The IPO craze is sweeping the market: Analysis of the five most popular projects

This week is definitely the busiest for major projects this year. Tether's Plasma (XPL) is about to launch, and DWF's Falcon Finance IPO is nearing its closing date. I've heard that the price of a KYC-certified account in the OTC market has soared to $120. Kraken also has a new project from the founder of Curve about to launch. The wealth creation effect of new coins, led by STBL and 0G, is quite significant.

So, what other IPO opportunities are there? BlockBeats has compiled a list of several projects that have recently garnered significant attention.

Upheaval

Upheaval, an AMM decentralized exchange built on the HyperEVM, previously issued PUP, mimicking Hyperliquid's pre-TGE airdrop of Memecoin. Its spot trading volume on Hyperliquid even surpassed Purr, the token's predecessor, at one point. The platform currently offers five key features, ranging from token launches to a treasury that monitors user funds.

First up is JumpPad, officially positioned as an incubator for new tokens and communities based on UIP-3. Addressing the difficulties of token issuance caused by Hyperliquid's auction mechanism, it serves as an alternative entry point for projects launching on Hyperliquid. While Hypurrfun previously developed similar functional requirements, Upheaval went a step further, building its own aggregator functionality to efficiently route transactions within the platform. It also established a fiat currency entry point and, mimicking Hyperliquid's governance mechanisms, used veUPHL and veUP to bind users to the platform over the long term through staking and governance, strengthening the supply-demand balance and expanding liquidity.

This relatively complete architecture makes Upheaval both a launch pad for new projects and a hub for funding and transactions, giving people the visual sense of a Hyperliquid version of Pumpfun+Moonshot.

Upheaval is also the first project after the Hypeliuquid omni-channel trading platform Based opened Launchpad. Since it is the first time to go online, there is no historical record to refer to, but its investor Ethena has also given a certain degree of endorsement to its expectations.

