Contribution: SoSoValue

On September 17th, the U.S. SEC officially approved the "Universal Listing Standards for Commodity Trust Units" (Release No. 34-103995). This is not just a simple technical document, but a true "institutional gate"—meaning that the future listing of crypto spot ETFs will shift from case-by-case approval to a standardized, expedited, and universally accepted process.

Against the backdrop of the Federal Reserve just launching a new round of interest rate cuts and rising expectations of US dollar depreciation , this institutional breakthrough has brought a dual resonance of "liquidity + institutionalization" to crypto assets, and can be regarded as one of the most iconic regulatory events in the crypto market this year.

In this article, we will answer the following questions:

- What exactly has changed in the new regulations and what impact will it have?

- Which cryptocurrencies will benefit first, and which spot ETFs are expected to be approved first?

- What should investors pay attention to? Against the backdrop of new regulations and the reshaping of capital migration logic, how can ordinary investors seize opportunities and control risks?

1. What has changed in the general standard? From “whether to allow” to “how to regulate”

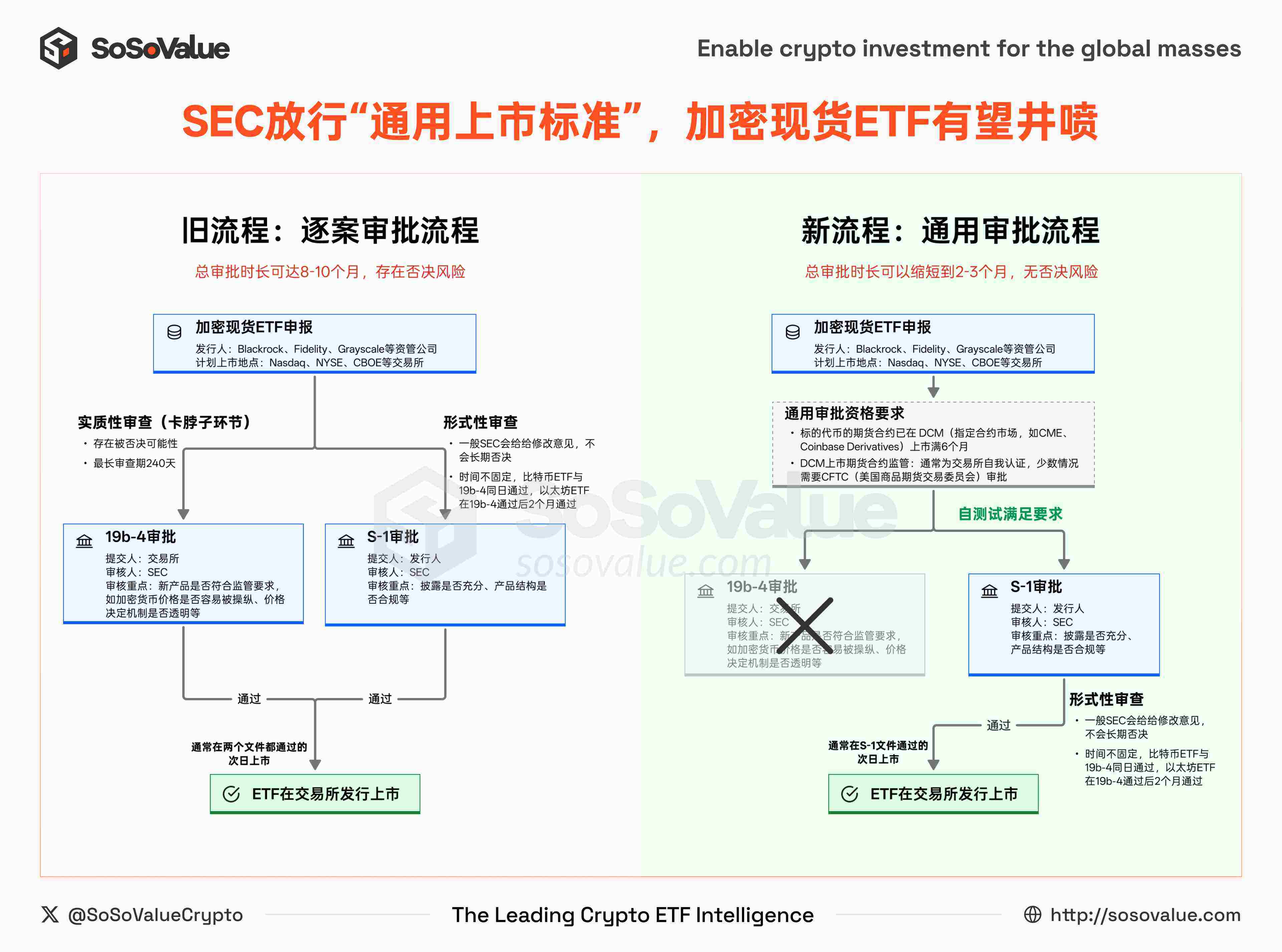

Prior to the release of this new regulation, crypto spot ETFs had to go through a case-by-case approval process and had to cross two approval thresholds:

1. 19b-4 Rule Change Approval - The exchange applies to the SEC for amendments to the exchange rules. This is a substantive review and may be rejected by the SEC.

2. S-1 prospectus approval - submitted by the ETF issuer to the SEC for approval, disclosing details such as fund structure, manager, and fees, which is more of a formal review.

This dual-approval model is not only a lengthy process but is also often hampered by political wrangling and compliance disagreements. For example, there was a surge in applications for Bitcoin spot ETFs in 2021, but in 2021 and 2022, each application was rejected by the SEC at the 19b-4 stage. A new batch of applications was submitted from May to July 2023, and finally, on January 10, 2024, both the 19b-4 and S-1 filings were approved on the same day, after nearly eight months of stalemate.

The "Universal Listing Standard" adopted by the SEC on September 17, 2025, brought about fundamental changes. This standard clearly stated that eligible commodity ETFs no longer needed to submit 19b-4 applications on a case-by-case basis, but only needed to go through the S-1 approval process, significantly reducing approval time and costs.

