Solana DEX’s “Hidden Champion”: How Prop AMM Quietly Captured the Market

- 核心观点:专业做市商自营AMM主导Solana交易。

- 关键要素:

- prop AMM占SOL交易量超70%。

- 预言机报价实现近乎零滑点。

- 做市收益远超无常损失。

- 市场影响:推动DEX效率提升,挑战CEX地位。

- 时效性标注:中期影响。

Original author: Eric, Foresight News

At the beginning of this year, Solana's proprietary AMMs sparked a lot of discussion in the English-language community. Initially, several unknown AMMs began to appear frequently in Jupiter's routing tables. These AMMs lacked a front-end website, a simple entry point for adding liquidity, and no promotional materials. Over time, the volume of transactions routed to these "unknown" AMMs grew rapidly, and they now constitute the largest category of DEXs on Solana.

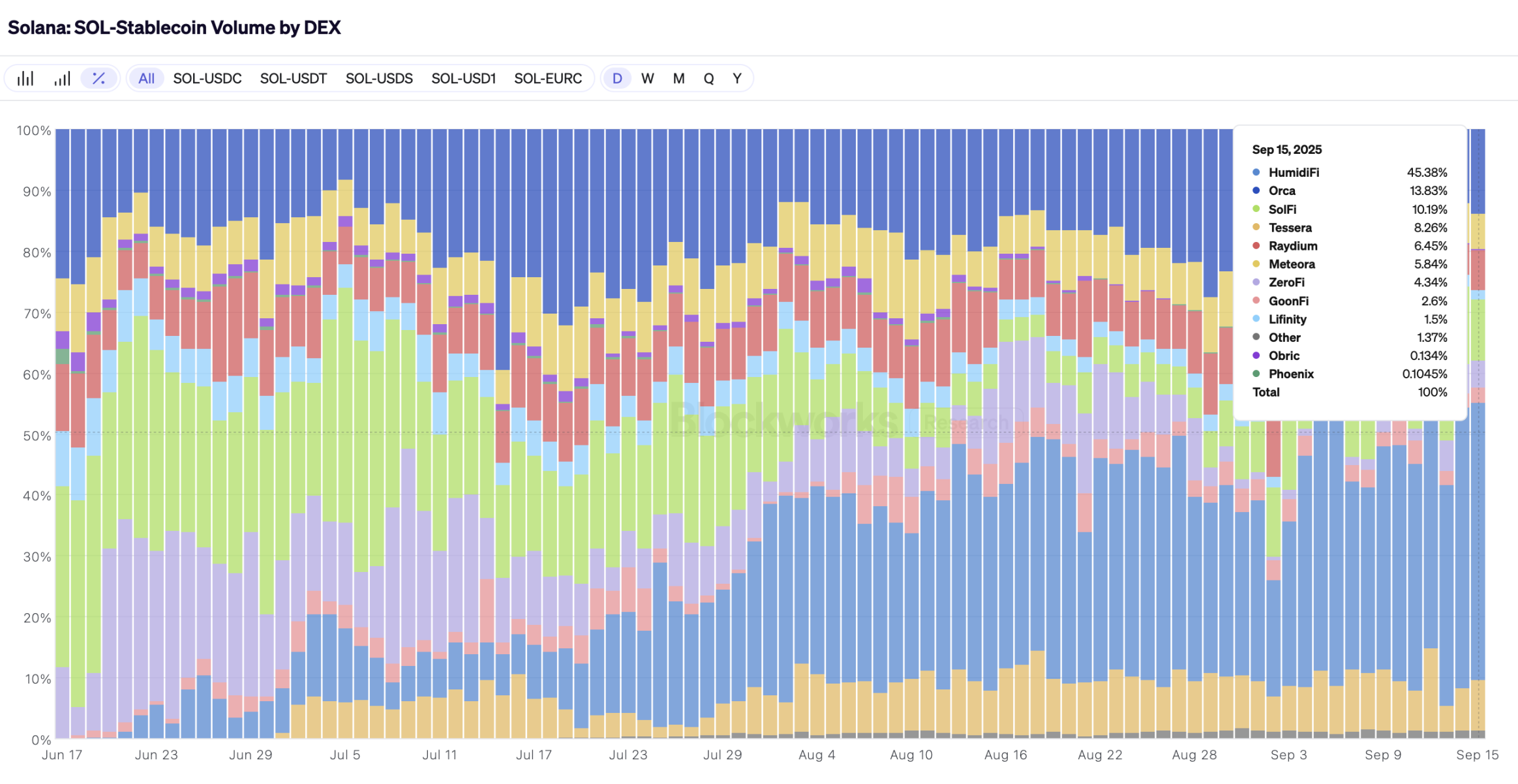

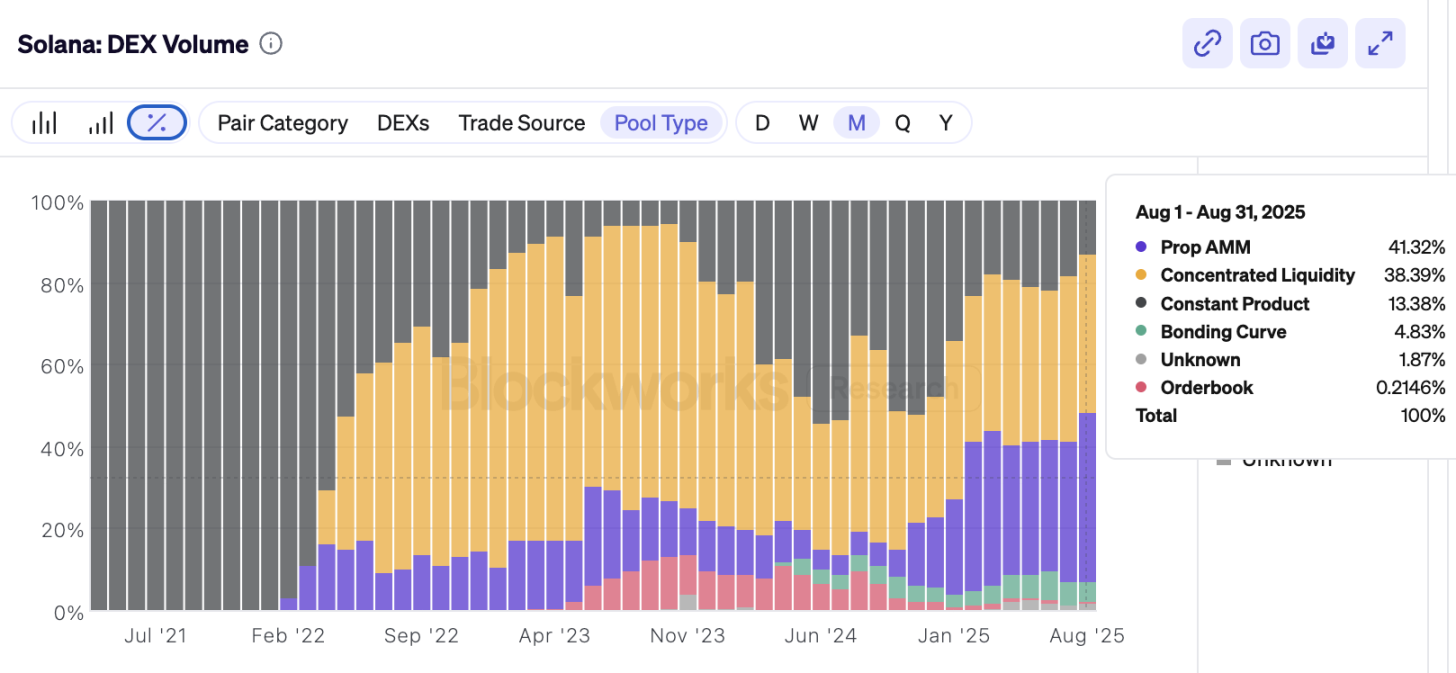

According to statistics from Blockworks, in the transactions of SOL and stablecoins on Solana DEX on September 6th local time, prop AMMs including HumidFi, SolFi, Tessera, GoonFi, ZeroFi, and Obric accounted for more than 70% of the trading volume. Prop AMM also ranked first in the share of all transactions on Solana, accounting for more than 40%.

