Original author: Ash

Original translation: TechFlow

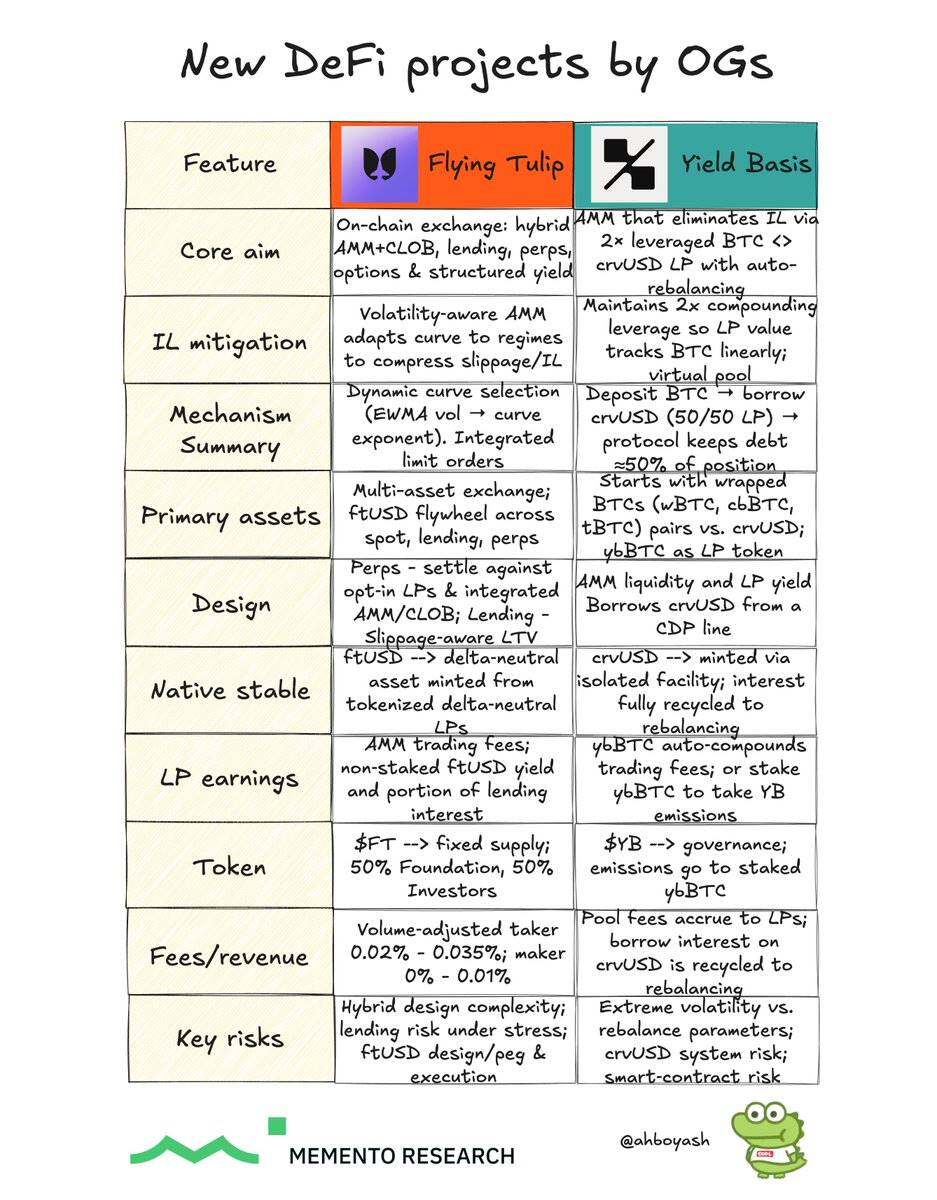

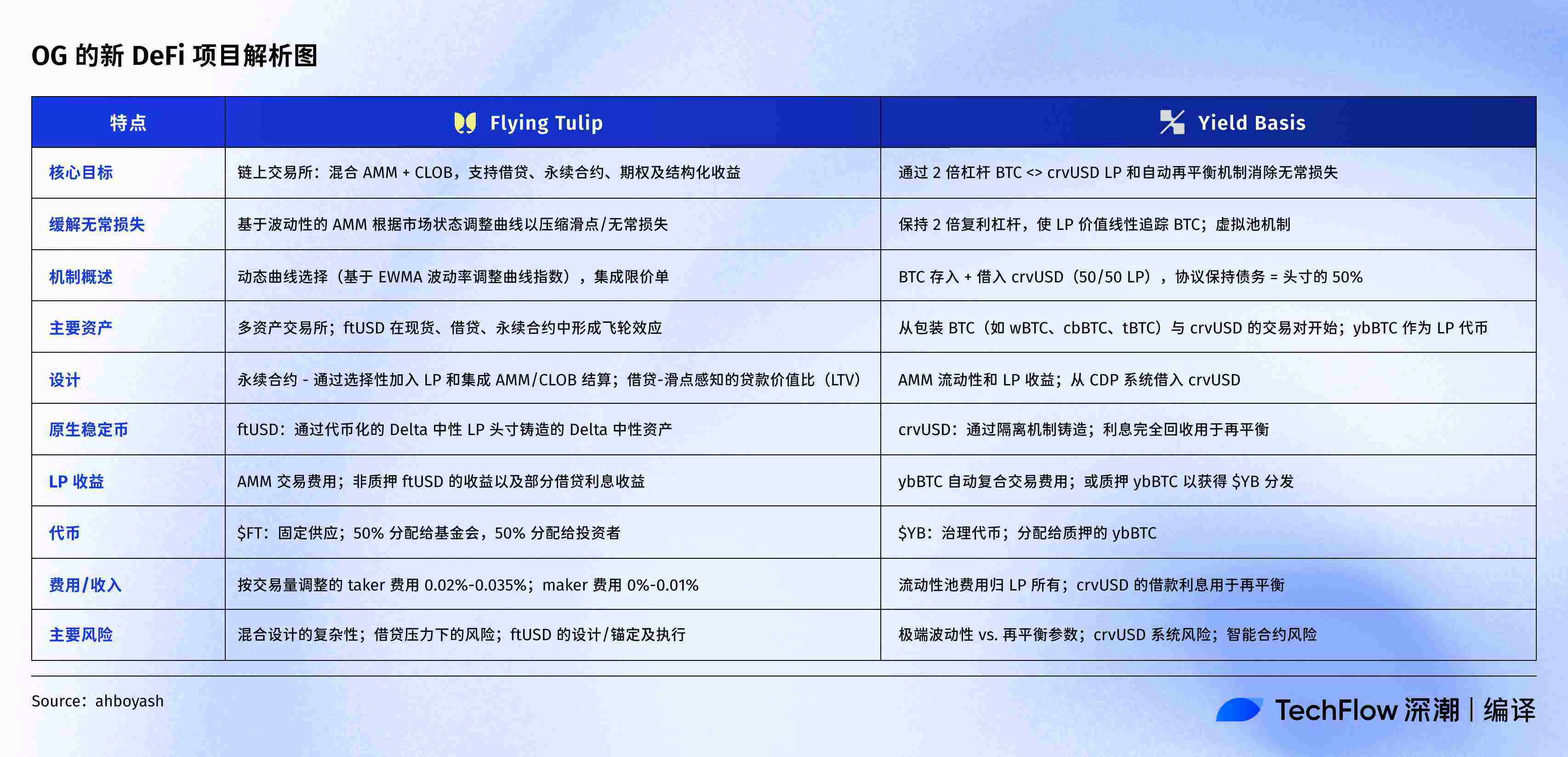

@newmichwill , founder of @CurveFinance , is launching @yieldbasis , a Bitcoin AMM liquidity platform with no impermanent loss.

Meanwhile, @yearnfi 's founder and DeFi god @AndreCronjeTech is building @flyingtulip_ , a unified AMM+CLOB exchange.

