Jia Yueting reviews Aster, and takes stock of 5 under-discussed Perp DEXs

- 核心观点:新兴Perp DEX聚焦技术优化与用户体验竞争。

- 关键要素:

- Bitverse主打AI驱动与零Gas费交易。

- DeriW通过L3实现高TPS与低费率。

- Pacifica整合AI工具提升CEX级体验。

- 市场影响:加剧去中心化衍生品赛道创新与分化。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web 3)

Since Hyperliquid's airdrop ignited the token economy in November 2024, Perp DEX quickly solidified its position as a major market in 2025. High revenue, rapid growth, and pressure to replace CEXs combined to drive a continuous migration of capital and users. Aster's second season airdrop reignited the hype, but also brought with it the challenges of high attrition, strong dilution, and anti-sybil protection.

In line with this, just now, Faraday Future founder Jia Yueting said at X that the success or failure of DEX no longer depends on the "decentralization" narrative, but on whether it can provide a user experience close to that of CEX and be supported by a truly community-driven incentive mechanism - Aster's phased performance has provided a sample of this logic.

This article by Odaily specifically collects some of the latest new players that have not been fully discussed , attempting to provide a more forward-looking sample library and observation portal beyond the hype.

Specifically, this article will focus on five representative technologies and ecosystems: Bitverse, DeriW, SunPerp, Pacifica, and BULK —spanning the TRON and Solana ecosystems. These initiatives range from Layer 3 zero gas fees to underlying optimizations for validator integration, to AI trading tools and innovative order books and automated machine learning (AMM) mechanisms. Furthermore, since we already covered the interaction strategy of StandX , a former Binance OG team, this article will not elaborate further . (For details, see: "Aster's second season is already going strong; why not interact with StandX, a Binance OG team?" )

It should be emphasized that many of the above projects are in their early stages: there are still gaps in key data (such as TVL/trading volume caliber, true net value of fees and income, user retention and risk control transparency, etc.), and some token information and airdrop rules have not been fully disclosed. Be aware of the risks when participating, DYOR.