The development and growth of Prop AMM is a conquest of the AMM field by professional market makers.

The original purpose of automated market makers (AMMs) was to solve the market making problem on-chain. On exchanges, the order book makers and takers of users and market makers collectively drive trading and underlying asset fluctuations. However, achieving the same level of order book efficiency as exchanges is difficult on-chain. AMMs, based on inverse proportionality functions, have become the only and best solution. Participants simply deposit a certain ratio of the two tokens that make up a trading pair into the liquidity pool to provide liquidity and earn transaction fees.

Since its launch, AMMs have continued to evolve, from automatically providing liquidity across all price ranges to enabling users to select their own liquidity range, and now to enabling users to adjust liquidity coverage at the protocol level. The inverse proportional function at the heart of AMMs is also being replaced by more complex functions.

These improvements to the existing protocol primarily aimed at two goals: reducing impermanent loss and optimizing execution prices. However, as a public AMM protocol, there was always an invisible ceiling: the protocol could not adjust liquidity arbitrarily; adjustments must be made according to the protocol's settings. Based on this premise, the idea of establishing a private AMM with flexible liquidity adjustments began to germinate.

Launched in January 2022, Lifinity is one of the earliest projects to offer this type of mechanism, billing itself as an oracle-based AMM. Because most major prop AMMs are currently operated by institutions (e.g., SolFi, operated by Ellipsis Labs, and Tessera V, operated by Wintermute), their actual pool liquidity and market-making mechanisms are not publicly disclosed. We used Lifinity, which has disclosed some information, to explore this further.

Prop AMMs have two key features: oracle-based pricing and flexible liquidity adjustments. While regular AMMs simulate transactions through corresponding liquidity pools, actual quotes often include potential slippage. Prop AMMs, on the other hand, directly use oracle quotes. In most cases, the oracle provides a weighted, real-time price that doesn't include slippage from specific liquidity pools, resulting in more competitive prices.

Prop AMM transactions are primarily conducted through aggregators, and the quotes provided directly to aggregators via oracles are often superior to those from regular AMM pools. After securing orders through superior quotes, the prop AMM's flexible liquidity adjustment capabilities come into play. In publicly addable AMMs, the rules for adding liquidity are fixed, such as Uniswap. Even though users can now select the range within which they add liquidity, it's still possible for insufficient liquidity within a certain price range to result in high slippage.

In a prop AMM, the deployer can concentrate all liquidity near the real-time price during transactions to achieve close to zero slippage. This is also the liquidity adjustment method disclosed by Obric in its documentation .