Eligible ETFs must meet one of three paths:

1. The underlying commodity is already traded on an ISG (Inter-Market Supervisory Group) member market, such as the NYSE, Nasdaq, CME, and LSE.

2. The futures contract for the underlying commodity has been traded continuously for at least six months on a Designated Contract Market (DCM), and a Comprehensive Sharing Surveillance Agreement (CSSA) has been established between the exchanges. DCMs are CFTC-authorized, compliant exchanges such as CME, CBOT, and Coinbase Derivatives Exchange.

3. An ETF is already listed on a U.S. national securities exchange , with at least 40% of its assets allocated to the underlying asset.

Since most crypto assets are considered commodities, this rule is practically tailor-made for crypto spot ETFs. The second path is the most viable : as long as a crypto asset has a futures contract running for six months on an exchange like CME or Coinbase Derivatives, it can bypass the 19b-4 approval process, allowing its spot ETF to be launched quickly.

Figure 1: New and old crypto spot ETF listing approval process (data source: SoSoValue)

Compared with the old model, the changes brought about by the new regulations are mainly reflected in two aspects:

1) Simplified approval process: 19 b-4 is no longer a roadblock.

Under the old model, crypto spot ETFs required simultaneous approval of both the 19b-4 rule change and the S-1 prospectus, neither of which could be neglected. This was the case with previous Bitcoin and Ethereum ETFs: 19b-4 review times of up to 240 days were a significant factor in slowing down the process. Under the new regulations, as long as the product meets unified standards, exchanges can proceed directly to the S-1 review process, eliminating the repeated 19b-4 negotiations and significantly shortening the time to market.

2) Shift in the focus of review authority: CFTC and DCM play a more critical role.

The eligibility review of futures contracts has gradually shifted from the SEC to DCMs (Designated Contract Markets) and the CFTC (Commodity Futures Trading Commission). Under the current system, DCMs have two main ways to list new contracts:

- Self-Certification : DCMs only need to submit a self-certification to the CFTC one business day before the contract goes live. If there are no objections, the contract automatically becomes effective. This generally requires that the spot market has price transparency, sufficient liquidity, and controllable market manipulation risks.

