RWA Weekly Report | US Treasury Initiates Drafting of GENIUS Act Rules; Plasma Announces Launch of Plasma One, a Stablecoin-Native Financial Application (September 17-24)

- 核心观点:RWA市场稳健增长,结构持续优化。

- 关键要素:

- RWA总价值达304.2亿美元,周增0.93%。

- 私人信贷占比55.9%,为主要增长动力。

- 用户数连续七周增长,新增818.3万。

- 市场影响:增强机构信心,推动RWA生态扩张。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web 3)

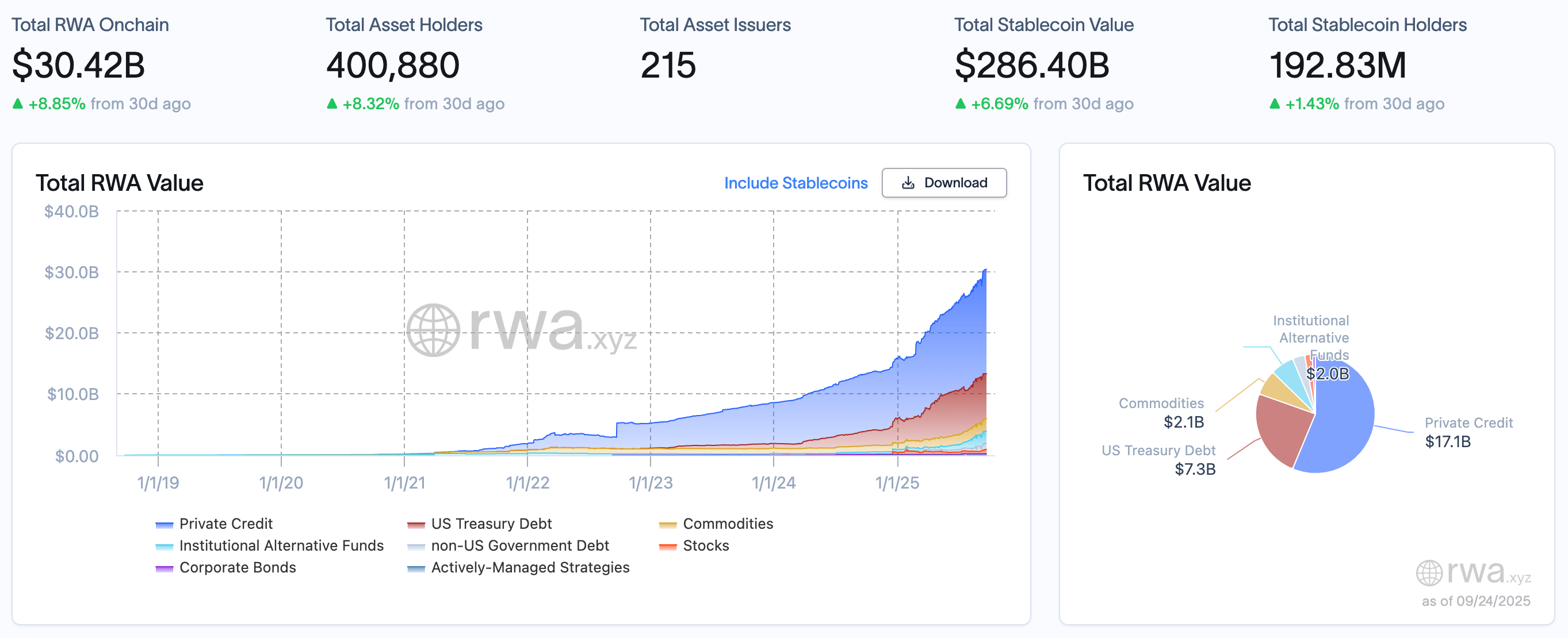

RWA Sector Market Performance

As of September 24, 2025, the total on-chain value of the RWA blockchain reached $30.42 billion, an increase of $280 million, or 0.93%, from $30.14 billion on September 16. While growth slowed compared to last week, the market remained above $30 billion, continuing its expansionary trend. User engagement continued to increase, with the total number of asset holders increasing from 392,697 million to 400,880 million, a weekly increase of 8,183 million, or 2.08%. This marked the seventh consecutive week of positive user growth, demonstrating continued market traction. The number of asset issuers saw a slight rebound, increasing from 211 to 215, with 4 new issuers, a 1.90% increase. The total value of the stablecoin market reached $28.04 billion, down $101 million, or 0.36%, from $28.141 billion on September 16. The number of stablecoin holders increased from 191.84 million to 192.83 million, an increase of approximately 990,000, or 0.52%. The overall fluctuation is still small, indicating a stable user base.

