Original author: TechFlow

Korea Blockchain Week (KBW) is in full swing in Seoul, and the eyes of crypto practitioners are focused on South Korea.

At this point, South Korean media Dong-A Ilbo reported on Thursday that South Korean internet giant Naver plans to conduct a share swap with Upbit's parent company Dunamu, which will make Dunamu its subsidiary.

This means that South Korea's largest internet company will control South Korea's largest cryptocurrency exchange.

At present, the Korean crypto market is indeed in an unprecedentedly active period.

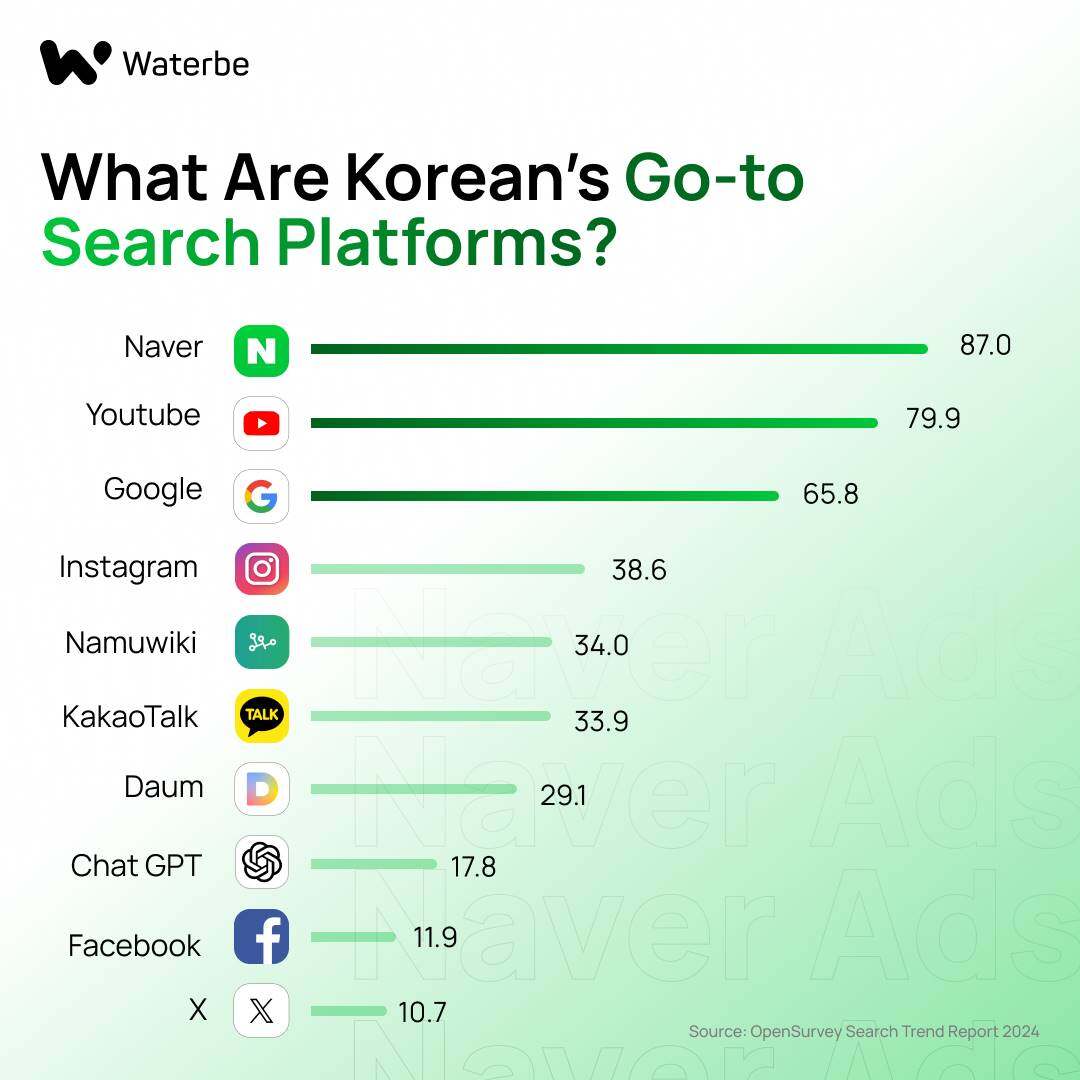

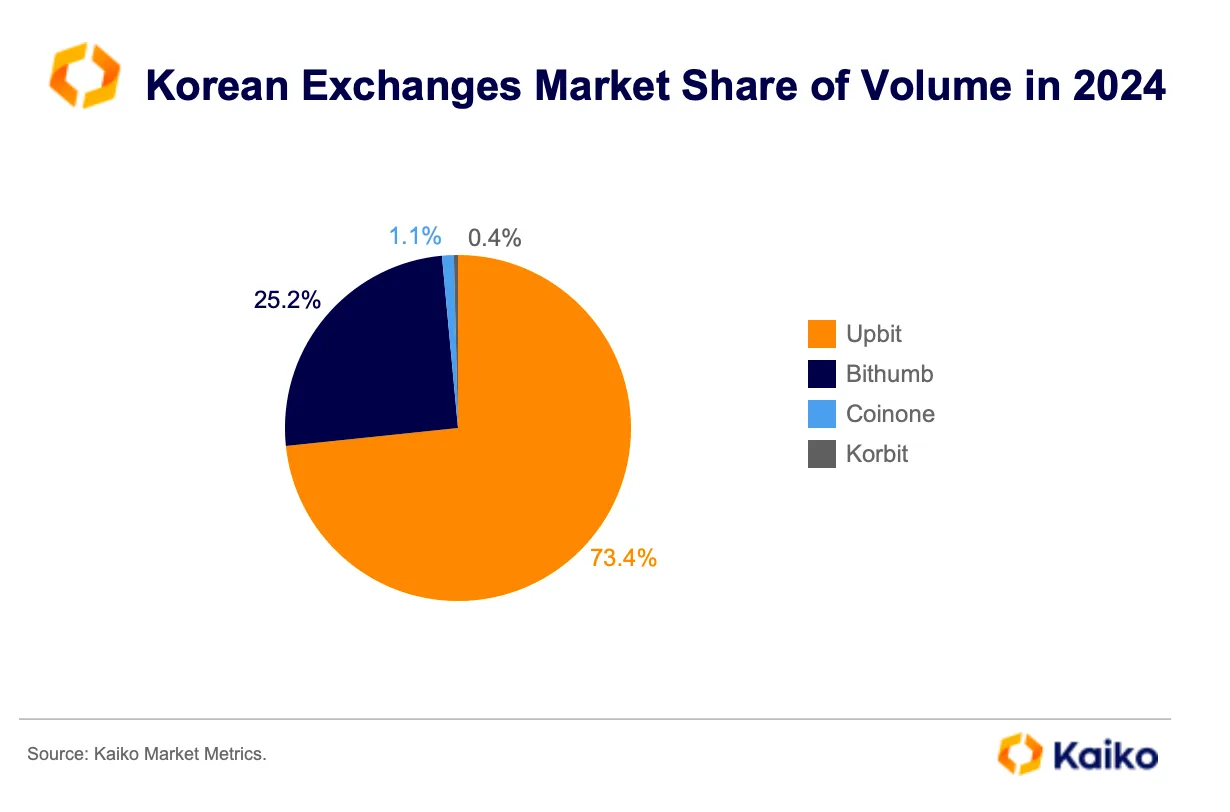

South Korea's top five exchanges now have over 9.6 million user accounts, representing approximately 18.7% of the total population. Upbit holds over 80% of the market share, with daily trading volume regularly exceeding $10 billion. The Korean won has become the second-largest cryptocurrency exchange globally, after the US dollar.