- Voluntary Approval : If there is a dispute over a contract, DCM can proactively apply for CFTC approval to obtain stronger legal protection.

This means that as long as the spot market for a particular crypto asset is healthy enough, DCMs have considerable autonomy in promoting the listing of futures contracts. Meanwhile, the SEC's review of the S-1 primarily focuses on the adequacy of information disclosure and compliance with product structure, essentially conducting a "formal review."

Overall, the SEC is transitioning from a case-by-case reviewer to a rule-maker. The regulatory approach is also shifting from "whether to allow" to "how to regulate." Under this framework, the launch of crypto spot ETFs will be more efficient and standardized.

2. Which cryptocurrencies are most likely to benefit? 10 major cryptocurrencies that already have futures contracts and have submitted ETF applications will be the first to see ETFs launched.

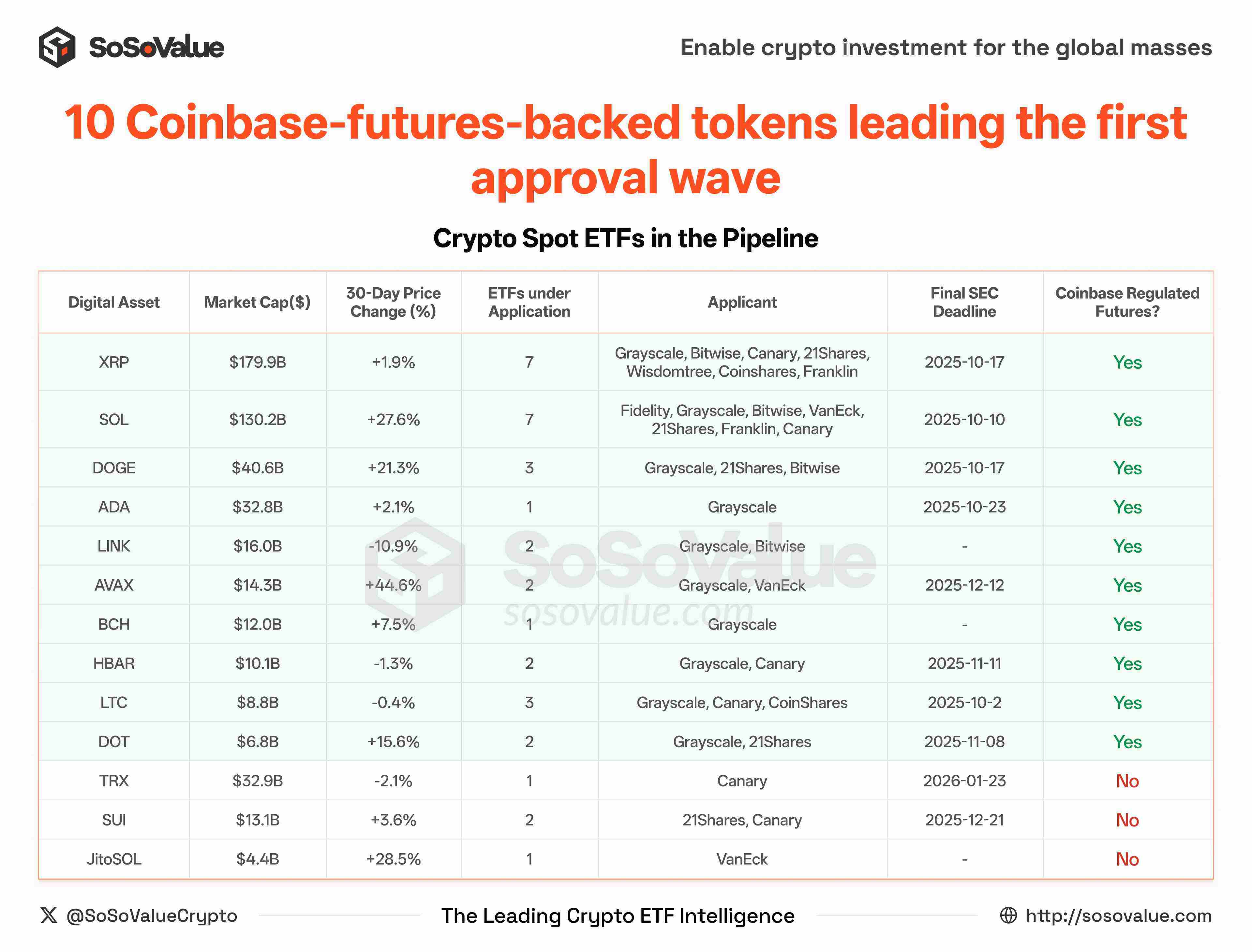

Among existing DCMs (Designated Contract Markets), Coinbase's Coinbase Derivatives Exchange boasts the most comprehensive crypto futures product line, currently covering 14 cryptocurrencies (see Figure 2).

Figure 2: List of futures products listed on Coinbase (Source: SoSoValue)

According to SoSoValue data, there are currently 35 crypto spot ETFs awaiting approval, covering 13 cryptocurrencies. With the exception of SUI, TRX, and JitoSOL, the remaining 10 cryptocurrencies have all had futures listed on Coinbase Derivatives for over six months, thus fully meeting the general requirements of the new regulations.

Figure 3: 10 major cryptocurrencies that already have futures contracts and have submitted ETF applications will be the first to see ETFs launched (Source: SoSoValue)

This means:

- About 30 spot ETFs covering 10 currencies including LTC, SOL, XRP, DOGE, ADA, DOT, HBAR, AVAX, LINK, and BCH are expected to be approved quickly in the next few weeks or months.

- The market is brewing the next wave of ETFs. For example, although cryptocurrencies like XLM and SHIB already have futures, no one has yet submitted a spot ETF application, making them likely to become the next wave of managers' focus.

3. When the interest rate cut cycle coincides with the ETF boom, what should investors pay attention to? ETF issuance progress, macro interest rate trends, cross-asset allocation, and capital flows.

In the short term, the implementation of universal standards will significantly accelerate the launch of crypto ETFs, lower the issuance threshold, and attract more institutional funds and compliant products to enter the market.