Bitverse

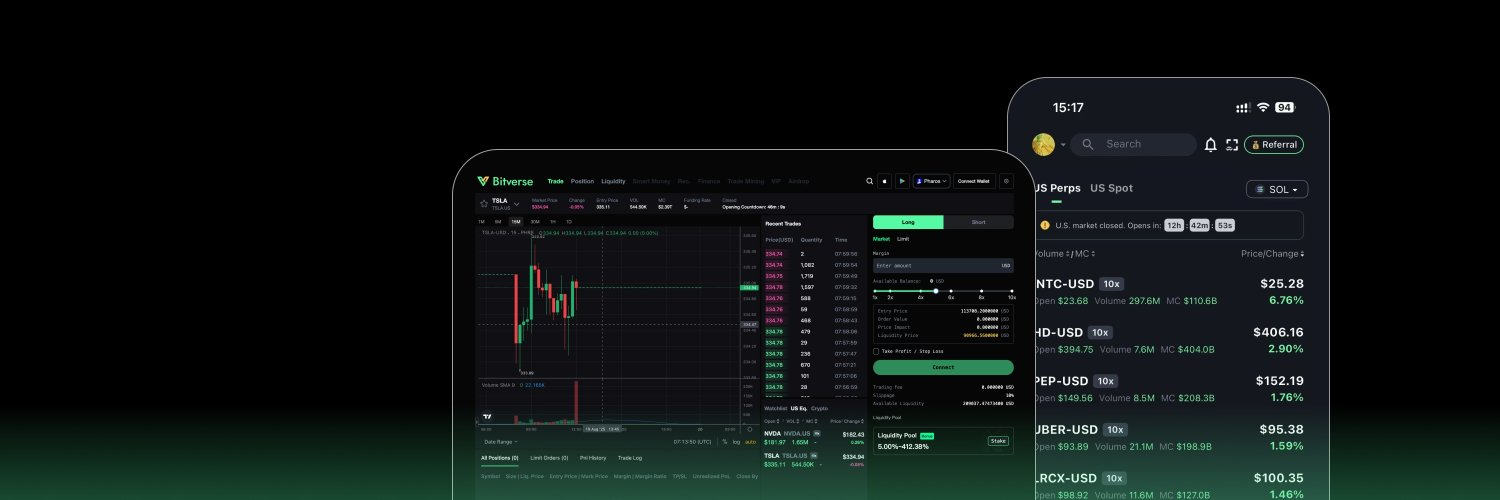

Bitverse , a perpetual contract DEX built on the Pharos Network , is positioned as an "AI-driven multi-asset trading platform." It supports RWAs, US stocks, and meme-related assets , and boasts a zero-gas, zero-slippage trading experience with up to 50x leverage. Its core narrative revolves around its "integrated architecture," a multi-layered technology stack that integrates the L1 public chain, native wallet, and Super DEX .

Regarding market expansion, Bitverse has announced a strategic partnership with Pharos for an "exclusive PerpDEX," aiming to attract contract trading users by leveraging the RWAFi (Real-Time Wafer Fidelity) scenario. Unlike traditional Perp DEX projects, Bitverse continues to highlight differentiated selling points such as " Perp & Meme Spot DEX " and " AI Precision " in its promotional materials.

In terms of incentive design, Bitverse adopts a points-first strategy: users can accumulate xBV points through transactions, referrals, task completion, and check-ins. Officials have previously hinted that xBV will be linked to future BV token airdrops . The platform's developer page also clearly states, " Every transaction will earn you a BV token airdrop ." However, key information such as the total BV token supply, release mechanism, and value repatriation model has not yet been fully disclosed in the white paper, requiring further observation and verification. (The only visible indication is that the total token supply is 100 million.)

In terms of products, Bitverse offers a native app, a points trading module, and an MPC/AA wallet. Currently, its TVL and trading volume data are unavailable on DefiLlama, and a verifiable on-chain dashboard is not yet available. It is recommended to directly track the on-chain contract trends to determine actual progress.

DeriW

DeriW is a Layer 3 perpetual contract DEX incubated by the leading exchange CoinW and built on Arbitrum Orbit . It features zero gas fees and 0.01% handling fees , and claims to achieve 80,000 TPS and millisecond-level matching on its self-developed L3 "DeriW Chain", aiming to bring CEX-level performance to on-chain derivatives scenarios.