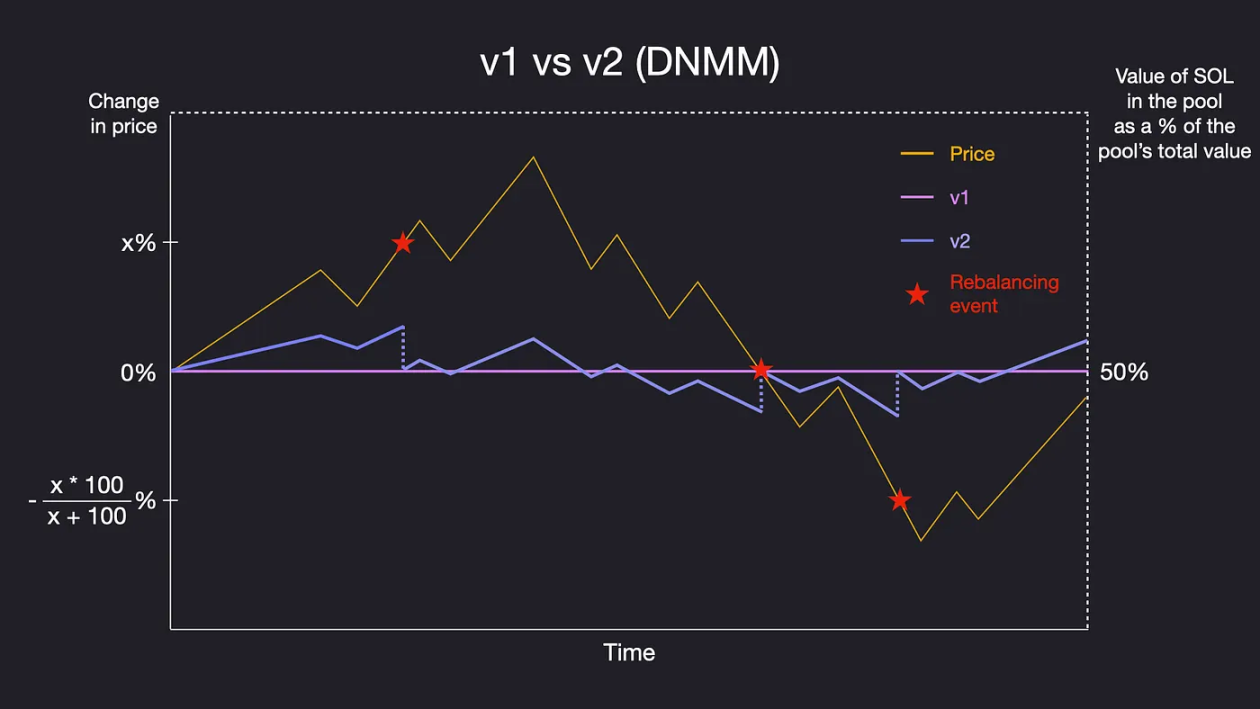

This method of pooling liquidity isn't the sole secret weapon of prop AMMs. Public AMMs can theoretically design mechanisms to centralize liquidity when executing trades. However, the real killer feature of prop AMMs is their undisclosed market-making strategy. Lifinity v2's market-making strategy, dubbed a "Delta-Neutral Market Maker," initially fixes the amount of SOL in the SOL/USDC liquidity pool, rather than maintaining a constant value of SOL and USDC (as in Lifinity v1). The liquidity pool proactively buys and sells SOL to balance the liquidity pool, rather than being subject to the constraints of oracles and arbitrageurs, which allow for proactive buy-low-sell-high trading. Unlike standard AMMs, which rely on arbitrage trading to balance liquidity pools, the flexibility of prop AMMs allows market making to generate inherent returns rather than impermanent losses.

According to data from Lifinity’s official website, its SOL/USDC liquidity pool has an annualized return of up to 1923.68%, and the market-making income even exceeds the transaction fee income, reaching 1049.2%.

Prop AMMs developed by professional market makers may offer better liquidity and more complex balancing algorithms, but this remains unknown due to their lack of transparency. Building your own AMM liquidity pool is clearly a more cost-effective approach than researching how to maximize returns by adding liquidity to public AMMs.