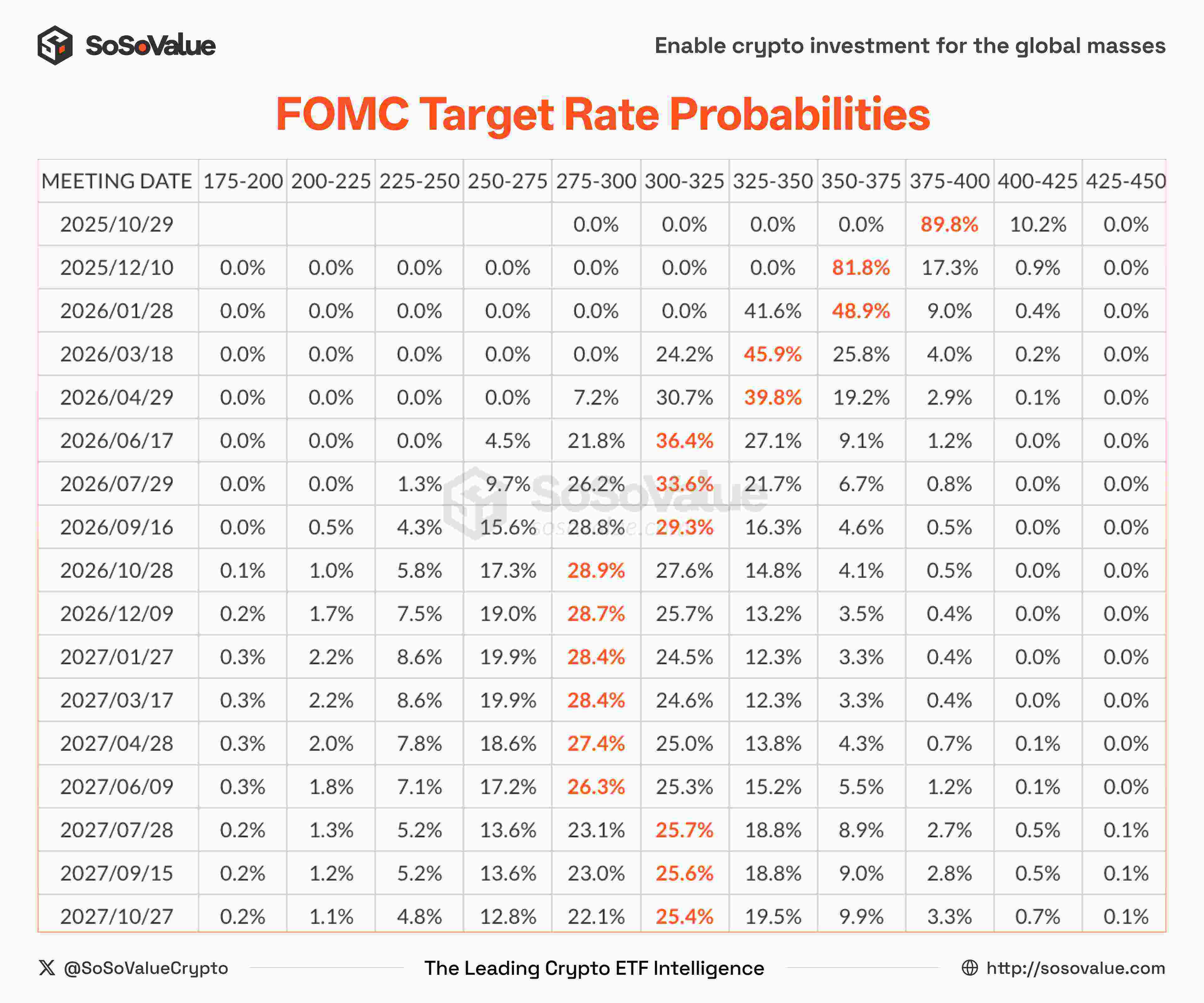

At the same time, the Federal Reserve cut interest rates by 25 basis points as expected on Thursday, and the dot plot signaled two more rate cuts this year. The interest rate cut cycle is beginning, expectations of a depreciation of the US dollar are beginning to ferment, and global capital is looking for new asset anchors.

The forces of macro liquidity and institutional innovation are colliding head-on: on one hand, the massive liquidity released by the US dollar system, and on the other, the potential explosion of crypto-asset ETFs. This intertwined dynamic may reshape capital allocation logic, accelerate the deep integration of traditional capital markets and crypto assets, and even mark the starting point for a reshaping of the global asset landscape over the next decade.

Against this backdrop, investors need to focus on four key areas:

1. ETF Issuance Pacing: For crypto spot ETFs that comply with common regulations, the S-1 prospectus often undergoes multiple updates before final approval, supplementing details such as fee rates and initial offering size. These updates often signal a countdown to the product's launch.

2. Macroeconomic environment: The Federal Reserve’s interest rate path, dot plot expectations, and the trend of the US dollar index will determine the direction of risk preference switching and are the core clues to asset pricing.

Figure 4: Expected Path of Fed Rate Cuts (Source: SoSoValue)

3. Cross-asset allocation: During periods of dollar weakness, gold, commodities, and crypto assets often complement each other. By diversifying exposure, investors can reduce risk while capturing multiple yield curves.