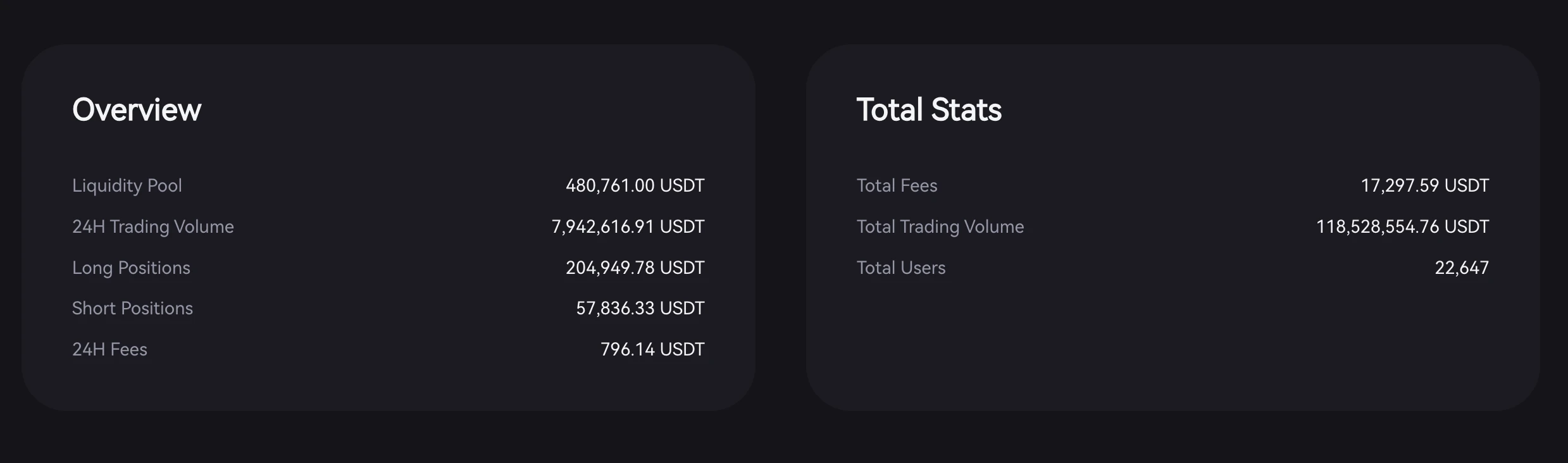

The mainnet was launched on August 4, 2025. According to official data, its cumulative transaction volume has exceeded US$100 million , with more than 22,600 trading users. It uses Pendulum AMM as its core mechanism to differentiate itself from traditional Perp DEX in terms of "low cost + high efficiency".

On the technical and fee side, DeriW adopts a fully decentralized architecture, with all transaction processes completed on-chain. This can be clearly queried through the DeriW block explorer ( https://explorer.deriw.com/ ), thus avoiding the potential "black box" possibility of traditional Perp CEX. While inheriting the security of Ethereum through Arbitrum Orbit L3 , it reduces congestion and fee sensitivity: transactions are frictionless, matching latency is low, and it is more friendly to high-frequency/quantitative strategies. Compared with competitors in the same field (such as Hyperliquid's 0.045%), its 0.01% fee rate has a structural cost advantage.

In terms of user incentives, the project offers long-term Supernova+ points : 5 DER+ points for every 50 USDT traded . Inviting new users earns a 300% bonus to their referral points. DER+ points will be used as tokens for future TGE airdrops. Historical data shows that LPs have achieved a peak APR of 351.62% under the Pendulum AMM (note: this value fluctuates significantly with market conditions). Regarding security, DeriW disclosed that it has completed a CertiK audit and is undergoing ongoing security monitoring.

SunPerp

SunPerp was launched on September 21 this year and was launched by TRON founder Justin Sun in the TRON ecosystem. It is positioned as a native perpetual contract DEX. Similar to Bitverse, it focuses on zero gas fees, low transaction fees, and a modular architecture that supports cross-chain liquidity and ADL (automatic deleveraging) . It is aimed directly at mainstream decentralized contract trading platforms such as dYdX, GMX, and Hyperliquid.

Despite the project's official announcement that no paid promotion was being conducted, the number of users exceeded 3,000 during the public beta period. Three types of early incentives were offered: first-time deposit fee rebates , deposit mining (with an APY of up to 12%) , and transaction mining/airdrops , which appealed to early adopters.

Regarding the token model, SunPerp has repeatedly emphasized that 100% of the protocol's revenue will be used to repurchase $SUN . However, the specific implementation is not transparent—for example, the repurchase frequency, address disclosure, and scale disclosure—which still require subsequent on-chain data and periodic reports to verify.

As the project is still in its early stages of launch, there's limited verifiable data on TVL and trading volume. DefiLlama currently records a TVL of approximately $2.3 million. We recommend focusing on its multi-chain expansion progress, risk management capabilities, and the sustainability of its fee subsidies.

Pacifica

Led by former FTX COO Constance Wang , Pacifica has rapidly risen on Solana this year. Integrating AI trading tools, it focuses on high performance and a CEX-level experience. The project is currently progressing rapidly, with a testnet launch in three months and a mainnet launch in six months. It currently supports over 20 perpetual contract assets, offers isolated and cross-margin margining, and 5–50x leverage, demonstrating that high-frequency and quantitative trading are the project's core competencies.

