Animoca Brands Research Report: A New Era for Exchanges: How to Go Mainstream?

- 核心观点:交易所正演变为全景交易所与链上门户。

- 关键要素:

- 整合DEX代币交易功能。

- 上线代币化现实世界资产。

- 构建支付与收益金融服务。

- 市场影响:推动加密资产向主流大众普及。

- 时效性标注:中期影响

Animoca Brands Research Report: A New Era for Exchanges: How to Go Mainstream?

Exchanges go mainstream

Centralized exchanges (CEXs) have played a critical role in the development of the crypto industry. They provide the core infrastructure for trading and discovering cryptocurrencies, forming the cornerstone of the entire crypto space. As the earliest entrants with clear business models, CEXs have rapidly evolved into large institutions employing hundreds or even thousands of employees. Their efforts to expand their user base have significantly boosted the adoption of cryptocurrencies among the general public.

The crypto exchange landscape has evolved over several stages. Initially, they were simply electronic upgrades to over-the-counter (OTC) trading. With the boom in Web3 projects and altcoins, exchanges capitalized on the surge in trading demand and transformed into professional-grade platforms. Subsequently, they added features like lending and hedging to cater to professional traders.

However, the growth of CEXs currently faces both challenges and opportunities. On the one hand, the crypto-native community is nearing saturation, leading to a slowdown in user acquisition in recent years. At the same time, innovations in decentralized exchanges, such as the Meme coin issuance platform and advanced DEXs like Hyperliquid, are diverting users away. These offer a similar experience to CEXs, but with greater transparency. This has forced exchanges to integrate self-custodial wallets with DEX trading to retain native users.

On the other hand, enormous opportunities for incremental users are emerging. The new US administration's pro-crypto stance, the devaluation of the US dollar, and the adoption of stablecoins driven by geopolitical competition are all driving a new wave of mass crypto adoption and on-chain trading. This means a double increase in both new users and tradable assets. Exchanges can leverage advantages like 24/7 trading, perpetual contracts, and global access to compete with traditional brokerages and attract mainstream users.

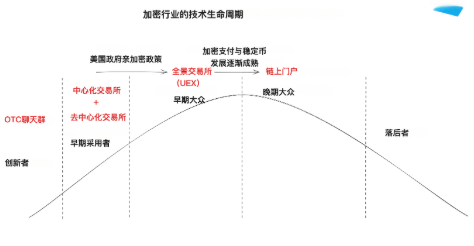

In line with the theory of the technology adoption lifecycle, we are transitioning from "early adopters" (Phase 2) to "early mass market" (Phase 3). For the past five years, crypto-native users and "degenerates" have driven exchange growth. Now, the early mass market—those who adopt innovations only after they see clear benefits—will become the new engine of growth. To prepare for this shift, exchanges are evolving from centralized or decentralized exchanges to fully integrated exchanges (UEXs).

We can further predict that, driven by the "late mass market," the second half of growth will primarily rely on exchanges, which will become the primary gateway to the on-chain world. Mainstream users may not require complex trading functionality, but they do need financial services such as payments, deposits, and returns. With their existing wallet and custody services, as well as strong organizational capabilities, exchanges are well-positioned to become the unified entry point for on-chain services.

Early Development of the Exchange

In its early stages, crypto activity was primarily driven by tech enthusiasts and miners. They were the first to experiment with new tools and quickly adopted trading, token sales, and payment use cases. Forums and OTC chat groups were the primary venues for trading. BitcoinMarket, launched in March 2010, was the first exchange to focus on crypto assets. Mt. Gox subsequently rose to prominence, handling over 70% of all Bitcoin transactions at its peak in 2013.

In 2013, Bitcoin's price began to rise, garnering media attention. Demand for secure and convenient Bitcoin-to-fiat currency exchange grew. While OTC trading still worked, it was slow and risky. More centralized exchanges emerged, offering order books and custodial services, freeing users from having to handle transaction details themselves.