From an asset management perspective, private credit remains the core of the RWA sector, accounting for approximately 55.9%. This week, it saw a slight increase of $100 million, or 0.59%, from $16.9 billion to $17 billion, contributing the majority of the overall growth. US Treasuries saw a slight decline, falling $100 million, or 1.35%, from $7.4 billion to $7.3 billion, possibly due to interest rate fluctuations or fund rotation. Commodity assets saw steady growth, increasing by 5% from $2 billion to $2.1 billion. Institutional alternative funds remained stable this week, remaining at approximately $2 billion, with no significant changes. Other asset classes, such as equities, non-US government debt, and corporate bonds, were relatively small (totaling approximately $2.12 billion), and had a limited impact on the overall structure.

What are the trends (compared to last week )?

Looking at overall market trends, the RWA market exhibited a combination of "modest growth and structural optimization" in the third week of September (September 16th to 24th). On the one hand, the total RWA market capitalization rose slightly by 0.93%, with private credit providing stable support. On the other hand, the stablecoin market experienced a slight correction, with user activity increasing modestly, indicating a more balanced capital cycle. The number of asset issuers rebounded, ending last week's unusual decline, suggesting a gradual standardization of the market ecosystem, potentially benefiting from dispute resolution or the influx of new projects. Overall, the market has shifted from last week's "breakthrough expansion" to a "steady accumulation" phase. Increased institutional participation suggests potential acceleration, but caution is warranted regarding liquidity risks associated with a pullback in government bonds.

Review of key events

The U.S. Treasury Department recently initiated the Advance Notice of Proposed Rulemaking (ANPRM) process to formally implement the GENIUS Act (National Stablecoin Innovation Guidance and Establishment Act), signed by President Trump. This marks the beginning of the substantive regulatory phase for stablecoin legislation. The Treasury is soliciting comments on details such as issuer restrictions, sanctions compliance, anti-money laundering requirements, the balance between federal and state regulation, taxation issues, and custody of reserve assets. The public and crypto companies have until October 20th to submit feedback. The GENIUS Act is the first crypto legislation to become law, and the Treasury's move aims to further refine the regulatory framework and complement the currently under discussion Digital Asset Market Clarity Act.

Apollo secures $50 million in backing to launch new tokenized credit fund

Centrifuge, a blockchain-based RWA, and Plume have jointly launched the "Anemoy Tokenized Apollo Diversified Credit Fund (ACRDX)," which has received a $50 million anchor investment from Grove, the credit infrastructure protocol within the Sky ecosystem. The fund allows blockchain investors to participate in Apollo's diversified global credit strategy, covering direct corporate lending, asset-backed lending, and mismatched credit. ACRDX will be issued through Plume's Nest Credit Vault under the token code nACRDX, enabling institutional investors to participate in the strategy on-chain. Chronicle will serve as the oracle provider, and Wormhole will be responsible for cross-chain connectivity. Upon approval, Anemoy will serve as the fund's manager.

Cardano Foundation Updates Roadmap: Plans to Focus on Supporting Stablecoin and RWA Development

The Cardano Foundation’s updated application roadmap mainly includes:

1. Will provide up to eight figures of ADA liquidity for the Cardano stablecoin project

2. We will also support the popularity and liquidity of DeFi through measures such as the stablecoin DeFi liquidity budget

3. Delegating 220 million ADA tokens to new DReps

4. Launch of a Real World Asset (RWA) project with a scale exceeding US$10 million

5. Allocate 2 million ADA tokens to Venture Hub

6. Comprehensively expand promotional activities and application implementation

It is reported that the Cardano Foundation will stop the current SPO delegation strategy in the next few months and will subsequently delegate tokens to the Cardano Foundation pool.

