help review users' trading profits and losses and provide specific action recommendations. For example, AI could suggest diversifying a user's holdings, such as shifting from ETH, which has outperformed the market, to BTC, which is relatively undervalued.

These AI agents will make DeFi and trading easier for the average person to understand. DeFi is currently quite complex and difficult to access, especially for those in traditional finance. This is the value of AI: it can help users navigate between traditional and crypto finance, finding the right trading targets and asset allocations for them.

Odaily Planet Daily: Many people say that the 1inch team is very good at trading and can always “buy low and sell high”. Do you think this is the case?

Sergej: Actually, we have dedicated personnel responsible for our investment transactions. As for the specific operations, it's more of an art form of portfolio management, known as rebalancing. Of course, technology often plays a significant role. We once sold ETH when its price was high and converted it into stablecoins. Simply by using our platform technology, we were able to generate an additional $200,000. This is undoubtedly a great validation of the effectiveness of our technology. In the crypto space, when your assets (such as Bitcoin and Ethereum) experience a 3x or 4x increase in value, rebalancing contributes to the sustainability of your business.

The logic behind this strategy is simple: if an asset in your portfolio experiences significant price appreciation, you can partially shift it to an asset with less significant price appreciation (like Bitcoin) or into a stablecoin to lock in gains and mitigate risk. Then, wait for the price to fall before buying more. This is a common practice in portfolio management, not gambling or professional day trading.

Odaily Planet Daily: Is there anything else you would like to share with readers, such as personal thoughts or business plans?

Sergej: My parents are from Serbia and Russia. When I was 12, they immigrated to Germany and started everything from scratch. They worked incredibly hard, and this family background taught me a lot about the realities of life. There are still many people who lack access to formal financial services and can't even open a bank account.

1inch was founded with the goal of helping these people change this reality. It's not about making money, but about providing people with what they truly need—financial services—based on technological advancements. Everyone needs an on-chain wallet, which is why we built a cryptocurrency wallet. For the first time, it gives users ownership of their assets, giving them control over their own assets. This is undoubtedly revolutionary.

I would even go so far as to predict that within the next five years, everyone will have a cryptocurrency wallet and it will become the new standard.

Interview photo

About 1inch

1inch's core goal is to provide a highly simplified user interface for cross-chain asset exchange and trading. 1inch focuses on the core needs of users: exchanging assets at the best execution price. 1inch also offers a corresponding Pro user experience for professional users, similar to the relevant pages of centralized exchanges (CEX) with trading charts and portfolio information, but its core is still non-custodial technology. Users do not need to trust 1inch or transfer funds to the platform, but instead interact directly with the blockchain and smart contracts. In addition, 1inch has also opened a SaaS product 1inch Business to corporate and institutional users, providing API interface integration for token exchange and Web 3 RPC calls, helping enterprises integrate Web 3 functions into their own corporate businesses, thereby saving a lot of product development and maintenance costs.