The ICO boom of 2017 saw the emergence of a large number of new tokens. Traders needed better tools to keep up. Exchanges became the preferred venue, and users began experimenting with more complex strategies like hedging and leverage. To support these needs, exchanges introduced perpetual contracts and margin trading.

By 2020, with falling US interest rates, more investors began to look into crypto. They saw opportunities and sought professional tools to manage their assets. Meanwhile, DeFi projects, driven by new narratives, maintained high liquidity, attracting more experienced investors.

As retail investors and early adopters drive demand, professional market makers and trading firms are following suit. Competition intensifies, forcing exchanges to evolve to support more complex strategies, adding structured products and wealth management yields. Users are experiencing a trading experience increasingly similar to that of traditional markets, equipped with the full suite of tools needed to navigate the rapidly evolving world of crypto.

From early adopters to mass market

Slowing growth

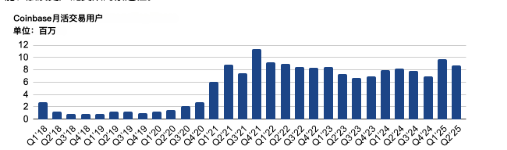

After a surge in 2020 and 2021, exchange user growth entered a period of slowdown. Early adopters had already entered the market, seeing crypto assets as a new investment frontier, but this was not enough to convince the wider public. The collapse of FTX and Luna pushed the industry into a "crypto winter" in 2022, with effects lasting until the end of 2023. During this period, exchange user growth stagnated. Early adopters had largely joined, while the early majority remained on the sidelines, awaiting more concrete returns before deciding whether to participate.

This stagnation is evident among leading platforms. For example, Coinbase's monthly active traders have remained between 8 and 9 million since 2021. Growth driven by new token issuance or narrative-driven growth has almost disappeared. This slowdown highlights the urgency for exchanges to expand their functionality and reach a wider audience.

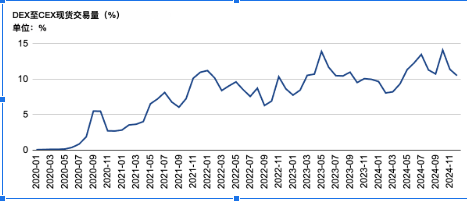

At the same time, the rise of decentralized exchange (DEX) token trading, particularly the popularity of meme coin issuance platforms, has attracted more risk-averse users away from centralized exchanges, retaining more liquidity and users on-chain. Meme coin platforms like Pump.fun have become a hot topic in 2024. On-chain launchpads not only make the creation of new tokens extremely easy but are also increasingly pegging everything to tokens. Platforms like Zora tokenize every piece of social content, directly converting social traffic into token transactions.

During this slow growth phase, leading exchanges focused on cultivating their existing user base and maintaining user engagement through on-chain and on-exchange activities. They primarily adopted three strategies: building an on-chain ecosystem, promoting self-custodial wallets, and integrating DEX token trading into wallets and exchanges.

Public chain and ecological development

Many exchanges have launched their own public chains and platform tokens. These public chains help exchanges retain crypto-native users familiar with on-chain functionality, while the exchanges themselves serve a broader audience. Tokens serve as a bridge between the on-chain ecosystem and the exchange's user base. This model also allows exchanges to integrate token issuance with listings, supporting more innovative marketing and ecosystem development.

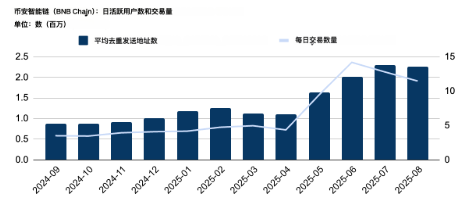

Take BNB Chain, for example, the core of Binance's on-chain platform. The Meme Rush page in Binance Wallet is powered by BNB Chain, allowing users to trade newly issued meme tokens directly on the on-chain meme launchpad, Four.Meme.