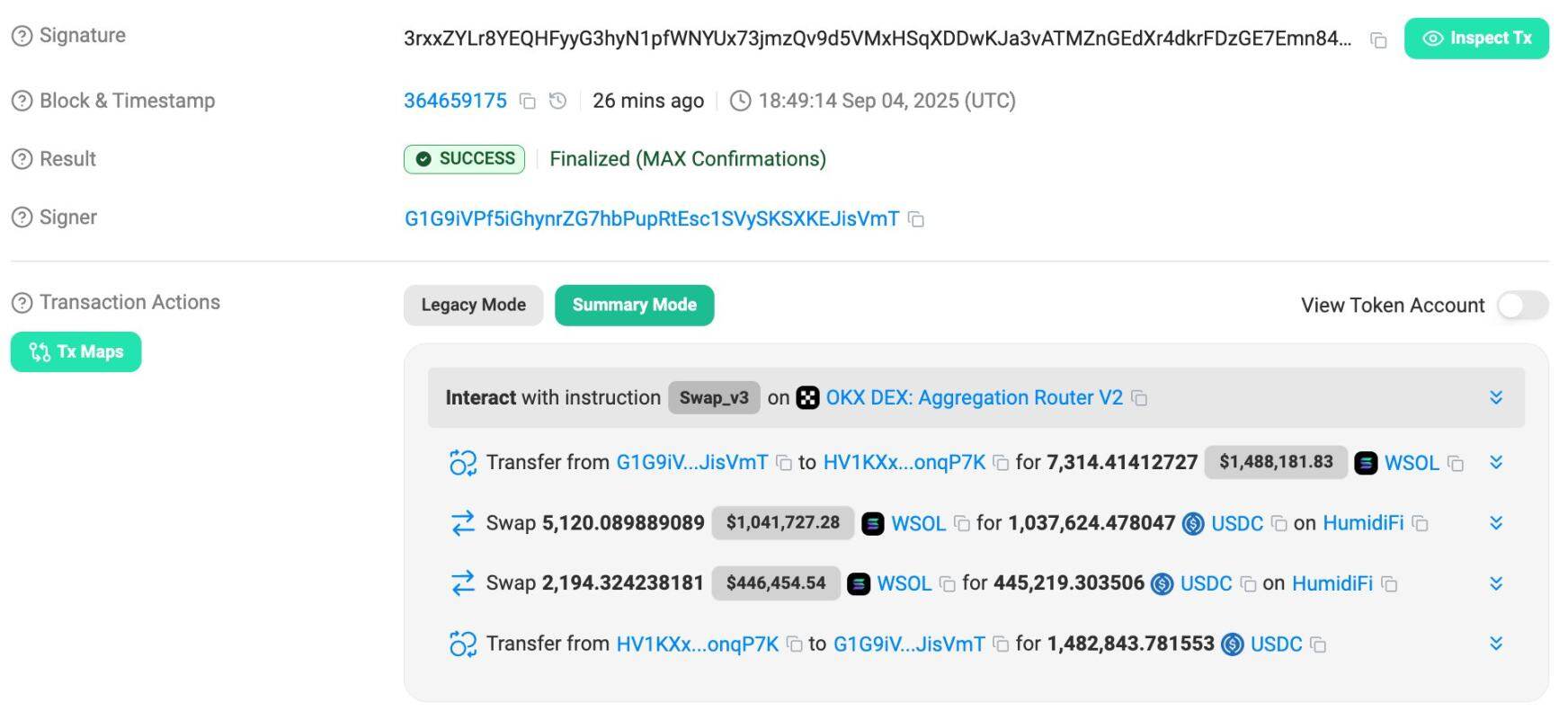

HumidFi, currently the largest prop AMM on Solana, previously displayed a transaction on X that sold nearly $1.5 million worth of SOL for USDC. The transaction sold 7,314.41412727 SOL for 1,482,843.781553 USDC. The SOL price at the time of the transaction ranged from 202.67 to 202.87. Even using the highest price of 202.87, the total "loss" from transaction fees and slippage was less than 0.7%, a very high figure on the blockchain.

All of the above possibilities are also made possible by some special mechanisms of the Solana chain itself.

The Helius report notes that prop AMMs leverage lightweight development frameworks like Pinocchio and even sBPF Assembly to minimize the computation required to update parameters, enabling them to refresh quotes at a negligible fee compared to the transaction value. HumidiFi, the most widely used platform on Solana, consumes only 143 CUs per quote update, costing less than $0.002. By comparison, a transaction using Jupiter consumes approximately 150,000 CUs.

The auction engine of Jito, the most widely used Solana client, prioritizes transactions based on per-CU tips. Oracle updates that consume fewer CU and offer higher tips per CU are naturally prioritized. This makes prop AMMs' price updates faster than standard AMMs. This not only allows prop AMMs to compete with standard AMMs through aggregators, but also serves as a prerequisite for prop AMMs to use oracles for near-real-time price updates.

Furthermore, Solana's high transaction confirmation speed and low costs are also excellent conditions. On Ethereum, simply frequently updating oracle prices could incur enormous costs.