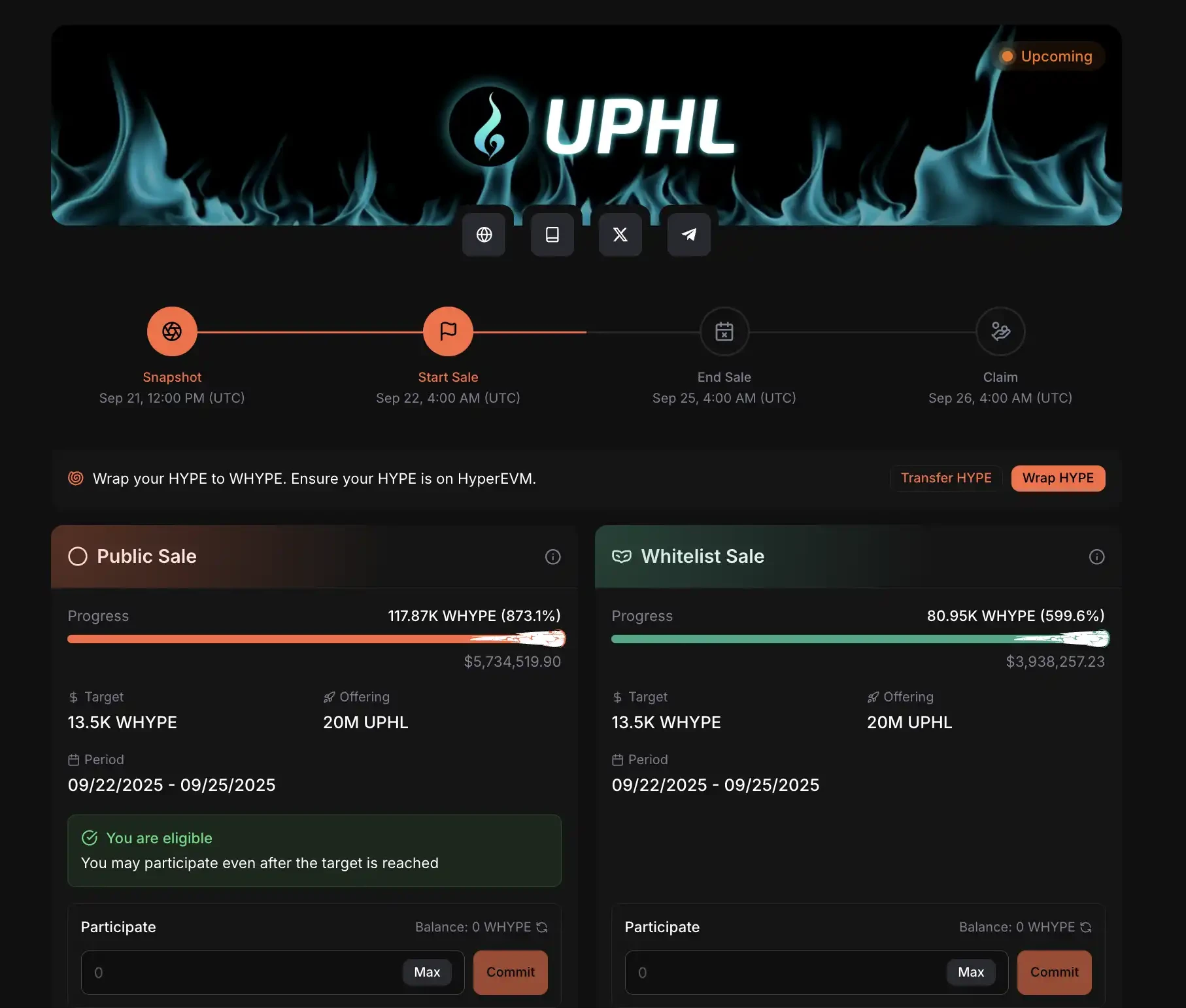

The presale is currently ongoing, starting at 4:00 UTC on September 22nd and running until 4:00 UTC on September 25th. However, the public sale has already surpassed its target of 870%. Interestingly, the presale mechanism includes both a public sale and a whitelisted phase for long-term Based users and PuP holders.