At the same time, the BNB token itself plays a core role in connecting exchanges and the blockchain. Users can stake BNB in Binance Launchpool events and participate in new token issuance on PancakeSwap through the Binance MPC wallet.

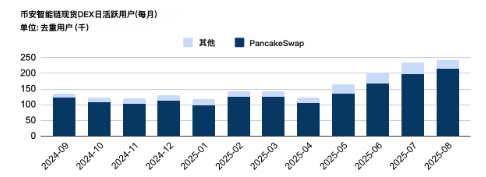

Over the past year, BNB Chain's monthly active users have doubled from 1 million to over 2 million, daily trading volume has jumped from 1 million to 10 million, and DEX activity has increased from 120,000 daily transactions to over 200,000. These figures reflect that as on-chain functionality matures, exchange integration is driving stronger user adoption and deeper ecosystem interaction.

Furthermore, exchanges are also beginning to experiment with integrating with social platforms. Coinbase's Base app is a good example. On February 5, 2025, it integrated Farcaster, allowing users to post directly within the app and tap into Farcaster's social network. This likely brought millions of new users to the Base app. Subsequently, Zora introduced content tokenization within the app, allowing the creator economy to be more directly integrated into the exchange ecosystem.

Decentralized wallet

With the development of decentralized exchanges (DEXs), centralized exchanges (CEXs) are increasingly pushing on-chain products to the forefront, with wallets and the blockchain ecosystem becoming key entry points. Decentralized wallets serve as a direct gateway to Web3, allowing users to manage assets, explore dApps through integrated app stores, and gradually participate in on-chain activities through token incentives.

In recent years, crypto wallets created by exchanges have often unified multi-chain accounts, facilitating smoother fund transfers and cross-chain swaps. These wallets not only support spot and meme coin trading but also integrate staking and DeFi yield generation capabilities, enabling efficient asset management. Furthermore, task-based reward mechanisms encourage users to explore new features and engage more deeply with the ecosystem.

OKX Wallet is a prime example. Initially focused on multi-chain asset management, it has gradually expanded to support over 150 blockchains, eliminating the need for multiple wallets. In terms of security, its use of multi-party computation (MPC) enhances the safety of on-chain staking, token swaps, NFT transactions, and DApp usage, gradually forming a complete Web3 ecosystem.

In terms of trading and earning, it supports spot, staking, and meme coin markets, and users can operate directly in the wallet. OKX Wallet also launched the DeFi Earn product.

To increase stickiness, OKX Wallet introduced task incentives, such as Crypto Quests and interactive trading challenges, allowing users to earn rewards by completing tasks, thereby deepening their usage.

Integrated DEX trading

In the first and second quarters of 2025, several exchanges launched on-chain trading capabilities. Users can trade on-chain assets directly through their CEX spot accounts without having to understand complex on-chain concepts or pay gas fees.

This design is particularly attractive to "degens" because it allows them to access a wider range of on-chain assets on the same platform. Exchanges that have launched similar functions include:

Binance (assets are selected by the listing team)

OKX (assets are selected by the listing team)

Coinbase (supports all on-chain assets on the Base chain)

Bitget (supports all on-chain assets on ETH, SOL, BSC, and Base Chain)

Binance, for example, has named this feature Binance Alpha, aiming to allow users to access high-potential early-stage projects without leaving Binance. To ensure quality and growth, Binance's listing team carefully selects tokens eligible for listing on Alpha.

Furthermore, users earn points by using Alpha tokens to trade or provide liquidity on PancakeSwap. These points then determine their eligibility for Binance Alpha project events, creating a continuous incentive loop that encourages user exploration and participation in emerging tokens. This strategy has driven rapid adoption of Binance Wallet.