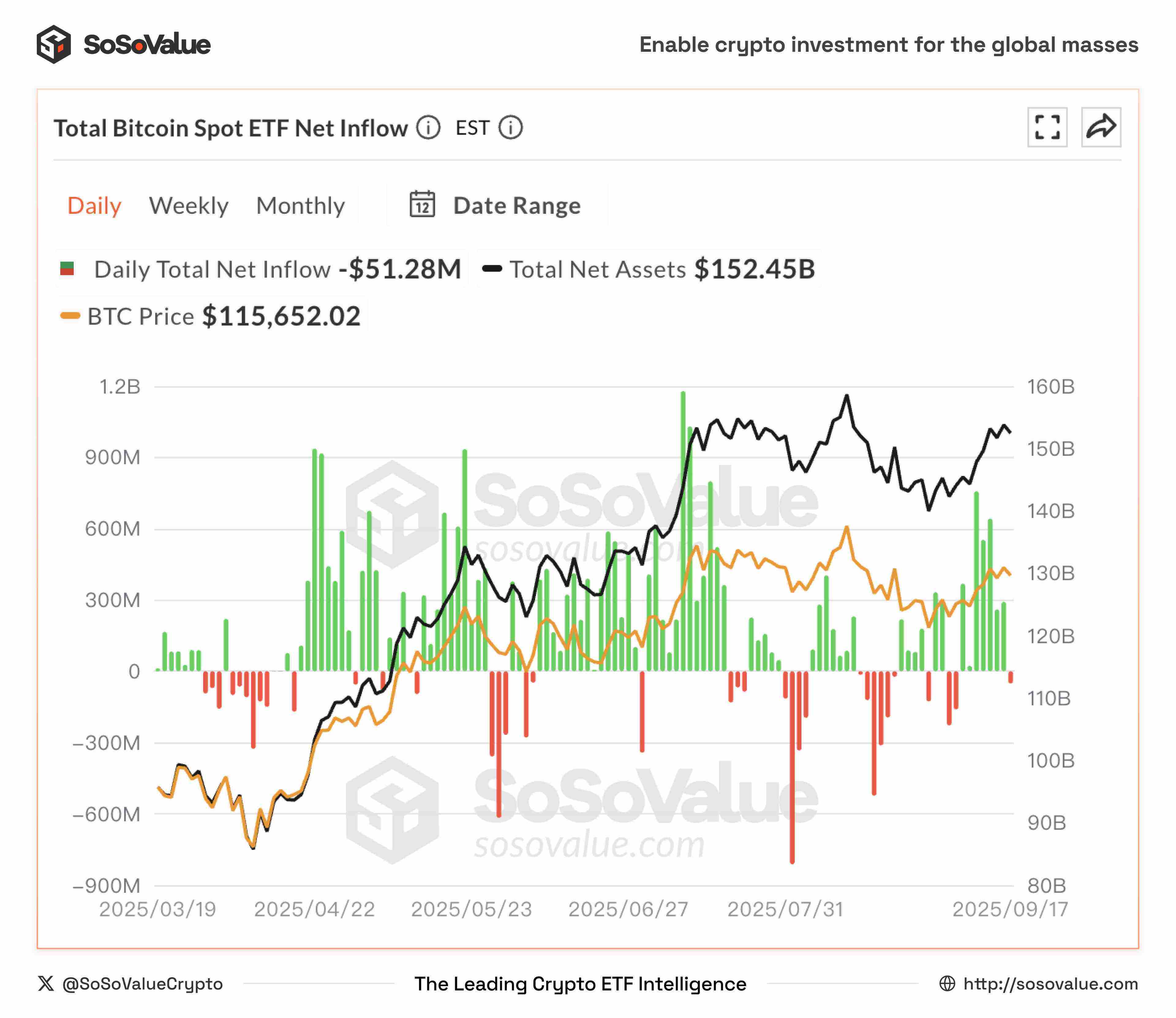

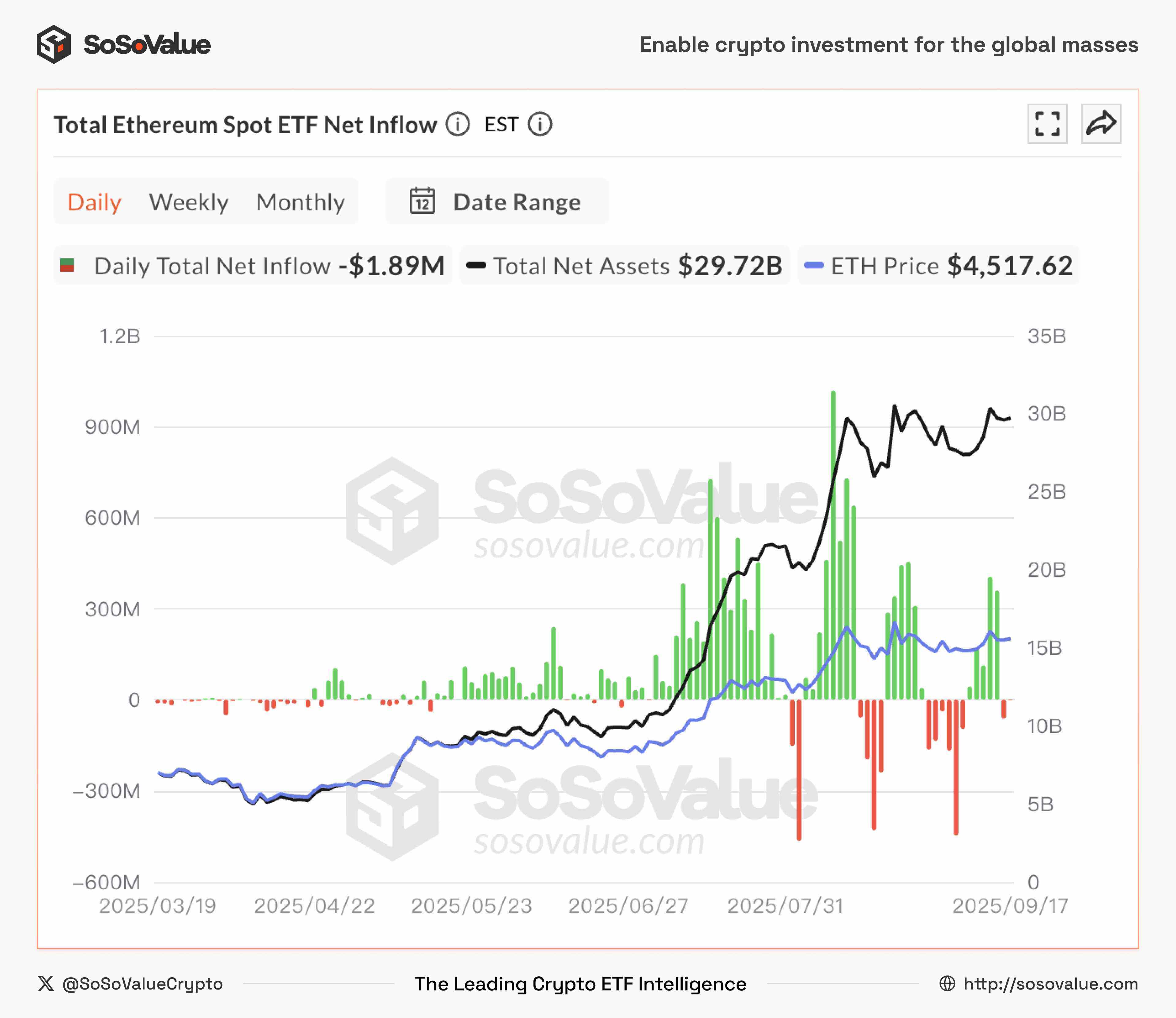

4. Capital Flows: Compared with price fluctuations, daily net inflows into ETFs better reflect market sentiment and trends and are often more forward-looking, helping investors seize opportunities before market reversals.

Figure 5: Bitcoin spot ETF single-day net inflow (data source: SoSoValue)

Figure 6: Ethereum spot ETF single-day net inflow (data source: SoSoValue)

Figure 6: Ethereum spot ETF single-day net inflow (data source: SoSoValue)

In summary, the new regulations, coupled with the interest rate cut cycle, are opening a "double floodgate" of institutional and liquidity for crypto ETFs. For investors, this presents both a new window of opportunity and a profound reshaping of asset allocation logic.

- 核心观点:SEC新规简化加密现货ETF审批流程。

- 关键要素:

- 取消逐案19b-4审批,仅需S-1形式审查。

- 已有期货合约的主流币种ETF将快速获批。

- 美联储降息与制度革新形成流动性共振。

- 市场影响:加速机构资金入场,提升市场流动性。

- 时效性标注:中期影响。