At the Upbit Developer Conference earlier this month, Dunamu released its own Web 3-based blockchain GIWA Chain and GIWA wallet; this Layer 2 based on OP Rollup technology demonstrates Upbit's technological ambitions.

(Related reading: Upbit enters the public blockchain race; how big is Giwa's on-chain ambition? )

Now this share swap transaction was not without warning.

In July of this year, the two parties announced a collaboration to develop a stablecoin for the Korean won. In September, Naver acquired a 70% stake in Dunamu’s securities trading platform. It now appears that these are all preludes to a full acquisition.

Dunamu is currently valued at approximately 8.26 trillion won (US$6 billion). If the deal is completed, it will be the largest merger and acquisition in the history of the Korean crypto industry.

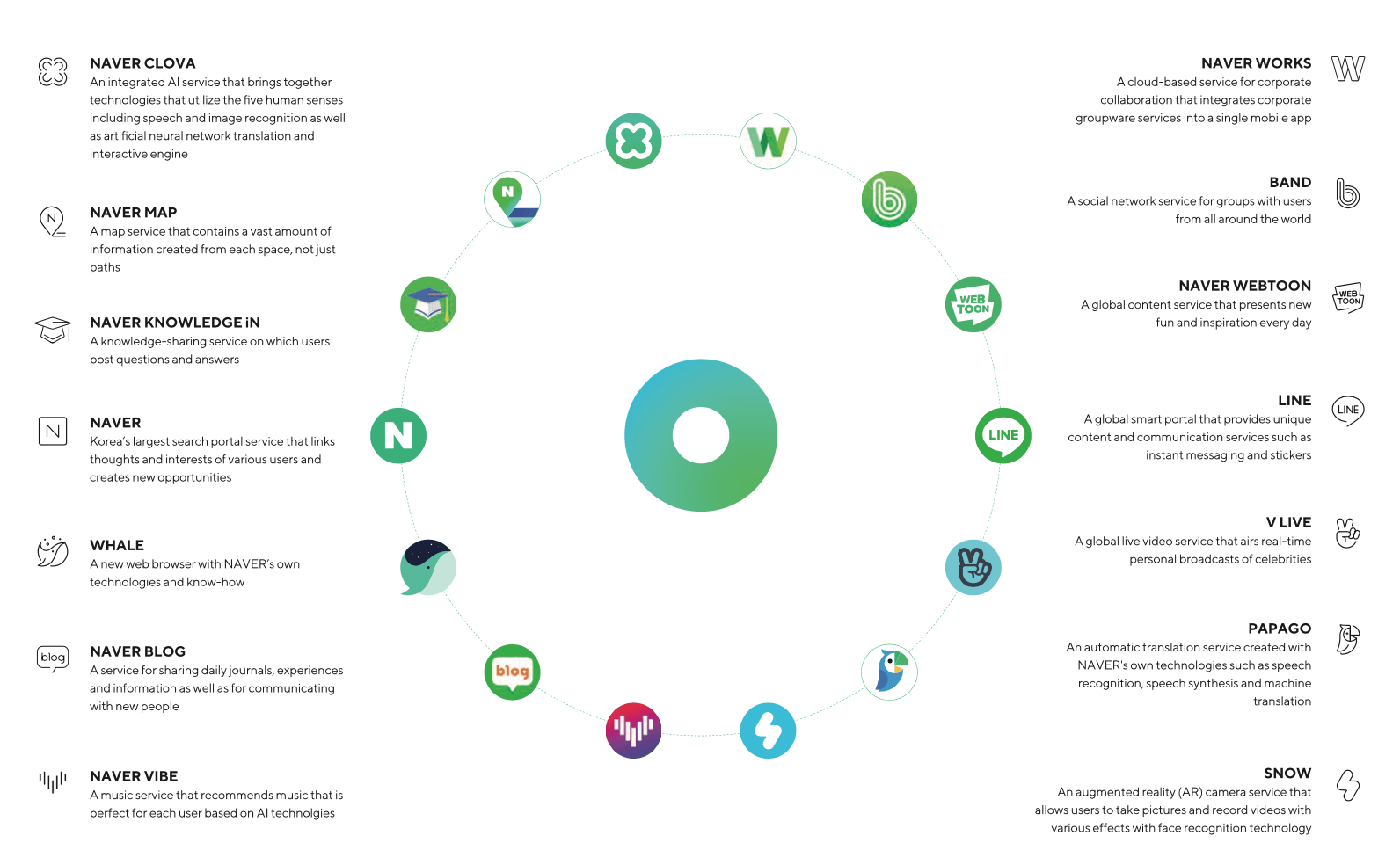

Who is Naver? Korea's Google+Tencent

Naver is South Korea's largest internet company, with a market capitalization of approximately $50 billion.

In South Korea, Naver's status is equivalent to that of Google combined with Tencent. It not only monopolizes 70% of the search engine market, but also has built a vast internet ecosystem through its products.

Most Chinese users may not be familiar with the name Naver, but they will definitely know LINE. LINE is a subsidiary of Naver and has over 200 million users in Japan and Southeast Asia, making it one of the largest instant messaging apps in Asia.

Naver's business scope goes far beyond this.

Naver Financial, its fintech subsidiary, operates Naver Pay, South Korea's largest mobile payment platform, with 30 million users, covering over half of the country's population. From online shopping to offline payments, from money transfers to financial management, Naver Pay has become an integral part of South Koreans' daily lives.

Similar to other global tech giants, Naver acquires users through its core platform (search engine) and then continuously expands its services to form an ecosystem that users find difficult to leave.

Naver has been accelerating its expansion into the financial sector. It established Naver Financial in 2019, launched digital banking services in 2020, and obtained a securities brokerage license in 2024. In September of this year, Naver Pay acquired a 70% stake in Securities Plus Unlisted, a subsidiary of Dunamu, for 68.6 billion won.