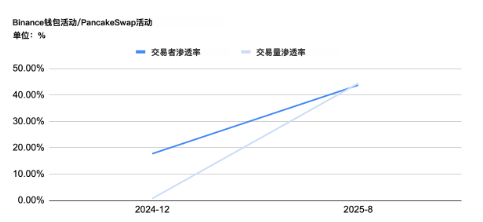

In December 2024, when Binance Wallet launched its revamped version, PancakeSwap's average daily trading volume was approximately $800 million, while Binance Wallet's was approximately $5 million. PancakeSwap had approximately 48,000 daily active traders, while Binance Wallet had only 8,500, resulting in penetration rates of 17% (traders) and 0.7% (volume), respectively.

By August 2025, PancakeSwap's average daily trading volume had risen to $3 billion, while Binance Wallet's had reached $1.4 billion. PancakeSwap's average daily active traders were 53,900, while Binance Wallet's was 21,400, with penetration rates exceeding 40%.

At the same time, features like AI-assisted trading are being introduced, driving user growth. For example, Bitget launched GetAgent, an AI trading assistant. Users can analyze tokens, obtain trading signals, and build strategies by communicating with the AI, all within the app.

While these efforts continue to generate new growth, the true large-scale user growth curve (the next S-curve) remains to be unlocked. By the second quarter of 2025, only 6.9% of the global population will hold cryptocurrencies, while 15–30% will participate in stock trading.

New development direction

In early 2025, a change in the US government shifted its stance from anti-crypto to pro-crypto. SEC Chairman Paul Atkins announced Project Crypto, a series of pro-crypto regulatory policies. This initiative aligns with the Trump administration's goal of establishing the US as a global crypto hub.

The policy changes not only boosted the confidence of native crypto users, but more importantly, they allowed traditional financial institutions to explore crypto as a new channel for financial services. More and more real-world assets (RWAs) are being brought online, including money market funds, private credit, gold, stocks, and even shares of private companies.

For crypto exchanges, these on-chain assets create an opportunity to compete with traditional brokerages, attracting users who are familiar with stocks but haven't yet entered crypto. Exchanges already have inherent advantages in 24/7 trading, no geographical restrictions, and perpetual contracts.

Tokenized RWAs can also unlock low-liquidity assets, such as private company shares, expanding accessibility for investors. Combined with other traditional assets on the chain (debt, stocks, money market funds), crypto exchanges can provide a trading experience superior to traditional markets, bringing these assets to a wider range of investors.

mutual penetration

In 2025, crypto exchanges will launch more assets and features for traditional financial users to lower the entry barrier for mainstream users. On the asset side, crypto exchanges will launch tokenized stocks and RWA-backed products. For example:

Binance and Bitget have launched tokens backed by money market funds, namely RWUSD and BGUSD.

Bitget has also launched stock tokens and partnered with Ondo Finance to allow users to trade directly without a traditional brokerage account.

Ondo Finance's tokenized stock market already supports over $180 million in assets, with over $190 million in minting and redemption volume. By offering services comparable to or superior to traditional brokerages, crypto exchanges have taken a lead and provided global accessibility.

Leveraging on-chain transaction advantages

Compared to traditional financial platforms, crypto exchanges have expanded the range of assets covered in two main ways: perpetual stock contracts and tokenization of private company shares.

Stock Perpetual Contracts

In traditional stock markets, trading is subject to clearing requirements and leverage limits. In the US, for example, Regulation T caps margin borrowing at 50% of the stock's price, which translates to approximately 2x leverage. Portfolio margin accounts offer higher leverage, sometimes up to 6x-7x, depending on risk profile. Traditional exchanges also have limited trading hours. For example, Nasdaq's trading hours are Monday through Friday, 9:30 AM to 4:00 PM ET. While pre-market and after-hours trading exist, liquidity is limited and volatility is high.