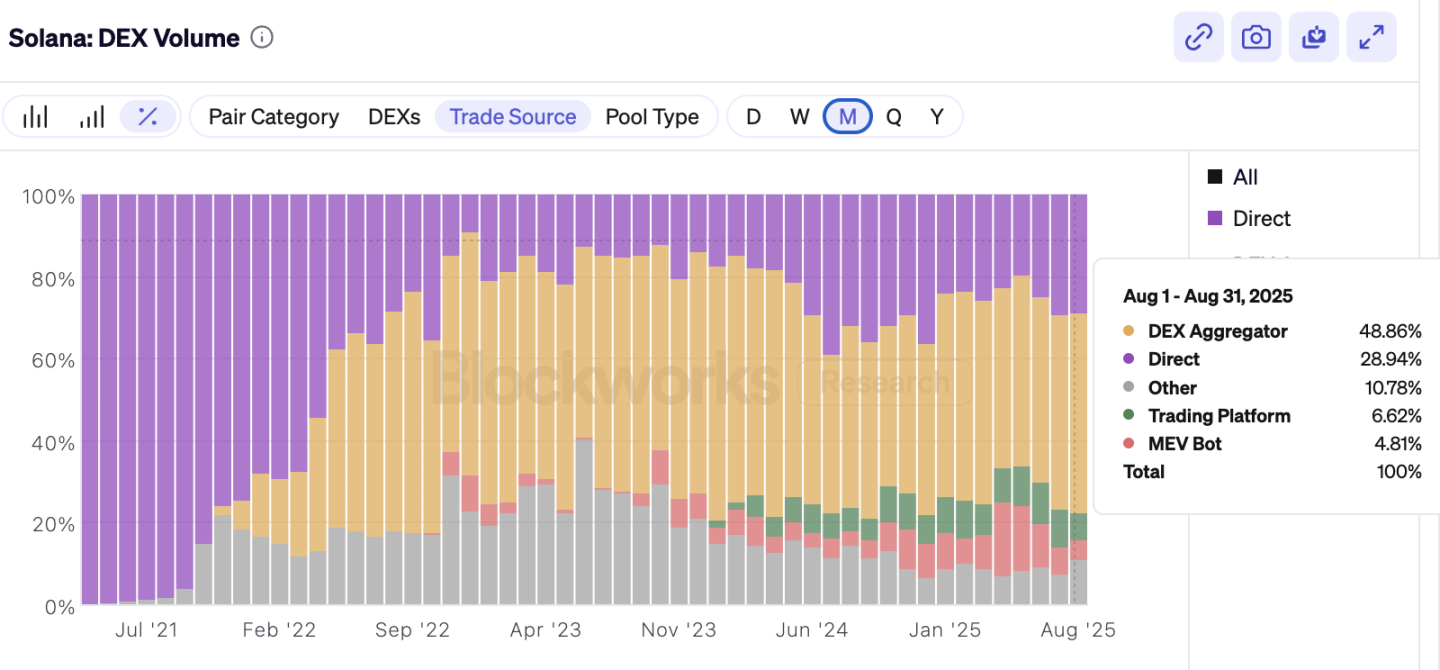

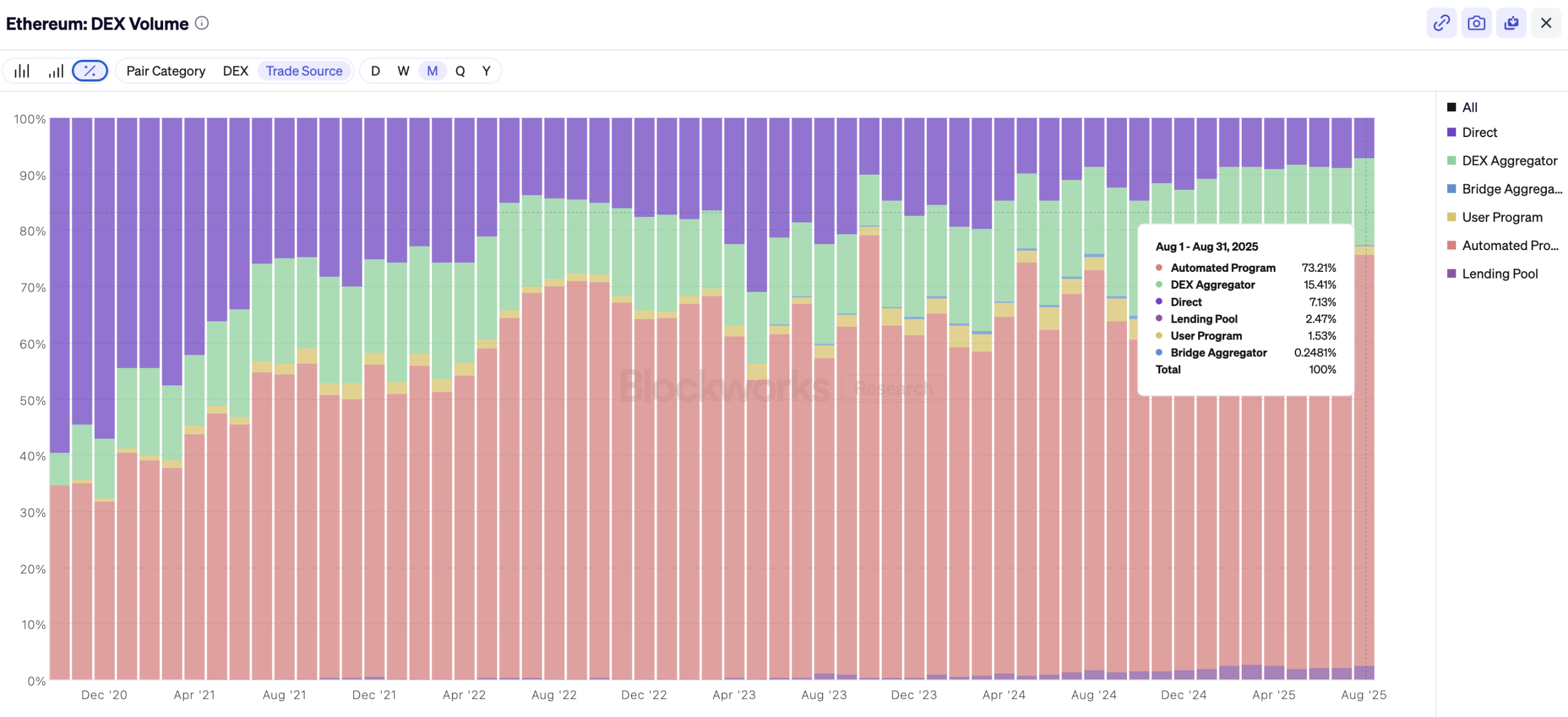

In addition to the transaction confirmation mechanism, the high proportion of trading volume of DEX aggregators on Solana also allows the advantages of prop AMM to be quickly reflected.

Blockworks data shows that nearly 50% of transactions on Solana were executed through DEX aggregators in August, while just over 15% of transactions on Ethereum were conducted directly through aggregators during the same period. Because prop AMMs primarily route transactions through aggregators, the advantages of high-frequency price updates, low slippage, and unique market-making algorithms are less readily apparent if aggregators are used infrequently and have low trading volumes.

Blockworks researcher Carlos Gonzalez Campo predicts that in the future, transactions for "mature" assets (those with relatively stable prices) may be increasingly conducted through prop AMMs, while transactions for newer or long-tail assets, whose prices are more volatile and preclude professional market makers from intervening, will likely continue to be executed through standard AMMs. In fact, transactions for some of Solana's larger meme tokens are already being routed to prop AMMs.

Many sources currently classify prop AMMs as dark pools, but there are fundamental differences between the two. While the characteristics of liquidity pools make MEV transactions difficult to meddle in, transactions executed by prop AMMs remain open and transparent, though the underlying design of the liquidity pool itself remains hidden. This, to some extent, reflects the blockchain's gradual loss of its commitment to "decentralization" and "permissionlessness." With the collapse of extreme idealism, sacrificing transparency for efficiency is beginning to take root in the mature Web 3 ecosystem.

But no matter what, we still welcome the challenge that DEX poses to exchanges. As Eugene Chen, CEO of Ellipsis Labs, which operates SolFi, said, the lowest-cost way to buy Bitcoin on Coinbase now is to transfer USDC to the Solana chain to buy cbBTC, and then transfer cbBTC back to Coinbase.