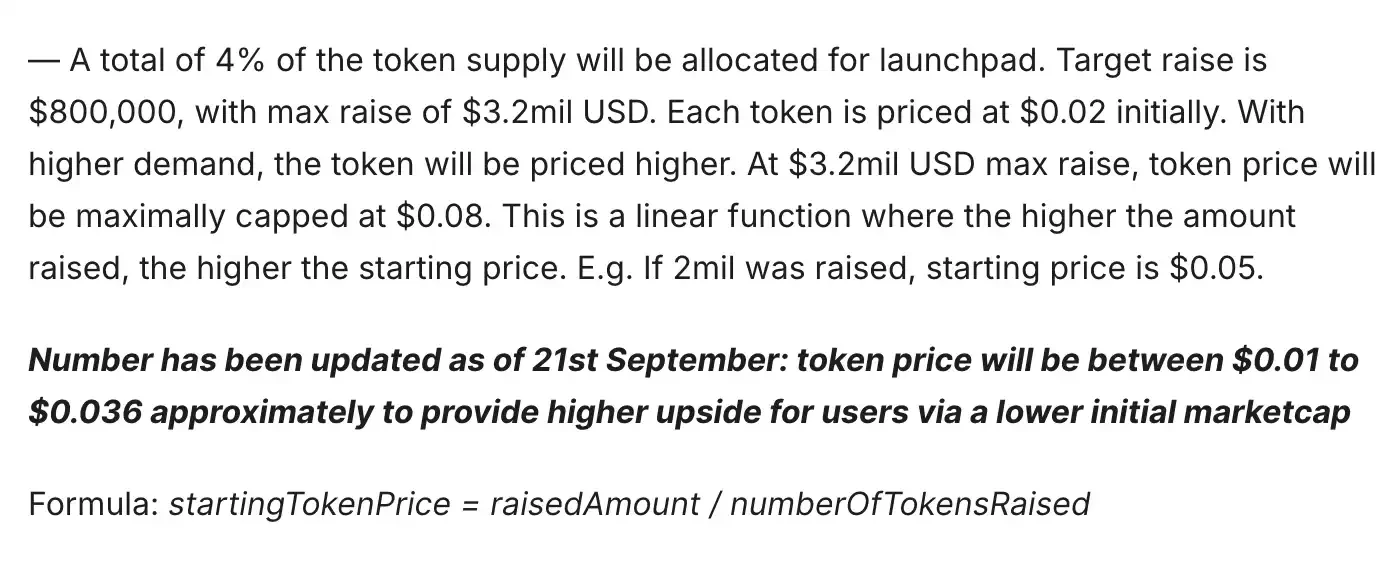

In fact, before the oversubscription, the price also fluctuated based on the Bonding Curve, from an initial $0.01 to $0.036. After reaching the fundraising target of 13.5K WHYPE, the pre-sale price remained at $0.036. For the oversubscribed portion, Upheaval tokens were distributed according to the proportion of individual contributions to the total, with any excess funds refunded. In other words, the more participants and the more funds invested, the less impact the Bonding Curve's price discrepancy would have had.

Upheaval's TGE tokens represent 4% of the total 1 billion tokens, with a FDV of $33 million and an initial circulation of 26%. However, whether its market capitalization will increase further will depend on whether Upheaval's trading volume can continue to grow and whether the "Jumppad" mechanism under the UIP-3 mechanism can truly boost the entire Memecoin ecosystem.

Yield Basis

Yield Basis is a Bitcoin-native yield protocol launched by Curve founder Michael Egorov. At the beginning of the year, it received $5 million in financing at a valuation of $50 million.

Yield Basis utilizes an automatic re-leveraging mechanism to generate transaction fee income for BTC liquidity providers while simultaneously mitigating the impermanent loss caused by AMM curvature risk. LPs can choose to receive BTC-denominated transaction fees directly or forgo them in exchange for YB token incentives. Locked veYB can participate in governance and share in protocol fees.