Crypto exchanges transcend these limitations, though they may operate in a legal and regulatory gray area. Users can trade perpetual stock swaps on crypto exchanges at any time and with higher leverage. For example, MyStonks offers perpetual stock swaps with up to 20x leverage, while Bitget currently supports up to 25x leverage. These arrangements offer investors global access and flexibility unmatched in traditional markets.

Private company shares

Another innovation among crypto exchanges is the tokenization of private company shares, allowing retail investors to participate. In contrast, the private equity market in traditional finance remains limited to institutions or accredited investors, with high barriers to entry and limited liquidity. Exchanges that allow users to trade tokenized versions of private company shares introduce price discovery mechanisms and secondary market liquidity for these assets. For example, Robinhood recently opened retail access to OpenAI's private equity. However, such products remain limited to widespread adoption due to legal and regulatory restrictions.

Traditional players are catching up

As native crypto exchanges expand into traditional assets, traditional exchanges and brokerages are also working to narrow the gap with the crypto world.

Robinhood

Robinhood is an American financial services company known for its commission-free stock trading platform, which focuses on a simple interface and low-barrier investing.

Building on this philosophy, Robinhood has also expanded into the crypto market, allowing users to buy, sell, and hold mainstream crypto assets like Bitcoin, Ethereum, and Dogecoin. The platform also features a crypto wallet that supports the sending, receiving, and storage of assets. It is also rolling out staking features for Ethereum and Solana, allowing users to earn returns directly within the app.

Robinhood further expanded into Europe, offering access to over 200 tokenized US stocks and ETFs. These tokens are traded 24/5, with dividends paid directly into the app, and no commissions or spreads charged.

To support tokenization and seamless trading, Robinhood is building Robinhood Chain, a second-layer blockchain based on the Arbitrum technology stack. Tokenized shares will initially be issued on Arbitrum, with plans to migrate to Robinhood Chain in the future. This will provide users with greater control, improved security, and a more integrated experience across traditional and decentralized finance.

The launch of Robinhood Chain also brings new possibilities to the platform: attracting liquidity outside of Europe and connecting global users to their tokenized assets.

PNC Bank

In July 2025, PNC Bank announced a strategic partnership with Coinbase to enhance digital asset services for its clients. Through Coinbase's Crypto-as-a-Service (CaaS) platform, PNC will provide clients with secure and scalable crypto trading and custody solutions. This will allow PNC clients to buy, sell, and hold digital assets directly within the bank's interface. PNC will also provide selected banking services to Coinbase, demonstrating their commitment to working together to build a more robust digital financial system.

stock exchange

While the crypto market has long operated 24/7, some stock exchanges have also begun to follow suit. In March 2025, Nasdaq announced that it would introduce 24-hour trading on its main US board to meet the growing global demand for US stocks around the clock.

The Next Era: Panoramic Exchange and the Gateway to the On-Chain World

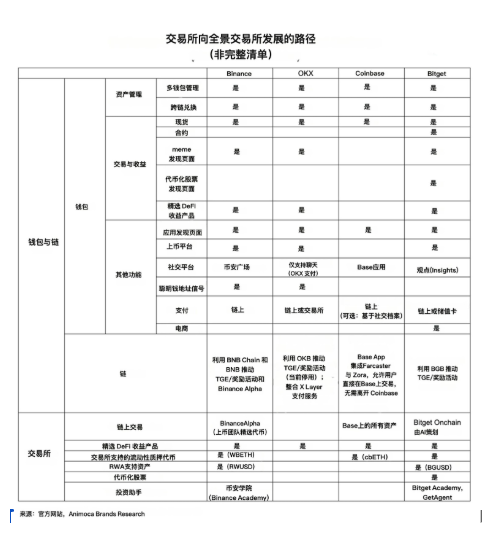

Combining the current development trends, we can see two major evolutionary directions for exchanges:

Universal Exchange (UEX) is a platform for everyone to trade all assets. It serves both native crypto users and mainstream users, regardless of location or time.