The acquisition of Upbit is the final piece in Naver's financial landscape. Once completed, Naver will own:

- Payment tool (Naver Pay)

- Securities Trading (Securities Plus)

- Crypto Exchange (Upbit)

- Upcoming Korean Won Stablecoin

This vertical integration allows Naver to provide users with a full range of financial services, from fiat to cryptocurrency. More importantly, through LINE's 200 million overseas users, this system has the potential to expand beyond South Korea and cover the entire Asian market.

Korean Characteristics: When Chaebol Meets Web 3

Naver’s acquisition of Upbit is not an isolated case. It is the latest in a wave of major South Korean companies entering the crypto market.

Kakao's plans began even earlier. In 2019, it launched the public blockchain Klaytn, promoting the Klip wallet through KakaoTalk's 50 million users. The KLAY token currently ranks among the top 50 in the world by market capitalization. In September of this year, Klaytn announced a merger with the Finschia chain, previously developed by LINE, to form the new Kaia chain.

Samsung is starting with hardware. Starting with the 2019 Galaxy S10, Samsung phones have included built-in crypto wallet functionality. Samsung SDS also provides blockchain solutions for enterprise clients. While Samsung doesn't directly operate an exchange, its infrastructure presence is evident.

Traditional financial institutions are also accelerating their entry into the market. In August of this year, eight banks, including KB Financial and Shinhan Financial, announced a joint development of a Korean won stablecoin project. This announcement came just one month after Naver and Dunamu announced their stablecoin partnership.

This pattern of being dominated by large enterprises is not surprising in South Korea.

South Korea's economy has long been dominated by large conglomerates, with the top ten chaebols contributing a major portion of the country's GDP. When new industries emerge, these large companies often move in quickly and establish a dominant position.

Dunamu was founded in 2012 and launched Upbit in 2017. In a market like South Korea, it's not easy for an independent company to reach a valuation of 8.26 trillion won. Their decision to join the Naver ecosystem now may be a strategic choice in the face of increasingly fierce competition.