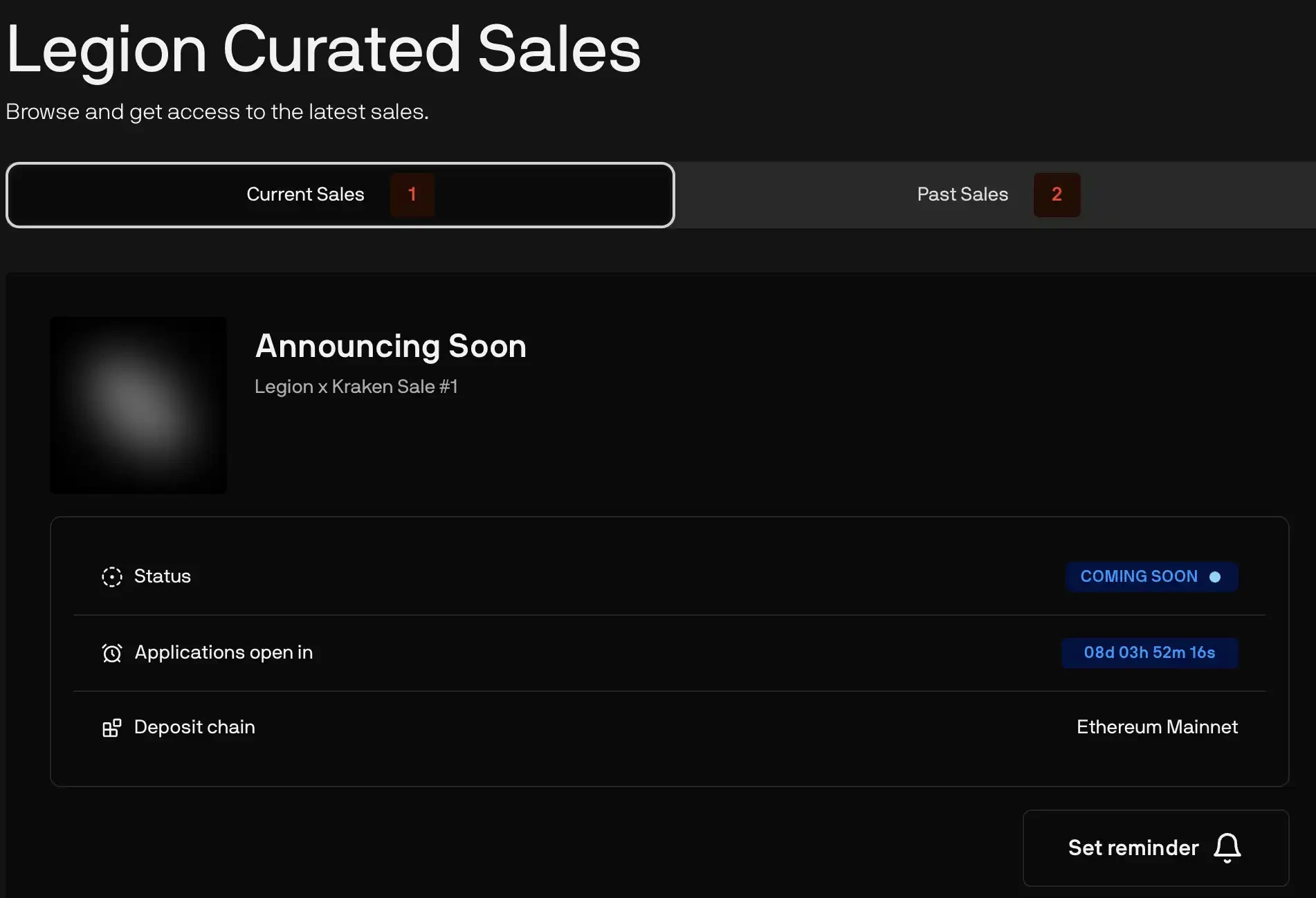

After a one-day delay, Kraken announced that it has partnered with Legion to select Yield Basis as the first project for its LaunchPad. Legion's "Legion Score" system allocates quotas based on on-chain behavior, social media activity, and developer contributions. This allows projects to screen out a significant number of multiple participants, ensuring that true builders and core users receive priority subscription shares. Coupled with Karken's access to an exchange, the market is highly interested in this collaboration.

The presale is currently being conducted in two phases. First, 20% of tokens are reserved for subscription by high-rated Legion users, while the remaining 80% are sold publicly on both Kraken and Legion using a FCFS model. $YB will be listed directly on Kraken after the sale. The total supply of 1 billion tokens will be distributed proportionally, with 30% allocated to liquidity mining incentives, 25% to the team, 15% to the ecosystem reserve, and 12.1% to investors. Another 7.5% will be allocated to Curve protocol licensing fees, 7.4% to the developer reserve, and 3% to Curve governance incentives.

Although its initial funding valuation was only $50 million at the beginning of the year, considering the support of the Curve community (Curve DAO has already passed a proposal to provide crvUSD credit support for YB) and Egorov's influence, the market anticipates that YB's FDV at IPO could reach hundreds of millions of dollars, significantly exceeding its internal funding valuation. Further pre-sale details, including the TGE schedule and sales pricing for each unit, will only be revealed when the public application is released in eight days.

Tea

Tea is a decentralized open-source software platform that fairly compensates developers based on their contributions to the ecosystem. It was founded by former Apple employee Max Howell, a proponent of open source, who previously created open-source projects such as HomeBrew and PromiseKit in Web 2. These plugins were used by major companies like Google and McDonald's, but they received no compensation. Therefore, he wanted to create a sustainable open-source ecosystem to drive Layer 2 development.

Previously, it received a total of US$16.9 million in financing from VCs such as Yzi Labs and Acuitas Group Holdings in the Preseed and Seed rounds.

Tea has chosen the established IDO platform Coinlist for its pre-sale, which will begin at 17:00 UTC on September 25th with a FDV of $50 million, totaling 4 billion $TEA ($0.0005/$TEA). Coinlist will choose a "bottom-up" distribution method after the purchase window closes (i.e., the smaller the amount of participation, the sooner it will be distributed, and the larger the amount, the later it will be distributed or may not be distributed at all).