Gateway to the On-chain World — Building super apps that connect users to the broader crypto ecosystem through everyday on-chain services like payments, and incubating a vibrant on-chain application ecosystem.

Panorama Exchange (UEX)

As CEXs seek to serve both crypto-native and mainstream users, they are expanding from single trading platforms into complete ecosystems. The “UEX” concept proposed by Bitget embodies this trend.

One important aspect is the integration of DEX tokens. Functions like Binance Alpha and Bitget Onchain allow users to access tokens that were previously limited to DEXs within the exchange.

Exchanges are also expanding the types of assets they can trade. For example, Zora tokenizes social media posts, bringing the creator economy directly into the exchange interface.

Meanwhile, the United States' pro-crypto policies have accelerated the on-chain integration of real-world assets. Currency-backed tokens, tokenized stocks, and even private company shares are now available for trading on platforms like Binance, Bitget, and Robinhood. With global reach and 24/7 trading, exchanges offer significant advantages over traditional brokerages.

All of this is giving more people the opportunity to enter the crypto world. By combining DEX tokens, new assets, and tokenized real-world assets, exchanges are creating a unified platform that can serve both new and experienced users.

Gateway to the on-chain world

With the implementation of pro-crypto policies, stablecoins are rapidly developing, with domestic and international issuers entering the market. Banks issue stablecoins to protect liquidity, while market platforms use them to attract capital and business. Exchanges play a key role in distribution, such as USDC on Coinbase and USDT on major platforms.

At the same time, exchanges and wallets are also building payment and transfer infrastructure. For example:

OKX Pay — provides zero-gas payments based on the X Layer, without the need to hold OKB.

Bitget Wallet PayFi — Supports QR code payment networks in countries such as Vietnam and Brazil, allowing users to spend directly in stablecoins.

As these systems mature, stablecoins are becoming part of everyday transactions. However, since holding stablecoins yields no returns, users are seeking interest-bearing options, fueling the need for "cryptobanks." Binance, OKX, and Bitget have all integrated DeFi returns and RWA-backed assets into their wallets, allowing users to earn returns while retaining their funds.

This approach is similar to traditional finance: Alipay first attracted users with payments, then added wealth management products; Ping An started with insurance, then expanded into comprehensive finance. Crypto exchanges are similarly integrating payments, deposits, and returns. Some are positioning themselves as full-service exchanges, while others are developing into super-apps (such as the Coinbase Base App), integrating payments, social networking, mini-apps, and tokenized content (such as Zora and Farcaster).

By integrating transactions, payments, and content, exchanges are becoming ecosystem hubs. Projects can directly reach users, tokens circulate within applications, and AI tools assist in trading decisions—all while lowering barriers to entry and deepening user engagement.

Summarize

Judging from the current trend, the driving force behind the development of exchanges into panoramic exchanges mainly comes from three aspects:

The integration of CEX and DEX transactions;

Launchpad-driven “tokenization of everything”;

The Trump administration is pushing for real-world assets to be put on the blockchain.

The exchange transformed into UEX not only to capture on-chain innovation, but also to attract mainstream users in the "early majority" stage.

After Panorama Exchange attracted the early majority, the "gateway to the on-chain world" will bring the "late majority" into crypto. These users do not need complex trading functions, but still value convenient financial services such as payment, deposits, and returns.

These two paths together define the next stage of growth: expanding from early enthusiasts to a wider audience, and positioning exchanges as the main entrance to the on-chain ecosystem.

However, while the concepts of panoramic exchanges and on-chain portals hold immense potential, achieving them is not easy. Mainstream adoption still relies on exchanges building trust and reliability. Regulatory barriers add to the complexity, with licensing requirements varying across jurisdictions and potentially prohibiting integrated financial services and requiring segregated operations. Despite these challenges, the trend continues to push exchanges toward this ultimate goal—even if not all exchanges can achieve it individually.