Judging from past information, there are several characteristics of large Korean companies entering the crypto market:

First, the investment of resources was massive and rapid. From Kakao's decision to develop a blockchain to the launch of Klaytn's mainnet, it took only about a year. From Naver's announcement of its stablecoin partnership in July to its current preparations for the full acquisition of Dunamu, it took just over two months.

Second, it is highly coordinated with government policies. The South Korean government suspended its central bank digital currency project this year and instead supported the development of stablecoins by the private sector. This policy shift coincided with the accelerated development of cryptocurrencies by major companies.

Third, each group is building its own independent ecosystem. Naver has its own payment system, Kakao has its own blockchain, and the banking alliance is promoting its own stablecoin. Each group is building a relatively closed system, making it very costly for users to migrate between different ecosystems.

The result of this model is increasing market concentration.

According to public data, Upbit once accounted for approximately 73% of South Korea's trading volume, Bithumb accounted for approximately 25%, and the remaining market share was divided among Coinone, Korbit, and others. With Upbit's acquisition by Naver, market concentration is likely to increase further.

South Korea has its own crypto industry development model, which is dominated by chaebols, rapidly promoted, and practical.

You might think this is a bit decentralized, but Koreans don’t seem to care. Nearly 20% of Koreans participate in crypto transactions, and they are more concerned about convenience and security.

The “New Chaebol Era” in the Global Crypto Market

Not only in South Korea, but looking around the world, the current crypto market is undergoing a transformation from grassroots entrepreneurship to monopoly by giants.

Let's look first at the Middle East. Binance received investment from the Abu Dhabi sovereign wealth fund this year. While the exact amount has not been disclosed, market rumors suggest it's in the billions. The Dubai royal family supports numerous crypto projects, establishing Dubai as a "global crypto capital." Saudi Arabia's Public Investment Fund (PIF) is also actively investing in blockchain.

The United States is taking a different path: traditional finance is gradually absorbing the crypto market and eventually turning it into another asset class.

As the government's attitude towards the crypto industry becomes increasingly friendly, major Wall Street institutions are beginning to shift their focus. BlackRock has launched a Bitcoin ETF, Fidelity is offering crypto custody, and Goldman Sachs has begun crypto trading...

Although Coinbase is still relatively independent, its institutional business accounts for an increasingly higher proportion, and retail investors are becoming less and less the main players in transactions.

The situation in Japan is more nuanced. Rakuten acquired a crypto exchange as early as 2018, and SBI Holdings operates one of Japan's largest crypto platforms. However, unlike the aggressive investment strategies of South Korean chaebols, Japan's major corporations are relatively conservative in their crypto investments, often taking a defensive approach.

Behind these different models, what is reflected is the different understanding of cryptocurrencies in various regions, but the results seem to be similar: the survival space for independent crypto companies is getting smaller and smaller; the proportion of institutional holdings of attractive crypto assets is getting larger and larger.

For example, large CEXs and crypto infrastructure companies (such as stablecoins) have to either gradually accept large investments from traditional capital or strive to be listed on the capital market for the sake of compliance and attracting more incremental users.

BTC and ETH have become popular assets for corporate crypto treasury play.

Perhaps a more accurate description of this phenomenon is that the crypto market is stratifying.

The upper layer is the institutional-led, regulated, centralized market. This includes ETFs, custody services, and licensed exchanges. The lower layer is the community-driven, experimental, decentralized market. This includes Perp DEX and Meme.

The mainstream market is controlled by big capital and serves ordinary users and institutions; the marginal market remains decentralized and continues technological innovation and experimentation.

As to whether this phenomenon is good or bad, there may be no simple answer.

- 核心观点:韩国互联网巨头Naver拟收购最大交易所Upbit。

- 关键要素:

- Upbit占韩国80%市场份额,日均交易量超百亿美元。

- Naver拥有支付、证券等全链条金融生态。

- 交易估值60亿美元,为韩国加密行业最大并购。

- 市场影响:加速韩国加密市场集中化,推动巨头主导格局。

- 时效性标注:中期影响