Although 100% of the tokens will be unlocked during this TGE, many users who participated in the testnet did not receive the promised airdrops, and were therefore boycotted by some community users. This practice also led the team to be suspected by the community of having a "possible scam" tendency.

Limitless

Limitless is a decentralized prediction market application on the Base blockchain. Users can create and trade prediction contracts on any topic like in Polymarket (supporting a centralized order book interface) to bet on real-world or crypto events.

Since its launch in 2024, Limitless has accumulated over $270 million in trading volume. Despite being previously embroiled in controversy over volume manipulation, the project completed two rounds of funding totaling $7 million between 2024 and 2025, with backers including prominent institutions like Coinbase Ventures and 1Confirmation. In July, the project even hired former BitMEX founder Arthur Hayes as an advisor.

Kaito recently launched its "Capital Launchpad" feature for project token presales. While the market has grown antipathetic to the mindless Yap-swiping on social media, and there were initial calls for a boycott of Kaito within the community, the launchpad has been remarkably successful, with the launch of several well-endorsed projects like Boundless, Rise, and Theoriq.

According to the project's announcement, the Limitless token presale is scheduled to begin on September 25th. As a reward for early supporters, Limitless has previously launched a Points Program, where users earn points through trading, market making, and other activities, with the potential to receive airdrop rewards after the TGE.

Kaito has not yet officially disclosed specific subscription thresholds and limits, but as is customary, it is likely to adopt a model that allows users to subscribe freely, with oversubscriptions allocated proportionally. Participation may also require completing tasks on the platform to qualify for a whitelist and passing Kaito's KYC verification. While the prediction market has been quite hot recently, whether it's worth participating will require further funding information.

Goated

Goated is a rapidly growing decentralized gaming platform within the Solana ecosystem. Since its launch in June 2024, Goated has processed over $1 billion in wagering volume, boasts over 12,000 monthly active users, and generated over $2 million in net gaming revenue. Its previous angel round included backing from SanDeep, founder of Polygon and Sentient, Thiccy, founder of Scimitar Capital, and several former FTX team members.

Metaplex, Goted's chosen launcher, launched its Solana on-chain token issuance protocol, Metaplex Genesis, this year, and has seen strong success with its projects. The recently popular $CARDS coin, after a period of decline, saw a surge in popularity, reaching a peak market capitalization of $800 million. Pre-sale participants saw returns of nearly 20 times their investment. Subsequently, other projects with impressive funding rounds, such as Portals, were launched.

Goated's token pre-sale through Genesis is also known as Solana's largest token issuance in the GambleFi track in 2025. Often, such products do not have the need to issue tokens because they have sufficient cash flow income.

This presale will be a fixed-price public sale, opening at 4:00 PM UTC on September 25th. The first two hours will be a community allowlist session, followed by public participation. 10 million $GOATED tokens (1% of the total supply) will be issued at a price of 0.0004 SOL per token. The maximum amount raised is 4,000 SOL (approximately $880,000 USD), at which point the sale will cease.

Allowed list eligibility is open to existing Goated users. They are required to register on the platform and bind their Solana wallet, deposit and stake at least $1,000, and complete designated Twitter follow and retweet tasks to obtain the whitelist. However, the snapshot has now ended, and users who have not participated in the project before can only wait for the public sale round to participate.

Based on the pre-sale price, the initial FDV of $GOATED tokens is approximately 400,000 SOL (approximately $88 million USD). Given Goated's stable cash flow and user base, the market expects its trading market capitalization to significantly exceed the fundraising amount, with the initial circulating market capitalization potentially reaching tens of millions of dollars.

- 核心观点:本周多个优质项目密集启动代币预售。

- 关键要素:

- Upheaval公售超募870%,机制创新。

- Yield Basis获Curve创始人及Kraken支持。

- Goated平台已有10亿美元投注额现金流。

- 市场影响:吸引大量资金关注,推高新币财富效应。

- 时效性标注:短期影响