Coinbase integrates Morpho to launch USDC interest-earning feature

According to Cointelegraph, Coinbase has launched a new feature by integrating Morpho, allowing users to directly participate in on-chain DeFi lending through its app and earn USDC income, with an annualized yield of up to 10.8%.

Plasma Announces the Launch of Plasma One, a Stablecoin-Native Financial Application

According to official news, Plasma announced the launch of Plasma One, a stablecoin native financial application, which supports payments directly from stablecoin balances while earning more than 10% in returns, focusing on markets with the highest demand for US dollars, such as cities such as Istanbul, Buenos Aires and Dubai.

Hot Project Dynamics

Ondo Finance (ONDO)

One sentence introduction:

Ondo Finance is a decentralized finance protocol focused on the tokenization of structured financial products and real-world assets. Its goal is to provide users with fixed-income products, such as tokenized U.S. Treasury bonds and other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, highly liquid assets while maintaining decentralized transparency and security. Its ONDO token is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application within the DeFi ecosystem.

Latest News:

On September 19, according to on-chain data , Ondo Global Markets’ total locked value (TVL) in the tokenized stock sector exceeded US$240 million, ranking first, and its scale has exceeded the total of other platforms.

Ondo Finance previously announced that Peter Curley has joined the company as Head of Global Regulatory Affairs. Curley brings decades of experience in financial policy, including stints as Senior Policy Advisor at Coinbase, Senior Advisor for Financial Institutions Policy at the U.S. Treasury Department, Deputy Director of the U.S. Securities and Exchange Commission, and Head of Strategy and Head of IPO Regulation at Hong Kong Exchanges and Clearing Limited.

MyStonks (STONKS)

One sentence introduction:

MyStonks is a community-driven DeFi platform focused on tokenizing and trading Reliable Warrants (RWAs) such as US stocks on-chain. Through a partnership with Fidelity, the platform offers 1:1 physical custody and token issuance. Users can mint stock tokens like AAPL.M and MSFT.M using stablecoins like USDC, USDT, and USD 1, and trade them 24/7 on the Base blockchain. All trading, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks is committed to bridging the gap between TradFi and DeFi, providing users with highly liquid, low-barrier-to-entry on-chain investment in US stocks, and building the "NASDAQ of the crypto world."

Latest News:

On September 19th, MyStonks officially announced a strategic partnership with CoinAnk, a cryptocurrency data analysis platform. MyStonks will support CoinAnk users in their operations and enrich their product benefits. MyStonks is a leading decentralized platform for RWA assets, supporting US stock tokens and derivatives trading. CoinAnk is a cryptocurrency data analysis platform that provides real-time market quotes, liquidation maps, fund flow monitoring, and other multi-dimensional indicators. Diamond members can unlock in-depth data on all cryptocurrencies and featured indicator tools. This partnership will drive MyStonks' technological innovation and product upgrades in the digital derivatives sector, enhancing the platform's competitiveness and user service capabilities.

Previously, the MyStonks platform officially launched Hong Kong stock futures trading , allowing users to trade directly with USDT/USDC using their wallets, with up to 20x leverage. This newly launched contract covers a number of high-quality Hong Kong stocks, including Guotai Junan International (1788.HK), BYD Co., Ltd. (1211.HK), Xiaomi Group (1810.HK), Mixue Group (2097.HK), Meituan (3690.HK), Tencent Holdings (700.HK), Pop Mart (9992.HK), JD.com (9618.HK), and SMIC (981.HK). These stocks cover a variety of industries, including technology, automotive, retail, internet, and semiconductors, meeting users' diverse asset allocation needs.

Related links

Sort out the latest insights and market data for the RWA sector.

The Hong Kong Stock RWA Tokenization Wave: Decoding the On-Chain Migration of Listed Companies

This article takes stock of the RWA concept listed companies that have been active in the market recently to see what new financial stories they are telling.

RWA Panoramic Analysis: Opportunities, Challenges, and Future of Asset Chain

RWA is at the crossroads of the "blue ocean" and the "red ocean". Ahead is a vast ocean leading to a trillion-dollar market, but also reefs full of laws, risks and liquidity.