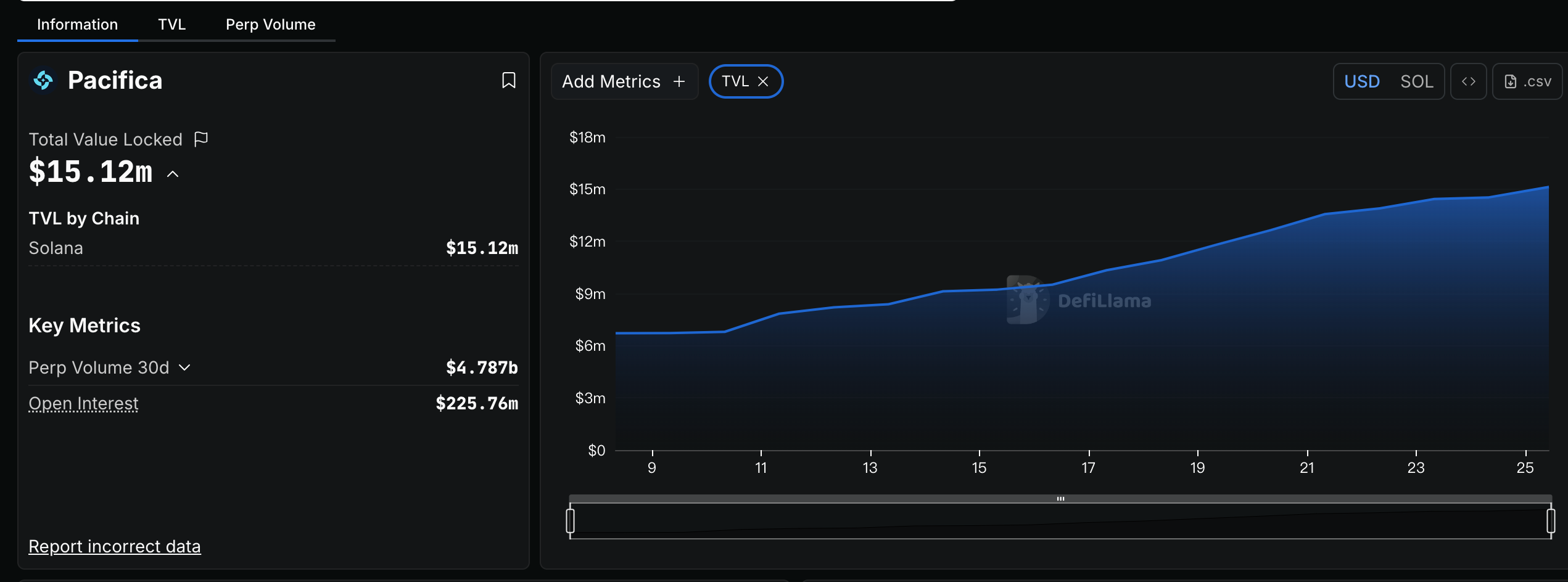

In terms of on-chain data, DefiLlama has begun to include its trading volume indicators, and its TVL has exceeded US$15 million. The steadily rising curve also verifies the growth momentum in the initial stage of launch.

The platform has also launched a points system to track user activity and pave the way for future incentives. Overall, Pacifica is pursuing a "performance + tools" approach, using clear rules and points to lower the barrier to entry. Next steps will require careful attention to its fee structure, risk control capabilities, and the completeness of its contract audits.

BULK

BULK is a perpetual contract DEX based on the Solana ecosystem, focusing on technological optimization. Its core feature is the integration of its matching and execution layers into the Solana validator stack, aiming to alleviate network congestion and priority fee surges during peak periods. In September 2025, the project secured $8 million in seed funding, led by 6th Man Ventures and Robot Ventures, with participation from institutions such as Wintermute, and with personal support from Solana co-founder Anatoly Yakovenko. The project plans to launch a testnet "within weeks" and a mainnet launch in the fourth quarter.

BULK utilizes the CLOB order book as its core trading model. Its overall strategy focuses on improving transaction speed and system stability from the underlying architecture, prioritizing solutions to the persistent challenges of Solana network throughput and transaction fees. From an ecosystem perspective, BULK avoids pursuing innovation in interface or gameplay, instead aligning its trading engine as closely as possible to the consensus layer, striving to maintain stable matching even during periods of network congestion. Given the ongoing debate surrounding Solana's priority fee mechanism and congestion issues, this approach offers a degree of differentiation and topicality. However, whether it can consistently deliver on its performance promises in extreme market conditions remains to be seen through actual validation on the testnet and mainnet, as well as third-party evaluation.

In terms of the market, since the project is too early, data panel platforms such as DefiLlama have not yet included it, so please participate with caution.