Two different attempts to solve the same problem: how to make on-chain liquidity truly effective:

- Yield Basis ($YB): A Curve-native AMM that eliminates impermanent loss for BTC liquidity providers by maintaining a constant 2x leveraged BTC-crvUSD liquidity pool (LPs maintain a 1:1 ratio with BTC while earning transaction fees). Users can mint ybBTC (yield-generating BTC).

- Flying Tulip ($FT): An on-chain unified exchange (including spot, lending, perpetual contracts, options, and structured returns), based on a volatility-aware hybrid AMM+CLOB architecture, combined with a slippage-aware lending mechanism, and ftUSD (a delta-neutral USD equivalent) as the core incentive.

Yield Basis

- Traditional AMMs allow BTC liquidity providers to sell when prices rise or buy when prices fall (√p exposure, DeepChao Note: market risk exposure measured in square roots of prices), resulting in impermanent losses that often exceed the fees earned from providing liquidity.

- The specific mechanism of Yield Basis will be introduced in detail later, but the core is: users deposit BTC into the platform, and the protocol borrows an equal amount of crvUSD, forming a 50/50 BTC-crvUSD Curve liquidity pool, and operating with 2x compound leverage.

- A re-leveraged AMM and virtual pool maintains a debt approximately equal to 50% of the liquidity pool value; arbitrageurs profit by maintaining leverage constant.

- This allows the value of the liquidity pool to change linearly with BTC while earning transaction fees.

- Liquidity providers hold ybBTC, a yield-generating BTC receipt token that automatically compounds BTC-denominated transaction fees.

- The platform also provides governance tokens $YB, which can be locked as veYB and used for voting (for example, selecting liquidity pool reward distribution).

- Yield Basis is primarily for BTC holders who want to unlock productive BTC in a protocol that solves the impermanent loss problem and earn fees.

Flying Tulip

- Traditional decentralized exchanges (DEXs) often have static user experiences and risk profiles. Flying Tulip aims to bring centralized exchange (CEX)-level tools to the blockchain by adjusting AMM curves based on volatility and adjusting loan-to-value (LTV) ratios based on actual execution/slippage.

- Its AMM adjusts the curvature based on the measured volatility (EWMA) - that is, it tends to be flat (close to the constant sum) in the case of small volatility to compress slippage and impermanent loss; it has more multiplicative characteristics in the case of large volatility to avoid liquidity depletion.

- ftUSD tokenized delta-neutral liquidity pool positions are generated and used for incentive mechanisms and liquidity programs.

- The platform token $FT may be used for revenue buybacks, incentives, and liquidity programs.

- Flying Tulip is a DeFi super app: an exchange that supports spot trading, lending, perpetual contracts, and options.

- Execution quality relies on accurate volatility/impact signals and robust risk control in stressed environments.

Outlook of the two projects

Yield Basis aims to become a platform for BTC liquidity, while Flying Tulip aims to become a platform for all on-chain native trading. In an era dominated by perpetual contract decentralized exchanges (Perp DEXs), Flying Tulip's launch seems timely. Frankly, if it can achieve best execution, Flying Tulip could even divert future BTC traffic to a pool similar to YB. If Yield Basis succeeds, ybBTC could become Bitcoin's "stETH" primitive: BTC exposure + liquidity provider (LP) trading fees, without impermanent loss. Flying Tulip has the potential to launch its integrated stack, providing users with centralized exchange (CEX)-level tools, attempting to become a "one-stop shop for all DeFi." While cautiously optimistic about both projects, it's important to note that these projects, led by OG founders and top-tier teams, remain untested, and their founders must also consider the development of other protocols, such as Curve and Sonic.

The above image was compiled by TechFlow as follows:

- 核心观点:两大DeFi项目探索链上流动性新范式。

- 关键要素:

- Yield Basis通过杠杆池消除BTC无常损失。

- Flying Tulip集成AMM+CLOB提升交易效率。

- 两者均推出治理代币激励生态参与。

- 市场影响:可能重塑DeFi流动性供给模式。

- 时效性标注:中期影响